- Home page

- Articles

- kak-borotsya-s-kollektorami

03/15/2017 If there is an outstanding overdue loan, then there is a risk that the borrower will be harassed by debt collectors.

Let's find out what powers they have, and what rights the borrower himself has. The main task of collection firms is to collect debt from a debtor who took out a loan from a bank and was unable to pay it on time. Many borrowers are afraid of such organizations because they do not know about their rights. In fact, collectors cannot force you to pay off a debt or seize property; their task is to inform the debtor.

The work of collection agencies today is regulated by the Federal Law “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts and on amendments to the Federal Law “On microfinance activities and microfinance organizations.” It was adopted relatively recently - on July 3, 2020.

Introductory information

OJSC Rostelecom provides fixed-line telephony services, high-speed Internet access, and interactive television to more than 100 million subscribers in 80 regions of the country.

In everyday practical work, client debt inevitably arises. According to various estimates, the level of overdue payments at the end of the month can reach from 20% to 40% of average monthly revenue, with one debtor sometimes accounting for up to 10% of all overdue debt. About 5% of debts at the end of the month fall into the category of “bad debts”. Check the counterparty for signs of a shell company, bankruptcy and the presence of disqualified persons

It is customary for our company to monitor the status of settlements with the client from the moment the service is provided. If the bill is not paid on time, the client is called, reminded of the debt, and informed of the consequences of non-payment. At different stages of debt recovery, different methods of working with the debtor are used.

Outreach

A common way to motivate a resident to pay bills is to charge a penalty. Notify the debtor in writing that you are forced to charge him a penalty for late payment of housing and communal services. Explain that payment for residential premises must be paid no later than the date established in the management agreement or determined by the decision of the general meeting of owners of premises in the apartment building (Part 1 of Article 155 of the Housing Code of the Russian Federation).

If the management agreement or the OSS have not determined the date for payment of payment for housing and communal services, then the last day of the payment period is considered to be the tenth day of the month (Article 190-192 of the Civil Code of the Russian Federation). Payment will be considered overdue from the eleventh day in accordance with paragraph 30 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated June 27, 2017 No. 22.

There are residents who do not understand how the amount on the receipt is calculated, so they do not pay their bills. In this case, the debtor can be called and invited to an appointment with the head of the management organization or the chief accountant. During the conversation, tell the owner that non-payment of bills leads to the accrual of penalties, and failure to transmit meter readings leads to the accrual of amounts in receipts according to the standards.

Another option to resolve the problem peacefully is to enter into a debt repayment agreement with the debtor. This way, the consumer will be able to avoid restrictions and suspension of utility services and repay the debt in a manner convenient for him.

Tell the debtor about the terms under which you propose to enter into an agreement to repay the debt. Specify in the agreement:

- validity,

- consequences for violation of obligations,

- details of the parties.

Offer the consumer to choose how to pay the debt: in a lump sum or in installments. If the owner is ready to repay the debt in one payment, include in the agreement the amount of the debt, the period of its formation and the expected date of payment.

Not the most common way to work with debtors for housing and communal services is to offer the owner to work off the debt. Working off a debt instead of paying housing and communal services is considered a change in the payment method provided for in Art. 409 of the Civil Code of the Russian Federation. The most convenient in this case is considered to be a mutual agreement concluded in writing in accordance with Art. 161 Civil Code of the Russian Federation.

Conduct claims work

Target

More than half of business disputes are resolved pre-trial. The claim settlement procedure can be provided for directly in the contract with the client. Pre-trial dispute resolution is a less expensive procedure and therefore more effective than litigation. Practice shows that in this way it is possible to repay from 30% to 60% of overdue receivables.

What to do

Agree with the client on a flexible payment schedule, discounts, and actively use mutual settlement schemes. The method is suitable if the client is stable in the market and intends to continue its activities, but for some reason is experiencing temporary financial difficulties. If these conditions are not met, use the general approach.

