To understand the basic provisions of personal bankruptcy , you need to understand how this procedure generally works and where it needs to start. First of all, it is worth remembering that the process of declaring a citizen insolvent is complex and multifaceted, and also includes many subsequent restrictions and prohibitions. It makes sense to take such a step when debts have reached a certain critical level and a court decision is the only prudent way out of the current situation.

Let's figure out what the conditions for bankruptcy of individuals .

Citizens have been allowed to submit an application to the arbitration court along with legal organizations to officially confirm their financial insolvency since October 2020, when the amended “Bankruptcy Law” was issued. Many lawyers noted that this step was made in order to reduce the number of unpaid debts in favor of banks and other credit institutions, because non-payments have increased significantly recently.

First of all, all citizens are interested in the question of what amount of debt causes bankruptcy of individuals . The basis for bankruptcy of an individual is a debt that exceeds half a million rubles. However, you should not believe the common myth that only loans are taken into account. Debt includes personal debts on receipts and specific bank loans such as mortgages. Having an apartment with a mortgage, do not forget that, even if it is your only home, such real estate is not protected from confiscation and putting up for auction. For each situation, the solution formula and the future debt restructuring plan are selected separately. This can best be done by an experienced professional who is well versed not just in laws and jurisprudence, but specifically in bankruptcy cases.

See also: Bankruptcy of individuals - pros and cons of the procedure, consequences

How the procedure works

Bankruptcy of individuals: step-by-step instructions in 2020

Step 1. The debtor/creditor/tax service submits an application to the arbitration court at the borrower’s place of residence, or less often at the address of his temporary registration. It is more profitable for the borrower to contact the justice authority himself, since it is the applicant who chooses the SRO, which will send its financial manager. In turn, it is this official who will manage the entire procedure.

Step 2. If the application is accepted, then the bankruptcy process begins. When errors and shortcomings are identified in the application, they will have to be eliminated urgently. Otherwise, the court will refuse to proceed further with the case.

Step 3. The first court hearing is scheduled. If the debtor himself is the applicant, then he should be present at the hearing, otherwise the case will remain without consideration.

Step 4. The first hearing is held. During it, it is determined whether there are signs of insolvency, a bankruptcy procedure is selected, and a financial manager is appointed.

Step 5. Restructuring or implementation is carried out. The case is successfully completed if it is declared insolvent, restrictions are lifted, and debt is eliminated. At any stage, the parties can enter into a settlement agreement. According to the law on bankruptcy of individuals, the manager gets access to all cards and PIN codes from them, the debtor’s accounts and the property that makes up the bankruptcy estate.

How to fill out an application correctly

- The name and address of the Arbitration Court, the applicant’s full name along with passport details are written in the header.

- The main part indicates the reason why the person decided to file for bankruptcy, as well as the total amount of the delay (penalties and fines are separately indicated if they are disputed). Creditors, amount and source of income, bank accounts and property composition are listed. The name of the SRO is written down, from which the court will select an arbitration manager.

The documents presented must include receipts, loan agreements and other financial documents indicating the formation of debt. You will also need a copy of your passport, a list of creditors, certificates confirming your financial and marital status, an inventory of property, copies of agreements on the alienation of property for the previous 3 years, and an extract from the Unified State Register of Individual Entrepreneurs.

Advice to the debtor! You should not alienate property shortly before declaring insolvency, especially sell it cheaply or give your property to relatives or friends. The purity of the transaction must be checked by the manager. If he confirms that the alienation occurred in order to hide his assets, then the property will return to the bankruptcy estate.

The cost of bankruptcy of an individual: prices in Moscow and throughout Russia

The applicant will have to pay:

- state duty of 300 rubles;

- deposit with the court an advance payment for the services of the financial manager for each bankruptcy procedure. Its amount is 25,000 rubles;

- representative services.

Thus, the minimum you will have to spend is 30-40 thousand rubles, and the maximum is 150-200 thousand rubles in legal costs.

Remember: If there is no money to pay procedural costs, then the legal proceedings are terminated.

