The actions of the bailiff in the event of bankruptcy of the debtor are provided for by the legislation of the Russian Federation. The procedure for appeal is regulated by the Federal Law “On Enforcement Proceedings”.

According to the bankruptcy law, enforcement proceedings can be initiated only on sufficient grounds. The procedure is initiated in case of evasion or refusal to comply with court rulings.

Compulsory actions in case of bankruptcy of a debtor can be carried out only by an authorized body. In Russia it is the Federal Bailiff Service (FSSP).

On what grounds can a bailiff initiate enforcement proceedings?

Enforcement actions may occur based on the following circumstances:

- External.

- Internal.

External reasons include increased global competition, the economic situation, and political instability. And internal ones include the conclusion of unfavorable credit agreements, an increase in the scale of production, an increase in expenses over income, weak sales, a large number of production balances, a lack of stable counterparties, the appearance of receivables, low capital turnover, costs above competitive ones, and others.

Types of executive documents:

- Court order.

- Act of the arbitration court.

- Act of an authorized official.

- A writ of execution, which was formed on the basis of relevant arbitration judicial acts or general jurisdiction.

- Notarized debt.

- A certificate issued by the labor commission.

- Agreement on payment of alimony payments. The document must be certified by a notary.

- Act on forced collection of debts. It must be accompanied by documents on accounts and a statement demanding the fulfillment of obligations.

- Pension Fund Act/Social Insurance Act.

- Resolution of the bailiff of the FSSP of the Russian Federation.

- Other documents.

Absolutely every document submitted to the authorized body must comply with the requirements specified by law. Thus, all of them must comply with the established template, and also contain the necessary details for the case under consideration.

In accordance with the provisions of the Federal Law “On Enforcement Proceedings”, from the date of introduction of supervision, the judicial authority does not suspend the execution of the following enforcement documents:

- On the intersection of certain actions that in any way violate the exclusive right to activities of an intellectual nature.

- On the release of the debtor's property from seizure.

- On stopping the violation of statutory rights.

- On the seizure of counterfeit materials, instruments of an administrative offense.

- And others.

