When are collectors involved?

Banks and microfinance organizations often use the services of collection agencies. Their relationship can be regulated:

- agency agreement.

A complete document that allows you to engage a collection agency for pre-trial collection of overdue debts on a legal basis. In such relationships, collectors work exclusively for the bank; they have no rights to the debtor’s money; - agreement on the assignment of the right of claim.

This is a situation in which the bank sells the debt to a collection agency. Further debt collection is already carried out in favor of the collectors: the payment details are changed, the collection agency becomes the creditor instead of the bank, but the terms of lending and interest accrual remain the same.

In reality, banks only use easy methods:

- calls to the debtor demanding the return of money;

- written and electronic warnings about the accrual of penalties;

- calls to the debtor's relatives and friends in order to clarify the borrower's contacts or lack of payment.

Why is that? The fact is that banks value their reputation. If they begin to use more stringent methods, the rating may fall and problems will arise with regulatory structures. Therefore, credit institutions prefer to “raking in the heat with someone else’s hands” - attracting collectors under agency agreements.

Sales of loans are carried out in the most advanced situations, when:

- payment has not been received for more than 6 months;

- the debtor does not have property that can be sold when collecting the debt through bailiffs;

- the person has a badly damaged credit history.

On what basis does your collector work?

When debt collectors can come home: law and reality

Collectors use a variety of methods to recover overdue debts. In general, their activities are regulated by the provisions of No. 230-FZ and a number of other regulatory documents. The supervision of such organizations is carried out by the FSSP.

Register of collection agencies on the FSSP website

What does this look like legally? It turns out that the collection agency:

- must have a license;

- be listed in the FSSP register;

- carry out activities in accordance with standards No. 230-FZ.

How does this work in reality? In practice, there is an unspoken division of agencies:

- white collectors - work according to the law, have permission;

- black collectors - work without permission, outside the law.

The former are included in the state register and try not to violate the provisions of the law. You can fight violations by filing complaints with the FSSP. Even just calling the head office of the collection agency can help.

Black debt collectors are a sore subject for debtors. They are not in the register; employees of such organizations often have a criminal background, and they use appropriate methods, originally from the 90s. It is difficult to bring them to justice - law enforcement agencies prefer not to get involved until the victim himself submits an application to the prosecutor's office or the Ministry of Internal Affairs.

In general, debt collectors resort to the following illegal methods:

- Frequent calls to contact numbers of the debtor and his relatives. By law, employees can only call twice a week

, but in practice the calls can come in endlessly. - Constant SMS. By law, messages can be sent 4 times a week

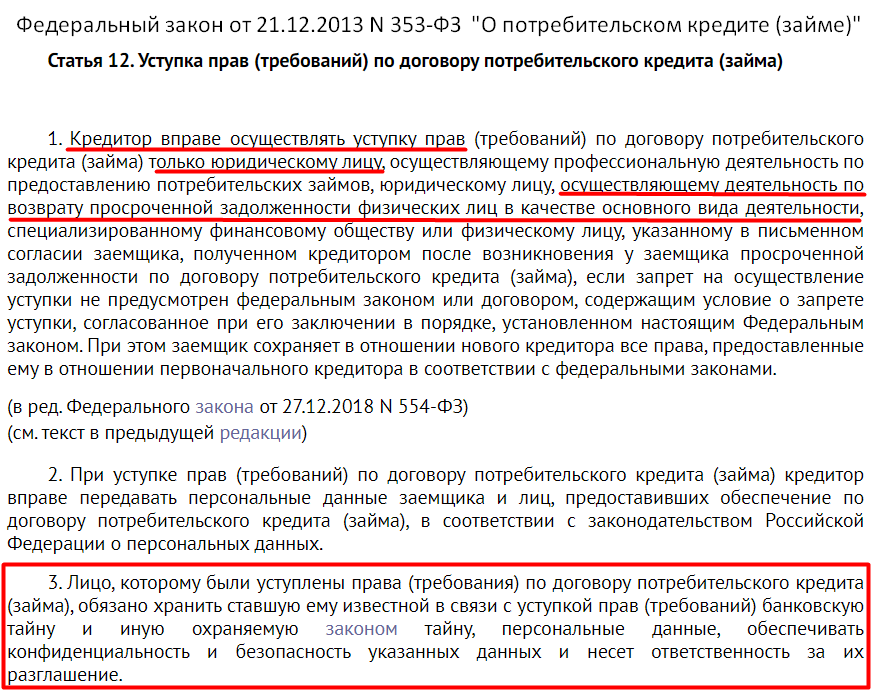

; in practice, collectors can only send several SMS at a time. They explain that it is impossible to fit the entire text into one message, but this is the basis for a complaint. - Disclosure of debt information to third parties. According to the provisions of Art. 12 No. 353-FZ, when assigning the right of claim, collectors receive personal data of debtors.

