Liquidation of a JSC is carried out according to the rules approved by the Civil Code of the Russian Federation and specialized legislation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In general, it is no different from the process that other societies must go through in order to legally cease to function.

Law

The key legislative acts that apply when closing a joint stock company are the Civil Code of the Russian Federation and the Federal Law “On Joint Stock Companies” as amended in 2020.

Civil legislation:

- establishes general requirements for the procedure;

- determines the responsibilities of the company that must be fulfilled before making an entry in the Unified State Register of Legal Entities.

In addition, it is the Civil Code of the Russian Federation that establishes the procedure for satisfying creditors' claims. The Civil Code of the Russian Federation defines cases when liquidation is carried out forcibly.

The Federal Law “On Joint Stock Companies” approves the procedure for making a decision on the voluntary closure of an organization.

This legal act establishes that such a decision can only be made by a general meeting of shareholders.

Closing a division

Liquidation of JSC branches can be carried out in 2 ways:

- through voluntary closure;

- by decision of the judicial authorities.

Voluntary termination of the activities of a branch of a joint stock company is initiated by the management body. Liquidation is carried out in stages:

- first, a decision is made using a method that depends on the form of ownership of the Company, a liquidation commission is appointed and begins to work, and responsibilities are distributed within it;

- the next stage is related to the introduction of amendments and changes to the text of the relevant constituent documents;

- further – notification of the Unified State Register of Legal Entities and timely notification of the tax authority for the latter to carry out the necessary checks.

If a branch of a JSC is liquidated based on a decision of the judicial authorities, the procedure is as follows:

- A liquidation commission is appointed and its composition is determined.

- Issues related to property are resolved. Based on the identified debts, a queue for payments is formed: payments to the budget and funds are made first, then the JSC pays off loans and pays off debts to branch employees. The remaining funds can be used by the company for its own purposes or distributed by the court. The leased property is returned to the person to whom it belongs.

- A written notice of closure is sent to the tax authorities, after which the branch is deregistered, and the corresponding entry is made in the Unified State Register of Legal Entities, and the liquidation is considered completed.

- Documentation is transferred to employees of the state archive at the location of the unit for storage.

Liquidation of JSC

Liquidation of a joint stock company can be carried out in an official manner, which is approved by current legislation.

In addition, there are other methods to close a company's activities. For example, a reorganization or alternative liquidation may be carried out.

In both cases, the procedure will take less time than when closing a joint stock company according to the official scheme.

However, these methods are legal. Participants will not have any problems with monitoring by competent services.

Reorganization

Reorganization is used as an alternative method of liquidating a JSC (Article 15 of the Federal Law “On JSC”).

The main difference of this procedure is that the obligations of the closing company are assumed by its legal successor.

Reorganization can be carried out in different ways.

The main difference and main advantage of this method is that registration of the closure of a joint stock company is of a notification nature.

That is, there is no need to obtain the consent of the tax service to terminate activities.

In addition, through reorganization, it is possible to close a joint-stock company with debts, including to the state. All obligations will be transferred to the newly formed company.

The reorganization is considered completed after an entry is made in the Unified State Register of Legal Entities on the creation of a new company or on the liquidation of the joint-stock company (in case of merger).

The general property of the formed organization will be formed from what the reorganized companies have.

Cost and terms of service provision

| Name of service | Service delivery period | Service price* | Turnkey price (with all expenses)** |

| Liquidation of a JSC with an electronic digital signature, including the existing JSC, St. Petersburg and the region | 3 months | 23,000 rub. | 25,000 rub. |

| Liquidation of a joint-stock company in St. Petersburg | |||

| Liquidation of a joint stock company (PJSC, NPJSC) | 3 months | 43,000 rub. | 50,000 rub. |

| Liquidation of a joint-stock company in the Leningrad region | |||

| Liquidation of joint-stock companies: Vsevolozhsky, Lomonosovsky, Kirovsky, Gatchinsky, Volosovsky, Tosnensky districts, Sosnovy Bor | 4 months | 48,000 rub. | 55,000 rub. |

| Liquidation of joint stock companies in other areas of the Leningrad Region | 4 months | 50,000 rub. | 55,000 rub. |

* PRICE OF JSC LIQUIDATION SERVICE INCLUDES:

1. The work of a liquidator

After the decision to close the JSC, the meeting of shareholders appoints a liquidator - a lawyer for our company. He assumes rights, carries out the closing procedure and terminates the agreement with the registrar.

In case of liquidation with digital signature, the liquidator is the director of the company . No need to pay.

2. The work of an accountant:

- restoration of accounting records,

- restoration of tax accounting,

- reconciliations, checking debts to the budget,

- drawing up a liquidation balance sheet.

** COSTS INCLUDED IN THE COST OF CLOSING A TURNKEY JOINT STOCK COMPANY:

1. Work of a notary:

- certification of a power of attorney in the name of the liquidator,

- certification of the protocol (decision) on liquidation,

- certification of notice of liquidation.

When liquidating with an electronic signature, a notary is not required . There is no need to pay for his services.