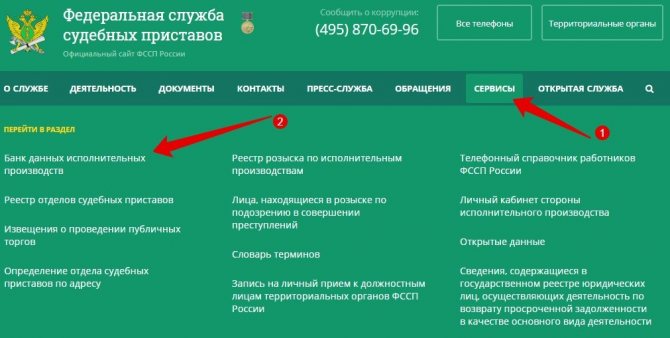

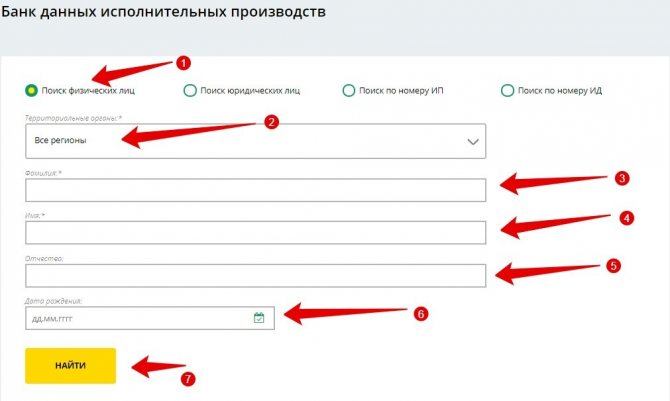

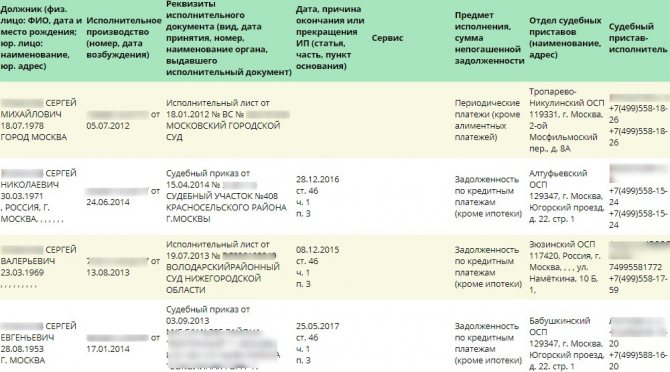

How to check if proceedings have been initiated

You can check all the information regarding the initiation of proceedings by having access to the Internet and knowing which website contains the information. A website where information on the initiation of proceedings regarding citizens, enterprises and financial organizations that have been overtaken by bankruptcy is structured - the official website of the FSSP of the Russian Federation.

This service is quite easy to use. It allows you to search for information regarding citizens and entrepreneurs, as well as search by enforcement proceedings number. To obtain information, you need to fill in information regarding the region of Russia, full name and date of birth, name of the company and its actual address, number of the resolution (if you are looking for the number of the writ of execution). The search will reveal the presence or absence of started production.

The service is useful not only to check data regarding your own situation, but also before concluding transactions and contracts.

Insolvency procedure for an individual

The actions of a bailiff in case of bankruptcy of a debtor allow you to get out of the debt hole. There is a specific procedure for carrying out the judicial procedure.

Insolvency proceedings can be carried out on the following grounds:

- If the debt exceeds or equals 500,000 rubles. In this case, the citizen is obliged to submit an application to the arbitration court to declare himself bankrupt.

- If the debt is less than 500,000 rubles. The debtor is not obligated, but has the right, to file for bankruptcy.

The debtor's actions in bankruptcy proceedings must be balanced and well thought out. The interested party must be confident that he will be able to bear all associated expenses.

To file bankruptcy you will need to incur serious expenses:

- State duty – 300 rubles.

- The arbitration manager's remuneration is 25,000 rubles.

- Guarantee of financing of bankruptcy proceedings for the court - up to 25,000 rubles.

Appeals for collection of funds are carried out in accordance with the procedure established by law. The bailiff is authorized to do this. Despite the fact that the lack of property and income is not an obstacle to bankruptcy, questions may arise in court, since the sale of property is provided as compensation for debt at the request of creditors.

However, in accordance with Art. 446 of the Code of Civil Procedure of the Russian Federation, the law provides for a certain number of things for which penalties cannot be imposed. This article can be used to protect property from seizure in court.

Suspension of proceedings

The law provides for situations in which a suspension may be possible during legal proceedings related to the bankruptcy of a person. The reason may be:

- appealing individual judicial acts in accordance with the established procedure;

- appealing decisions of a meeting of creditors;

- other factors enshrined in the Arbitration Procedure Code of the Russian Federation.

If the court makes a ruling according to which the case is suspended, then it does not have the opportunity to adopt other procedural acts provided for in Article 52 of Federal Law No. 127. However, this does not prevent other determinations from being made in this proceeding.

Free legal consultation We will answer your question in 5 minutes!

The decision to temporarily suspend the consideration of the case is made by the arbitration court. It is based on a statement written by one of the parties. A prerequisite for this will be the presence of a legal and justified basis for the suspension.

Free legal consultation

We will answer your question in 5 minutes!

Not only the creditor and the debtor, but also their representatives have the right to submit a corresponding request. However, they must act on the basis of a notarized power of attorney. In addition, they should have the organization’s statutory documentation with them.

Bankruptcy of legal entities

Initiation of a bankruptcy case against a legal entity is carried out only after the authorized body receives a corresponding application. According to the current legislation, the arbitration court is responsible for considering the application.

A debtor can be declared bankrupt only after filing an application from:

- An enterprise that is in debt on its own obligations.

- Lender.

- Government agencies.

- Control authorities.

The saving solution will be the case when the initiator of the bankruptcy filing is the debtor himself. It is worth filing a claim when the resulting debt significantly exceeds the amount of financial assets.

After a company enters the bankruptcy process, certain conditions arise:

- All funds are recovered as part of the bankruptcy case.