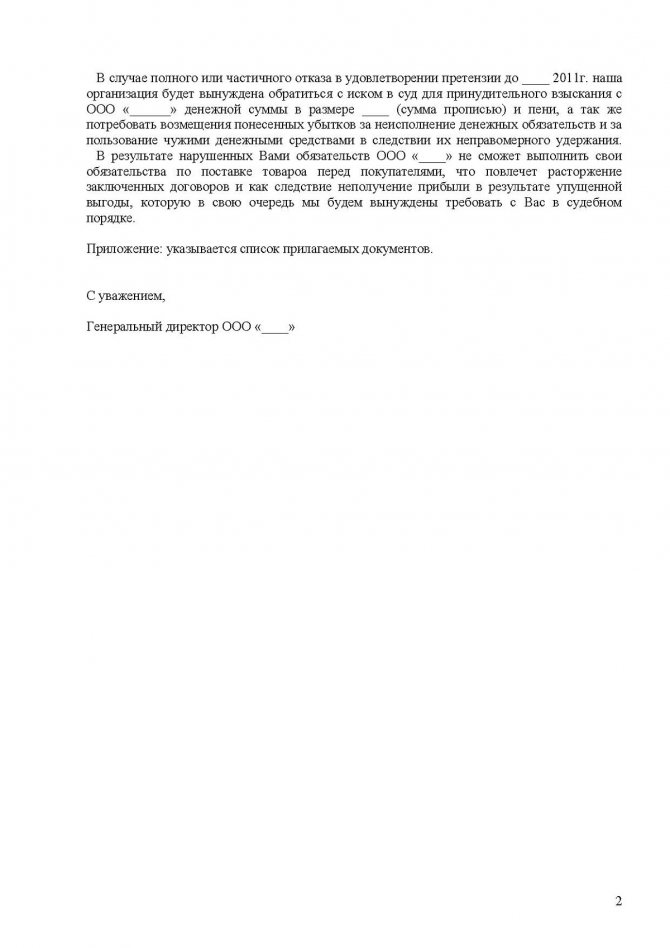

Send the client requests for debt repayment to the legal and actual addresses. The first is usually indicated in registration documents, the second, as a rule, is in the agreement, used in correspondence, and often appears in financial documents or on the debtor’s website. It is a good idea to mention in the request the collection of interest on the amount of debt through the court (Article 317.1 of the Civil Code of the Russian Federation, introduced in 2020) and compensation for losses caused to the creditor.

Inform the debtor's accounting department about the need to reconcile the calculations and send a reconciliation report. The accountant must submit the act to the manager (authorized person) of the debtor for signature. By signing the document, the debtor thereby acknowledges the debt. This will serve as strong evidence in court if it comes to it. In this case, it is better to immediately stock up on additional evidence. To do this, it is worth taking control of sending financial documents to the debtor: invoices, invoices, etc. They should be sent by registered mail, preferably with acknowledgment of delivery and a list of the contents. Save all receipts and carefully keep logs of incoming and outgoing correspondence.

Author's advice

The more scrupulously all this work is carried out, the more stable your position in court will be. With the help of documents, it will be easier for judges to get an idea of the development of the situation with the disputed debt, and the chances of a positive decision in favor of the creditor will increase.

Choosing a strategy

As a general rule, the stages should occur sequentially:

- conversations;

- meetings;

- court.

In fact, it is not advisable to immediately go to court without finding out the reason for the delay from the debtor. However, it is also inappropriate to divert company resources to calls to the counterparty if he does not respond to them. Sometimes the debtor can simply delay time to take away the property. In this case, a 30-60 day delay is just enough for him to accomplish his plans. In another case, it makes sense to wait longer with the court if a bona fide debtor is waiting to receive a subsidy or maternity capital, or money from his debtor, whose property has already been put up for auction.

However, there are cases when an urgent transition to the Legal collection is necessary:

- The debtor changes his place of residence without notifying the creditor.

- Information has emerged about the sale of the debtor's property to third parties.

- Information has appeared about the start of bankruptcy proceedings.

