Kinds

The following are the most common types of restructuring:

- Prolongation. With this method, the amount of monthly loan payments is reduced, but the total amount of overpayment increases.

- Credit "holidays". The lender does not charge interest on the loan for 3-12 months, but only the “body” of the loan. In some cases, payment of debt and interest may be completely frozen until the debtor's solvency improves.

- Loan refinancing - to pay off existing debt, the debtor receives a new loan on more comfortable terms.

- Changing the lending currency. This type of restructuring is most often resorted to in the event of unexpected and rapid changes in exchange rates.

- Reduced loan rates.

- Full or partial write-off of fines and penalties.

- The most radical way of restructuring is to write off part of the debt.

Financial organizations often use combined restructuring methods.

Between legal entities

The situation is less rosy for enterprises that are registered as legal entities. The debtor is awaiting an inspection , during which the following are analyzed:

- Financial and economic indicators of the enterprise;

- Circumstances that caused the legal entity to default;

- External reasons that influenced the payer’s condition (crisis, drop in demand, increase in competition);

- Prospects for the enterprise;

- Availability of other unfulfilled obligations;

- Financial situation of the founders and management of the legal entity.

After a comprehensive analysis, the bank may come to the conclusion that it is advisable to initiate an insolvency procedure. After observation, as a result of bankruptcy proceedings, he will be able to receive partially or fully the issued loan and interest on it.

The following factors may induce a creditor to restructure a legal entity::

- A small amount of liquid property;

- A decrease in the solvency of an enterprise is the result of objective reasons that exclude subsidiary liability;

- Many creditors, little recovery expected;

- The organization has prospects for growth and increased solvency.

Another feature of the debt restructuring agreement for legal entities concerns the form. Thus, the document is not only signed by the parties, but is also necessarily sealed by both the bank and the borrower.

Some features

All of the above concerned debtors – private individuals. How does the procedure work with business entities? In general, everything said above is true for them. But the essence lies in the little things or nuances.

It’s easier for business entities that are individuals. Despite the fact that they are liable to creditors with all their property, the bank will not be able to deprive them of everything they have. For example, you cannot foreclose on :

- For a single apartment;

- For personal belongings;

- On property that belongs to a minor child.

This gives some room for maneuver to an entrepreneur who is unable to fulfill obligations to a creditor. Even if the apartment is the subject of a pledge, but children under 18 years of age are registered there, it will be problematic to seize and sell such housing at auction.

In such situations, in order to minimize financial losses, the lender can accommodate. The result is restructuring on favorable terms and writing off part of the debts.

Drawing up a debt repayment schedule

As a result of the terms entered into the restructuring agreement, a payment schedule is drawn up. He can be:

- Annuity - the payment is distributed into equal parts, first the interest on the loan is paid.

- Differentiated - uneven payments, their size decreases as payments are made, since interest is paid on the remaining amount of the debt.

A schedule for debt repayment is drawn up by bank employees. It is an annex to the agreement and is signed by both parties.

Under what conditions is debt restructuring possible?

Carrying out debt restructuring is the bank’s right, but not its obligation. To protect himself, the borrower must, at the time of drawing up the loan agreement, find out the conditions whose compliance makes it possible for him to receive this service. Most common conditions:

- Absence or presence of minor delays. Often, an application for restructuring is accepted after the existing debt has been paid off.

- Large debt balance. Banks are interested in such cases, as they provide an opportunity to return the issued funds and earn good money on interest.

- Objectivity and documentary evidence of the reasons that led to the deterioration of solvency, including: loss of job, salary delays, illness, death of close relatives, etc.

How to enter into a debt restructuring agreement

Restructuring is beneficial to both the Debtor (obviously) and the Creditor. After all, going to court and making a positive decision does not always mean a real possibility of collecting funds, incl. forcibly. And the use of a pre-trial dispute resolution procedure can help the Lender return his money and even receive the planned profit.

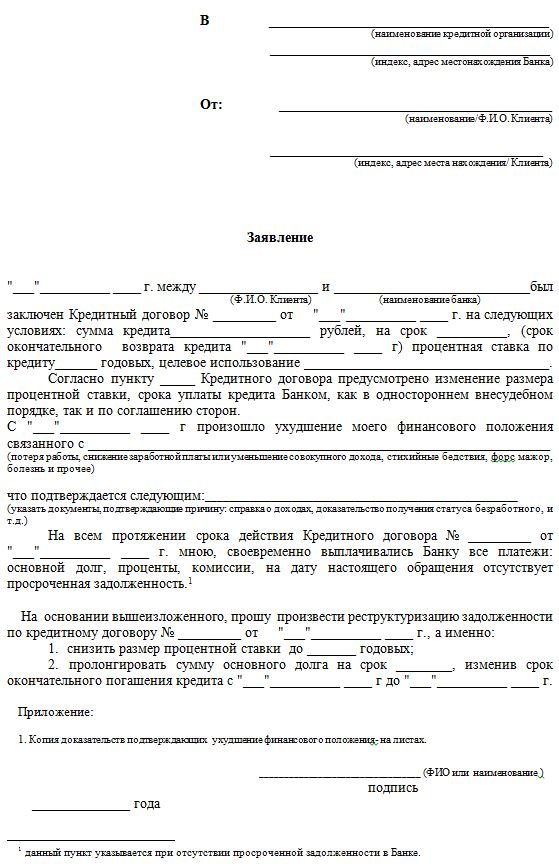

Therefore, any party to the legal relationship can take the initiative to conclude such an agreement. To do this, the Debtor may send an application to change the terms of the agreement. At the same time, attach documents that would confirm the difficulty of his financial situation and the ability to fulfill the obligation.

