The overdue loan debt of compatriots is growing and, according to the latest data from the Central Bank of Russia, amounts to almost 810 billion rubles.

Article on the topic Not paying a loan is legal. Five important questions about mortgage holidays

No card delay goes unnoticed. Firstly, it affects the borrower’s credit history (the next time he needs to borrow money from the bank, the financial institution can easily refuse). Secondly, delay entails fines - you will have to repay the debt, only more. Failure to pay your monthly payment has other unpleasant consequences. For example, a ban on traveling abroad.

Can a bank block a salary card if there is a loan debt? AiF.ru sorted it out together with lawyers.

How financial institutions work with debtors

If the borrower treats his obligations in good faith, then there is no reason to worry.

If you regularly make mandatory payments under the terms of the loan yourself, you don’t have to worry that the lender will start withdrawing the funds you earn from your salary card. After all, debt as such is not created. The situation is completely different when it comes to a debtor whose debt has become “problematic” for the bank.

If payment under the loan agreement previously signed with the borrower (hereinafter referred to as the agreement) does not arrive for more than 90 (ninety) days, then the lender, represented by the bank, will in every possible way remind its client of his loan obligations and the need for their proper fulfillment.

Here begins an endless series of calls, SMS mailings, and constant notifications sent by email. In some cases, letters are sent to the postal address indicated in the application and contract.

If no measures have an effect on a heavily indebted client, then other methods are used to recover the debt - of a forced nature. The issue is referred to the collection service.

If there is a debt in one credit institution, the creditor does not have the right, without appropriate sanctions, to take away the client’s funds that are in his account in another bank. If such attempts are made, then the debt collection procedure has moved to the stage of forced collection.

Those. The debt case was considered in court, and the bailiff service is now enforcing the court decision.

Seizure and write-off of funds

Blocking of a bank account occurs within the framework of the law and is conditioned by the implementation of the following actions:

- The creditor applies to the court with a statement of claim against the debtor, providing the necessary documents. If there is sufficient argumentation, a decision is made and the requirements are satisfied.

- The borrower is asked to independently repay the debt within the agreed period. If this does not happen, the resolution is transferred to the federal service for forced collection of the arrears.

- The executors request information from banking institutions about the debtor’s accounts, and the financial institution must unconditionally provide them.

- The bailiffs oblige the monetary structure to seize the client’s active card and direct the money on it in favor of the applicant.

Please note: the actions imply the inability of the person to use the account in any case - cash or non-cash option. Even if the plastic contains a larger amount than what is needed for repayment, the debtor will be able to count on it only after the arrest is lifted.

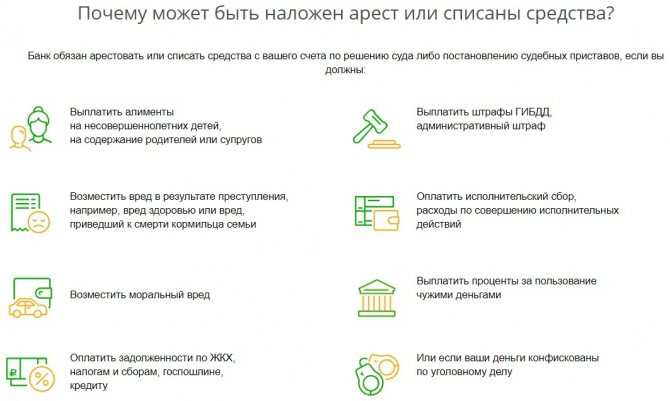

In what cases do bailiffs have the right to collect funds?

Typically, the issue of withdrawing funds from a debtor to pay off debts is regulated by Federal Law in force in the territory of the Russian Federation.

According to it, the bailiff has the right to withdraw funds from the debtor’s personal accounts only after they receive a court decision.

Thus, this suggests that the actions of bailiffs can be considered legal only if the following grounds occur in relation to the debtor:

- Court order, decree or court decision;

- Obtaining a resolution to collect funds from the debtor, which is provided by other competent authorities. In this case, such a body may be the Pension Fund;

- Upon receipt of a writ of execution by the bailiff service.

In other cases, the actions of the bailiffs will be considered illegal.

How much can they write off?

