Procedure for appointing a liquidation commission

As mentioned earlier, the commission is appointed by the body that made the decision to liquidate the organization.

The initiator of liquidation may be the founder or participant of the organization, as well as its director or other body authorized to do so by the constituent documents. Such a decision can also be made by the court if a claim was filed on one of the grounds listed in paragraph 3 of Art. 61 Civil Code of the Russian Federation. In any case, the authorized person must make a decision on the appointment of a liquidation commission. A sample of such a document will be given later in the article.

This decision can be made by the management body together with the decision on liquidation or issued subsequently in the form of an order (instruction), which indicates:

- information about the organization - name, address, registration data, other details;

- date and number of the act;

- the basis for issuing the order is “in connection with the decision to liquidate the organization”, indicating the details of the relevant decision;

- composition of the liquidation commission;

- terms and procedure of the commission;

- persons who are entrusted with the execution and control over the execution of the order;

- position and signature of the person who issued the order.

The above powers and duties are assigned to the commission from the moment specified in the order, or from the moment this act comes into force.

As a rule, members of the liquidation commission are:

- Head of the organization;

- founders or participants or their representatives;

- representatives of the organization's employees.

If a member of the organization is a municipality, a subject of the Russian Federation or the Russian Federation, the commission must also include representatives of the relevant authorities.

order on the creation of a liquidation commission (sample)

Order on liquidation of an enterprise

Liquidation of an enterprise is a complex process that includes performing standard actions: forming the company’s balance sheet, signing orders for the dissolution and dismissal of employees.

Writing an administrative act

The sample order does not have a form generally established by law, but nevertheless includes some standard blocks:

- document header: name of the administrative act, name of the company (must match the name of the enterprise that is being liquidated), serial number of the order;

- the reason for the termination of the organization;

- time to liquidate the organization (usually does not exceed one month);

- appointment of a liquidation commission with the names of each of its members (ensure the implementation of all legal procedures), selection of a chairman (control of the process).

The order is signed by the head of the enterprise. He also indicates the date of writing the order; it is from this date that the period for liquidation of the enterprise is counted.

It is also necessary to submit an application to the tax service to terminate the company's activities.

The life cycle of a legal entity is inextricably linked with the economic situation in the country and begins with the decision to create it and ends with liquidation.

The sequence of actions for the last stage is established:

- Civil Code of the Russian Federation (Part 1),

- Federal Law of December 26, 1995 No. 208-FZ “On Joint Stock Companies”,

- Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”,

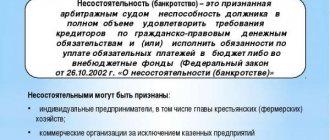

- Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”.

But the current legislation does not regulate all issues arising during the liquidation of an organization. Let's try to understand this procedure.

The procedure for forming a liquidation commission and appointing a liquidator

The decision to liquidate a business entity is made by the founders of the legal entity or another body specified in the charter, or the sole participant of the company.

- Protocol of the liquidation commission - .

- The decision of the sole participant of the LLC on liquidation - .

Notification of such a decision must be certified by a notary and, within three working days, sent to the registration authority (tax authority) at the location of the legal entity, in order to enter information about the created commission in the Unified State Register of Legal Entities.

In this case, the official of the registration authority issues to the representative of the organization a certificate of entry and an extract from the Unified State Register of Legal Entities.

Sample notification - .

All forms of documents submitted to the tax service can be found in the Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/ [email protected] “On approval of forms and requirements for the execution of documents submitted to the registration authority for state registration of legal entities , individual entrepreneurs and peasant (farm) farms.”

The same regulatory legal act invalidated the Decree of the Government of the Russian Federation of June 19, 2002 No. 439 “On approval of forms and requirements for the execution of documents used for state registration of legal entities, as well as individuals as individual entrepreneurs.”

The bank must be notified of the liquidation procedure in order to enter the relevant information and information about the chairman of the commission into the business entity’s registration card.

The liquidator of the organization acts on the basis of the charter or decision

On March 14, 2012, the LLC filed an application with the arbitration court to declare the company bankrupt.

On March 15, the LLC enters into a transportation contract with a third-party organization. On the LLC side, the agreement is signed by the liquidator, not the general director of the company. Is this agreement valid and what are the powers of the liquidator? Having considered the issue, we came to the following conclusion:

The liquidator, exercising powers to manage the affairs of the company in the process of liquidation of this company, on the basis of the decision of the general meeting of participants (sole participant) of the company on his appointment to this position, has the right to make transactions on behalf of the company, including entering into agreements subject to generally established requirements and restrictions.

In accordance with paragraph 1 of Art. 20 of the Federal Law of 08.08.2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” (hereinafter referred to as Law N 129-FZ), the founders (participants) of a legal entity or the body that made the decision to liquidate the legal entity are required to inform the registering body at the location of the legal entity being liquidated (hereinafter referred to as the registering authority) that the legal entity is in the process of liquidation, by sending a notification of a decision to liquidate the legal entity by a person authorized by them or by him, who has the right to act on behalf of the legal entity without a power of attorney with such a decision attached to the registration authority in writing within three working days after the date of the decision on liquidation.

According to paragraph 3 of Art.

A commission member can be released from property liability only if he can prove his innocence (for example, if he did not participate in the vote or voted against the issue under consideration).

>Who can be the liquidator during the liquidation of an LLC?

Who can be the liquidator during the liquidation of an LLC? A comprehensive answer to the question posed is contained in the article offered to readers.

>Liquidator of LLC, decision on appointment - sample

According to Part 3 of Art.

Thus, the transfer of funds using the electronic signature of the former director was recognized as a void transaction (ruling of the 1st Arbitration Court of Appeal dated December 29, 2014 in case No. A/2013).

