Inventory form for a citizen's property in case of bankruptcy

MINISTRY OF ECONOMIC DEVELOPMENT OF THE RUSSIAN FEDERATION

dated August 5, 2020 N 530

On approval of forms of documents submitted by a citizen when applying to the court to declare him bankrupt

1. Approve:

the form of the list of creditors and debtors of a citizen in accordance with Appendix No. 1 to this order;

a form of inventory of a citizen’s property in accordance with Appendix No. 2 to this order.

2. This order comes into force on October 1, 2020.

Registered with the Ministry of Justice of the Russian Federation on August 26, 2020, registration N 38699

Inventory and assessment of the property of a bankrupt citizen for the purpose of sale

It is important for the debtor to ensure that these estimates coincide with reality. If he believes that this is not happening and the prices are too low, then he has the right to attract another appraiser for an additional fee.

If the debtor's bankruptcy procedure has entered the competitive stage, this means that previous measures could not solve financial problems, and a decision has been made to sell his property. First of all, the person responsible for this process, the bankruptcy trustee, must have an inventory of the property.

Conducting an assessment is the competence of a financial manager, who must have a sufficient level of special knowledge to analyze the financial condition of the debtor and is obliged to do so. Involvement of other persons for such assessment is allowed only on the basis of a court ruling and at his own expense.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual.

The bankruptcy law recognizes the need to carry out an inventory and assessment of a citizen’s property in order to determine the initial sale price of his property. However, in Chapter X of this law, which contains special rules for bankruptcy of a citizen, there is no indication of the timing of these activities.

Salary cards are also included in the inventory: they refer to current accounts, the second type - loan account - refers to credit cards, including those with a grace period. The balance of money is given on the day of preparation of the inventory. Deposit accounts are bank deposit agreements.

The main block requires stating the essence of the requirements, as well as indicating where and under what circumstances the loan was issued. The amount of the debt (principal and accrued interest), the period of delay, and penalties are also indicated here.

But if creditors are dissatisfied with the results of the market value assessment, they can conduct an additional examination. At the same time, they will need to pay the costs of its implementation from their own pocket.

Complete information on the topic: “Sample inventory of property in case of bankruptcy of an individual” to help a literate citizen.

Amounts expressed in foreign currency are indicated in rubles at the Bank of Russia exchange rate on the date of compiling the inventory of the citizen’s property.

The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT. A citizen was given a car for his birthday. If his wife goes bankrupt, this property cannot be included in the bankruptcy estate, because it was received under a gratuitous transaction.

In accordance with paragraph 1 of Art. 213.3 of the Federal Law “On Insolvency (Bankruptcy)” No. 127-FZ of October 16, 2002 (hereinafter also referred to as the “Bankruptcy Law”), the right to apply to the court to declare a citizen bankrupt belongs to a citizen, a bankruptcy creditor, an authorized body.

Thus, the lists must indicate, in particular, the names or full names of creditors and debtors, the amounts of accounts payable and receivable, their location or residence. In addition, it is necessary to separately register monetary obligations and (or) obligations to pay mandatory payments that arose when a citizen conducted business activities.

What is this procedure

One of the stages of the bankruptcy process is competitive bidding. In order to sell property at auction, it is necessary to draw up an inventory of the debtor's property. Inventory is the responsibility of the bankruptcy trustee. He uses a special inventory form, which includes a list of movable and immovable assets, and funds. The task of the financial manager:

- verify the information entered in the document;

- identify transactions completed over the last three years;

- challenge the facts of sale at a low price.

