What is a bankruptcy estate?

Bankruptcy is regulated by Federal Law No. 127 of October 26, 2002. However, this law does not define the bankruptcy estate. But it also states that the bankrupt’s property forms this mass. Refers to property discovered on or during the commencement of bankruptcy proceedings.

There is an alternative definition. The bankruptcy estate is a set of real and liability rights. Sometimes the CM includes the obligations of the debtor. In particular, this happens when the bankrupt is an integral property complex.

The procedure for forming the bankruptcy estate

Mass formation includes these stages:

- List/inventory of the bankrupt's property. Performed on the basis of accounting or reporting documentation.

- Measures to search for or return property that was illegally transferred to third parties.

- Isolation from the mass of collateral property, which involves drawing up a separate inventory.

- KM adjustment. At this stage, the property that is subject to exclusion is excluded from the mass.

- Analysis of asset withdrawal transactions that were completed right before bankruptcy. Knownly unprofitable transactions can be challenged.

After the final property inventory report is drawn up, the objects are assessed.

What is included in the bankruptcy estate

The bankruptcy estate includes these objects:

- Fixed and working capital.

- Accounts receivable.

- Intangible assets.

Assets can include both tangible and intangible assets. The main feature is the ability to convert into money through sale. The funds received are used to pay off debts to creditors. Cash is a stable form of bankruptcy estate.

Formation of CM is a procedure that is also divided into stages. Its essence is the transformation of property and rights into money. First the mass is formed and then realized. Sales can be carried out using various methods. As a rule, these are open electronic auctions. They are organized by arbitration managers.

Formation of CM of the enterprise

The management of a legal entity has its own characteristics, because companies often have a more than powerful production base, even if they cannot pay off their debts. The manager has to work hard to draw up a correct CM.

The bankruptcy estate of a liquidated enterprise may only include property that is listed on the company’s balance sheet. Therefore in conc. mass include:

- money in the company account;

- assets such as tools, equipment, company transport;

- flow rate debt - money that the company has not yet been returned by its customers;

- funds received by the company from cooperation with other companies;

- targeted funding, which was not received;

- intangible assets, which include brands, patents, company developments, in general, everything that is intellectual property;

- securities and shares of LLC.

Since 2020, there is subsidiary liability of legal entities. It concerns the general director of the company, the chief accountant and the majority shareholder. She assumes that if these people deliberately brought the company to bankruptcy, they will also bear financial responsibility with their own property.

Recently, a manager can carry out an assessment of the value of assets himself, without inviting a third specialist to do this.

Read more: How to attach a plot of land to an existing one

Formation of the bankruptcy estate of a legal entity or enterprise

Bankruptcy proceedings are appointed when rehabilitation measures against legal entities have not proven to be effective. That is, the manager proceeds to forming the bankruptcy estate. It includes these objects:

- Fixed assets: vehicles, equipment, production tools, buildings, roads. An asset is classified as fixed assets only when its useful life is more than a year.

- Working capital: funds invested in production assets. The latter may be materials, equipment, tools.

- Intangible assets: patents, brands, software, various intellectual property.

- Accounts receivable.

- Targeted funding not fully received.

- Income from participation in other legal entities.

Formation and assessment of property are carried out on the basis of information from accounting and management reporting. The CM includes all property that can be used to repay debts to creditors.

FOR YOUR INFORMATION! Property valuation can be carried out either by a professional appraiser or by the manager himself.

Definition

The bankruptcy estate of the debtor is all real estate and other objects and funds that are eligible for sale and are owned by the defaulter. The list includes both known property on the date of commencement of proceedings and those identified during the proceedings. To correctly compile such a list, the manager has the right to seek the services of accountants and auditors.

The estate includes the following property:

- fixed assets and those in circulation;

- intangible assets;

- debts of debtors;

- other assets on the balance sheet.

On controversial issues regarding composition and exclusion from it, court hearings are held.

What is excluded from the bankruptcy estate

Not all property of legal entities and individual entrepreneurs can be included in the bankruptcy estate. There are objects that are excluded from it. Let's look at their list:

- An apartment or a share in it, if this is the person’s only home.

- Household items.

- A plot of land.

- Personal belongings of the individual entrepreneur. For example, clothes, shoes. However, there are exceptions. In particular, these are luxury items and jewelry.

- Fuel.

- Nutrition.

- Equipment and tools needed to perform professional activities. However, the exception is objects costing more than 100 minimum wages.

- Seeds.