Features of debt restructuring of citizens

Restructuring of a citizen's debts is carried out in order to restore his solvency and repay debts to creditors. This procedure is carried out in accordance with a debt restructuring plan, the draft of which can be drawn up by the debtor, creditors or the managing body. The final draft of the plan is sent first to the financial manager and then considered by the meeting of creditors. The restructuring plan contains the procedure and timing of debt repayment; it should be designed for no more than 3 years.

To take advantage of the opportunity to restructure a debt, a citizen must meet a number of requirements:

- have a source of income on the date of submission of the plan;

- do not have an outstanding criminal record related to economic activity;

- not be declared bankrupt within 5 years before drawing up the plan.

Consequences of paying rent

The law (Russian Housing Code) obliges residents to pay for the services provided for the supply of electricity, water, heat, and gas. If this is not done, the debt accumulates, and public utilities receive the right to fight unscrupulous apartment owners and protect their property interests - a statement of claim is drawn up to collect housing and communal services debt.

The following methods of claiming unfulfilled obligations to supplying organizations are established by legal norms:

- Penalties. This is the accrual of penalties on the amount owed. Since January 2020, their size has increased significantly. If the period of non-fulfillment of the debt obligation to resource suppliers does not exceed 90 days, then the previous amount applies - one three hundredth of the Central Bank refinancing rate. But, starting from the 91st day of delay in payment, the fine will be 1/130 of the specified rate for each day of delay in the obligation to pay utility bills.

- Forced collection of the debt amount. To do this, service providers can go to court.

Two scenarios:

- Obtaining a court order (used when concluding an agreement with a tenant on the provision of resources).

- Claim proceedings (provided that the agreement was not formalized).

In any case, the unpaid money will have to be returned according to the debt collection procedure along with penalties.

- Eviction. This is a last resort measure against non-payers. Eviction is permitted only through court. No other authority has the right to evict tenants from an apartment.

- If the residents are tenants, and the apartment belongs to the municipality, then expulsion to the street is allowed if there is no payment for housing for more than six months.

- If the residential premises are private property and the owners live in it, then it is more difficult to evict. This method is used provided that the residents own the apartment, then one of the premises is sold to obtain funds to repay the debt.

It is important that you cannot be evicted from your only apartment, regardless of the amount of debt.

- Validity period (depends on the payer’s income and the amount to be returned). In practice, there are situations where deals are concluded for one year.

- Debt repayment schedule. All payments that will be received from the debtor and the dates of each payment are listed.

- Liability for failure to fulfill the terms of the agreement. If the payer stops complying with the payment schedule, he will have to repay the debts (with interest) and pay losses from non-fulfillment of the restructuring transaction.

We invite you to familiarize yourself with: Loan insurance payment

Such agreements are individual, they depend on specific circumstances - the amount of unpaid funds, the income of the defaulter, the compliance of the management company.

This situation is complex due to its versatility. Without a competent lawyer, it is difficult to defend preferential terms for debt repayment. Therefore, it is worth consulting with professionals before starting the conflict resolution procedure with representatives of utility companies and correctly drawing up a debt restructuring agreement.

When making a decision to collect rent for an apartment, the courts proceed from the rules established by housing legislation and satisfy the requirements of management companies. The statute of limitations for collecting debts for housing and communal services is taken into account.

Thus, the Kashira City Court of the Moscow Region, having examined the case materials on the claim of United Housing and Communal Services CJSC against E.V. Semykina. on the collection of debts for housing and utilities, established:

- The plaintiff acts as an organization that is legally authorized by the owners of apartment buildings to manage the building.

- The defendant lives in the apartment indicated in the application.

- The defendant did not pay for housing due to dismissal from work and temporary lack of earnings. After employment, utility bills were resumed.

- The defendant returned part of the rent debt to the plaintiff.

Having studied the case materials, the court granted the claim partially, because part of the debt was paid.

If you have a debt for an apartment, you want to pay it off without imposing sanctions, then contacting the site will solve the problem. There are competent lawyers here who are ready to help:

- Submit applications for debt restructuring.

- Motivate the management organization and give a positive decision on concluding the transaction.

- Draw up a debt restructuring agreement (we also have a sample).

- Defend your rights when drawing up an agreement.

- Extend the validity period of the deal.

The portal’s employees provide consultations online, so you will save time searching for a law office; a free consultation with a lawyer will help solve the problem.

By visiting the site, you will find the answer to the question of how to draw up a rent debt restructuring agreement. We work for the convenience of our clients.

A rent debt restructuring agreement can help avoid such problems. Under this agreement, the payment procedure can be significantly simplified. The timing of the relevant payments is determined individually, based on the existing requirements of regulatory organizations.

To become more familiar with the specifics of the contract, interested parties should refer to the provisions of the law, the nuances of drawing up the form, the established payment deadlines, as well as the legal consequences of delay.

Thus, in accordance with Federal Law No. 83 of 2001, it is established that commercial organizations have the right to establish a procedure for the gradual repayment of debt obligations. In the corresponding application for restructuring, it is especially important to indicate the fact of what legal relations arise when drawing up the document.

A sample agreement can be requested by a citizen interested in the procedure from representatives of the service provider organization.

Rent recalculation is possible in several situations defined by law, in particular, when the provision of utility services is of poor quality.

You can learn how to pay rent in a communal apartment from the article at this link.

Such agreements have an individual procedure for drawing up. Each provision of the agreement is based on certain circumstances, for example, the current amount of debt, the income of the payer, or the compliance of the controlling organization.

Drawing up a contract is a relatively complex operation, which is why every interested citizen is recommended to contact a highly qualified lawyer for advice before starting the restructuring procedure

The timing and procedure for paying existing debt obligations are determined on an individual basis. In most cases, restructuring is issued for 12 months. If the basic terms of the agreement are violated, the payer may be subject to certain penalties.