Let us remind you that according to Art. 63 of the Civil Code of the Russian Federation, no longer the head of the LLC, but exclusively its liquidator has the right, on behalf of the LLC:

- represent as a plaintiff or defendant;

- sign powers of attorney;

- perform other legally significant actions (clause 12 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation “Review of the practice of resolving disputes related to the liquidation of legal entities (commercial organizations)” dated January 13, 2000 No. 50).

IMPORTANT! The former manager is obliged, upon request, to hand over to the liquidator all the documents, seals and stamps of the enterprise in his possession. Failure to comply with this requirement may be challenged in court.

(hereinafter referred to as Law N 129-FZ) the founders (participants) of a legal entity or the body that made the decision to liquidate the legal entity are required to inform the registration authority at the location of the liquidated legal entity (hereinafter referred to as the registration authority) that the legal entity is located in liquidation process, by sending a person authorized by them or him, who has the right to act on behalf of a legal entity without a power of attorney, notice of the decision to liquidate the legal entity with the attachment of such a decision to the registration authority in writing within three working days after the date of the decision on liquidation .According to clause

Composition of the liquidation commission, its chairman

The liquidation commission is formed by issuing a local act containing a list of powers transferred to this body.

The current legislation does not define the requirements for members of the commission (liquidator), so in practice they are interested employees of the organization - founders, accountants, lawyers, managers.

In addition, the said act determines who will become the chairman of the liquidation commission, who is charged with organizing and monitoring the activities of the entire commission, as well as signing the acts issued by it. The role of chairman is often the former head of the legal entity.

If the liquidation of a legal entity is forced (bankruptcy), the liquidator becomes the liquidator.

The procedure for liquidating an organization is quite complex and confusing for the uninitiated person, which is why there are currently many companies offering relevant services.

Of course, the level of professionalism of such specialized organizations is much higher than that of employees of a liquidated legal entity, but it is also necessary to take into account the increase in financial costs to support their activities.

The tax authority must be notified of the completion of the formation of the liquidation commission (appointment of a liquidator).

A sample of this notice can be viewed.

Current legislation does not distinguish between the concepts of liquidation commission and liquidator, so the choice of body remains at the discretion of the organization. But it is necessary to pay attention that in some cases, in practice, when liquidating limited liability organizations, the tax authorities indicate the need to create a liquidation commission, even if it consists of one person.

Powers of the liquidation commission (liquidator)

So, the decision on liquidation has been made, a liquidation commission headed by a chairman or a liquidator has been appointed, and now it is they who must comply with the procedures defined by law.

The next step is the publication in the journal “Bulletin of State Registration” of a message about the beginning of the liquidation of the organization, containing the following information:

- full name of the legal entity;

- OGRN;

- TIN, checkpoint;

- location;

- details of the decision on liquidation;

- procedure, deadlines, as well as contact information for filing creditor claims.

Based on the Order of the Federal Tax Service of the Russian Federation dated June 16, 2006 No. SAE-3-09 / [email protected] “On ensuring the publication and publication of information on state registration of legal entities in accordance with the legislation of the Russian Federation on state registration” filing an application for the beginning of liquidation through another publication is considered not to comply with the law.

It should be noted that the current legislation does not provide for a period for publishing such a notice, however, the period for filing creditor claims, which cannot be less than two months, begins to run from this moment.

The commission must take other measures aimed at finding and notifying creditors in writing, indicating the deadline for submitting claims. Copies of such notices should be kept by the organization.

The liquidation balance sheet, reflecting the financial condition of the organization, is compiled by the commission after two months from the date of publication. The preparation of such a balance sheet will make it possible to assess the size of the legal entity’s property, its assets and liabilities, accounts receivable and credit, as well as the ratio of these indicators.

The sequence of actions required to draw up an interim liquidation balance sheet is not established by law, therefore it is necessary to be guided by the rules of accounting and reporting.

The chairman of the liquidation commission is obliged to notify the registering authority about the readiness of the balance sheet, and also send the following set of documents:

- application for state registration of a legal entity in connection with its liquidation;

- liquidation balance sheet approved by the persons who made the decision on liquidation;

- receipt of payment of state duty.

- download the application for state registration - .

- download liquidation balance sheet - .

The authenticity of the applicant's signature on the notice and application must be notarized.

Since 2020, organizations have been relieved of the obligation to notify the Pension Fund authorities about liquidation, and a document on the submission of information to this body can be received by the tax authority as part of interdepartmental cooperation.

This set of documents can be sent to the registration authority in one of the following ways:

- the head of the liquidation commission personally;

- a representative with a notarized power of attorney;

- by post;

- in electronic form through the service on the website nalog.ru.

Only after receiving the specified documents does the tax authority make a decision on registering the liquidation of the organization and the tax return must take into account the period of time up to this day, and not until the moment the business entity makes the decision on liquidation.

The activities of the liquidation commission are aimed not at improving the financial condition of the company, but at maintaining the rule of law and respecting the rights and legitimate interests of the company and its creditors during the liquidation procedure, therefore the following, not yet considered, powers can be distinguished:

- collection of receivables;

- management of the organization's property, inventory and assessment of property;

- transfer of funds of a business entity to one account, closing of other accounts;

- protecting the interests of the organization in court;

- issues powers of attorney;

- making decisions on dismissal of employees;

- transfer of organization documents to the archive.

Liability of the liquidator upon liquidation of an LLC

2, Article 62 of the Civil Code, the apparatus that issued the resolution on the liquidation of the LLC is obliged to appoint a liquidation commission. The competent apparatus in making such decisions may be the founders of the company or the meeting of shareholders. As well as the judicial authorities that made a decision to terminate the organization’s activities. The procedure for appointing a liquidation commission is usually prescribed in the organization’s Charter.