A separate question should be considered: what maximum portion of the salary received is the bank entitled to withhold in order to repay the loan debt. There is a clear indication in this regard in the legislation.

Please note! The maximum possible amount of deduction from the client’s income is 50% of the amounts received each month. But the bank does not have the right to engage in such collections independently, only through the executive service, which follows from Law No. 2300-1.

Here you may come across a conflict of law - even though the client previously provided consent to financially compensate the bank for the delay by debiting from the card, the bank does not find out where the money comes from on the client’s card.

Here, it would be quite appropriate to immediately, when notifying the creditor about the debiting of funds from the account, to ensure that the total amounts taken do not exceed the maximum limit provided.

First situation

When a bank writes off money from a debit salary card in a pre-trial manner without trial, this occurs in cases where you have both a loan agreement and an agreement for servicing a bank card in the same bank.

It often happens that your employer works with a large bank, for example Sberbank, VTB-24 or HomeCreditBank, and these financial structures provide your employer with the opportunity to provide preferential lending conditions to the company's employees. That is, your company issues you a salary card to which your wages are transferred, and a preferential loan can be provided to the same card.

Why can they seize or collect money from the card?

Only bailiffs have the legal right to seize money from accounts and seize them, if they have a court decision. The financial institution where you opened the credit or debit account can also withdraw money from your account:

- The court may decide to withhold funds from the borrower’s salary card to repay the loan, but this amount cannot exceed 50% of his income. The law prohibits the seizure of accounts and credit cards to which all kinds of social payments, benefits and compensation are credited.

- Perhaps the bank independently withdrew funds from your card in order to pay off the loan debt. In this case, find in your loan agreement the corresponding clause that allows the financial institution to take such actions. The same condition may be specified in your contract drawn up for servicing a salary card.

Can a bank write off debt from your salary card without a court decision?

Recently, the disappearance of money from a salary card has become more frequent due to the write-off of loan debt, payment of utilities, overdue alimony, etc. A phenomenon that has already become commonplace requires close consideration. Before delving into the legal nuances of the procedure, you should firmly know that in any case, the amount of withholding should not exceed 50% of all cash receipts.

In 2012, changes to the Federal Law and legislative acts came into force, and bailiffs were vested with expanded powers. Financial and credit authorities have received the right to block client accounts in the amount of his debt, that is, banks must, without alternative, assist judicial proceedings. Before the amendments were adopted, the order of the bailiffs was carried out within 3 days; in the new edition, the blocking is carried out on the day the court order is received. That is, before this, large depositors had the opportunity to prevent the impending threat and cancel accounts, but from now on, withdrawal of funds is impossible. The amount withdrawn from salary cards is strictly regulated by law and cannot exceed the 50% barrier; as an exception, up to 70%. Writing off funds by a banking organization for someone else's benefit is considered an unlawful act.

Can a bank write off money from a card to pay for a loan from another bank?

As mentioned above, the bank does not have the right to independently collect debt from client accounts. This rule also applies to writing off funds to pay off a debt on a loan from another bank.

Initially, the bank must sue the debtor. The court decision will indicate how much the loan debt must be collected monthly, as well as the possibility of writing it off from accounts in other financial institutions. After this, bailiffs and executors are involved in the work. They are looking for client bank accounts. Then they are seized so that the debtor does not have time to remove them. After this, information is provided to the bank where the borrower has a loan debt. He, in turn, transfers a copy of the court decision to the bank in which the debtor has an account. Its employees write off the loan debt to the recipient bank in the specified amount.

What if the loan is from one bank and the salary card is from another?

If you receive wages on a card issued by one bank, and a loan for which you do not pay was issued by another financial organization, you are still a debtor, and an appropriate court decision on collection will be made against you, then the funds will also be collected from the bank cards from another credit institution.

“If there is no court decision, then another bank does not have the right to block your card or take any similar actions. Therefore, until a court decision is made, you can safely use your cards, and in case of any obstacles, it is recommended to resolve the issue in court. And then the bank will be obliged to compensate for the damage caused to you,” emphasizes Andrey Lisov.

When is it possible to write off funds to pay off a debt?

