Signs of a crisis in a company

Main signs of bankruptcy:

- the amount of debt on loans exceeded 300 thousand rubles, not counting penalties and fines;

- the company does not make current mandatory payments for 3 months;

- arrears in wages and benefits.

Additional signs of insolvency (bankruptcy) of a legal entity:

- increase in accounts receivable;

- change in the company's cash balance;

- delay in payments to investors;

- the emergence of conflict situations in the enterprise.

For a company, its own bankruptcy can be an opportunity:

- deferment of loan payments:

- debt refinancing;

- protection from unfair competition;

- reorganization.

For a creditor, the debtor's bankruptcy is sometimes the only way to force him to fulfill his overdue obligations, at least through the sale of property.

What documents are required?

The procedure and consequences of declaring an individual bankrupt are described in the Federal Law “On Insolvency”. It states here that to initiate this process, certain documents must be prepared. The applicant to the court may be the direct debtor, government agencies, private creditors or banks.

To begin the process, the following papers are prepared:

- a correctly drawn up statement of claim demanding that a specific citizen be declared insolvent;

- documentation confirming that the citizen has debts, and this includes various contracts, receipts or court decisions;

- papers confirming that a person is engaged in entrepreneurial activity or officially works in a company;

- list of all creditors;

- a list of debtors who do not return funds to the citizen;

- information about what property belongs to the debtor, and for this purpose information from Rosreestr and other government agencies is used;

- an extract from the company register, if the person is a member of any company;

- certificates and other papers with the help of which a citizen’s income for three years is determined, and this includes not only the 2-NDFL certificate, but also documents from the Federal Tax Service, Pension Fund and other funds on the payment of taxes and insurance contributions;

- certificates from banks where a person has accounts, since with their help it is determined how much money is on deposit with a citizen;

- information on transactions carried out within three years, and their subject must be real estate, securities or vehicles, and the value of such transactions must exceed 300 thousand rubles;

- if the debtor is unemployed, then a corresponding certificate from the employment service is required;

- If a citizen is officially married to a woman, then a marriage certificate is prepared.

Additionally, the court may require documents for the debtor’s children or dependents. This information allows you to understand how much income a person should have so that he can support his family. In this case, the consequences of declaring an individual bankrupt will not be negative for all family members.

Start of the process

An application for insolvency (bankruptcy) of legal entities may be submitted to the arbitration court by:

- executive body of the debtor company;

- owner or shareholders of the organization;

- creditors of the enterprise;

- tax office or social funds;

- prosecutor.

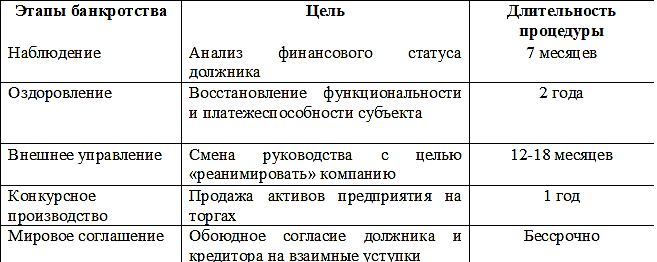

Within 3 months after filing the application, the court decides to initiate bankruptcy proceedings. It is carried out in several stages, however, at any of them it can be terminated under certain conditions. In this case, a settlement agreement is signed between the participants in the process. Stages of the bankruptcy procedure:

First stage

The bankruptcy procedure is regulated by Federal Law No. 127-FZ “On bankruptcy (insolvency) of legal entities.” The initial stage of the process is observation. By decision of the arbitration court, a manager is appointed for this time. The principles of its work are objectivity and an unbiased attitude towards all participants in the process. During observation:

- the company's property and financial assets are analyzed and their safety is ensured;

- a list of creditors, employees and other persons to whom the enterprise has debt is compiled;

- the amount of debt obligations is calculated;

- a register of loan agreements is compiled;

- ways to get out of the critical situation are being sought.