Lending is a very popular banking service that allows you to purchase goods using borrowed funds. But a debtor who is unable to repay the debt to the bank faces a big problem - collectors and bailiffs. Collectors only put psychological pressure on the debtor, but bailiffs can seize accounts. What to do with official wages in this case? This material will tell you how to save your salary and protect your salary card from bailiffs.

What is “account seizure”? When is it used?

Seizure means restriction of debit transactions on the account. The entities authorized to seize are: tax, bailiff service, customs service, court, and other government bodies.

The Tax Service may seize an account in the following cases:

- If an organization has not submitted the required declaration within the prescribed period of time, the law establishes that if there is no information on the declaration within 10 days after the deadline for its submission, the tax office has every right to seize the account.

- In case the organization has not complied with the tax authorities’ requirement to pay the required amount (for example, taxes, fines, etc.). The account is blocked within the limits of unpaid amounts.

- If, as part of a tax audit, serious violations were found that fall under tax or criminal liability.

- The bailiff service may block the account, for example, for security purposes or to ensure the execution of a claim.

When can a bank card be seized?

If there is a debt itself, the bank card will not be automatically seized; a certain procedure must be followed. First, a court decision must be made to recover funds or a court order. Then, on the basis of a writ of execution or a court order, enforcement proceedings are initiated. After the initiation of enforcement proceedings, the bailiff is obliged to send a resolution to the debtor and provide 5 days for voluntary fulfillment of the obligation. And only after this period has expired, the bailiff makes inquiries to the banks and, after receiving information about the accounts, seizes them.

The bailiff has the right to seize all accounts that become known to him. The law does not limit the amount of debt. It can be 1000 rubles, or even 100. As the Supreme Court of the Russian Federation confirmed, even credit cards can be seized, and this will be completely legal.

Therefore, actions should be taken to prevent such developments.

How can I save my account?

The account freeze can be lifted quite easily. To do this you need:

- Eliminate existing problems (contradictions) with the authority that imposed the arrest. Thus, based on all of the above, if, for example, accounts were seized due to non-payment of taxes, then in this case it is necessary (to unblock the account) to pay the established amount of taxes. If the arrest was imposed in connection with a court decision, then in this case it is necessary to comply with the requirements of the court.

- If the existing problems are resolved, then you can count on the seizure being lifted from the account.

How to protect income from foreclosure?

Cases of foreclosure on wages are provided for in Article 98 of the Law “On Enforcement Proceedings”. First of all, the recovery is applied to money (this can be wages that are transferred to a card or current account).

In the event that the issue has already been resolved by deducting funds in favor of repayment from the salary, then other methods of collection tried by the bailiffs were unsuccessful. Also, the person did not have the appropriate property with which to solve the problem.

The accounting department at the place of work does not have the right to refuse bailiffs and is obliged immediately after receiving the necessary documents to begin withholding funds from the debtor’s salary. The seized funds are transferred to a special account of the bailiffs department within three days. From this department, employees will distribute money between collectors and redirect them to the appropriate accounts.

How much of your salary will be withheld?

No more than 50% of wages and any other income can be withheld (regardless of the number of enforcement proceedings). The amount is determined from wages “net”, that is, after deducting all taxes.

In some cases, up to 70% of the salary may be withheld. This applies to debtors of child support for minor children. This also applies to those citizens who must compensate for harm caused to health or damage as a result of a crime.

How to lift an arrest imposed by bailiffs

The bank will remove the seizure from the card only after a paper is provided to cancel the decision from the bailiffs or from the court.

If the banking organization delays the cancellation period, the citizen can write an appeal to the following authorities:

- to the Prosecutor's Office at the place of registration;

- to the territorial department of bailiffs;

- apply to the court.

The complaint can be brought in person to the office or sent by registered mail. In accordance with the rules for considering citizens' appeals, a response to a complaint must be received no later than 30 days from the date of registration of the appeal.

After this, the citizen will be given a response in writing. The process of annulment of arrest is a lengthy procedure.

Therefore, the best option is to prevent your bank card from being blocked. For this purpose, provide the bailiffs with the address of your official place of work.

