Bankruptcy practice of foreign citizens (non-citizens)

For the first time, a foreign citizen’s application to be declared bankrupt by the Arbitration Court of the Yamalo-Nenets Autonomous Okrug was accepted for processing in 2020. The court then took into account that the Ukrainian citizen had been living in Russia for a long time, received a pension here, owned real estate, and had also taken out a loan from a Russian bank ( see case materials

).

As an example, we can cite one of the recent cases in which creditors initiated bankruptcy proceedings against a German citizen who has a residence permit in the Russian Federation ( see case materials

).

His debt was formed from a guarantee obligation under two loan agreements. The court found the bank's statement to be justified. The defendant, in turn, appealed to the appellate court with a complaint against the decision in the case, in which he asked to cancel it and terminate the proceedings. As a justification, he, in particular, notes the absence in the Law of the Russian Federation “On Insolvency” of legal regulation of the issue of cross-border bankruptcy. However, the court left the foreign citizen’s complaint unsatisfied, citing Part 3 of Article 62 of the Constitution of the Russian Federation. According to it, foreign citizens enjoy rights in the Russian Federation and bear responsibilities on an equal basis with Russian citizens

, except in cases established by federal law or an international treaty of the Russian Federation. Similar provisions are spelled out in Article 4 of Federal Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation.”

The concept of debtor from Article 2 of the Bankruptcy Law, to which the foreign citizen draws attention in the complaint, was interpreted by the court as follows. “The Bankruptcy Law understands a debtor as a citizen, including an individual entrepreneur, or a legal entity who is unable to satisfy the demands of creditors for monetary obligations and (or) fulfill the obligation to make mandatory payments within the period established by this Federal Law. Thus, the Bankruptcy Law does not connect the definition of the concept of a citizen-debtor with his status as a citizen of the Russian Federation

“,” says the decision of the Second Arbitration Court of Appeal dated June 22, 2020 in case No. A28-8319/2016. It is also noted here that the Russian Federation is not a party to international treaties on issues of insolvency of individuals or legal entities; bankruptcy issues complicated by a foreign element are not regulated by federal law.

Conditions for declaring bankruptcy

Both the citizen himself and his creditor or an authorized agency can file an application to declare an individual bankrupt. It is better to involve a lawyer practicing in Moscow to formalize the process itself. The price of professional services is justified by the volume of their work.

The legislation establishes the conditions the occurrence of which is mandatory for the court to accept an application:

- Firstly, the amount of debt accumulated by a citizen must be at least 500 thousand rubles. The total debt to all creditors taken into account is taken into account.

- Secondly, legal demands for debt repayment are not fulfilled by an individual for 3 months or more.

The Federation Council approved the law on the extrajudicial procedure for declaring citizens bankrupt

MOSCOW, July 24. /TASS/. At a plenary meeting on Friday, the Federation Council approved a law that introduces a procedure for out-of-court declaring a citizen bankrupt.

According to the law, support for such a bankruptcy procedure will be free for citizens. It will affect citizens whose debt ranges from 50 to 500 thousand rubles. The developers of the initiative justify the need for innovation by the low efficiency of the current judicial procedure for recognizing bankruptcy. In particular, as noted in the accompanying documents to the law, according to the Unified Federal Register of Bankruptcy Information, for 70-80% of debtors entering bankruptcy proceedings, the inventory did not reveal property with which to pay off debts. In 2018, the number of court decisions declaring citizens insolvent increased by 1.5 times compared to 2020, to an average of 44 thousand.

The law completely excludes professional market participants—insolvency practitioners—from the process. The entire procedure will take place through multifunctional centers. Debtors for whom enforcement proceedings have already been completed will be able to go through the bankruptcy procedure, while the lack of property that could be sold cannot be an obstacle to completing the procedure. A citizen who has completed enforcement proceedings will be able to submit a corresponding application through the MFC, where they check how correct it is; after 6 months the applicant becomes bankrupt. From the moment the application is accepted, he is released from fines and after 6 months, if there are no claims against him, he becomes bankrupt by law.

