MUNICIPAL BANKRUPTCY

Content

- 10 steps to quickly bankrupt urban education

- Bankruptcy of a city unitary company (insolvency)

- Features of MUP bankruptcy

- What are the aspects of bankruptcy of a municipal unitary enterprise?

- Activities of local government bodies

- Persons not subject to bankruptcy

- Analysis of foreign experience of bankruptcy of urban entities

- Taxes and Law

- Liquidation of a municipal entity: features and algorithm, responsibility of the parties

- Study of the experience of the role of constituent entities of the Russian Federation (urban entities) in bankruptcy cases and bankruptcy procedures

- Analysis of trends in regionalization of the insolvency sector. The role of a subject of the Russian Federation as an owner of assets in bankruptcy and financial recovery procedures. Mechanisms for restructuring debt to regional and municipal budgets.

- As previously noted, fed. The executive body is endowed with the ability to present demands for payment of mandatory payments in a bankruptcy case, regardless of the level of the public legal entity to which the debt arose.

- The Constitutional Court of the Russian Federation refused to accept for consideration the request of the Government of the Capital (Determination of the Constitutional Court of the Russian Federation dated December 25, 2003 No. 455-O is given in Appendix 3), but established the following.

Civil law. Lecture 2

Bankruptcy of an autonomous institution

Hello, in this article we will try to answer the question “Bankruptcy of an autonomous institution.”

You can also consult with lawyers online for free directly on the website. Is it possible to terminate the obligations of an autonomous institution that has arrears in paying for the work of a contractor, who also has a debt for goods purchased from the institution, by offset? Experts from the Legal Consulting Service GARANT Sergey Shirokov and Alexey Alexandrov answer.

A non-profit organization can voluntarily close if its founders decide so. Most often, the reasons for voluntary closure are the termination of the organization's life or the achievement of all its goals. Funds, being non-profit organizations, cannot be closed without the approval of the arbitration court, that is, voluntarily. Bankruptcy of a non-profit organization in this case requires the availability of supporting documentation from all interested parties, otherwise the procedure will be impossible to begin.

Can a budget institution go bankrupt?

Will vicarious liability not fall on the head of this enterprise? Or is it better that it is not the debtor himself who comes forward with the application? The debtor himself has the right to file an application for bankruptcy; as for liability, it may arise if it is established that the debtor did not file such an application within the period established by law. According to our source, Federal Law No. 83-FZ of May 8, 2010 “On amendments to certain legislative acts of the Russian Federation in connection with improving the legal status of state (municipal) institutions”, as well as by-laws to it will be tested on the site Republic of Tatarstan.

The main regulatory legal act regulating relations arising from the insolvency of participants in property transactions is the Law under comment. In addition, the system of legislation regulating insolvency (bankruptcy) includes the Federal Law of February 25, 1999 No.

Noteworthy is the legislator's reference to the fact that legal regulation is carried out in accordance with the Civil Code of the Russian Federation. In this regard, it should be noted that legislation in the field of insolvency is a complex system of legal norms, which is based on the norms of the Civil Code of the Russian Federation. At the same time, in accordance with the amendments made to the Civil Code of the Russian Federation by Federal Laws of January 3, 2006 No.

In addition to the listed laws, you should also be guided by the Arbitration Procedural Code, which has been in force since 2002, and the resolution of the Government of the Russian Federation, which has been in effect since 2004.

Thus, the legislation does not provide any guarantees for the rights of creditors of autonomous institutions during its liquidation.

The process of bankruptcy of a non-profit organization includes the standard five stages characteristic of any bankruptcy procedure, ranging from monitoring to financial recovery.

Let us recall that offset is a unilateral transaction, that is, for its implementation, a statement by only one party to the obligation is sufficient (Article 410 of the Civil Code of the Russian Federation).

According to an extract from the Unified State Register of Legal Entities, ONO DOS GNU VNIITTI was registered by the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 3 for the Lipetsk Region on April 20, 2005 as a state unitary enterprise based on the right of economic management.

The debtor, a scientific service organization, the Dryazgin Experimental Station of the State Scientific Institution of the All-Russian Scientific Research Institute of Tobacco, Shag and Tobacco Products of the Russian Academy of Agricultural Sciences, applied to the arbitration court to declare it insolvent (bankrupt).

