Existing restrictions

According to ch. 12 of the Federal Law, MFOs do not have the right to charge interest on a short-term loan agreement for an amount that is more than three times the amount of the loan.

For example, upon receipt of 20 tr. loan, the maximum the borrower can pay on it is: 20+ 3*20= 80 thousand rubles. This applies only to the amount of accrued interest, without penalties, fines, penalties and payments, which are provided for a fee.

If the loan becomes overdue, penalties are charged daily, the amount of which cannot be more than 2 times the amount of the remaining debt.

It is very difficult to prove the existence of an enslaving transaction and the company’s abuse of its rights, which, according to the Civil Code, will lead to its insignificance.

Who can challenge interest on a loan?

Not all borrowers received the right to go to court to reduce the loan rate, but only those who received a loan from illegal and shadow lenders who charged interest rates exceeding the market average, says Mikhail Alekseev, Chairman of the Board of the Interregional Public Organization “Credit Human Rights Defender” .

“It is important to understand that the current amendments to the Civil Code regulate relations when the creditor is another individual or legal entity that does not have the status of a professional participant in the financial market. In other words, we are talking about regulating loans between ordinary people and ordinary organizations. Essentially, this applies if, for example, an individual borrows money against a receipt and the lender records 1000% per annum as the interest rate. Or, let’s say, an individual borrowed money from an organization that charged interest rates that exceeded the market average. It is precisely these relations that are regulated by the new amendments to the Civil Code. They have no relation to microfinance organizations and banks, which, in turn, also do not have the right to set inflated rates,” says Alekseev.

Question and answer Is it profitable to take out a new loan to pay back the old one?

Bank interest rates on loans have been regulated by the state for several years. They are tied to the average market value determined by the Central Bank and cannot exceed this indicator by more than one third. Such rules apply to all lenders: banks, credit cooperatives, microfinance organizations, pawnshops.

“These rules have been in effect for more than two years. The Central Bank, the regulator of all professional market participants, publishes the average market rate quarterly. Loan rates should not exceed this average market rate by more than a third. In other words, for each type of loan the Central Bank sets the maximum possible interest rate. If an MFO issues a short-term loan of up to 30 days to a citizen, then this organization cannot do this at any interest rate. If the interest exceeds 600-700% per annum, then the borrower can appeal to the Central Bank or appeal the rate in court, because it does not correspond to the one set by the regulator. These standards have been in effect for a long time, and it is worth paying attention to them,” says Alekseev.

Arbitrage practice

In what cases can you sue an MFO:

- If the company complies with the restrictions established by law, the court can try to reduce only the accrued penalties and penalties. The basis for this will be Article 333 of the Civil Code of the Russian Federation, according to which, if the accrued penalty is incommensurate with the balance of the debt, the court can reduce it if there is an application from the debtor.

- The interest accrued under the agreement can be reduced only if the transaction is recognized as enslaving on the basis of Article 179 of the Civil Code of the Russian Federation. To recognize a transaction as enslaving, the presence of two circumstances is required: the presence of documentary evidence of enslaving conditions, the presence of evidence that at the time of the conclusion of the transaction the debtor was in a hopeless situation, and the creditor took advantage of this.

- Violation by the MFO of Art. 17 of the Constitution of the Russian Federation. Here the case concerns cases where an MFO deliberately delays filing a lawsuit against the borrower in order to charge more interest.

Why were new amendments made?

According to the expert, the latest amendments to the Civil Code regulate relations exclusively between individuals and non-professionals. “The Central Bank has identified more than a thousand shadow lenders. In fact, illegal moneylenders, under the guise of ordinary individuals or under the guise of ordinary organizations that do not have a banking license or the status of a microfinance organization, lent money to citizens. And people in the courts could not challenge the inflated interest rate. The amendments are a blow to such illegal microcredit. The new norm will allow us to bring down far-fetched interest rates. Judicial practice will show how this will happen,” says Alekseev.

Debt rake. What don't we know about loans? More details

What could be the consequences for a borrower of challenging a penalty?

