Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 07/14/2019

Reading time: 4 min

0

201

Running your own business involves certain financial risks. In order to ensure the reliability of a potential partner, additional information may be required from commercial companies and government agencies. One of such documents is a certificate of absence of bankruptcy of a given legal entity. It serves as additional confirmation of the absence of signs of insolvency of the company and another fact in favor of its reliability.

- Who needs it and why?

- Where can I get it?

- What information should the certificate contain?

- Receipt deadlines and state fees

Why do you need a bankruptcy certificate?

The reasons for requesting a certificate of solvency may vary. But in each case, the organization requesting the document insures itself against losses that may arise as a result of cooperation with an unreliable counterparty.

An approximate list of organizations requiring a bankruptcy certificate:

- potential business partners - before concluding an important transaction;

- arbitration court - when considering certain cases;

- government bodies - during competitions and tenders;

- banking organizations - to obtain guarantees for loan repayment;

- notary – for real estate transactions.

In many cases, a certificate of absence of bankruptcy is an admission to participate in tenders.

Not only a legal entity, but also an individual can declare themselves bankrupt, therefore, in some cases, citizens are also required to provide a certificate.

What you need to know: document features and types

There is no specific form for this certificate by law.

The free form of the document is based on the inclusion of certain details, while by analogy of law it is permissible to use a sample of another certificate.

In 2009, the Government issued Rossreestr Order No. 23 with a sample of guarantees for strategic enterprises. This sample can be used as a template for drawing up a certificate of absence of bankruptcy. It must be remembered that there is no insolvency department in Russia, and the committee was abolished 10 years ago.

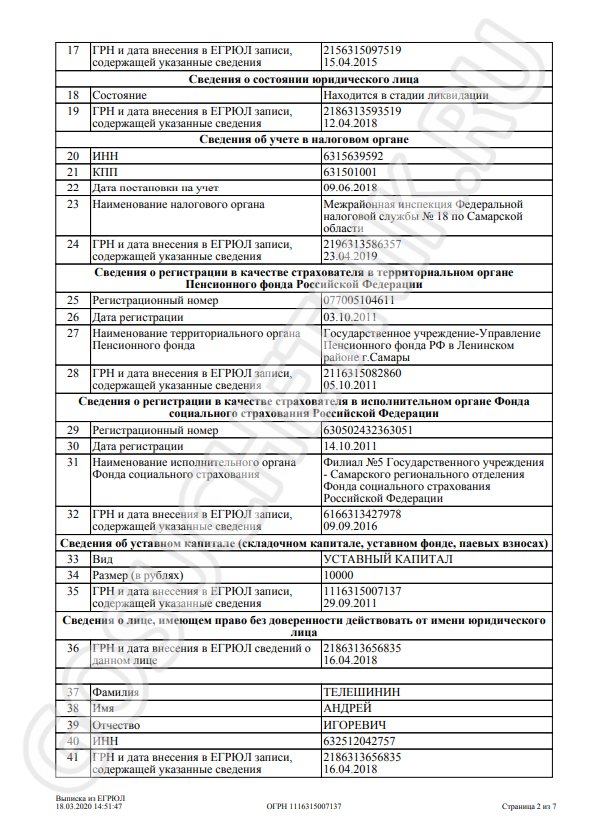

One way to obtain such a certificate is to contact the registration authorities. The Federal Tax Service is authorized to issue extracts from the registers of taxpayers - Unified State Register of Individual Entrepreneurs and Unified State Register of Legal Entities.

Such an extract contains complete information about the subject. The document is issued to the interested person, and is drawn up on the basis of Federal Law No. 129 “On State Registration of Legal Entities and Entrepreneurs” and Government Decree No. 462 “On the amount of fees for providing information.” According to the Resolution, an enterprise receives an extract regarding itself free of charge, and other persons must pay 200 rubles for a regular extract and 400 rubles for an urgent one.

Attention: An extract from the register of taxpayers is not a certificate indicating bankruptcy. The document only contains the entire range of necessary information, but it must be accompanied by a randomly compiled document. The extract is the basis and is attached to the specified certificate.

