Navigation

Bankruptcy is a fairly common, but most extreme way to collect debt from a debtor. Creditors resort to bankruptcy proceedings in situations where all other methods of recovering funds have been tried, and the debtor still avoids repayment. Another reason is a change in the financial condition of the borrower. Let's understand the intricacies of the procedure.

Who files for bankruptcy and in what case?

In accordance with paragraph 1 of Art. 7 Federal Law No. 127 of October 26, 2002 (as amended on July 31, 2020) “On Insolvency (Bankruptcy)” the following have the right to file a bankruptcy petition:

- Debtor. A person obligated to perform a certain action in favor of another person - to provide services or repay a debt.

- Competition creditor. A financial institution for monetary obligations, with the exception of authorized bodies and citizens to whom the debtor is responsible.

- Authorized bodies. The federal executive body of the Russian Federation, executive bodies of the constituent entities of the Russian Federation and local government bodies with the corresponding powers.

- An employee or former employee of a debtor with a legitimate claim for payment of wages and (or) severance pay.

Attention! The applicant has the right to propose the candidacy of an arbitration manager who will take over all management of the business for the period of the bankruptcy procedure. It is important to be the first to submit an application proposing a loyal candidate.

In Art. 9 Federal Law No. 127 “On Insolvency (Bankruptcy)” specifies cases in which the debtor is obliged to apply to the Arbitration Court to declare himself bankrupt:

- impossibility of fulfilling all loan obligations - repaying a debt to one creditor forces late payments to another bank;

- property foreclosure significantly complicates or completely paralyzes economic activity;

- presence of signs of insolvency and (or) lack of assets;

- the presence of arrears outstanding for three months in terms of wages, severance pay and other payments due to employees and former employees in the amount and manner established on the basis of labor legislation.

Russian legislation determines the time limit for a debtor to file an application for declaring himself bankrupt equal to one month from the date of discovery of signs of bankruptcy.

Attention! A late application for liquidation is fraught with legal consequences in the form of an administrative fine. In accordance with paragraph 5 of Art. 14.13 of the Code of Administrative Offenses of the Russian Federation for citizens - from 1,000 to 3,000 rubles, for officials - from 5,000 to 10,000 rubles.

What is voluntary bankruptcy

In addition to the forced bankruptcy procedure, the debtor has the opportunity to declare himself insolvent on his own.

Voluntary bankruptcy is an independent declaration of a person who owes money about his own financial insolvency, that is, bankruptcy.

In accordance with paragraph 2 of Art. 65 of the Civil Code of the Russian Federation, any legal entity with the form of a commercial organization or consumer cooperative has the right, by mutual agreement with the lender, to declare itself bankrupt and begin the self-liquidation procedure.

Attention! Not all persons have this right, which creates a certain difficulty in resolving the financial issue.

The voluntary bankruptcy procedure includes several stages:

- Liquidation decision.

- Notification of creditors about voluntary recognition of bankruptcy.

- Obtaining consent from the financial institution.

- Official declaration of bankruptcy.

- Carrying out liquidation activities.

- Completion of the procedure.

Attention! According to paragraph 2 of Art. 149 Federal Law No. 127 “On Insolvency (Bankruptcy)” requires 5 days to remove a legal entity from the state register from the moment the judicial authority issues a determination to complete proceedings on a competitive basis.

Pros and cons of obtaining financial insolvency status

The obvious disadvantages of financial insolvency status are the consequences of bankruptcy of an individual. First of all, you need to be prepared for the fact that the procedure is not free. The amount of expenses may seem significant to many. Secondly, during the conduct of the case, the citizen is deprived of the right to:

- conduct transactions for the purchase and sale of property, pledge it, and issue guarantees. If a person is declared bankrupt, he completely ceases to dispose of the property constituting the bankruptcy estate;

- travel abroad (at the discretion of the court);

- manage money in bank accounts. The citizen is obliged to hand over all bank cards to the financial manager.