It is considered illegal if the bank writes off all the money from the card account as payment for the loan. In this case, the client is left without a livelihood. He can challenge the write-off in court. But there are exceptions to this rule.

The loan agreement may indicate that the bank has the right to debit money from the account to pay for the loan.

Let's give an example. The borrower is a participant in the salary project. The bank provides certain discounts and bonuses to such a client. Applying for a loan takes place in a matter of minutes , since no proof of income is required. All information about wages is stored in the database. And if the loan agreement states that the bank has the right to withdraw funds to repay the loan, the borrower will not even need to make monthly payments. The bank will automatically debit the funds after your salary arrives.

There is another case when it is possible to write off money from the card - the bank has collected the debt in court. First, the financial institution files a claim for full or partial recovery of funds to pay for the loan.

Even if the loan agreement does not indicate that the bank has the right to write off money to pay for the loan, it can do this at the request of the borrower.

The client needs to come to the bank and write an application. In it, indicate the loan repayment amount, terms, and also how much you trust to write off . To control loan repayment, you need to activate the SMS notification function.

Bank actions

In some cases, the creditor bank independently withdraws funds from the accounts of its debtor clients. From the point of view of the law, this is legal only if the debtor works in this bank and receives wages from it.

But many banks include conditions in the texts of loan agreements that allow them to write off amounts owed from a salary card.

If there is no such condition in the agreement, the bank’s actions are unlawful and you can safely file a complaint against it in court or the prosecutor’s office.

If such a condition exists, you can contact the employer with a request to pay wages to the current account of another bank or pay them in cash at the cash desk.

You can try to “negotiate” with the bank by sending it a letter asking to withdraw not 100%, but 50% of the funds received, citing the fact that the bank, through its actions, is depriving the debtor of his livelihood. As a rule, the bank meets halfway and returns half of the funds already withdrawn. In the future, he will withdraw only ½ of the amount of income received. It is more profitable for the bank to receive half the payments than to receive nothing.

Does the bank have the right to withdraw money from a salary card?

There are many cases when funds are written off from an account belonging to a borrower, but some of them are the most common:

- A bank client opens a separate debit account with the bank. Salaries are systematically transferred to him. Next, the loan is issued here. One and the second account operate independently, but if the client develops a debt, the financial institution begins debiting funds from the salary account, through which fines and accrued commissions are repaid. The bulk of the debt remains untouched. To avoid such unpleasant incidents for the client, many recommend issuing an additional debit card. Separately, automatic replenishment of funds is configured to ensure the availability of financial reserves;

- despite the fact that the person is left without means of subsistence, the credit institution does not make any concessions. At the slightest suspicion of such an approach by the financial structure, the employee should contact his superiors or the chief accountant. You need to ask to transfer your salary to another bank or, as an option, ask to issue the earned money through the cash desk in cash. To do this, you will need to refuse your bank card in writing. It should be noted that it is difficult to persuade employers to make such manipulations in the interests of the employee.

Before making any claims against the lender, it is necessary to review each of the clauses of the current agreement. It clearly states what actions the lender has the right to take in the event of a significant delay in loan payments, and what rights the borrower has.

It happens that the conditions stipulate the possibility of repaying the debt by withdrawing funds from the debtor’s accounts.

Sometimes such rules are even posted on the information stands of some institutions, and they are open for review on the websites.

Such an established rule is aimed at infringing on the client’s rights and is in conflict with current legal norms.

Important! The law, which legally takes precedence over written agreements (including a loan agreement), allows such actions only if there is a corresponding court decision. In this case, the amount of funds collected should not be half of the amount received by the debtor at work.

The opinion of Rospotrebnadzor on this matter reflects a similar position - the presence of such clauses in the contract is a direct contradiction to the norms contained in the Law “On the Protection of Consumer Rights”. Failure to comply with such standards entails admin. liability under Article 14.8 of the Code of Administrative Offenses of the Russian Federation.

Watch the video. What to do if the bank writes off your salary to pay off the debt:

What is the bank not allowed to do?

We especially emphasize that the bank has the right to block part of the money on the borrower’s card only in the event of a court decision. The money on the card is the property of its owner, and no financial institution can simply dispose of it.

