Bankruptcy forecasting

Bankruptcy is a widespread problem that individual entrepreneurs and legal entities face in the course of their activities. Many organizations go bankrupt every year in our country; Therefore, timely identification of adverse trends is of paramount importance.

What is bankruptcy?

Bankruptcy is the inability of an organization to pay its debt obligations and finance ongoing core activities due to a lack of cash. The main sign of bankruptcy is a delay in payment of debt for more than 3 months.

The probability of bankruptcy is one of the estimated characteristics of the current financial condition of the organization under study. The management of an enterprise can constantly maintain the probability at a low level if it periodically analyzes the probability of bankruptcy and takes the necessary measures in a timely manner.

Altman Z-score

Currently, there are various methods for assessing the likelihood of bankruptcy of an enterprise. The most accurate in a market economy are multifactor bankruptcy forecasting models, which usually consist of five to seven financial indicators. In practice, the so-called Altman “Z-score” is most often used to assess the probability of bankruptcy. The final bankruptcy probability coefficient Z is a function of five indicators characterizing the economic potential of the enterprise and the results of its work over the past period: the structure of assets and liabilities, profitability and turnover. Each of the indicators was given a certain weight, established by statistical methods.

Z = 1.2 * K1 + 1.4 * K2 + 3.3 * K3 + 0.6 * K4 + K5, where

K1 - the share of current assets in the total assets of the organization. The indicator characterizes the degree of liquidity of the organization.

K2 - return on assets on retained earnings. The indicator characterizes the level of financial leverage of the organization.

K3 - return on assets based on profit before taxes. The indicator characterizes the efficiency of the organization's operating activities.

K4 - ratio of equity and borrowed capital.

K5 - asset turnover. The indicator characterizes the profitability of the enterprise's assets.

Depending on the value of the “Z-score”, the probability of bankruptcy within two years is assessed on a certain scale. When analyzing an organization, you should pay attention not so much to the scale of bankruptcy probabilities, but to the dynamics of this indicator.

Altman's Z-score allows you to determine not only the risk of bankruptcy, but also the level of creditworthiness, therefore it is used by banks to assess the borrower's creditworthiness, financial stability and likelihood of bankruptcy.

Methods for predicting possible bankruptcy of enterprises and assessing their effectiveness

Oskirko Yu.A. Scientific supervisor: Sukharev P.N. Donetsk National University of Economics and Trade named after Mikhail Tugan-Baranovsky

Bankruptcy is an inevitable phenomenon of any modern market, which uses insolvency as a market instrument for the redistribution of capital and reflects the objective processes of structural restructuring of the economy.

Secondly, in conditions of mass insolvency, measures to prevent crisis situations, as well as restore the solvency of the enterprise and stabilize its financial condition, become of particular importance.

The main goal of this work is to analyze methods for predicting the possible bankruptcy of enterprises and assess their effectiveness

When writing the work, a lot of different literature was used, including the works of famous economists, bankruptcy legislation, as well as methodological materials on analysis and articles by practicing lawyers and economists considering bankruptcy problems. The works of such scientists were considered: G. Shershenevich, P. Tsitovich, A. Trainin, E. Smirnova, P. Barenboim, O. Bulko, L. Shevchuk, A Sheremet, D. Agapov, Yu. Adaev and others.

At the present stage of development of the Ukrainian economy, problems associated with identifying unfavorable trends in the development of an enterprise and choosing a method for assessing bankruptcy come to the fore. And there are practically no methods that allow one to predict an unfavorable outcome with a sufficient degree of reliability. Moreover, there is no single source that describes most of the known techniques. We reviewed the literature sources of domestic and foreign authors and developed a comparative description of the main methods for predicting bankruptcy, and also examined the advantages and disadvantages of each method. The results of the work are presented in Table 1.

Table 1

Comparative characteristics of bankruptcy forecasting methods

| Forecasting method | Flaws | |

| 1. Statistical method (probabilistic assessment) | ||

| 1 Altman two-factor model | simplicity and possibility of application with limited information. | impossibility of use in domestic conditions; no comprehensive financial assessment, deviation from reality; the accuracy of the calculations depends on the initial information when constructing the model; the forecast error is ± 0.65. |

| 2 Altman's five-factor model | as a first approximation, it is possible to divide business entities into potential bankrupts and non-bankrupts; the accuracy of the calculations depends on the forecast period of time: 1 year - 95%, 2 years - 83%. | scope limited (only large companies with listed shares); does not take into account the impact of profitability; in its content it is an indicator of return on capital (assets). |

| 3 Taffler's four-factor model | allows you to track the company's activities over time (moments of decline and revival). | scope of application is limited (only for companies whose shares are quoted on the market); the accuracy of the calculations depends on the initial information when constructing the model. |