The MFC, within one working day from the date of receipt of the application, checks the availability of information about the return of the enforcement document to the claimant, as well as the absence of information about the conduct of other enforcement proceedings initiated after the date of return of the document to the claimant and not terminated at the time of checking the information, using publicly available information from the data bank in enforcement proceedings published on the website of the Federal Bailiff Service.

If the citizen complies with these conditions, the MFC, within three working days, includes information about the initiation of an extrajudicial bankruptcy procedure for the citizen in the Unified Federal Register of Bankruptcy Information (USFRB), and if these conditions are not met, the MFC, within three working days, returns the application submitted by him to the citizen indicating the reason for the return. The return of the application can be appealed to the arbitration court at the citizen’s place of residence. If the application is returned, the citizen has the right to reapply with it no earlier than one month from the date of return. If signed by the president, the law will come into force on September 1, 2020.

What consequences of bankruptcy are provided for relatives of individuals?

A person may be declared insolvent if, after paying all debts, there remains an amount on hand that does not reach the subsistence level. It is impossible to live on such an amount, but simply not letting creditors know about you is not the best idea. The only possible option to deal with the situation is to officially declare yourself bankrupt.

A prerequisite for recognizing the bankruptcy of individuals is to be a citizen of Russia. In addition, you must prove that there are circumstances that prevent the payment of debt obligations. This could be a layoff at work or an injury that prevents you from continuing to perform your job duties. The following conditions must also be met:

- You are a bona fide borrower and have made attempts to deal with creditors on your own (you can provide correspondence with the bank);

- You do not hide your income or property. Otherwise, the court will refuse to declare bankruptcy.

- You are working or looking for a job (you must be registered with the official job exchange).

Since property will be sold to eliminate debts if you are declared bankrupt, you need to weigh the pros and cons of such a step

- Preparation: collecting the necessary documents. To apply you will need:

- personal documents (marriage certificates, documents on the birth of children, guardianship, etc.);

- copies of SNILS, INN, personal account statement;

- a list of property with confirmation of ownership;

- income certificate and account statements;

- extract from the register if there are shares;

- loan agreements under which debts have accumulated, indicating the amounts and location of creditors;

- inventory of property;

- medical documents confirming guardianship, injury, operations.

- Prepare a written description of the situation that led to bankruptcy (attached to the application).

- Submit an application and documents to the court in person, by mail or online.

Once the application is submitted, no creditor will have the right to collect funds from you. You will also not have the right to repay the debt. The court will have a maximum of 7 months to review the information provided and make a decision.

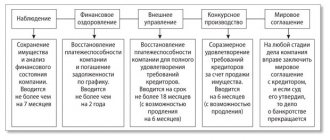

The judicial authority may propose to restructure the debt. The procedure schedule is proposed by the debtor or lender; it cannot last more than 3 years. The debtor's income is of primary importance. Minus funds to ensure life, the debtor's money will be used to eliminate the debt in such a way as to meet the three-year deadline and not leave the individual without a means of subsistence.

You need to pay a one-time fee for the services of a financial manager - 25,000 rubles. If it is necessary to obtain an installment plan, a corresponding application must be submitted to the court.

After the bank’s decision to declare an individual bankrupt, a property valuation is assigned. If the borrower and lender do not agree, they can challenge the decision. The financial manager organizes the auction. Can be sold:

- real estate;

- transport;

- Appliances;

- jewelry.

Property worth more than 100 thousand rubles. sold at public auction, of which all creditors are notified. The proceeds will be used to pay off the debt.

Once the preparatory steps have been completed (this includes collecting the necessary documents and paying the mandatory court fees), you can contact the Arbitration Court to submit an application along with the necessary documents. It is filled out in free form, but must contain key information (reasons for the debt, its size and period of non-fulfillment). If an installment plan is required to pay the manager’s remuneration, an additional application must be submitted.