Despite the fact that not all non-profit organizations are allowed to proceed with bankruptcy, for some of them it is still possible. In this case, bankruptcy will have a number of its own characteristics.

The fact is that an autonomous institution does not apply to recipients of budget funds (Article 6 of the Budget Code of the Russian Federation) and the provisions of Art. 219 of the Budget Code of the Russian Federation, according to which recipients of budget funds can fulfill their obligations exclusively at the expense of budget allocations.

The debtor himself has the right to file an application for bankruptcy; as for liability, it may arise if it is established that the debtor did not file such an application within the period established by law. State institutions are state (municipal) institutions of a new type that will transfer all income received from income-generating activities to the budget.

Thus, when determining the organizational and legal form of ONO DOS GNU VNIITTI, the court rightfully proceeded from the provisions of the Charter of ONO “Dryazginsk Experimental Station”, according to which the organization is commercial, the purpose of activity is to make a profit, the property belongs to the organization on the right of economic management.

In accordance with this law, all budgetary institutions of the Russian Federation can have varying degrees of financial freedom. It will depend on the efficiency of management of enterprises with their financial resources.

In accordance with Art. 410 of the Civil Code of the Russian Federation, an obligation may be terminated in whole or in part by offsetting a counterclaim of a similar nature, the due date of which has come or the due date of which has not been specified or is determined by the moment of demand. Consequently, offset has the same consequences as proper fulfillment of an obligation (determination of the Supreme Arbitration Court of the Russian Federation dated May 18, 2012 N VAS-5866/12).

Bankruptcy of enterprises and institutions in the Russian Federation is regulated by bankruptcy laws. Until recently, any legal entity, enterprise or institution of any form of ownership, except state-owned, could be declared bankrupt.

The autonomous institution is in arrears in payment to the contractor for the work performed by the latter. In turn, the contractor acts as a buyer of the products of an autonomous institution and has arrears in payments for the purchased goods.

References to the law and documents If you carefully read Article 165 of the Civil Code of the Russian Federation, it becomes clear that legal entities can be considered a non-profit organization.

Bankruptcy of enterprises and institutions in Russia

Bankruptcy of enterprises and institutions in the Russian Federation is regulated by bankruptcy laws. Until recently, any legal entity, enterprise or institution of any form of ownership, except state-owned, could be declared bankrupt.

On May 8, 2010, “On amendments to certain legislative acts of the Russian Federation in connection with improving the legal status of state (municipal) institutions” was adopted.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!

According to this law, a reform of budgetary institutions is being carried out, the main feature of which is granting them the right to engage in commercial activities and use the profits received from it at their discretion.

This expands the rights of institutions, gives them greater financial freedom and contributes to the development and improvement of the quality of services provided to the population.

Responsibility of the management of non-profit organizations

Closing and liquidation The liquidation of any non-profit organization due to bankruptcy usually occurs in three main stages. Firstly, a decision is made to close the organization and a liquidation commission is formed. During the organization of the commission that will deal with the process, a liquidator is selected.

In the event that the procedure for executing a judicial act established by budget legislation has not been observed, the creditor may apply to the court with a demand to declare the inaction of the relevant financial authority illegal and demand the suspension of transactions on the expenditure of funds in relation to the debtor on his personal accounts.

An autonomous institution is liable for its obligations with the property assigned to it, with the exception of real estate and especially valuable movable property assigned to it by the founder or acquired by the autonomous institution at the expense of funds allocated to it by the founder for the acquisition of this property.

Responsibility of the institution for obligations

The institution is liable for its obligations with the funds at its disposal. This should be understood to mean that existing debts are not repaid with property. Considering that the financing of the non-profit organization in question is carried out by its owner (in most cases - in full), then the responsibility, initially

, for his unfulfilled obligations was assigned to its owner.

Since such liability is, in essence, additional, it is called “ subsidiary liability

”.

According to Part 2 of Art.

120 of the Civil Code of the Russian Federation as amended on September 1, 2006, subsidiary liability for the debts of any institutions was assigned to their owners, including the budget of the Russian Federation. However, these provisions have been significantly changed by the legislator, which I will write about below.