- Information has appeared about the problem of the debtor - the presence of legal proceedings on other claims.

- Change of company management to dummies.

- Filing a claim against the creditor to challenge the main agreement.

Track debtor status

Target

If the counterparty avoids negotiations, does not communicate, or does not sign documents, then the debt will most likely have to be collected through the court. You need to prepare for it, for which at the first stage it is important to assess the situation in the debtor company. An extract from the Unified State Register of Legal Entities will help with this.

What to do

Request an extract, analyze the information in it and outline further actions.

Receive a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs with the signature of the Federal Tax Service Send an application

If it follows from the extract that the debtor is going through reorganization in the form of a merger (Article 196 of the Civil Code of the Russian Federation), notify the legal successor of the outstanding debt before the statute of limitations expires (as a general rule, it is 3 years - Article 196 of the Civil Code of the Russian Federation). File a claim first, and if there is no result, file a lawsuit against the legal successor. Claims can be made against a debtor who is being liquidated within two months from the date of announcement of liquidation (Art. , Art. Civil Code of the Russian Federation).

If you learned about the liquidation of the debtor as a result of joining another legal entity during the trial, file a petition with the court to replace the defendant (Article 48 of the Arbitration Procedure Code of the Russian Federation).

If the debtor is liquidated according to some other procedure (without legal succession, for example, the debtor is declared inactive), then immediately after making the corresponding entry in the Unified State Register of Legal Entities, the debt should be written off as bad. And add information about the head of the debtor company to your “stop list” (even if he is not included in the Register of Disqualified Persons of the Federal Tax Service of Russia) and in the future do not deal with the companies he manages.

Check the founder and address of the counterparty for “massiveness” Start checking

What are they really capable of?

If the creditors acted only according to the law, the borrower would have to face a qualified lawyer who:

- He introduced himself and explained in detail the reason for the visit/call.

- He presented documents confirming the legality of his visit.

- I would indicate the requirements made by the agency, explain them (why this particular amount) and confirm it with documents.

- I established the true cause of the debt.

- Helped find a solution to eliminate it.

- I would carry out calculations using professional skills and knowledge.

- Drew up the necessary documents (applications, appeals, requests, draft agreements) that are aimed at repaying the debt.

This type of work does not require frequent visits and calls. The significant problem is that it is ineffective. Borrowers are much more willing to respond to threats and frequent calls, psychological pressure on them and their loved ones. This significantly affects what collectors can do with the debtor. Therefore, in reality the opposite picture is observed :

- Frequent calls - 10 or more per day, including at night;

- The borrower and his relatives are met on the street by menacing-looking persons who clearly indicate dire consequences in case of non-repayment of the debt;

- Insulting leaflets are posted at the debtor’s place of residence and work, which damage business and personal reputation;

- The demands presented are significantly higher than the borrower's obligations to the bank.

That is, the actions of collectors in relation to debtors violate Article 7 of the Law on Collection Activities. Particularly sophisticated methods of agency employees are based on misleading debtors . The result is that the borrower pays off part of the debt in the hope that the pressure from collectors will stop, but the debt is resold to another organization. For the debtor, calls and threats begin in a new circle.

However, the legislator prohibits misleading the borrower on the following issues:

- The nature of the obligations, their size, the reasons for their failure to fulfill them by the borrower, the repayment period;

- Transferring the dispute to court;

- Consequences of non-repayment of credit debt;

- Application of administrative and criminal legislation in relation to the debtor;

- Affiliation of collectors with law enforcement or other bodies representing government power.

Collectors may be former law enforcement officers. It is prohibited for current employees of government agencies to collect debt on loans.

From the above we can conclude: debt collectors who threaten and harass with multiple daily calls are acting illegally and can be ignored. The first part of the output is correct, the second is not.

Some legal websites recommend ignoring debt collectors. But this is wrong, such actions can lead to dire consequences, including the death or loss of health of the borrower or his loved ones. On the contrary, competent and active actions can help get rid of obligations to the bank for a relatively small amount.