After the decision of the competent authority to appoint a liquidation commission, it is vested with all rights to manage the company’s activities. From this time on, the sole executive body of the company is deprived of its rights.

Composition of the liquidation commission

Members of the liquidation commission can be the heads of the organization, founders or participants of the company, as well as directly members of the company’s team. The powers of the head of the liquidation commission include initiating the termination of the functioning of the company, therefore, as a rule, the general director of the closing enterprise plays this role.

The chairman of the liquidation commission: his rights, powers and responsibilities

After the founders of the company have properly executed an order or other document, which will reflect the decision to terminate the activities of the enterprise and indicate the time interval allotted for liquidation, it is necessary to take into account an important nuance. A separate paragraph in this document must include organizational issues related to the appointment of the chairman of the liquidation commission.

After the chairman is appointed, all powers related to the implementation of the company’s activities for this period are transferred to him in accordance with paragraph 3 of Article 62 of the Civil Code of the Russian Federation. In practice, there are often cases when one of the company’s employees or its managers is appointed chairman. This is done to ensure that the organization of procedures related to the liquidation of the company is carried out by a person who is well versed in the internal affairs of the organization.

Powers and responsibilities of the head of the liquidation commission

The liquidator is assigned special functions and powers on the basis of which he will carry out activities and carry out the procedures necessary to terminate the activities of the enterprise in accordance with the current law.

Therefore, the head of the liquidator bears enormous responsibility for the work of the liquidation commission; his duties include signing documents issued by this body.

The head of the liquidation commission takes responsibility for monitoring the work of all members of the commission, as well as for the timely organization and implementation of the following actions aimed at liquidating the organization in accordance with the law (Article 63 of the Civil Code of the Russian Federation):

1. First of all, the registration authority must be notified of the intention to liquidate the enterprise so that the company is excluded from the register of existing legal entities;

2. Place a notice in print media about the planned liquidation of the organization. Including the time frame and in what order applications from creditors containing demands for debt payment will be accepted. The minimum period established for submitting requests should be two months;

3. Try to personally deliver written notices to creditors about the upcoming liquidation of the company;

4. After the allotted time, it is necessary to prepare a liquidation balance sheet. This balance sheet should reflect the tangible and intangible assets and liabilities of the company, contain information about receivables and payables, as well as decisions on the possibility of minimizing them;

5. Depending on the specific situation, the competence of the liquidation commission includes the sale of the company’s property through public auctions. This procedure is resorted to to fulfill the organization’s obligations to creditors;

6. After paying all creditors’ claims, it is necessary to draw up a final liquidation balance sheet reflecting the final state of the organization;

7. If there are funds left at the disposal of the enterprise after paying all obligations, they must be distributed among the founders;

8. To complete the process of liquidating a company, the liquidation commission must submit a corresponding application to the Federal Tax Service. Tax service employees register the fact of liquidation of the company in the Unified State Register of Legal Entities.

Once you receive from the tax authority a registered certificate of liquidation of the enterprise, the organization is officially recognized as liquidated, and the activities of the liquidation commission are automatically terminated.

Responsibility of the liquidation commission

When carrying out the procedure for annulment of an organization, property liability arises from:

- Directly to the organization;

- Business owners;

- Heads of the organization;

- Liquidation Commission;

- Creditors to whom the company owes money.

To answer the question regarding the responsibility borne by the liquidation commission, it is necessary to determine its legal status.

If we are guided by paragraph 3 of Article 62 of the Civil Code, then we can consider the liquidation commission as a body that manages a legal entity. Thus, after the liquidation commission assumes its duties, all functions related to the management of the organization are assigned to it, this also applies to the representation of the liquidated organization in court.

The powers of the liquidation commission are the same as those of the sole liquidator. Based on this, it can be argued that the liquidation commission is a collective management apparatus, and the manager is vested only with functions related to organizational and representative activities.

In order to legally represent the interests of the canceled organization, the participant of the liquidation commission or its head must provide the relevant document. Namely, a recorded decision on approval of the composition of the commission, adopted at a general meeting of company participants (in some cases, a court decision), as well as a protocol that identifies a person vested with a number of powers.

There is a misconception that if the chairman of the liquidation commission also happens to be the former head of this company, then he has privileges and should not provide the above-mentioned documents.

Paragraph 3 of Article 56 of the Civil Code refers to the participants of the liquidation commission as other persons entitled to give instructions that are binding on this legal entity. Based on this, they bear subsidiary liability. A commission member can be released from property liability only if he can prove his innocence (for example, if he did not participate in the vote or voted against the issue under consideration).

Part 1. One of the key issues in the process of liquidating an organization is the issue of liability of the participants/founders of the company, and it is advisable to resolve it before the start of the liquidation procedure.

It should be noted that in the practice of liquidating organizations, consideration of issues of liability of the founders for the tax debts of the liquidated organization is essential, but this type of liability is not the only one. Participants in a liquidated organization are also responsible for improper execution of the liquidation procedure itself. Let’s take a closer look at the second type of liability and try to figure out what awaits the participants/founders of a liquidated organization during liquidation.

The procedure for any enterprise, be it a commercial organization or a non-profit organization, begins with the adoption of decisions by the company's participants on liquidation and the appointment of a liquidation commission/liquidator. The next step is to notify the authorized body of the commencement of the liquidation procedure. In accordance with Federal Law No. 129 “On state registration of legal entities and individual entrepreneurs” (Article 20), the founders of a legal entity are required to notify the registration authority at the location of the legal entity within three working days from the date of the decision. In case of violation of the deadline, Article 14.25 of the Code of Administrative Offenses provides for liability for company participants. So, according to paragraph 3 of Art. 14.25 failure to submit or untimely submission of information about organizations to the tax authority entails a warning or the imposition of an administrative fine on officials in the amount of five thousand rubles.

