Hello, in this article we will try to answer the question “How to avoid payment under a writ of execution.” You can also consult with lawyers online for free directly on the website.

Submit the registered Resolution to the accountant responsible for payroll for signature.

Finding themselves in a difficult financial situation, many citizens are faced with the fact that their debts are forcibly collected from them by deduction from their salaries. And in principle, this is a normal measure, subject to a reasonable calculation of the share that is left for debt repayment. 50% of your salary is written off from you, and you independently provide for a minor child or provide for your parents, while paying off a second loan. Or you are the father of a family who has to support his wife on maternity leave, children, pay a mortgage and loan, and 50% of your salary is also withheld. Such cases are not uncommon and it is possible to achieve a reduction in payments.

Is it possible to negotiate an installment plan with the bailiffs?

What if you deliberately do not receive all the writs of execution that are sent, ignore calls from the bailiffs, do not open the door to the official when he visits your home and do not go to the bailiff when he invites you to his place? The law has long been abolished that debt payments cannot be forcibly withdrawn from a person who has not personally verified his or her knowledge with a signature.

The following factors may be significant reasons for reducing payments: after deducting 50%, you are left with less than the subsistence level for you and your dependent family members, loss of a job or lack thereof, the presence of dependent minor children, as well as your state of health or the illness of loved ones , due to which you are forced to pay for treatment.

And if the debtor is located in another region, then there is no hope at all, not only for execution, but even simply for receiving information about the work of the bailiff. Enforcement proceedings thus drag on for years, writs of execution are lost, and the debtor manages to hide all his liquid property from collection.

Money cannot be withheld from:

- benefits for the birth and death of a child;

- payments upon registration of marriage;

- survivor benefits;

- child support;

- payments to Chernobyl victims and victims of other disasters;

- monthly social payments.

As a result, the debtor lost the opportunity to fulfill his obligations to the bank, which threatened, among other things, the loss of expensive real estate. The participation of our lawyers made it possible to create legal conditions under which the seizure of some of the debtor’s property became controversial. Subsequently, the seizure of the loan account was challenged administratively, and the seizure was lifted.

After analyzing this and several similar cases (both negative and positive), I was able to draw several conclusions.

Sometimes this helps, but in most cases the situation develops according to a well-worn rut: bailiffs do not respond to requests, do not carry out enforcement actions, and often do not even send copies of decisions to initiate enforcement proceedings.

Attention! Need protection from bailiffs? in the form, go to the lawyer help page for free, go, free today!

Will it be possible to reach an agreement with the bailiff to fulfill the requirements of the writ of execution in a smaller amount?

Definition: a writ of execution (IL) is an official document of the court, drawn up on the basis of its decision.

So, the legal battles are over, the enemy is defeated, but for some reason the taste of victory is not as sweet as we would like. Why? The court decision has entered into legal force, it seems that you only need to send a writ of execution to the bailiffs and voila, the money is already in your account.

The conditions specified in such a document are binding on all legal entities and individuals. Evasion leads to prosecution under the law.

So, the legal battles are over, the enemy is defeated, but for some reason the taste of victory is not as sweet as we would like. Why? The court decision has entered into legal force, it seems that you only need to send a writ of execution to the bailiffs and voila, the money is already in your account.

Property that does not actually belong to the debtor may be seized, but it is not possible to prove the ownership of other persons to it. This is, for example, a laptop, TV, furniture, and other undocumented items located in the room of a debtor living in an apartment together with other persons.

Is it possible not to allow bailiffs into the house while performing their official duties?

Can. In three cases. Don't let the bailiff into the house -

- If a visit to your home threatens the life and health of the bailiff. There is no need to hang an ax over the door.

- If you have a court decision to postpone enforcement proceedings.

- If you independently fulfill the requirements of enforcement proceedings.

Where can you appeal the actions of a bailiff?

- to court,

- to senior management,

- to the prosecutor's office.

All these actions can be performed simultaneously, without waiting for a response from one of the authorities.

Rate this article

Did you find this article helpful? Share your opinion with others

If a court decision to collect a debt from you has entered into force, and the documents have been transferred to the enforcement service, sooner or later you will have to meet with bailiffs.

Of course, the situation is unpleasant, but if you act correctly, you can get out of it with minimal losses. In this article, we will look at how a debtor can properly communicate with bailiffs, what needs to be done first, and how to challenge their actions if they seem to you to be unlawful.

What happens if there is nothing to pay under the writ of execution?

This right is provided for in Art. 434 Code of Civil Procedure of the Russian Federation. Moreover, it is better to do this immediately after receiving the decision to initiate enforcement proceedings, before the five-day period for voluntary execution has expired.

Quite often, the rights of the debtor are violated when assessing seized property to be sold.

There are several legal ways to write off debt from bailiffs. But remember that each of these methods is much more troublesome than paying your debts honestly.

Debt write-off occurs in the following cases:

- Bankruptcy.

- Death of a citizen.

- Lapse of time.

- Bank liquidation.

Based on the fact that the legislation of the Russian Federation describes in great detail the procedure for the seizure of debt obligations, any failure to comply with established standards on the part of the creditor, the court or the bailiff may serve as a reason for deferring payments.

This is important to know: Compensation for a garage during demolition in St. Petersburg

How to avoid paying debts to bailiffs and is it possible to pay in installments?