The most unpleasant consequence of late payment may be the accrual of penalties, which is carried out in accordance with the provisions of Article 155 of the current Housing Code. This measure is intended to encourage debtors to make prompt payments in full.

The fine is 1/300 of the established refinancing rate of the Central Bank of the Russian Federation for one day of late payment. However, in cases where receipts are not paid for several years, the amount of penalties can be quite large.

If such a sanction was not enough, then the organization acting as a service provider has every reason to stop providing them until the debt is fully repaid. This possibility is regulated by the territorial Rules for the provision of energy services to the population.

To carry out such a procedure, representatives of the authorized organization must notify the owner of a specific property about the debt obligations that have arisen, as well as the possible use of pressure measures. The corresponding notification form can be provided for review at the same branch of the service company.

At the same time, in cases where payments for utility bills are delayed for 6 months, representatives of the management company may demand that the debtor repay the obligations in full and within a certain period. If the requirement within the framework of such restructuring is also not fulfilled, then an appeal to the highest judicial authorities follows.

It is worth noting that if, within the framework of such a relationship, a special agreement was drawn up for the provision of utility services, then legal proceedings will be carried out:

- without the participation of the debtor himself;

- with consideration of case materials provided only by the service provider;

- with the issuance of a special court order for collection.

Whatever the outcome, the case will be transferred to the hands of bailiffs, who will continue to deal with procedural aspects of debt collection.

The most negative decision for the owner may be his eviction from the occupied apartment. However, this sanction can only be imposed on those persons who live in a municipal property under a social tenancy agreement. The corresponding decision can only be made in court. This provision is regulated by Article No. 80 of the Housing Code of the Russian Federation.

In case of accumulated debt on utility bills, you should contact the government agency that provides those same services. A rent debt restructuring agreement is concluded between the organization and the defaulter, and the payments themselves are distributed evenly over several months, taking into account the income of the person who applied and the situation in the family.

The content of the contract must contain the following information:

- the amount of total debt;

- repayment terms;

- amount of mandatory payments.

Also, the document must contain personal data of the apartment owner (debtor) and the company. The restructuring comes into effect from the moment the agreement is signed by both parties.

The agreement is canceled as soon as the debtor violates its terms. After this, the company has the right to file a claim in court to collect the entire amount of debt by selling the defaulter’s real estate.

The fact that every owner, tenant or tenant of housing is obliged to pay for the utilities provided to him is an indisputable truth enshrined at the legislative level.

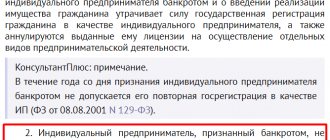

In case of bankruptcy of individuals

“Bankruptcy of a citizen” or “bankruptcy of individuals” as legal categories arose in Russian legislation relatively recently – in the fall of 2020. It is important to note that the court has the right to choose between 3 procedures for resolving debt disputes: restructuring, sale of property and settlement agreement. Moreover, the first option is the most preferable for the borrower.

After a court decision to begin the restructuring procedure, the amount of debt is frozen: interest, penalties and any other financial sanctions stop accruing, and creditors’ claims cannot be satisfied. However, these restrictions do not apply to a number of property penalties, for example, compensation for harm to health or life, current payments that arose after the bankruptcy petition was accepted, etc.

The debtor also loses the opportunity to freely dispose of finances or property, for example, open bank accounts, purchase shares, enter into certain types of contracts, etc. To do this, he needs the written consent of the financial manager, whose task is to prevent the debtor from abuses during the bankruptcy procedure.

How to prepare the form

A similar benefit can be provided to citizens for a period of up to 6 months. The contract can be extended only after submitting a new similar application.

The following documents must be attached to the document:

- the applicant's civil passport and identification documents for other family members living in the apartment;

- a certificate confirming the relationship between the applicant and these persons;

- birth certificate of persons under 14 years of age;

- a document confirming the right to use the premises;

- certificate of family composition;

- income certificate in form 2NDFL for each adult family member for the last 6 months;

- personal account extract from the house register.

Document confirming ownership

The corresponding statement must clearly state the reason for the occurrence of debt obligations to service provider organizations. The document also indicates the expected repayment terms of the debt, the procedure for transferring funds and other related nuances.

We invite you to read: Agreement of donation of an apartment to both parents

It is worth noting that in most cases, management organizations try not to bring the matter to court if the issue concerns conscientious citizens who are experiencing financial difficulties on a temporary basis.

Features of debt restructuring of legal entities

The debt restructuring procedure for legal entities is generally similar. This service is provided to companies only if the bank is confident in the future efficiency, and most importantly, the solvency of the legal entity.

At the first stages of restructuring, an audit of the company is carried out. Then a strategy for overcoming the crisis is developed and implemented.

Unlike restructuring the debt of individuals, in each individual case an individual approach is developed for each company. The biggest difficulty lies in resolving the interests of a credit institution or bank, as well as the interests of the owners of the enterprise. In addition, the goals, scope of activity and market position of all enterprises are different.

Types of restructuring

Determining the types of procedures depends on the interests and internal reserves of the company, as well as on external circumstances. The areas of change relate to the scope of the organization's activities, the internal structure of the enterprise, capital structure and control.

Classifications of types of restructuring are divided according to various criteria, including:

- Stages of enterprise development:

- operational (if it is necessary for the organization to overcome a crisis situation);

- strategic (to maintain the functioning of the organization).

- To the initiator:

- passive, associated with external circumstances under which the enterprise is interested in structural transformations;

- active when the initiator is the company itself.

