Receivables are sometimes a signal of illogical actions in business

Accounts receivable are the costs exclusively of the post-payment system, when a company/firm gives away goods for which the counterparty will pay only after its sale. This can be avoided by cooperating on prepayment, however, not everything is so simple; there are situations that force sellers to deliver goods on a postpaid basis.

What makes companies act so illogically:

- Lack of working capital. Most often, the seller’s entire financial volume is always in circulation, and he cannot allocate extra funds for the purchase of a new batch of goods; by “pulling” a fair amount from circulation, there is a risk of completely ruining the business.

- Unknown product. Such products are unlikely to be purchased with an advance payment; newcomers have to take risks and give new brands for sale, receiving from the second party the agreed price only after the complete sale of the lots taken for resale.

- High storage costs. For some types of goods it is necessary to hire warehouses; long-term rent results in significant expenses. It turns out that in such situations it is much cheaper to store the products on the seller’s premises and wait a little while he sells it and repays the debt.

- Products with a short shelf life. There is no point in storing perishable goods at all; it is difficult to sell them quickly and in full with prepayment, so releasing them to accounts receivable is an excellent way to reduce waste resulting from spoilage and receive optimal earnings in a timely manner.

- Competition. When a seller chooses his supplier, he looks for the most favorable conditions for himself, and therefore many small companies work on a postpaid basis, trying to survive among “prepaid” companies with a stable regular clientele.

In such situations, it is important to realize that the seller to whom you give the goods is trying not only to earn money and return you money, but also to delay the deadline and put it back into circulation again. Sometimes there may be cases when he fails to sell the product at all, and then the chance of returning the money is small. Therefore, when delivering goods, it is necessary to strictly monitor the timing and turnover ratios and regulate receivables.

Types of legal services

The range of services we provide is diverse and directly depends on the characteristics and specifics of each individual case, for which completely unique and non-standard tactics, strategy and step-by-step instructions are developed. This personalized approach allows you to consistently achieve your goal – repayment of debts and return of receivables.

As part of cooperation with Legal Mil Group of Companies, the following services are possible:

- careful monitoring of the current situation, analysis of all documentation available to the client (both on paper and electronically)

- determining the legal basis for collecting receivables, identifying the client’s strengths and weaknesses in a specific situation

- preparation of a complete package of documentation for pre-trial resolution of a conflict situation

- conducting negotiations with the debtor, stating requirements

- collection and preparation of the required documents for going to court, drawing up and filing a statement of claim

- collection and formation of evidence and indictment base

- prevention of attempts of fraud or deceptive actions on the part of the debtor, his evasion of responsibility and delay of legal proceedings

- full and comprehensive protection of the client’s interests and rights at all stages of the trial

- interaction with bailiffs and executive authorities to speed up enforcement proceedings

- assistance to the client during the execution of court decisions, monitoring the actions of bailiffs

- monitoring and interaction with supervisory government authorities, control of the debtor’s actions

Each employee of our organization is a true professional in their field, with many years of experience, the highest qualifications and focus on achieving their goals and objectives. Therefore, you can completely entrust Legal Mill with all work with debtor enterprises, without wasting your own resources and insuring yourself against mistakes. After all, repeated recourse to court on the same grounds between the same persons is not allowed (Article 150 of the Federal Law of July 24, 2002 No. 95-FZ “Arbitration Procedural Code of the Russian Federation”), which means that the creditor has only one way to collect receivables legally chance. It should not be missed or used incorrectly.

What can you do with accounts receivable?

Receivables that are getting out of control need to be adjusted in a timely manner.

How to do it:

- Hiring a merchandiser is an employee who fully monitors the sale of the shipment, interacting with the stores where the product is sold. He controls prices, favorable placement on shelves, etc.

- Conduct a promotion.

- Change packaging.

- Convince the seller to change the priority of positions and give your products more advantageous places.

- Convince the company that took your product for sale to reduce the price if the sales process is too slow.

- Giving an additional loan if appropriate, sometimes this step, coupled with an extension of the repayment period and additional marketing tricks to promote titles, can help save you from financial ruin.

- Getting out of debt is an extreme, but often effective measure. For this purpose, collectors are hired who regularly put pressure on the debtors’ psyche with calls and visits, which almost always works. However, this is an extreme measure; it is better to try to regulate receivables at an earlier date, avoiding longer deadlines.