A person declared bankrupt is obliged to report this fact to the bank during the next 5 years when applying for a loan or loan. For 3 years he is deprived of the right to hold any positions in the management bodies of a legal entity and to participate in any way in this process.

The disadvantages of personal bankruptcy may seem significant.

However, many voluntarily undergo the procedure for the main purpose. When a person is declared bankrupt, the following information is provided by the legal portal BukvaPrava https://bukvaprava.ru/

- satisfaction of creditors' claims for monetary obligations, for payment of obligatory payments (except for taxes, fees, fines). Claims can be made against a citizen only within the framework of a bankruptcy case;

- accrual of penalties and interest on obligations;

- effect of enforcement documents on property penalties.

In other words, a citizen who has been declared bankrupt must not fulfill the demands of creditors who remain unsatisfied after the sale of his property.

What are the requirements for filing an application for bankruptcy?

To avoid gross errors, when filling out an application for bankruptcy recognition, truthful information without distortion is indicated. If false data is detected, the procedure is refused.

What should be included in the application

The application must be submitted in writing. If the applicant is a legal entity, then the document is signed by the head of the enterprise or a person with appropriate authority.

In Art. 39 Federal Law No. 127 “On Insolvency (Bankruptcy)” reflects the information required to be indicated in the bankruptcy application:

- Name and address of the judicial authority for filing the document.

- Full details of the debtor organization: legal and postal addresses, registration data.

- Creditor details: name of organization or full name. and the address of the applicant citizen.

- The amount of debt with a legal document confirming this obligation.

- Request for the candidacy of an arbitration manager and his address to the SRO.

- Signature and date.

A copy of the application with a list of documents attached to it remains with the debtor.

Attention! Creditors or employees to whom the company owes money have the right to combine their own claims into a single application and submit it in the manner prescribed by law.

The application is supplemented with the following documents:

- personal documents: copy of passport, TIN, SNILS, pension certificate;

- credit documents: lending agreements, contracts for the purchase of goods or services with deferred payment;

- information about income;

- information about financial situation: documents for dependents, certificate of marriage or divorce;

- an inventory of assets with their approximate value and a list of existing bank accounts;

- a list of creditors indicating the amount of debt in each case;

- receipt of payment of the state duty and payment for the services of the financial manager;

- a certificate from the Federal Tax Service on the presence or absence of the debtor’s individual entrepreneur status.

Depending on the status and position of the debtor, the list of documents differs.

Attention! If a judicial filing for bankruptcy is mandatory for the applicant, then the lack of applications is not an obstacle to initiating proceedings. A request for missing documents from the applicant is possible later.

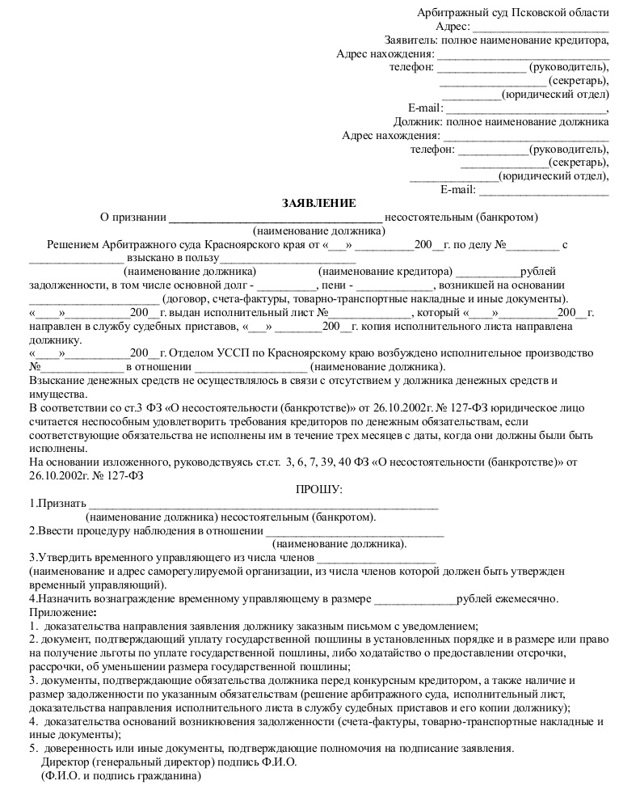

Sample bankruptcy petition

To avoid refusal, it is important to take a responsible approach to preparing the submitted documents, including filling out the application by the debtor. It is recommended to use a sample document posted on many official legal and banking portals.