- According to the degree of interaction with the external environment:

- external, aimed at changing relationships with the external environment;

- internal, aimed at internal adjustments and not directly related to changes in the external environment.

- Coverage of the organization's activities:

- comprehensive (for all aspects of activity);

- element-by-element (for individual elements - production, finance, management system);

- multi-element (for a complex of a number of system elements).

- By time:

- short-term;

- mid-term;

- long-term.

- By degree of accountability and funds raised:

- centralized, carried out in the company by decision and under the control of state (municipal) structures at the expense of raised funds;

- decentralized, carried out by the enterprise independently (with its own funds);

- mixed using own and attracted financing.

- By the number of operations (stages) performed:

- one-stage;

- multi-stage.

- According to the pace of the procedure:

- sequential;

- spasmodic.

By the way! The variety of types of procedures does not have strict boundaries; some of them contain overlaps or duplication of actions at certain stages of execution.

Loan restructuring

The most important decision that a debtor in financial difficulties must make is whether it needs restructuring. This procedure is a “last chance” and not a way to save money, especially when it comes to a bank loan.

You should contact the bank in writing and before the loan becomes overdue. The application must be accompanied by a document that explains the financial difficulties involved.

After receiving a positive response from the bank, the debtor, together with a bank employee, develops a loan restructuring scheme. Banks prefer to use ready-made and familiar schemes, but individual approaches to the problem are not excluded.

The final decision to initiate the procedure is made by the bank’s credit committee, which, among other things, receives documents that characterize the current financial condition of the debtor. If the restructuring plan is approved by the committee, the bank signs an additional agreement with the debtor to the existing loan agreement. In practice, when restructuring a loan, the debtor is charged a fee for providing this service.

Types and purposes

Depending on the specific changes that are planned, restructuring can be strategic or operational. Below we consider the features of each type:

- The operational view involves changing the company’s work processes with the aim of its financial recovery. Performed by selling assets. The procedure should improve the performance of the enterprise.

- Strategic implies a process aimed at expanding the company's capabilities. The implementation of this procedure is aimed at increasing the competitiveness of the organization and the market value of its equity capital.

Improving your financial condition is a complex and time-consuming task. Proper setting of goals for future restructuring will allow us to determine the type and methods and set deadlines.

For mortgage

Mortgage debt restructuring is the same change in payment terms as in the case of a loan. It allows the debtor to:

- preserve housing;

- change mortgage housing to cheaper one;

- receive benefits for loan repayment.

This procedure can be carried out either by the bank that issued the loan or by a real estate company. In the first case, the process of restructuring mortgage debt is identical to the loan option. In the second case, the property will be assessed by an expert and sold to pay off the debt to the bank. The money remaining after the transaction will be offered to be invested in real estate (buy a less expensive apartment, possibly with an additional payment) or in the first tranche of a new mortgage.

Concept of restructuring

The etymology of the word allows us to understand its meaning. The prefix “re” means a repeated, renewable action. Structure – structure, structure. That is, re-building or changing something that already exists. In specialized dictionaries, the term “restructuring” is defined as follows – a change in these conditions (agreement, agreement, contract).

Debt restructuring is a reform of lending conditions based on the replacement of one debt obligation with another, with different servicing and repayment (with optimal conditions for the debtor). Relief occurs by:

- refinancing with more favorable conditions (terms, interest);

- providing “vacations” (the borrower temporarily does not pay the principal debt, only the interest on it);

- currency replacement;

- forgiveness of part of the debt;

- suspension of payment of all kinds of penalties;

- increasing the debt repayment period.

A restructuring agreement (agreement) is a legal document, a civil transaction between the borrower and the lender. The contract specifies all amended terms and conditions of the contract. The document requires the consent of the creditor.

Restructuring allows the debtor to receive more favorable conditions for the return of funds

Examples of a restructuring agreement:

- between the bank and the lender (car loan, targeted loan, mortgage, other credit products);

- between housing and communal services and the owner of the apartment.

In the first option (banking institution), the basis of the agreement is the existing loan agreement. In the case of housing and communal debt, this is a new agreement that stipulates the debtor’s obligations to regularly pay not only for current services (heat, electricity, water), but also for part of the accumulated debt.

When the debtor is the state

The main distinguishing feature of the restructuring of public debt is that the debtor is not an individual or legal entity, but an entire country. During the procedure, the amount of debt increases, the time for its payment is extended, thus, the next generation of the country's population becomes debtors. After all, taxes are the main source of repayment of state debt obligations.

In the process of restructuring public debt, methods that are not typical for the debts of citizens and companies can be used, namely:

- Conversion. The state may be asked to: repay the debt with commodity supplies, redeem the debt on special terms or exchange it for property, etc.

- Debt securitization is the transformation of government debt into securities and their subsequent sale on the market.

- The use of Brady bonds is a complex financial mechanism to support stability in developing countries, which consists of converting government debt into special securities backed by US Treasuries.

- Unification of loans consists of combining several debts into one by exchanging old bonds for new ones.

Sample agreement

The restructuring process is carried out both between individuals and between legal entities. Debt may arise to various organizations: a bank, housing and communal services, etc. Accordingly, the content of the agreement will differ. As an example of filling out, you can use various samples of a debt restructuring agreement that are relevant for 2018-19. For individuals, the most acceptable option is installments.

An agreement to change debt obligations between legal entities has a more complex form. A standard debt restructuring agreement developed by the Government of the Russian Federation can be viewed on the ConsultantPlus website. A sample debt restructuring schedule developed as an annex to the government agreement can be found there.

Thanks to debt restructuring, you can keep your business afloat

Features of debt restructuring for utility bills

Owning and using real estate, in addition to undeniable advantages, is a source of obligations to pay utility bills. And although it is necessary to pay for housing and communal services on time, various circumstances happen in life that can lead to debt. A large unpaid debt for housing and communal services, in turn, can lead to a disconnection of communications or even eviction.