Bankruptcy of individuals consequences of inclusion in the register

Recognition as an insolvent debtor is accompanied by the following features:

- During the consideration of the case, you cannot buy and sell property, pledge it, or participate in surety. Based on the results of recognition of insolvency, the right to dispose of the assets included in the bankruptcy estate is terminated;

- at the discretion of the court, travel abroad is prohibited;

- You cannot manage funds in bank accounts;

- within 5 years after a person is declared bankrupt, he is obliged to inform credit institutions about this when applying for a loan or credit;

- For three years, you are not allowed to hold any positions in the management bodies of companies or participate in any way in this process.

Obtaining bankruptcy status leads to the termination of:

- claims of creditors (except for fines, fees, taxes);

- accrual of interest and penalties on obligations;

- legal force of executive documents on property penalties.

Presentation of these demands is possible only during the insolvency procedure.

Please note which debts cannot be written off:

- compensation for any damage, including moral damage;

- alimony;

- current payments, including wages and severance pay;

- claims that are inextricably linked to the identity of the creditor (for example, debt under subsidiary liability).

Amount of arrears to start the procedure

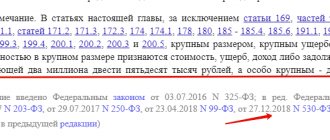

Keep in mind that it will not be possible to declare complete financial insolvency with a minimum amount of debt. A bankruptcy case is initiated if the claim against the debtor is at least 500,000 rubles . Moreover, in such situations, the defaulter has not made payments for at least 90 days, and the financial situation of this person does not allow him to pay off creditors. This is stated in paragraph 2 of Art. 213.3 Federal Law No. 127 .

The amount of debt for bankruptcy of an individual is specified in Federal Law No. 127 and is 500,000 rubles

It should be noted that legislators are developing a separate project regarding the lower limit of this amount. After all, an arrears of half a million is a critical figure for most citizens . Moreover, in situations where a person suddenly loses his ability to work, even 200,000 becomes an unaffordable amount. However, this innovation has not yet been adopted, so citizens have access to the procedure under the conditions described above.

Please note that in addition to the established minimum arrears, it is appropriate for the borrower who initiates the procedure to expect repayment of the services of the manager, payment of state fees and legal costs.

Sometimes this amount does not correspond to the economic capabilities of the citizen. In such situations, the court meets the defaulter halfway and offers payment in installments. However, without paying the state duty, which will cost 6,000 rubles, the claim will not be accepted. Take this nuance into account.

Today, amendments to the law have been developed to reduce the minimum debt established for citizens.

Keep in mind that bankruptcy of legal entities is a more democratic procedure. Here it is enough to accumulate an arrears of 300,000 rubles . This point is enshrined in Article 6 of the Federal Law “On Financial Insolvency (Bankruptcy)” .

Simplified bankruptcy of individuals: advantages and reviews from experts

By April 17 of this year, a law is expected to appear aimed at facilitating the write-off of debts of low-income people and citizens affected by the crisis due to the spread of coronavirus infection.

The advantages of the new procedure include:

- no need to go to court. You should only place information independently or through the MFC in the Unified Federal Register of Bankruptcy Information;

- the minimum debt threshold is 50,000 rubles;

- low cost of the procedure: the main costs will come from a special Fund;

- as soon as the case is transferred to the financial manager, the debt does not grow, and no other claims are made against the debtor;

- You can write off late payments for utilities, loans, fines, taxes;

- simplification from a legal point of view: you do not need to understand the basics of judicial proceedings or file petitions.

Amount of debt for declaring a company (legal entity) bankrupt

The Federal Law on Bankruptcy (Article 3) specifies the circumstances that allow a company to initiate an insolvency process. The delay in payments must be (in time) from three months or more from the moment when it is necessary to make a transfer of funds. Regarding the amount of debt for declaring bankruptcy , the following nuances apply:

- for ordinary companies - from 0.3 million rubles;

- for strategic firms and monopolistic enterprises - 1,000,000 rubles.

Features of bankruptcy of a legal entity in 2020:

- filing an application is available to the debtor company, authorized structures and creditors;

- the period for considering cases of insolvency of legal entities is up to seven months from the date of submission of the application;

- It is allowed to involve any persons who have the necessary package of documents in their hands as representatives;

- refusal to declare a bankrupt is possible in the absence of signs of insolvency considered in the relevant Federal Law.

