Home / Collection of alimony / Where to file a claim for debt collection from an individual

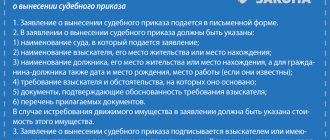

- name and address of the court;

- plaintiff and defendant;

- briefly the circumstances under which the transaction was concluded;

- data of witnesses, if available;

- data on violation of debt payment terms;

- the amount to be recovered from the defendant;

- grounds for collecting money from the defendant.

Statement of claim for debt collection from an individual

According to the general rule (Article 28 of the Code of Civil Procedure of the Russian Federation), a statement of claim is filed at the location or place of residence of the debtor , however, there are exceptions (alimony, moral damage, compensation for damage to health, etc.) when the plaintiff can choose the court at his own discretion. If the amount claimed does not exceed 50,000 rubles, it is necessary to apply to the judicial district of the magistrate’s court, if more, to a federal court of general jurisdiction.

Also read: Are Payments Reliable from the State If There is One Child in the Family and Only One Husband Works?

Attaching documents

In addition to the statement of claim itself for the recovery of interest, a number of documents must be submitted to the court, including evidence of your innocence.

Article 132 of the Code of Civil Procedure of the Russian Federation establishes a list of such documents:

- a copy of the statement of claim in accordance with the number of defendants and third parties;

- a document confirming payment of the state duty;

- a power of attorney or other document certifying the authority of the plaintiff’s representative (if you decide to involve a representative);

- evidence that you have the right to receive interest for using someone else’s money;

- evidence confirming the implementation of the mandatory pre-trial dispute resolution procedure, if such a procedure is provided for by federal law or agreement;

- calculation of interest (with copies for the defendant and third parties), such calculation can be made in the text of the statement of claim, or can be attached as a separate document.

Statement of claim for debt collection under a loan agreement

For the consideration in court of a case of debt collection on a receipt, a state fee must be paid, the amount of which depends on the amount of the claim. The price of the claim also determines which court the claim must be filed in (up to 50,000 rubles – in the magistrate’s court, and in excess of 50,000 rubles – in the district court). The state fee must be paid in full. Otherwise, the case will not be considered. Then you need to actually file a claim with the appropriate judicial authority.

How to recover in court

If you have decided to collect the interest due to you for the use of someone else's money in court, this must be done within the framework of legal proceedings according to the rules provided by law for filing claims. The request can be stated in a statement of claim along with other demands (for example, if you are not repaid a debt, you can file a statement of claim to collect the debt, as well as interest for the use of other people’s money), or you can file a separate claim to collect only interest from the debtor (for example , in case the wrongfully withheld funds are returned to you, but with a delay).

Execution of a court decision

As judicial practice shows, debt collection through the court is generally resolved in favor of the creditor. The result is a court decision on forced collection of finances. This is the last stage of collection - in the future, bailiffs will act. They must exercise full control over the implementation of the court decision.

Bailiffs work intensively with the debtor. Their responsibilities include seizing the debtor’s property, blocking bank accounts, and restricting actions.

The presence of a court decision does not mean that the debtor will immediately pay the money. He often hides his real financial situation in order to evade execution of the decision and payment of the debt.

The court may require various documents. Find out where to get a certificate of debt. Debt collection against a receipt follows general rules. Read more in the article.

Did you know that accounts receivable can be sold? See here.

Is it possible to reverse the decision?

It happens that the court cancels the decision to collect the debt.

The reasons are:

- circumstances that are important to the case were presented incorrectly;

- no evidence;

- false documents, etc.

A court decision can be canceled not only for formal reasons, but also in accordance with the laws of the Russian Federation.

Pre-trial work of a lawyer for debt collection in an arbitration court

| Collection of information about the debtor and his financial situation | From 11 000 |

| Work to clarify the circumstances of debt formation | From 9 000 |

| Collection of additional documents and facts for use at the court hearing | From 10 000 |

| Work on pre-trial settlement of the issue | From 12 000 |

| Representation of the client in government bodies | From 8 000 |

| Involving law enforcement officers in cooperation | From 11 500 |

First steps

Debt collection in arbitration court is carried out in accordance with a certain procedure. An entrepreneur needs to know what documents are required for the application. It is also important to correctly draw up and timely submit a claim demanding repayment of the debt.