- Collection of debt on current payments is suspended.

- If the sequence of debt repayment is violated, it is prohibited to offset counterclaims.

- Dividend payments are prohibited.

- For violation of monetary payments, the accrual of penalties is stopped.

When making transactions to remove the debtor's property, it will be necessary to obtain the written consent of the temporary manager. The book value of the property must exceed 5% of the company's assets.

During the recognition of insolvency, consent from the temporary manager is required for transactions on processing loans, guarantees, transfer of debts, etc.

When the court makes a decision to declare a legal entity bankrupt, external executive management, reorganization, bankruptcy proceedings and monitoring procedures will be appointed. Thus, the rights of the head of the company will be temporarily reduced for a period of no more than one year, and the bankruptcy trustee, during the exercise of his powers, will evaluate the enterprise, conduct an inventory, and also track the progress of trading of the debtor’s property.

The main task of the bailiff is to conclude a settlement agreement. However, this will not be possible if at least one side of the conflict is against it.

If the bailiff, through his actions, achieves a settlement agreement between the debtor and the creditor, the latter may offer a preference to reduce interest. Thus, it will be much easier for the debtor to repay the debt.

Suspension and completion of enforcement proceedings

Termination of enforcement proceedings can be carried out either by a judicial authority or by the bailiff service. The end of enforcement proceedings means the revocation of the decision and termination, as well as annulment of the actions of the bailiff. Here are some of the reasons for this turn of events:

- A court decision regarding the death or disappearance of a creditor or debtor.

- The creditor himself canceled the application.

- Conclusion of a settlement agreement.

- The creditor withdrew the claims.

- The resolution cannot be implemented.

Suspension of enforcement proceedings is carried out in the following cases (more details in Article 40 of Federal Law No. 229 and in Article 39 of Federal Law No. 229):

- Death of the debtor, recognition of him as missing.

- The fact of loss of legal capacity of the debtor.

- The debtor is a participant in combat operations as part of the armed forces of the Russian Federation.

- A long business trip during which the debtor is located.

- Long stay in treatment.

And much more, according to current laws.

Any legally significant action has its consequences. An exception is not the termination of proceedings related to the bankruptcy of a legal entity or individual. For example, all restrictions that were in force during the observation phase are canceled. Other consequences include:

- restoration of the ability of counterparties to submit claims in the general manner;

- restoration of the debtor’s legal capacity to the founders and creditors in the presence of various types of sanctions;

- abolishment of restrictions applied to the organization's managers;

- resumption of proceedings related to disputes over financial obligations if they were suspended at the request of the counterparty;

- termination of powers of the manager;

- restoration of the debtor's rights regarding the disposal of property.

In the relevant Federal Law No. 127 there is a separate article that describes all the possible consequences of terminating the insolvency procedure. First of all, it says that after such a decision is made by the arbitration court, all restrictions imposed on the organization cease to apply. They could either be specified in other legislative acts, or implied by the very essence of the procedure (for example, observation). We are talking about returning the right to freely dispose of property owned by a person and travel to other countries.

Usually, following the results of the proceedings, the arbitration court makes a decision either on the bankruptcy of the organization or on the introduction of a recovery procedure. He may also issue a ruling to terminate production. Recovery provides a chance to restore the solvency of a legal entity, that is, it presupposes the availability of a certain amount of funds.

Let's consider a separate situation when, during the process of monitoring, it turns out that the company does not have enough money to cover all the necessary expenses associated with legal costs and management fees. Sometimes creditors give written consent in which they express their desire to finance these activities.

Moreover, if at least one of the counterparties does not agree to cover the current legal costs, the bankruptcy proceedings of the legal entity may be terminated. In such a situation, the court does not proceed to bankruptcy proceedings. If he nevertheless does this, then the bankruptcy trustee has the right to appeal such a decision. The reason is the impossibility of covering expenses from the company’s own funds.

When a lack of money is identified already during bankruptcy proceedings, the administrator is authorized to petition for the recovery of the necessary funds from the original applicant. Even if it concerns expenses already incurred.

