How can debt collectors contact me?

The collector can contact you in any convenient way: call, send SMS and emails. Organizations often send registered letters with return receipt requested. And it is also not prohibited to come home or meet in any other place. But we must remember: you are not obliged to let anyone into the house. And it is better to arrange a meeting in neutral territory in advance.

The rules on how to behave with debt collectors when meeting are slightly different. It’s better to record the conversation on video or a voice recorder and act confidently. Usually, collectors are good psychologists and have a great sense of when a person might give in.

How to avoid falling for a scammer

Fraud among debt collectors is a very common activity. Many banks sell “bad” loans to collection firms, and these people do not really care about the security of the borrower’s data. Thanks to this, information about the loan can be seen by scammers, but they do not stand on ceremony for a long time.

In order not to get into a difficult situation, you need to control yourself and not panic. Even if threats are made over the phone and requests are made to immediately pay off the debt with interest, it is necessary to record all this on a voice recorder. And then you just need to call the police and report the scammers, providing incriminating evidence on them.

In most cases, these people are identified and punished. You need to know that the bank will never require its borrower to pay the debt in cash to an employee. All normal organizations operate solely on the principle of transferring debt to a bank account.

Therefore, in order not to fall for scammers, you need to take into account all the above information. You should not give your personal information to a stranger; this can lead to bad consequences.

How to deal with a collector?

How to make a conversation with a debt collector over the phone

Payments are overdue, no one has contacted the bank - which means it’s time to prepare for a call from the collection company and further communication with them. But while this has not yet happened, you need to carefully study the agreement. As a rule, information on the transfer of debt is indicated at the very bottom of the document in small print.

Dear readers! Our articles talk about typical ways to resolve legal issues with debts, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call . It's fast and free!

If the document does not contain such a clause, collection firms do not have any rights to put forward any demands, in which case it should be reported to law enforcement agencies. If the document states the right to transfer the debt to collectors, nothing can be done; you will have to talk to this organization.

Here are a few rules that need to be followed when calling a collection agency, and it would be better to make scripts from the conversations:

- It is not recommended to transmit any data. If it is truly a collection company, it will have all the information about the borrower;

- Be sure to ask the interlocutor to introduce himself (company name, position). All information should be written down on a piece of paper, it may come in handy later;

- it is necessary to speak civilly and not raise your voice, collectors, as a rule, record all conversations, so rudeness on the part of the client can turn out badly against him;

- Collectors do not like it when people cry to them and complain about their fate; it is better to immediately indicate your intention regarding the debt.

It is important to know: if a collection company does not want to take the case to court, but simply wants to get the debt in hand, then it means that it has something wrong with the law.

How should you communicate with a collector when you meet?

When meeting with an agency, you need to remain completely calm and not show your feelings outwardly. The threats from these people are just some kind of psychological pressure. The only thing they can legally do is sue the borrower for refusing to pay the debt. But such a solution is most beneficial for the defaulter.

When you meet, you should immediately ask him for a document to conduct this type of negotiation. Naturally, this document must be officially certified by a notary. If there is no such document, then you can safely reschedule the meeting until the next time the collector has this document in hand.

At the next meeting, you can read the agreement for a long, long time and if even one typo is found, you can reschedule the meeting again, since such an agreement with errors has no legal force.

You also cannot sign any documents, they can slip in anything and then it will be very difficult to prove anything in court. In some cases, collectors even threaten to charge interest, but they have no right to do this, since they are not a credit institution. If such a conversation arises, you can safely go to court and write a statement against the collection agency.

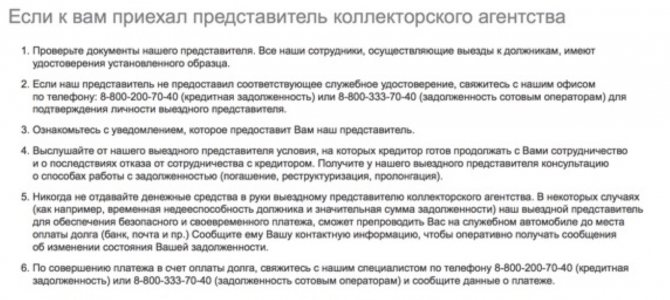

List of documents that the collector must show when meeting with the debtor

According to the law of the Russian Federation, a lender can assign rights to a loan agreement. But at the same time, the borrower also has his own rights, which must be fully respected. By law, the debtor must be notified one month in advance about the assignment of his debt to another creditor.

