Long before Pacioli, the author of a treatise on accounts and records (which is considered the beginning of accounting), merchants and moneylenders made notes, which in our time are called debits and credits. For example, a moneylender who lent gold coins received a promissory note in return. We can say that in this case a receivable has been formed. In a nutshell, debit indicates what the company has in stock, and credit indicates the source from which this debit was formed.

- 2 Receivables quality

- 3 Optimization of accounts receivable

3.1 Analysis of receivables and risk minimization

Accounts receivable turnover

| This section is missing references to information sources. Information must be verifiable, otherwise it may be questioned and deleted. You may edit this article to include links to authoritative sources. This mark was set on May 12, 2011 . |

Receivables turnover ratio (RTR)

— the ratio of sales revenue to the average amount of accounts receivable minus reserves for doubtful positions.

RTR = (credit sales or revenue) / (average accounts receivable).

The ratio shows how many times accounts receivable were converted into cash or how many units of revenue were received from 1 ruble. accounts receivable. The higher its value, the shorter the period of time passes between the shipment of products to consumers and the moment of payment. High values of this indicator have a positive effect on its liquidity and solvency.

Accounts receivable turnover ratio in days (day's sales outstanding - DSO)

calculated by the formula:

DSO = (Average Debt Outstanding * 365) / (Credit Sales or Revenue).

Characterizes the average period of time during which funds from customers arrive in the company’s current accounts. Hence its other common name and abbreviation - ACP (average collection period). The lower the value of this indicator, the more favorable conditions the enterprise is in.

What is the optimal ratio

In the process of doing business, an enterprise has various types of debt, when the enterprise owes money to suppliers, personnel and other creditors, but also various counterparties have debt to the enterprise (accountable persons, customers).

The coefficient showing the ratio between the amounts of debt of debtors and obligations to creditors is calculated as the quotient of division, where the numerator reflects the amount of all receivables available to a given business entity, and the denominator reflects the amount of all existing obligations to creditors.

K = amount of accounts receivable / amount of accounts payable (1)

The indicator calculated on the basis of formula 1 shows how much accounts receivable accounts for one ruble of liabilities to creditors.

The optimal indicator is equal to one, which means equality between the debt of debtors to a business entity and obligations to creditors.

The optimal value of the indicator is 0.9, which means that obligations to creditors can be no more than 10% of receivables.

A ratio of less than one means an excess of accounts payable over accounts receivable. If the coefficient taking into account the ratio of these types of debt is more than one, then this indicates an excess of receivables over obligations to creditors.

Deviations in one direction or another from the optimal ratio can pose a threat to the financial position of the enterprise:

- in case of receiving a coefficient of more than one, indicating that the enterprise as of a specific date, the amount of accounts receivable is greater than the amount of accounts payable, it means that funds are being diverted from the enterprise’s turnover. This entails the risk of having to attract loans and borrowings if there is a lack of funds to support the activities of the business entity. Bank loans or loans can be expensive, which can negatively affect the financial condition of the enterprise;

- in case of receiving a coefficient of less than one, indicating that the enterprise as of a specific date, the amount of accounts payable is greater than the amount of accounts receivable, creates a threat to the financial position of the enterprise due to the likelihood of the impossibility of paying off its obligations due to lack of funds.

Let us give an example of calculating the ratio between various types of debt based on Mikron LLC for 2014 – 2020.

Data for calculation are presented in table 1.

Table 1. Calculation of the ratio of various types of debt of Mikron LLC for 2014 – 2020.

| Index | 2014 | 2015 | 2016 | Changes | |

| 2015 to 2014 | 2016 to 2020 | ||||

| Debt of debtors, thousand rubles | 17890 | 20167 | 16432 | 2277 | —3735 |

| Liabilities to creditors, thousand rubles | 19567 | 18348 | 37564 | —1219 | 19216 |

| Ratio of accounts receivable and accounts payable, rub. | 0,91 | 1,09 | 0,43 | 0,18 | —0,66 |

As can be seen from the data presented in Table 1, the debt of debtors at Mikron LLC in 2014 amounted to 17,890 thousand rubles, and obligations to creditors - 19,567 thousand rubles. The coefficient reflecting the ratio between these types of debt in 2013 is: 17890 / 19567 = 0.91. The obtained result means that for 1 ruble of creditors' debt there are 0.91 rubles of receivables and this indicator is within the optimal ratio.

We suggest you read: How to buy an apartment from two owners?

In 2020, the debt of debtors is 20,167 thousand rubles, obligations to creditors are 18,348 thousand rubles, the ratio between them is: 20,167 / 18,348 = 1.09. The result obtained indicates that in 2020, the debt of debtors exceeds the obligations to creditors and for one ruble of accounts payable there are 1.09 rubles of receivables.

Next year, 2020, the ratio between the debt of debtors and obligations to creditors is 16432 / 37564 = 0.43, which is much lower than the acceptable value, which ranges from 0.9 to 1. In 2020, for every ruble of obligations to creditors there are only 0.43 rub. accounts receivable, which creates a threat to the financial position of the enterprise due to the likelihood of the inability to pay off its obligations due to lack of funds.