Legal grounds for paying off debt with receivables

Based on Art.

76 Federal Law No. 229 “On Enforcement Proceedings”, accounts receivable (hereinafter referred to as DZ) are property, therefore they can be recovered by the bailiff service (hereinafter referred to as the Bailiff Service). Art. 382 of the Civil Code of the Russian Federation states that under an agreement on the assignment of property rights, the right to claim it can be transferred to another person (individual and legal entity).

https://www.youtube.com/watch{q}v=upload

As a rule, the mechanism works when the debtor does not have an official source of income or any property. The exception is the only housing and the land plot underneath it, which are not the subject of a mortgage (Article 446 of the Code of Civil Procedure of the Russian Federation) and are not used in business activities.

How to make money on accounts receivable

You can not only lose money on accounts receivable, but also, on the contrary, increase it. This can be done through assignment - assignment of debt to a third party.

When a company is unable to return its money on time, which is urgently needed here and now, it resells its debt to another person at a reduced price. If the information provided confirms a satisfactory prospect of receiving interest on the forced deferment, you can buy out such a receivable “at a discount” and later receive the full amount from the debtor, making money on the difference. However, it is first worth checking the company for bankruptcy on a federal resource.

How to close enforcement proceedings through accounts receivable. Algorithm

Step one: you buy someone else's receivables under an assignment agreement.

Step two: formalize succession for this debt through the court (possibly remotely).

We invite you to read: Replacing rights when changing your last name in 2019, what you need for this: 8 correct steps

https://www.youtube.com/watch{q}v=ytpressru

If the debt is a legal entity, apply to the arbitration court with an application for procedural succession. If the debt of an individual is to go to a court of general jurisdiction with a similar application.

After reviewing the application, you receive documents stating that you are a creditor of a particular legal entity or individual. The procedure takes from one week to one month.

Step three: Contact the SSP with an application to file a foreclosure under your enforcement proceedings (hereinafter referred to as the IP) on this property (you can do it remotely - by mail).

The court must provide the following documents:

- confirming your DZ (assignment agreement, transfer and acceptance certificate, payment documents for payment of this DZ);

- about succession (a court determination that you are the copyright holder of this DZ).

If there was a writ of execution for the debtor, then you attach it too.

Step four: Wait for all stages of offsetting your receivables against the SSP debt.

You need to monitor the situation, call periodically and clarify at what stage the process of crediting your credit score is.

The following options exist:

- The bailiff will contact your creditor (bank) and offer him your loan. If the bank agrees, the individual entrepreneur will be closed;

- if the claimant (bank) does not agree or the debtor has deposited the claim to the deposit account of the bailiff division, then the claim will be sold at auction (Article 87 of the Federal Law No. 229). If someone acquires it (this has never happened in our practice), then the individual entrepreneur will be closed;

- if no one buys the property, the SSP will appoint a secondary auction with a price reduction of 15% (Article 87 of Federal Law No. 229). If someone acquires it, the individual entrepreneur will be closed;

- if the secondary auction is declared invalid, the bailiff sends the recoverer (bank) an offer to retain the property at a price 25% lower than the initial price at the primary auction, counting this amount towards repayment of the foreclosure (Article 87 of the Federal Law No. 229);

- if the claimant (bank) refused to retain the property of the debtor (DZ), which was not sold at auction, then the IP ends, the writ of execution is returned to the claimant (Article 46-47 of the Federal Law No. 229), and the DZ is returned to the debtor (you). They justify this as follows: “The claimant refused to accept your property, the SSP did not find any other property from the debtor, therefore the enforcement proceedings against the debtor will be closed”;

- in the resolution on the termination of the IP, the search for the debtor and his property, the restrictions on leaving the Russian Federation established for the debtor, and restrictions on the debtor’s rights to use his property are canceled (Article 47 of the Federal Law No. 2 29).

We suggest you read: Examination of the causes of apartment flooding

How to avoid delays in receivables - advice from professionals

In order to ensure that accounts receivable do not exceed the planned terms, it is necessary to organize a system for its accounting.

This will require a number of activities:

- Appoint a person responsible for control over receivables.