In accordance with Art. 26 No. 152-FZ, collectors and other creditors do not have the right to disclose this data. Often disclosure occurs in a “sneaky” way: by posting advertisements around the entrance and area of the debtor, supposedly from an anonymous person. If you manage to collect evidence, this can also be appealed.

- Visits to the victim. Collectors have the right to come to borrowers’ homes strictly once every 7 days

. According to No. 230-FZ, collectors have the right to visit the debtor during the day - until 10 pm on weekdays, until 9 pm on weekends. Visits at night are prohibited.

In reality, they can come more often, often at night, using all the elements of intimidation: aggression, pressure and blackmail.

Black collectors commit more severe illegal actions: they use physical force against family members and the debtor himself, they damage property - they break windows, break the front door, and so on.

We will help you get rid of debt collectors according to the law

Techniques for coercing debtors

Conversations with neighbors and pressure on the borrower's relatives become a violation of the law

Now let’s take a closer look at whether collectors have the right to come to the debtor’s home, since this measure frightens 85% of bank clients.

Let's start by studying the powers of the person who performs such work and the tools of influence on non-payers.

In such situations, the law allows for oral negotiations and persuasion.

https://www.youtube.com/watch?v=qKSj0cwFwb0

Accordingly, representatives of the creditor do not have the right to demand funds by intimidating clients.

However, collectors neglect legal powers. At the first stage of negotiations, such actions are rare.

However, if the debtor refuses to communicate, already at the second stage of “work” the pressure on the defaulter increases.

If pressure on the client does not have the expected effect, debt collectors do not neglect going to work with the defaulter. Formally, such visits fall within the legal framework.

Although in such circumstances it is appropriate to take into account the content of conversations between the creditor’s representatives and their interlocutors. An attempt to disclose confidential information here becomes a violation of the rules.

What to do if collectors are already on the doorstep, and how to deal with extortionists?

Important!

If collectors come with some documents and require your signature, do not believe them and do not sign anything right away. Read all agreements and documents carefully. It is quite possible that these are conditions that worsen your situation - an extension of the statute of limitations for debt collectors or the transfer of property as collateral.

You DO NOT need to give an answer instantly - ask to leave the documents for review or send them by email. If any points are in doubt, call the lawyers, we will help you figure it out for free.

How to prepare for a ransomware visit?

- No one has the right to claim a debt without a court decision. After the trial, only bailiffs are involved in enforcement. Debt collectors - Debt collectors cannot demand your bank cards, PINs or passwords, describe your property, or take it away. This is illegal and is regarded as violent acts and robbery under the Criminal Code of the Russian Federation.

- Collectors are required to have documents that give them the right to claim. This may be an agency agreement or an assignment agreement (assignment of rights). You can request them for review purposes.

- Extortionists are required to introduce themselves: give their full name, position, organization, its legal address and details (TIN, OGRN). Moreover, you have the right to check whether the organization is included in the FSSP register (this can be done on the official portal of the body).

- If debt collectors come home at night, just don't open the door. If they make noise, call the police. They cannot visit you on weekends or outside of business hours.

- Warn visitors about recording and shooting video if they come to your home. Turn on your phone and record the entire conversation; it is advisable, of course, not to be alone - call your neighbors. This will allow you to avoid unauthorized demands and threats (if the organization is included in the FSSP register).

The debtor may also:

- Refuse to communicate with debt collectors.

This right is provided for by law. It is provided to borrowers who are overdue for more than 4 months. What do we have to do:- draw up a statement of refusal to communicate with creditors;

send the document by registered mail to the legal address;

- wait for delivery and notification from the mail.

- Check deadlines.

In our country, the statute of limitations is 3 years. If you have not made any payments on the loan during this period, there is a chance to cancel your debt obligations altogether. How to calculate the statute of limitations when selling a debt to collectors, we described here.

(19 kb)

Further attempts by the collection agency to contact you will be illegal.

Do debt collectors have the right to visit relatives?

According to the law, collectors have such a right if relatives do not express disagreement. Debt collectors cannot threaten relatives or demand the return of money for the debtor; this is prohibited. They also cannot disclose debt information to third parties.

With such contacts, collectors can only:

- clarify the contact details and address of the debtor;

- clarify the debtor’s place of work;

- find out if the debtor has financial problems.

But relatives, neighbors, colleagues, friends are not obliged to answer them.

And of course, no one is obliged to pay for someone else’s loan or microloan - not parents for adult children, not spouses for each other, and especially brothers, sisters and friends.

If they demand money from you for the debt of your son or, for example, your ex-wife, send the collectors to court. If it doesn’t help, feel free to file a police report, this is extortion.

Are you worried about other people's loans?