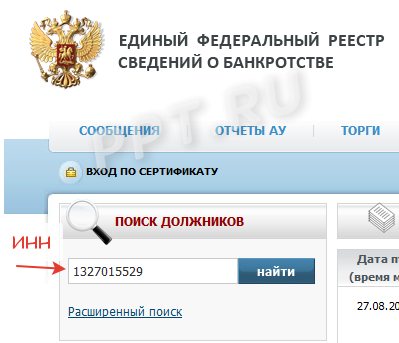

Until 2013, a certificate confirming the absence of bankruptcy proceedings could be obtained from the Arbitration Court, but after the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation at the end of the year, the courts no longer confirm the absence of bankruptcy proceedings. In this regard, confirmation of the solvency of an enterprise can be made by printing out the corresponding page of the website of the EFRS (Unified Federal Register of Bankruptcy Information) and the CAD (Arbitration Case Files).

The attached copy of the page must contain the name of the enterprise and the issuance of the database for it.

While the EFRSB contains information about the current state of the entity, the file contains decisions on bankruptcy cases from the BRAS (Bank of Arbitration Court Decisions). This information is provided free of charge. At the same time, the databases are filled on a regular basis as required and from the personal funds of the bankruptcy managers, which is compensated by the payment of expenses by the bankrupt.

How to compose and format correctly?

This certificate is drawn up as a document confirming the existence of grounds to consider the specified person bankrupt or a creditworthy person. The following documents may serve as grounds:

- extracts for the subject from the Federal Tax Service;

- copies of other documents from the Federal Tax Service;

- letters from the tax office about the absence of the requested information;

- issues of the Kommersant newspaper with bankruptcy data.

In addition to indicating the solvency or bankruptcy status of the person, the certificate must contain comprehensive details of the subject from the general principle of the formation of civil documents, such as:

- full and abbreviated name of the enterprise;

- organizational and legal form (OKOPF);

- registration codes (OGRIP, OGRN, OKPO);

- date and address of registration;

- authorized capital;

- Full names of owners and members of the management team;

- legal successors of the subject.

An important feature of the attached evidence is the potential procedure for inspecting the pages of the card index by a notary. Interested parties have the right to request notarization of pages.

An alternative may be electronic confirmation of the requested information from the tax office, but this procedure is significantly more expensive. On average, a single confirmation of data with an electronic signature will cost 50 thousand rubles, and an annual service with unlimited confirmation will cost no less than 150 thousand.

Why get a certificate of insolvency?

The certificate is needed to ensure the reliability of the company or individual. A request is sent to obtain information. The request indicates the name of the organization, INN, OGRN, or personal information for a private entrepreneur.

The request can be submitted to government authorities in person or sent by registered mail with notification. In Russia there is no separate insolvency department. To generate a certificate, the information specified in the Unified State Register of Legal Entities as of the date of the request is taken.

When is an insolvency document required?

7 cases for obtaining a bankruptcy certificate:

- Take part in a competition for a government order or auction.

- Check the counterparty.

- Inspection of the company by government organizations.

- The judge will require the certificate.

- Creditors require a bankruptcy certificate.

- To open a bank account and provide information about the management of the organization.

- To occupy leadership positions.

Who can request a bankruptcy document

The document may be needed by counterparties. As they say: trust, but verify. Often information is required to make a decision on further cooperation.

The arbitration judge may have an interest in obtaining the document. State bodies and municipal authorities may also request a bankruptcy certificate.

Help contents

Sample text of the certificate: With this certificate I confirm that insolvency proceedings were not initiated against StroyKomplekt LLC, bankruptcy proceedings were not initiated, and liquidation applications were not sent to the court.

Obtaining an extract from the Federal Tax Service

To obtain a document indicating the presence or absence of a bankruptcy case, you can contact the Federal Tax Service. Upon request, the Federal Tax Service can provide information from the Unified State Register of Individual Entrepreneurs and the Unified State Register of Legal Entities.

To receive such an extract, you do not need to make any payment if the applicant requests information about his company. If a third party applied for an extract, he will have to pay 200 rubles. If the document is needed urgently, the payment will be 400 rubles.