- Items needed for medical care (for example, a wheelchair).

- Livestock that is not used in business activities.

- Prizes and memorial signs.

This list is not final. The arbitration court may supplement it depending on the individual case. Excluded is property the sale of which does not have a significant impact on satisfying the claims of creditors. This is property whose value does not exceed 10,000 rubles, as well as illiquid objects worth no more than 100 minimum wages.

What is a bankruptcy estate in bankruptcy cases?

Reading time: 5 minutes(s)

Bankruptcy is a universal way to write off debts that cannot be repaid by the payer at all due to his difficult financial situation. But in accordance with the law, the borrower must pay off his debt to the maximum - this is done by forming a bankruptcy estate in bankruptcy and selling this property at an open auction. An arbitration manager is appointed responsible for the operation, who acts only on the basis of a court decision.

Definition

The Law “On Bankruptcy” No. 127-FZ contains a clear definition of what is a bankruptcy estate (CM) and what kind of property is included in it.

In accordance with Article 131 of this law, the bankruptcy estate is the property of the bankrupt that belongs to him on the basis of ownership on the date of opening bankruptcy proceedings. It may also include property discovered during the proceedings, for example, intentionally hidden.

The CM is formed by the arbitration manager on the basis of data provided by the debtor himself, in parallel with the formation of the register of creditors. Often, the CM includes objects that are pledged to credit institutions or individuals.

The following property is not included in the bankruptcy estate:

- not owned by the bankrupt, but used by him on a rental basis, for example, rented housing;

- held by the debtor for temporary storage;

- belonging not to the bankrupt, but to his relatives, including his spouse.

The assessment of property included in the CM is made on the basis of reporting data or documents of ownership.

In accordance with the latest changes, the manager cannot involve independent specialists in the assessment or independently determine the price of the property. The final value of the property involved in the bankruptcy estate is determined during the auction.

Joint property of spouses, for example, an apartment or car acquired during marriage, is also subject to inclusion in the CM. But, if the second spouse is not declared bankrupt, then he is entitled to compensation in the amount of his share. He receives monetary compensation after the sale of the property.

For example, an apartment worth 3 million rubles belongs to the spouses in equal shares. After its implementation, the bankrupt spouse will receive 1.5 million rubles in cash - these funds will not be included in the bankruptcy estate and can be used by the family at their discretion.

After the CM is formed, the property is put up for auction through an open auction. In this case, the following obligations are repaid out of turn at the expense of the bankruptcy estate:

- before the court - court costs and state fees are paid if a corresponding petition has been filed;

- before the arbitration manager - he receives his remuneration in the amount of 15 thousand rubles + 2% of the sold property;

- related to the further functioning of the enterprise.

In addition, the collateral property is alienated first. The creditor has the right to sell it and take no more than 80% of its value and no more than the amount of current liabilities. The remaining funds are returned to the bankruptcy estate.

Features of formation

The formation of a CM has its own characteristics depending on who is going bankrupt - an individual, an entrepreneur or a company.

For citizens

Seizure of property is the most painful procedure in case of bankruptcy of citizens, since almost all expensive property will be confiscated. Thus, the bankruptcy estate will include:

- any real estate (apartment, house, garage, land, cottage, etc.), with the exception of the only dwelling;

- vehicles – car, motorcycle, trailer, etc.;

- funds in accounts;

- securities - shares, bonds, shares in LLCs, etc.;

- expensive household appliances and furniture (more than 50 thousand rubles);

- luxury items and jewelry.

In this case, the property will remain:

- the only housing, unless it is pledged (mortgaged);

- funds in the amount of the subsistence level;

- medicines and medical equipment;

- Food;

- domestic animals and livestock;

- cooking equipment, seeds, feed, etc.;

- personal awards and prizes;

- children's things, toys, books;

- tools needed to earn money, etc.

If the borrower does not have enough funds to pay the state fee and make a deposit into the court account, then he can file a petition to recover legal costs from the bankruptcy estate. Then the funds in favor of the court will be withdrawn immediately after the sale of part of the property.

All transactions of an individual over the past 3 years will be verified. If it turns out that the borrower, shortly before filing for bankruptcy, transferred the property to relatives or executed a fraudulent sale, the transaction will be declared invalid, the property will be alienated and included in the bankruptcy estate.

For entrepreneurs

Unlike legal entities, an individual entrepreneur is responsible for his debts with personal property. Consequently, the CM of a bankrupt entrepreneur includes the same property as in the case of individuals.