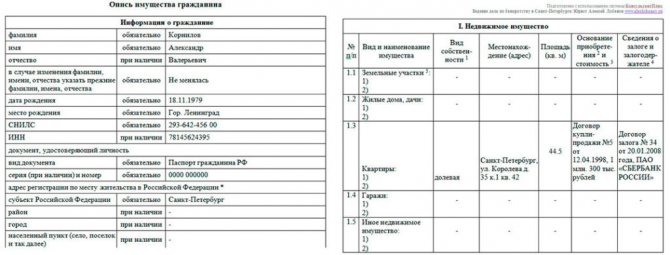

Appendix No. 2

Appendix No. 2 to the order of the Ministry of Economic Development of the Russian Federation dated August 5, 2020 No. 530

in case of configuration of surname, first name, patronymic, indicate the previous surnames, first names, patronymics

address of registration (registration) at the place of residence in the Russian Federation*

Type, make, model of vehicle, year of production

III. Info about accounts in banks and other credit institutions

Name and address of the bank or other credit company

IV. Shares and other roles in commercial organizations

Name and organizational and legal approved form of the company*(12)

VI. Info about cash and other valuable property

*(2) The name and details of the document that is the legitimate basis for the emergence of the right of ownership are indicated.

Have you decided to prepare and submit an application to the Arbitration Court about your insolvency? It is very important to analyze all transactions and agreements for the alienation of any assets before filing an application. After all, the manager has the right to challenge dubious transactions and redistribute property in the interests of bankruptcy creditors who are in the register. Get a consultation for free!

*(10) The type of account is indicated. (for example, deposit, current, settlement, loan) and account currency.

*(19) Information about the agreement for storing valuables in a personal bank safe (deposit box) and the name of the credit company are indicated.

How does the assessment work?

The next step after taking inventory is to evaluate each item. If an item was purchased for foreign currency, the price is indicated in rubles at the bank exchange rate. In the interests of the debtor, it is important to ensure the objectivity of the assessment of implementation. An undervalued or inflated price is equally uninteresting to a bankrupt. In the first case, the total amount of debt is reduced by a smaller amount. In the second case, the sale of assets in the event of bankruptcy of an individual will be complicated due to the high cost. If the bankrupt does not agree with the actions of the head of the process, he can attract an independent expert at his own expense.

Price information in the inventory is established according to documents containing information about the cost:

- payment accounts;

- trade orders;

- purchase and sale agreements.

For used items, the value report refers to the market price, taking into account wear and tear, usefulness, and sales costs.

If an individual has nothing

Justice does not care whether a bankrupt has property or not. The debtor has the right to admit his insolvency in his absence. However, he is obliged to pay a fee for the bankruptcy procedure. Solvency must be confirmed with the following documents:

- certificate from the accounting department;

- receipt for payment for the procedure;

- If the bankrupt does not have property to cover debts, inventory through an inventory is still done. The judge admits

- documents on the progress of the process;

- guarantee financial obligation.

If the bankrupt does not have property to cover debts, inventory through an inventory is still done. The judge declares the citizen insolvent and writes off the bankrupt's debts. The insignificant value of the property upon sale is insignificant.

The inventory list does not include property worth less than 10 thousand rubles.

What if an individual has no property?

Regardless of whether the debtor has property or not, he has the right to admit his insolvency. The fact of absence of property must be indicated in the application. After this, the arbitration manager will verify the veracity of the information provided.

To check whether the debtor has any property, requests are submitted to the following authorities:

- Banking organizations.

- Unified register of registration of legal entities and individuals.

- State Road Safety Inspectorate.

If a citizen does not have real estate or valuables, then an inventory is still compiled. The court declares the borrower insolvent and writes off his debts.

Implementation

After the inventory has established the estimated value, it is time to sell the property. There are deadlines established by law, no more than 6 months. At the request of the participants in the case, the implementation period can be extended.

Only liquid goods are involved in sales. Real estate, vehicles, technical equipment, expensive jewelry, and luxury items have a high cost. They are sold exclusively through auction. Items costing less than 100,000 are sold through direct sales through public advertisements.

Anyone has the opportunity to purchase goods at a discount using any of these methods. The proceeds are used to pay off debt. If there is no demand for the seized property, the manager will offer it to creditors in payment of the debt. Unsold items are returned to the owner according to the act.

The end of the procedure for the sale of a citizen’s property means that the individual is declared bankrupt.

Property that is not subject to foreclosure

The Civil Code prohibits taking away all things from the debtor. Article 446 provides a list of those not subject to arrest:

- the only housing, except for a mortgaged apartment or house;

- land and outbuildings on it;

- domestic animals;

- cash savings in the amount of the subsistence minimum;

- food for own consumption;

- cloth;

- personal belongings;

- award badges;

- machines and equipment for carrying out professional activities worth up to 100 minimum wages;

- means of transportation for the disabled;

- firewood, coal.

