You cannot declare bankruptcy yourself, that is, become bankrupt based on your own decision. You should contact the competent authority - the MFC or the Arbitration Court. If the debtor has property or debts of more than half a million rubles, the property is sold in the event of bankruptcy of individuals. It involves the sale of property at auction to pay off debts and write off the balance of debts.

Do you qualify for bankruptcy?

When does the sale of the debtor's property apply?

Bankruptcy provides for 2 possible procedures:

- rehabilitation of the financial situation through debt restructuring;

- full-fledged bankruptcy, that is, the sale of property.

Starting in the fall of 2020, a third option will appear - free out-of-court bankruptcy for citizens. If the amount of debts is less than 500 thousand rubles, and the bailiffs have completed enforcement proceedings due to the lack of property, the person has the right to apply to the MFC for simplified debt write-off.

In this material, we described in detail how out-of-court loan write-off will occur.

Important!

At any stage, the parties can enter into a settlement agreement. In this case, the judicial or extrajudicial process is terminated.

Next, we will look at how bankruptcy proceeds in the Arbitration Court.

Restructuring is introduced first, unless a petition has been filed to introduce the sale of property. As part of the restructuring, a plan is being developed to repay debts for a period of up to 3 years. If the court approves the schedule, the debtor will gradually pay off his debts.

The sale of property is introduced if:

- the participants in the trial did not present a restructuring plan;

- there is no constant income, or it is not enough to pay off debts;

- the court did not approve the plan;

- the debtor violated the schedule and was late twice;

- some creditors are against the debt repayment plan;

- the parties entered into a settlement agreement, but the debtor failed to comply with its terms.

The sale of a citizen’s property is introduced when the debtor or the Federal Tax Service submits a substantiated application to the Arbitration Court.

Sample petition to the Court of Justice for the transition to the procedure for the sale of property, bypassing restructuring (35 kb)

Grounds for the court's decision to sell property

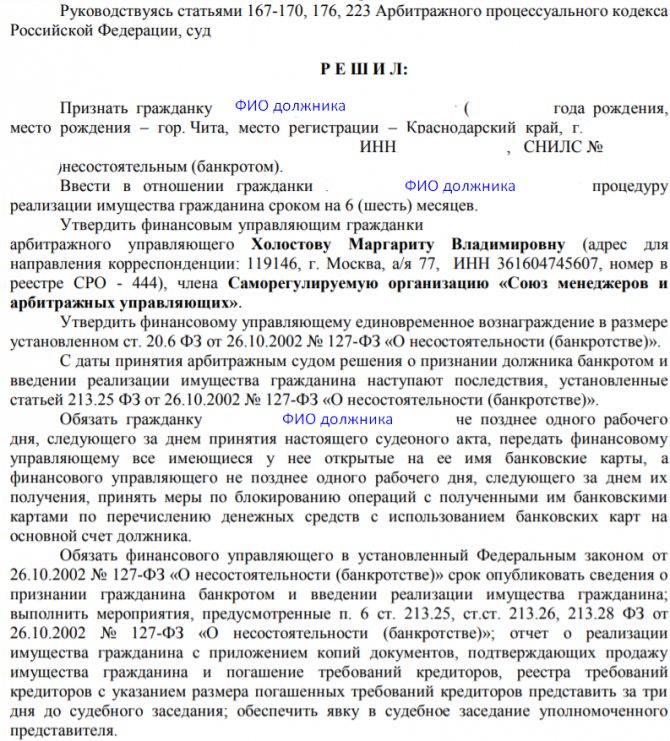

1. At the request of the debtor. Based on the results of considering the validity of an application to declare a citizen bankrupt, if the citizen does not have a source of income, the arbitration court has the right, based on the citizen’s petition, to make a decision to declare him bankrupt and introduce a procedure for the sale of the citizen’s property.

2. On the initiative of the financial manager. If the financial manager has not received a single draft plan for restructuring the citizen’s debts, the financial manager submits to the meeting of creditors for consideration a proposal to declare the citizen bankrupt and introduce the sale of the citizen’s property. The amount of interest on the remuneration of the financial manager in the event of introducing a procedure for the sale of a citizen’s property is 2% of the proceeds from the sale of property.

How does the sale of property proceed in the event of bankruptcy of an individual?