Thus, we answered the question of how to file for bankruptcy of an individual. Let us emphasize once again that each situation is individual, so you need to be prepared for the fact that you will need to collect any additional information. We also note that before going to court to obtain bankruptcy status, read the current legislation and make sure that your situation meets the conditions set for bankruptcy recognition.

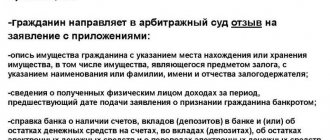

The full list of documents that must be included in the package attached to the submitted application is determined in each specific situation depending on the existing features. However, there is a basic set that is worth focusing on in this situation. In accordance with it, the list of documents that are required when filing a bankruptcy application includes the following:

- documented confirmation that the citizen has outstanding financial obligations in the form of credits, borrowings and any other loans, indicating the amount of debt incurred (all this information can be requested from creditors);

- court decisions - in the presence of outstanding debts;

- documents indicating the income received by the citizen over the last three years (here, not only wages are taken into account, but also pensions, social benefits, dividends and interest on deposits, if any);

- a certificate from the bank about all open accounts, which should indicate information not only about the balance of funds, but also about their movement across the accounts over time;

- information on the flow of funds through accounts in electronic payment systems, if any;

- documents that contain information about movable and immovable property that is owned by the debtor (this even includes shares in the authorized capital and securities, if any);

- agreements concluded by the debtor, the object of which is property worth more than three hundred thousand rubles (confirming the facts of donation, purchase and sale or assignment of the right of claim);

- personal identification documents of a citizen, including a passport, TIN certificate, insurance certificate;

- documents confirming the citizen’s family status (children’s birth certificates, marriage or divorce certificates, marriage agreement, etc.);

- documents containing information about tax payments made (statement of a personal account opened with the Pension Fund);

- a certificate from the tax office, which contains information about whether the citizen has the status of an individual entrepreneur (note that its validity is only five days).

There are two types of transactions that a court can consider invalid and make an appropriate decision on them.

The first type is “preferred” - transactions that were concluded with a certain number of creditors (1 or more). So, if, in the end, financial interests were infringed and the claims of other organizations, which are also creditors of this debtor, were not satisfied, there is reason to suspect a preference for the interests of one of the creditors in relation to others. In the context of the first type of transactions, it is customary to consider agreements that were signed no earlier than six months before the start of the bankruptcy procedure.

The second type is “suspicious” - transactions that were concluded with a deliberately stipulated unequal remuneration. In this case, it is allowed to challenge transactions concluded for a period of no less than 12 months before the start of the bankruptcy procedure, and 12 months after. The second type also includes transactions that were concluded with the clear intention of causing harm to creditors. Such transactions can be challenged if they were concluded no earlier than 36 months before the start of the bankruptcy procedure.

Usually, in order to avoid the negative consequences of an impending bankruptcy, the debtor can begin in advance to get rid of property that will be subject to bankruptcy proceedings. This is done through:

- purchase and sale agreements;

- transfer of property allegedly as a gift;

- according to the outpost agreement.

Such transactions during bankruptcy proceedings must be agreed upon with the manager.

Let us consider in more detail the actions that are performed during this procedure and their order.

- Creditors turn to the arbitration manager or make their decision at the council of creditors, so that the manager can subsequently initiate proceedings on this issue.

- If the council of creditors refuses to file an application with the court, the creditor has the right to file it independently.

- If the council of creditors agrees to submit the application, then the manager applies to the Arbitration Court.

- The court starts proceedings.

- The court considers the package of documents attached to the application.

- Based on this consideration, the court makes a decision: the transaction is either canceled or the court refuses to implement this procedure.