About the time of visit

Federal Law No. 230 states that the debtor is likely to be worried only in the period from eight in the morning to ten in the evening on weekdays. If collectors come on a holiday or weekend, the permissible period is reduced from 9 to 20 hours.

Lawyers say that this regulation is not violated, because night visits by debt collectors were rarely practiced even before the adoption of the law in question.

If such a situation arises, it is appropriate for the client to record these actions on the part of the representative of the collection office. Here it is appropriate to warn your opponent about a direct violation. Ignoring such a request becomes a reason to call law enforcement officers and write a statement to the police.

What not to do when contacting debt collectors

There is a list of actions that are best avoided in such situations:

- Making false promises.

If you don’t have money, you don’t need to promise that you will repay the loan within a certain time frame. Collectors will cling to these words and will press even harder. - Believe promises.

Often, agency employees promise debtors that if they make some part of the payment, the debt will be written off and closed completely. Trusting people take collectors at their word and deposit money, but after a few days they are faced with severe pressure.

Collectors begin to demand money with triple their efforts, realizing that the debtor has resources. If you have been made such an offer, demand official documents and the conclusion of an additional agreement.

- Avoid threats.

If you are treated with obscene language, rudeness, rudeness, threats and blackmail, you should not respond in kind. It is better to take advantage of the situation and record all threats on a voice recorder. This will greatly help the FSSP and the prosecutor’s office when considering a complaint against a collector. - Press for pity.

Collectors are constantly engaged in the collection of overdue debts. They are used to tears and pleas. Such tactics will lead nowhere; it is better to choose a business attitude with a certain degree of rigidity.

Is bankruptcy right for you?

What to do if the collectors have crossed the line?

Reviews and questions on our forum confirm that when an MFO sold a debt to collectors, the situation is worse than if it was a loan from a large bank. Still, Sberbank, VTB, Tinkoff check their connections and do not cooperate with criminal collectors.

But microloans and quick loans on the Internet give rise to more problems. Unfortunately, serious violations and crimes occur. What to do?

To begin with, recommendations from those who have suffered from debt collectors:

- If you have property outside your home (such as a car), take steps to protect it. In particular, it is better to leave the car for some time in a paid guarded parking lot or at least in a place where video surveillance is carried out.

- Stock up on a good recording device - voice recorders, video on your phone, and so on. When talking, turn them on immediately.

- Place cameras in the entrance or around a private house, or an alarm button. This will be additional insurance to protect the debtor's home.

- Take your family out into the safe hands of your relatives for a while. This is important, especially if you have small children. Take care of yourself too - don’t walk alone at a late time, choose crowded routes. Make appointments in places where video surveillance is carried out - for example, at the MFC, at the tax office, near work. Don't go home with debt collectors.

- Warn your superiors and colleagues about possible pressure and pressure, explain in general terms the current situation. Let the visits of collectors and their stories not become a surprise or a reason for disappointment for them.

Now legal advice:

- Any violations should be documented through recordings (audio or video).

- If you are threatened, don’t wait, write a complaint to the FSSP, call the police.

You can complain to the following authorities:

- judicial authorities. We are talking about filing a civil lawsuit against the collection agency if your property was damaged or broken;

- FSSP - for any reason, from private calls to real threats;

- law enforcement agencies - if they threaten life, health, property;

- to the prosecutor's office - additionally, if complaints to the bailiffs and the police do not help;

- NAPCA is the Association of Professional Collection Agencies, which monitors their activities; they should report all violations in addition to complaints to government agencies.

For example, if collectors came home, taped up or broke the door lock, or wrote something on the wall in the entrance, the mechanism is as follows:

- Do not open the door, film everything. If they break in, call 112 to register a police call.

- Record the damage - photograph the walls and door, draw up a damage inspection report in front of witnesses.

- If the door was repaired by an official organization, or you had to buy a new lock, keep the receipts. The amount of damage can be recovered.

- Complaint to the FSSP + statement to the police about threats. The form will be given at the department, take with you documents about the debt, notices of assignment, demands from collectors, download the records onto a separate medium for attaching to the case, but do not delete them on your phone.

- Contact a lawyer to file a lawsuit to recover material (cost of repair/replacement) of the door and moral damages.

Need help dealing with debt collectors? Seek legal protection! We will protect your interests, negotiate with creditors, and, if necessary, help you go to court and other departments with a guarantee of results.

To get a consultation

Ask any question about bankruptcy and receive a detailed answer. It's free.

How to protect yourself from debt collector threats

In accordance with paragraph 2 of Art. 6 Federal Law No. 230, threats of the use of physical force, threats of murder or damage are unacceptable when carrying out collection activities. When using them, the person in contact should:

- point out to him the inadmissibility and illegality of such behavior;

- detect threats by any available means;

- contact law enforcement agencies to obtain protection and bring the collector to justice under Art. 119 CC;

- contact the FSSP with a complaint against the collection company for the specified reasons.