Formation of a register of creditors' claims

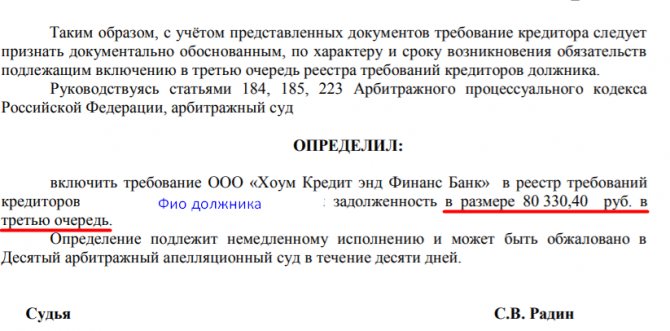

After the introduction of the implementation procedure, creditors apply to the court with an application to include them in the register of creditors' claims (RTC) and documents about the debt - these are receipts, loan agreements, court orders and determinations, enforcement proceedings.

All requirements are checked and included in the register, which is filled out and maintained by the manager. This shows the total amount of debt.

Formation of the bankruptcy estate

All property of the bankrupt that can be sold constitutes the bankruptcy estate (CM). The debtor attaches an inventory of his property to the bankruptcy application (sample at the bottom of the page).

The bankruptcy estate is formed on the basis of this information, but in addition the manager carries out the following activities.

- Requests to registration authorities

- to Rosreestr on rights to real estate (apartments, dachas, garages, parking spaces, share in the right to non-residential premises), State Traffic Safety Inspectorate (about cars), Rostechnadzor (about tractors, snowmobiles, equipment), Rospatent (about copyrights), GIMS ( boats, boats, yachts).

May also check property availability information reported by lenders. The financial manager receives a certificate from the Federal Tax Service about bank accounts, then looks at statements of cash flows on these accounts, analyzes real income (so the gray salary will be visible) and expenses, and learns about transactions.

Sometimes the bankrupt himself does not even know what he is entitled to. For example, a share in the right to a land plot or shares is discovered that was registered in the name of a former spouse and was not divided during the divorce (oral agreements do not count). The manager can collect a debt (for example, from an employer) that the person thought was long forgotten.

Hidden and forgotten property will be returned to the bankruptcy estate for sale.

- Verification of debtor's transactions

. The manager or creditor can challenge questionable transactions in court and demand the return of property. Suspicious transactions are those made by a citizen 3 years before declaring himself bankrupt, at a price significantly lower than the market price (Article 61.2 of the Bankruptcy Law).

“Transactions with preference” are also checked - when the debtor paid one creditor to the detriment of others (Article 61.3).

Attention will be drawn to transactions with relatives, business partners, ex-spouses, donation or pledge of property shortly before bankruptcy.

If the transaction is contested, the property is returned to the debtor's ownership and included in the bankruptcy estate for further sale at auction.

Read more about challenging transactions during bankruptcy of an individual.

Excluding objects from CM

First, the manager makes an inventory of all property, and then excludes from the bankruptcy estate:

- the only housing and property that is not foreclosed on in accordance with civil procedural legislation (Article 466 of the Code of Civil Procedure of the Russian Federation) - more about it below;

- property worth up to 10,000 rubles;

- if the debtor has income, he is given monthly funds in the amount of the subsistence minimum for him and according to the number of dependents (minor children, disabled parent or spouse).

If the manager has not excluded personal property from the bankruptcy estate, you can contact him and then go to court with a Petition to exclude property from the bankruptcy estate or a Petition to establish the amount of monthly payments in bankruptcy (Sample at the end of the article).

Grade

Before sale, the property must be appraised, and this is the responsibility of the financial manager. The parties have the right to engage an independent appraiser; his services are paid for by the inviting party. This is relevant when:

- complex and expensive property is being sold;

- it is necessary to inflate the price so that the property remains unclaimed at auction. It can be purchased during public trading at a discount, so there is a risk of still losing property;

- relatives or trustees intend to buy the property at auction, and you want to set a lower price.

Learn more about conducting and challenging bankruptcy assessments here.

Approval of the sales procedure

The Financial Manager prepares the Regulations on the procedure for holding auctions: where, when, and at what price the bankrupt’s property will be sold. This document is presented to the court for approval. Creditors file objections if disagreements arise. For example, if excessive requirements for participants are specified. The court considers disagreements and approves the Regulations.

Bargaining

How electronic auctions for bankruptcy of individuals work, and how a debtor can leave property, read in our review.