Bankruptcy of a non-profit organization

It must be taken into account that by virtue of clause 4 of Art. 61 of the Civil Code of the Russian Federation, a legal entity, with the exception of a state-owned enterprise, institution, political party and religious organization, is also liquidated in accordance with Art. 65 of the Civil Code of the Russian Federation due to its recognition as insolvent (bankrupt). The legislation of the Russian Federation quite clearly explains how bankruptcy of any commercial organization occurs, however, with non-profit organizations, things are somewhat more complicated. There are a number of non-profit organizations that cannot go through bankruptcy proceedings at all.

This process does not require significant organizational costs. You just need to make changes to the constituent documents.

An attempt has been made to harmonize the rights and obligations of institutions. The state will finance autonomous institutions in the same way as before, but will not bear subsidiary responsibility for them, will not pay their debts...

Bankruptcy is the inability of a debtor to fulfill his debt obligations. It can be either a legal entity or an individual. According to the laws of the Russian Federation, only the Arbitration Court can declare a debtor bankrupt.

According to the law, the list of government institutions will be limited. These will include a variety of military departments, pre-trial detention centers, correctional institutions, psychiatric hospitals, leper colonies, institutions of a number of federal departments, including fire protection, migration and customs services, the Federal Security Service, etc.

If you carefully read Article 165 of the Civil Code of the Russian Federation, it becomes clear that legal entities can be considered a non-profit organization.

Federal authorities must no later than November 1, 2010. submit to the federal treasury lists of budgetary and government institutions under their jurisdiction. Until January 1, 2011 the founders must draw up lists of real estate assigned to them. Until March 1, 2011 founders must make decisions on classifying movable property of institutions as particularly valuable.

Bankruptcy of a city unitary company (insolvency)

Bankruptcy procedure for a city unitary company

Thus, they are not at all like corporate institutions. Unitary institutions include not only state unitary enterprises and municipal unitary enterprises, but also foundations and autonomous non-profit organizations.

Moreover, he can make all decisions (how to dispose of property, not counting real estate).

1. production, reorganization and liquidation of municipal unitary enterprises are regulated by the Civil Code of the Russian Federation (stat.. stat.. 65.1, 113-114) and a special law.

- All aspects of the bankruptcy procedure for a legal entity are prescribed in the Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”.

Does the type of institution affect insolvency?

- The debtor himself.

- His creditors.

- Debtor's employees.

- Municipal bodies.

After the arbitration court recognizes the debtor as insolvent (bankrupt), one of the procedures prescribed by law is introduced.

Their task is to satisfy creditor requirements to the greatest extent possible. The end of the bankruptcy procedure is the liquidation of the legal entity. faces.

The law prescribes unique rules for conducting bankruptcy procedures for certain categories of debtors - legal entities. persons

How does a city enterprise become insolvent (bankrupt)?

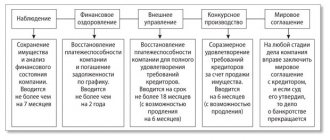

- Observation procedure.

- Rehabilitation stage.

- External control procedure.

- Conducting bankruptcy proceedings.

- Conclusion of a settlement agreement.

But before this, procedures such as observation and sanitation may be carried out.

But if after these procedures the situation does not change, external control is introduced.

It is appointed by the arbitration court. The choice is made in favor of a specialist - an arbitration manager.

If bankruptcy proceedings are introduced, the enterprise is liquidated.

The purpose of this step is to satisfy creditor requirements as much as possible.

On what aspects is recognition carried out?

If we are talking about a municipal unitary enterprise - a management company in the field of housing and communal services, there may be another sign that the company is bankrupt.

In other words, does not provide them with high quality public services.

On what grounds is forced liquidation likely?

Is there any difference from a standard company?

Features of bankruptcy of municipal institutions

The law provides for increased responsibility of top managers for the results of the commercial activities of the enterprises and institutions entrusted to them.

The document entitled “On amendments to certain legislative acts of the Russian Federation in connection with the improvement of the legal status of state (municipal) institutions” proposes to divide all state and municipal institutions into three types: state-owned, autonomous and budgetary.