The method works especially well if the claimant is an individual (that is, an ordinary person), but you can also try to negotiate with an organization. In order to avoid being harassed by the bailiffs, the claimant must withdraw his Application, because, in the end, you, as civilized people, can come to an agreement peacefully. The main thing here is to find a common solution that suits both parties. Our experts monitor all changes in legislation to provide you with reliable information.

There are many different ways to avoid paying your debts, because if all people were conscientious and responsible, such factors as bailiffs and writs of execution simply would not exist. We have selected for you the 5 most effective ways to help you avoid paying under a writ of execution, and have arranged them in descending order according to the degree of legality and feasibility.

In 2000, he graduated from the Faculty of Law of the National Research University Higher School of Economics. She has been working in the legal field for 16 years, specializing in resolving housing disputes, property transactions, family matters, inheritance, land disputes, and criminal cases.

How exactly to communicate with a bailiff?

What reasons could there be to try to return property from seizure?

- Items are not your property;

- You were able to find documents confirming that the seized items belong to the category of “production tools” or “household items”;

- In accordance with the established procedure, the decision on collection was canceled;

- The trades took place illegally, after the court suspended the enforcement proceedings.

For example, with a car loan, as a rule, the car is pledged to the bank and if the debtor does not pay the loan, then the car can be seized, sold and the debt on the car loan will be repaid using the proceeds, even if the debtor has other debts.

It should be said that the parties to the proceedings must know their rights, which are provided for by the current law.

It is advisable to tune in to a polite dialogue and search for a mutual solution to your problem. After all, you had plenty of time to prepare for the meeting, from the moment of the trial until the arrival of the bailiff; our practical advice will help you resolve a complex issue, and even if the bailiffs suddenly came to your apartment or house.

Is it possible to pay a debt to bailiffs in installments?

Today there are no problems that cannot be solved together with a lawyer. The main thing is to describe the current situation in detail and point out important details.

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

Recently, in a number of regions, as part of a pilot project, a system of taxation for self-employed and…

Even before receiving the first writ of execution, the company should:

- appoint an employee responsible for receiving, processing and storing executive documents;

- develop and approve forms for registers of incoming correspondence and writs of execution;

- approve the procedure for document flow of writs of execution and document forms.

How to pay bailiffs so as not to seize property

The decision on how much and according to what schedule a person with physical disabilities should repay the debt is made by the court.

To get out of this situation, you must obtain a court order (either from the court or from the bailiff service) and send objections to the court regarding its execution. Along with your objections, you must indicate that the court order was not sent to you, and if it was sent, you did not receive it. In this case, the court will most likely restore the missed deadline and cancel the order.

Don't accumulate debts. Pay utility bills at least partially. Do not wait until the amount becomes large, because it is more convenient to pay in equal small payments. Even if a settlement agreement is concluded with the claimant at the stage of enforcement proceedings, it must be approved in court in order for the bailiffs to take it into account.

The writ of execution can be received by the organization both from the claimant himself, in whose favor the deductions should be made, and from the bailiff.

Let us note that if the writ of execution was received by the organization by mistake (for example, the person indicated in it was never listed on its staff), then, in the author’s opinion, the document must be returned to the sender as soon as possible.

Today, the state of affairs is such that most often during enforcement proceedings, bailiffs unreasonably violate the rights of debtors.

And can an honest and decent person be satisfied with a fraudulent method aimed at avoiding paying debts?

Therefore, to successfully resolve the issue, it is better to use the right granted by the legislator. Namely, Article 203 of the Code of Civil Procedure of the Russian Federation provides that participants in the process can receive an installment plan to fulfill the requirements of a court decision and pay the debt in installments.

The bailiff’s job is to take measures to ensure that the court decision is executed in full within the established time frame. If the debtor voluntarily does not comply with the court's demands, the bailiffs are forced to take enforcement measures. Moreover, such participation of bailiffs imposes additional responsibilities on the debtor - he must pay into the budget for the work of the bailiffs (against himself). Attention: the court is obliged to take into account the difficulties faced by a disabled citizen.

Expert: How to avoid payment under a writ of execution

According to the law, the writ of execution will be sent to the official place of employment of the debtor and in accordance with Art. 138 of the Labor Code of the Russian Federation, 50% can be withheld from the latter’s wages. But if he does not have an official place of work, the bailiff can seize the property or other income of the debtor (for example, a bank account, a car). It is also possible to make an inventory of his belongings (household appliances, expensive furniture, etc.) at his place of residence or registration, if they really belong to him.

Today, public opinion is such that the debtor is deprived of any rights, he is categorically obliged to fulfill what was awarded to him by the court and unquestioningly obey the demands of the bailiff: to pay the debt; return his property to the owner; vacate the occupied premises, etc. Based on the court decision to collect the debt, a writ of execution is issued, payments under which can be made in parts or in a lump sum to the plaintiff’s account. Forced debt collection is carried out through the bailiff service (Federal Law No. 229-F3).

How to file an application for deferment of execution of a decision

In principle, any of the parties to the enforcement proceedings and the bailiff himself have the right to apply for a deferment. When preparing an application, it is necessary to justify why the court should apply such a measure. First of all, the financial situation of the debtor will be recognized as a valid factor. One that currently does not allow the decision to be executed. But in the future (indicate a specific period of time and event in the text) it is expected to change. And the court's decision will be implemented.