The bank cannot write off money without notifying the defaulter on the loan. By law, debiting funds from a bank card or account is permissible only after notification of the card or account owner. Without notification, this action is also considered illegal. If a financial institution has notified you of its plans to block money on your salary card, you have the right to request an appropriate court decision from the bank.

“In addition, it is worth remembering that the bank does not have the right to write off all funds from the client’s card. The bank is allowed to write off only 50% of the amount on the bank card. If a financial organization acts without a court decision, or writes off more than 50% of cash receipts, you have every reason to contact the prosecutor’s office with a statement about the bank’s illegal actions. And then the credit institution will be held accountable,” suggests Andrey Lisov.

Article on the topic

Plastic turns into brick. Why do banks block cards?

“It is worth noting that the bank cannot always write off absolutely all receipts from a salary card. Such income as social benefits, alimony payments, pensions, child benefits, compensation, maternity capital cannot be written off,” explains Svetlana Burtseva.

Let's find out where the money disappeared

As a rule, malicious defaulters hide from bank employees and bailiffs. Therefore, it is not possible to personally serve them with a court decision on forced collection. But this is optional. The decision has been made and must be implemented.

If you discover that funds are being debited from your account without your knowledge, you must:

- Contact the bank with an application to receive a detailed account statement. This document indicates where and in what amount the funds went.

- If the loan agreement does not stipulate that the bank has the right to write off money against the loan debt, you must contact the prosecutor's office.

Unfortunately, banks often refuse to provide information. In this case, you need to seek help from the management of the financial institution. Be careful, if you have a credit and deposit account opened at the bank, debiting funds to pay off the debt may begin as early as the first overdue payment. This rule must be specified in the loan agreement.

How to return written-off money?

Let us explain how bailiffs write off money from a card. When an account is found, they do not see its purpose; they simply withdraw funds if they are on the balance. However, citizens can have several different accounts open - pension, for receiving benefits, savings, salary. Some of the funds cannot be written off and if this happens, the money can be returned.

First, check with the bank where the money was transferred. Get information about enforcement proceedings and try to obtain a writ of execution from the bailiff. Then you need:

- prepare documents indicating that social benefits, payments for children, compensation, write-offs for which are prohibited by law;

- quickly send your bailiff to the FSSP a statement about the illegality of the write-off, attaching documents to it;

- wait for the writ of execution to be recalled and the funds written off to be returned.

If your request is denied at first instance, you can file a complaint with a higher official, up to and including the Chief Bailiff or the Prosecutor's Office.

Expert opinion

Dmitry Tomilin

Experience more than 8 years.

Free consultation

If the write-off is legal, but exceeds the permissible amount, then you can request a certificate from work about the amount of the official salary and contact the bailiff in order to establish the amount of deductions allowed by law (up to 50%).

Cases of collection from a salary card

The seizure of a bank client's account occurs due to debt to the state, financial organizations or individuals. Budget debts are expressed in fines or taxes. The Federal Tax Service has the right to block the accounts of organizations until obligations are fully reimbursed. This provision does not apply to ordinary citizens. Similar sanctions may be applied if individuals are private entrepreneurs (IP). Operations on the account are suspended only at the request of the FSSP, based on the writ of execution.

However, the debtor is given 5 days for independent compensation, as indicated in the court ruling - Art. number 30 of the mentioned Law. If a citizen does not have a written warning, the seizure of accounts is considered illegal.

Bailiffs have the right to withdraw the following compensation from the salary card:

- debt for housing and communal services;

- overdue child support;

- penalty due to judicial authorities;

- administrative fines.

Sanctions are applied only if a person continues to evade fulfillment of financial obligations.

Ways to solve problems

Let us note that if a bank withdraws money from a salary card to pay off a debt without permission, it is appropriate for the borrower to declare his own rights. The first step towards solving the problem here is a conversation with a representative of a financial institution .

During the conversation, it is advisable to ask about the reasons for this decision. Please keep in mind that even if the creditor receives legal grounds for such actions, the bank has the right to withdraw up to 50% of cash receipts.