A ban on the seizure of inviolable items is imposed regardless of the size of the debt.

Mortgaged property

A mortgaged apartment is not considered the only home. Even minor children living in the house will not stop creditors. Selling housing is profitable if the amount of debt is less than its price. Vehicles purchased with a car loan are also included in the bankruptcy estate.

When preparing for the procedure, it is wiser for an individual to start selling on their own.

If it happens that the collateral is nevertheless sold at auction, then the proceeds from the sale will be distributed as a percentage:

- 70% - secured creditor;

- 20% - credit organizations and individuals;

- 10% - covering legal costs.

The insufficiency of collateral proceeds will be supplemented by funds received from property free of collateral.

Sale of property

The sale of property begins after the debtor is declared bankrupt. Only those things that are included in the inventory of a citizen’s property during bankruptcy are subject to sale. The property must be sold within six months. If during this time some things have not been sold, the court may extend the period for sale. Once the property is sold, the proceeds are transferred to the creditors.

What you can't sell

Not all things that belong to the borrower can be sold. The law clearly defines property that is prohibited from being confiscated, including during the bankruptcy of an individual:

- single dwelling;

- personal hygiene products;

- Pets;

- farm animals;

- animal feed;

- items that are used to earn money.

The full list of items that are prohibited from being confiscated is specified in Art. 446 of the Civil Code of the Russian Federation. In judicial practice, the status of some things can be interpreted differently, and the decision is left to the discretion of the judge. For example, a moped or a car will not be confiscated if it is not a means of transportation, but a tool for earning money, or transport is vital for a disabled bankrupt person to travel, etc.

Mortgaged property

Property that is pledged may be sold in accordance with the procedure established by the pledgee. The proceeds will be used to pay off debt. If there are insufficient funds, other property of the borrower that is not pledged will be sold. If the mortgagee in bankruptcy does not declare his claims and is not included in the register of creditors, there is a risk of losing the mortgage rights.

How to preserve common property

Property acquired during marriage can also be sold in bankruptcy. Part of it can be saved if you allocate your spouse's share. It can also be proven that the loan was received for personal purposes not related to the family. In practice, this is quite difficult to do. As for housing, you need to prove that it is the only one for the family. If one of the spouses goes bankrupt, part of the funds after the sale of joint property is returned to the other. Experts recommend contacting a lawyer who thoroughly knows the norms of current legislation and can interpret them in favor of the debtor, preserving the common property of the spouses.

Inventory form

The inventory list in case of bankruptcy of an individual is a type of established form, with information:

- Full name of the citizen;

- information about joint and shared property;

- assets;

- location;

- price;

- description;

- bank account numbers;

- balances on cards.

The debtor is required to provide truthful information in the inventory. Distortion and concealment will entail legal consequences. The debtor is not declared bankrupt. His liability to creditors will remain. It should be remembered that fictitious bankruptcy is a criminal offense.

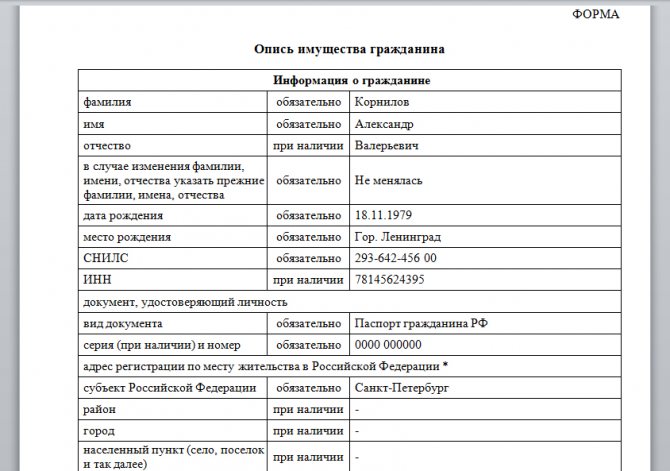

Sample filling

It is easy to fill out the inventory form yourself, following the sample. It contains several sections. Information is entered into certain columns of the inventory.