The choice of whether or not to initiate bankruptcy is up to you. However, sometimes the debtor simply has no choice. The consequences are the same for everyone, but everyone has different opinions about it. So, after declaring an individual bankrupt, according to the Federal Law on Bankruptcy of Individuals:

- will not be able to hold leadership positions for 3 years;

- the bankruptcy procedure cannot be carried out again in the next 5 years;

- creditors must be notified of the new bankruptcy procedure.

- from this moment on, all the citizen’s property is managed by his manager, who can use it to pay off debts through a special procedure for its sale;

- the citizen himself is deprived of the right to conduct any transactions with his property;

- if a citizen has shares or shares in companies, then from that moment on they are also managed by the manager;

- all bank cards must be transferred to the manager within 1 day after the court decision;

- it is prohibited to open or close your bank accounts, this right also passes to the financial manager;

- If someone owes the citizen himself, then the manager files a lawsuit to collect all these debts.

The process is shortened due to the reduced number of active actions during the resolution of the bankruptcy issue, and a significant influence is also exerted by the fact that entities falling under this category, as a rule, are not active market participants; they have neither income nor expenses.

This paperwork algorithm is actually used when the monetary value of the value of a legal entity or individual is not enough even to compensate for the costs of the paperwork itself.

- The appointed manager must check the presence/absence of financial transactions completed over the last year, where the parties were the relatives of the bankrupt and the bankrupt citizen himself. Subsequently, the property is sold at auction in order to resolve the dispute with the creditors of the person declared bankrupt.

- The parents and children of the bankrupt will have to adapt to new conditions, associated, first of all, with a decrease in the level of income. Confiscation of property will in any case affect relatives.

The important thing here is that the court, when considering each issue, takes into account the interests of both parties and will not take away the last crumb of bread from the debtor, but will also try not to leave the interests of the creditor aside. Margarita Kholostova, financial manager

- Impossibility of registering individual entrepreneurship for five years.

- Impossibility of concealing the fact that an individual has been declared insolvent.

- Impossibility of taking on new debt obligations (if the bank is not notified of the previously conducted bankruptcy procedure).

- Significant deterioration in credit history.

- An individual declared insolvent cannot re-file for bankruptcy within five years from the date of sale of property and eight years from the completion of debt restructuring.

- Inability to hold leadership positions for three years (a bankrupt person will not be appointed to the post of general director, he will not join the board of directors of the enterprise, etc.).

- When restructuring debts, the debtor's spouse will not face any consequences, because according to the court decision, a cash payment scheme is prescribed if the applicant has a stable income and job.

- When selling property, it is seized for subsequent sale in order to satisfy the claims of creditors. The interests of the spouse are affected here, because jointly acquired property is confiscated, transactions that relate to jointly acquired property are disputed.

Bankruptcy is not the end of the world: RuBaltic.Ru advice for individuals

A person who has fallen into a “debt hole” does not have many acceptable options to get out of it: borrow again or try to escape from creditors. But in this case, the bailiff can withhold part of the salary of an unscrupulous debtor, seize his property and obtain a ban on leaving the country. The only legal alternative is bankruptcy.

What is personal bankruptcy?

For people who are not involved in finance or business, the word “bankruptcy” is associated exclusively with something negative. The phrase “I'm bankrupt” actually means that life is over and the rest of your days will be spent paying off the debt. But this is an emotional approach.

“I’m bankrupt” actually means that life is over / Photo: dom-i-zakon.ru

In fact, the term “bankruptcy” has several meanings. Firstly, bankruptcy is the inability of a debtor to fully fulfill its obligations to creditors, which can be commercial companies, individuals or the state. Secondly, this is a special procedure that helps a bankrupt debtor get out of this state.

Moreover, financial insolvency applies to both legal entities and ordinary citizens.

Residents of Estonia had the opportunity to declare bankruptcy in the early 2000s, then similar laws were adopted in Latvia and Lithuania. In the summer of 2020, the Russian State Duma adopted Law N 154-FZ, and since October of the same year, Russians have been able to prove their insolvency in court.