After completion of the bankruptcy procedure, writs of execution are returned to the applicants or creditors. However, after the end of the proceedings, counterparties have the right to present additional demands, following the established rules.

The writ of execution is handed over to the bailiffs. It must be taken into account that collection is carried out only in relation to current payments, or those that cannot be expressed in monetary terms. This is about:

- prevention of violations that cause harm to intellectual property;

- preventing a possible violation of rights when this is not related to the deprivation of property;

- removal of property from someone else's possession.

In the absence of the above grounds, there is no official, legal reason for filing a statement of claim.

Reasons for introduction

We list the most common reasons why an individual or company is declared bankrupt and debt collection begins against him.

External circumstances:

- economic crisis;

- instability in politics;

- global competitive environment.

Internal circumstances:

- low level of capital turnover;

- outdated technologies and equipment;

- due to high costs, increased cost of goods or services, which negatively affects competition;

- unstable counterparties and partners, which entails significant receivables;

- large volumes of unsold goods, slow sales;

- registration of unprofitable credit transactions with inflated interest rates and non-market lending conditions.

The reason for enforcement proceedings can be both external and internal circumstances

The reason for the commencement of enforcement proceedings and bankruptcy of citizens and legal entities is the refusal of the defaulter to repay debts to creditors on the basis of a court decision. A valid basis for the process is the claimant’s statement, on the basis of which the document is drawn up. The role of the latter is played by:

- decision of a judicial authority;

- an act of a court or other authorized institution to make such decisions;

- a document issued on the basis of decisions of arbitration and courts of general jurisdiction;

- an inscription certified by a notary office acknowledging the existing debt;

- resolution of an employee of the FSSP in the Russian Federation and others.

Deadlines and filing complaints

The decision taken by the court to initiate bankruptcy proceedings for an individual or entrepreneur is sent to the bailiffs by the arbitration manager. By law, he must do this within a reasonable time. Exactly how many days this period takes is not established by law. But in judicial practice, a reasonable period means 1 month.

Consequently, documents stating that a citizen has been subjected to bankruptcy and for this reason the enforcement proceedings need to be “frozen” are sent to the FSSP within a month.

We invite you to read: The annual bonus was not paid

It is in the manager's best interest to do this as early as possible. The fact is that enforcement actions are terminated only after the relevant decision is made by the senior officer - and this also takes time. Without this act, it is impossible to begin the procedure for selling property in bankruptcy, since it will formally be under arrest.

If the deadline has passed and the manager still has not transferred the data or the bailiffs have not issued a decision, you should send a complaint to the senior bailiff.

From the date of receipt of the debt collection sheet when the debtor is declared insolvent along with the application, the bailiff service officer must begin the process and fulfill the requirements within two months.

In practice, due to the large number of cases and the workload of bailiffs, the procedure is often delayed, so you need to be prepared for such a development of events

Responsibility of the parties

Based on the scale of the debt and the commission of unlawful acts, liability is applied under the administrative and criminal codes. The key measure of administrative punishment is the use of fines or penalties. Disciplinary measures such as reprimands and warnings are also often used. Violations for which such measures are applied include:

- violation of deadlines for the execution of orders by the responsible FSSP employee without good reason;

- loss of a court order;

- ignoring and failure to comply with official orders;

- intentional provision of false or unreliable information about the financial position;

- concealment by the defaulter of the fact of a change of residence or employment.

Cases for applying criminal penalties:

- one of the parties committed a crime, which became known;

- the debtor refuses to comply with orders to repay the debt for a long period.

Methods for collecting debt from a legal entity

In accordance with the methodological instructions, the enforcement fee collected by the bailiffs in the event of bankruptcy of an individual is not subject to collection, since de jure the conduct of the proceedings is terminated.

If the enforcement fee has already been paid, then it must be returned to the bankrupt’s accounts simultaneously with the removal of encumbrances and arrests and the closure of the case.

Securing a claim is the adoption by the court of certain measures that are aimed at executing the judge’s decision.