The debtor may not pay the debt until the new creditor provides all the necessary information that he has rights to the debt.

What to do if a collector comes home?

Here is a list of documents that the new lender must provide:

- A letter from a banking organization notifying about the assignment of rights; the document must indicate the address of the new creditor, the debt has been calculated, and there must be a waiver by the bank of claims.

- Assignment agreement between credit institutions.

- Extract from the Unified State Register of Legal Entities.

- Document confirming the place of registration of the new creditor.

- A list of all employees of the organization with contact information for each.

- A claim to the debtor with demands, an attachment to this document in the form of a calculation of the debt amount.

Among other things, since that year, collectors have been required to enter the state register. Organizations that operate without registration in the registry are unscrupulous collectors. They will face a large fine.

Among other things, you can only communicate with the debtor officially. Therefore, it will be possible to calmly demand the relevant documents from the claimant. If the collection agency does not provide these documents, you can safely show them the door.

To summarize, I would like to note: there is no need to be afraid of a collection agency, every borrower has rights and protection from the state. If violations are discovered against the borrower, the actions of the collection agency will be illegal.

Every person has their own rights, you just need to be able to use them correctly. To avoid falling for scammers, you need to carefully check all the information provided, and it is best to hire a qualified lawyer to protect your rights.

This video will show you how to talk to debt collectors:

What should I do if debt collectors call?

Based on clause 5 of Article 15 of the Federal Law “On consumer credit (loan)” it follows:

- demand to name the collector's full name (or name of the organization);

- contact number of the organization;

- information about the debt (non-payment period, amount of overdue).

If they don't clarify the information, just hang up. You should not give out your personal information (contacts of relatives, place of work, residential addresses). Even without paying, the client has the right not to provide such information - it is all in the contract and the collectors must be aware.

Site Expert

Fasakhovva Elena Alexandrovna

Member of the Russian State Duma Committee on Non-Bank Credit Institutions. Engaged in bankruptcy proceedings since 2020.

Ask a Question

The best option is not to communicate with collectors at all and change the SIM card. The debtor has no obligation to communicate with creditors and report to them how and when he will repay his debt.

How to communicate with them

Under no circumstances should you show that you are afraid of them. Then they will start to intimidate even more. You need to show your legal literacy. It is better if you have several universal articles of legislation at hand that you can refer to to protect your rights.

You can offer your own solutions to the problem: when and in what amount the payment will be made. But there is no need to promise something of which you are unsure. An additional broken promise will only make the situation worse and negatively impact your credit history.

If the borrower refuses to pay at all, then he must prepare arguments, references to regulations confirming that he is right. If the agency representative has a different position, then you can immediately say that they would like to resolve the issue in court.