Here you can online

Law on bankruptcy of individuals in Russia

Every year, about 12 thousand companies in Russia are declared bankrupt. After the adoption of Law N 154-FZ “On Amendments to Certain Legislative Acts of the Russian Federation” and the revision of Law N 127-FZ “On Insolvency (Bankruptcy)”, the number of bankrupt citizens began to increase sharply and already in 2020 almost doubled the number legal entities that have gone through this procedure.

Next, we will look at what the bankruptcy recognition procedure is, as well as its main features, which often cause difficulties for people who are not legally savvy.

The number of bankrupt citizens in 2020 was almost 2 times higher than the number of bankrupt legal entities / Photo: samso.ru

How does the bankruptcy procedure for an individual work?

General instructions for declaring a person bankrupt could look like this.

First thing

it is necessary to make sure that the situation of the bankruptcy applicant complies with the law: the debt must be at least 500,000 rubles, and the delay in payments must be at least three months.

You can file an application to declare an individual bankrupt if you have a debt of up to half a million rubles. If debt obligations exceed this amount, then the appropriate appeal to arbitration is the responsibility of the citizen.

Next step

- this is the filing of an application for bankruptcy of an individual to the arbitration court at the place of residence of the person or the location of the property. The application must be accompanied by a package of documents that will confirm the insolvency of the individual.

The application must be drawn up and submitted to the court within 30 working days from the moment signs of bankruptcy arise. Typically, the document collection stage takes about 14 days.

An application for bankruptcy of an individual is filed with the arbitration court at the place of residence or location of the plaintiff’s property / Photo: Nostalgy

As a rule, during the preparation of a package of documents for a lawsuit, the approval of the arbitration manager takes place. This person is a member of a self-regulatory organization (mandatory condition - note by RuBaltic.Ru) - during the period of bankruptcy, manages the finances of an individual, balancing between the demands of creditors and the needs of the debtor. The manager is also obliged to sell the bankrupt’s property in whole or in part.

Step three

— holding meetings of creditors. This stage can last from one to three months. The purpose of the meetings is to decide how exactly the debt will be repaid. Creditors are interested in restructuring the debt, partially writing it off and, ultimately, paying it off. The plaintiff’s side, as a rule, on the contrary, seeks bankruptcy for its client so that the debt is written off completely.

Creditors are interested in debt restructuring and repayment / Photo: ccbc.com

If the official income is sufficient to repay debts within three years, the citizen is not declared bankrupt. In this case, the court prescribes a loan restructuring procedure: the debt is paid in smaller installments over a longer period and without accruing bank interest and penalties.

Fourth stage

bankruptcy procedures - valuation and sale of the bankrupt’s property during open bidding based on the auction principle. Depending on the liquidity and amount of the debtor’s property, this stage may take 1–3 months. The proceeds from the sale will become the basis for repaying debts.

The only housing, household furnishings and personal belongings of the bankrupt are not subject to sale at auction.

Final stage

— a court decision declaring bankruptcy of an individual. As a result, the debts are written off and enforcement proceedings are terminated. The bankrupt's accounts are unfrozen, and the ban on traveling abroad is lifted.

As you can see, the process of declaring bankruptcy is step-by-step and quite lengthy.

The decision to declare an individual bankrupt in Russia is made only by an arbitration court. The cost of the procedure ranges from 40 to 200 thousand rubles.

Acquiring bankrupt status leads to a number of consequences: the debtor’s property and bank accounts are “frozen”, and the court may decide to ban travel abroad. Also, for three years, a person loses the right to manage legal entities and for five years acquires the obligation to inform banks about the fact of his bankruptcy.

At the same time, the individual receives judicial protection from creditors. The most favorable consequence of bankruptcy is the cessation of accrual of penalties and interest on debts.

It should also be added that restrictions for an individual declared bankrupt significantly complicate the repeated bankruptcy procedure.