The first page of the inventory is devoted to identifying the applicant. Standard information: full name, year of birth, tax identification number, passport details, registration, SNILS.

Information about the availability of property is entered into 4 tables:

- Real estate: residential, non-residential, land with addresses. Information on purchase and sale agreements. Information about the pledge and the pledgee. Information in the form of an inventory of a citizen’s property in bankruptcy is confirmed by the details of the pledge agreement.

- Movable property: name, registration numbers, location.

- Bank accounts with a complete description of the cards.

- Savings: deposit agreement, amount. For valuable items, write the original cost. The equipment and its price upon purchase are indicated.

The sample inventory of the debtor's property ends with a list of things that are in the house.

Sample filling

[354.83 Kb] (downloads: 208)

Filling out the inventory yourself will not be difficult. The approved form contains few sections; the average person can easily fill it out. To eliminate errors, it is recommended to use a sample property inventory. It specifies in detail which column to enter which information, in what format it should be presented, and also provides an example of how to fill it out.

Is it possible to make an inventory of the property of a spouse?

The consequences of one spouse's bankruptcy affect the other. They lived together and made purchases, regardless of who paid for them. As long as the property of one family member is sufficient to pay debtors, the share of the second is not touched. In the reverse version, general things will be used.

How to preserve common property

There are chances to save the defendant’s possessions in a debt collection case even in a difficult situation. There are several ways:

- draw up a division agreement;

- sign a marriage contract.

The marriage contract divides the joint property between the spouses. It is recorded who owns the apartment, transport, shares. An important circumstance is to sign the contract in advance. If it was done on the eve of bankruptcy, the lenders will challenge the deal.

Property inventory is one of the most important procedures in bankruptcy. The last things will not be taken away, and after the property is sold, the debts will be written off. The citizen is declared bankrupt and owes nothing to anyone.

How will the property of spouses be sold in 2020?

Bankruptcy of individuals is a personal, separate procedure, but as long as it does not affect the common property of the spouses.

What if, for example, the car was purchased as a marriage? Unambiguously indicate in the inventory of property with clarification of ½ share in the right.

In the event of bankruptcy of an individual - one of the spouses - jointly acquired property will be sold to the manager. The second spouse will be compensated for the cost of his share.

The question often arises: is it possible to secure joint property? Bankruptcy of individuals is a process that requires accurate and informed decisions based on experience and knowledge.

Spouses can enter into an agreement on the division of property, a purchase and sale agreement or a gift agreement. It must be remembered that any transaction with property can be challenged. If you decide to make a property transaction, consult a specialist to assess the risks.

Nothing. Until recently, some courts reported that they terminated proceedings for debtors who had neither income nor assets.

The Supreme Court of the Russian Federation (Decision dated January 23, 2017 in case A70-14095/2015), followed by the appellate courts (Decision of the Thirteenth Arbitration Court of Appeal dated February 7, 2017 in case A21-6697/2017) indicate the possibility of going through the personal bankruptcy procedure regardless of income and property.

As part of bankruptcy, the court most often orders the sale of property. It consists in the formation of the bankruptcy estate and its further sale. The proceeds are used to pay off creditors' claims. The average period for selling property is 6 months.

What property is being taken? The bankruptcy estate may include:

- collateral property (for example, housing with a mortgage);

- property that belongs to the debtor, as confirmed by title documents;

- property hidden by the debtor, which was revealed as a result of an audit by the financial manager;

- property that was alienated by the debtor (if the transactions were challenged by the financial manager).

Also, during bankruptcy, an inventory of property is carried out. It is carried out only by the financial manager. If there is no property, then an act is drawn up stating that there is no property available for sale.

It is interesting that debtors often incorrectly imagine the inventory procedure: the doors are wide open, where the manager and his assistants burst in to take away everything that catches their eye... Many, out of ignorance, think that the inventory of property occurs approximately according to this scenario.