In addition to late submission of documents to the tax authority, current legislation provides for liability for the provision of false information, for example:

- incorrect indication of the passport details of the founders/liquidator;

- placement of a publication about liquidation in an inappropriate printed publication; for your information: it is necessary to place a notice of liquidation only in the journal State Registration Bulletin (letter of the Federal Tax Service of Russia dated June 16, 2006 No. SAE-3-09 / [email protected] );

- drawing up an interim and liquidation balance sheet that does not comply with the requirements of the law.

In case of submission to the registration authority of information that is knowingly false, but does not contain a criminal offense, these actions may entail a fine on the official in the amount of 5 thousand rubles or his disqualification for up to 3 years (Clause 4 of Article 14.25 of the Code of Administrative Offenses ).

Thus, if the founder/participant of the company made these mistakes accidentally or intentionally, he will face administrative sanctions from the authorized body. It should be noted that these actions cannot serve as a basis for invalidating the liquidation.

Responsibility of the liquidation commission (liquidator)

The powers of the liquidation commission (liquidator) are quite extensive; therefore, a number of strict requirements are provided, for example, regarding the liquidation procedure itself.

Thus, in the event of a violation of the procedure established by current legislation, the guilty person is obliged to compensate losses to the legal entity, as well as to its creditors.

In addition, bankruptcy is a separate and more carefully regulated procedure, therefore the law provides that failure to report signs of insolvency in an organization within ten days entails subsidiary liability of such persons; criminal law also provides for liability for unlawful actions in bankruptcy.

The decision to change a member of the liquidation commission (liquidator) can also be attributed to one of the forms of responsibility. This decision can be made:

- at a general meeting of founders, in connection with poor performance of prescribed duties (documented in minutes);

- by the court when opening bankruptcy proceedings;

- face yourself.

In the event of a change in the chairman of the commission (liquidator), it is necessary to send the specified decision together with a notification to the registration authority; in other cases, no additional notification is required.

Download the notice of change of the chairman of the commission - .

Thus, in the current legislation there are many gaps left in regulating the procedure for the formation and functioning of liquidation commissions (liquidators), but with due care this procedure does not seem so confusing.

Can a liquidator enter into an agreement?

The basis for such liability is the unlawful actions of the liquidator or chairman, which resulted in the exclusion of the organization from the Unified State Register (USR) without applying the bankruptcy procedure provided for by law. The amount of liability is established within the limits of those claims that are presented by creditors of the liquidated organization and which have not yet been satisfied. If the liquidator (chairman) violates the legislation on the economic insolvency procedure, claims against the liquidator or chairman may be brought by authorized bodies within a three-year period from the date of making an entry on the exclusion of a legal entity from the Unified State Register. Article 235 of the Bankruptcy Law specifies that the liquidator (chairman) bears subsidiary liability for the payment obligations of the organization and for obligations arising from labor and related relations, as well as for other expenses established by the Bankruptcy Law.

The resolution of the Supreme Economic Council expands the list of cases in which the liability of the liquidator (chairman) arises. According to this document, the liquidator (chairman) bears property and other liability for actions that caused the property owner (participants or founders) and (or) third parties to suffer damage. In addition, the liquidator (chairman) is responsible for failure to comply with court orders in accordance with the legislation of the Republic of Belarus.

If, for any reason, the liquidator (chairman) does not fulfill his duties or performs them in bad faith, the economic court relieves such liquidator (chairman) from performing his duties. For the same reasons, the liquidator (chairman) has the right to resign independently. Also, according to clause 30 of the Resolution of the Supreme Economic Council, the liquidator (liquidation commission) is responsible for the accuracy of the liquidation balance sheet.

Legislative regulation of the stage

When an organization can no longer continue to operate for any reason, be it the inability to pay debts, lack of profits, or the decision of the co-founders to reorganize or merge with another company, the process of dissolution of the enterprise begins.

The concept of liquidation refers to the complete cessation of the legal and economic activities of the company. So this process is quite difficult.

Often, business owners turn to specialized agencies, which take on most of the work, including communication with government agencies. The rest prefer to sort it out on their own, interacting with the liquidation commission.

Before the company's operations are completely discontinued, its managers are required to pay all their debts, as well as payments to employees, state taxes, etc. This entire process is regulated by civil, tax and labor codes. A tax audit will also be carried out.

After a decision is made to terminate the operation of the enterprise, the founders submit a special appeal to the Unified State Register of Legal Entities, and then a liquidator or liquidation commission is appointed, depending on the number of founders of the company.

After a decision is made to terminate the activity, a liquidation commission is appointed. Subsequently, it will be she who will make all decisions that will be aimed at paying all payments to employees and closing debts. The head of the liquidation committee is also appointed, who will lead and manage all the activities of the meeting.

Procedure for creating a commission

The decision to liquidate the organization can be made by the founders themselves or from the outside (for example, by an arbitration court); subsequently, the formation of a commission begins, the participants of which are selected by the apparatus that made the decision to liquidate the company. Usually this process is stipulated in the company's Articles of Association.

The legislation does not establish any specific composition of the commission, however, there are precedents when the legislation sets clear requirements for the composition.

However, the members of this commission can be the co-founders of the company themselves or employees who were on staff at that time (accountant, lawyers, etc.). This choice is made so that the begun process of closing all the affairs of the enterprise goes as quickly and smoothly as possible, because people who worked in the organization know all the nuances and specifics of the company’s work better than third-party specialists.