Working closely with a bankrupt

Target

The chances of repaying the debt if the debtor goes bankrupt are noticeably reduced, but you can try.

What to do

Try to include the debt in the register of creditors' claims:

- within 30 calendar days from the date of notification of the introduction of surveillance (initial stage of the bankruptcy procedure) (Article 71 of the Federal Law of October 26, 2002 No. 127-FZ). If this does not work out, then you can count on repayment of the debt amount only from the property that will remain after the claims of the creditors from the register have been repaid;

- declare your claims before closing the register of creditors, if bankruptcy proceedings have already begun (the final stage of bankruptcy). No more than two months are allotted for this from the date of publication of information on declaring the debtor bankrupt and on the opening of bankruptcy proceedings (Clause 1, Article 142 of Federal Law No. 127-FZ).

There is one subtlety. Creditors whose claims are already in the register are required to be notified of the appearance of a new creditor (Articles 100, 142 of Law No. 127-FZ), and notifications are sent at the expense of the “new one”.

Author's advice

If you do not pay the costs of notifying the new creditor, the court will not accept the application to include your claims in the register of creditors. You can find out the amount of compensation and details for transferring payment from the bankruptcy trustee.

If you have not managed to achieve inclusion in the register, you can enter the list of creditors “behind the register” through the courts. In any case, from the moment the bankruptcy procedure begins, the debt that arose before filing an application to declare the debtor bankrupt is “frozen” for the entire period of the procedure (Article 202 of the Civil Code of the Russian Federation) until bankruptcy proceedings are completed or recovery occurs. Many creditors do not attach much importance to joining the register of creditors, “you won’t get anything anyway...”, but if you actively follow the bankruptcy proceedings of a particular debtor, there are chances to profitably assign your debt to those creditors who were first on the register.

Find out about the claims brought against your potential counterparty

How do collectors collect?

From the first days of their existence, collection agencies have established themselves as criminal structures that use crude methods of physical and psychological pressure.

Thanks to the new Federal Law-230, in force since January 2020, the work style has become more civilized.

Currently, only organizations that meet the requirements specified in Art. 13 FZ-230.

For example, an agency must have special software equipment, an authorized capital of at least 10 million rubles, and be included in the State Register of the FSSP. Citizens who have a criminal record cannot work as collectors.

According to Art. 7 Federal Law-230, agency employees should not disturb the debtor by calling a landline phone more than once a day, twice a week. Calls and SMS messages to a cell phone more than twice a day and four times a week are prohibited.

You can call debtors only from 08.00 am to 22.00 pm on weekdays, from 09.00 am to 20.00 pm on holidays and weekends.

The collector can personally meet with the defaulter only once a week.

The debtor has the right to refuse to communicate with the new creditor, or to interact with him through his representative (Article 8 of the Federal Law-230), however, only 4 months after the presentation of demands for payment.

According to Art. 6 FZ-230 agency employees do not have the right to:

- use physical force, threaten health and life;

- damage property;

- psychologically pressure, use rude, offensive expressions when communicating with the debtor;

- give false information about the amount of debt, liability for refusal to repay the debt;

- distribute confidential information about the debtor to third parties.

For violation of the law, collection agencies are punished with a fine (up to 500 thousand rubles), suspension of activities for 3 months, and exclusion from the State Register.

Debtors can file a complaint about the activities of debt collectors:

- In the FSPP. You can write and submit an application at the branch of the local regulatory authority, on the official website of the organization or by calling the helpline.

- NAPCA is an organization that unites large collection agencies. Today it includes 40 companies. You can leave a complaint on the official website of NAPKA.

- Roskomnadzor protects personal data. According to Art. 4 clause 5 of Federal Law-230, collectors have the right to disclose information about the debtor to other persons only with written consent. If agency employees ignore the requirement of the law, the debtor has the right to bring the collectors to administrative liability under Art. 13.11 Code of Administrative Offences. You can report a violation by leaving a complaint on the Roskomnadzor website or sending it by registered mail.