How is bankruptcy carried out for an individual if there is no property?

The general bankruptcy procedure is clear: there is no money, there is nothing more to pawn in the pawnshop, in order to save vital things, for example, an apartment and your wife’s curlers, you need to legally protect yourself from creditors. However, this process has a number of nuances, and the first of them is the lack of property that could be sold.

Lack of property does not prevent an individual from being declared bankrupt / Photo: etalon-pravo.ru

The issue of the mandatory possession of property by bankruptcy applicants arose especially acutely in 2020, when the number of people wishing to undergo the procedure and become free from debts increased. At some point, the courts refused to satisfy the claims of debtors without property, indicating that the bankruptcy procedure was aimed, among other things, at satisfying part of the creditors' claims.

In the summer of 2020, the case of a citizen from the Tyumen region, who was denied bankruptcy status by a local arbitration court, reached the Supreme Court of the Russian Federation (RF Supreme Court). As a result, the higher court interpreted the law and determined that a debtor must not own property in order to become bankrupt. The plaintiff's debt of 5.4 million rubles was written off.

Article 46 (part 1, paragraphs 4 and 3) of the Federal Law “On Enforcement Proceedings”

The saving straw for preserving the bankrupt’s property is laid down in Russian legislation. The key to protecting the property rights of a debtor declared bankrupt is Part 1 of Art. 46 of the Law “On Enforcement Proceedings”.

Clause 3, part 1, art. 46 says that the bailiff returns the writ of execution to the collector without full compensation of the debt, if it is impossible to find the debtor and the property to be recovered. Paragraph 4 separately emphasizes the impossibility of executing a court decision if the debtor does not have property for sale, that is, valuables and property, except for the only home, home furnishings and personal belongings.

If enforcement proceedings have been opened against you, it will be useful for you to read the answers of lawyers on this issue.

The only housing, home furnishings and personal belongings are not subject to sale to pay off creditors / Photo: sTwity

Bankruptcy and mortgage: how to save an apartment and get rid of debts?

The second aspect of bankruptcy is the availability of housing purchased with a mortgage. If you have an outstanding mortgage, bankruptcy is not such an attractive option for “writing off” debts. Article 446 of the Civil Procedure Code of the Russian Federation, which protects a person’s right to a single home, does not apply to real estate with a mortgage.

Mortgage and bankruptcy do not mix well. An apartment in a mortgage loan acts as collateral, which means it can be alienated from the owner. By the way, this applies to any mortgaged property.

The only clause that can protect housing taken on credit from being sold under the hammer is the absence of a secured creditor in the register of persons intending to collect what is due from the debtor. But, as practice shows, secured creditors do not play heroes: business is business, and debt is worth paying.

Is there a danger to the debtor's spouse's property?

Married people often wonder whether a claimant can demand alienation of the property of a bankrupt spouse. According to Article 45 of the Civil Code of the Russian Federation, spouses are not responsible to each other’s creditors.

However, if the collected funds are not enough to cover the debt, the creditor may insist on the allocation of a share of the marital property. However, such processes require a separate trial and can take more than one year.

To protect property during bankruptcy proceedings, lawyers recommend:

● change the regime of common joint ownership, for example, enter into a purchase and sale agreement;

● sign a marriage contract; this document is equivalent in meaning to the first.

However, such manipulations on the eve of bankruptcy or during the court’s consideration of the application may be subsequently challenged by creditors and recognized as abuse.

According to Article 45 of the Civil Code of the Russian Federation, spouses are not responsible to each other’s creditors / Photo: ojivaem.ru

Features of a guarantor's bankruptcy

A guarantee is a common method of securing a loan. If a serious guarantor acts as a guarantor for the return of funds, banks reduce interest on loans. However, even guarantors are not protected from unscrupulous debtors and bankruptcy.