After selecting specialists who will take places in such a commission, a special order is drawn up, which will indicate the following information: details of the organization, starting with the address and ending with all its details, the reason for the liquidation of the company, the composition of the liquidation commission and the period given to it to fulfill all obligations, and the same procedure for further work.

After certification of the document, all the rights of the company, as well as responsibility for solving its problems, fall on the shoulders of the commission until the end date of its activities indicated in the order.

How is the chairman elected?

Most often, the role of chairman of the liquidation committee falls to the general director of the company, because it is in the hands of the chairman that further management of the organization, or rather its abolition, passes.

Not only the founder or director of the organization, but also any other employee of the organization can be appointed chairman. Also, in some cases, the position of head of the liquidation commission may be taken by a third party, for example a specialist appointed by an arbitration court, if, for example, we are talking about bankruptcy of an enterprise.

Authority

As mentioned earlier, all rights to manage the company pass into the hands of the liquidation commission, that is, all management functions in all areas of the organization’s activities, starting with the management of finances, inventory, execution of all necessary documents, closure of all accounts, protection of the company’s rights in court proceedings and ending with communication with the staff and third parties (for example, creditors).

All this is done in order to quickly deal with all the company’s accumulated debts, close all loans and pay mandatory compensation to the staff, as well as carry out a number of procedures aimed at closing the company.

The powers of the chairman of the liquidation commission include full supervision of the work of the committee and certification of all subsequent documentation drawn up by it. In fact, all powers of the former director of the company are transferred to the chairman of the committee.

Who can be a liquidator

To liquidate small companies, one liquidator is appointed - usually a former executive director, and when the activities of large companies are terminated, a liquidation commission is appointed, which may include:

- lawyer;

- Chief Accountant;

- founders;

- Executive Director;

- economist.

When liquidating an enterprise with a share of state or municipal capital, the commission usually includes a government representative. If the bankruptcy case of a company was initiated before its liquidation, then the functions of the liquidator are performed by a bankruptcy trustee appointed by the arbitration court.

If the liquidation of a company is initiated before the opening of a bankruptcy case, then a sign of insolvency that allows one to immediately open bankruptcy proceedings under the management of a liquidator is the excess of the amount of creditors' claims over the value of all assets of the company, regardless of the duration and size of delays in mandatory and loan payments.

If you want to find out how to solve your particular problem in 2020, please contact us through the online consultant form or call:

- Moscow.

- Saint Petersburg.

Procedure for the liquidation committee

The functions of the liquidation commission include many different responsibilities. The main functions are listed in the following list:

- Exclusion of an enterprise from the register of existing legal entities.

- Conducting negotiations with all creditors in order to determine the timing of payment of debts and the amount thereof.

- Provide all information about the liquidation balance sheet. This economic indicator includes all the enterprise’s savings, including tangible property, as well as data on all financial debts and decisions on their repayment.

- Sale of company property to pay off debts.

- Direct repayment of all loans and debts and the subsequent preparation of a liquidation balance sheet, which will reflect the state of the remaining capital of the company.

After carrying out the above procedures, the chairman again contacts the Federal Tax Service, after which its employees will register the final liquidation of the organization and exclude its name from the Unified State Register of Legal Entities.

Accordingly, after performing the designated functions, the liquidation commission is dissolved.

Responsibility of the liquidation commission

All members of the liquidation committee may subsequently be brought to subsidiary or criminal liability if they are found to have committed violations such as falsifying documents, concealing some of the company’s financial savings, or neglecting their duty to notify the arbitration court about identified signs of bankruptcy of the company.

Punishment is imposed commensurate with the offense. It is possible to impose such punishment as payment of newly incurred debts or restriction of freedom.

It is also worth saying a few words about the tax audit during the liquidation of an LLC. The Tax Service is also one of the participants in the liquidation process and, as a rule, its employees check the liquidation documents provided by the organization, approve the liquidation balance sheet and make a decision to exclude the legal entity from the Unified State Register of Legal Entities.

In addition, she checks whether all loans and compensation to the organization’s employees have been paid, although, first of all, they are of course interested in whether all state taxes and duties have been paid.

In such cases, the tax service carries out an on-site audit during the liquidation of an LLC. That is, specially authorized specialists from government agencies come to the company itself.

On site, they inspect all documentation, check the results of the liquidation committee’s activities, etc.

The liquidation commission assumes all the powers associated with coordinating the actions of the company to solve all previously set tasks, and the work done by it determines how long it will take to resolve all financial and legal issues, and therefore they have a great responsibility for the most painless resolution of these problems for the company and 3rd parties.

Contacts

building 26, bldg.

The essence of subsidiary measures is that if the company’s own property is not enough to pay off debts to creditors, additional penalties may be imposed on the personal property of the liquidator or members of the liquidation commission at their request;

- when there are signs of bankruptcy and the liquidator deliberately hides or destroys the company’s property, information about it or its location, property rights and obligations, falsifies, hides, destroys accounting or other accounting documentation; improperly satisfies the claims of individual creditors. If these actions lead to damage on a large scale, they entail criminal liability under Art. 195 of the Criminal Code.

The liquidator may be subject to penalties such as a fine, restriction or imprisonment, forced labor, or arrest.

As we can see, the liability of the liquidator during the liquidation of an LLC can be civil and criminal. In the civil case, property damages are compensated or the debts of a legal entity are repaid; in a criminal case, the liquidator may receive a more severe punishment.

Legal basis for the creation of the commission

The legal basis for the creation of a commission is the termination of the activities of a legal entity through its liquidation in accordance with Art. 61 Civil Code of the Russian Federation. Termination of activities can be carried out either by decision of the founders or by force (by a court decision).