How to deal with debt collectors when talking on the phone

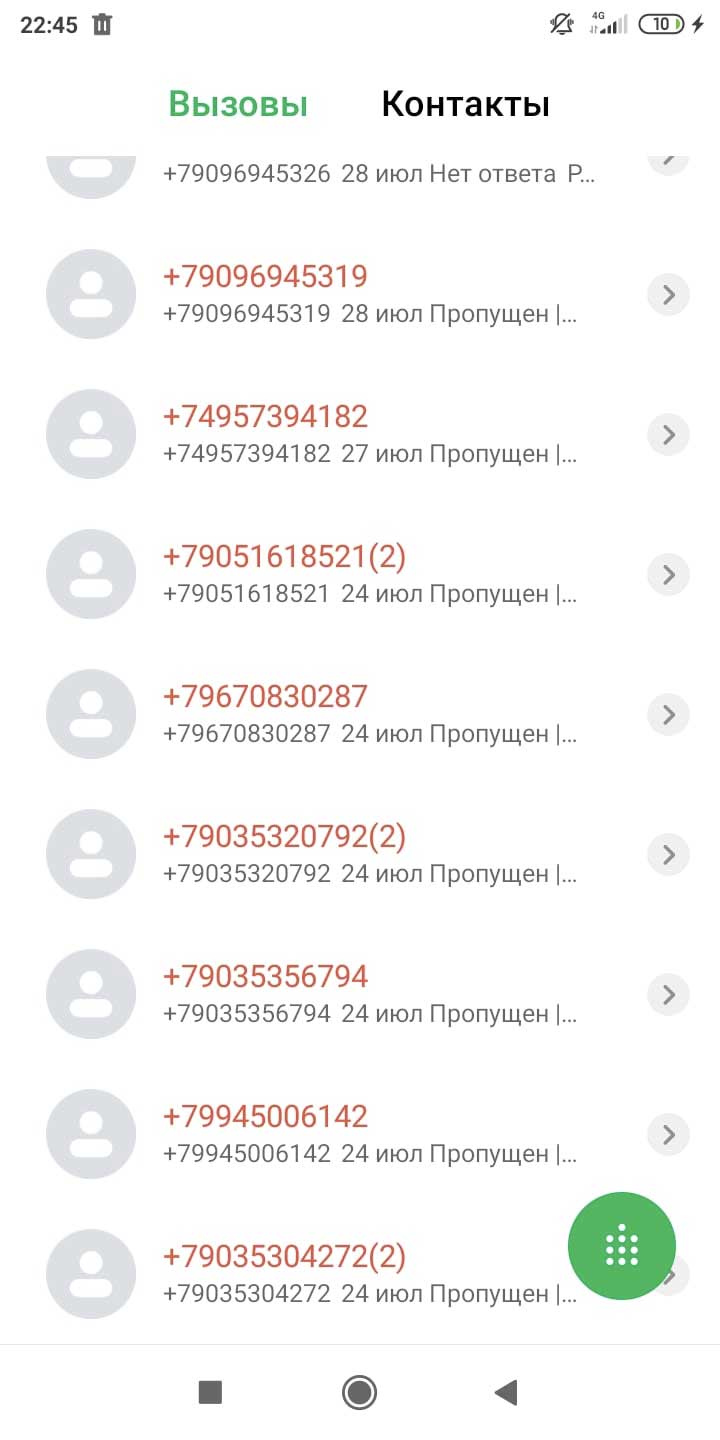

Law No. 230-FZ regulates all communications between collectors and debtors. Creditors can call no more than once a day and 2 times a week. The number of telephone conversations per month should not exceed 8. In this case, the agency representative must:

- name your full name, position and place of work;

- provide information about the debt and ways to resolve the problem.

If a debt collector calls from an unknown phone number, the debtor has the right not to answer such calls. It is also prohibited to disturb debtors between 22:00-8:00 on weekdays and 20:00-9:00 on non-working days.

Experts offer the following advice on communicating with debt collectors by phone:

- Do not interact with unlicensed agencies.

- Track time and number of calls.

- Stop inappropriate communication.

- Consider refusing personal communication with debt collectors. The law allows you to hire a lawyer who will communicate on behalf of the debtor.

If violations are detected, the debtor has the right to complain to higher authorities.

How to behave if collectors come home

The best option is to turn on the video recording and direct it to the person who came to you. You have this right because... you do this not in a closed security facility, but at home.

The debtor has no legal obligation to host bank employees and debt collectors at his home. Only bailiffs have the authority to conduct such communication and only with the appropriate resolution to initiate enforcement proceedings.

If a collector or bank employee comes to your home, then you don’t have to open the front door at all, but when you meet him on the street or at the entrance, you can walk past him, recording his behavior on a video camera.

What should I say to debt collectors over the phone?

Let's look at typical questions, collectors' arguments and possible answers to them.

“Hello, is this Ivanov Ivan Ivanovich?”

In the first seconds of a call, collectors always try to establish the identity of the person who answered the phone. If the collector himself refuses to introduce himself, you have every right not to give your name and end the call. The obligation of a collection service employee to provide the debtor with complete information about his position and contact information before starting a conversation is enshrined in Federal Law-231.

“Our company bought your debt to the bank”

If the collectors called for the first time since the transfer of rights to claim the debt to their company, the debtor has the right to request confirmation of the assignment agreement. Until such a document is provided, he may suspend communication with the new creditor and not pay the debt. This right is enshrined in Article 385 of the Civil Code of the Russian Federation, which any employee of a collection agency knows about.

“Are you going to repay the debt?”

There are three possible answers to this question. Firstly, the debtor has the right to demand documents that indicate and justify the amount of debt. Secondly, he can declare that he is ready to resolve the issue only in court. At the same time, he himself is not obliged to file a lawsuit, and can wait for a claim from the bank.

The third way is

an offer to record a refusal to pay .

As a rule, such a straightforward statement causes confusion among collectors, because it does not fit into the standard conversation plan. “If the bank goes to court, you will have to pay the entire amount at once and reimburse the costs of the process.”

Indeed, after a court ruling, the responsibility for debt collection passes to the bailiffs, with whom it will not be possible to pay off with monthly payments.