The necessary conditions

Now let’s briefly go through the list of requirements that the court imposes on defaulters in such situations. The key task for the debtor is to prove personal insolvency . This criterion includes the following features:

- termination of financial payments after the final settlement date;

- the debtor paid less than 10% of the arrears from the date of actual completion of the transaction;

- the amount of an individual's debt is greater than the value of that person's property;

- there is a decree from the relevant department about the absence of collateral property.

Please note that if loan payments are not overdue and the final payment deadline has not arrived, the insolvency of the applicant-debtor is called into question. However, the actual inability to pay bills or the anticipation of such a fact is a reason to initiate bankruptcy proceedings.

The main requirement for a defaulter when filing an application for bankruptcy is that the financial situation corresponds to the realities and payment of the necessary court fees

To start consideration of the case, the defaulter will need to submit an application to the Arbitration Court and support this paper with documentation confirming the correctness of the defaulter. This list is specified in Art. 213.4 and consists of the following positions:

- evidence of the occurrence and accumulation of arrears;

- confirmation of the financial insolvency of the borrower;

- an extract from the state register to determine the status of the debtor;

- a list of creditors indicating the specific amount of obligations for each item;

- a detailed inventory of the defaulter’s property;

- documentation of transactions carried out over the past three years;

- papers on income and payment of taxes by the borrower for 3 years;

- certificates of financial accounts in banks, securities, deposits;

- other documentary evidence of the borrower’s words.

Accordingly, the main requirement for the debtor is the argumentation of the current economic situation while observing the minimum level of accumulated late payments . It should be noted that the court always provides a chance for the rehabilitation of such debtors, offering restructuring of payments of a fixed amount.

The stated facts will need to be supported by documentary evidence.

This solution becomes a solution for people whose earnings allow gradual settlement with creditors and partial payment of the balance of the accrued amount. Considering that banks practice a constant increase in interest and fines for such debts, the Arbitration Court simply determines the specific amount of arrears and orders the development of a project for payments in installments. This nuance works in favor of the defaulter and allows you to restore your business image.

What is the amount of debt for bankruptcy of a company?

A company is declared insolvent (bankrupt) if funds are not transferred for three or more months. after the reporting date.

Insolvency is a tool for financial recovery. Or a method to get rid of current debts that have become unbearable.

The debtor must apply to the arbitration court no later than 1 month after the occurrence of events related to the debts.

Documents are submitted to the courts, as mentioned earlier.

- Authorized authorities.

- Salaried employees who were not paid wages.

- Creditors.

- The organization itself.

The abstract for those conducting insolvency remains very common. And it only involves a few simple steps.

The first meeting of creditors is held specifically during observation.

Have you decided to prepare and submit an application to the Arbitration Court about your insolvency? It is very important to analyze all transactions and agreements for the alienation of any assets before filing an application. After all, the manager has the right to challenge dubious transactions and redistribute property in the interests of bankruptcy creditors who are in the register. Get a consultation for free!

- Preparation of documentation for subsequent actions.

- Notifying all persons whose interests are affected by bankruptcy.

Observation takes a maximum of six months, a minimum of three to four months.

Creditors and the debtor can achieve this agreement at any stage of bankruptcy.

If bankruptcy proceedings are used, the problem is resolved in a few simple steps.

The final price after these operations is the so-called final mass.

The remaining debts are simply written off and nothing else happens to them. The state fee for appealing to the arbitration court is 6 thousand rubles.

Stages of the bankruptcy procedure for citizens

From the moment the amount for bankruptcy exceeds the minimum threshold, you should not waste time. The procedure for citizens and individual entrepreneurs is as follows:

- Drawing up an application to arbitration. The document highlights the reasons why an individual lost the ability to pay creditors for their obligations. Be sure to provide an accurate list of existing valuable property (real estate, cars, art, jewelry, etc.). List bank accounts and indicate the amount of debt. If claims for debt collection have already been filed by the current moment, then they are also reported. By this time, the applicant must decide which SRO of financial managers will apply to and indicate the organization’s details in his application. Money to pay for the services of the manager is deposited with the court.

- The application is submitted to arbitration at the place of registration. If this is not possible, then the documents are sent to the court by registered mail with a list of the contents and a delivery notification.