On the founders in the event of termination of the organization’s activities by virtue of clause 3 of Art. 62 of the Civil Code of the Russian Federation may be assigned an obligation to resolve certain issues, for example:

- appointment of a liquidator or commission;

- developing a procedure for carrying out liquidation;

- establishing deadlines for liquidation.

When exercising powers to terminate the activities of an organization, the created body is obliged to act in strict accordance with current legislation and taking into account the interests of both the organization’s founders and creditors.

According to paragraph 5 of Art. 62 of the Civil Code of the Russian Federation, if the founders evade the creation of a commission and fail to comply with the regulatory procedure for terminating the activities of the organization, a judicial liquidation procedure may be initiated. Both interested parties (for example, creditors of an organization that cannot pay its obligations) and government agencies can demand that a case be initiated. In such a situation, liquidation occurs in court with the participation of an arbitration manager.

Who can be a liquidator during the liquidation of an LLC?

At the same time, the completion of bankruptcy proceedings in itself does not entail material consequences in the form of releasing the manager from liability. Contrary to the arguments of the representative of the debtor’s manager, who referred to the absence of any mechanism for the execution of a judicial act in the event of satisfaction of the creditor’s claim after the completion of bankruptcy proceedings, bankruptcy legislation does not limit the ability of creditors to satisfy their claims even after the completion of bankruptcy proceedings (clause 11 of Article 142 of the Bankruptcy Law). In addition, the enforceability of a judicial act on bringing the manager to subsidiary liability during the liquidation of the debtor can be achieved by resuming the bankruptcy case after revising the determination on the completion of bankruptcy proceedings according to the rules of Chapter 37 of the Arbitration Procedure Code of the Russian Federation - in accordance with Part 1 of Article 46 of the Constitution of the Russian Federation, everyone is guaranteed judicial protection of his rights and freedoms. The right to judicial protection and access to justice refers to the fundamental inalienable human rights and freedoms and at the same time acts as a guarantee of all other rights and freedoms; it is recognized and guaranteed in accordance with the generally accepted principles and norms of international law (Articles 17, 18; Parts 1 and 2 of Article 46 , Article 52 of the Constitution of the Russian Federation) Procedural norms regulate the procedure for protecting substantive rights and specify constitutional principles. Thus, in particular, the parties to the dispute are given the right to appeal a ruling made based on the results of consideration of an application to hold the debtor’s manager to subsidiary liability (clause 7 of Article 10 of the Bankruptcy Law, Article 188 of the Arbitration Procedure Code of the Russian Federation). Termination by the appellate court of proceedings on a complaint in connection with the liquidation of the debtor makes it impossible to revise the ruling of the court of first instance, thereby violating the rights of the parties to the dispute to judicial protection. Due to the above, as well as by virtue of Articles 7, 8 of the Arbitration Procedure Code of the Russian Federation, both the creditor and the head of the debtor have the right to appeal the ruling of the court of first instance and obtain judicial protection through consideration of the appeal on the merits, regardless of the liquidation of the debtor in connection with his bankruptcy. Similar conclusions were made by the Judicial Collegium for Economic Disputes in relation to the situation of termination of a bankruptcy case: By Decree of the Supreme Court of the Russian Federation dated February 29, 2016 N 306-ES14-7672 judicial acts on termination of proceedings to consider a cassation appeal in a separate dispute on bringing a controlling debtor to subsidiary liability in connection with the termination of a bankruptcy case was cancelled, the case was sent for a new consideration on the merits to the court of first instance with reference to paragraph 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 06.22.2012 N 35 “On some procedural issues related to the consideration of bankruptcy cases.”

The procedure for drawing up and a sample order for the creation of a liquidation commission

To confirm the fact of the creation of the commission, an order is drawn up signed by the head of the legal entity. A sample of this document is available for download on our website.

The order is a local act and therefore must be in writing, signed by the head of the organization and certified with a seal. Responsible employees and officials must be familiar with the document, which is confirmed by their personal signatures in the act of familiarization, receipt or text of the order.

The order is drawn up taking into account the following features:

- Done on the organization's letterhead. This requirement is optional and is advisory in nature. You can read more about the letterhead.

- Must have registration number and date. The numbering order depends on the local acts regulating this procedure in the organization. You can read more about numbering in our other article.

- Before the introductory part, the title is indicated - “Order on the liquidation of the organization and the creation of a commission.”

- If the order is not issued on the company’s letterhead, it must indicate the name of the organization (full and abbreviated) and its details.

- The document must contain the basis for its preparation, indicating the details of the decision on the basis of which the liquidation procedure was initiated.

- The document includes a list of persons included in the commission, indicating information about the chairman, deputy, and members of the collegial body.

- The order must indicate the time period during which the liquidation must be carried out, and the deadlines for submitting reports on the work performed, including interim and final liquidation balance sheets.

- The order must contain information about the person who is obliged to control its execution. After signing, all members of the commission and other officials must be familiarized with the order and signed.

Composition of the liquidation commission during the liquidation of an organization. How many people should be in it?

The issue of liquidation of an organization falls within the competence of the general meeting or the sole founder. In the event of voluntary termination of activity, the fundamental document will be the decision of the company's participants, which must additionally contain a condition on the creation of a commission. The composition of the liquidation commission during the liquidation of a legal entity is prescribed in the order on the creation of this body.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

The legislation does not establish requirements for the presence of certain skills, experience and level of professional education of commission members. This means that the founders and head of the organization independently decide on the composition of the liquidation body.