Sales are made through electronic platforms in 3 stages. If the lot is purchased at auction, the financial manager enters into a purchase and sale agreement with the winner. For real estate, the contract is considered concluded after registration with Rosreestr.

Objects that were not purchased at auction are first offered to creditors to repay the debt. If they refuse, the property is returned to the bankrupt.

Who can participate in your bankruptcy?

Carrying out calculations

In accordance with section 213.27 of the Law:

- First, the requirements that have accumulated during the procedure:

- creditors for current payments are alimony, legal expenses, remuneration to the financial manager and payment for the services of attracted specialists (justified by documents);

- requirements for payment of severance pay and wages for persons working under employment contracts - for individual entrepreneurs;

- requirements for payment for housing and communal services, utilities, major repairs;

- other payments for the period of bankruptcy.

- After the current ones, the register requirements are satisfied one by one, which are included by the court in the RTC (in proportion to the share of the debt in the total amount):

- first of all - claims of citizens related to harm to life or health, as well as claims for the collection of alimony (debt for 3 years);

- secondly, calculations are made for the payment of severance pay and wages of persons working or working under an employment contract;

- thirdly, settlements are made with other creditors (tax office, banks, microfinance organizations, collectors).

- If the property was pledged, then 80% of the amount received from the sale of the pledged item is taken by the pledge bank. The remaining 20% is allocated to current payments (10%) and satisfaction of the 1st and 2nd stages (10%), and if they are not there, they are included in the bankruptcy estate.

A bankrupt has fewer assets than debts, therefore the law directly states that the claims of creditors not satisfied due to insufficient property are considered repaid, with the exception of alimony, debts to employees, subsidiary liability and compensation for harm.

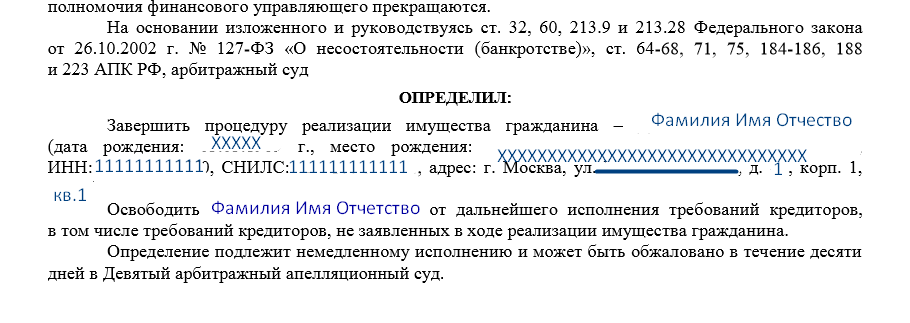

Completion of the implementation procedure

The manager submits a report on the work and results to the court. The balance of the debt is determined, which is ultimately written off at the final meeting.

To get a consultation

Sale of the debtor's property during bankruptcy - what is the procedure?

Understanding how and why the debtor’s property is sold during the bankruptcy of an individual or company will allow you to better understand the topic of trading and its intricacies. I have provided general information in this article.

More and more people are interested in bankruptcy trading as a way to make money. However, along with the number of brokers, the number of those who consider trading to be almost a fraud is growing.

All these judgments are associated with a lack of knowledge about where the lots at auction come from and what regulations regulate the sale of the debtor’s property within the framework of bankruptcy.

How does the debtor's property sell during bankruptcy?

The sale of any property seized from bankrupts is strictly regulated by law.

First of all, this is Law No. 127-FZ “On Insolvency”. The procedure for selling confiscated property is also described in Law No. 229-FZ “On Enforcement Proceedings”. The debtor can sell property worth up to RUB 30,000 on his own. Everything that exceeds this threshold is sold through an auction.

The value of most property is determined by the average cost of identical or similar goods, excluding depreciation. Due to this, already at the beginning of trading the price is lower than the market price.

This is due to the fact that on the open market the retail price always includes:

- planned profit from the sale;

- the cost of renting premises and equipment;

- employee salaries;

- taxes;

- other seller expenses.

In the case of a sale of property by the state, any additional benefit for the seller is excluded, since the sale price of the lot does not affect the salary of the bankruptcy trustee.

Typically, the condition of the property and its normal market value are assessed. Based on them, the average price is derived.