It is important to understand that the extract received from the Federal Tax Service is not a certificate of absence of bankruptcy; it only covers information about the taxpayer, for example, the absence of signs of impending bankruptcy. This document is an attachment to a freely completed certificate.

Electronic extract from the Unified State Register of Legal Entities

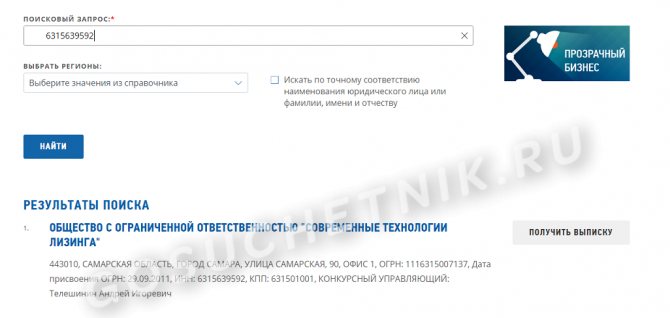

A step-by-step algorithm on how to obtain a certificate of absence of bankruptcy in electronic format.

Step 1. Select the “Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs” service on the Federal Tax Service website.

Step 2. Indicate the OGRN or TIN or the name of the organization for which the extract is requested.

You will receive an electronic document signed with an electronic signature (clauses 103, 107 of the Regulations) in real time (clause 4 of the Appendix to Order of the Ministry of Finance of Russia No. 121n dated 08/05/2019). An extract from the Unified State Register of Legal Entities is actually a certificate from the Federal Tax Service about the absence of bankruptcy or liquidation - the information is given in a separate section of the form.

What does it look like

It is necessary to understand that this certificate must be supported in the form of evidentiary forms. It is used to ensure that the other party ascertains the reliability of the LLC or individual entrepreneur.

The document does not have a single accepted and approved sample, so it can be drawn up in free form, indicating the information requested by the interested party. It is necessary to indicate the basic information of the LLC. The document must be supported by supporting data. A paper that is not supported by documentation that proves the absence of bankruptcy is deprived of legal force.

Methods of obtaining

Despite the fact that today there is a need for a certificate of absence of bankruptcy or liquidation, there is no specialized authority issuing it. Most people who are interested in receiving visit the tax office. This organization can issue extracts from registers, but the authority can provide information about the financial condition of the LLC only after receiving the relevant information from the court.

In accordance with the order of Rosreestr, responsibility for issuing certificates of insolvency of individual entrepreneurs and LLCs was assigned to the Federal Service, which is responsible for registering legal entities. But the issuance of a certificate by this authority is not possible for all LLCs, more often for government agencies. There is no other organization that could deal with this issue in Russia.

LLC representatives can draw up an insolvency document independently. It must be issued on a form and provide information confirming that the LLC is not bankrupt. If the requested information is not available in other sources, the document may be provided by the arbitration court. You can obtain information from the bankrupt data register. You can also find the data in full on specialized websites on the Internet; to do this you need to go through the registration procedure.

Where can I get the document?

The rules related to the maintenance of documentary circulation in the state register approve certain norms and procedures for requests for the issuance of a certificate confirming the absence of bankruptcy proceedings in relation to a legal entity.

Where to get it?

To obtain a certificate, you will need to contact the Department of State in the bankruptcy department. The absence of a bankruptcy case can be confirmed by the Arbitration Court. To obtain the relevant information, you will also need to submit a request to the authority.

All information and documentation is issued in the form:

- Extracts from documents containing information about legal entities in the Unified State Register of Legal Entities;

- Photocopies of documents that are kept in their custody;

- A certificate indicating the absence of the requested data. Such a document is issued if information about the legal entity is missing.

These papers can be provided to persons who have submitted a request to the tax authority at the actual location of the business entity.

If the state registration of a company was carried out in a special manner, then the request can be sent to the Office of the Federal Service of the Russian Federation. It is compiled in any form.

The request must indicate:

- Name of the legal entity, its TIN;

- Personal information about an individual who has the status of an entrepreneur, his TIN.