Before going to court to accuse the investor of incompetence, the payer needs to be well prepared and it is best to first consult with a lawyer.

Of course, all legal proceedings will be conducted in accordance with the law, but the borrower will only benefit when his actions are structured correctly and correspond to reality.

For example, if the debtor did not transfer any payments to the sponsor’s account, ignored warnings, did not notify the creditor about his problems and does not have documentary evidence for him, then this is fraught for him with a complete denial of his claims and, moreover, the court will set a period for which, in strict order, it is necessary to repay the debt to the investor.

The consumer must apply to reduce the amount of penalties after the principal debt on the loan has been paid, this means from that moment the lender has no legal basis for charging penalties and any monetary accrual is unjustified.

If you can prove such bank fraud to the judge, then only then can the remaining debt be written off.

Resolving the issue at the bank

It is difficult to resolve the issue of reducing penalties with the bank, but it is possible. In any case, one should not neglect the opportunity to resolve the matter peacefully, because a trial is still long and nerve-wracking, and in a trial the bank will resist much more actively than when discussing the problem with the borrower.

As part of negotiations with the bank and sending an official statement to it, it is worth emphasizing that the courts very often accommodate debtors, and borrowers have every right to demand a reduction in the amount of the penalty.

We invite you to familiarize yourself with: The tax system in Spain in 2019. What taxes exist in Spain for citizens and non-residents.

At the same time, it is advisable to argue your position not only with legislative norms, but also with the existing financial difficulties, which led to the loan being overdue. It wouldn’t hurt to prepare proposals to resolve the debt issue as a whole. Moreover, reducing the penalty will not solve the debt problem as such.

The most effective when resolving an issue with a bank are constructive proposals to resolve the debt problem, in which the credit institution will see its benefit. You need to try to convey to the bank that the delay is due to temporary difficulties, and if they insist on their way, you are seriously considering resolving the problem with the penalty in court.

When resolving the issue of reducing the amount of the penalty with the bank, you can also raise the issue of the credit institution completely waiving the amount accrued on it. It is not a fact that the bank will agree, but it will be almost impossible to achieve such a decision in court, but with the bank it is easier.

Borrower's responsibility

Signing an agreement means voluntarily accepting the terms of the transaction. The borrower becomes obligated to repay the specified amount within the specified time frame. If the loan was taken out online and there is no physical agreement with a signature, then an SMS confirmation or digital signature is confirmation of the conclusion of the transaction.

Disputes that arise are regulated by the Civil Code of the Russian Federation. The claim is being heard in civil court. A lawsuit with an MFO may end in victory for either party. If the debtor wins, he can count on a reduction in interest or complete write-off of the debt. In rare cases, he is paid a penalty.

If the microcredit organization side succeeds in suing, then the case is transferred to the bailiffs. They begin collecting the amount of the debt, including fines and penalties, from the borrower. Bailiffs are looking through bank accounts. If funds are not available, they may garnish part of your wages. In case of its absence, the process of confiscation of property begins.

If the actions of the debtor by the microfinance organization are regarded as fraudulent (in case of intentional non-payment), it can write a statement to the police and indicate the elements of the violation.

As a result of the trial, the debtor may be brought to criminal liability on the basis of two articles:

- 159 art. Criminal Code of the Russian Federation: fraud in the credit sector;

- 177 of the Criminal Code of the Russian Federation: malicious and intentional non-payment of debts.

However, there are very few debtors brought to criminal liability as a result of a trial with a microfinance organization. In order for the crime to be confirmed, according to the law, the amount of all debts on microloans must be at least 1.5 million rubles, and the debtor must refuse to pay the debt to the court.

Cancellation of interest and reduction of loan debt

No one is immune from deterioration in their financial situation.

Sometimes circumstances do not allow you to pay the loan on time, which results in arrears. Violation of the loan agreement leads to fines and penalties.

The issue can be resolved by reducing the debt: for example, by canceling interest on the loan or reducing the penalty.

To change the terms of a financial agreement, compelling reasons are needed.