Of course, this is not true. In fact, the procedure is carried out in a more civilized manner:

- you provide a list of your property to the financial manager;

- the financial manager makes an assessment of the property from the provided list;

- requests are submitted to various authorities to check the property that has been in your possession over the past 3 years. A car, land plot, apartment, weapon and other property are subject to state registration.

We invite you to read: If the employer does not pay compensation for vacation, free consultation

Very often, during bankruptcy, disputes arise regarding the jointly acquired property of the spouses. The fact is that all property acquired during marriage belongs to both spouses. Upon sale, the financial manager is obliged to seize the debtor's property. But how to do this if the owners are two spouses? How to preserve property during bankruptcy?

- Mortgage. It often happens that spouses took out a mortgage for which they acted as co-borrowers. Circumstances have changed, there is no way to pay the loan. Bankruptcy proceedings have begun.

Regardless of whether the spouses are married or already divorced at that time, recourse to the collection of collateral property by banks is almost inevitable. In this case, the wife’s property in the event of her husband’s bankruptcy is half of the apartment or house purchased under a mortgage agreement. If funds remain after the sale of the collateral property, they will be transferred to the spouse in the established amount.

- Joint property. For example, a couple lived together for 10 years, after which, as a result of a difficult situation, the spouse filed for bankruptcy. The property acquired during the marriage includes the apartment where the debtor and his family live, a car and a summer house.

As part of bankruptcy, everything listed, except for the only home, will be sold, including the part that is the property of the spouse. The financial manager submits a petition for the allocation of the bankrupt's share. As a rule, this happens like this: property is sold, part of which is given to the second spouse.

If there are funds left after satisfying the creditors' claims, they will be transferred to the spouse in the amount due to her. The same is with the property of a spouse - if bankruptcy is carried out in relation to his wife, the property will be confiscated without division into parts.

- Children's property. If a mother or father files for bankruptcy, but the children own any property, that property will not be sold.

How to protect yourself and avoid property loss? First of all, having decided to declare bankruptcy, you need to contact qualified lawyers for advice. Only professional specialists will be able to assess your financial condition from a legal point of view and give competent advice. In particular, you will learn how to prepare for the procedure, identify your strengths and weaknesses, and do everything possible to protect yourself from property loss.

Remember, with a competent approach, bankruptcy is a good opportunity to write off all debts and stay with your own!

Assessment procedure in case of insolvency of an individual

Before initiating the sale of property to pay off debts, its composition and value should be determined. For this purpose, a so-called bankruptcy estate is formed, which includes:

- property directly owned by the debtor;

- objects that he owns jointly with his spouse, relative or partner.

- shares in real estate or securities.

The bankruptcy estate is determined by the bankrupt himself or a specially appointed financial manager. The list of property subject to sale may be adjusted up or down, depending on:

- Were objects excluded from it that are not subject to seizure under bankruptcy law?

- Whether it included found property that was deliberately hidden or sold by the debtor.

After the list is compiled, the bankrupt's assets are assessed. For this purpose, a licensed expert is involved. If the property owner decides that the valuation results are deliberately underestimated, he has the right to contact an independent appraiser.

To formulate the value of property, data from preserved receipts, purchase agreements, and bank documents can be used. This takes into account the general wear and tear, external and technical condition of the objects. In addition, the result is influenced by the market price prevailing in a particular region.

After the list and price of objects are finally fixed, ways of their implementation are determined:

- Valuables and household items worth up to 10 thousand rubles can be sold directly to interested parties who received information through printed publications or advertisements on Internet pages.

- Expensive objects find their buyers through auctions held on specialized electronic platforms.

What if there is nothing on the property?

However, the bankrupt is not always the owner of liquid assets, which may include:

- real estate;

- vehicles;

- luxuries;

- jewelry;

- stock;

- accounts in banking institutions;

- expensive equipment.

Often the debtor has nothing to offer for sale. In this case, the bankruptcy procedure also involves drawing up an inventory. But only the objects contained in it are not subject to forced sale. The court considers the bankrupt’s property capabilities and makes a decision to write off debts.