The debtor can pay the entire amount of debt in one payment or resort to restructuring. The insolvency of the debtor must be confirmed by documents, and the application for restructuring must be written to the management company or other organization to which the debt exists. However, it is not the responsibility of management companies to carry out this procedure, and the debtor may be refused. Then the only way to avoid punishment is through court.

How to compose and format correctly?

The agreement to carry out the procedure is strictly in writing. To complete it, it is best to use a template to avoid missing important information, such as:

- detailed personal and contact information of both parties;

- number of the document that is the basis for the debt;

- date of the agreement;

- amount of debt as of the current date;

- deadlines for extending payments on obligations;

- debt repayment schedule;

- detailed terms of restructuring.

The agreement on the procedure must be signed by both parties and also certified by the seals of the creditor.

Agreement by providing installments

In the vast majority of cases, providing installment payments is the most acceptable restructuring option, allowing one to find a way out of the current situation.

Between legal entities

Both parties to the restructuring may be legal entities.

Letter on debt restructuring of an organization

In order to initiate the start of restructuring, the debtor needs to draw up an official letter requesting the procedure.

The application does not have an approved form , therefore it is compiled freely according to a certain algorithm:

- the “header” indicates the personal and contact information of the addressee (in most cases, the lender’s head office) and one’s own full name, address and current telephone number;

- in the middle of the page the word “statement” is written;

- the text of the application indicates: a request describing the terms of the loan agreement;

- amount of debt;

- reasons for insolvency;

- proposed solutions to the problem: reducing the interest rate/reducing the monthly payment/providing a deferment;

This application can be handed over to a company employee or sent by registered mail with notification. If a positive decision is made on this appeal, the lender and the borrower negotiate the terms of the restructuring and draw up an appropriate agreement.

Thus, signing an agreement on the procedure can significantly simplify the current situation and avoid unpleasant consequences in the form of the formation of a debt trap, deterioration of credit history and communication with debt collectors.

Sample loan agreement between legal entities

Interest-free loan agreement between legal entities: sample and rules for drafting

How to write a complaint to a bank about fraud: sample and rules for drawing up a document

How to properly file a complaint against a bailiff?

Analytics Publications

At the moment, when only serious, stably operating organizations remain on the market, restructuring is becoming one of the pressing business issues. At a certain stage, a situation arises when a successfully operating enterprise faces the problem of dispersing resources, complicating control, and increasing the costs of maintaining the structure. This is often associated with the practice of making momentary management and organizational decisions that were implemented based on a specific situation, which is not good management practice.

Why is restructuring needed?

Like every business project, restructuring is driven by one or more key goals. The following can be cited as typical, most frequently occurring goals:

- creation of effective separate business units or a single company with a satisfactory balance sheet structure and the ability to attract investment funds (the need for additional resources strongly encourages company reform), which are able to provide the necessary level of production and administrative activities based on the assets transferred to them;

- disposal of unprofitable assets, optimization of management of non-core assets;

- reduction of current costs in predetermined cost areas (administrative expenses, taxation, production costs, labor costs, etc.);

- ensuring the security and unity of the organization’s main resources (land, real estate, intangible assets);

- increasing company transparency.

The purpose of restructuring may also be very specific points: preparation for the sale of part of the business, assets, for the placement of bonds, including Eurobonds. Of course, the purpose of restructuring has a direct impact on its content.

A practical example: shareholders of a Russian company acquired a business in 10 regions of Russia, consisting of more than 50 legal entities created at the end of the last century, when the passion for tax optimization was very widespread. The business was poorly managed; it took about six months just to understand the volume and actual activities of each person. It turned out to be absolutely impossible to achieve the goal of bringing the business to a modern, efficient level and preparing it for sale without reducing the number of legal entities to three using a branch network.

For shareholders, the restructuring should clearly lead to the creation of additional value by increasing the company's capitalization.

In its content, restructuring has a complex (system) of organizational measures to improve and update the structure of a legal entity (association of legal entities), forms and methods of marketing, production, financial, investment activities, personnel structure, management methods, etc. The result of restructuring is a favorable and long-term impact on the profitability of the structure.

The formation of an updated organizational structure requires taking into account the tax and other legal consequences of the actions taken; in certain blocks, restructuring consists of strict adherence to legal requirements.

The legal aspect of restructuring will be discussed further.

Where to begin

There are certain basic questions that need to be answered before you begin not only implementing, but also developing a restructuring plan. Let us identify the following questions:

- who decides: the possibility of approval of major decisions within the framework of restructuring by the management bodies of the company (or several companies) (the highest management body, the board of directors or supervisory board, collegial and sole executive management bodies) is analyzed;

- what is in the asset:

“strong” and “weak” links in the current structure of the organization are identified, including through an inventory of the legal status and efficiency of use of assets. The structure of those costs that are supposed to be optimized as part of the restructuring is determined; - what gets in the way:

the main problematic issues of the organization are systematized - these could be unfriendly creditors, conflicts with government agencies, etc.

Let us consider in more detail the preparatory stage of restructuring in the light of the questions posed.

Who decides

The decisive question for developing a model and action plan is: in whose hands are strategic powers concentrated in the company (companies) preparing for restructuring. In particular, taking into account the requirements of joint stock legislation, it is necessary to assess the “passability” of certain innovations through the corporate structure of the company, and perhaps develop ways to circumvent existing contradictions in this matter.

For example, if the main shareholder is the state, then the reform program should be based on ensuring state interests and provide for coordination with the FAUFI and industry departments. From our experience, in this case, the main motive for restructuring is greater management transparency, managerial responsibility, and improved bottom line performance.