The court has the right to recognize any other circumstances as valid for granting a deferment: serious illness when making a decision on eviction, dismissal, etc. However, the applicant must document all these circumstances. If this is a difficult financial situation, then in addition to the 2-NDFL certificate or certificate of registration as unemployed, you will need to provide information about the presence (absence) of ownership of housing, vehicles, etc.

Protection of the debtor's rights. Reasons not to pay according to the writ of execution.

Let's imagine the following situation. You took out a loan from one of the banks. At the time of granting the loan, your property situation was normal and the amount of monthly payments completely satisfied you. But we live in a society, and anything can happen at any moment: you can lose your job, you can get sick, your income can decrease, and so on. Representatives of banking organizations or even debt collectors will start calling you and demanding to repay your overdue debt, or will even seek a personal meeting with you. If you find yourself in a similar situation, and it has led to the inability to pay the loan, then there is no need to despair. Indeed, if you stop paying your loan, the bank will most likely go to court to collect the debt under the loan agreement. Based on the fact that the legislation of the Russian Federation describes in great detail the procedure for the seizure of debt obligations, any failure to comply with established standards on the part of the creditor, the court or the bailiff may serve as a reason for deferring payments. If the debtor does not remain inactive, and responds to every court decision, action of the bailiff and careless word of the claimant with many complaints, appeals and counterclaims, then the likelihood of getting a chance not to pay debts for some time is high.

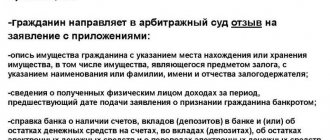

In this case, the documents are submitted to the bailiff service, where the bailiff initiates proceedings in the case, and the issued decision is sent to the debtor and to the credit institution. As soon as the court has made a decision to collect the debt under the writ of execution from the debtor, it comes into force. The claimant must immediately write an application to the court of first instance in order for a writ of execution to be issued. Article 319, paragraph 3 of the Arbitration Procedure Code of the Russian Federation states that the issuance of a writ of execution is carried out only on the fifth day after the court receives the relevant application.

Where to apply

A claim for deferment of collection of the enforcement fee is filed with the court that issued the writ of execution in the case. It could be:

- A court of general jurisdiction or a magistrate in a dispute involving individuals;

- Arbitration court for a commercial dispute between legal entities or individual entrepreneurs.

Expert opinion

Lawyer Alexander Vasiliev comments

A statement of claim for deferment or installment payment of the enforcement fee is not subject to state duty. This was indicated by the Plenum of the Supreme Court of the Russian Federation in Resolution No. 50 of November 17, 2011 (clause 59).

How to avoid paying debts to bailiffs and is it possible to pay in installments?

Conversation with an investigator by Kornev and partners 1 year ago 12 minutes 1,757,710 views">>,"simpleText":"How to behave during interrogation?

The first thing a person who is interested in the question “How not to pay debts?” needs to know. is that no one can avoid paying debts forever. You can only postpone the process of paying off debt, postponing it until better times, when you are in a more favorable financial position.

This is important to know: For those over 70 years old: payment of 3000 rubles

The main task of a lawyer in enforcement proceedings is to minimize the negative consequences associated with the application of compulsory measures against the debtor under a writ of execution. The procedure for forced collection from the debtor of monetary obligations occurs only at the moment when the court has satisfied the claims of the credit organization to collect the debt under the loan agreement.

Of course, effective protection of the debtor’s rights is possible only by professionals who have extensive experience interacting with bailiffs and who know how the laws and mechanisms of the debt collection system actually work. How not to pay a debt if enforcement proceedings have already been started, and whether it is possible to pay in installments, will be discussed in more detail in the following chapters.

In accordance with Article 8 of the Federal Law on Enforcement Proceedings, these actions are legal. A writ of execution to collect money from a debtor or to seize it can be sent directly by the collector to a bank or other credit organization. Together with a lawyer, you will be able to individually analyze your situation, compare it with the current legislative framework and, perhaps, find any loopholes that will help you delay debt payments.

Tip 1: How to pay court judgments

How not to pay a loan in 2020 by Taras Lawyer Lawyer Odessa 1 year ago 4 minutes, 39 seconds 460,392 views">>,"simpleText":"7 tips from a lawyer if you have nothing to pay the loan with. If you are ordered to pay a debt, you can do so by paying the entire amount in one payment to the plaintiff's account. This type of execution of a court decision must be carried out by bank or postal transfer, so that there is confirmation of the transfers in the form of a receipt. If you transfer the debt to the plaintiff from hand to hand, obtain a written receipt indicating the full amount and the date of repayment of the debt.

After the court makes a decision to collect the debt from you, you will be given a period to appeal the decision - one month from the date of the decision. You can exercise this right and try to appeal the court's decision. To do this, you need to prepare an appeal, indicate in it exactly what you disagree with, attach all the necessary documents and send it to the court that made the decision. The appellate court may cancel, change or refuse to satisfy the appeal. After the court decision comes into force, the plaintiff will be issued a writ of execution to collect the debt from you. The writ of execution is presented to the bailiff service, and from that moment you officially become a debtor.