Then the court decision will be sent directly to the employer and the required payment amount will be charged every month until the salary is transferred to the card.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Seizure of wages by bailiffs

You can submit an Application for refusal to write off money without acceptance (2 copies) to the bank, the main thing is that your copy is stamped with a seal, input.

We recommend reading: How many vouchers have Artek allocated to the Rostov Region for the 7th Shift

Good time. You should look on the court websites for the judicial act that collected the debt. Apparently a court order was issued. Having established the initial data, you should file an objection regarding the execution of the court order. It will be canceled by the court, get a court ruling on cancellation, visit the bank and withdraw the order from execution.

Help for bailiffs about salary cards

It is legally determined that the retention of debts on loans, fines, alimony, utilities, etc. cannot be made in an amount of more than 50%, and in exceptional cases - more than 70% of the debtor’s salary. Therefore, in order to exclude the possibility of complete debiting of amounts from a bank card, it is necessary to confirm that it is a salary card.

If the bailiff is on site, the client gives him a written application to remove the seizure from the card account and the entire package of collected documents. The application is written in any form with a request not to deprive the cardholder of his livelihood, since salary is the only source of income.

About detention during arrest

Have you heard above about the maximum deduction of the amount only up to 50% of your income? So this does not apply to the amount available in your accounts. They can just “finance out” her in full until the debt is repaid. Based on this policy, I have long come to the conclusion that a card is a convenient means of payment, but it is not worth storing savings on it or in accounts. Due to someone's mistake, everything can end badly.

But not the entire amount will be written off. Just from the last regular “salary” payment they will not be able to take more than 50%.

And there are exceptions. In some cases the percentage increases to 70%:

- Debt of alimony.

- Refund for damage to human health.

- For the death of the family breadwinner.

- Return of funds identified during the crime.

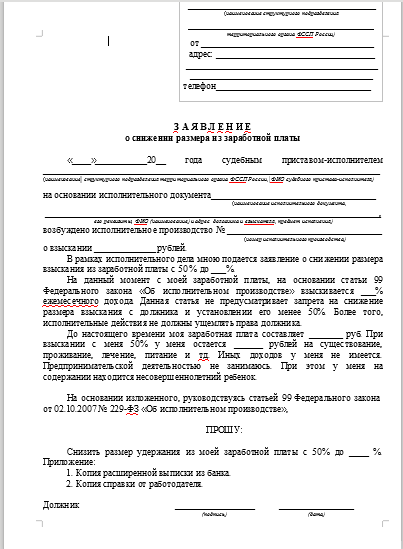

Decrease in retention percentage

Like a retreat. If you have minor children, you can reduce it to 30%. If only one of the parents is involved in upbringing – 25%. Isn't it nice? Here is a sample application for such a case.

Application for interest reduction

Wage garnishment - is it legal?

In accordance with Part 2. Art. 99 of the Law, when executing an executive document (several executive documents), no more than fifty percent of wages and other income may be withheld from a debtor-citizen. Withholdings are made until the requirements contained in the executive document are fulfilled in full.

We recommend reading: What you need to register a low-income family in 2020

The amount of deductions from wages cannot exceed 50%. Your husband should be returned the illegally collected amount after he writes a statement and provides a document confirming that his salary is transferred to this account. Please keep in mind that if there were any savings on the account, they will be recovered in full, with the exception of the last salary. If there are difficulties, please contact me, I will help, this is my specialty.

In what cases is a salary card seized?

A salary card is seized for the following reasons:

- if a person has a large rent arrears;

- there are unpaid bills for fines and taxes;

- alimony debts have accumulated;

- large loan debt. Accounts are frozen if the debtor has not paid the loan for several months.

Card blocking is not always related to debt. The bank may suspend its operation if attempts to use it by criminals are detected.

How to change the amount of withholding from income?

Experts offer three methods to resolve the issue that are legal and will not provoke new problems. Read more about how to keep your money safe below.

Another debt recovery option

According to the law on enforcement proceedings (2nd part of Article 69), the debtor has the right to offer to the bailiff the property that needs to be foreclosed on first. For example, the debtor has property that he can easily part with to pay off the existing debt.

To make the idea a reality, you will need to write a petition addressed to the bailiff. It must indicate that it is necessary to cancel the foreclosure on wages, and the foreclosure must be directed at other property.