| Photo: Andrey Dorozhny |

The entry into force of the law on personal bankruptcy has led to a tenfold increase in the number of anti-collection agencies that protect the interests of debtors in disputes with creditors.

The market for anti-collection services in St. Petersburg is at the peak of development; the number of such companies in the city has grown significantly over the past year, market players interviewed by dp.ru told us.

The State Duma proposed to forgive mortgage debts to families with children State Duma

Start of activity of anti-collection bureaus

Previously, such organizations did not exist because there was no demand for them. In the 90s of the last century, the “debt recovery system” did not look entirely legal, so there was no talk about rights and their protection. In the 2000s, when legislation came into force, the need for such specialists arose. The first anti-collection agency was opened in the capital in 2004, after which this practice spread to other regions. Currently, there are a huge number of such organizations.

How much do anticollector services cost?

Anti-collector services are far from cheap and are always calculated individually, depending on the complexity of the specific situation. Some agencies offer the first meeting or telephone consultation for free.

A one-time consultation costs about 500 rubles.

Review of the loan agreement and its analysis for the presence of clauses that violate the law or the rights of the lender will cost about 2,000 rubles.

Client protection in court is assessed as a percentage of the amount expected to be sued from the bank. The cost of the work is additionally affected by the complexity of the case and the total amount of debts. When defending in court, the amount for a specialist’s work will be a monthly payment, and given the time frame for conducting court cases, this can last more than one or two months.

Benefit for the debtor when turning to anti-collectors

By resolving the debt issue on your own, you may not get out of the situation, but rather complicate it even more, since the borrower in most cases does not have specialized knowledge in the field of jurisprudence. The services of an anti-collection agency have the following advantages:

- Knowledge of the nuances of legislation allows employees of the anti-collection bureau to make maximum use of them to protect the interests of their clients.

- Often, representatives of a bank or collection service try to intimidate a borrower - consultation with a loan lawyer allows you to receive instant information about how real the threats are.

- Anti-collectors help to completely protect against annoying calls or visits from debt collectors who illegally interfere with the borrower’s personal space.

- If the debtor does not have time to collect the necessary documentation to go to court, representatives of the anti-collection service can do this for him.

Lawyers come to the rescue

An anti-collector lawyer helps resolve disputes with banks and debt collectors. He draws up statements, letters, suggests contacting the bank, court and collection company. If necessary, he can file a lawsuit, thereby lowering the interest rates on the loan, changing the amount of payment per month or the payment period. This usually occurs within 2–6 months.

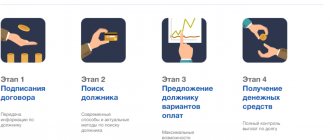

The whole process consists of several stages:

- The client describes the problem to the agency specialist, who offers prospects for solving it, gives advice on how to behave, how to talk (or not talk) with debt collectors, etc.

- An agreement is signed and a fee is paid for services. In most cases, the payment is monthly; it can be a fixed amount or a percentage of the loan amount.

- Issuing a power of attorney to a company representative so that the creditor's claims are forwarded to the agent.

- Initial contact with the collection agency, negotiations with the bank.

- Submitting an application to law enforcement agencies or the court if a peaceful solution to the problem cannot be achieved.

The anti-collector is obliged to notify the debtor about all actions taken, the progress of the case, and also discuss controversial situations, if any.

Anti-collectors (did the bank sell the debt to collectors):

During the proceedings, it is possible to cancel the credit commission, illegally imposed insurance, and fines. You can combine several loans into one and go through the refinancing process. If necessary, a citizen can be declared bankrupt.

How to choose a company

The anti-collection agency in Moscow and other regions is not represented in a single copy, so the borrower is faced with the question of making the right choice - which organization to trust, so as not to later regret his decision.

It is recommended to pay attention to reviews about the organization and the period of its existence. If the company has been present on the market for a long time, and clients are satisfied with the services provided, then you can safely agree to cooperate. If there is minimal information about the company, and its period of activity is only a few months, then it is better to continue the search.