However, not a single collector will tell you that the courts often side with the borrower and write off fines and penalties from the total amount of the debt. That is why collecting a debt out of court is more profitable than filing a lawsuit.

Often in a conversation, debt collectors try to intimidate the debtor with liability for violating the criminal or civil code.

In 95% of cases, such threats are unfounded and are used for psychological pressure.

It is very easy to challenge them, since most collectors do not even know the content of the articles they named. Art. 159 of the Criminal Code “Fraud”

A criminal case under this article can be initiated if the following conditions are met:

- When drawing up the contract, false information was provided;

- the borrower did not contact the bank or deliberately indicated the wrong number;

- not a single payment has been received under the loan agreement.

It is difficult to find a debtor who would commit each of these violations. If the collector calls you at the phone number specified in the contract, the clause regarding the unreliability of contact information is no longer valid. Therefore, by threatening to accuse them of fraud, debt collectors are contradicting themselves.

Art. 165 of the Criminal Code “Causing property damage by deception or abuse of trust”

Remember that any property purchased on credit belongs only to you, unless it is designated as collateral in the contract. This means that it can be sold, exchanged or broken, and the claimant has no right to make claims in this regard.

Article 177 of the Criminal Code “Malicious evasion of repayment of credit debt”

An article that is completely inapplicable to ordinary consumer loans. The amount of debt to hold individuals accountable, according to its content, is at least 1.5 million rubles. Only employees of the FSSP of the Russian Federation have the right to go to court on this basis.

What should I do if collectors are rude and threaten me?

Regardless of whether you owe a loan or not, no one has the right to threaten or be rude to anyone. And even more so cause real harm. But in order to get a reaction from law enforcement officials, you need to prepare evidence (video, recordings of telephone conversations, photos, SMS). If there is no evidence, the application may be refused.

It is important to initially specify the limits of what is acceptable in communication and ask to adhere to a business style.

When contacting law enforcement agencies, you can only refer to real threats. If a person saw a personal insult in the words, but there was no direct rudeness, then no action will be taken.

But don’t go too far in the opposite direction. You must understand that the collector can also record and, just like any person, has the right to contact the police if threats are made against him. That is why, so as not to have to explain yourself to law enforcement officers, you should not be rude or threaten representatives of the debt agency.

The right approach

Now is the time that many are familiar with the situation when there is no way to pay overdue payments, various sanctions in the form of fines, all this is the outcome of outstanding loans. Having received your debt from the bank, the collectors begin to “harass” you. Calls and messages give me no rest. They persistently call you, put pressure on you, and this discourages you so much that it gives the “extortionists” a pretty good outcome. In addition to paying off your loan, you will have to pay large fines. This is all because many people are not familiar with the laws and do not know how to properly communicate with annoying debt collectors. You need to know how to talk to debt collectors. There is always a way out! The dialogue will change radically if you know the law!

The law is with you!

You should definitely know that the work of debt collectors is strictly regulated by law. This protects our freedom and rights. No one has the right to violate this! Collectors use a certain number of threats:

- Under article one hundred and seventy-seven of the Criminal Code of the Russian Federation “Malicious evasion of repayment of accounts payable.” The threats associated with this article are a bluff. There have not been a dozen such precedents in our country.

- According to article one hundred and fifty-nine “Fraud” This article is most often argued by collectors. Even if you paid only once, you can already assume that there was no intent to commit fraud. You won't have to answer to the law. This article does not apply to you.

- A competent debtor can confuse a debt collector who does not know the laws.

Arrogant "Psychologists"

Each collection organization is a commercial company. They have narrow rights. They can only persuade you to pay and nothing more. If there was no trial and there was no verdict, which was transferred to the executive services, then they can do nothing more. Therefore, you need to behave correctly. Anyone can be menacing in a telephone conversation, that’s how they behave. How to communicate with rude interlocutors?

Their task is to scare you as much as possible and pull out emotions. Don’t let yourself get into a panic. You don’t need to behave like a redneck, behave calmly. Try to communicate calmly and without swearing, but if you were insulted, be sure to say that you recorded it and pass it on to the necessary authorities. Record such calls so that you can present them later if anything happens. Ignore any reasons why you were insulted.

No need to be shy

Be persistent in asking questions that interest you. For example, you definitely need to know the name of the organization and request documents confirming the transfer of debt into their hands. If they refuse to provide it, then just hang up. Ask questions about which bank they handle your business with and from what date. You need to behave correctly in all matters.

By and large, collectors are conducting illegal activities, since there have been no court decisions, and they do not have the right to demand money. Add a qualifier to inform collectors that you are ready to complain about them for illegal actions.