This does not apply to expensive property - cars and real estate, securities or things of significant value. In this case, an independent assessment of the value of such a lot is carried out. And taking into account the fact that during public auctions the price of the lot decreases, the cost of sale becomes much lower than it could be.

In addition, the creditor’s task is to quickly repay the debt or most of it. At a lower price, the property will be bought faster, so any benefit fades into the background.

There is a separate category of property, the value of which can fall to 15-20% of the market value. This is usually real estate that is pledged.

The procedure for selling the debtor's property in bankruptcy

Property valued over RUB 30,000 is subject to a forced sale procedure.

In some cases, bailiffs are involved in the sale of confiscated property. To learn how to buy such property, and why selling confiscated goods in a regular store is a marketing ploy, read the article:

A bankrupt can cover the debt in whole or in part by transferring rights to property directly to the creditor. However, as a rule, property is sold through an open auction, accessible to everyone, and as a result, the following are included in the auction:

- real estate;

- cars;

- securities;

- pledged property;

- works of art;

- antiques;

- any items worth more than RUB 500,000.

It is important that even property in which the debtor owns only a share can be put up for auction.

The bankruptcy trustee who will deal with the sale of the property is appointed by the court. Anyone can have access to the auction. Due to this, complete transparency of the procedure for selling the debtor’s property at bankruptcy auctions is achieved.

Despite this, there is a belief that bankruptcy trustees themselves buy out the property of bankrupt people and then sell it for a profit.

If you delve into the procedure itself and understand how clearly it is regulated by law, it will become obvious that this is impossible. For this reason, buying property at auction will always remain profitable.

By the way, at the free master class we talk about how to communicate with a bankruptcy trustee, give the best strategies for getting started and answer popular questions.

Click on the button and sign up for a free master class to learn about the 5 steps of Dr. Watson's Formula, how to buy cars, apartments and houses at bankruptcy auctions with a 50 - 90% discount!

The bidding procedure takes place in three stages:

- primary trading;

- re-tenders;

- public auction.

At the first stage, the price of the lot usually increases. The cost increase step must be determined in advance.

At the first stage, auctions are very often declared invalid for some reason, usually due to the fact that few people want to buy the lot at a high price.

In this case, the price of the lot is reduced and the second stage is announced.

If, even though the price has been reduced by 10%, the lot has not found its buyer, the procedure moves to the stage of a public auction, at which the price of the lot does not rise, as at the primary auction, but, on the contrary, decreases. At this stage, there is usually a serious struggle for obviously highly liquid lots.

For example, at the beginning of my career as an auctioneer, I bought a premises at the last stage of the auction. In this video I talk about how I then sold it, receiving more than RUB 350,000 in net profit:

Purchasing a lot from bankruptcy auctions

Deadlines for the sale of the debtor's property

The established period for bankruptcy proceedings is 6 months. At the request of the arbitration manager, this period can be increased by a maximum of another six months.

The creditor, if its share is more than 2% of the bankrupt’s total debt, may require an independent assessment of the property. In this case, within 10 days from the moment the property is included in the Unified Register of Bankruptcy Information, he sends a demand to the bankruptcy trustee.

If a decision is made on an independent examination, it must be carried out no later than 2 months from the date of receipt of the requirements. By the way, it is carried out at the expense of the debtor, and its cost is included in the amount of the total debt. Sometimes a re-examination is required. In this case, it is paid by the interested party - the lender himself.

The same period - 2 months - is also allocated for the inventory of the enterprise, if an independent examination is not required.

After this, the bankruptcy trustee presents to the creditors a document that sets out all the conditions for the auction:

- composition of property;

- form of bidding;

- auction conditions;

- initial cost and the step of its increase or decrease;

- timing of property sale;

- list of sites and media where information will be published.

If the bankruptcy trustee and creditors do not come to a decision within 2 months, it will be made by the arbitration court.

The announcement of the auction must be published in open media at least 30 days before the start.

Potential participants have 25 days to submit applications. Notification of admission or refusal to participate is received by those who submitted applications within 5 days after the deadline for their acceptance.

After the end of the auction, the bankruptcy trustee also has 5 days to announce the winner. After another 5 days, everyone except the winner gets their deposit back. And after 15 working days, the results are published in the media.

The whole procedure just seems complicated. If you plan to buy property at auction regularly, then quickly remember all the deadlines and procedures. Most of my students already at the training stage begin to freely navigate the legislation and the auction process.