The plaintiff has the right to contact the bailiff service if funds have not been received into his account within two months after the court ruling. The plaintiff also has the right to personally contact your company’s accounting department and submit an application for debt collection by submitting the original and a photocopy of the writ of execution. If you have a bank account, based on the plaintiff’s application and the presented writ of execution, the account may be seized to pay off the amount of debt under a court order. According to paragraph 12 of Art. 30 Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ), after the debtor receives a resolution to initiate enforcement proceedings, issued on the basis of a court decision or court order, a bailiff, a five-day period is established when the debtor can voluntarily fulfill his obligation. This resolution can be appealed by the debtor in court, and a petition can also be filed to suspend enforcement proceedings in the cases specified in Article of Law No. 229-FZ.

The reasons for this reluctance to work and collect funds under a writ of execution from the debtor lie not only in the low salaries of employees of the enforcement service, but also in the enormous burden placed on them, responsibility and constant pressure from superiors, collectors and even debtors. Therefore, the strongest employees remain in the service of this body, mainly in leadership positions. And among ordinary employees there is a very high turnover. And, accordingly, not all bailiffs have the experience to quickly and skillfully force the debtor to comply with a court decision on a writ of execution.

Today, the state of affairs is such that most often during enforcement proceedings, bailiffs unreasonably violate the rights of debtors.

If you do not have a permanent job or your income is irregular, you can make monthly transfers by postal or bank transfer to the plaintiff’s account. The minimum amount of transfers must be indicated in the writ of execution. This may be a flat amount or a percentage of the minimum wage in force in the country at the time the claim is paid. How to reduce the amount of deductions under a writ of execution? Probably this question was asked by every debtor who found himself in a difficult situation with the bank and could not pay the loan.

How to collect a debt from a debtor if enforcement proceedings are terminated?

There are several options for how a writ of execution can be presented for collection. According to the Federal Law “On Enforcement Proceedings”, you have the right to submit a writ of execution to the territorial branch of the Bailiff Service.

This can be a branch located both at the place of residence (registration) of the debtor, and at the place of his stay (actual location), as well as at the location of his property. In addition, you can bypass the appeal to the bailiffs and submit a writ of execution to the bank where the debtor’s current account is opened.

To find out which bank the debtor uses, contact any tax authority with an application to provide information about the debtor’s accounts - and you will be able to receive this information after 7 days. And if your debtor is a citizen from the public sector, then you can start with Sberbank: given the share of the banking market that it occupies, the chances of writing off the debtor’s money “at random” are quite high. The bank that has received the writ of execution from the claimant is obliged to independently establish accounts and write off funds from all existing accounts within the amount specified in the writ of execution.

Finally, the writ of execution can be presented to the organization that pays the debtor-citizen periodic payments (salary, pension, scholarship). This could be the debtor’s employer company, a pension fund, an educational institution, etc. The legislation allows this method of collection if the amount of the debt does not exceed 25,000 rubles or if the writ of execution compensates for harm to health, alimony or other periodic payments are collected. How to properly fill out an application to the bailiff service? If it is impossible to collect the debt with the help of banks, employers and other organizations, you should contact the Bailiff Service. Enforcement proceedings are initiated by a bailiff based on an application from the claimant or his representative.

The application to initiate enforcement proceedings is accompanied by the original writ of execution and the representative’s power of attorney (if he signs the application himself). Before submitting the writ of execution, it is important to check whether the three-year period for presenting the writ of execution has expired, whether all the necessary information is indicated in the writ of execution (for the list of requirements, see Article 13 of the Federal Law “On Enforcement Proceedings”) and whether there are any errors in the writ of execution. Otherwise, the bailiff is obliged to refuse to initiate enforcement proceedings. True, it is worth noting that, for example, in recent years, judicial practice has been critical of refusals to initiate enforcement proceedings due to the lack of information about the debtor’s place of birth in the writ of execution, pointing out the insignificance of this identifying information (see Resolution of the Arbitration Court of the Ural District dated October 7, 2020 in case No. A 60-19042/2015). Particular attention should be paid to the power of attorney, that is, the powers of the representative. The text of the power of attorney must indicate the right of the authorized person to present and revoke the executive document. Otherwise, the bailiff will issue a decision to refuse to initiate enforcement proceedings and return the writ of execution.

It is also worth knowing about other powers of the representative, which are specifically stipulated in the power of attorney. Such powers are: transfer of authority to another person (subassignment), appeal against decisions and actions (inaction) of the bailiff, receipt of awarded property, refusal to recover under a writ of execution, conclusion of a settlement agreement. Thus, when preparing a power of attorney, you need to check whether the scope of powers specified in the power of attorney corresponds to those powers that are actually necessary when representing the interests of the claimant. It is important to carefully work on the content of the application. The application must indicate requests for seizure of property that you know about: information about bank accounts, real estate (you can make requests in advance and attach an extract from the Unified State Register to the application), vehicles (you may have taken a copy of the vehicle registration certificate), information about the place of work (indicate the employer's details, address, telephone number), information from the Unified State Register of Legal Entities about the rights to the debtor's shares in organizations, information about the spouse of the debtor-citizen (the spouse's property may be arrested, and the creditor may demand the allocation of the debtor's share through the court). Sometimes, due to a lack of information in the application, the bailiff carries out enforcement proceedings for several months, when this could have been done much faster. When submitting documents to the office of the bailiff department, we recommend that you immediately inquire which bailiff will receive the writ of execution, find out his office number and contact telephone number. The claimant's application and the writ of execution are transferred from the office to the bailiff within 3 days. It is important to monitor compliance with this deadline (you can call or come again). In enforcement proceedings, non-working days and holidays are not taken into account when determining the period. In practice, there are cases when, without any legal grounds, an executive document can lie in the office for more than a year.