If a bank withdraws money from a salary card to pay off a debt, it is appropriate for the defaulter to talk to a representative of the creditor about this situation

Violation of this rule is grounds for filing an application with an organization that protects consumer rights. Employees of this department provide the necessary legal support to citizens who find themselves in a similar situation. In addition, employees of the institution have the right to sue the bank on behalf of the injured client. Remember, the second unchangeable rule regarding withdrawals is the obligatory warning of the borrower about such actions.

Note! Unauthorized blocking of a card by a bank is a reason to write a statement to the prosecutor's office. In addition, lawyers recommend that in such situations, duplicating intentions and filing a civil lawsuit.

However, gaps in the legal literacy of Russians become the cause of violations on the part of financial institutions. Let's find out how to behave for citizens whose Sberbank card has been blocked for debt. What to do in situations where the bank commits arbitrariness, and what to do when the creditor’s actions comply with the law, we will look into it below.

Legal measures against the defaulter

If the blocking was a consequence of a court decision, you need to contact the bailiffs

Let's start by studying the question of what to do if Sberbank blocked a salary card for debts by court decision.

In situations where the client, upon first contact with the organization’s employees, learns about a court verdict in favor of the bank, it is advisable to demand the original of such paper.

Moreover, the client’s failure to receive notice of upcoming sanctions is a reason for filing a claim.

The second nuance here is the mechanism of the executive service. Please note that the restrictions that are imposed on the defaulter after a court decision in favor of the plaintiff are applied only by FSSP inspectors.

Accordingly, the bank does not have the right to block debtors’ cards or write off money from there. Thus, to correct the situation, you will need to contact the bailiffs .

Note! If the case has passed the court hearings and fallen into the hands of the executive service, information about the defaulter appears on the FSSP website. This method helps to quickly clarify the situation, bypassing communication with the lender.

If there is no response to the request to the FSSP, it is advisable to file a lawsuit

To remove the seizure from the accounts, the borrower writes a statement to the inspector who is handling the case.

Such paper contains the details of the local executive service, the initials of a specific service employee, the surname and address of the debtor himself.

The originating number of the judge’s decision on which the arrest was imposed, the name and details of the creditor, and bank card identifiers are also indicated here.

In the main text of the letter, it is appropriate to competently argue the reasons for the appeal and formulate a request to lift the arrest. Please note that to ensure that the statement is not unfounded, please attach here a certificate of income.

Keep in mind that the operation to unblock the card can take up to a day . Therefore, it is appropriate to complain to the prosecutor’s office or file a lawsuit about the inaction of the bailiffs.

Arbitrariness of the creditor

If the write-off was the result of the bank’s arbitrariness, it is appropriate for the client to complain about these illegal actions

In situations where a bank, bypassing the court and taking advantage of the client’s legal ignorance, independently implements the measure in question, it is appropriate to complain about such violations.

The first step here is to talk with an employee of the structure and submit a complaint to management.

If registration of such paper is refused on site, it is advisable for the client to use postal services by sending a registered letter with notification and a list of the contents attached.

In addition, as stated above, it is appropriate to complain to the Consumer Rights Protection Society or the prosecutor's office. The last organization that has the right to resolve such disputes is the court .

Moreover, this option is suitable for borrowers who have previously signed an agreement on the probable debiting of funds by the bank to repay the arrears. Please note that withdrawing money from the card where the salary is received without an appropriate decision is prohibited.

Note! By competently defending his own position, the defaulter will be able to obtain a court ban on such actions of the creditor in the future.

However, this requires the simultaneous filing of the relevant petition along with the claim. Keep in mind that the law protects the rights of borrowers, but in order to achieve the desired result, it is appropriate to involve an intermediary who is knowledgeable in the intricacies of jurisprudence. Remember, a competent and reasoned position here guarantees the success of the case.

How to find out who withdrew money from your bank account

The branch of the bank that issued your credit card will be able to tell you exactly who withdrew the funds from your account.

- If the bailiffs have legal proceedings, according to which more than 50% of the income is withdrawn from your card, you should prepare an application to remove the seizure from the account and submit it to the bailiffs themselves. If the arrest is not lifted, file a claim with the court.

- It is possible that the money was debited from your card by the bank itself. In this case, prepare a statement demanding a full report - in particular, find out what exactly caused this decision. If bank specialists do not respond to your request, contact management directly.