How long does the implementation procedure take?

The bankruptcy law provides for a period of 6 months, which can be extended by court decision. This need often arises, for example:

- the debtor's transactions are disputed;

- the bankrupt's property is wanted in the Russian Federation or abroad;

- court decisions are appealed;

- in the case, other separate disputes arise that require time: division of property, disputes about law, etc.

There is also a regional component. For example, in Moscow and St. Petersburg, judges are busier than in the regions. In the Sverdlovsk region they require documentary evidence of the income and expenses of the defaulter, etc. Ask lawyers how long does bankruptcy of an individual in the region last on average, and what factors to consider in your case?

How long does it take to sell a property?

Even if there is no property, the bankruptcy procedure lasts on average eight months. It all depends on the court schedule, the speed of work of creditors and financial managers. Therefore, we strongly advise you not to believe promises of bankruptcy in two months! If you have property that will be included in the bankruptcy estate, for example, a mortgaged home, a car, then the procedure may take a year and a half. You can find out about the deadlines for implementation specifically in your situation in consultation with our lawyers. Leave a request below and our specialists will contact you shortly.

What property is being sold at auction?

According to the general provisions of No. 127-FZ, all property is subject to sale, except for those protected by legislative immunity. Will sell:

- real estate other than a single dwelling. A second apartment, a country house, land, commercial premises, etc. It is important to understand here that restrictions on the area and cost of a single dwelling have not yet been established. But the court proceeds from the principle of fairness: after all, the goal of bankruptcy is to satisfy the demands of creditors as much as possible.

Since 2020, judicial practice has been emerging, according to which the only housing is considered the cheapest residential property.

For example, if a person has a five-room apartment in Moscow and ½ share in his parents’ apartment in the Moscow region, then metropolitan real estate is more likely to be auctioned.

To check which real estate lenders will see, request an extract from the Unified State Register in advance. According to the experience of bankrupts on the forum, if the debtor “disclosed” foreign assets on social networks or during bank payments, they will also be found and sold.

- cars and equipment (everything that was registered can be found);

- securities: shares, shares in LLCs, participation in DDUs, cooperatives. If a former individual entrepreneur goes bankrupt, they can sell the business as a whole, or separately lease rights, commercial information, customer base, trade name;

- copyrights, patents (relevant for creative professions, scientists, inventors, programmers);

- if someone owes money to a bankrupt, the money will either be collected or the right to claim will be sold;

- cryptocurrency, contents of Yandex wallets, qiwi, digital assets;

- jewelry, luxury items - paintings, designer furniture. It is better to transfer movable property for storage to parents/acquaintances so that financial ex. did not include it in the bankruptcy estate. This is not the time to show off your expensive phone, laptop or other nice extras.

What will be sold in your case?

Consequences of declaring an individual bankrupt

An individual is declared bankrupt and the procedure for the sale of property begins in relation to him in the cases established by clause 1 of Art. 213.24 of Law No. 127-FZ. These include:

- failure to submit a debt restructuring plan;

- disapproval of the presented plan by the general meeting of creditors;

- cancellation during the implementation of the plan by the arbitration court conducting the insolvency case of an individual, etc.

Initially, the sale of property in the event of bankruptcy of individuals is introduced for no more than 6 months. This period may be extended at the request of interested parties.

From the moment an individual is declared bankrupt:

- only the financial manager can dispose of the property of an individual included in the bankruptcy estate;

- the seizure of such property is lifted;

- the accrual of financial sanctions and interest on an individual’s obligations stops;

- fulfillment of obligations of third parties to the debtor is possible only in relation to the financial manager;

- the debtor loses the right to open accounts and deposits in banks.

What property cannot be taken away during bankruptcy?

Not withdrawn:

- a single apartment or house and the plot below it;

- professional equipment that the debtor needs for work (a sewing machine for a tailor or a car for a taxi driver);

- means of transportation or ensuring normal living conditions for a disabled debtor;

- seeds for sowing, livestock, agricultural objects;

- furniture, household items, equipment (for home and individual use);

- other objects listed in Art. 446 Code of Civil Procedure of the Russian Federation.

The sale of collateral is carried out, even if it relates to paragraphs of Art. 446 Code of Civil Procedure of the Russian Federation. The only housing will be sold if it is pledged or under a mortgage.