At the same time, in the event of liquidation of certain types of organizations and enterprises, special regulations may establish certain requirements for the composition of the commission. In particular, if the organization is established by the Russian Federation, its subject or local government body, it is a member of the commission, in accordance with clause 4 of Art. 57 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, must include a representative of a federal body, a body of a constituent entity of the Russian Federation or a municipality.

It is not established by law how many people should be on the liquidation commission. As a rule, the commission includes:

- accountant;

- lawyer;

- economist;

- other persons whose entry will ensure the achievement of the set goals, taking into account compliance with the norms and principles of the law.

In addition, the liquidation commission usually includes members of the organization.

Regardless of the number of members of the commission, including in cases where the liquidator is the only founder, the issuance of a corresponding order will be required. In practice, the commission most often includes the head of the organization, the chief accountant and the head of the legal department. If there are two or more members, a chairman is appointed from among them.

Let us note that the members of the commission, by virtue of Art. 2.4 of the Code of Administrative Offenses of the Russian Federation are officials and can be brought to administrative liability in case of violation of the law, for example under Art. 14.25 of the Code of Administrative Offenses of the Russian Federation (in terms of violation of the obligation to timely provide the Federal Tax Service with information about the progress of the liquidation procedure).

Who can be the liquidator during the liquidation of a LLC

The competence of the liquidation commission includes all management functions in relation to the company that is ceasing its activities. After it begins its work, the powers of the senior management team are removed.

InfoZa's appointment is the responsibility of the apparatus that made the decision to close the legal entity. In case of voluntary liquidation, this may be a meeting of founders or a council of shareholders (depending on the form of business organization: LLC or JSC). The procedure for appointing a liquidation commission must be specified in the charter. If this procedure is forced (for example, due to the illegal activities of the company), then the liquidator is appointed by the court simultaneously with the issuance of a decision to close the enterprise.

There are many nuances and pitfalls that need to be taken into account.

Therefore, the founders resort to the services of companies that specialize in this. Then the liquidator can become a person who cooperates with such a company.

It often happens that a company has only one participant - he is also the founder, he is also the general director.

He can also be a liquidator if he himself decides to terminate the business. This is not prohibited by law.

To do this, he will have to make a sole decision to terminate his powers as an executive body in the company and appoint him as liquidator.

The liquidator is appointed from the publication of the minutes of the general meeting of founders, at which the liquidator is appointed.

Then you need:

- notify the tax authorities.

Submission of these documents to the Federal Tax Service within the specified time frame;

- payment of the state fee for registering the termination of the company’s activities and receiving an extract from the Unified State Register of Legal Entities stating that information about this LLC has been removed from it.

The liquidator is obliged to carefully ensure that all actions are carried out in accordance with current legislation.

The process of closing a business is quite complex. Sometimes doing this on your own is not at all easy. A “newbie” may get confused about the procedure and documentation.

Therefore, it is better to entrust the closure of a business to professionals who specialize in providing such services to entrepreneurs.

The chairman of the liquidators has the right to sign declarations, agreements and other legally significant documents. He can freely dispose of the company's property, as its director previously did. The chairman also has the right to convene a meeting of the liquidation commission at any time, control its work and organize the current activities of this structure. Members of the commission may sign accounting documentation. To do this, they must notify the bank in which the company has a current account about the persons authorized to sign payment orders. Signatures on the bank card are reissued to the chairman and other persons (if necessary).

Liquidator or LLC liquidation commission? Legal status and competence

From the moment of creation/appointment, the liquidation commission and the liquidator are representatives of the legal entity, while the head loses the right to represent the interests of the organization in state and municipal bodies, courts, and relations with counterparties.

It is important to note that the legal status of the liquidator and the commission is the same due to the absence of differences in competence, as directly indicated by clause 1.4 of the letter of the Federal Tax Service dated March 29, 2018 No. GD-4-14 / [email protected] At the same time, the founders independently decide whether to create a commission or appoint a liquidator.

The legal powers of the commission and the liquidator are also identical and usually provide for the following set of rights and obligations:

- representing the interests of the organization;

- publication of information in the media about liquidation and the procedure for filing claims within the prescribed period;

- implementation of measures aimed at identifying creditors and generating receivables;

- sending notices to creditors about the upcoming liquidation;

- formation of an interim liquidation balance sheet;

- sale of property to pay off debts to creditors;

- applying to the arbitration court to declare the organization bankrupt if there are signs of insolvency;

- making payments in the order of priority of funds according to the claims of creditors;

- preparation of the final liquidation balance sheet.

This list is not exhaustive and can be expanded by the decision of the founders of the liquidated organization. The created temporary body ceases to operate upon achieving its goal, that is, after entering information about the termination of the activities of the legal entity in the Unified State Register of Legal Entities.

***

Thus, a liquidation commission of a legal entity is appointed in the case when a decision is made to liquidate the company or the organization is forcibly liquidated. From the moment the commission is appointed, the head of the legal entity ceases to exercise his powers, which are transferred to the commission. The task of this body is to prepare the organization for final liquidation, draw up liquidation balance sheets, organize payments to creditors on existing debt obligations, etc.

Liquidation of the debtor is not an obstacle to bringing to subsidiary liability

The liquidation of a debtor declared bankrupt is not an obstacle to consideration of the requirement to bring its former manager to subsidiary liability.