However, you should not think that by getting rid of expensive property in advance, you can avoid liability to creditors. In the process of compiling an inventory, the bankruptcy trustee studies in detail all the transactions performed by the debtor over the past 3 years.

All suspicious transactions can be contested, and the objects transferred under them can be returned and sold. In addition, the bankruptcy trustee sends out requests, looking for bank accounts, securities and other liquid assets.

What items are not subject to collection?

Not everything acquired by a bankrupt can become a source for repaying obligations to creditors. Article 446 of the Civil Code of the Russian Federation establishes restrictions according to which it is impossible to confiscate from the debtor what he needs for life and income. In particular, the exceptions are:

- Household items and personal items, unless they qualify as luxury items.

- Residential premises or a share thereof, if the bankrupt has no other housing. This restriction does not apply to mortgage lending objects pledged by the bank.

- A plot of land, if the house built on it is the only home for the bankrupt.

- Any property from which the debtor earns a living. An example would be a car if its owner is engaged in freight or passenger transportation.

- Domestic animals used in private farming, buildings and food for them.

- Sowing seeds.

- Money, if the amount does not exceed the minimum subsistence level established in the region, food.

- Transport that serves as a means of transportation for a disabled person declared bankrupt.

- Awards and valuable prizes received for achievements in work and sports.

- Fuel, if it is used for cooking and heating living spaces.

What happens to collateral in bankruptcy?

The bankruptcy law recognizes the need to carry out an inventory and assessment of a citizen’s property in order to determine the initial sale price of his property. However, in Chapter X of this law, which contains special rules for bankruptcy of a citizen, there is no indication of the timing of these activities. At the same time, this chapter provides for the application of the provisions of other sections of this law to the bankruptcy of a citizen.

As such, not contradicting Chapter X, in terms of determining the timing of the inventory and assessment of the debtor's property, we can consider the provisions of the Bankruptcy Law regarding the actions of the bankruptcy trustee as part of the implementation of the bankruptcy procedure. Thus, according to paragraph 2 of Article 129, the period for inventorying the property of a debtor declared bankrupt should not exceed 3 months from the date of commencement of bankruptcy proceedings, unless a longer period is established by the court.

When submitting an application to the court, a person wishing to admit his insolvency must indicate a list of his property. It is confirmed by documents - in particular, certificates of ownership, court decisions and other title documents.

Accordingly, if you own an apartment, you must provide a purchase and sale agreement, or a document confirming that you inherited the living space, or other title documents.

Why is this being done? The financial manager will definitely check the accuracy of the submitted documents. He will also check to see if you have hidden assets. A credible list submitted by you along with your application will be a positive sign of your integrity.

Everything you need to know about arbitration managers in bankruptcy proceedings for individuals. persons

When the court appoints a sale procedure, the list of property you provided will be confiscated for its further sale. The proceeds are transferred to creditors to satisfy their claims.

Under no circumstances make hasty decisions! It is necessary to prepare for bankruptcy in advance. What does it mean? Let's look at examples.

- We were contacted by a client who was planning to file for bankruptcy. She lives in an apartment with her mother, where she is registered. He is not the owner of the living space or share. The main question is how to save real estate and valuables during bankruptcy?

Lawyers' answer: since the woman is not the owner of the apartment, but only has a residence permit there, in the process of selling the property the financial manager will not be able to seize the property and the valuable property that is located in it. But only if the property does not belong to the client. To do this, you will need to prepare documents that confirm that the property in the apartment belongs to another person. Such documents may include, in particular, checks and certificates of ownership. Household items and personal belongings are not subject to confiscation.

- We were approached by a client who had quite serious debts to the bank and was about to declare bankruptcy. He planned to re-register the apartment in his son’s name under a gift deed. The apartment is the only residence of an individual. How can you protect yourself in this situation? Is it worth urgently getting rid of the apartment so that it is not taken away for debts?

Lawyers' answer: there is a list of items and things that cannot be seized for sale under any debt. In particular, this includes the only housing. If the debtor no longer has any other legal place of residence, no one has the right to evict him or sell the real estate. Thus, re-registering the apartment to relatives in this situation is unnecessary. Moreover, the bankruptcy procedure would be significantly delayed.