The request will be sent in the form of a postal order, like a registered letter. If desired, it can be submitted in person. It is possible to conduct a request using the Internet.

Find out what are the stages of voluntary liquidation of a legal entity. What documents are needed to liquidate a non-profit organization, see here.

How long does alternative liquidation take ]read here[/anchor].

What is it for?

The purpose of registration may be requests from creditors or future partners. In some cases, government agencies may request a document confirming the absence of bankruptcy. This is required so that the interested party can protect himself from financial and other losses and ensure the reliability of the partner. You can request paper:

- partners - before drawing up a contract or agreement;

- judicial authorities - if a case of insolvency is being considered;

- government agencies - when tenders are organized;

- banking institutions - to provide a guarantee of loan repayment;

- notaries - when transactions are executed.

Paper may also be required by developers or suppliers. This document is direct evidence of solvency. Therefore, such a certificate is defined as a guarantor of payment.

Letter about the absence of bankruptcy proceedings: sample

Several categories can send a request to obtain a certificate of insolvency of a bankrupt. Let's consider each of them separately.

In addition, the interested party may, if necessary, request electronic confirmation of the information provided. It is necessary to clarify how much the service of confirming data with an electronic signature costs.

You have the opportunity to obtain a certificate from the Federal Tax Service. At your request, the Tax Service will provide information from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. When a third party applies to receive a document, she will have to pay 200 rubles. for receiving it. Urgent payment will be about 400 rubles. Access to personal data is free. Paper may also be required by developers or suppliers. This document is direct evidence of solvency. Therefore, such a certificate is defined as a guarantor of payment.

Current information indicating the solvency of a business entity is located on one of the available sources:

- official website of the arbitration court (section with a file of cases);

- unified federal register of information on bankruptcy (to obtain information about a specific organization, you need to enter the TIN or OGRN).

All information posted on these resources is up-to-date, so to use it there is no need for certification by an arbitration court. The interested person can independently draw up a certificate based on the information taken.

Organizers of auctions, courts, potential business partners, banks, and notary offices can request official information about the absence of bankruptcy of a legal entity. Such information confirms that insolvency proceedings have not been initiated against the company, that it is efficient and reliable.

If the issued certificate is not accompanied by accompanying documents proving the absence of signs of bankruptcy of the company, it will have no force.

How to correctly compose and format

The legislation does not provide for a single approved paper format. The list of information that must be specified depends on the requirements of the second party. If the certificate is issued on behalf of the LLC itself, then the paper will be issued on the letterhead of the enterprise. The sample text for each certificate will be common. It must be indicated that bankruptcy proceedings have not been initiated in relation to a specific enterprise. The information contained in the paper must give a clear idea to the interested party about the financial position of the organization or individual. Among the required information it is worth highlighting:

- name of LLC or individual entrepreneur;

- type of ownership;

- registration date and codes;

- method of opening an LLC;

- personal data and signature of the manager;

- size of the authorized capital.

Rarely, the interested party may require that the document be certified by a notary.

Price and terms

Confirming information about the bankruptcy of an LLC is a paid service. To request information from the state register, you will need to pay two hundred rubles. Then the finished paper can be received in five days. Persons can also request an urgent receipt of an extract, in which case the terms and price of the service will be changed. To receive the paper the next day, you will need to pay four hundred rubles. If a person chooses open access to electronic resources, then this will be free.

When a company requests information about its own position from the tax authority, the service will be free. Payment will be required if it is necessary to issue a certificate for third parties. The amount will directly depend on how urgently the completed document is needed. In terms of timing, the standard service for issuing information on the insolvency of an LLC is performed within five days. The interested party can pay more and take the document in hand the very next day.

There is no clear time frame for the validity of the certificate. Counterparties, courts and other institutions have the right to arbitrarily determine the temporary period of validity. For example, judicial authorities set the validity period of a document to thirty days. Partners can set a validity period of about a year or more. During this time, the information in the document will be considered current.