Read about the fate of a mortgaged apartment when debts are written off in this material.

Do you want to write off your debts, but you have a mortgage?

Prohibition on sale

The Civil Code of the Russian Federation provides for property that cannot be sold to pay off a debt. This includes:

- the only suitable housing for living is an apartment or a plot of land with a house;

- items included in the consumer basket;

- cosmetics and hygiene products;

- farm animals, if they are used for private farming, as well as feed for them;

- devices and accessories worth up to 100 minimum wages that a bankrupt person needs to work.

The full list is specified in Art. 446 Code of Civil Procedure of the Russian Federation. It should be noted that the new version of the law has been expanded to include the concept of luxury goods. Now an ordinary iron, refrigerator or washing machine can fall under this category. It all depends on the subjective opinion of the judge who will make the decision.

On the one hand, this limits the rights of the bankrupt, on the other hand, he has every chance to prove that “a car is not a luxury, but a means of transportation.” By involving a lawyer in the process, the chances of a successful outcome increase significantly.

This is especially true for those cases where the debtor has no property. In this case, the court will aim to confiscate the maximum number of items in order to somehow cover the debt to creditors.

How much does the property sale procedure cost?

It is necessary to pay: 25,000 for the payment of the Arbitration Manager, 300 for the state fee and 17,000 for announcements about the introduction of the procedure.

Further, prices depend on whether the financial manager will sell anything. If the debtor has no property, then the period and cost are minimal: 6 months and 70 thousand rubles.

When selling property, expenses arise:

- for publication 15,000 rub.,

- estimate from 3000 rub.,

- electronic trading platform services from 10 thousand rubles,

- state duty for registering the transfer of ownership of real estate is 1000 rubles,

- mail/courier services - from 1000 rub.

Whether an individual goes bankrupt with lawyers or on his own, the more lots there are, the more expensive the bankruptcy. If there is a lot of property, it is better to entrust the procedure to credit specialists from the very beginning: they have wholesale rates on trading platforms, have lawyers, auditors, accountants, attentive managers and appraisers.

We talked in detail about the cost of bankruptcy for citizens in this article.

Don’t believe advertisements like “Citizens’ Bankruptcy for 20,000”! These are scammers. A simple calculation of expenses that we provided shows that mandatory costs exceed 40 thousand rubles. Either you will pay for a one-time service to prepare documents and submit them to court (read in the contract what the executor’s responsibilities are), or you will simply be deceived.

You need to be vigilant, when paying for services on the Internet, check the OGRN of the organization, see how long ago it was created - on this site.

How much will your bankruptcy cost?

Procedure for selling property

The sale of a citizen's property is regulated step by step by the Bankruptcy Law. A potential bankrupt will have to go through all the stages in order to write off his debts.

Please pay attention to the following stages of property sale:

- Implementation introduction

. The court recognizes that the citizen is insolvent and appoints a financial manager.

- Inclusion of creditors' claims in the register

. Within 2 months after the introduction of the sale, creditors file statements that the bankrupt owes them money. The court checks the appeals and makes a ruling on inclusion in a specific queue of the register of creditors' claims.

For example, employees are in the second line, and banks, the MFC, the tax office, collectors and citizens with loans against receipts are in the third. The register is drawn up and maintained by the financial manager.

- Formation of the bankruptcy estate

. At this stage, the financial manager describes all property owned by the debtor, including shared property and property acquired jointly during marriage).

- Property search

. The financial manager analyzes the debtor's transactions for concealment of property. If suspicious transactions are identified, he submits a petition to cancel them - if the contract is canceled, the property is included in the bankruptcy estate.

- Adjustment of bankruptcy estate

. The financial manager determines what property is subject to sale and excludes property that is not allowed for auction in accordance with Art. 446 Code of Civil Procedure.

- The court approves the list of property

which will be sold.

- Property valuation

. The assessment is prepared by the financial manager according to the scheme established by law. For complex and complex objects, as well as when selling real estate, a professional appraiser is hired.

- Drawing up an implementation plan

. The arbitration manager submits to the court for approval a plan on the procedure and timing of the sale of objects of the bankruptcy estate.

- Sale of property

.

Objects worth up to 100 thousand rubles are sold through direct sale (ads on Avito or in a local newspaper).

Property worth more than 100 thousand rubles is sold through auctions. The bankruptcy auction has the right to be conducted by the financial manager himself, or to hire a specialized auction organizer, transferring the bankruptcy estate under an acceptance certificate. Information about the auction can be tracked on the EFRSB website.