- Check the liquidity and reputation of potential partners.

- Complete all procedures on paper in accordance with the law.

- Set limits and track due dates.

- Work out the conditions for granting a deferment, all limits and conditions, and also monitor the situation.

- Study the composition of receivables according to accounting documents.

- Carry out planning based on the results at the end of the month.

Types of accounts receivable and their features

Before building strategies and plans, it is necessary to carefully understand their varieties, features and specific characteristics. According to established practice in Russia, the following types of receivables are distinguished:

Normal remote sensing

It implies that the previously agreed repayment period (payment) has not yet arrived, but the debtor has already received goods, products, or services from the creditor. If you have no doubt about the good intentions and responsibility of the client, then normal accounts receivable is a common practice in modern business. If you have the slightest doubt about the likelihood of payment from the debtor, we strongly recommend that you contact our specialists for advice.

Expired claim

Occurs when the contractual terms of payment for goods, products, or services received are violated. Sometimes this happens, and this is already a signal to which you should respond promptly and legally competently. We strongly recommend not to transfer overdue receivables to the rank of doubtful or hopeless, since the defaulter may go bankrupt, and then it will be much more difficult to return the receivables. If the debtor has initiated reorganization, liquidation or bankruptcy procedures, urgent measures must be taken. Just contact the professionals of the Legal Mil company, and we will help you not make mistakes, react in time and get your money back.

Doubtful and hopeless remote control

Delay in all payment terms, lack of guarantees on the part of the debtor or its unstable position in the market, insolvency can become a well-founded reason for recognizing receivables as bad or doubtful. But even in this case, the legal company Legal Mil has effective and efficient tools to resolve such a conflict of interest in your favor. We know how to turn a hopeless or dubious receivable into a more realistic one.

Justified or recoverable

Due to the unstable state of markets and the shaky economic situation in the world, even proven and reliable lenders may be delayed in paying for previously received products, goods, services and services. In the modern financial world, recoverable and justifiable receivables are almost a 100% guarantee of debt repayment if the work is entrusted to highly qualified specialists.

It is also necessary to clearly separate short-term and long-term debt. The first assumes that the debtor will transfer payment for the goods and services received within 12 months from the date specified in the contract. Long-term implies the possibility of repayment within more than 12 months from the date approved in the signed agreement. The period for collecting receivables depends on the time parameter established in the contract.

Video – the whole truth about collection of receivables

As a result, out of 10 receivables, you will find 1-2 that are realistically recoverable, and of these, collect one, but you will earn at least half of the nominal value.

Hundreds of percent on just one simple transaction!

The first step is to gain knowledge and experience in this matter.

The author of our guide, Vadim Kuklin, used to be a simple doctor in Smolensk and in 1 year was able to earn 22 million rubles from debt collection.

Watch a special video by Vadim Kuklin about his experience in collecting receivables:

How much can you buy debt at auction for?

When buying receivables at auctions in Moscow and not only, most likely, buyers are interested in the question of their value. The fact is that lots, by which debts are meant, can be both very expensive and quite affordable.

There are lots priced at several thousand rubles, as well as millions. This depends on many factors, but basically you need to focus on the initial amount of debt. The higher it is, the higher its cost may be. For example, if the initial amount of the receivable is 500 thousand rubles, then for this lot they may demand about 10% of its original cost. In recalculation, this is 50 thousand rubles.

Percentage pricing is very convenient when controversial situations arise. In addition, cost can be an excellent way to find out whether the debt is promising and whether it is possible to repay it. If the price of the lot is disproportionately low, most likely the debt has a very low chance of being returned. By purchasing one, you will only spend money, but will not get the desired result.

Although you can’t focus only on high cost. The principle “it’s better to buy more expensive” does not work in this case. It is quite possible that if a lot has just recently come up for auction, its price is deliberately high, but if you wait a little, the price will gradually fall.

But buying cheap receivables is also not the best option. It is quite possible that it is “dead”, that is, the chances of collecting it are approaching zero. Of course, whether to make a purchase or not is up to you, but it is better to correctly analyze the proposed options.

Possible risks when purchasing remote control

Acquiring debt can be very risky, because the buyer may not only be left without profit, but also lose all the invested funds. In addition, he will fray his nerves trying to repay the debt.