Confirmation of the financial status of an LLC may be required in various situations. Most owners and managers of companies and organizations, as well as individuals, want to know how to correctly draw up a certificate that can refute or confirm the fact of bankruptcy. It is quite easy to obtain certificates confirming the absence of bankruptcy of an individual.

Statement that there is no decision to liquidate the applicant. Sample

An organization may request a notification letter stating that the company is not in the process of liquidation, reorganization or bankruptcy in order to insure itself against possible force majeure circumstances, which often arise when collaborating with a partner (counterparty or borrower).

Thus, the following may request a letter or certificate confirming the absence of an insolvency or liquidation procedure:

- banks that want to receive guarantees that the loan will be repaid. And in the event of a potential bankruptcy, credit institutions may refuse a loan altogether;

- business partners when you need to conclude an important deal;

- government bodies during tenders or competitions;

- arbitration court;

- notary.

There is no special form established by law for drawing up this application. This document is drawn up according to the rules of a business letter.

Declaration of absence of a bankruptcy decision. Sample

The notification letter must be drawn up on the basis of documents that confirm the financial condition of the company. For example, such documents could be:

- extract from the Federal Tax Service;

- an extract from the media, where information about liquidation and bankruptcy is published;

- letter from the tax office and more.

Up-to-date information on the solvency of a business entity can be obtained through:

- arbitration court website;

- EFRSB website.

Who issues a certificate of absence of bankruptcy?

Currently, there is no valid act on the territory of Russia that could determine the body that has the authority to provide this document. There are also no specific legal requirements regarding form and content. However, the legislator is gradually moving to develop current regulations.

Thus, on May 22, 2009, Rosreestr issued order No. 23 related to the organization of work to implement this issue. The document contains information on the procedure for obtaining a certificate. It still has legal force, but its functioning is extended only to specific types and forms of legal relations.

In accordance with the order, the federal service responsible for state registration, cadastre and cartography is recognized as the person responsible for issuing the document. The circle of persons who have the right to apply for this paper is strictly limited, but concerns mainly the public sector.

Since the arbitration court primarily deals with cases related to the bankruptcy process, it would be logical to assume that it is the court that issues certificates. But in practice, this picture is not always the same. In this case, you should pay attention to another regulation - Federal Law No. 262 of December 22, 2008. It states that the courts have the right to refuse to provide information that is already available on other resources.

If you contact the tax authorities, they will provide an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. From the same archives it is possible to obtain data on the solvency of the organization. A document confirming the fact of bankruptcy can be obtained from the tax office upon completion of the bankruptcy procedure.

The receipt of data to the tax and duties inspectorate comes from the arbitration court.

If the certificate is drawn up on behalf of a potential partner, then this is done on the organization’s letterhead. The document must contain information that no insolvency proceedings have been opened regarding the company.

Certificate of absence of bankruptcy proceedings

The only problem is that such a certificate about the absence of arbitration cases is not confirmed by anything or anyone; you can only print out a screenshot of the page. If desired, it can be certified, but it is not worth spending money on this, since the card index is a public resource, the data from it is provided free of charge, and all information provided to the bank or counterparty is easy to verify.

A bankruptcy certificate is a document that confirms the absence of insolvency of a company and is accompanied by evidentiary forms. It can be used to influence creditors or to certify third parties about the reliability of an enterprise or individual entrepreneur.

Until 2020, this certificate could easily be obtained from the Arbitration Court. But starting in 2019, the courts stopped issuing them. Important! Information that is open in nature is presented to any interested party. Information of a confidential nature is presented in accordance with legal requirements.

According to Rosreestr order No. 23 dated May 22, 2009, responsibility for issuing certificates of absence of insolvency of enterprises or individual entrepreneurs was assigned to the Federal Service, which is responsible for registering legal entities.

You can obtain information from the tax office about the solvency of the company after completing the bankruptcy procedure. Information to the tax office comes from the arbitration court.

The time period for receiving a letter depends on the method of transmission by the counterparty, therefore this action is not limited by a time period. It is in the interests of the recipient to receive it as quickly as possible: preference should be given to electronic methods of transmitting information.

Tax inspectors provide an extract from the Unified State Register of Legal Entities for organizations. For private entrepreneurs, information from the Unified State Register of Private Entrepreneurs is provided.