Do not forget that the bank where you took out a loan and opened a deposit may begin to withdraw funds from your deposit immediately after the first delay. No one at the bank will be interested in the exact purpose for which you collected the money on deposit. As soon as funds are received on deposit, a certain amount will be immediately withdrawn from it to pay off the debt. The loan payment mechanism will be the most unfavorable for the borrower - first, the bank will pay off all fines and penalties accrued during the delay, then it will move on to paying off interest, and lastly, it will begin to pay off your principal debt. In other words, the bank will withdraw your money, while the loan debt will decrease very slightly.

Do bailiffs have the right to withdraw money from a bank card{q}

The bailiff has the right to seize the debtor's property or financial accounts on the basis of a writ of execution. Bank cards are also subject to seizure procedures, and the citizen cannot use his own funds. See also: can bailiffs seize a card{q}Seizure by a bailiff

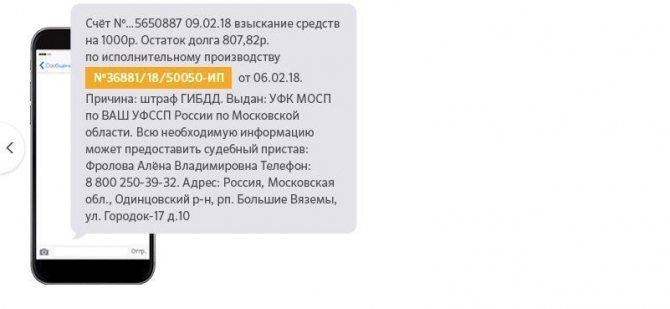

There is often no advance notice of seizure. A citizen learns about this trouble from an SMS message from a bank or at a branch of a credit institution.

A credit card stores the bank's money, which it transfers to the borrower for use at an agreed interest rate. That is, these funds do not belong to the borrower, for this reason, withdrawing money from a credit card is illegal.

During a lawsuit, where the plaintiff demands to recover a certain amount from the defendant, an appropriate decision is made.

As soon as the writ of execution falls into the hands of the bailiff, the procedure for searching for the debtor citizen begins. If the defendant does not want to pay the resulting debt on his own, the bailiffs have to use coercive measures.

First of all, the bailiffs are interested in the debtor’s permanent income or funds stored in banks in the form of deposits and deposits.

Inquiries are sent to various banks regarding the availability of accounts. After a satisfactory response from the bank, the bailiff sends a seizure order. If the client has several accounts in this organization, then in the resolution the bailiff specifies which account is seized.

The resolution also indicates in what time frame and in what order the bailiff will lift the arrest.

Banks and other credit organizations fulfill the order of the resolution within a short time (no more than 3 days) and notify the bailiff of the transaction in writing or in electronic document form.

From the moment the bank card is seized, the holder cannot use his funds. The amount owed is debited from the account. If the money on the card is not enough to cover the entire debt, the available amount is written off. The balance of the debt will be collected from subsequent receipts. See also: what to do if your credit card runs out.

Starting from Art. 857 of the Civil Code of the Russian Federation, information about the existence of an account can be communicated to the client himself, employees of the credit history bureau, as well as government agencies, in the case provided by law. The list of government bodies and their officials is regulated by the Banking Law. The Bailiff Service is included in this list, so providing information about the existence of an account is legal.

Types of income that cannot be seized:

- Funds received for compensation for damage to health.

- Benefits related to the death of the breadwinner.

- Remedies for injuries at work.

- Compensation for victims of a man-made or radiation disaster.

- Alimony.

- Temporary disability benefit, funded part of pension.

- Work-related compensation.

- Benefits for citizens with children.

- Maternal capital.

- One-time assistance in case of natural disasters and terrorist attacks.

- Compensation for travel costs to the place of treatment.

- Funeral benefit.

For other income, including old-age pension and disability pension, it is allowed to apply exacting measures.

And now we come to the main question of our article. To answer this, we monitored reviews and forums for most popular banks in our country and found out in which banks bailiffs do not write off money, and in which they write off money very often.

But keep in mind that the information here is based only on reviews from bank customers themselves, and not official data, so it may not be accurate. Moreover, the situation with such write-offs can change at any day, and it cannot be said that it is 100% relevant as of August 24, 2020.