An example of a bankruptcy petition looks like this:

Important! Filling out the application incorrectly, lacking the necessary attachments, certificates, and certificates can delay the production process.

How to prepare applications for your application yourself

When talking about how to start bankruptcy proceedings for an individual on your own, you cannot ignore the list of documents that the legislator requires to be attached to the application. After all, to successfully apply to the arbitration court, just filing for bankruptcy of an individual in 2020 is not enough - the debtor will need to collect a package of documents confirming the fact of his inability to pay his existing obligations and allowing him to determine the period of time during which he did not pay his bills.

This is also important to know:

What consequences await the debtor in case of bankruptcy of individuals

The list of documents that must be attached to the application (if any) is established by the provisions of paragraph 3 of Art. 213.4 Federal Law No. 127. These include, in particular:

- an inventory of the applicant's assets and copies of certificates confirming the fact that he has ownership rights to such assets;

- list of creditors;

- documents confirming the existence of debt;

- extracts confirming the presence/absence of the applicant’s entrepreneur status;

- other documents, the list of which varies depending on the circumstances of a particular situation.

Debts to each creditor or lender

List what you owe and to whom. Debts can be of any kind; the main thing is to have a document supporting the information. Moreover, you also need to indicate such debts that will not be written off from you, but the court must know about their existence.

For example, if you pay alimony, indicate this fact and the amount of alimony. If you have caused damage to the health of a citizen and are paying him money for treatment, also indicate this fact, etc.

To simplify your task, you can find a sample bankruptcy petition for an individual online and look at examples of creditors in it.

Justification for bankruptcy

Declaring bankruptcy of individuals always has good grounds.

Therefore, you need to briefly but specifically outline the circumstances that led you to make this decision.

The court must be convinced that you have not been able to pay your debts for three months. Another condition is that you yourself tried to establish contact with the banks and convince them to reconsider your payment schedule.

If the banks did not cooperate, and your income fell so much that it became impossible to pay, you must explain why this happened and provide evidence.

For example, you received an injury that caused you to lose your ability to work. In this case, attach documents from the doctor and tell about this episode in the application.

If you had a high salary level, but there were layoffs at work that you fell under, explain that you were unable to find a new job with such a salary, although you joined the labor exchange, trying to somehow improve your situation. There may be other reasons, the main thing is to be able to prove them.

Current litigation and decisions

If there are any legal proceedings against you, or you are complying with any court decisions, list them. After the bankruptcy decision is made and during the restructuring, all of them will be suspended. The exception is alimony payments, compensation for harm to life and health, etc.

Bank accounts and deposits

If you have money in banks, provide a list of the accounts in which they are stored and add copies of agreements to the appendices.

This is also important to know:

The bankruptcy trustee for bankruptcy of legal entities: who is he and his functions

An application for bankruptcy of individuals must necessarily contain this information, since concealing it may end disastrously for you, because the financial manager will still discover this fact.

Of course, one of the disadvantages of bankruptcy is that if you have these financial “excesses,” the court will oblige you to cover your debts or part of them with them, but hiding the existence of accounts is jeopardizing the possibility of filing bankruptcy and getting rid of debts that you will not be able to do anyway pay.

Property

As with bank accounts, do not try to hide assets.

Concealing property can be regarded as an attempt to carry out a fictitious bankruptcy, and this is already a criminal liability.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Make a detailed inventory and enter there not only the property that you have in Russia, but also that which is located outside its borders (if any).

Property can be movable and immovable. As a rule, the fact of the existence of property is confirmed by certificates of state registration of property.