- Prosecutor's office. A complaint should be filed with the prosecutor's office when the collection agency is not listed in the FSSP register and operates illegally, or the collector threatens with physical violence, damage to property, or exerts psychological pressure.

It is advisable to attach evidence of illegal actions to the application:

- audio and video recording of conversations;

- call printouts;

- witness statements.

Despite the fines and the work of regulatory authorities, collectors have not yet had time to rebuild their activities in accordance with the new requirements. They still use the old methods: intimidation, false information, damage to property, spreading negative information about the debtor.

The effectiveness of countering such methods of collection will largely depend on the debtor himself. By collecting the evidence base and submitting the received materials to the appropriate authorities, you can achieve an end to the arbitrariness.

Don't rely only on bailiffs

Target

About 75% of the total number of claims for the collection of debts filed in court reach the stage of enforcement proceedings. It often happens that the court makes a decision to collect the debt, but the money never arrives from the defendant. Enforcement proceedings can drag on for up to three years after the court issues a writ of execution, but companies are strictly not recommended to behave passively in such a situation.

What to do

Obtain a writ of execution from the court. Send a copy of it to the tax authority to request a list of the debtor's bank accounts. Find information about the debtor's current current account - for example, on the websites of electronic trading platforms (if the debtor participates in trading) or on the website of the debtor himself. Send the writ of execution to the bank where this same account is located.

Revoke the writ of execution if the bank reports no transactions on the account or the debtor’s obligatory payments have been placed on file. And contact the bailiff service. At the same time, continue to analyze information about the debtor’s dependent companies: it is possible that you will be able to discover some assets in them. Inform the bailiffs about this - they are obliged to take into account all the information.

Order an electronic signature for remote submission of documents to the court Receive in an hour

How to protect a company from debtors

An effective way to avoid cooperation with a potential debtor is to check your credit history. This document will show how the company or individual entrepreneur handled borrowed money and how regularly they repaid debts. Credit history will show past and present delinquencies. Current arrears are the most obvious stopping factor. If the counterparty does not pay the bank, then it certainly will not pay you.

Get a credit report

The article was prepared based on the presentation of Alexander Vladimirovich Matveev, president of the NP “Society for the Protection of the Rights of Creditors and Claimants.” Website: www.enabling.ru

In what situations is a debt transferred to a collection agency?

Russian legislation allows banking organizations to file a lawsuit if any delay occurs (for example, one day). However, due to the costs of court lawyers and government fees, banks turn to court services in the following situations.

The client made late payments on a loan issued by a large state-owned bank. Typically, organizations that have the means to pay for lawyers and government fees go to court. For example, debts on loans from Sberbank, VTB, and MKB are collected through the court. Large banks are not interested in speedy debt collection, so they can wait several months for the outcome of the trial.

A client who is late will not be contacted. If, after applying for a loan, the borrower does not answer the bank’s calls, or changes his phone number or residential address, the lender is not inclined to conduct further negotiations. Many banks regard such clients as unreliable, the debt is recognized as problematic and transferred for forced collection. For small debts, the bank's lawyers receive a court order; for debts above 500 thousand rubles, legal proceedings begin.

The client who is in arrears has the means to repay the debt. In this case, judicial collection of overdue debt will help the bank receive the amount of the loan, interest, penalties and penalties on it. For example, when applying for a loan secured by real estate, a trial will help the bank seize the living space for further sale. If an unsecured loan is issued, the debt will be written off automatically from the citizen’s monthly income (up to 50%).

The client does not have valid reasons for late payments. If the client makes significant delays or avoids paying the debt without good reason, the bank turns to a collection agency to speed up the return of funds. For example, a borrower has taken out a car loan in the amount of two million rubles and has an official place of work with a monthly income of 70 thousand rubles. In this case, the bank benefits from both contacting a collection agency and filing a claim in court.