Despite the fact that the charter of ONO DOS GNU VNIITTI does not directly indicate the organizational and legal form of the debtor as a state enterprise, at the same time, the charter determines the property and organizational status of the latter in full accordance with the provisions of Art. 114 of the Civil Code of the Russian Federation on a unitary enterprise based on the right of economic management, which the court of appeal rightfully pointed out.

In this case, the founders are relieved of the need to carry out all stages of voluntary liquidation, because the reason for closure becomes obvious.

New budget institutions will be financed on the basis of a state assignment in the form of a subsidy, and they will be able to enter into major transactions only with the consent of the founder (state or regional government, municipality). The budgetary institution will not have the right to open accounts outside the treasury system. The procedure for maintaining accounting records in such organizations will be established by the Russian Ministry of Finance.

The municipal enterprise has large debts, and a proposal has arisen for its bankruptcy. Does the debtor (municipal enterprise) itself have the right to file for bankruptcy, and what risks may arise?

From the literal interpretation of this norm, the conclusion follows that any institution, both budgetary and autonomous, cannot be declared bankrupt.

Liquidation of a municipal entity: features and algorithm, responsibility of the parties

The initiators are the owners or the judiciary. If you have large debts, you need to apply to the arbitration court to initiate bankruptcy.

The elimination algorithm is general. When liquidation begins, creditors and municipal authorities must be notified.

To implement the closure of a facility, a decision from the administration of the municipal district is certainly required.

- Algorithm for the procedure;

- The time frame within which creditors can submit their claims;

- Closing dates.

- Receive municipal government assets to the treasury;

- Make related adjustments to the municipality register.

If the company has debts, closure is carried out in accordance with the general procedure. Lenders are given 2 months. to pay off debts.

- Selection;

- Merger;

- Conversion;

- Separation;

- Joining.

- Restructuring plan;

- Decision of the expert commission;

- Expert opinion regarding the consequences of the event.

Is it possible to bankrupt a private educational institution?

The process is complete when all debts are paid. Bankruptcy of an autonomous institution Bankruptcy is the inability of a debtor to fulfill its debt obligations. It can be either a legal entity or an individual. According to the laws of the Russian Federation, only the Arbitration Court can declare a debtor bankrupt. This can be done if three basic conditions are met:

- the presence of monetary debt for enterprises and institutions, for citizens and entrepreneurs;

- if the debtor fails to fulfill loan obligations for three months;

- the amount of debt must be greater than the value of the debtor's property.

The state organizational form (CO) of an institution has the strictest regulation of economic activities. Its financing is carried out in full accordance with the budget.

Features and differences of the forms of new budget institutions

The most financially independent is the autonomous form (AU). It allows enterprises to create orders for their activities themselves and allows them to open accounts in commercial banks.

The budget form (BU) limits the freedom to place orders and allows you to have an account only with the Federal Treasury.

The state organizational form (CO) of an institution has the strictest regulation of economic activities. Its financing is carried out in full accordance with the budget. This usually includes institutions of the Ministry of Defense and the state penitentiary system and all income received by the KU

All three of these forms assume one thing: their owner is the state represented by the Federal or municipal authorities. And the liberalization of their financial activities does not at all exclude their financing from the budget.

The budget remains the main source of normal functioning of such organizations. The law only created the conditions for their more harmonious development.

Only the procedure for state participation in financing institutions has changed. Only for government officials did it remain the same. And autonomous and budgetary enterprises, according to the new law, are financed in the form of subsidies based on the State Assignment.

Liquidation of a budgetary institution, application of the Bankruptcy Law by analogy

The essence of the problem: the company performed work for a budgetary institution. The budgetary institution did not pay anything and went into liquidation. According to paragraph 5 of Article 123.22 of the Civil Code of the Russian Federation, the founders, i.e. The regional government is not responsible. The director of this institution was imprisoned, but the money was not given to anyone.

Proposed solutions: legal norms for liquidation are very “general” and there are few of them Art. 61,62,63 Civil Code of the Russian Federation. I have found practice that bankruptcy law can be applied by analogy. I want to try through the institution of the Bankruptcy Law (bringing controlled persons to account, obliging the liquidator to file a claim with the government to recover funds that should have been allocated for construction) to extract money from the government.

I ask you to provide active assistance in thoughts, practice, and guidance.