Total debt

A bankruptcy claim for an individual must contain information about the total amount of debt as a justification for your bankruptcy.

SRO of arbitration managers

According to the Law on Bankruptcy of Individuals (2015), the application must contain the name of one of the organizations of arbitration managers. The court will select from it a financial manager for your trial.

Applications

The list of applications that must be present in the general package of documents is reflected in the law on bankruptcy of individuals. The sample statement of claim presented on our website will help you understand the variety of applications.

The main sections of the applications include the following:

- Documents of the borrower about his personality, marital status, children and status as an individual entrepreneur;

- Information about the borrower’s debts and about the creditors who provided funds: private individuals can also be indicated here, and not just credit organizations;

- Information about the borrower’s income and finances for three years;

- Inventory of property with the attachment of relevant papers;

- Medical certificates, documents recognizing the borrower as unemployed or disabled, documents on guardianship, documents on transactions in amounts exceeding 300 thousand over the last three years;

- Receipts for payment of state fees and labor of the financial manager.

Date, signature

Place a date and signature at the end of the application.

After completing the collection of papers and writing the application, you need to file a bankruptcy petition for an individual in court.

Since the process of writing an application and collecting papers is quite labor-intensive and requires attention, we offer you applications to the court.

Bankruptcy of individuals is not just a formal procedure, therefore the absence of certain applications or positions in the application may lead to the fact that the case simply will not be considered.

How and where to file an application for bankruptcy of a citizen

Bankruptcy refers to a legal procedure. Therefore, an application to begin the process is submitted to the Arbitration Court at the place of registration or actual residence of the debtor.

The following methods for submitting documents are provided:

- Personal visit. The applicant submits documents to the secretariat of the Arbitration Court.

- Through the debtor's legal representative.

- By post. By registered mail with a mandatory list of attachments.

- Through the official service of the Association of Arbitration Courts of the Russian Federation.

Note: The method of filing an application for bankruptcy is chosen by the debtor independently.

What else is required when filing for personal bankruptcy?

Applying requires money. This will turn out to be a not so small amount. Before an individual sits down to complete the necessary documentation, it is worth setting aside about 26 thousand rubles for the procedure.

A citizen will need to pay for the following list of services provided by government representatives:

- state fee of 300 rubles;

- deposit to the account of the arbitration court, in which the procedure for reviewing documents and possibly recognizing bankruptcy will take place - 25 thousand rubles (it goes towards payment for the services of the debtor’s financial manager).

This is the standard amount expected to be paid. But sometimes there are deviations from the mandatory rules. Among them are: a deferment from payment, which can be obtained by filing a petition with the court. This can only work if payment is delayed until the first trial date. The petition can be taken into account if the amount has been paid by the debtor at least half.

Sometimes judges decide to accommodate citizen borrowers who submit an application

If any of the procedures have not been paid by the beginning of the court hearing, the case will be suspended. According to data provided by the Judicial Department of the Supreme Court of the Russian Federation, about a quarter of all cases were suspended for this reason. Therefore, it is important to prepare all funds before the start of the bankruptcy procedure, since otherwise all the time spent collecting documentation, completing it and waiting for certificates may go down the drain.

Filing an application to declare an individual bankrupt is a difficult and painstaking process that requires close attention on the part of the person filing the claim. Collecting documentation and filling out an application, taking into account all the nuances, is a lengthy stage. The citizen will also have to wait when the court begins to consider the application, because the queue cannot be called short. That is why any little thing can stand in the way of approval of the application. Only a painstaking approach and attention to detail will help achieve the desired goal - being declared bankrupt.

0

Author of the publication

offline 17 hours

What to consider during voluntary bankruptcy

When starting proceedings voluntarily, the tax service must first be notified of the liquidation. The debtor sends information to the inspectorate about the composition of the liquidation commission, whose role is most often the founders of the enterprise. At the same time, the bankruptcy decision is published and creditors are notified. The procedure ends with the preparation of a liquidation balance sheet, which is also submitted to the tax office. After 5 days, the liquidator is issued a certificate of termination of the organization’s activities.