The main methods of collecting loan debt used by banks

All banks act according to instructions. The instruction involves a set of specific steps that are taken depending on the situation and the debtor’s reaction.

First of all, when a debt arises, the bank is obliged to notify and remind the debtor about it in the form of a letter.

If the debtor has responded to the notice, the bank can meet halfway and restructure the debt.

If not, the debt will continue to grow, while the bank will turn to a collection organization for help.

The collection organization will act using its own professional methods, and perhaps the result will not be long in coming.

If the debt has grown, and the borrower has not deigned to repay the money for more than 3 months, the bank will begin the process of debt collection.

Methods for collecting debt from Moscow banks:

- letter - claim;

- collectors;

- law firms;

- court;

- enforcement proceedings.

Legal status

Today there are many other firms providing collection services. Law firms, and even notaries.

Legal Firms, like collectors, help achieve debt repayment using legal regulators and methods.

A notary can help and become a witness to the debtor’s violation when completing a transaction. To do this, a notary's stamp is placed on the agreement, and the bank can start the enforcement process with this document.

Pre-trial claim

The claim is written in voluntary measures to resolve the issue or when the contract has a mandatory condition to send such a letter before going to court.

[Show slideshow]

The claim is sent by registered mail to the debtor, where he must sign that he has read it. A sample claim letter is available.

Next, a statement of claim is written, and the trial begins. After the hearing, the court makes a decision and a deadline for payment is given.

[Show slideshow]

How to notarize a claim

For the claim to have legal force, the notary must provide an agreement indicating that the client has a debt.

But this is not a prerequisite, because It will be enough for the court that you wrote a letter to the debtor, and after a month of waiting, he did not respond, and still did not pay.

Judicial proceedings

If the borrower, even after the measures taken against him, has not realized the seriousness of the process, the bank goes to file a statement of claim, and then with a court decision to the bailiffs, and on the basis of the statement they issue a request for the debtor’s solvency, availability of accounts, information from the tax service, ownership of property and etc.

Once the information is gathered, the foreclosure judgment is put into effect and the process of selling or seizing the property that will serve as payment of the debt begins.

Maximum term

Bank waiting periods are standard everywhere, this is 3 months for the debtor to try to pay off his accumulated debts. After this, the trial begins.

Banks cannot delay this for long due to the restriction that if the application has not been made within 2 years from the date of delay in obligations, the court can charge the bank with deliberately delaying the application in order to increase the debt.

The trial can drag on from 1 month to infinity, depending on the situation, counterclaims, availability of evidence, and other nuances.

Video: interview with a trainer. Methods for collecting debt from a bank

The process will be longer if the debtor files a counterclaim alleging illegal actions on the part of the bank.

General provisions

1.1. An accounts receivable specialist is hired and dismissed from work by order of [name of manager's position] and reports directly to him.

1.2. A person with a higher education: legal, economic or financial, without any work experience requirements, is appointed to the position of specialist in working with receivables.

1.3. A specialist in working with receivables in his activities is guided by the Constitution of the Russian Federation, federal laws, other regulatory legal acts of the Russian Federation, orders and instructions of his immediate superior.

Rights

An accounts receivable specialist has the right to:

4.1. For all social guarantees provided for by law.

4.2. Get acquainted with the draft decisions of the enterprise management concerning its activities.

4.3. Submit proposals for improvement of work related to the responsibilities provided for in these instructions for consideration by management.

4.4. Within your competence, inform your immediate supervisor about all shortcomings identified in the process of activity and make proposals for their elimination.

4.5. Receive from structural units and specialists information and documents necessary to perform his job duties.

4.6. Sign and endorse documents within your competence.

4.7. Involve specialists from all (individual) structural divisions of the enterprise in solving the tasks assigned to it (if this is provided for by the regulations on structural divisions, if not, with the permission of the head of the enterprise).

4.8. Require the management of the enterprise to provide assistance in the performance of their official duties and rights.

4.9. Improve your professional qualifications.

4.10. Other rights provided for by labor legislation.