If shareholders are a group of individuals, they are usually concerned with getting rid of unprofitable assets that significantly reduce the share of income, perhaps getting rid of unwanted creditors.

The situation of the presence of several opposing factions with one driving force for restructuring cannot be ruled out. In this case, the plan itself should be preceded by the development of a set of measures to work with various groups of shareholders, taking into account their interests. So, perhaps, it is necessary to predict the repurchase of shares of those minority shareholders who will be against any reorganization, which means that it is necessary to determine the approximate market price of the shares, the funds that the company is able to spend on such events (including taking into account 10% threshold of net assets that the JSC has the right to use to repurchase shares).

Working with minority shareholders

The minority shareholder, of course, is against restructuring by default if it leads to an even greater dilution of his stake. In particular, a minority shareholder cannot be satisfied with the situation when his shares are converted into shares of another company if, in his opinion, this company is less attractive for investment.

Large companies usually resolve emerging issues according to a fairly standard scheme: first, it is necessary to provide the shareholder with any evidence that he will not lose from the restructuring, but will only benefit (in particular, business conclusions about the prospects of a new business, bank opinions on the fairness of share exchange ratios ). If shareholder loyalty cannot be ensured, companies attempt to buy back shares (shareholders receive an appropriate offer).

It should be understood that in order to make a decision on the reorganization of a legal entity, it is necessary (and sufficient) to consolidate votes in the amount of 75% + 1 share.

If for various reasons it is not possible to achieve such a result, the reorganization as planned will be blocked. Usually in these situations, other options for achieving the required scheme are explored - through property transactions.

The main thing here is to be ahead of the conflicting shareholder, without giving him the opportunity to drag the company into endless litigation by initiating disputes or obtaining interim measures.

Building a structure

It is necessary to deal with assets for several reasons. Preliminary actions will be required to ensure the security of the legal status of fixed assets and guarantees for the main owners.

Further, during restructuring, there inevitably arises the need to identify and select significant liquid assets that can and should be used in the economic activities of the renewed company, and those that do not carry a functional load, and therefore must be removed from the main production facilities and current assets in this way so as not to impose forced expenses on the company and negatively affect the investment attractiveness of the structure.

The fate of non-core assets, in fact, is decided by the calculator - after determining their structure, assessing the results of their past activities, forecasting independent activities, assessing the possibility of selling non-core assets or the advisability of maintaining control, you can proceed to formulating options for disposing of assets: liquidation (termination of activities), separation of a division into an independent legal entity, preservation of the asset with minor changes in structure, sale.

That is, economists prepare their proposals on the efficiency/ineffectiveness of certain links, lawyers, in turn, develop a model for building a company, taking into account the input information.

The variety of options for forming a company structure, be it a single company or a holding company, should not be intimidating. First of all, the final model depends on the initial conditions of restructuring and the tax consequences of implementing a particular scheme. Typically, business restructuring is planned and carried out according to one of two models: consolidation (merger of capital) or disaggregation. In the second case, it is often necessary to create a holding structure, possibly with the separation of a management company.

Without going into a legal study of the principles of building holdings, in any case, I would like to note that a holding is the most adequate economic form of organizational structure of a large business, which consists in the strict economic dependence of one company included in the holding on another.

Companies can be distinguished based on production: a production holding can be divided into raw materials, transport blocks and independent structures in certain industries. It is also common to consider the potential to sell the legally separated part of the business.

After breaking up the main company into several independent units, the main need will be the creation and legal registration of new structures with unified corporate governance mechanisms and properly organized business relations.

Thus, based on the chosen model for constructing the structure, the legal procedure for its creation will have different content, but will nevertheless include two basic stages:

- preparatory stage - creation of legal and economic prerequisites for the formation of the structure;

- the main stage is the direct formalization of relations within the new structure.

Owner agreements

It has become common practice for private Russian companies to create an ownership company in foreign jurisdictions. Obviously, this allows for more flexible solutions to issues with the distribution of participation and management in the company.

A shareholders agreement, as an instrument that is legitimate abroad, can consolidate any intentions and agreements of the parties: let one party own the majority of shares, and the other party will manage the company; let the companies be completely equal partners (50/50), but there will be no blocking of activities in the event of failure to reach agreement on certain issues (by describing the conditions when unanimity will not be necessary).

It is easier to attract investors to a foreign company, including when it is a direct investment fund.

Often, one of the partners immediately prescribes for himself the options, terms and conditions for exiting the business in the future, for example, through the development of an option scheme.

A practical example: agreements with a foreign investor in a dealer network reached a dead end at the stage of discussing the mechanism for entering the business. On the one hand, the investor did not feel so strong in Russian reality as to “sign up” as a participant in Russian society, on the other hand, the current owners had in the past negative experience of coexistence in society of several participants with different opinions regarding the development of the company. The final structure, where 100% of the company's shares belonged to a single foreign company, which, in turn, had both Russian and foreign shareholders, suited everyone. The Russians included in the shareholder agreement a maximum of controversial situations and the procedure for shareholders to act in them, and the investor received confidence that, if necessary, he could protect his interests in a familiar jurisdiction with mechanisms and principles of legal proceedings that were clear to him.

At the same time, it is clear that a foreign company should not become the general rule for owning shares/shares in Russian assets. It is clear that this is rather a forced measure, caused both by less regulation of foreign corporate law and by the desire, in some cases, to protect the ultimate owners from publicity.

However, the instruments offered by Russian financial companies (depository, nominal holding of shares) in some cases allow one to achieve the same results. Formulating non-standard but legal terms of constituent documents under Russian law is sometimes also sufficient.