The bailiff, within three days from the date of receipt of the enforcement document, issues a decision to initiate enforcement proceedings or to refuse to initiate enforcement proceedings. This process also cannot be ignored: if necessary, you need to remind the bailiff of the deadline established by law. It is noteworthy that the claimant now has the opportunity to receive information about the progress of enforcement proceedings via e-mail. To do this, you must provide your email address in the application to initiate enforcement proceedings or in a separate notification. In addition, it has become possible to send electronic appeals through the personal account of a party to enforcement proceedings on the website of the Bailiff Service. Electronic interaction in this field is still being improved, but is already producing modest results, allowing for the prompt receipt and transmission of information, statements and petitions. Information about the initiation of enforcement proceedings and the data of the bailiff who is conducting the proceedings can also be obtained from the Data Bank of Enforcement Proceedings on the Bailiff Service website. In addition, you can subscribe to changes in information on your debtor’s enforcement proceedings, which is very useful. In addition, we recommend that you subscribe to change information about the debtor on the arbitration case filing website. If bankruptcy proceedings are initiated against the debtor, you will have two months (from the date of publication) to include your claims in the register of creditors' claims for their subsequent satisfaction from the debtor's bankruptcy estate. At the end of the procedure, the bankrupt organization will be excluded from the register of legal entities, and the bankrupt citizen may be released from paying debts. Enforcement proceedings have been initiated, what next? After initiating enforcement proceedings, the bailiff sends electronic requests to Rosreestr, the Federal Tax Service, the State Traffic Safety Inspectorate, the Pension Fund of the Russian Federation, to banks with which electronic document management is organized, the Civil Registry Office, the State Inspectorate for Civil Information Services, Rostechnadzor, cellular operators, and the Federal Migration Service. Responses to requests, as already noted, arrive to the bailiff within a few days, and some within a few weeks.

If there is an urgent need to seize the debtor’s property, then you need to agree with the bailiff on a joint departure, if possible, providing motor transport. It is best to go to the debtor in the very first days of enforcement proceedings, that is, while he does not yet know about the initiation of a forced collection procedure. In this case, the debtor may not have time to transport liquid property to another place or “draw” documents confirming the disposal of property from his property. During your departure, insist (or better yet, agree with the bailiff in advance) on drawing up an inventory of property, issuing a resolution to seize the property and transferring the seized property for safekeeping to you (with the exception of real estate, which cannot be transferred to the claimant for safekeeping). If property, upon seizure, is transferred for safekeeping to the debtor or members of his family, then the debtor must be warned in writing about criminal liability under Art. 312 of the Criminal Code of the Russian Federation “Illegal actions in relation to property subject to inventory or seizure or subject to confiscation.” If the amount of debt is over 2,250,000 rubles, remind the bailiff of the need to warn the debtor about criminal liability under Art. 177 of the Criminal Code of the Russian Federation “Malicious evasion of repayment of accounts payable.” In the future, this may provide additional opportunities to encourage the debtor to repay the debt. If the debtor interferes with the bailiff or refuses to comply with his legal requirements, then he may be brought to administrative liability under Art. 17.14 Code of Administrative Offenses of the Russian Federation. By the way, under this article, any persons and organizations that do not comply with the bailiff’s requests to provide information, transfer money, etc. can be fined. How can a debtor be restricted from traveling abroad?

The bailiff has the right to restrict the debtor from traveling outside the Russian Federation for six months if: the debtor is notified of the initiation of enforcement proceedings, the basis for collection is a judicial act, the 5-day period for voluntary execution of the judicial act has expired, the debt exceeds 30,000 rubles (and for socially important penalties - alimony, compensation for moral damage, etc. - 10,000 rubles). If the amount of collection is from 10,000 to 30,000 rubles, then such a measure can be applied after the expiration of two months provided for the voluntary execution of a judicial act. If, six months after the issuance of the judicial act, the debtor has still not repaid the debt, the bailiff may re-impose a ban on leaving Russia. It is important for the collector to monitor the completion of the specified periods and remind the bailiff of the need to re-issue a resolution restricting the debtor from traveling abroad. How do bailiffs sell a debtor's property? The first step is to foreclose on the debtor's funds. Until all of his bank accounts are verified, the seized property will not be put up for sale. Therefore, it is important to find out whether the debtor’s existing accounts have been verified and whether the banks’ responses are on file. If there is no money in the debtor’s bank accounts or there is not enough money, the bailiff begins the assessment and sale of the seized property.