To get a consultation

Ask any question about bankruptcy and receive a detailed answer. It's free.

We have come close to the issue of single housing. This is property that is included in the list of Art. 446 of the Code of Civil Procedure of the Russian Federation - it cannot be seized and sold in order to pay off the debts of the debtor. In fact, you can carry out any transactions with your only home; it cannot be sold.

It is impossible to challenge such transactions, based on the provisions of Art. 61.2 of the Law on Bankruptcy of Individuals. The fact is that they cannot in any way harm the property interests of the creditors, which means they have nothing to do with the case.

Thus, in the event of bankruptcy of an individual, the only housing always remains with the debtor. But not if it is pledged under a mortgage agreement. Let's take a closer look.

If the debtor had a loan secured by collateral, then when sold, the collateral object is sold in most situations. The initial price is set by the secured lender. If the bankrupt or the manager does not agree with the established price in this property matter, then the establishment of the price is submitted to the court for consideration. Collection of collateral is carried out on the basis of the following conditions:

- if the delay is more than 3 months;

- if the amount of debt is at least 5% of the value of the collateral.

After the sale of the collateral property, the funds are distributed as follows:

- 70% goes to the secured creditor;

- 20% - to repay the claims of other creditors (if other property is not enough);

- The remaining 10% is for legal expenses, remuneration for the manager, appraisers.

After a citizen declares himself bankrupt, consequences arise not only for him, but also for his married couple. This is due to the fact that the husband and wife make joint purchases while living together, so the debt must be repaid from the common property.

The law establishes that in normal cases, only the debtor’s property is used to repay the debt. In other circumstances, it is also necessary to pay with common property. Joint property is usually called all valuable things that were purchased during the marriage. And here it does not matter whether the wife was working at that time or not.

The debtor's wife has the right to take part in the consideration of the spouse's bankruptcy case. After the sale of the common property, the spouse's share is allocated. If the owner of the property is the wife, then the procedure will look different.

Lenders must submit an application to allocate part of the property owned by the borrower.

To preserve common property, you can use one of two methods:

- sign an agreement on changing the joint ownership regime;

- write and sign a marriage contract by both spouses.

When you have property but no income, we recommend using a simplified scheme. A simplified scheme makes it possible to declare bankruptcy if there is no property. The debtor writes a petition to the justice authority stating that he has no property and therefore cannot pay off his debts.

If there is no property, you can use one of three procedures provided by law.

Insolvency proceedings have consequences not only for the debtor himself, but also for his spouse. After all, a husband and wife make common acquisitions over the years of marriage. Debt repayment will be made from common property.

The general procedure established that each spouse is responsible for his own obligations with his own property. In some cases, foreclosure is applied to the joint property of the wife and husband. Purchases made during the marriage become common property. It does not matter if the wife did not work and took care of the children.

Community property is all income received during the marriage. Includes earnings, benefits, scholarships and other income. Cash deposits and securities are also joint property.

We suggest you read: How to file for bankruptcy of a company

The Insolvency Law allows for foreclosure on common property. The wife receives the right to take part in the consideration of the husband's insolvency case. Once the property is sold, the spouse's share is allocated and the other half becomes part of the bankruptcy estate.

The situation changes when the owner of the property according to documents is the wife. Lenders apply to allocate the borrower's share of the joint property. Joint ownership does not include property on which execution cannot be imposed.

The sale of property in the event of bankruptcy of individuals does not affect household furnishings and basic necessities. The only house and the land on which it is located cannot be taken away either.

The question arises of how to preserve common property during bankruptcy.

- Change the joint ownership regime. For this purpose, the spouses sign an agreement.

- Draw up and sign a marriage agreement.

But it must be taken into account that creditors may try to challenge any agreement and invalidate the transaction.

Document filling form

The inventory form was developed by specialists from the Ministry of Economic Development of the Russian Federation and is an annex to Order N530 dated August 05, 2020. The debtor can fill out the form independently or with the help of a consultant. At the same time, he must not only list the property objects, but also indicate their identification and quality characteristics, including name, location, cost, license plate numbers, and account balances.