- Settlements with creditors.

The manager accumulates the proceeds in a special account and distributes them among creditors according to priority and in proportion to the share of the claim in the register.

- Report of the arbitration manager.

The financial manager submits to the court a final report on his activities, indicates the volume of requirements fulfilled, and attaches a list of sold and unsold property.

The implementation procedure ends with debt write-off. Even if there is no property or not enough to pay off in full, loans, microloans, housing and communal services debts and taxes will be written off.

In the determination of completion, the court directly writes about the release from debts.

Duration.

Bankruptcy Law No. 127-FZ establishes

a 6-month period for the procedure

, but the court has the right to extend the period, more than once. How long the implementation takes depends on the number of creditors and the composition of the property. The more lots there are at auction, the longer the process will take.

Consequences of the implementation procedure

While bankruptcy is underway:

- The financial calculations are carried out by the manager.

- The bankrupt's income goes to a special account of the manager.

- Transactions worth more than 50,000 rubles require the approval of the manager.

- Enforcement proceedings are suspended.

- All claims of creditors are submitted only through the court.

- Accruals of interest, penalties, and penalties for delays are stopped.

- The debtor is obliged to provide documents and information at the request of the manager.

After the case is completed and debts are written off, the consequences of bankruptcy arise.

- A bankrupt cannot occupy a leadership position for 3 years.

- You cannot become bankrupt again within 5 years.

- In the loan application, write that you have gone through bankruptcy within 5 years.

- Additions to the credit history about delays and non-performance are stopped, but an entry about bankruptcy is made. Based on experience and reviews on our forum, within six months you can begin to correct CI.

Also, if the bankrupt previously conducted business activities, he will not be able to register an individual entrepreneur again for 5 years after the procedure.

After the sale of property and completion of bankruptcy, the citizen is free from debt - loans and borrowings are written off completely, and you can move forward.

Stages of sale of seized property during bankruptcy

The procedure for selling property occurs in several stages:

- A bankruptcy estate is being formed. It should be noted that the debtor is obliged to independently prepare a list of items and things that can be sold to pay off debts. This list is attached to the application for recognition of bankruptcy and is submitted to the arbitration court. After the decision is announced, a specially appointed manager submits a report to the court a month later on the composition of the property and prepares an estimate of its value. To fulfill this order, the financial manager is allowed to make requests to various authorities, enter into a dispute regarding the legality of the transaction between the bankrupt and third parties, in order to prevent the removal of certain items from the property of an individual;

- The property is being assessed. The actions of the financial manager are fully consistent with Article 213.36 of the federal law. In particular, it is said here that the organization of property valuation lies entirely with the manager. Next, the results obtained are reported to the court and the parties to the bankruptcy case. If someone does not agree with the provided figures, then he can challenge them in the manner prescribed by current legislation;

- Open bidding is held. If the value of the property is more than 100,000 rubles, then an auction is organized where the property is sold. The money received is transferred to pay off debts arising as a result of non-payment of financial obligations.

According to the law, auctions for the sale of the debtor's property must be conducted only electronically. The initial cost is set, which is equal to the market price at the opening of the auction. If the initial auction does not lead to a sale, then the next auction begins at a price reduced by ten percent. When it is not possible to sell the property at the second stage, a public auction is organized. Here, the price of the lot decreases gradually. In this case, the price can be reduced several times.

Sample documents

Application for bankruptcy of an individual (43 kb)

Petition for the introduction of implementation bypassing restructuring in the bankruptcy of an individual (35 kb)

Inventory of property (form). Appendix to the bankruptcy application (24 kb)

Petition for deferment of payment of remuneration to the financial manager (41 kb)

Petition to exclude funds from the Cabinet of Ministers (36 kb)

Statement of claim for the division of common property of spouses during bankruptcy (39 kb)

If you are interested in the details of the procedure for selling property, you intend to go through bankruptcy and get rid of bank claims, please contact our lawyers. We will answer questions for free, provide legal support and help you write off debts with minimal losses!

To get a consultation

Ask any question about bankruptcy and receive a detailed answer. It's free.

Video on the topic. Soloviev: law on bankruptcy of individuals

Share with friends:

Topics: seizure of propertyCompetition estateBankruptcy proceduresale of property