2. State duty (800 rubles). When liquidating with an electronic signature, no duty is paid.

3. Fee for publication in the “Bulletin of State Registration” (about 2,000 rubles)

We agree on a payment schedule individually and select a convenient option for the client.

Staged payment : advance payment – 50%, final payment – upon completion of liquidation.

Liquidation with digital signature for 25,000 rubles

There is no need to meet with a lawyer, have documents certified by a notary, or pay for notary services.

The state duty for liquidation with an electronic signature has been abolished since 2019.

Call +7 to start liquidation.

Methods

All methods of closing a joint stock company can be divided into two categories:

- voluntary;

- forced.

They are classified depending on the basis for the procedure:

- if the decision was made by the shareholders themselves, then we are talking about voluntary liquidation;

- when the verdict is rendered by the courts - about compulsory.

The procedure itself will practically not differ depending on the method of termination of activity.

The only difference is in the documents that are submitted to the registration authority:

- voluntary liquidation – minutes of the general meeting of shareholders;

- forced liquidation – court verdict.

Voluntary

Voluntary decisions to close a JSC are made by the shareholders themselves.

Unlike an LLC, the decision must not be made unanimously, but by no less than 25% of the votes.

The motives for accepting such a verdict can be very diverse.

At the general meeting of shareholders, a liquidation commission is immediately appointed. It is she who will manage the activities of the JSC until the entry of liquidation is made in the Unified State Register of Legal Entities.

In case of voluntary liquidation, the tax service must be notified of the decision made no later than 3 days from the date of its adoption.

Otherwise, the control service may impose a fine. Notification is made by sending a message in a form approved by the competent authority.

The minutes of the general meeting of shareholders must be attached to it.

A sample notice of liquidation of an organization is here.

Forced

The forced liquidation of a JSC is carried out exclusively by court decision.

It may be issued in the following cases:

- during the registration of the JSC there were gross violations of existing legal norms that cannot be eliminated;

- it was revealed that the JSC is engaged in activities that are prohibited on the territory of the Russian Federation;

- The joint-stock company allowed actions that did not comply with the norms of the Constitution of the Russian Federation;

- The JSC had cases of repeated or gross violation of the norms of current legislation.

Liquidation of an insurance company takes place in accordance with the procedure established by law. Do you need a sample claim from creditors during liquidation? See here.

Alternative

Alternative liquidation will significantly save money and effort due to the fact that there is no need to undergo a tax audit.

It should be noted that this method is legal.

The essence of alternative liquidation comes down to changing the current owner of the business.

During the process, the following data changes:

- executive agency;

- Name;

- legal address;

- types of economic activities.

During the first three years, no activity is carried out on behalf of the company.

Moreover, all reports are submitted on time in accordance with legal regulations.

The main advantages of alternative liquidation:

- lack of tax audit;

- minimum costs of funds;

- efficiency (liquidation will take only 2 weeks);

- opportunity to revive the company's affairs.

Carrying out alternative liquidation involves the following actions:

- transfer of powers of the executive body and chief accountant to a third party;

- change of name, OKVED;

- transformation of the legal address of the JSC.

Bankruptcy lawyer

Forced liquidation of a JSC is a common occurrence in judicial practice. An analysis of numerous processes during which the termination of the activities of Companies for a number of different reasons was considered can serve as a good information field for entrepreneurs who want to avoid a similar fate.

As stated in the resolution of the Constitutional Court of the Russian Federation, if the size of the net assets of an enterprise falls below the minimum level of authorized capital established by law, the enterprise is subject to liquidation by court decision. This is primarily due to the insolvency of the organization.

After all, it is net assets that guarantee the fulfillment of the company’s obligations to creditors.

However, in this case, the organization retains the legally enshrined right to improve its financial situation or independently decide to terminate its activities and begin liquidation actions.

However, in practice there are cases where insufficient assets may not entail forced liquidation.

A striking example is a case considered in the Arbitration Court, as a result of which a government agency was denied a claim for compulsory liquidation of a company.

It was this right, mentioned in the resolution of the Constitutional Court, that saved the JSC from forced liquidation. In addition, based on an analysis of the norms of the Civil Code of the Russian Federation, it was concluded that the liquidation of an organization is not at all the responsibility of the court, but only its initiative right.

The tax authority filed a lawsuit to liquidate the joint-stock company, which had a negative net asset value that was increasingly increasing from period to period. At the same time, there was no debt on taxes and fees, which was explained by the lack of a tax base, that is, income.

During the proceedings, the provisions of the Civil Code were touched upon, requiring the liquidation of an enterprise in the event of repeated or gross violations, and the Law “On Joint-Stock Companies” in terms of the net asset indicator.

When making its decision, the court referred to:

- firstly, that the organization must be given a legislatively enshrined chance to independently overcome the crisis. A decrease in net assets is not at all a reason to immediately wipe the organization off the face of the earth;

- secondly, on the objectivity of the assessment of indicators. According to the judges, the assessment of the situation of society must be adequate and proportionate. In the case under consideration, despite the unprofitable activities, there were no debts to government agencies and to employees, and there was real estate in the property. There were no demands from creditors for early fulfillment or termination of obligations.

All these arguments allowed the court to rule in favor of the entrepreneur.