You can achieve cancellation of interest through the court, but only if the creditor unilaterally violated the terms of the agreement. For example, if the bank increased the interest rate without the knowledge of the client, after which the total debt increased. According to Article 29 of the Civil Code of the Russian Federation, the creditor still has the right to do this. But the parties must come to a single agreement in accordance with Article 452 on changing the terms of the contract or terminating it.

If this does not happen, the court may reduce the interest rate.

We recommend reading: The insurance company sells additional insurance

In contractual relations, the borrower is a weakly protected party.

Types of credit interest

The percentage, which is determined before signing the agreement between the assignor and the borrower, is the amount that is added to the payer’s principal debt, that is, this is the amount of monthly charges that are mandatory and cannot be challenged or canceled by the court.

Accruals in the form of penalties are an amount that is established by the creditor for the untimely fulfillment of obligations by the debtor. A prerequisite for the bank in this case is a reasonable amount of the penalty, which should not exceed the amount of the full debt.

As practice shows, investor violations are most often associated with exaggerated penalties, which can legally be minimized by going to court.

Statistics show that during legal proceedings it is the payer’s position that remains advantageous, since the creditors themselves often take the position of a malicious punisher who takes away any opportunity to solve financial problems.

But one way or another, bank investors are recognized as more loyal and often allow their debtors to resolve the situation without involving the court, so to speak, to sort it out at the internal level, which cannot be said about MFOs, where penalties and fees for financial services grow daily, accumulating amounts that are unaffordable for the client .

How to reduce loan debt in court?

Faced with the fact that it is impossible to fulfill obligations under a loan agreement, borrowers act in different ways:

- repay the loan as necessary, as funds become available.

- stop making all regular payments;

- regularly, in accordance with the schedule, they repay only the interest, leaving the body of the loan for later - when the opportunity to pay arises;

Any of these situations means one thing - the borrower’s failure to fulfill its obligations in full, which, as a rule, always entails retaliatory measures on the part of the bank. The lender's actions are regulated by law and the loan agreement, but the terms of the latter cannot contradict the law. In practice, the bank is often guided by its own benefit, interpreting the terms of the agreement at its own discretion, taking advantage of the borrower’s ignorance or misunderstanding of the law, and sometimes even doing as it sees fit,

Law on banks: how to force a reduction in penalties for overdue debts

Penalties for late payments on loans often exceed the cost of borrowing. How to force the bank to reduce the penalty?