Documents for bankruptcy of a citizen

The list of applications for declaring insolvency is impressive and is compiled individually for each situation. As a standard, an individual’s bankruptcy application must be submitted:

- Notifications that all creditors named in the claim have received copies of the papers filed with the court;

- Receipt of paid duty;

- Confirmation of the existence of debt, agreements with creditors;

- Papers indicating the reason why the debtor cannot fulfill his obligations;

- Copies of all documents on monetary transactions for transactions over the past three years;

- Insurance company certificate (copy);

- Certificates of deposits, deposits, accounts;

- A copy of the certificate from the Federal Tax Service, if the debtor is registered there;

- Inventory of property;

- Copies of papers on ownership rights to property;

- Papers about marital status (including a copy of the marriage contract, if any), the presence of minor children;

- An extract from the register, if the debtor is a shareholder;

- Data on income and tax payments for the last three years;

- Papers confirming the lack of employment and attempts to get a job officially (as appropriate);

- A copy of the court decision on the division of property, if there was such a fact.

Additionally, any documents relating to the financial insolvency of the borrower are attached.

Consequences of declaring a debtor bankrupt

After the procedure for considering the submitted application for liquidation, the judicial authority, on the basis of current legislation, makes one of the following decisions:

- Declares the debtor bankrupt. At the same time, the court determines the date for opening bankruptcy proceedings in the case.

- Notifies about the absence of signs of bankruptcy and refuses.

- Determines measures for the financial recovery of the debtor.

- Appoints an external manager.

In 2020, the bankruptcy procedure is still regulated by Federal Law No. 127 “On Insolvency (Bankruptcy)” and is carried out on an individual basis.

Step-by-step instructions for filling out the application

Like any procedural document, an application to declare a citizen bankrupt consists of three consecutive parts:

- Address – data of the court, plaintiff and defendant;

- Motivation - description of the situation with links to applications, characteristics of debt and property;

- Petition - specific requirements, in particular, assignment of insolvency status, appointment of an insolvency practitioner.

An example of a claim for bankruptcy is presented below, but first we will take a closer look at what exactly to write in the motivation part.

List of debts and loans

It is necessary to mention all the debt that an individual has at the time of filing a claim: debts to banking organizations, citizens, alimony, to the state, for housing and communal services, and so on.

To declare bankruptcy, the amount of debt must be more than 500,000 rubles or more than the value of all property that belongs to the debtor. Consult with a qualified attorney before taking any decisive steps.

All information mentioned must be proven by attached documents, for example, bank agreements, promissory notes, otherwise a refusal will follow due to the unreasonableness of the requirements.

Justification for bankruptcy

An emphasis is placed on the citizen's difficult financial situation, indicating the reasons for its occurrence. The argument must be weighty so that the court does not suspect the debtor of deliberately worsening his financial status. For example, a long-term illness with hospitalization, loss of ability to work, staff reduction or liquidation of the enterprise where the debtor worked, fire, etc.

Current litigation

In the event that legal proceedings have already been opened regarding the problem debt, this is also indicated in the application with a mention of the details of the case. This is an important point, since according to the law, during the period of consideration of the bankruptcy of an individual, collections under writs of execution are suspended.

If earlier attempts were made to resolve issues with creditors amicably, for example, asked for debt restructuring or credit holidays, this must also be indicated by attaching evidence.

Accounts and deposits

Data on income, existing deposits and accounts must be displayed in full and supported by relevant financial certificates. All transactions that the citizen has made over the past three years must be indicated if they involved amounts over 300,000 rubles. Attached are contracts, checks, invoices.

Property

Complete information about the real and movable property of the debtor must be indicated. We are talking about property, the right to which is confirmed by a certificate of state registration and other documents. This includes even property located outside the Russian Federation.

An attempt to hide property is regarded as fraud with the registration of fictitious bankruptcy and entails criminal liability.