The following can be interim measures (Article 91 of the Arbitration Procedure Code of the Russian Federation):

- seizure of LLC accounts and property;

- prohibition on the debtor company to perform certain actions in relation to the disputed object;

- imposing on the LLC the obligation to take actions aimed at preventing loss or damage to the disputed object;

- transfer of the disputed object for storage to the applicant or third parties;

- suspension of the sale of seized property;

- other measures permitted by law.

Purposes of securing a claim:

- Debt collection guarantee.

- Active influence on the LLC - it is assumed that after the measures taken, the defendant will make contact and begin to pay the debt.

- Minimizing the risk of loss of disputed property.

We invite you to read: Bailiffs withheld wages without warning

In order for the judge to consider the issue of securing a claim, you need to file a statement of claim along with a request to secure the claim, or simply send a statement of security at any stage of the proceedings. The application is considered immediately or the next day and can be submitted at any time during the consideration of the case, as well as before the court makes a decision.

Conditions under which the judge agrees to choose a security measure (one of them must be present):

- failure to take this measure will make it difficult or impossible to repay the debt;

- failure to take action will prejudice the plaintiff.

When choosing a measure of security, the judge is guided by the following rules:

- The chosen measure corresponds to the size of the creditor's claims.

- The interim measure is related to the execution of the decision.

- The interests of third parties and parties are not infringed.

The judge's decision to apply the chosen measure is subject to immediate execution. To do this, the judge issues a writ of execution, which is immediately sent to the bailiff service.

Even if interim measures were not taken, if you have a writ of execution in your hands, you can influence the debtor in the following ways.

The presence of a writ of execution allows you to collect a debt from a legal entity using both the common method of transferring it for execution to the FSSP, and some other, less popular options.

In accordance with Part 8 of Art. 69 of Law No. 229-FZ “On Enforcement Proceedings”, you, as a claimant, have the right to contact the tax authority and request information about the financial condition of your debtor. Information is provided upon presentation of a writ of execution.

The Federal Tax Service can tell you how much money is in the debtor’s accounts, the numbers of these accounts and the data where they are located.

According to Part 6 of Art. 70 of Law No. 229-FZ, you independently have the right to contact the bank and demand foreclosure on the funds stored in the current account of the debtor company. This is the easiest and fastest way to collect a debt under a writ of execution from the debtor.

Foreclosing on property is more difficult, as you will need to seek help from the court or a bailiff.

The procedure consists of two stages:

- Seizure of property or arrest. Carried out on the basis of a bailiff’s order, a court decision or a notary’s writ of execution. The procedure is carried out by a representative of the FSSP. The debtor himself can indicate the property that will be seized or seized within the limits of the amount of the debt. The purpose of this stage is to limit the right to dispose of property.

- Implementation. The sale of property is carried out in order to pay off debts from the proceeds. Sales are carried out through auctions. Inexpensive property (up to 30,000 rubles) is allowed to be sold to the debtor independently.

If the LLC does not have the funds to pay off the debt, which is why the process of declaring the company bankrupt has begun, it is allowed to hold the founders or controlling persons of the debtor liable (Chapter III.2 of Law No. 127-FZ).

The grounds for bringing the perpetrators to justice may be:

- damage caused to creditors by the actions of the founders or management of the debtor;

- failure to file an insolvency application within the prescribed period;

- violation of business activities, which resulted in the insolvency of the LLC;

- concealment or distortion of data when entering information about bankruptcy into the state register;

- inaction of management resulting in bankruptcy.

The consideration of the creditor's application to hold the management of the LLC or the founders liable takes place in court, where the bankruptcy case is being heard.

If the debtor has no other property, the creditor has the right to foreclose on the participant’s share in the authorized capital of the LLC.

Typically foreclosure is carried out on the basis of a court decision. But there is an exception - if the collection clause is included in the pledge agreement, there is no need to go to court.

If the company owes you more than three hundred thousand, you can independently initiate bankruptcy proceedings against the debtor. 15 days before applying to the Arbitration Court, you must publish a notice of your intention in the EFRSDUL - a register of information on the activities of legal entities, which reflects information about all bankruptcy claims brought against the company.

Next, submit an application to the Arbitration Court to declare the unscrupulous counterparty bankrupt. Be prepared for the fact that the process may take a long time, and in some cases it may not be possible to repay the debt at all.