Choosing a reliable anti-collection organization can resolve all the debtor’s issues.

TAGS: anti-collectoranti-collectoranti-collectionanti-collection agencyanti-collectorsfirst anti-collection agency

Share:

How to open an anti-collection agency

Greetings, readers of Million Rubles, today we are interviewing entrepreneur Dmitry Guryev, from whom we will learn how to make money on the services of an anti-collector.

Dmitry, how did you become an entrepreneur? What were you doing before this?

Previously, I studied at the Saratov State Academy of Law. Then I worked in one of the district courts of the city of Saratov. He worked his way up from a court specialist (this is a position in the office - he issued copies of court decisions at the request of citizens, to an assistant judge).

Then he worked in the bailiff service. He came home and seized the debtors’ property. He arrested bank accounts and blocked the exit of debtors.

All this is public service, which has strengthened me in the professional sense of the word. On state service - responsibility, discipline and strict adherence to laws.

Plus, as a result of my work, I learned the “wisdom of work” of this or that government. organ, which I use beneficially in my activities today.

When I opened an anti-collection agency - many acquaintances, friends, relatives - EVERYONE! They twisted their finger at their temple and said, where did the debtors get the money? Why associate yourself with losers.

Everyone was against my leaving the government service “for free space.” Then I understood and applied one well-known saying - “If you are so smart, why are you so poor!” The point is that you don’t need to listen to those who have not achieved results in your matter, you need to take it and do it.

So I took it and did it. Happened.

Dmitry, why did you decide to open an anti-collection agency? How old is the business?

While studying at the Saratov State Academy of Law, I worked part-time, as students always lack money. And when I analyzed the service market, I noticed that all lawyers help creditors. Advertisements like “I’ll help you quickly collect your debt” appeared more and more often.

I thought, what about debtors? Who will help them? And he began to advertise.

There were barely enough clients, because few people at that time could even think about how they could help the debtor, how they could even reduce the amount of debt or, even worse, cancel it altogether.

In this prim way the first client in my life appeared. Naturally, Saratov is a city of lawyers, and I lost my first trial to smithereens. I didn’t even understand how this happened and then the judge declares that So and so’s claim will be satisfied. That's all. I thought I’d have to give the money back, but the client came for a second consultation and said, let’s work with the bailiffs!

That’s how I realized that anti-collection activities are not only about victories in court. Many people need moral support and reduction of financial burden at the stage of enforcement proceedings.

Official company statistics:

We have been officially operating since 2011. First, my wife opened an individual entrepreneur. Then in 2013 she closed the individual entrepreneur and we opened an LLC. Registered the trademark “Anti-Banker”.

But in an unofficial manner, I started from the bench of the Academy of Law. Yes, then there was a long break from working in government agencies. But during this break, I also underwent training, studied the work of government bodies.

Let me give you an example. You were not sent a copy of the court decision. You are already approaching the deadline for filing an appeal. But there is no solution at hand! What to do and who to complain about? Where to complain? All these questions are not difficult now. Why? Because I know the structure of a government agency from the inside: I know who is responsible for what, who is assigned to do what.

That is why in our company next to the logo there is an inscription - founded in 2001. Since 2001 I have been going to this business. Yes, then there was no business, no LLC, there was no Anti-Banker, no one knew me, there was no line of clients. There was none of this. Yes, and I never thought about it.

How do you even open such a company? Where can I get up-to-date information? Do you need a business plan and how to draw it up? Need a license?

How to open such a company?

An anti-collection agency, at its core, is a law firm that specializes in providing assistance to debtors. It’s simple – go to the tax office and submit an application to open an LLC or individual entrepreneur. And after a week you receive a OGRN certificate. Then you enter the OKVED code corresponding to the legal services and that’s it - the business is open - you have the right to advertise and attract clients.

Do you need a business plan and how to draw it up?

I didn't make any business plan. I just knew that the market was free (by the way, the market is still free - how strange it sounds!). And when there are no competitors, in my opinion, a business plan is not needed.