Here it is worth considering the composition of the board of directors, the principles of its formation, and the involvement of independent directors; it is necessary to determine the competence of the sole executive body up to the upper limit of transactions for which he has the authority. Russian legislation leaves a significant field of activity for the creation of internal services, the provisions of which are internal documents of the company and, from this point of view, are mandatory for the company. Controlling and conflict bodies can be created. You can again take advantage of foreign experience, where the average company has a dozen committees (remuneration committee, advisory committee, executive committees - each with its own competence, procedure for convening and making decisions). There is room for creativity, the main thing is to have an idea for a future structure, reach a fundamental agreement between the parties, and then implement it.

Dealing with problems

When developing a restructuring plan, in addition to assessing the loyalty of shareholders and top managers as the main players on whom the fate of the restructuring depends, the position of creditors in relation to the company (companies) should also be taken into account.

Creditors (and the state represented by the Federal Tax Service should also be included) should be effectively divided into the following large groups: affiliated creditors (debt to them can become one of the restructuring tools used), loyal creditors (they do not interfere with restructuring, but are not ready for significant changing the terms of repayment of obligations), conflicting creditors. The presence of a significant group of the latter can lead to the risk of uncontrolled bankruptcy due to the presentation of demands for early fulfillment of obligations in a significant amount.

What activities should be carried out with such creditors? Firstly, the consequences of the most negative scenario should be assessed in advance: is the company able to cope with the entire volume of demands from creditors insisting on early fulfillment of obligations? Could such a situation lead to a loss of control over the company (for example, if there is some third force that wants to take advantage of the moment of reform)? In the event of inevitable bankruptcy, is it worth initiating a restructuring process? Is it possible to turn a bankruptcy situation to your advantage?

Secondly, options for changing the position of creditors should be prepared in advance. Restructuring usually involves not only a restructuring of the structure, but also a restructuring of obligations. Therefore, it is worth using the tools of compensation, innovation, obtaining the required installments, deferments, and attracting bank loans to pay off debts to conflicting creditors. It is also acceptable to use such instruments as issuing bonds or placing an additional issue of shares.

The system of working with creditors can, in principle, be extended to resolve other pressing issues of the company: the available legal methods for protecting one’s interests allow almost any conflict to be examined from different perspectives and either resolve it or reduce its impact on the company’s plans.

Example from practice: the main creditor of a holding group whose main business is related to film distribution is Sberbank of the Russian Federation. At the same time, when providing loans, Sberbank of the Russian Federation took as much as possible as collateral: real estate, guarantees of participants, shares of the companies themselves. Accordingly, it was the decision of the credit committee of Sberbank that became critical for the approval and launch of the restructuring process, and here it was necessary to disclose the entire scheme to the bank and convince it that the chosen method of reorganization presupposes universal succession and does not carry the risk of non-repayment of loans.

Forecast of consequences

The consequences of restructuring, of course, need to be predicted based on the achievement of the economic indicators for which it was started. However, it is also necessary to make forecasts regarding:

- changes in the management/disposal scheme for fixed assets (primarily from the point of view of the interests of the main owners);

- changes in the pattern of movement of the main financial and production flows (the usual pattern of production relations with the outside world should not be broken; counterparties should be protected as much as possible from the details of restructuring);

- tax consequences;

- consequences for company personnel;

- consequences from the point of view of compliance with the requirements of antimonopoly legislation.

The outcome of the forecast of consequences may be different: either there are no risks in a particular area, therefore, there are no obstacles to the implementation of the restructuring plan. Risks may have been identified, but according to the results of the study they are assessed as insignificant. A separate risk reduction program can be specially developed. We should not exclude the possibility of discovering a risk that will call into question the need for restructuring.

Example from practice: before the issue of VAT restoration on the sale of fixed assets was resolved with the help of arbitration courts, there was a real threat of significant adverse consequences of operations to contribute to the authorized capital of property. A very convenient and progressive structure was built from the point of view of corporate governance and dispersal of assets based on production purposes, but the plan for restructuring a large chemical enterprise in the Nizhny Novgorod region “stumbled” on the issue of VAT. The risk of additional charges from the tax authority was too great. At that time, the company was not ready to go through a round of arbitration proceedings with an unclear outcome, although this option was proposed by lawyers. Only when the risk of adverse tax consequences was eliminated by the more litigious companies did shareholders consider it possible to return to discussion of the restructuring plan.

Other aspects: civil law issues of renegotiation of contracts, intellectual property legislation, licensing issues, labor and antitrust laws - in almost all cases will require certain time and financial resources that must be taken into account as part of the overall costs of restructuring.

Usually, the result of the preparatory work for restructuring is a schedule agreed upon by all parties: a scheme has already been chosen, all risks have already been taken into account, all decisions have been made, and now the implementers are involved in implementing the scheme. Inventory, shareholders' meetings, registration of rights to shares/shares, property - the work is both voluminous and routine.

The most difficult thing is understanding the desired “picture” and developing a plan.

Restructuring is designed to build an effective working system. Consistency is the principle that determines the content of legal work on the preparation and implementation of restructuring projects for large companies.

Opportunities and consequences of restructuring debts to housing and communal services

Granting a debtor for a utility service a deferment in the fulfillment of obligations is permitted when the following circumstances arise: In order to enter into an agreement on preferential terms for repaying the debt for utility services, the debtor must go through a procedure consisting of the following steps: It is important to know that from the moment the additional agreement is signed, penalties are imposed on the tenant are not applied, the previously calculated amounts of penalties continue to exist and are included in the amount of the total debt.

The application form addressed to the service company is not regulated by law and regulations of the Russian Federation. There are a number of recommended details of the form that will speed up the process of processing it: Additionally, it is advisable to indicate information about the identity document and a list of attached papers.

