Credit insurance

Insurance of the loan amount for the period of lending is carried out by banking institutions in order to protect themselves and receive funds issued to the client under any circumstances.

According to the current law, life and health insurance of the borrower is possible only if he wishes , while collateral is subject to mandatory insurance.

Many banks, in essence, force all types of insurance on their clients. However, insuring the purchased property or vehicle, which serves as collateral for the bank, is also beneficial for the borrowers themselves.

In the event of unforeseen situations, such as partial destruction or complete destruction of the house, the balance of the debt must be covered by the insurance company. But in most cases, the insurance premium is an unnecessary and expensive option.

If the borrower has confidence in the speedy repayment of the loan received, the insurance service will only take away additional funds from the client.

It is worth agreeing to conclude an agreement with an insurance company in a situation where borrowed funds are taken for a long period and there is a threat of loss of solvency in the event of loss of health or loss of job due to job cuts.

Such cases are considered insurance, and you can count on compensation from the insurance company.

Interested in learning about mortgage borrower life insurance?

Or read THIS article on what to do if you have nothing to pay off your car loan.

Is it possible to return insurance for a loan?

The actions of financial institutions seeking to impose insurance services upon signing a loan agreement are understandable. In this way, the bank will be less exposed to the risk of non-payment, having an additional guarantee in the form of the client’s insurance policy. However, the borrower is also interested in minimizing expenses, and if the insurance portion is 2-5% of the total loan amount, then the amount of savings will be significant.

In accordance with Bank of Russia Directive No. 3854-U, the client no longer has to refuse voluntary insurance when concluding an agreement; he can do this later. This document applies to all contracts concluded after June 1, 2020, but does not affect collective programs with the participation of the bank and cases of compulsory property insurance for auto and mortgage lending.

For an outstanding loan

The simplest situation is a newly issued consumer loan, when, in the client’s opinion, insurance services were imposed on him. The law here is entirely on the side of the borrower, so solving the problem of how to return insurance for a loan will be simple. You need to contact a bank or insurance company (depending on who you have an agreement with), and then you can get back up to 100% of the money paid.

- Mirror glaze for cake - recipes with photos. How to prepare glaze for covering a cake at home

- Water diet - weight loss results with photos and reviews. Water diet menu by day

- Egg soup: recipes with photos

For an early repaid loan

Early repayment also implies the return of the loan insurance along with the unused portion. For example, a client took out a consumer loan for a period of 4 years, paying 50,000 rubles for insurance services, but in fact the loan taken was repaid in half the term. Since he does not use these services for the remaining 2.5 years, he is entitled to a refund of 50% of the cost of insurance.

First, you should contact the bank with the issue of insurance compensation (it is best to simultaneously with the issue of early repayment of the loan by submitting two applications at once). It is possible that you will need to contact the insurance company itself. However, as experts note, such cases are not very complex and can be solved.

Features of drawing up an insurance contract

Often, when receiving a loan, the borrower pays various fees that the organization’s employees did not tell him about, including the insurance amount.

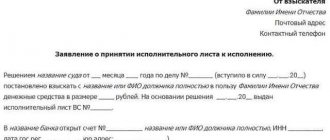

If there was no corresponding agreement, you can contact the bank with a written application for a refund of the money spent on insurance. If the banking institution refuses, a lawsuit is filed in court.

When deciding to enter into a loan insurance agreement, you must carefully study its terms. It must indicate the amount of the insurance policy and include clauses on the possibility of returning the insurance amount in various situations and conditions of termination of the contract.

The borrower has the right to put forward certain and essential terms of the contract, under which he undertakes obligations to fulfill them.

The subject of such an agreement may be:

- life and health of the person who received borrowed funds from the bank;

- real estate purchased under a mortgage program and acting as collateral;

- a vehicle purchased with money from a car loan.

All these types of insurance make it possible to repay the loan debt upon the occurrence of an insured event.

Refund of Insurance under the Collective Agreement - Video Instructions

First of all, if you refuse, you should find out a few things:

- how does the bank justify its negative decision;

- what are the terms of return under the contract;

- whether the contract was concluded without violating legal norms;

- whether the “cooling period” has been missed and whether it is possible to apply for payments after it.