You may be interested in: Opening a sports club: healthy lifestyle to the masses

On the other hand, if there was a business plan, then the development of the company would be much easier and faster. Many mistakes would not have been made. We probably saved not a single hundred thousand rubles.

How to draw up a business plan is probably not a question for me. It’s better to ask accountants and economists. I read somewhere that a business plan should be drawn up by several specialists: marketers, financiers, accountants, economists and other specialists, and each specialist writes his own part of the plan.

The activities of a law firm do not require any license... There is a law on licensed types of activities. Activities in the field of law - there is no such activity, which means a license is not needed.

How did you understand the intricacies of the matter? Do you have any education?

By trial and error.

There is no magic pill. I didn’t like the wording in the agreement, for example, for cash withdrawals the debtor pays 1% of the withdrawn amount. What is this? Why is this happening?

I was looking for an answer to this question - I devoured a ton of literature, asked more experienced lawyers and attorneys, on legal forums.

I appealed this point in court. I looked and carefully studied how the court described and normatively explained this issue in its decision.

And so on for each point. Now I know about 15 main violations of the rights of Borrowers, which are found in almost every agreement.

Dmitry, what difficulties did you have at the beginning of your journey, and how did you overcome them?

There are many difficulties. But these difficulties, as they were before, are still there now.

The first is the lack of legal literacy among the population.

Many people do not understand why an anti-collection lawyer is needed. How can it help? Many people think about writing off the debt completely. But that's not true. Sometimes even a word or other support is enough to make the client satisfied.

On the other hand, in the West, before signing anything, a person turns to a lawyer to conduct a legal study of the document. Roughly speaking, a person goes to the bank with a lawyer, and only after his recommendation does he sign an agreement. We don't have this in our country.

The second problem is the banks themselves. When I first started, the banks laughed. They called me a scammer who helps other scammers not pay their loans.

Now banks are increasingly starting to launch information wars, writing about how anti-collectors cannot help people in any way. I am subscribed to changes to the main requests and see what is being written and discussed.

This all goes according to the “Order” of the banking machine. So that people do not seek protection of their rights, so that people do not believe in success.

The third is horror from television and the media. There they constantly talk about how the collectors were killed, blown up, or set on fire. And under such circumstances, people begin to understand that it is better to pay; they have no other choice.

There is always a way out, you just need to know in which direction to look for it. Currently, my number of partners has decreased, and it is difficult to fight the information war alone. When there are partners, it will be easier to solve these problems together.

Do you have an individual entrepreneur or LLC? Why? What is your tax regime?

First there was IP. Then it was closed. Everything is trivial - the wife became pregnant. And she gave birth to my son. I could no longer work and lead, because I was on maternity leave - you understand.

I opened an LLC. I just used to always dream of being the head of a federal LLC, a project, and so on... This is how AS and GID LLC appeared.

The tax regime is simplified. We have 6% of income. Many former partners had a simplified 15% of income minus expenses. We do not have and cannot have any other taxation system.

What services do you offer today? Maybe some other additional services?

We do not provide legal services - we offer solutions to solve financial problems. This is achieved through our debtor assistance system. It is the system that helps us feel comfortable in any lawsuit against any bank.

At the very beginning, the client orders a legal examination of documents. Both he and we need this. Before going into battle, it is necessary to conduct reconnaissance.

Legal examination of documents, or as we in the organization call ELE (electronic legal examination), allows us to identify violations that are included in the client’s agreement with the Bank, as well as prescribe specific actions that need to be taken in order to achieve the most successful result.

As a result of these actions, several options are obtained, ways to solve the client's problem. We are moving in one direction - for example, challenging a loan agreement due to its lack of funds. If you learn, good.

You may be interested in: Business idea: how to open a service station

And if not? And here a simple and ordinary lawyer has a question - additional payment for another trial. We have no additional fees. We go another way, then a third. We don’t know in advance which direction or path will work, but something will work in any case.

As a result, the client receives a result, which is expressed in solving his problem in several ways, ways, directions.

This system was patented, as a result of which we received the Anti-Banker trademark.