The valuation and sale of the debtor's property is carried out by specialized organizations. At open auctions in the form of an auction the following are sold: things more expensive than 500,000 rubles, real estate, securities, property rights, pledged property that has been foreclosed on to satisfy the claims of a claimant who is not the mortgagee, items of historical or artistic value. The Federal Property Management Agency is responsible for organizing and conducting auctions. Information on the sale of property at auction is published in periodicals and on the auction website. If the property is not sold after the first auction, the bailiff reduces its value by 15% and puts it up for auction again. If the re-auction does not take place, the bailiff offers the claimant to take back the unsold property with a reduction in value by 25% of the initial price to pay off the debt. If the claimant does not pick up the unsold property within five days after receiving the offer, it is returned to the debtor. According to the law, the sale of property is carried out within two months, but in practice this procedure takes three months to two years (this depends on the efficiency of the bailiff, appraiser, seller, as well as on the involvement of the claimant himself in the sale process). It is impossible not to mention the simplified procedure for selling property worth less than 30,000 rubles. If such property is seized, the debtor has the right, within ten days from the date of notification of the assessment, to file a petition for its independent sale. The bailiff may give the debtor the opportunity to sell the property within ten days. After receiving the property assessment, the claimant also has ten days to file a request to retain the property. In the absence of a request for independent sale on the part of the debtor or the unsuccessful sale of property by the debtor, the bailiff offers the property to the collector to pay off the debt. If the claimant refuses to accept it, the property is transferred for forced sale in the usual manner. Thus, the debtor is first given the right to sell property worth less than 30,000 rubles. Then the right to take the property to pay off the debt is given to the claimant. If there are several claimants who filed the petition, then the first will be the one whose demands are higher in the order established by Art. 111 Federal Law “On Enforcement Proceedings”, and if the claimants belong to the same queue - the one whose sheet was received for forced execution earlier than the other. It is important to take into account that the debtor-citizen has executive immunity established by Art. 446 Code of Civil Procedure of the Russian Federation. Residential real estate that is the only one suitable for residence by the debtor and his family is not subject to sale. Disputes regarding the provision of immunity to multi-meter buildings and apartments of the debtor still do not subside.

The Constitutional Court of the Russian Federation recommended that the legislator develop the necessary legislative framework to overcome immunity for living space exceeding social housing standards, and several bills appeared that failed. Nevertheless, the issue is being discussed, and someday it will be settled. There are two important aspects worth noting. Firstly, immunity implies a prohibition of sale; seizure of property is not prohibited. Therefore, when opening an inheritance within the value of the inherited property, the heirs will be responsible for the debts of the testator, and if the property is escheated, it will be inherited by the state represented by the Federal Property Management Agency or a municipal entity (if land plots or residential real estate are inherited). It is important that the seizure imposed on the debtor’s residential property is preserved and the enforcement proceedings are not erroneously completed or terminated. Secondly, while the legislator is thinking about how to correctly foreclose on part of the debtor’s multi-meter residential premises, judicial practice has emerged that makes it possible to allocate part of the property (one or several rooms) and sell it at auction. It's quite bold, progressive, but not too common.

In compulsory execution, an important issue is whether the debtor has common property acquired during marriage. Sometimes all the property is registered in the name of the spouse, and here the bailiff has a rarely used opportunity to request information about such property and seize it until the issue of separating the debtor’s share from the common property of the spouses is resolved. Is it worth appealing the actions of the bailiff? According to the law, the requirements contained in the executive document must be fulfilled by the bailiff within two months from the date of initiation of enforcement proceedings. This does not mean that the debt will be collected in two months. Also, this does not mean that the bailiff will issue a decision to end the enforcement proceedings. The expiration of the deadlines for carrying out enforcement actions and applying compulsory enforcement measures does not entail consequences in the form of the end of enforcement proceedings. The enforcement document may remain with the bailiff for years. Therefore, appealing against the bailiff’s inaction due to a delay of two months may turn out to be futile. A higher official (senior bailiff of the department) or the court will refuse to satisfy such an application. In practice, appealing the actions of a bailiff leads to excessive formalism in his work on your case. Therefore, it is better to have a trusting relationship with the bailiff. We recommend complaining to the senior bailiff, the prosecutor's office or the court only when it comes to a significant violation of your rights (for example, if the bailiff commits illegal actions or if there is information and facts that the bailiff is in collusion with the debtor). We recommend that you notify the bailiff of your intention to file a complaint: perhaps the bailiff will correct the mistakes made or stop inaction, and you will not have to complain.

Is it possible to pay off a debt in installments?

The second option for executing a court order. Contact the accounting department at your place of work with an application, present the original and a photocopy of the writ of execution, indicate the bank account number and home address of the plaintiff. After all, it often happens that the bank incorrectly calculates the amount of debt and demands a slightly larger amount from the client. We recommend that you check the debt calculation for compliance with Article 319 of the Civil Code (the order of write-off). We will not go into details of this article of the Civil Code, since this is not the main point. In most cases, the loan agreement contains a provision for the payment of penalties in the event of late fulfillment of obligations to pay the loan. The law allows for a reduction in penalties within reasonable limits. Therefore, file a petition in court to apply Article 333 of the Civil Code to reduce penalties. The court is obliged to consider the petition and satisfy it, or refuse to satisfy it. By sharing the state of your affairs with a lawyer, you can be sure that in 90% of cases he will definitely find a reason to appeal to the courts with a request for a deferment of payments and will help you win in court. Statistics show that three quarters of court decisions on writs of execution remain unfulfilled. This statistic is horrendous. Among the unfulfilled obligations, there are many that have valid reasons. But there are many cases when debtors simply ignore the court decision. They are successfully “helped” by bailiffs who are in no hurry to work on the writ of execution.