- 1029

- rating 0

Construction law: complex issues and ways to solve them

Challenging transactions on the basis of the Bankruptcy Law

Bachelor of Laws University of London

Persons not subject to bankruptcy

Rice. 1. Persons not subject to bankruptcy procedures

- state-owned firms (clause 2 of article 1 of the Bankruptcy Law)

— institutions (clause 2 of Article 1 of the Bankruptcy Law).

Based on the types of owners, the law divides institutions into personal, municipal and city.

— general educational institutions (initial general, basic general, secondary (complete) general education);

— special (correctional) for students and pupils with developmental disabilities;

- other institutions implementing educational procedures.

Autonomous establishment of a cultural company (stat. 46.47 “Fundamentals of the legislation of the Russian Federation on culture” (approved by the Supreme Court of the Russian Federation on October 9, 1992 No. 3612-1 (as amended on December 29, 2006)))

Libraries (Law of the Russian Federation “On Librarianship” dated December 29, 1994 No. 78-FZ (as amended on June 26, 2007))

— political parties (clause 2 of article 1 of the Bankruptcy Law).

- religious enterprises (clause 2 of article 1 of the Bankruptcy Law).

! All other non-profit firms may be declared bankrupt.

Comments (10)

Answer “major deal”: I can’t say for sure about a major deal, I’ll let you know today. What does it matter? if it was large and can be declared invalid? Can I demand money from the founders of a budget institution?

The answer is “the object has been completed”: the work that we have completed has been completed and is being used, this is a storm drainage system in the entire microdistrict in which residential buildings are built. And the residential buildings themselves are partly commissioned, partly not.

Yes, a municipal contract, the owner is a budgetary institution (it is being liquidated and has not yet distributed all the property or transferred it to the “state”).

There is no way to make a claim against the owner of the property: The claim was refused, since due to changes in legislation from 09/01/2014, in the event of insufficient funds of a liquidated budgetary institution, the owner of its property bears subsidiary liability only for obligations related to causing harm to citizens (ARBITRATION COURT OF THE MOSCOW DISTRICT DECISION of August 31, 2017 in case No. A41-70870/16 Resolution of the Arbitration Court of the Volga-Vyatka District of September 29, 2016 N F01-3688/2016 in case N A31-5617/2015)

“Liseitseva and Maslov against Russia” - https://europeancourt.ru/2014/10/09/17199/

“The ECtHR did not find sufficient grounds to conclude that the state is responsible for all municipal unitary enterprises.

As for the Liseytseva case, it was about a transport municipal unitary enterprise. It provided public transport services to the population. Including free. These services subsequently had to be paid for by the authorities. However, some authorities did not fulfill their obligations to the Municipal Unitary Enterprise. In addition, as in the Maslov case, the property of the enterprise was transferred by the municipal authorities to the newly created transport municipal unitary enterprise, while the wage arrears were left at the old enterprise. According to the ECHR, this is enough to come to the conclusion that the state is liable for the debts of this municipal unitary enterprise;”

“Kim and Rindina against Russia” - https://pravo.ru/interpravo/news/view/137756/

“In Strasbourg, they came to the conclusion that the fact that local authorities disposed of the MUP’s property actually indicates that the company was under state control. The ECtHR decided that the enterprise did not enjoy “sufficient institutional and operational independence from municipal authorities.” Therefore, the court determined that the state should be liable for defendant's debt."

Review of arbitration practice on repayment of obligations of autonomous institutions

Author: Orlova O. E. , magazine expert

Autonomous institutions have the right to attract borrowed funds, including bank loans. At first glance, credit institutions are reliable borrowers with government funding and their own income, which allows lenders to count on uninterrupted repayment of funds. For such borrowers, lenders are willing to reduce rates and extend borrowing terms. However, the legal status of autonomous institutions, which provides for a special procedure for covering debts, puts creditors at a disadvantage - this may weaken their interest in cooperation with autonomous institutions. Read the article about how disputes related to the sources of repayment of the obligations of an insurance company are resolved in court.

Main sources of covering liabilities.