As part of the bankruptcy case, the bankruptcy creditor applied to the court with an application to hold the director of the company vicariously liable for the debtor’s obligations that arose after the expiration of a month from the date of occurrence of circumstances indicating signs of insolvency. By the ruling of the Arbitration Court of the Kaliningrad Region dated February 24, 2015 in case No. A21 -460/2007, the stated claim was rejected. Having disagreed with the ruling of the court of first instance, the bankruptcy creditor appealed to the court of appeal against this ruling. By the ruling of the Thirteenth Arbitration Court of Appeal dated February 24, 2015, upheld by the decision of the Arbitration Court of the North-Western District dated 06/01/2015, the appeal proceedings were terminated due to the liquidation of the debtor. The courts came to the conclusion that it is impossible to consider an appeal regarding the legality of a judicial act adopted in the framework of a bankruptcy case of an organization that has ceased to exist. By ruling dated December 7, 2015 N 307-ES15-5270, the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation overturned the ruling court of appeal and the decision of the arbitration court of the district and sent the case for a new trial to the court of appeal on the following grounds: - the manager’s failure to comply with the requirements of the Bankruptcy Law to apply to the arbitration court with an application from the debtor upon the occurrence of the circumstances specified in paragraph 1 of Art. 9 of the Bankruptcy Law entails unreasonable and dishonest acceptance of additional debt obligations in a situation where existing ones cannot be fulfilled, the obvious impossibility of satisfying the claims of new creditors and, as a consequence, losses for them. In this case, one of the legal mechanisms ensuring satisfaction of the claims of such creditors in the event of insufficient bankruptcy estate is the possibility of bringing the head of the debtor to subsidiary liability for the obligations of the debtor in accordance with paragraph 2 of Article 10 of the Bankruptcy Law. The subsidiary liability of the head for the debts of the organization he heads arises as a result of causing harm to creditors.

The decision on liquidation and the creation of a liquidation commission

Liquidation of a company is a very lengthy procedure. The Civil Code of the Russian Federation establishes the obligation of founders or other persons who decide to begin liquidation to notify the authorized bodies about this. This is due to the following goals:

- protection of the rights of third parties;

- exclusion of any unlawful actions on the part of an organization undergoing liquidation;

- proper supervision of the procedure by regulatory government bodies.

From Art. 23 of the Tax Code of the Russian Federation dated July 31, 1998 No. 146-FZ, it follows that a notice of liquidation must be sent within 3 days after the relevant decision is made. The notification is sent to the territorial tax office at the location of the organization. Such notice must contain information about:

- liquidation procedure;

- the procedure for filing claims by creditors;

- timing of the procedure.

In this case, the liquidation procedure is determined by the persons who made the decision on this, independently, but taking into account the characteristics of the legal entity, with mandatory compliance with the laws. For example, Art. 58 of the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ establishes that the property that remains after all settlements is transferred to the participants of the organization. On the contrary, Art. 26 of the Federal Law “On Public Associations” dated May 19, 1995 No. 82-FZ states that the remaining property must be directed to the statutory purposes of such an association.

Information from the notification is entered into the Unified State Register of Legal Entities and is publicly available.

Liquidation of an organization implies the cessation of its further activities. The purpose of liquidation is not only to terminate activities, but also to ensure in the process the legitimate interests and rights of third parties (creditors, employees). In this case, liquidation can occur either voluntarily or compulsorily. In the first case, the founders of the company or another authorized body that decided to liquidate it appoint a liquidator or liquidation commission.

Who is a liquidator, and how does this concept relate to the concept of “liquidation commission”

A liquidator is a person dealing with issues arising during the implementation of the procedure for terminating the activities of an organization. The liquidation commission is a collegial body that resolves similar issues.

p, blockquote 2,0,0,0,0 —>

The procedure for appointing a liquidator or liquidation commission is prescribed in Art. 62 Civil Code of the Russian Federation, Art. 57 Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14. However, the provisions of the law are extremely stingy and do not fully regulate the activities of the liquidator or liquidation commission. Moreover, Federal Law No. 14 does not even contain a hint that a liquidator can participate in the termination of an organization’s activities, using the concept of a “liquidation commission.”

p, blockquote 3,0,0,0,0 —>

In practice, it is possible to appoint both a liquidator and a liquidation commission, and this issue is resolved by the general meeting of the LLC. To organize the termination of a small company, they most often use the services of one person. If the company is large, a commission is appointed (including at least two participants, one of whom is the chairman).

Composition of the liquidation commission

The legislation does not define the procedure for electing the liquidation commission, nor does it establish requirements for the inclusion of any specific employees of a legal entity in this body. However, in practice the situation is such that the liquidation commission includes:

- accountant;

- lawyer;

- economist;

- the founders of the organization themselves;

- other persons.

The liquidation commission is formed by issuing a corresponding act (order), which is announced to its members and head. The powers to form the body in question, as a rule, fall within the competence of the company’s founders.

The laws of the Russian Federation and other regulatory documents may impose certain requirements on the composition of the liquidation commission. This largely depends on the organizational and legal form, type of legal entity, and its participants. For example, according to paragraph 4 of Art. 21 of the Federal Law “On Joint-Stock Companies” No. 208-FZ of December 26, 1995, if in a joint-stock company one of the shareholders is the state, then the liquidation commission must include a representative of a local government body or a certain property management committee.

Liquidator or liquidation commission: rights and obligations

The liquidator is vested with the following powers by law:

- management of all company affairs - both external and internal;

- publication in the media of an announcement about the upcoming liquidation of the organization, indicating the time of filing claims by creditors (at least 2 months);

- identification of persons to whom the legal entity has debts;

- identifying persons who have debt to a legal entity and taking measures to repay it;

- representing the interests of a liquidated organization in relations with third parties, including judicial authorities;

- conducting an inventory of the property mass;

- carrying out measures aimed at repaying all debts of the liquidated organization to its counterparties, employees, and other third parties;

- formation of balance sheet (interim and liquidation);

- making a decision on the future fate of the organization’s property remaining after full settlement with creditors and other persons.

- other issues within the competence of the liquidation commission aimed at liquidating the organization.