The form contains two sheets. First, you need to provide personal information about the owner:

- FULL NAME;

- passport details;

- place of birth and date;

- SNILS;

- TIN.

At the same time, residents of federal cities, such as St. Petersburg and Moscow, should indicate the name of their locality not in the “city” column, but in the “subject of the Russian Federation” column. If a citizen does not know his TIN, he will have to use the tax office search engine. You cannot leave columns empty.

The second sheet contains 4 sections:

- Properties including:

- personal plots;

- apartments, dachas, houses, garages;

- other objects.

Each object requires detailed characteristics, including:

- location;

- total area;

- type of property;

- right of ownership.

- Movable property. The section should contain a detailed description:

- Name;

- VIN;

- location;

- price;

- type of property;

- encumbrance with collateral;

- basis of ownership.

- Accounts in banking organizations indicating:

- type of account;

- organization details;

- account currency;

- opening dates;

- balance.

- Cash and other valuables. In this section the inventory includes:

- money;

- objects of art;

- jewelry;

- means of labor.

Which of the property objects indicated in the inventory has value and should be included in the bankruptcy estate is decided by the judge, who declares the debtor bankrupt and gives permission to sell his property.

Sample from the Ministry of Economic Development

The law does not prohibit citizens from filling out the inventory themselves. To draw up the document correctly, just download a sample for reference on our website or from the website of the Ministry of Economic Development.

Form and example of filling out an inventory in case of bankruptcy of an individual

The property inventory form, which must be drawn up in case of bankruptcy, has been approved by the Ministry of Economic Development. Let's look at the nuances of filling it out.

| Sheet | Content | Nuances |

| First sheet | Information about the applicant:

| For residents of Moscow and St. Petersburg, the city must be indicated in the “Russian Federation Subject” field, and not in the “City” field. |

| Section I | Real estate:

| For each subsection you must indicate:

|

| Section II | Movable property | For each subsection the following is indicated:

|

| Section III | Bank account information:

| Indicated:

|

| Section VI | Information about cash and other property:

| This section is the most voluminous in the inventory. Anything of value should be listed here, indicating:

|

How not to lose property during bankruptcy of individuals: advice from money managers

It doesn’t matter the amount of debt, 100,000 or 10 million rubles - such property in any case remains with the debtor.

Get comprehensive self-bankruptcy management

- A 45-year-old man decided to admit his failure. The debt to 3 banks is 589 thousand rubles. Among the assets owned are a car and an apartment, where, in fact, the debtor lives with his wife and 2 minor children. Every month's income is 34,000 rubles. How to save property? Out of fear of being left without an apartment and without a livelihood, the debtor decided to sell his only home to a relative at a market price.

We will solve your debt problem. Free legal consultation.

- alienation of assets in favor of close relatives (more often through a gift contract).

carrying out loan settlements with one of the creditors to the detriment of the others.

- the amount of delay was more than 3 months;

- the amount of debt on a secured loan amounted to 5% of the price of the collateral.

- 70% - for the secured creditor;

- 20% - for other creditors - banks and individuals;

- 10% - payment of legal costs.

- Those who do not have and did not have assets;

- Those who previously had property.

We will solve your debt problem. Free legal consultation.

We will solve your debt problem. Free legal consultation.

Inventory in insolvency proceedings

- Transfer of necessary documents to the inventory commission.

- Establishing the assets that are actually owned by an individual or organization.

- Data analysis that associates the actual presence of assets with what documents reflect.

- Documentation of inspection results. They should reflect the identified discrepancies.

Based on the results of the inventory, the claims of creditors are satisfied.

- Material or natural verification. The material and material base of the company is subject to verification. Weighings, measurements and calculations are carried out.

- Documentary check. The rights and obligations of the company, confirmed by documents, are identified. Intangible assets of a legal entity, debts of receivable and payable types are considered.

What property of the debtor do bailiffs have the right to seize?

The acquired data is analyzed and entered into the inventory results report.

One of the circumstances of conducting an inventory during an insolvency procedure may be to check the safety of certain property values.