The bankruptcy of a guarantor, according to the procedure and conditions, is the same as in the case of individuals. But the former has options. Liability for debts can be subsidiary (part of the outstanding debt is paid) and joint (the entire debt, interest and expenses on it are paid). Also, the guarantor may be liable for loans from individuals and legal entities.

Despite the fact that the bankruptcy procedure is becoming more applicable and understandable every year, going through it is labor, physical and mental. However, this is also a legitimate chance to get rid of debt and start life with a clean slate.

If you still have questions about the bankruptcy procedure for individuals, ask them to qualified lawyers and receive an answer in 15 minutes.

Bankruptcy is a legal chance to get rid of debts and start life with a clean slate / Photo: Google Plus

Access of foreign persons to bankruptcy procedures in Russia

Another issue of great importance for the spread of cross-border bankruptcies in the Eurasian space is the issue of access to insolvency proceedings in a foreign country. Of particular importance in light of the development in Russia of the institution of insolvency of individuals is the problem of access of citizens of the EAEU member states to Russian consumer bankruptcy.

, as well as the consequences of recognizing such bankruptcy on the territory of their domestic states.

In Russia, the issue of determining international jurisdiction in bankruptcy cases, as is known, has not been resolved. COMI, known to foreign law, does not apply for these purposes.

- standard - the center of the main interests of the debtor as a marker of the competence of the court of a particular state.

For a long time, the approach was in force according to which foreign persons could not go bankrupt in Russia and had to go through this procedure in the state of their nationality. For legal entities this is the country of their incorporation, for individuals it is the place of citizenship.

However, the entry into force of personal bankruptcy regulations in 2020, after literally a year of enforcement, forced the courts to look at this problem differently.

Two cases are noteworthy in this context - the case of Mr. Briskin, which addresses the issue of the bankruptcy of foreign citizens, and the case of Ms. Kuznetsova, which raised the issue of the competence of the Russian court to initiate bankruptcy proceedings against a foreign debtor.

In the bankruptcy case of German citizen Briskin <32> the Russian court was faced with the question of whether a foreign entity could be subject to Russian insolvency legislation, if the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)” itself in the articles on bankruptcy of individuals uses the term “citizen”. The court gave a positive answer to this question and declared the foreigners bankrupt. The justification for this decision was provided for in Part 3 of Art. 62 of the Constitution of the Russian Federation, national regime, according to which foreign citizens and stateless persons enjoy rights in the Russian Federation and bear responsibilities on an equal basis with citizens of the Russian Federation, except in cases established by federal law or an international treaty of the Russian Federation. The bankruptcy legislation does not contain such exemptions.

———————————

<32> See: Resolution of the Moscow District Court of 07/08/2016 in case No. A40-186978/2015.

The above approach corresponds to the ideas of non-discriminatory attitude towards citizens of member states of the integration association and freedom of movement. Referring again to the experience of the European Union, let us say that in 2012 the EU Court of Justice recognized the restrictions of the Swedish right of access to individual bankruptcy, requiring the debtor to reside in Sweden, as discriminatory and violating freedom of movement in the EU <33>.

———————————

<33> See: case C-461/11. Ulf Kazimierz Radziejewski v. Kronofogdemyndigheten i Stockholm

(URL: https://curia.europa.eu; access date: 04/25/2017). The procedure at issue in this case was not covered by the EU Insolvency Regulation because it was not named in its Annex A, which lists the procedures covered by it. In this regard, the question of the jurisdiction of the bankruptcy court was considered on the basis of the debtor's domestic law, and not on the basis of secondary EU law.

In the case of Ms. Kuznetsova, the court was faced with the following circumstances <34>. The debtor, being a citizen of Ukraine, lived in Russia legally for a long time, got married here, worked and then received a pension, purchased an apartment, a garage box, a plot of land and, importantly, took out loans from Russian banks. At some stage, she stopped servicing them, and questions arose: could she go through bankruptcy proceedings in Russia and get relief from debts? Or does she have the right to rely only on the bankruptcy law of Ukraine? And the other side of the relationship: can its creditors initiate bankruptcy in Russia, where part of its assets are located, or are they also forced to turn to Ukrainian jurisdiction?