| 4 W. Beaver’s system of indicators for diagnosing bankruptcy | allows you to determine the “bankruptcy risk rating”; bankruptcy forecast not only in quantity, but also in temporary nature. | weighting coefficients for key indicators of the model are not provided; a comprehensive indicator of the probability of bankruptcy is not calculated. |

| 5 Rating number of Saifulin and Kadykov | application for the purpose of classifying enterprises by risk level. | does not allow assessing the reasons why enterprises fall into the insolvent zone; does not take into account the industry specifics of the enterprise |

| 2. Method of expert assessments | ||

| 1 Multi-criteria model | is developed for a specific organizational system, with the participation of its employees, has wide application for different levels of management; efficiency and high productivity of obtaining information to develop management decisions. | depends on the qualifications of the participants in the development of the model (the influence of the human factor); - depends on the knowledge and experience of the expert (the influence of intuitive characteristics). |

| 3. Method of analogies | ||

| 1 Project life cycle model | the project is considered as a “living” organism that has certain stages of development; the ability to evaluate each stage, identify the causes of undesirable consequences, classify and assess the degree of risk. | used to determine the risks of new projects; - in practice it is difficult to collect relevant information |

| 3 Enterprise price"> | at the latent stage of bankruptcy, an imperceptible decrease in this indicator begins, especially if special accounting is not imposed, due to unfavorable trends both inside and outside the enterprise | forecasting the expected price decline requires analysis of the prospects for profitability and interest rates; demandingness in forecasting the price of an enterprise for the short and long term |

| 4 Multifactor model | the ability to determine the impact of the use of each of the enterprise resources (labor, materials, raw materials) on profit; the ability to quickly develop a management decision and build a forecast of profitable options. | It is quite difficult to plan the volume of cash receipts with the required degree of accuracy, the volume of upcoming payments for the long term, as well as the necessary analytical accounting data at the enterprise. |

| 5. Cost feasibility method | ||

| 1 Profitability threshold and production leverage. | evaluates the influence of internal factors (cost mechanism) on financial stability: allows you to determine the lower limit of production output at which profit is zero; shows the degree of influence of fixed costs on profit when production volume changes; a way to identify enterprises that have large volumes of production and sales and have a steady demand for their products. | For domestic enterprises, this method is not officially recommended, and therefore it is still used for predictive calculations of price and profit values. |

Having analyzed the above forecasting methods, we can come to the conclusion: the problems of bankruptcy forecasting in order to identify and financially improve insolvent enterprises have not been fully developed in the domestic literature.

The lack of domestic theoretical knowledge is compensated by the widespread borrowing of conceptual proposals from Western science. Western economic thought, of course, has achieved serious results in this area.

However, the use of these methods in Ukraine is extremely difficult due to their development in countries with market economies different from Ukrainian ones.

It is necessary to note the lack of sufficient statistical data to develop a multifactor model for predicting the bankruptcy of enterprises in Ukrainian conditions and the need for a systematic approach to the problems of solvency of enterprises.

The choice of specific methods may be dictated by the characteristics of the industry in which the enterprise operates. Moreover, even the methods themselves can and should be adjusted taking into account the specifics of industries.

It is necessary to develop a universal method for predicting bankruptcy, which will focus on various types of crises. And it should easily adapt to the characteristics of the industry in which the enterprise operates.

Literature: Law of Ukraine “On updating the payability of a debtor or declaring him bankrupt” dated 06/30/99. No. 784-XIV. Third party V. It’s not like that with bankruptcy, because there’s not enough business... //Accounting - No. 12 (427) - 2001 r. – p.8. Vargich S. Mechanism of bankruptcy: bank accounts in Ukraine. //Valuable papers of Ukraine. -No. 8 – 2000 rub. – p.4-5.

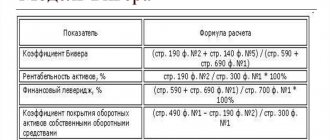

Concept of coefficient

This indicator is used to analyze the share of net working capital in the total assets of the entire balance sheet of a particular analyzed enterprise.

Definition 1

The bankruptcy ratio is an indicator that reflects the ability of an enterprise to pay short-term debts (liabilities) with the condition that all reserves will be successfully sold.

It is worth noting that in the economics of an enterprise there are a significant number of different models for predicting bankruptcy; there is no single approach, since each enterprise, due to its individual characteristics, has the right to independently choose a methodology for predicting bankruptcy.

In general, there are quantitative and qualitative methods.

Quantitative methods are based on the analysis of figures from financial statements and other documents of the company, and qualitative methods are based on the study of economic prerequisites, comparisons with successful and bankrupt enterprises).

Thus, the bankruptcy ratio refers to a quantitative method for assessing the welfare of a company.

Finished works on a similar topic

- Coursework Bankruptcy ratio 480 rub.

- Abstract Bankruptcy ratio 230 rub.

- Test work Bankruptcy coefficient 230 rub.

Receive completed work or specialist advice on your educational project Find out the cost