A correct assessment of the economic situation of a company is impossible without the ratio of debtors and creditors. It is important to ensure that the amount of accounts receivable exceeds the amount of accounts payable.

Don't panic if the opposite happens. The current situation may be temporary. In addition, other indicators also play an important role. To prevent this situation, it is necessary to set a deferment in the payment of accounts payable approximately for the period of waiting for payments on receivables.

Accounts receivable are recorded in accounts: 62 “Settlements with suppliers and contractors” and 76 “Settlements with various creditors and debtors”.

The following accounts are intended to reflect accounts payable: 60 “Settlements with suppliers and contractors” and 76 “Settlements with various creditors and debtors”.

The main tasks facing the accounting of debtors and creditors are as follows:

- Carrying out accounting of transactions reflecting the cash flow of the organization. This accounting must be carried out in full, be clear and as accurate as possible;

- Monitoring cash and settlement and payment discipline;

- Determining the structure of receivables and payables, as well as their composition and main elements, such as payment terms, type of debt, etc.

When the terms specified in the contracts expire, accounts payable and receivable become overdue. If after three years no action is taken to repay the debt, then this amount must be written off.

Most of the amounts that form the company's receivables cannot be realized within a short period of time. Amounts transferred in larger volumes to the budget and extra-budgetary funds can be written off from the enterprise’s balance sheet only after the overpaid amount has been recalculated against future payments.

If we talk about the debt of employees of an enterprise, it is repaid in parts over a long period of time by deductions from the amounts that are intended for payment. If these employees resigned from this organization and did not pay their receivables before the expiration of the statute of limitations, then the amounts of debt should be written off as losses of the organization. Write-off of receivables after the expiration of the limitation period is carried out at the expense of the organization.

Write-off of accounts payable with an expired statute of limitations is carried out separately for each of the obligations. The total amount is determined by conducting an inventory.

Debt to the budget and extra-budgetary funds does not have a write-off deadline.

Still haven't found the answer to your question?

Just write what you need help with

Making a mathematical interpretation, the ratio of accounts receivable and accounts payable shows how well the company is operating. This is important because companies often use not only their own resources, but also borrowed ones. If money is lent to someone, there will be a receivable, and if they take it, there will be a credit. The same company may have one or the other debt.

The relationship between these debts shows how effectively the company operates - whether it is moving up or, conversely, its economic condition is deteriorating.

Any accountant will tell you that accounts payable should be lower than accounts receivable. If this is not the case, some measures will have to be taken to stabilize the situation. Even a minimal excess of the balance of these two indicators indicates problems with the rational distribution of the company’s funds. Perhaps the problem is not with the company itself, but with the officials who manage the business part. It is important to reduce the difference to at least one, otherwise the enterprise will be unprofitable.

Monitoring the ratio of accounts receivable to accounts payable is considered an important task for managers and accounting departments. Ignoring and untimely tracking of the relationship between credit debt and receivables can provoke a problem. Their values must be at a certain level. This indicates a healthy environment in the company.

If the indicators begin to fluctuate, the situation does not change for the better. If debts continue to grow, it will lead to bankruptcy. In order not to deal with the consequences, it is important to initially monitor the situation. As soon as some bad changes begin in the ratio of accounts receivable and credit, you need to take action immediately.

The optimal indicator for the company is one. Then the size of loans will correspond to profits, even potential ones. But there is an opinion that the difference may be two units. According to some financiers, it’s even better. If the indicator is different (too high or low), this does not play into the hands of the company.

K = Amount of accounts receivable / Amount of accounts payable.

The coefficient formula is calculated at the current moment. To assess the pace of development of an enterprise, you need to check the indicators for the past period. This will show progress or regression.

It is important that the resulting indicator is within the normal range. If not, this is a cause for concern for managers.

In addition to the described formula, you additionally need to determine the share of borrowed and equity funds of the company. This will make it possible to make a more reliable correlation of the current financial situation.

Accounts receivable management

Accounts receivable management

— a separate function of financial management, the main goal of which is to increase the company’s profits through the effective use of accounts receivable as an economic tool.

Main goals

- comprehensive verification of the debtor at the initial stage

- legal support of transactions

- accounts receivable financing

- accounting, control, assessment of the effectiveness of accounts receivable

- collection of overdue debt

- claims work with undisciplined debtors

- expression of economic relations that arise between the state and enterprises

Functions

- use (definition of financial and management goals)

- organizational function (ensuring the fulfillment of planned goals)

- motivation (approval of a motivation system for employees involved in the receivables management process)

- control

- analysis of results and feedback

Participants

In the modern economy, accounts receivable management has long gone beyond the functions of financial management alone. In a modern commercial organization, the following persons and structural units are involved in the management process:

- CEO

- Commercial and sales department (commercial director, head of sales department, sales managers)

- Financial department (financial director, financial manager)

- Legal department and security service

Process

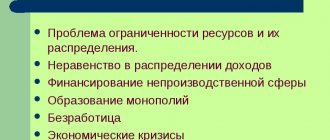

The problem of accounts receivable liquidity is becoming a key problem for almost every organization. It, in turn, is divided into several problems: optimal volume, turnover, quality of receivables.