Since a document containing a mandatory clause about the absence of bankruptcy of a legal entity is not provided for at the legislative level, the company has the right to draw it up independently in any form.

For example, when a company is liquidated, column 13 of the extract from the Unified State Register of Legal Entities indicates the status “The legal entity has been declared insolvent and bankruptcy proceedings have been opened against it.” State bodies will not be able to answer the question of where to get a certificate of absence of bankruptcy, because issuing a document of this nature is not within their competence.

Knowing the name, INN or OGRN of the organization, using the search column you can obtain information about the status of the counterparty.

Important to keep in mind! The form of such paper does not confirm the absence of an insolvency process. It provides information about the taxpayer and provides assurance that there is no impending liquidation of the company.

You can send a request to the arbitration court about whether insolvency proceedings have been initiated against the applicant (Article 18 of the Law “On ensuring access to information about the activities of courts in the Russian Federation”).

The certificate for individual entrepreneurs indicates an identification number; for a legal entity, a registration number is indicated.

The organization prepares a document such as a certificate of non-liquidation of the organization and sends it to its counterparty. By checking the supplier company through the means of verifying counterparties and taking into account the data received, Party 1 LLC can make the right decision on starting a contractual relationship and minimizing financial risks.

The certificate for individual entrepreneurs indicates an identification number; for a legal entity, a registration number is indicated.

In the process of commercial relations between legal entities, new counterparties often have to confirm the status of a bona fide organization. Among the documents that can confirm this is a letter about the absence of bankruptcy proceedings for a legal entity. The letter is intended for third-party organizations with which new contractual relations are planned.

One of the documents to confirm trustworthiness is a certificate of absence of bankruptcy of the LLC. Providing it indicates the absence of signs of an insolvent individual or other entity. Many individuals and businesses often have a question: where can I get a certificate of no bankruptcy?

Procedure for issuing a certificate

The procedure for registering and receiving a document traditionally includes several stages.

Application for issue and additional documents

In the Russian Federation, there is no separate department responsible for resolving insolvency issues. Previously, a similar committee operated in Moscow, but since 2007 it has ceased functioning. Currently, to confirm the solvency of a company, you need to obtain an ordinary printout from the website:

- files on arbitration issues;

- a unified database on online insolvency;

- newspaper (periodical) “Kommersant”.

The proposed form should clearly show the name of the enterprise and some information about it, including its legal form, code values, names of managers, and contact information. The information received will be available only in electronic form, without official confirmation.

On some official resources, the user can obtain information from a number of registers:

- debtors (persons who have certain debts to government agencies);

- arbitration managers;

- electronic resources on the Internet (for example, the State Services portal, the FSN website;

- auction organizers.

On the sites you can also familiarize yourself with the reporting documents of managers and economic publications. In order to have the most complete access to information, you need to acquire a personal account, that is, go through the registration procedure.

Help form

In addition to the state register and information resources, the necessary information can be obtained from the potential partner itself. The answer to a request to confirm your financial situation may be a written assurance on company letterhead.

Legislative norms do not provide for strict templates and forms for filling out the document, so its content may vary based on the requirements put forward by the counterparty. Compilation is carried out on a form belonging to the organization, in any form.

The document must indicate that the legal entity is in good financial condition and has no money problems. The following materials are required information indicated in the document:

- full legal name of the company;

- data on the moment of commencement of activity;

- form of ownership and organizational and legal type;

- personal information about management and founders;

- size of the authorized capital;

- signature belonging to the general director;

- contact details.

If there are restrictions in terms of access to the requested information, the procedure for provision is determined within the framework of federal legislation.

Where else can you get information?

Important! If the information is public, then it can be provided to any person. Information that is confidential is provided in accordance with the law.

In our country there is no separate body that would resolve issues of insolvency of persons. In order to confirm the solvency of the company, you will need to obtain a printout from the website:

- files of arbitration issues;

- unified insolvency database;

- newspaper "Kommersant".