Photo: Ekaterina Kuzmina / RBC

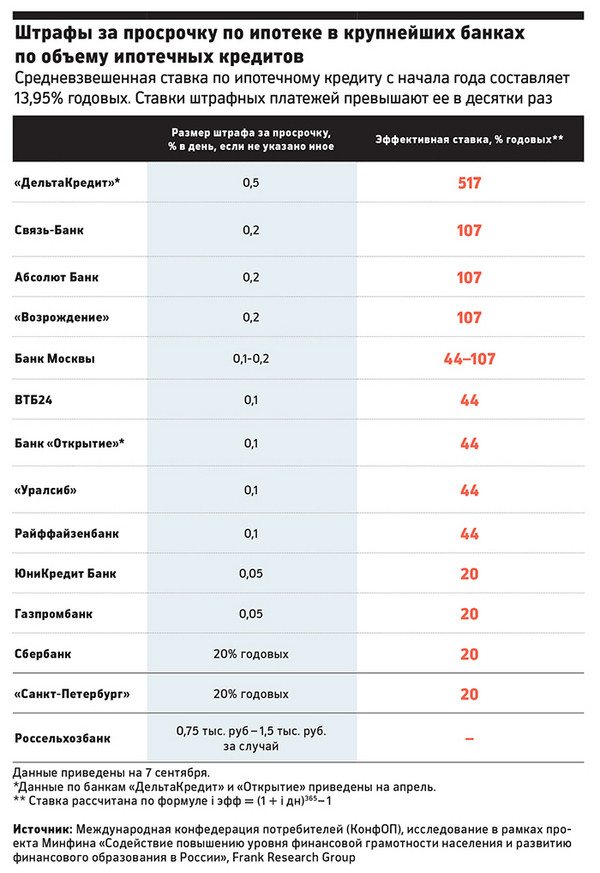

In mid-August, Rospotrebnadzor announced its decision to fine VTB24 Bank 20 thousand rubles. declared legal. The bank was fined this amount after checking the loan agreement at the request of the borrower. The agreement stated that the penalty for failure to fulfill loan obligations is 0.6% per day. This corresponded to an annual effective rate of 788%. Rospotrebnadzor managed to prove in the Moscow Arbitration Court back in the summer that such a high rate is contrary to the Civil Code and is disproportionate to the loan rate. In general, penalties under lending agreements are regulated by law in ambiguous ways. Banks take advantage of this. According to the International Confederation of Consumer Societies, among 15 large banks in terms of volume of loans to the population, DeltaCredit has the maximum penalties for late mortgage payments: 0.5% per day (effective rate - 517% per annum). For three banks out of 15, the fine is 0.2% per day (107% per annum).

Is it possible to force the bank to reduce the amount of the penalty if you are late? Banks set fines for consumer and mortgage loans differently. In the first case, there are restrictions: the law on consumer loans (Article 5 of Law 353-FZ) prohibits setting a fine higher than 20% per annum if the bank continues to accrue regular interest on the loan, or 36.5% if such interest is not accrued, explains the general director legal Vasily Nedelko. In the case of mortgages, banks are given almost complete freedom. Partner Roman Terekhin says that the amount of the fine under Article 395 of the Civil Code is determined in this case based on the regional average deposit rates for individuals (Articles 811 and 395 of the Civil Code of the Russian Federation). For example, a bank in the Central Federal District may require a penalty at the regional average of 10.51% per annum, or 0.028% per day, Terekhin notes. There is a nuance here: these rules apply only if other conditions are not specified in the loan agreement, which happens extremely rarely, notes Dmitry Yanin, Chairman of the Board of the International Confederation of Consumer Societies (ConfOP). The VTB Group press service also refers to the terms of the agreement: “The bank must indicate the amount of the penalty for late payment of a mortgage, as well as other key terms of the mortgage loan, in the loan agreement.” “But the Civil Code also has a rule according to which the fine must be proportionate to the violation, and VTB24 violated this rule,” continues Yanin. Another norm (Article 428 of the Civil Code of the Russian Federation), to which the VTB24 borrower appealed, is that so-called adhesion agreements (when one party offers conditions, and the second can only agree or not) cannot include onerous conditions that one party would not accept if she has the opportunity to change something. According to Artem Sirota, a partner at the law firm Sirota & Partners, the court drew attention to the violation of this rule when it made a decision in the VTB24 case. It is possible to achieve a reduction in the amount of the fine under the current agreement, says Terekhin from Delovoye Fairvater. Another thing is that the need for this usually occurs only in case of arrears on the loan. The first step is a letter to the bank with a request to reconsider the amount of penalties, he says. If the bank refuses, contact the Central Bank and Rospotrebnadzor: a free-form application accompanied by a loan agreement and a copy of correspondence with the bank is sufficient. You can also go directly to the court. The application should refer to the listed standards. Terekhin advises referring to the article on reducing penalties (333 of the Civil Code of the Russian Federation). It states that the court has the right to reduce the penalty if it is clearly disproportionate to the consequences of breach of obligation. “But this is a right, not an obligation of the court,” Nedelko from the legal department is in no hurry to reassure. “Often the amount of payment in arrears may be commensurate with the amount of the principal debt. In such a situation, you can very successfully appeal the amount of the fine,” Anastasia Astashkevich, head of the international legal practice of the Chaadaev, Kheifets and Partners bar association, is more optimistic. In the case of VTB24, the court concluded that such a penalty could lead to unjust enrichment of the bank and complicate the process of repaying the debt for the borrower. “The bank, as a stronger economic party, should have made every effort to ensure that the law was observed, but did not do this (violation of part 1 of article 1.5 of the Code of Administrative Offenses of the Russian Federation),” the court’s decision said.