In normal business practice, organizations cover their obligations through the influx of cash from their core activities. Lenders who practice deferment rarely require collateral, but the deferment period is short (14–60 days). Banks issue loans for a longer period (from a year), and the provision of loan collateral becomes a critical condition for financing. If payments are made on time and in full, the matter does not come to the question of what sources cover the obligations. In case of financial difficulties, repayment of obligations can occur at the expense of the debtor’s property, and if there is not enough property, under certain conditions, funds can be recovered from the owners of the organization.

How are things going with ensuring the obligations of an autonomous institution? A regular influx of funds is ensured by the property that the founder has endowed the institution with, subsidies for the implementation of state (municipal) tasks, as well as income from paid services and work.

If there is a shortage of money, it is extremely difficult to rely on property other than highly liquid funds to pay off obligations, since it does not belong to the AU by right of ownership. According to Part 4 of Art. 2 of Law No. 174-FZ[1] to satisfy the claims of creditors, the AU uses the property that it has under the right of operational management, with the exception of real estate and especially valuable movable property assigned to it by the founder or acquired by the AU at the expense of funds allocated to it by the founder for this target. It is unlikely that many institutions have such a volume of property acquired through paid activities that will be sufficient to cover debts in the event of financial difficulties.

The owner of the property is not liable for the obligations of the AU (including during the liquidation of the institution), as evidenced by Part 5 of Art. 2 and part 2 art. 19 of Law No. 174-FZ. Since the formation of the legal status of an autonomous institution, this type of institution has not provided for the subsidiary liability of the founder (owner) for the debts of the autonomous institution[2]. We will talk about this in more detail below when considering specific cases.

Stages of bankruptcy of a state-owned company

If a bankruptcy procedure is initiated, it occurs according to several stages. The result can be the restoration of the enterprise, the establishment of its successful operation. Then there is no need to declare the company bankrupt.

Otherwise, the company is declared bankrupt, the property is sold and payments are made to creditors and other organizations to which the company is in debt. Below we consider the stages of bankruptcy.

Observation process for bankruptcy of state-owned companies

The purpose of this stage is to analyze the current state of the company. A resolution is also adopted on the course of action in the future. At this point, any actions that can preserve the company's assets are taken. This is done by a temporary manager appointed by the court.

He only observes, he has no other functions. The result of his activities may be a transition to recovery, or directly to the stage of bankruptcy proceedings. Recovery occurs if there is a chance to rescue assets and return to the status of a solvent enterprise.

Sanitation or recovery

This stage involves taking actions that can restore the company's solvency. Now an external manager gets the opportunity to manage the company. Responsibilities are transferred entirely to him, and he is obliged to fulfill them effectively. Previous unproductive management is removed from action, and any powers of the owners and previous boards are terminated.

However, the only action not available to the new external manager is the sale of assets. This function will open if the reorganization does not lead to anything and it is necessary to proceed to bankruptcy proceedings. The desired result at the end of the manager’s actions is the rehabilitation of the company. If it is not possible to restore it, then the transition to the next stage occurs.

Bankruptcy proceedings in case of bankruptcy of a state company

If an enterprise managed by a temporary manager has reached this stage, then the court has declared it bankrupt. At this stage, a competitive sale of the company's property takes place in order to repay loans taken from creditors.

However, at this stage a return to the reorganization and subsequent rehabilitation of the company is not excluded. The main goal of the stage is to satisfy the demands of creditors and other borrowers for the repayment of debts, in accordance with the obligations assumed by the company.

At this stage, the administrator appointed by the court has the right to sell the property. He appoints a competition and sells those assets that, after sale, will be able to pay off the debts of the MUP. After all debts are repaid, the company is liquidated.

Settlement agreement

This is not the last stage, because it can be reached even when initiating the observation stage. The main goal of this stage is to conclude an agreement between creditors/borrowers and the debtor. The agreement was aimed at maintaining the productive operation of the enterprise.

That is, if the owner of the company (debtor) enters into an agreement with creditors, for example, to restructure the debt or increase the payment period, then it will be possible to restore the solvency of the enterprise.

An agreement can be concluded at any stage, but to do this you will have to draw up an effective plan to repay all loans. It must be approved not only by creditors and the court administrator, but also by the arbitration court itself. Approval occurs only if the plan has potential. As a result, the company will not be liquidated, but will resume its activities.

The creditor challenged the liquidation of the company.