———————————

<34> See: Determination of the Arbitration Court of the Yamalo-Nenets Autonomous District dated June 30, 2016 in case No. A81-6187/2015.

In the absence of other rules, the court applied Art. 247 of the Arbitration Procedure Code of the Russian Federation, which regulates the general rules for determining international jurisdiction in cases involving foreign persons, and used the criterion of a close connection between legal relations and the legal order. Clause 10, Part 1, Art. 247 of the Arbitration Procedure Code of the Russian Federation states that a Russian court is competent to consider a case if there is a close connection between the disputed legal relationship and the legal order of the Russian Federation. This provision was initially aimed at determining international jurisdiction for claims in which there is a dispute about the law, but the court applied it by analogy to a bankruptcy case involving a foreign debtor and, considering that Ms. Kuznetsova’s bankruptcy was closely connected with Russia, initiated appropriate proceedings . The court also drew attention to the fact that Ms. Kuznetsova herself and her property were located on the territory of Russia, which, by virtue of paragraphs 1 and 3 of Part 1 of Art. 247 of the Arbitration Procedure Code of the Russian Federation also formed the competence of the Russian court.

Additionally, the court indicated that the approach it used complies with international legal standards for determining international jurisdiction in cases of insolvency of individuals, since both the UNCITRAL Model Law and EU Regulation No. 2015/848 determine the jurisdiction of the competent court not by the nationality of the person, but by his permanent place residence.

Despite the debatable nature of the application of Art. 247 of the Arbitration Procedure Code of the Russian Federation for bankruptcy cases, the solution to the problem proposed by the court may be very promising for Russia. It overcomes the formalism of such a criterion of jurisdiction as citizenship, allows individuals to go bankrupt in the state with which their life and professional activities are closely connected, and, in fact, performs the same functions as COMI

- standard abroad.

We also note that it is possible to extrapolate the position used in the mentioned cases of personal bankruptcy to legal entities (this prospect is not obvious, but it is not excluded). The issue of the possibility of bankruptcy of foreign legal entities in Russia remains unresolved. On the one hand, for now this excludes manipulations with jurisdictions to transfer the center of business activity and other criteria that form the very close connection between bankruptcy and the rule of law to a country with a more favorable Dolzhdnikov bankruptcy regime. On the other hand, the continuing uncertainty formed by the legal vacuum, coupled with not always predictable judicial enforcement, creates unpredictability

for entrepreneurs and foreign investors, including those from the EAEU states, when assessing their legal risks in the event of bankruptcy. And this fact clearly does not contribute in any way to the construction of a single economic space.

To summarize, we note that the judicial acts adopted in the cases of Mr. Briskin and Ms. Kuznetsova open the way for foreign persons to personal bankruptcy in Russia (subject to the appropriate conditions for the presence of a close connection with the legal order of the Russian Federation), which can significantly affect development of cross-border insolvency within the EAEU.

At the same time, as already noted, the prospects for recognition of such foreign bankruptcies in the state of citizenship or nationality of the debtors are not obvious.

Results

In our country, attention to the problems of cross-border insolvency is growing, and this trend is not accidental. It is associated with the phenomenon of globalization of bankruptcy cases and their acquisition of a truly multi-jurisdictional nature (in comparison with the simple complication of a foreign element of domestic proceedings). Examples include the initiation of several bankruptcy proceedings against the same debtor (the V.A. Kekhman case), the recognition of Russian bankruptcies abroad (the Vneshprombank bankruptcy case and the bankruptcy case), access to foreign assets of Russian debtors and their beneficiaries (the bankruptcy case of Mezhprombank and S.V. Pugachev). Conventionally, such bankruptcies can be characterized as moving in a western direction.