How to reduce fines and penalties on an overdue loan?

As a rule, it includes:

A penalty (penalty) is charged on the entire amount of debt and can reach incredible amounts. As for interest, there are three types:

- For using a loan.

- For the amount of the principal debt.

- For the amount of overdue debt.

The lion's share of the debt falls on penalties (penalties). And it is precisely its reduction that is meant in court. This means that there is only one answer to the question of how to reduce interest on a loan through the court.

And, unfortunately, it is negative. The fact is that the court, having considered your arguments convincing, will not be able to force the bank to abandon its claims: reducing interest, as well as the principal debt, is impossible due to the conditions specified in the loan agreement.

Calculation

For example, the loan amount is 12,000 rubles. Interest on the loan for the period from October 8 to November 10, 2020 – RUB 4,360. (401.5% per annum). Interest paid. Further, interest is subject to accrual based on the weighted average interest rate calculated by the Bank of Russia on loans provided by credit institutions to individuals, namely 19% per annum. From November 10 to November 29, 2020 (20 days), the amount of accrued interest was 124.8 rubles. 19%: 365 = 0.052% per day 12000: 100 X 0.052 = 6.24 rubles. 6.24 X 20 = 124.8 rubles. From November 30, 2020 to January 10, 2020 (42 days) – 205.8 rubles. 9424.4: 100 X 0.052% = 4.9 rubles. 4.9 X 42 = 205.8 rub. From January 11 to March 28, 2020 (77 days) – 164.78 rubles. 4110.6: 100 X 0.052 = 2.14 rubles. 2.14 X 77 = 164.78 rubles. From March 29 to August 3, 2020 (128 days) – 252.16 rubles. 3785.38: 100 X 0.052 = 1.97 rubles. 1.97 X 128 = 252.16 rubles.

From theory

So, a little "water". By virtue of Article 421 of the Civil Code of the Russian Federation, citizens and legal entities are free to enter into an agreement. The terms of the agreement are determined at the discretion of the parties, except in cases where the content of the relevant condition is prescribed by law or other legal acts (clauses 1, 4).

In accordance with paragraph 1 of Article 807 of the Civil Code of the Russian Federation, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things defined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things he received of the same kind and quality.

The loan agreement is considered concluded from the moment the money or other things are transferred. Based on paragraph 1 of Article 809 of the Civil Code of the Russian Federation, unless otherwise provided by law or the loan agreement, the lender has the right to receive interest from the borrower on the loan amount in the amount and in the manner determined by the agreement.

The possibility of establishing interest on the loan amount by agreement of the parties cannot be considered as violating the principle of freedom of contract, including in conjunction with Article 10 of the Civil Code of the Russian Federation on the limits of the exercise of civil rights.

The specifics of providing a loan at interest to a citizen borrower for purposes not related to business activities are established by law (clause 3 of Article 807 of the Civil Code of the Russian Federation).

The procedure, size and conditions for providing microloans are provided for by Federal Law No. 151-FZ of July 2, 2010 “On microfinance activities and microfinance organizations” (hereinafter referred to as the Law on Microfinance Activities). Clause 4 of Part 1 of Article 2 of the said law provides that a microloan agreement is a loan agreement, the amount of which does not exceed the maximum amount of the borrower's obligations to the lender for the principal debt established by the said law.

Based on the mandatory requirements for the procedure and conditions for concluding a microloan agreement, provided for by the Law on Microfinance Activities, the borrower’s monetary obligations under the microloan agreement are urgent in nature and are limited by the maximum amounts of the principal debt, interest for using the microloan and the borrower’s liability established by this law.

The principle of freedom of contract in combination with the principle of conscientious behavior of participants in civil legal relations does not exclude the obligation of the court to evaluate the terms of a particular agreement from the point of view of their reasonableness and fairness, taking into account the fact that the terms of the loan agreement, on the one hand, should not be clearly burdensome for the borrower, and on the other hand, they must take into account the interests of the creditor as the party whose rights are violated due to the failure to fulfill the obligation.