In addition, the following will be confiscated:

- fixed and working capital of the company from all current accounts of the individual entrepreneur;

- material assets of the company - equipment, machinery, furniture;

- finished products.

Typically, bankruptcy is quite painful for an entrepreneur, since most often the business debt is an order of magnitude higher than the debts of an individual. Therefore, the chances that it will be possible to save some property are an order of magnitude lower.

For companies

Unlike an individual entrepreneur, a legal entity during bankruptcy risks only the property on the company’s balance sheet. Thus, the CM of an enterprise includes:

- funds in the accounts of the enterprise;

- main assets of the company - equipment, vehicles, tools, structures, etc.;

- intangible assets - patents, developments, software, brands and other intellectual property;

- accounts receivable – funds owed to the company;

- securities, including shares in other LLCs;

- profit received from participation in the capital of other companies.

However, it is worth considering that starting from 2020, subsidiary liability applies to the founders, general director, accountant and majority shareholders. If the court finds that the bankruptcy of the enterprise was intentional or the actions of the business owners somehow influenced the ruin of the company, then the recovery will be directed to their personal property.

Distribution among creditors

After the formation of the bankruptcy estate, in the event of bankruptcy of an individual, other debts to creditors are repaid. The order is:

- people who have suffered health damage;

- employees of the bankrupt enterprise and funds (PFR, Social Insurance Fund, etc.);

- country budget (taxes and fees);

- bankruptcy creditors (banks, microfinance organizations, individuals, etc.);

- business co-owners;

- other owners;

- other persons.

The payment procedure is fully observed - until the debts of the first-priority creditors are repaid, the second-priority will not receive payment.

Exclusion from the bankruptcy estate

Some property may be excluded from the CM. Part - on the basis of the law, part - at the personal request of the borrower. Let's consider each case separately.

Property

One of the most painful issues during bankruptcy is the loss of your own home. If an apartment or private house is the only real estate, then its confiscation can be avoided. But if the bankrupt has at least a small share in another property, then the housing can be foreclosed on.

You can also avoid its loss if children are among the owners. In this case, the guardianship and trusteeship authority will stand up to protect their rights. Such housing cannot be sold without special permission.

However, if the housing is secured, for example, purchased with a mortgage, then it will be transferred to the mortgagee. Even if it is the only one and children are among the owners.

If the home is owned by several owners, it will still be alienated. But the co-owners will be paid monetary compensation in accordance with their shares.

The debtor can file a petition to exclude from the bankruptcy estate property that he needs, for example, for:

- carrying out professional activities - a car for a courier or a laptop for a designer;

- further residence - fuel for heating, food, equipment, etc.;

- carrying out treatment;

- servicing debts that cannot be written off (this includes debt for housing and communal services, alimony, payments by court decision, wages to employees).

The petition is drawn up according to the general template and submitted to the court before the final formation of the bankruptcy estate. Theoretically, one can declare the preservation of any property, as long as there is a legal justification.

The exclusion of property from the CM is carried out solely by a court decision; the arbitration manager cannot influence this in any way.

Living wage

Funds in the bankrupt's accounts remain in the amount of the subsistence minimum for each family member living with the debtor. In order to prove the fact of cohabitation, it is necessary to provide to the court:

- documents confirming relationship;

- certificate of family composition from the Management Company.

That is, relatively speaking, you cannot register a neighbor and get more money from this - there must be confirmation of family relations and joint farming.

When filing a petition, you must refer to Article 213.35 of the Bankruptcy Law, which explicitly states that property that cannot be foreclosed on in accordance with the Code of Civil Procedure of the Russian Federation is excluded from the bankruptcy estate. Article 446 of the Code of Civil Procedure of the Russian Federation states that on the basis of enforcement proceedings, the penalty is not applied to funds in the amount of the subsistence minimum.