Let's take a closer look at the main risks:

- Dead debtor. This is an illiquid debt, which cannot be repaid or the chances of this are very small.

- Bankruptcy is initiated against the debtor. In this case, his debts can be written off, since the latter’s assets are not enough to repay them.

- The debtor has no assets of his own. This also means that the debtor simply will not be able to pay the debt.

- The former management does not transfer all the necessary documents to the new owner, so it is very difficult to prove that the recovery is transferred to another person. Almost impossible.

- They sell already repaid debts. debts. To prevent this from happening, it is necessary to check the reconciliation report. You can get it from the con. manager

To get rid of, if not all, then most of the risks, it is advisable to find out:

- whether the debtor has been declared bankrupt;

- Is there a lawsuit against the debtor? processes;

- Is there any enforcement proceedings?

If you are redeeming the debts of individuals, you need to find out whether the debtor has property that can be sold or a source of income.

Accounts receivable can be a truly profitable investment, but in order to make a profit from them, you first need to learn how to analyze the available offers. This is the only sure way if you want to receive at least small dividends. If this is your first experience, it is advisable to first buy inexpensive debt instruments for small amounts. And you shouldn’t buy large lots if their price is suspiciously low. Even if at first glance it seems that everything is fine, in reality there may be nuances. It is better to focus on lots that cost between 5% and 10% of the total debt.

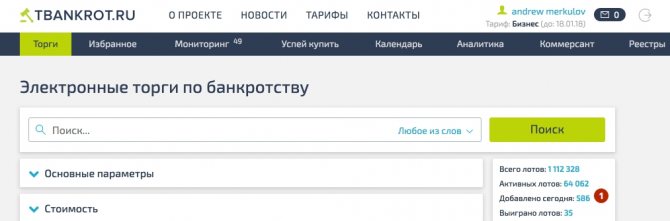

During a crisis, the number of bankrupt companies increases many times over; hundreds of lots are put up for auction every day, growing exponentially.

- Where to buy accounts receivable

- What receivables can be purchased at auction and from bailiffs

- Analysis of receivables before purchase - how to weed out 80% of illiquid receivables

- Video – the whole truth about collection of receivables

- How to make money by collecting accounts receivable

At the time of writing, according to one of the bankruptcy aggregators, sold under bankruptcy proceedings or through bailiffs were added per day

The great thing is that you can do this business without leaving your home , simply by selecting receivables on aggregator sites and selling debts or collecting them through lawyers for a small fee.

The essence of the idea is that unpaid debts are also growing, companies are holding back their turnover and are in no hurry to pay their bills. As a result, their counterparties are forced to go bankrupt because they were not repaid on time.

How to analyze receivables and weed out illiquid ones

To redeem a debt that has a high chance of being repaid, you need to carefully analyze the situation. If you buy “dead” debt, you will most likely just throw money away. But if the analysis gives a good result, then the debt purchased at auction during bankruptcy can significantly improve the financial condition.

But the federal resource publishes many advertisements, and choosing the right one is akin to winning the lottery. To reduce the risk to a minimum, you can conduct an analysis based on the following factors:

- Find out what is causing the debts. debt. Typically, statistics show that this debt arises due to non-payment of services or goods provided. These include more than 80% of debts. There may also be debts on wages, taxes, and bills. But in these cases there is a specific nature of recovery, which is why they are in less demand in the bankrupt market.

- The second thing you need to pay attention to is the debtor himself. You need to collect as much information as possible about him. For example, find out what area the company worked in, names of debtors, addresses, etc. It will also be useful to find out whether the debtor company has the funds to pay off its debts. If there is no money, property, goods, etc. may well be suitable.

- It is very important to check the composition of the papers for the lot. If you do not have all the documents confirming the existence of debt, then there is no point in buying it. You simply cannot prove the existence of a debt. It is important that there is an agreement between the creditor and the debtor, and that there is a court. resolution regarding the collection, writs of execution, invoices confirming the fact of receipt of goods or services were attached. It is also desirable to have an extract from the persons. accounts receivable and a report on the assessment of debtors' property. If such information is not available, the buyer can request it from the bankruptcy trustee. Of course, this is unnecessary red tape, so it is more rational to choose debts for which the documents are already ready.