Preparation of papers

At the initial stage of collection, it is necessary to prepare a certain package of papers. It must include documents that confirm the existence of a debt of one person to another. The contents of the set may vary.

But most often you need:

- agreement between the parties;

- acts of acceptance and transfer of goods sold;

- invoices;

- invoices;

- work acceptance certificates;

- pre-trial claims;

- other papers.

The plaintiff needs to file a claim in the arbitration court, demanding to collect the debt from another entrepreneur.

In addition to the application, you must have:

- power of attorney;

- confirmation of the fact that the defendant was notified of the filed claim;

- a certificate certifying the registration of a person as an individual entrepreneur;

- extract from the Unified State Register of Legal Entities for the plaintiff and defendant;

- a receipt confirming that the state duty has been paid.

There are several options for filing an application with the court. You can bring it yourself to the authority or send it by mail.

An entrepreneur can also log into the “My Arbitrator” system and submit an electronic version of the claim, which saves time and effort

How to properly file a claim

A claim is an option for pre-trial proceedings between persons. It is needed to notify the debtor of the need to pay for services or goods.

The document is drawn up in accordance with a certain scheme:

- The main point is a complete description of the main points of the contract between the parties, which provides for the supply of goods or provision of services.

- It is important to point out that, by agreement of the parties, after shipment of goods or provision of services, payment should have been made within a certain period.

- It is necessary to characterize the situation that arose during the cooperation (the goods were delivered and accepted, but the funds were never received).

- It is important to indicate the legal acts according to which cooperation is regulated.

- It is necessary to specify the requirements for the debtor.

- At the end of the document, the consequences that will occur if the requirements specified in the claim are ignored. This may include charging a penalty, a fine, going to court, etc.

Documents for the arbitration court for debt collection

and the intention of the creditor to apply to the arbitration court if the debt is not repaid in a timely manner. Typically the claim is sent by registered mail with return receipt requested. The receipt for sending the claim must be kept so that it can later be attached to the statement of claim. The claim can also be sent by fax, but then the copy of the transmitted text, which remains with the creditor, indicates the surname of the person who sent the claim, the date and time of transmission, as well as the position and surname of the person who accepted the claim.

Important nuances when filing a claim in court for a debt

1. Receipt.

A receipt is a two-sided document that is concluded between the parties to a transaction. To receive a debt, first of all, it is necessary that the receipt be drawn up correctly and have legal force. If any doubts arise about its authenticity or the voluntariness of the conclusion of the contract, the statement of claim to the court regarding the debt will be declared illegal, and the creditor will be forced to pay legal costs.

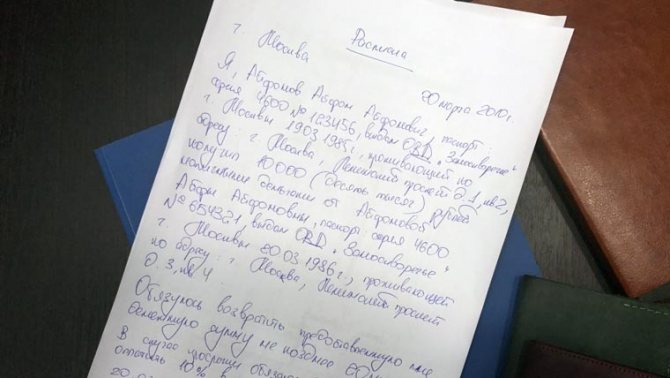

The receipt is issued according to certain rules:

- This document is always drawn up by hand and not typed on a computer. The borrower's handwriting is one of the main evidence of the authenticity of the transaction between the parties.

- The receipt must contain the date of preparation, the date of receipt of borrowed funds and the period of repayment of the debt.

- It is better to write the month in words and write the year as a four-digit number.

- Of course, no corrections in the text are allowed.

- Information about both the borrower and the lender must be provided in full. You need to write not initials, but your full name and patronymic, not only your birthday, but also all your passport details.

- The amount is indicated both in numbers and in words, and the borrower must sign the document.