Violation of the law regulating the issue of shares before the entry into force of the alternative law “On the Securities Market” is a valid reason for the forced liquidation of the Company.

We suggest you read: Where to go if you were deceived with a loan

If documents for registration of shares are not filed in a timely manner, the court will most likely make concessions, proposing that the violation be corrected without fail.

If instructions are not followed, the offense will become a serious offense, and termination of activity cannot be avoided.

However, the mere fact that the issue of securities was not properly executed may not turn out badly for the entrepreneur.

In the practice of Russian legal proceedings, there are many cases where the removable nature and absence of negative consequences made the fact of violation of the legal framework insignificant.

Tax authorities, called upon to monitor the correctness of registration of organizations, filed a lawsuit to liquidate a legal entity (joint stock company) on the basis of an incorrectly indicated legal address. This information was obtained during an on-site inspection at the location specified in the constituent documents.

The court took the position that it was illegal to close a joint stock company for one violation of legal requirements.

According to the judges, such sanctions can only be applied in case of systematic violation of regulations and (or) the significant nature of these violations, that is, a real threat to the interests and rights of other persons. In addition, there was no evidence that at the time of registration of the Company the indicated location did not coincide with the actual location.

Liquidation of a JSC by court almost always entails new legal proceedings, which most often involve the property of the organization that has ceased its activities.

Thus, the Arbitration Court considered the shareholders’ demand for the distribution of the property of a closed joint-stock company after its forced liquidation.

During the process, it turned out that the company was closed due to its bankruptcy, and a bankruptcy trustee was appointed.

At the time of the shareholders' appeal, an entry had already been made in the Unified State Register of Legal Entities.

According to the Civil Code, shareholders have the right to the property of a bankrupt organization only in the order of priority. The claims of creditors are satisfied first, and then the members of the Company.

In the case considered, all property was used to pay off debts. In addition, the wrong line of defense of their rights was chosen.

The shareholders presented their demands to the bankruptcy manager, and all powers were removed from him as soon as the liquidation process was completed.

https://www.youtube.com/watch{q}v=1HOLGg_lv_U

Voluntary closure of a joint stock company is a labor-intensive process that requires a lot of time and effort. The duration of the entire procedure ranges from three months to a year. This most often depends on the state of the financial statements and the absence (or presence) of debt obligations to creditors and state extra-budgetary funds.

By contacting a law firm, you will receive:

- an in-depth analysis of the state of affairs of the company, which makes it possible to identify existing possible risks and take measures to eliminate them;

- qualified free consultation with lawyers from various fields of law and assistance in maintaining tax and accounting records;

- a ready-made plan of step-by-step liquidation actions, which allows you to realistically assess possible time and financial costs;

- full support at all stages of the liquidation process, including accounting and legal support.

Our services:

- consultation on the procedure for terminating the work of a JSC;

- full legal support at all stages of the enterprise closure procedure;

- preliminary express audit of financial statements before the liquidation process (to identify and prevent risks associated with tax audits);

- accounting support of the liquidation procedure (preparation of interim and final liquidation balance sheets);

- representing clients' interests in the tax service;

- carrying out mutual settlements with creditors and debtors of the liquidated company, etc.).

Step-by-step instruction

The procedure for liquidating a JSC involves the following stages:

- Making a decision to terminate the activities of a JSC at a general meeting of shareholders.

- Notification of the registration authority about the verdict in the form approved by the competent service.

- Publication of a message about the upcoming liquidation in a special publication in order to identify obligations to creditors.

- Determination of existing receivables.

- Creation of an interim liquidation balance sheet and its approval.

- Settlements with creditors according to the rules defined in the Civil Code of the Russian Federation.

- Preparation of the final liquidation balance sheet.

- Transfer of documents to the registration service for making an entry in the Unified State Register of Legal Entities.

The maximum duration of the procedure has not been approved. The minimum is two months.

This is the period provided for the presentation of creditor claims.

A sample application for liquidation of a joint stock company is here.

Satisfaction of creditors' demands

Satisfaction of creditors' claims is carried out after the creation of an interim liquidation balance sheet. It will include all the commitments that have been announced.

Creditors' claims are satisfied in the order established in the Civil Code of the Russian Federation.

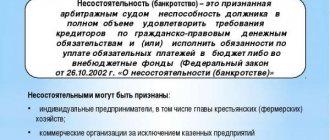

If there is a shortage of JSC property and there are signs of bankruptcy, a procedure for recognizing the insolvency of the company is initiated.

A sample application for bankruptcy of a joint-stock company is here.

Cost of the procedure

During the liquidation process, you will have to incur some expenses.

Basic:

- state fee for registering the closure of the company’s activities – 800 rubles;

- payment for publications in a specialized publication – about 2000 rubles.

All JSCs will have these types of costs.

The price will increase if specialized companies are involved in the liquidation (from 15,000 rubles and above).

Currently, there are many offers on the market for this procedure from law firms.

The cost of liquidation will change if it is carried out through reorganization or an alternative method.

Payments to employees upon liquidation of a company are mandatory. How does a commercial bank liquidate? Read here.

Is it possible to liquidate a public organization? Details in this article.