The creditor tried to bring the founder of the AU to subsidiary liability on the basis of clause 6 of Art. 63 of the Civil Code of the Russian Federation (as amended before the amendments were made by Law No. 99-FZ)[3]. Having not received the desired result in this case (Resolution of the AS ZSO dated December 11, 2015 No. F04-27172/2015 in case No. A81-968/2015[4]), the creditor appealed to the Constitutional Court with a complaint about the need to verify compliance with clause 7 of Art. . 63, paragraph 1, art. 65, paragraph 6, art. 123.22 Civil Code of the Russian Federation, clause 19 art. 1 of Law No. 99-FZ to the norms of the Constitution of the Russian Federation. This appeal formed the basis of the Decree of the Constitutional Court of the Russian Federation dated 02/09/2017 No. 219-O (hereinafter referred to as Determination No. 219-O), which considered the general grounds and procedure for liquidating an institution, as well as the rules for satisfying the claims of its creditors.

As the Constitutional Court of the Russian Federation explained, participants in civil law relations, acquiring civil rights of their own will and in their own interest, being free to establish their rights and obligations on the basis of an agreement, including with an autonomous institution, bear the risk of not satisfying their property claims. Since the legislation did not and does not provide for appropriate guarantees for creditors of an independent enterprise (since the emergence of institutions of this type), this directs counterparties to exercise the necessary degree of caution even when entering into civil legal relations with entities whose specific legal status does not fully allow resort to the institution of subsidiary liability. The counterparty could have foreseen and used existing civil law methods to ensure the fulfillment of obligations.

It is unlikely that many institutions have a volume of property acquired through paid activities sufficient to cover debts in the event of financial difficulties.

Payment of sums of money to the creditors of the liquidated enterprise is made by the liquidation commission in the order of priority determined by Art. 64 of the Civil Code of the Russian Federation, according to the interim liquidation balance sheet. If the funds available to the liquidated institution (including income received at the independent disposal of the institution) are not enough to satisfy the claims of creditors, the liquidation commission sells the property at public auction in the manner established for the execution of court decisions (Parts 4 and 5 of Article 19 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations”). Real estate, as well as especially valuable movable property assigned to the AU by the founder or acquired by the AU at the expense of funds allocated to it by the founder for this purpose (Part 4 of Article 2 of Law No. 174-FZ) are not subject to sale.

In cases No. A51-7345/2017 and A51-7343/2017, the LLC challenged the decision to liquidate the management company and withdraw property from operational management. The plaintiff indicated that the liquidation of the institution as a debtor of the LLC would lead to the impossibility of fulfilling its monetary claims. Refusing the society, the judges in the Resolution of the Supreme Court of the Russian Federation of August 17, 2017 No. F03-2932/2017 in case No. A51-7345/2017 referred to the legal position set out in Determination No. 219-O.

By the way, this creditor also showed persistence and reached the Constitutional Court of the Russian Federation, trying to point out the violation of constitutional rights and freedoms by the norms of paragraph 1 of Art. 65 Civil Code of the Russian Federation. According to the complainant, there are no statutory guarantees for creditors of an independent enterprise comparable to the guarantees of creditors of commercial organizations and similar ones, including with regard to the application of subsidiary liability. As one would expect, the Constitutional Court refused to consider the applicant’s complaint (Determination No. 2945-O dated December 19, 2017).

The bank challenged the seizure of the AU's property from operational management.

The Resolution of the Autonomous District of the Far East No. F03-2872/2018 dated July 27, 2018 in case No. A51-3103/2017[5] describes the following dispute regarding the property of the AU under the operational management. A credit line agreement was concluded between the bank and the institution, under the terms of which the bank provided the institution with a loan to pay current expenses (salaries and taxes). Soon after the institution received the loan, the founder issued an order to seize property from the owner. At the date the loan was issued, the bank had a real opportunity to return the funds, but it completely lost it after the owner made a decision to seize the property. Due to a delay in repaying the loan, a writ of execution was issued to enforce the court decision to collect the debt, but it was returned without execution due to the lack of funds in the institution’s accounts.