In general, any bank is obliged to provide an answer about the availability of the debtor’s accounts and cards, as well as to comply with the requests of the bailiffs to impose blocking of money (for fines and other debts) and seizure of such accounts. But there are banks that ignore such requests, despite a substantial fine of 50 thousand rubles for this.

| Bank | Number of reviews in the sample |

| Tinkoff [update 01/08/2018: isolated cases of write-offs have appeared] | 14 |

| Promsvyazbank | 9 |

| Citibank | 8 |

| MTS-Bank | 6 |

| Vanguard | 4 |

| Bank | Number of reviews in the sample |

| Sberbank | 37 |

| VTB 24 | 34 |

| Alfa Bank | 34 |

| Bank of Moscow | 22 |

| Gazprombank | 20 |

| Rosselkhozbank | 19 |

| Raiffeisenbank | 16 |

| Opening | 13 |

| Home Credit Bank | 13 |

| Rosbank | 12 |

| Probusinessbank | 12 |

| Binbank | 9 |

Something else useful for you:

The financial institution does not reserve any right to withdraw “children’s” money from a bank card. It is worth remembering the main thing: if there is no court decision, no one ever has the right to take away your money. Moreover, the law states that proceeds addressed to children cannot be seized under any circumstances.

- compensation for harm caused to health;

- compensation for the death of the breadwinner;

- money transferred to persons who were injured;

- payment amounts for persons affected by disasters;

- money transferred due to the care of disabled citizens;

- funds that come to the account in the form of alimony and other income for the maintenance of minor children;

- benefits for families with children coming from the federal and local budgets.

The law provides for 17 categories of such payments, to which children's money relates. Therefore, a borrower who by chance finds himself a debtor should fight for his rights and contact experienced lawyers.

Can a bank withdraw money from a salary card for credit? {q} This question often worries many clients of banking organizations. It is necessary to clearly understand who exactly is responsible for withdrawing funds from your account. There are two options in total - either the financial institutions themselves, or bailiffs.

If it is necessary to remove the seizure from the account to which the salary is received, you must send an appeal to the bailiff who is handling your case. By submitting a written statement explaining why your account should be released. If you receive a refusal from the bailiff, you should go to court, which will 100% be on your side.

In a situation where funds are debited from a card by a financial institution, it is necessary to find out the reason why this is happening. If the agreement contains a clause stating that if a credit debt arises, the financial organization has the right to write off amounts from other accounts opened with the bank, then this action may be legal.

In this situation, the procedure is as follows: initially, you need to send an application to the bank, which will create a request for a written response. The document must contain the causal factors on the basis of which funds are written off. And if this happens precisely through the bank’s efforts, there will be no choice but to ask the employer to transfer your wages to the card of another financial organization. Another option is to ask to receive your wages in cash.

To prevent money from being written off from your salary card, you must follow several recommendations and take a number of precautions. All this will definitely allow you to avoid problems with financial structures, government organizations and your own employer.

You should apply for a loan only to a trusted financial institution, which takes such measures only in rare cases and treats all its clients favorably.

If you have a debt, you must inform the bank about it. Currently, financial organizations are developing a huge number of programs that can reduce the debt burden and alleviate the plight of the debtor. These include refinancing, restructuring, interest rate reduction, and other conditions.

It is advisable to inform the banking organization about your difficult financial situation in advance, even before accumulating a large amount of debt. This will allow the bank to be on your side if litigation becomes necessary.

Things have reached an extreme, and you have already begun to sue a financial institution; you need to behave with restraint and not show the bank representatives that you are belligerent and aggressive. In any case, you must try to come to an agreement with him.

These measures will allow you to avoid withdrawal of funds and feel more confident. And if the borrower learns to behave with restraint and show that he is by all means interested in timely repayment of the debt and the absence of problems, then all authorities will be on his side.

As it turned out, financial institutions do not have the right to simply take and write off finances from a client’s account, even if he is on the “black list” and is classified as a debtor. Banks have only a limited range of powers, and here is a list of actions that a client should expect:

- accrual of fines and penalties on loan amounts: despite the general harmlessness of such phenomena, they can seriously affect the debtor’s budget;

- going to court in case of failure to fulfill the terms of the contract on the part of the borrower;

- trial in court with a certain number of charges;

- withdrawal of commissions for additional customer services (in order not to “get caught” out of money, you must carefully read the terms of the contract);

- A demand for payment of principal and interest.