Where can I complain?

If communication with debt collectors goes beyond what is permissible, lawyers advise immediately filing a complaint with regulatory authorities. If debt collectors make direct threats to relatives, the debtor himself or third parties, everyone has the right to equally contact the following authorities:

- police;

- the prosecutor's office (if the police do not want to deal with your case);

- Central bank;

- NAPCA (an organization that was created to combat fraudulent debt collectors using illegal methods);

- Roskomnadzor.

How to respond to collectors if I am not a debtor

If collectors call, but you are not the borrower, then you have every right not to talk to them at all. But in practice, in order to get rid of annoying calls, it is better to talk and ask to call a different number, explaining why. The debtor may not be known at all; he may turn out to be an employee, a neighbor, or a distant relative. You can give the borrower's phone number, if available. No need to worry about this. If the debtor gave the number as a contact number, it means he suspected that they would help contact him if necessary.

Usually after this the calls stop. But sometimes collectors do not stop calling if the debt is really owed by this person. You will have to pay for someone else if your name was indicated as a guarantor under the loan agreement. This possibility also exists if the heirs of a deceased bank borrower are called.

Legally, the debt will have to be repaid to collectors. The credit history deteriorates, fines will increase in the same way as if the person took out the loan himself. That is why, if representatives of collection agencies try to contact you, it is better to talk right away and clarify the situation forever.

What rights do debt collectors have and can they come home?

Collectors have a number of rights that allow them to take certain measures for pre-trial collection, but they also cannot exceed their powers. So what measures can collectors take:

- Send a letter to the debtor demanding repayment of the debt, which must include the following information:

- the total amount of debt as of the current date, as well as what it consists of, i.e. how much principal, debt and fines there are;

- information about the repayment period, as well as about the measures that will be taken if it is not fulfilled on time. The letter is usually sent by registered mail, less often it is delivered in person against signature.

- Personally visit the debtor . There are also a number of restrictions on this measure. The agency representative has the right to visit the debtor only at his place of residence. It is strictly forbidden to come to the place of work or to visit relatives. Also, collectors are not allowed to enter the house without the consent of the debtor, otherwise their actions fall under the article “illegal entry,” which provides for criminal liability. The debtor, in turn, has every right not to open the door to them and not to answer.

- Phone calls. Employees of collection companies very often use this measure of influence on the debtor. But at the same time, we must remember that they have the right to call no more than once a day from 8 am to 10 pm on weekdays, and on weekends from 9 am to 8 pm and only at their place of residence. Calling relatives, friends or acquaintances is illegal.

The activities of collection agencies involve only pre-trial persuasion measures . They cannot oblige or collect.

Summarize

Sometimes it happens that answering debt collectors by phone is simply boring. If they call too often or at night, you can contact Rospotrebnadzor with a complaint. In case of direct threats, contact law enforcement agencies. If there is evidence, they are obliged to take action.

The easiest way to prevent collectors from bothering you with calls is to add their numbers to the blacklist. Gradually the phone calls will stop.

In any case, it is difficult to figure out how to competently resolve the issue and how to behave correctly in relation to persons representing debt agencies. To avoid problems, it is better to turn to competent specialists who know how to deal with debt collectors when you owe a debt and how to behave if you don’t have to. With the help of lawyers, you can prepare a text for appeal to banks and courts. You can even appoint a representative to combat them and then not even pick up the phone. It should be remembered that debt collectors often take advantage of people’s legal ignorance. If you transfer the matter to a competent person, then more than half of the requirements will disappear during the first conversation.

How to talk if they call about someone else's loan?

When calling about someone else's loan, you need to talk calmly, without emotion.

You should introduce yourself and clarify that the collectors made a mistake, and you know nothing about the citizen who is really the borrower. However, usually the matter does not end there - they are not inclined to take their word for it.

To prove that the collectors are indeed contacting the wrong address, obtain a certificate of no debt from the bank and send a copy of it to the collection agency by e-mail.

If this does not stop the collectors, you need to write a statement against them to the prosecutor's office.

Even if the defaulter is your relative, you are not at all obliged to suffer from intrusive calls because of this. The only exception is a guarantee; in this form, the guarantor is responsible for the actions (and inactions) of the borrower.

For smartphone owners, there is another way - you can download a mobile application for Android or iOS, which “knows” the numbers of most collection agencies and blocks incoming calls from them (on iOS the application is called “Anti-collector”).