The rights of the debtor during enforcement proceedings are enshrined in Art. 50 of the “Law on Enforcement Proceedings”. However, in the said article they are presented in general terms, are not specified, and do not give a complete idea of what rights a person obliged by a court decision has.

There are many different ways to avoid paying your debts, because if all people were conscientious and responsible, such factors as bailiffs and writs of execution simply would not exist. We have selected for you the 5 most effective ways to help you avoid paying under a writ of execution, and have arranged them in descending order according to the degree of legality and feasibility.

If the resolution has not been contested and the debtor has not fulfilled the obligation to repay the debt within the specified period, the bailiff begins a procedure to search for funds, property and other income of the debtor, which may be subject to foreclosure. You need to prepare for it in advance.

Adaptation, life in Canada and immigration by Career without borders - Canada, America and Europe 4 months ago 20 minutes 91,160 views">>,"simpleText":"At what age should you NOT go to Canada - the bitter truth.

Rules for notification of a visit, and the time at which the bailiff can come to your home.

According to the current legislation, before paying you a visit, the bailiff must notify you that enforcement proceedings have been initiated against you, as well as the time frame within which you are obliged to repay the existing debt to the creditor. If you refuse to pay the debt, or you do not have such an opportunity, then you will be notified exactly when and where your property will be seized. Arrest and seizure are made at the location of your property. Failure to comply with this rule is fraught with legal proceedings, only now the defendant in court will be the bailiff.

PS You can appeal the actions of the bailiff within ten days from the moment he committed, or failed to commit, any actions. Art. 122 of the Law “On Enforcement Proceedings”

When sending you a notice of an upcoming visit, the bailiff is not obliged to track the fact that it was received and read; a postal notification that the letter was delivered to the addressee will be sufficient. After notification of the visit, the bailiff has the right to come later than the agreed date.

A bailiff can come to your home from 6:00 am to 10:00 pm on weekdays and from 9:00 am to 8:00 pm on weekends and holidays.

What property can a bailiff describe - Bailiffs cannot describe all the property in your home. The list of property not subject to arrest and seizure is stipulated in the Civil Procedure Code of the Russian Federation, Article 446.

How to avoid paying bailiffs following a court decision?

When your debt to the creditor is settled, the next step will be the execution of the court decision. For this purpose, the bailiff initiates enforcement proceedings. Within its framework, the debtor is given 5 days to independently repay the debt in full. But debtors have completely legitimate reasons not to pay bailiffs or to delay payment of debt for several years.

This is important to know: Payment code field in a payment order - where is it

Let's consider whether it is possible to reach an agreement with the bailiffs and what to do if your accounts are blocked and travel abroad is prohibited.

What powers do bailiffs have?

Before looking for ways to get rid of paying debts in enforcement proceedings, you should understand what bailiffs can do. As part of ensuring the execution of a court decision, they have the right:

- Seize all bank accounts of the debtor, except salary cards. But in practice, the salary cards of debtors are also blocked - after all, they are not identified by the program and are included in the general list of accounts. However, it is quite simple to lift the arrest from them - just bring the bailiff a certificate stating that the account is used to receive wages and/or benefits.

- Seize the debtor's property. When seized, the debtor loses the right to manage his property: any transactions for its alienation become illegal. But contrary to popular belief, the seizure of property by bailiffs does not mean an immediate loss of control over it - in most cases, it remains in the custody of the debtor, and is subject to sale only when the creditor submits a corresponding demand.

- Send the writ of execution to the employer. On its basis, the employer will be obliged to withhold part of the salary and transfer it to the account specified in the executive document. For arrears on loans and other debts, the amount of deductions cannot exceed 50% of wages, and for alimony - 70%.

- Ban travel abroad. It is imposed for debts of 10 thousand rubles (if the debts are caused by traffic police fines, then from 30 thousand). The ban is lifted only after the enforcement proceedings are closed.

- Deprive your driving privileges. This applies only if driving is not the main source of income of the debtor and if the debts arose as a result of non-payment of alimony, compensation for health damage, or traffic police fines.

All restrictions imposed by the bailiff are temporary and are subject to mandatory cancellation upon repayment of the debt or cancellation of enforcement proceedings at the request of the creditor.

How can regional authorities help? Bailiffs are a federal structure.

Governor Evgeny Savchenko, at a meeting of the regional government, proposed transferring bailiff services to the MFC and establishing an additional fee for people who want to quickly process everything and are willing to pay.

“But not thousands of rubles, but pennies. The money will already go to the MFC as from paid services. Everything can be done within the framework of the law,” the governor said.

In the Belgorod Department of the Federal Bailiff Service, the idea of connecting the MFC to the recording of the bailiffs was considered interesting. On their basis, you can sign up for an electronic queue for those who are not very computer- and Internet-friendly.

In addition, the regional government will help bailiffs with the implementation of lean management technologies, which have already proven their effectiveness in MFCs, employment services and medical institutions.

Is it worth paying bailiffs?