- They pay the state fee. Its amount in cases of bankruptcy of individuals is 300 rubles.

- The court accepts the case for consideration within 55 days from the date of filing the application.

- The fact that a case has been accepted for consideration is published in the Unified Federal Register of Bankruptcy Information. This is done for a fee at the expense of the debtor.

Next, the court considers the case and decides how exactly the resulting debts will be repaid. For this purpose, restructuring or sale of property is prescribed.

Before submitting documents to the court, you should carefully check them

For the defaulter himself, restructuring is more profitable. Without selling his acquired property, he gets a chance to pay creditors on significantly more lenient terms. A new payment schedule is drawn up with the participation of all parties:

- the amount of monthly contributions is reduced;

- provide a deferment;

- increase the loan repayment period;

- take other mitigating measures.

In fact, we are talking about the fact that after the easing of credit conditions, citizens have the opportunity to gradually pay off the credit institution. At the same time, bankrupts are charged increased interest, penalties, and late fines. Restructuring is not available to those who do not have a stable source of income, or whose earnings are too low (statistics for the last 3 years are taken into account).

The deadline for filing applications to arbitration for personal bankruptcy is limited. In addition, you need to know: bankruptcy of individuals - at what amount it will start, how to proceed, what documents to collect and where to submit them. Therefore, the help of a lawyer in such a situation is very important, since in practice the procedure has a lot of procedural subtleties.

0

Author of the publication

offline 17 hours

The right and obligation to file an application for insolvency of an organization

The presence of the above-mentioned signs of bankruptcy of an organization gives the right to go to court with a statement of its insolvency:

- employees who have not been paid wages or benefits (the existence of debt and its amount must be established by a court decision that has entered into legal force);

- by authorized bodies after 30 days from the date of the decision to collect the debt;

- creditors to legal entities on claims confirmed by a court decision that has entered into legal force.

Extrajudicial bankruptcy procedure

A new section with rules for simplified out-of-court bankruptcy will be introduced into Law No. 127-FZ. The preferential procedure is as follows:

- you need to make sure that the bailiffs have issued orders to end the proceedings (this can be done in person at the FSSP, or on the bailiffs’ Internet portal via the link);

- you need to check that the amount of debt is more than 50 thousand rubles, but less than 500 thousand rubles. (the value of property assets owned by the defaulter does not matter);

- you must fill out and send an application to the MFC at your permanent or temporary residence address;

- when contacting the MFC, you must accurately indicate the list of creditors and obligations (for obligations not included in the application, write-off is not allowed);

- within 6 months, creditors have the right to file objections and complaints, demand that the bankruptcy case be transferred to court if the debtor does not meet the conditions of simplified bankruptcy;

- If creditors do not file objections within 6 months, or they are considered unfounded, the MFC will make a decision on bankruptcy of the individual. persons and debt write-off.

- After the application is accepted by the MFC and the information is included in the EFRSB, banks and collectors will be obliged to stop the forced execution of judicial acts.

- The accrual of penalties on debt also stops.

- The out-of-court insolvency (bankruptcy) procedure will be completed within 6 months.

In addition to the standard consequences specified in Law No. 127-FZ, citizens will not be able to re-use the simplified procedure for 10 years. If the application to the MFC is returned due to errors and inaccurate information, you can resubmit it only after a month.

To avoid such problems, we recommend contacting our lawyers to prepare documents and support out-of-court bankruptcy.

Note!

The law on extrajudicial bankruptcy does not provide for the obligation to notify creditors. However, the MFC will immediately transfer the information to the EFRS, so banks and MFOs will be able to regularly check information about the debtor and protect their interests.

If the debtor does not have property to be sold, and the application is drawn up strictly in accordance with the law, problems with write-off will not arise for a long time.

Do you need an arbitration manager?

The peculiarity of the simplified bankruptcy procedure is not only the appeal to the MFC, but not to the court. Since the procedure does not provide for the identification and sale of property, an insolvency practitioner is not involved.

MFC employees will process documents, requests and verify information. If a non-compliance with the conditions of extrajudicial bankruptcy is revealed, you will have to submit documents to arbitration, attract a manager, and pay his fee.