The information obtained in this way will only be in electronic form, without any official confirmation. Also, on a number of official resources it will be possible to obtain information from the following registers:

- register of debtors (contains information about persons who have certain debts to government agencies);

- State Services portal, Federal Tax Service website;

- auction organizers.

On the websites you can also view the reporting documentation of managers, as well as economic publications. In order to get maximum access to information, you will need to have a personal account. Therefore, the user will need to register on the site (

Is it possible to compose it yourself?

Since a document containing a mandatory clause about the absence of bankruptcy of a legal entity is not provided for at the legislative level, the company has the right to draw it up independently in any form. But it is advisable to follow the following rules:

- use the organization's letterhead;

- write the full and abbreviated (if any) name of the company;

- indicate the date on which the information provided is correct;

- certify with the personal signature of the manager;

- Attach to the certificate scans of pages from the Card Index of Arbitration Cases and the Data Bank of Enforcement Proceedings, and a copy of an extract from the Unified State Register of Legal Entities.

We offer a sample certificate of absence of bankruptcy proceedings, drawn up taking into account the recommendations.

You can add information to the template about who the document is intended for. If a company has a seal, it must be affixed.

Please note that it is better to prepare the certificate several days before presentation. Scans of pages and a copy of an extract from the register of legal entities should be dated to the same date (or a few days earlier). Although such a document does not have an expiration date, counterparties, banks or government customers will not like it if the information is stale.

When is it needed and where to get it?

In the process of commercial relations between legal entities, new counterparties often have to confirm the status of a bona fide organization.

Among the documents that can confirm this is a letter about the absence of bankruptcy proceedings for a legal entity. The letter is intended for third-party organizations with which new contractual relations are planned. Government bodies do not have the right to request such a document, since they have the opportunity to obtain it through interdepartmental cooperation. Let's consider a situation in which the provision of a document is relevant, using the following example: I approached with a proposal to supply raw materials at prices below market prices. LLC "Party 1" is interested in the proposal, but due to the fact that it does not have information about the business reputation and integrity of LLC "Party 2", it asks for confirmation from LLC "Party 2" of a stable financial position. The organization prepares a document such as a certificate of non-liquidation of the organization and sends it to its counterparty. By checking the supplier company through the means of verifying counterparties and taking into account the data received, Party 1 LLC can make the right decision on starting a contractual relationship and minimizing financial risks.

Legal entities have the right to draw up a letter themselves, without applying to government agencies for this. We recommend that organizations that have received a certificate from their counterparty check the information on the official website of the Unified Federal Register of Bankruptcy Information. Knowing the name, INN or OGRN of the organization, using the search column you can obtain information about the status of the counterparty.

The search will not return results if the legal entity does not have the status of being liquidated or insolvent.

Receipt deadlines when applying to various authorities

The time period during which a document can be received depends on the method of its request. For example, if we are talking about an extract from the state register, the time interval is five days. It is similar in electronic format.

The legislative regulations state that the provision of a response may occur within the framework of an expedited procedure. You won’t have to wait long for information if you place an order for an urgent extract. Its cost is higher, but the period for issuing information is reduced to one day. The very next day after contacting the user will receive the set of data he needs.

Validity and receipt dates

There is no legal limitation on the validity period, so the certificate of absence of bankruptcy does not have an exact validity period. It is most advisable to request a document on the date of signing the contract or accepting obligations. In this case, it will be possible to avoid the risk of dishonest actions on the part of the counterparty.

The time period for receiving a letter depends on the method of transmission by the counterparty, therefore this action is not limited by a time period. It is in the interests of the recipient to receive it as quickly as possible: preference should be given to electronic methods of transmitting information.

How long is the certificate valid for?

Important! Current legislation does not provide for a specific time frame for the validity of the statement, as well as other information about the financial condition of the company. In this case, much will depend on who is requesting this document.

An unofficial principle has been established according to which the validity of the certificate is determined by when changes are made to the register. That is, the document will be valid until any changes are made to the register.

Thus, a document can have a different validity period: one day or several years. However, the requirements for the document are established by those authorities and contractors who request this document. Usually an extract from the register is required, the period of which does not exceed 30 days.