Enforcement proceedings initiated by a court decision can “hang” on you for years, leaving your dreams of vacationing at foreign resorts unfulfilled. And sacrificing half of your income to pay off debts is not pleasant. Let's consider whether you really need to pay bailiffs and why:

- Paying off debt is the quickest way to remove all restrictions and remain with your property.

- Despite the fact that no penalty is charged on the outstanding debt, the bailiffs charge an enforcement fee: 7% of the debt amount, but not less than 1 thousand rubles. Since the abolition of enforcement proceedings with re-initiation is often practiced, the total amount of debt will only increase.

- Information about your outstanding debt is publicly available on the FSSP website. This can cause problems when getting a job or taking out loans.

Therefore, you should not ignore the enforcement proceedings brought against you. But this does not mean that you urgently need to pay off the entire debt - there are many ways to resolve the issue, even if you have nothing to pay the bailiff.

Get an answer to any question regarding personal bankruptcy

How to avoid paying debt to bailiffs

There are several completely legal ways to avoid paying bailiffs at all or to achieve a significant relaxation of the terms of debt payment:

- If your income is equal to or less than the subsistence level, then bailiffs do not have the right to collect funds from you. Also, a significant argument will be the complication of the financial situation due to loss of ability to work and the appearance of dependents. True, very often bailiffs ignore these legal requirements. In this case, you should complain to the senior bailiff or the prosecutor's office. You will either be given a deferment in execution, or a minimum payment under the writ of execution will be established that does not violate your legal rights to a decent existence.

- If the source of income is a pension or benefits, then from June 1, 2020, money under the writ of execution will not be charged from you. This applies to pensions, maternity capital, disability benefits, incapacity for work, unemployment, payments for compensation of material, moral damage and physical harm. From the summer of 2020, this will become an excellent option on how to pay bailiffs if you are not working due to health reasons or retirement.

- Within 10 days from the date of notification of the initiation of enforcement proceedings based on a court decision, you have the right to apply to the court for its cancellation. This will give you the opportunity to challenge your debt or its amount through normal legal proceedings.

- You can delay the execution of a court decision by filing a complaint against it within the legally defined time frame. You can appeal the amount of accrued interest, the subject of the debt itself, and if the bank makes serious mistakes when drawing up a loan agreement (the interest rate or the full amount to be paid is not indicated), then you can completely cancel your debt.

- You can avoid paying debts to bailiffs by creating priority enforcement proceedings. For example, if one of the parents applies for payment of alimony, his demands will be fulfilled by the bailiffs as a matter of priority.

- Agree with the claimant. An agreement can be reached at any stage of enforcement proceedings. We are talking about both concluding a settlement agreement with the creditor and a written agreement with him defining the procedure for repaying the debt.

It is worth noting that filing a request for an installment plan, deferment or cancellation of enforcement proceedings can be carried out by any party: the creditor, the debtor or directly by the bailiffs.

But whether it is possible to reach an agreement with the bailiffs is a purely individual question, and often their decision depends on your interaction with them. If you hide from the bailiffs and openly refuse to repay the debt, then it is unlikely that they will meet you halfway.

How to completely get rid of all debts

An effective way to legally avoid paying a writ of execution, while simultaneously getting rid of all loans, traffic police fines, tax and utility debts, is to declare personal bankruptcy. When an application is submitted to the court, the validity of all enforcement documents is suspended, and the accrual of penalties and fines for late payments on loans is also stopped.

An obvious advantage of bankruptcy is that in one court proceeding you legally get rid of all debts at once, albeit at the expense of selling part of your property.

On the other hand, without bankruptcy, your property is also at risk of being sold by bailiffs, not without a procedure for writing off all debts. And there is no guarantee that its value will be enough to cover at least one debt. You can always find out how to correctly file a complaint against the actions of bailiffs and obtain a deferment of execution of a court decision by consulting with our credit lawyers by phone or online.

What can't they take away from you?

So, according to this legal norm, your home cannot be confiscated if it is your only one and you have nowhere else to live, but this does not exclude the sale of your mansion and providing you with more modest housing in return.

- household items and your personal use, excluding jewelry and luxury items,

- food and cash in the amount of the subsistence minimum for the debtor and persons who are dependent on him,

- property you need to conduct your professional activities, except for property whose estimated value exceeds 10 minimum wages. The current minimum wage is 5,554 rubles, so if you are a videographer and your camera costs more, it is subject to confiscation.

Read more: How to get a second passport through government services

In more detail: What can bailiffs seize for credit debts? This list is not complete; to familiarize yourself with the full list of property for which foreclosure cannot be applied, please refer to the above article of the Code of Civil Procedure.

Unfortunately, there is a gap in the law here and the list stipulates only very general requirements for the debtor’s property, everything else remains on the conscience of the bailiff. So, for example, a washing machine, a computer and a cell phone will probably be classified as luxury goods and described; the same applies to personal items, for example, a fur coat.

If you live in the apartment of your parents, cohabitant, etc., then the bailiffs will come to describe the property exactly at your place of residence indicated in the writ of execution. In order to protect the property of people close to you, you must ensure in advance that you have documents confirming their ownership of a particular item. Otherwise, property whose owner is not identified will also be arrested and subsequently confiscated. If it is not possible to provide such documents, then you have the right to challenge the actions of the bailiff in court by presenting other evidence of property ownership. Testimony from friends and relatives will do.