Restructuring of loan debt in Sberbank, Tinkoff, housing and communal services

Otherwise, the Company reserves the right, within days from the date of the decision to liquidate the JSC, to file a claim with the liquidation commission.

And when you turn to a qualified specialist for help, he will definitely provide you with a sample agreement that suits your case, and will also tell you all the nuances and subtleties of the regulatory and legal part of your issue. There are also cases of debt forgiveness between legal entities.

It is this kind of agreement that is one of the most common ways to terminate obligations between the lender and the borrower, and is regulated by the Civil Code of the Russian Federation.

In situations where the borrower loses his income and is unable to repay his obligations to the lender, the parties are looking for ways out of this crisis. The optimal solution to the problem here is to revise the original terms of the agreement in order to reduce the financial burden of the debtor.

Please provide agreements on debt restructuring between legal entities with sanctions in case of delay and violation of the payment schedule. These restructuring actions are formalized through novation.

It must be taken into account that in the case of novation, the guarantee, if it took place, is not preserved, see Novation: how a debtor can replace one obligation with another.

The novation agreement, like any transaction of a legal entity, must have a simple written form, sub.

What to do if the commission refuses to restructure

Restructuring can only be carried out with the approval of the territorial commission. If she refuses to sign a restructuring agreement, this is usually due to the following reasons:

- untimely provision of the agreement;

- the conditions or requirements of the process are not met;

- the agreement does not contain the required number of creditors;

- a case has been initiated against the debtor, according to which he is declared bankrupt.

Important! If the commission makes a positive decision, then on the day the agreement is signed, the accrual of penalties and fines on all debt obligations of the debtor stops.

This video will tell you whether restructuring is worth it:

Action diagram

The process starts with the defaulter writing a statement of desire to review the terms of the primary contract. Then the creditor reviews the application and announces the result within five days. If the borrower has not provided convincing arguments for insolvency, in such situations the lending party is likely to refuse.

However, if the bank’s decision is positive, the client and the financial institution sign a debt restructuring agreement. This documentation is developed by the lender, but the wishes of the borrower are taken into account. The paper becomes legally binding from the moment the new agreement is signed by each other .

Here, the changed conditions for transferring funds to the bank are determined, the specific amount of the mandatory contribution, payment terms and the amount of arrears are fixed.

Please note that after receiving a refusal from the lender, the borrower has the right to ask to refinance the debt with another company . Another way out of the situation is to have the court declare the contract an invalid document. However, it will not be possible to force the lender to start the operation. Restructuring is also possible if the defaulter initiates bankruptcy.

Keep in mind that banks are reluctant to make concessions to clients with a “dubious” business reputation. Therefore, sign an agreement on debt restructuring between legal entities

or the bank and the citizen will succeed when arguing temporary financial difficulties and the confidence of the creditor company in full payment in the future. Let's clarify the specific nuances of drawing up the paper.

Registration for individuals

First, let's look at the procedure for developing the paper that citizens sign. The following items become mandatory items taken into account in the agreement:

- Name . Here they write down the name and originating number of the document, indicating the content of the contract and the intended path to solving the problem. Below indicate the locality where the transaction is concluded and the date.

- Introduction . This block describes the name and details of the parties, noting the grounds on which the creditor and debtor act.

- Contents of the problem . The part contains a detailed description of arrears issues. Here they indicate documentation that confirms the fact of late payments, the specific amount of debt and the period of delay in payments. The next paragraph indicates the method chosen by the creditor to resolve the situation.

- Conditions . Here it is appropriate to describe in detail the new rules for transferring funds: the amount of the mandatory contribution, payment of commission, penalties, write-off of fines. Moreover, for a detailed description of the payment schedule, it is advisable to develop a separate application, indicating the number of this paper. In addition, the creditor has the right to outline the specific amount for which the “benefit” is provided.

- Powers and Obligations . This block is developed taking into account the wishes of both parties. Moreover, in this case, the lender can discuss special conditions. As a rule, the debtor here insists on specifying the conditions for early repayment of the loan, and the creditor insists on unilaterally terminating the agreement in the event of violations by the defaulter.

- Procedure for termination of the contract . The part describes the situations and reasons when the contract is terminated. As a rule, a unilateral order, violation of conditions or a court decision are noted here.

- Peculiarities . This point is the prerogative of the creditor. Here the party indicates special nuances to increase personal benefit, not provided for by the provisions specified above.

- Conclusion . This stipulates the procedure for resolving disputes and the day the contract enters into legal force.

A similar agreement can be found at this link. Please note that the publication provides a sample that can be “remade” to suit specific circumstances.

At the end, the parties sign the paper, making a detailed transcript of the initials and indicating the details. Such agreements are drawn up in several copies - each interested party receives a separate original document. Moreover, when an agreement is drawn up between a bank and a citizen, the documentation is certified with the stamp of the institution.

Purpose of the event

The main goal of debt restructuring is to reduce the burden on the borrower and maintain the possibility of full repayment of the arrears. Both parties to the agreement are interested in resolving the dispute without litigation. Lawsuits will bring additional time and money costs and increase moral pressure.

The task of revising contract clauses is beneficial cooperation between counterparties. Lending conditions are relaxed for the client, and the lender receives a reliable partner. After productive negotiations, the debtor is freed from intrusive conversations, messages, and letters. The phone will not receive calls with threats, demands, or claims. The defaulter does not pay penalties or penalties, and accordingly the amount of debt does not increase.

At the same time, the counterparty improves its own economic performance by reducing the amount of overdue debt. Provisions for doubtful debts will not be formed, which increases the amount of costs. Peaceful resolution of issues increases the efficiency of repayment of debt arrears, and accordingly the financial health of the company improves.