In the lawsuit, the bank indicated that the unilateral transaction to seize property violates its rights and legitimate interests, since as a result of the execution of this transaction, the activities of the AU were actually terminated, which deprived the bank of the opportunity to exercise its right to receive funds. According to the bank, the owner, having transferred property to an institution with the right of operational management, does not have the right to dispose of such property and can only remove from operational management that property that is redundant, not used, or used for other purposes. The execution of the contested order led to the inability of the institution to carry out the activities provided for by the charter, receive income and answer for its obligations to the bank due to the complete lack of assets.

The Supreme Court recognized the right of the founder of an autonomous enterprise to withdraw property from operational management at almost any time, without linking this with the institution’s non-use of the seized property.

In refusing the bank, the judges noted that the owner has the rights to own, use and dispose of his property. The owner of property has the right to withdraw excess, unused or misused property assigned to the institution or acquired by the institution at the expense of funds allocated to it by the owner for this purpose. The owner has the right to dispose of property seized from an institution at his own discretion. Having assessed the circumstances of the case, the court did not see in the actions of the founder abuse of rights, exercise of his civil rights solely with the intention of causing harm to other persons, actions in circumvention of the law for an unlawful purpose, as well as unfair exercise of civil rights.

At the end, the court clarified: since the founder made a decision to liquidate the joint venture, the bank’s material interest can be satisfied in the liquidation procedure. However, as the above arbitration practice has shown, the liquidation of an institution does not add rights to its creditors.

Bankruptcy of a budgetary institution

Bankruptcy is the official recognition of a debtor as insolvent before its creditors. The law provides for the possible bankruptcy of state institutions. In this case, 3 conditions must be met simultaneously:

- The amount of debt for the organization is 300,000 rubles or more;

- The debtor does not fulfill his obligations to the creditor, employees or the state within 3 months;

- The amount of debt is higher than the value of the debtor's property.

If all the conditions listed above are met, then the borrower may be declared bankrupt and be liable to the creditor. Moreover, until recently, the arbitration court of the Russian Federation could declare absolutely any legal entity or individual bankrupt, except for state-owned institutions. How does a government institution differ from other government organizations?

Taxes and Law

Bankruptcy practice of municipal companies

But this is rather an exception to practice. Usually the courts declare bankrupt only the city firms through which the administration operates.

Municipal Unitary Enterprise for providing fuel to the population, organizations and institutions of Ivanovo.

Prerequisites for mass bankruptcies of municipal companies

Bankruptcy procedures for municipalities abroad

1) it did not dispute or pay the invoice sent by the creditor within 60 days. from the date of receipt or due date of payment, if the due date is later,

2) failed to pay a recognized debt within 60 days. from the date of payment due date.

— refusal of the central government to buy out the debts of municipalities;

— production of clear and predictable rules for the behavior of parties in the event of default to form fair expectations of creditors;

— dispersal of losses from default between creditors and the territorial unit;

— rules for negotiations between creditors and debtors on restructuring obligations and easing the debt burden;

Examples of municipal bankruptcies in the USA

Within just 3 years, he eliminated the budget deficit and paid off almost all (except 1 million bucks) debts.

Positive aspects of municipal bankruptcy

Arbitrage practice

Federal Law No. 83 excludes declaring a municipal institution bankrupt. Since all their property belongs to the state itself, even if the organization is closed or declared bankrupt, all the property will return back to the state, which means that the creditors’ demands for debt repayment by selling the debtor’s property cannot be fulfilled. To date, no court decision in favor of creditors is known. However, there is an option for government organizations to bear subsidiary liability. For example, for the debts of departments belonging to the Russian Academy of Agricultural Sciences, the academy itself will be responsible to the creditor.

Thus, we can say that in the Russian Federation any legal entities, non-profit organizations, individuals, but not government organizations, can become bankrupt.

Article rating:

Save to:

Bankruptcy of an autonomous institution Link to main publication

Features of municipal enterprises

Before considering the process and features of the bankruptcy procedure that enterprises created by the municipality go through, it is necessary to briefly highlight their features.

- Article 65.1 of the Civil Code of the Russian Federation determines that the founder of a municipal unitary enterprise (municipality) cannot be a participant in the enterprise.

- Article 113 of the Civil Code of the Russian Federation determines that the right to property, which is under the control and use of a municipal unitary enterprise, is assigned to the municipality that organized this municipal unitary enterprise.