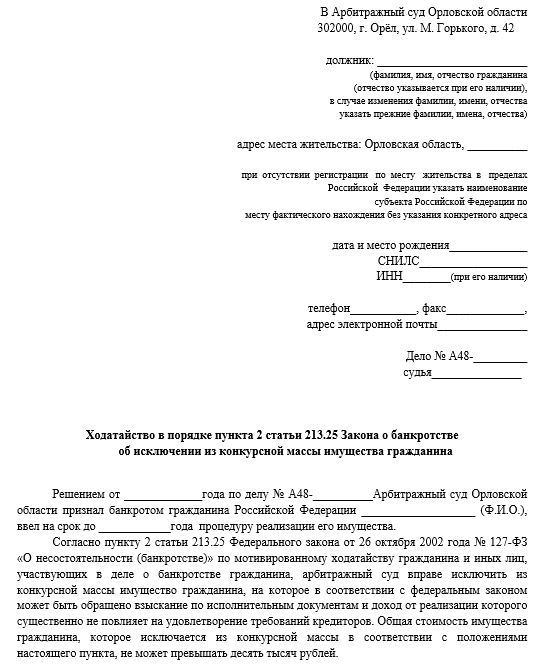

Sample documents

Petition to exclude property

You can submit such a petition here: https://yadi.sk/i/kAOIjjEwP4iyvA

Thus, the formation of a CM is a labor-intensive and rather complex process, both for the bankrupt himself and for the arbitration manager. As a general rule, it includes all the expensive property of the debtor, which is then sold at auction and serves to pay creditors in order of priority. Some property may be excluded from the bankruptcy estate at the request of its owner.

Did this article help you? We would be grateful for your rating:

0 0

Exclusion from the bankruptcy estate of a legal entity

The following objects are excluded from the bankruptcy estate formed from the property of a legal entity:

- Objects that are withdrawn from circulation in favor of the state treasury. For example, a similar circumstance is possible when recognizing the insolvency of unitary enterprises.

- Property rights related to a sole proprietor. For example, this is a permit for a certain activity.

- Leased objects, since they are not the property of the legal entity.

- Property, the ownership rights to which belong to third parties. For example, these are objects that are in the custody of a legal entity.

- Special objects, actions with which are regulated by special laws. For example, these are cultural monuments and socially significant structures.

- Housing stock, communal facilities necessary for the livelihoods of citizens.

The special status of the property must be confirmed by documents.

What is included in KM

estate includes funds recorded on the bankrupt’s balance sheet. It also includes those objects of property to which the debtor citizen or enterprise has rights.

KM includes both movable and immovable property, as well as cash and funds in bank accounts.

The law also determines the moment which property will be considered to pay off the debt, and in relation to which these measures will not be applied. Such an exception may be:

- objects of property of the organization withdrawn from civil circulation;

- property rights of the debtor;

- housing and housing funds for social purposes.

The CM does not include property to which the bankrupt does not have ownership rights, as well as other types of property that are in the debtor’s custody.

In the future, it is possible to return some property to the debtor if part of it is sufficient to pay off all creditors’ claims, or to enter it into the Cabinet of Ministers.

How to draw up an application for the exclusion of objects from the KM

Exclusion from the mass is carried out on the basis of a petition. It is sent to the arbitration court, which hears the bankruptcy case. The application includes this information:

- Document header: court details, plaintiff’s full name and contact details, insolvency case number.

- Date of the last inventory, inventory of property by the manager.

- A list of property that needs to be excluded from the mass. It is required to indicate the characteristics of this property.

- Grounds for exclusion (for example, the property is included in the list of property from which the bankruptcy estate cannot be formed).

The document must be completed with a formulated request. Let's look at the general exclusion procedure:

- The manager transfers the results of inventory and assessment to the bankrupt.

- If the bankrupt does not agree with the composition of the bankruptcy estate, he files the claim in court.

- The expulsion case is reviewed, after which the judge makes a ruling.

If the court makes a positive decision, the property is transferred to its owner.

Property not included in the mass

Not all objects and funds may be included in the list of realizable property. In accordance with the current legislation, the property of individuals not included in the bankruptcy estate implies:

- the debtor's only home or share of ownership;

- household items and household items;

- land allotment;

- citizen’s personal clothing and footwear;

- food products;

- fuel;

- living wage;

- working tools for performing activities, the price of which does not exceed 100 minimum wages;

- livestock;

- wheelchairs and prostheses, without which a person cannot fully exist;

- state awards, prizes.

The court may exclude from the list property the sale of which will not have a significant impact on the repayment of debts

This category includes illiquid property whose price is below 10 thousand rubles, but may be more than 100 minimum wages.

When an enterprise is declared insolvent, the list does not include:

- property confiscated from circulation to the state. Federal authorities are given six months to make a decision: to take away the property or provide it to another government organization;

- proprietary rights of an individual, for example, permission to carry out specific activities;

- rented premises, transport, since the defaulter does not act as the owner;

- objects owned by other persons and held in safe custody;

- special types of property: monuments, kindergartens, schools and other institutions;

- residential facilities used for the normal functioning of the region.