- The number should ideally be written in numbers, the month in words, and the year in a four-digit number.

When signing the receipt, third parties must be present who act as witnesses in court. If you have one or two witnesses, then future disputes will be eliminated. The receipt must indicate the full name, passport details and contact information of witnesses along with their signatures.

2. Jurisdiction.

The statement of claim must be filed with the court located at the place of residence of the defendant or at the address of the company if the legal entity has a debt.

It happens that the creditor does not know the location of his debtor at the moment. In such a situation, the application should be submitted at the location of the borrower's property or at his last known place of residence.

If disagreements arise about a debt not related to business activities, the statement of claim is sent to a court of general jurisdiction (district or world). If at least one of the participants is a legal entity, the issue is considered by the arbitration court.

3. Limitation periods.

The limitation period is three years, as stated in Article 196 of the Civil Code of the Russian Federation. When filing a claim in court about a debt, remember the time frame. During this period, your task is to have time to go to court.

The limitation period is counted from the day following the day on which the contractual condition should have been fulfilled. In other words, if the payment was supposed to be received on a specific day, then the limitation period begins to count from the next day.

If the borrower has partially repaid the debt, then from that time the period for filing a claim in court is recalculated. At the same time, if the agreement stipulates payment of the debt in installments, then the limitation period applies to each of them separately.

You can file a claim with the court about the debt even after the allotted period. The court is obliged to accept such an application for consideration. But if the defendant claims that the statute of limitations has expired, the court will certainly refuse to satisfy the claims.

4. Example of interest calculation.

The amount of debt is calculated taking into account the rules specified in the Decree of the Supreme Arbitration Court of the Russian Federation No. 5451/09 dated September 22, 2009.

The amount of debt is 30,000 rubles. 00 kop., including VAT 20% 5000 rub. 00 kop.

The period of delay is from 05/16/2017 to 09/29/2018. 494 (days)

Refinancing rate: 7.75%

Total interest for the period = (30000) * 494 * 7.75/36000 = 3190 rub. 42 kopecks

5. State duty.

Any statement of claim to court regarding a debt requires payment of a state fee. Its size depends on the type of court and the legal form of the plaintiff (individual or legal entity).

Be that as it may, the state duty is in any case calculated as a percentage of the debt amount. The exact amount of the payment can always be found in the Tax Code of the Russian Federation or use a special calculator for calculation.

6. Period for consideration of the claim on the merits.

After submitting an application to the court, it is accepted for consideration. The statement of claim to the court about the debt remains in this status for five working days, after which it is either accepted or rejected.

From the moment the statement of claim is accepted for consideration until a decision is made on it, it takes from one to two months.

After the judge makes a decision in the case, the losing participant has the right to appeal it to a higher authority. 30 days are allotted for this.

The appeal period starts from the moment when the participants in the process are given the reasoning part of the court decision.

Don't forget about the state duty

Since the requirement to collect interest for the use of someone else’s money is a property claim, when filing a claim in court, it is necessary to pay a state fee for its consideration. The amount of the state duty depends on the value of the claim (that is, on the amount of your claims).

For cases heard in courts of general jurisdiction by magistrates, the state fee is paid in the following amounts:

- when filing a claim of a property nature subject to assessment, with the price of the claim:

- up to 20,000 rubles - 4 percent of the claim price, but not less than 400 rubles;

- from 20,001 rubles to 100,000 rubles - 800 rubles plus 3 percent of the amount exceeding 20,000 rubles;

- from 100,001 rubles to 200,000 rubles - 3,200 rubles plus 2 percent of the amount exceeding 100,000 rubles;

- from 200,001 rubles to 1,000,000 rubles - 5,200 rubles plus 1 percent of the amount exceeding 200,000 rubles;

- over 1,000,000 rubles - 13,200 rubles plus 0.5 percent of the amount exceeding 1,000,000 rubles, but not more than 60,000 rubles (clause 1 of Article 333.19 of the Tax Code of the Russian Federation).

Bank details for paying state fees can be obtained in court. As a rule, they are posted in front of the office on an information stand. In addition, details for paying state fees are usually available on the official websites of the courts.