Why can money in a debit account be seized?

Often, the bank withdraws money even if the client has no debt on the loan. To find out what could cause such actions, take a look at the official portal of Sberbank - everything is described point by point there.

You can find out about all your financial problems via the Internet. In the same way, using the Internet, you can pay off existing debts, fines, etc. - for this you need to have a card with a certain amount in your account. To find out all the necessary information about your case, look for an SMS from the bank informing you that your card has been seized. There you will find the enforcement proceedings number - use it to get the necessary data on the official website of the FSSP (to do this, go to the “Search by IP number” section).

If the bailiffs withdrew funds from the debtor’s salary card

Initially, after the bailiff receives the writ of execution, he has the right to send the debtor a written notice of the existence of the debt, its size and the timing of its payment.

The debtor is given about a week to repay the debt on his own.

If this does not happen within a week, then the bailiff has the right to begin proceedings to collect funds from the debtor’s card to pay the debt.

If no action is taken from the debtor, then the bailiff service has the right to independently, without warning the debtor, withdraw money from all of a person’s bank accounts and seize his property. In addition, bailiffs have the right to recover costs that were incurred by them in carrying out enforcement actions.

It should be remembered that money is debited not only from open bank accounts available to the debtor, but also from the credit card that was approved for the person.

In addition, debits are carried out from debit accounts that the debtor has in various financial organizations, funds and electronic accounts.

Thus, if money was withdrawn from you from a Yandex or Qiwi wallet, then the actions of the bailiffs are considered legal.

The bailiffs withdrew money from the card without warning

Attention

When carrying out their activities, bailiffs are guided by the law “On Enforcement Proceedings”. The regulatory legal act regulates:

- procedure for carrying out enforcement proceedings,

- timing of the event,

- rights of the executor of a court decision.

After reviewing the provisions of the law, the debtor will find out that the withdrawal of funds from a bank card is forcibly permitted. Such a right is enshrined in Article 69 of the Law “On Enforcement Proceedings”.

However, the right to withdraw funds arises from an employee of a government agency only if a number of grounds are present. They arise during enforcement proceedings. Bailiffs can write off funds stored both on a bank card belonging to the debtor and in his account.

It happens that a person discovers that money has been withdrawn from his card, but he has not received information about the opening of production. In this case, you will need to contact the bailiffs with a claim. If money is withdrawn by mistake, it will be returned to the owner.

Allowable amount of deduction

What proportion of your income can be written off by bailiffs.

Bailiffs cannot completely seize a debtor’s salary card if it is the citizen’s only source of income. The law allows you to withdraw no more than 50% of the money transferred to such an account. The entire amount may be withheld, but subsequent monthly collections will only equal half of the funds.

However, bailiffs have the right to assign 70% of deductions if the following circumstances arise:

- child support for several minor children;

- compensation payments for damage to health;

- actions resulting in disability or death of the main breadwinner;

- covering arrears resulting from theft.

But the executors cannot seize more than a quarter of the monthly income if the card belongs to a single parent. And also no more than 30% for a family with several minor children.

Rights of financial organizations

None of the credit institutions has the authority to independently make a decision on writing off finances in the client’s account. Neither the inclusion of a client in the “black list” nor the inclusion of a client among the first debtors gives such a right.

The list of powers of banks is limited by law. Here is a list of expected actions that the bank is allowed to perform:

- charge fines (penalties) to clients who fail to fulfill loan obligations. It sounds, of course, harmless, but the implementation of such actions in practice creates quite a significant additional financial burden for debtors with a noticeable reduction in the budget;

- contact the judicial authorities if the borrower does not comply with the terms of the contract;

- initiate legal proceedings, presenting separate demands and charges regarding the violation;

- take commissions from the client for additional service (in order not to feel a financial shortage, you must initially carefully read the contract);

- demand payment of the principal amount of the debt, as well as interest accrued on it.

Other actions not specified in this list, not specified by the terms of the agreement, are contrary to the norms of current legislation.