Solving these problems requires qualified accounts receivable management, which is one of the methods of strengthening the financial position of the enterprise. Measures to recover accounts receivable are among the most effective measures to improve efficiency using the internal reserves of the enterprise and can quickly bring positive results. Debt repayment in a short time is a real opportunity to make up for the shortage of working capital.

Accounts receivable management can be identified with any other type of management as the process of implementing specific management functions: planning, organization, motivation and control.

- Planning is preliminary financial decisions. For it to be effective, it is necessary to determine the long-term goal of the organization, formulate the organization's strategy, determine the policy of action, and choose rational procedures for action.

- Organizing management means coordinating actions according to the following sequence: the entire area of action should be grouped according to selected functions; persons responsible for their activities must be given adequate rights.

- Motivation means a set of psychological factors that determine human behavior as a whole.

- Control activities are the preparation of performance standards and comparison of actual results with standard results.

Thus, accounts receivable management is part of the overall management of current assets and the marketing policy of the enterprise, aimed at expanding the volume of product sales and consisting in optimizing the overall size of this debt and ensuring its timely collection. At the heart of a firm's skilled accounts receivable management lies financial decision-making on the following fundamental issues:

- Accounting for accounts receivable at each reporting date;

- diagnostic analysis of the condition and reasons why the company has a negative situation with the liquidity of accounts receivable;

- development of an adequate policy and introduction into the practice of the company of modern methods of managing receivables;

- control over the current state of accounts receivable.

The objectives of accounts receivable management are:

- limiting the acceptable level of receivables;

- selection of sales conditions that ensure guaranteed receipt of funds;

- determination of discounts or allowances for various groups of buyers in terms of their compliance with payment discipline;

- acceleration of debt collection;

- reduction of budget debts;

- assessment of possible costs associated with receivables, that is, lost profits from non-use of funds frozen in receivables.

Formation of standards for assessing buyers and differentiation of loan conditions

The basis for establishing such standards for evaluating buyers is their creditworthiness. The buyer's creditworthiness characterizes a system of conditions that determine his ability to attract credit in various forms and fully, within the stipulated time frame, fulfill all financial obligations associated with it.

The formation of a system of customer assessment standards includes the following main elements:

- determination of a system of characteristics that evaluate the creditworthiness of individual groups of buyers;

- formation and examination of the information base for assessing the creditworthiness of buyers;

- selection of methods for assessing individual characteristics of buyers' creditworthiness;

- grouping product buyers by level of creditworthiness;

- differentiation of credit conditions in accordance with the level of creditworthiness of buyers.

The formation of standards for assessing buyers and the differentiation of credit conditions are carried out separately for various forms of credit - commodity and consumer. Determining a system of characteristics that assess the creditworthiness of individual groups of buyers is the initial stage of constructing a system of standards for their assessment.

For a commodity (commercial) loan, such an assessment is usually carried out according to the following criteria:

- the volume of business transactions with the buyer and the stability of their implementation;

- the buyer's reputation in the business world;

- buyer's solvency;

- the buyer's business performance;

- the state of the commodity market on which the buyer carries out its operations;

- the volume and composition of net assets that can serve as security for a loan in the event of the buyer’s insolvency and the initiation of bankruptcy proceedings.

For a consumer loan, assessment is usually carried out according to the following criteria:

- the buyer's legal capacity;

- the level of income of the buyer and the regularity of their formation;

- the composition of the buyer’s personal property, which can serve as security for a loan when collecting the amount of debt in court.

ALSO SEE: Practical Budgeting Tips

The purpose of the formation and examination of the information base for assessing the creditworthiness of buyers is to ensure its reliability. The information base used for these purposes consists of:

- from information provided directly by the buyer (their list is differentiated by loan form);

- from data generated from internal sources (if transactions with the buyer are permanent);

- from information generated from external sources (a commercial bank serving the buyer; its other transaction partners, etc.)

Examination of the information received is carried out by logical verification, in the process of conducting commercial negotiations with buyers, by directly visiting the client (for a consumer loan) in order to check the condition of his property and in other forms in accordance with the volume of lending.

The choice of methods for assessing individual characteristics of buyers' creditworthiness is determined by the content of the characteristics being assessed. For these purposes, when assessing individual characteristics of the creditworthiness of buyers discussed earlier, statistical, regulatory, expert, scoring and other methods can be used.

The grouping of product buyers by level of creditworthiness is based on the results of its assessment and usually involves the identification of the following categories:

- buyers to whom credit can be provided to the maximum extent, i.e. at the level of the established credit limit (group of “first-class borrowers”);

- buyers to whom a loan can be provided to a limited extent, determined by the level of acceptable risk of non-repayment of the debt;

- buyers to whom credit is not provided (with an unacceptable level of risk of non-repayment of debt, determined by the type of credit policy chosen).

Differentiation of credit conditions in accordance with the level of creditworthiness of buyers, along with the size of the credit limit, can be carried out according to such parameters as:

- loan term;

- the need for credit insurance at the expense of buyers;

- forms of penalties, etc.