Our system works in any weather and in any frost.

Another example for convincing. Imagine a Rubik's cube. Can you assemble it? Right now?

It's all about the system. If you know the procedure (when and in which direction to turn the edge), then you will solve the Rubik's cube without any problems. If you don’t have a system, you will spin the Rubik’s cube forever and never solve it. This is what the system is all about.

How are sales going, is there any seasonality?

There are debtors in every family. There are no problems with clients at all. We don't even advertise. We don't need her. Just like that saying - a good product does not need advertising. There is also no seasonality - because people stop paying in summer and winter, problems can begin in spring and autumn... This is a clean business that is in demand in any weather at any thermometer.

How do you find clients? What kind of advertising do you use?

No, we're not looking. They find us themselves. We are one of the few who turn their clients into their friends. Word of mouth works very well for us. + our website with articles, step-by-step instructions on how to behave in a given situation. It's enough.

But to my surprise, advertising also works in the region - a recommendation from

- Judicial workers

- Bailiffs

- Collection agencies and banks.

Those. employees, when they see a hopeless client who is having a hard time, they refer him to us. And we take and fight for everyone.

Dmitry, how do you learn your business?

We have a school of anti-collectors for partners. In it we teach not only the theory and legal basis of our activities, but also practical activities.

Also at school we analyze the judicial practice of past years. Moreover, during training we use a one-on-one format, i.e. It turns out personal coaching for a partner. With this format, the partner receives maximum experience.

As for me – practice and law. For example, I take the Civil Code and open an article that interests me. For example, Article 381 of the Civil Code of the Russian Federation. I'm looking for case law on this issue. I'm taking notes. I'm adding it to the archive. Then if I come across news that changes something, I change it in the archives. So step by step. It's simple.

There is an opinion that it is difficult to find good employees. What do you think? How many employees are on staff? How do you select staff?

We currently have few employees - only three people. Me, my wife and an accountant. But I think finding good specialists is not such a big problem. The only question is time and money.

How long does work take and how do you plan your day?

In my opinion, Anti-collection is not a job, but a way of life. If you are born to help people, you don’t need weekends. There have been times when, on vacation on the Black Sea, we attracted clients to our network. We are known in Sochi, Anapa, and on the Crimean coast. And that's great!

We plan the old-fashioned way - with the help of a notepad and pen, where we write down the scheduled court hearings. On average, three to five meetings take place per day. In the evening you open it and see what you have tomorrow. In the evening you prepare the necessary documents, and in the morning you hand them over to the court and present them. This is how we work.

How much can you earn? Average? The biggest and the smallest earnings in a month?

There is no income less than 100,000 rubles. This is from my provincial region. If we include income from franchising, then the income reached up to a million a month.

What's the most unusual order you've ever had to fulfill?

In Saratov they recaptured 25 million. The arbitration court dismissed the case. Then the client left us, but I heard that the Bank was never able to repay the debt.

Have there been any funny incidents in your business?

He calls a client who lives in Astrakhan - a colonel of the Ministry of Internal Affairs from Rostov. And he says that a criminal case has been initiated against the debtor. The client calls us in hysterics. I had to calm him down. What’s funny is that the colonels don’t call their “suspects” at all.

You may be interested in: Carpet weaving as a business idea

3 main mistakes you made in your business

Answer: 1. I'm trying to do everything myself.

This happened very often. And the website, and writing articles on the website, and going to court and much more. It's all on me. You can not do it this way. Everyone should mind their own business, like on a submarine - everyone in their place. It's the same in business.

2. Little automation

It's fashionable now. Create your own newsletter, your own newsletter service, your own CRM system, your own program. I am against process automation. This is probably the biggest mistake.

And, despite the fact that I understand my mistake, I do not take steps to eliminate it. This is probably the third mistake.

3. I don’t work much with legal educational program. People love to improve their literacy levels. Especially in matters of fighting banks. I need to release more for people. I have everything for my partners, I have a well-functioning system. But it’s just not for people - the situation needs to be corrected.

What are your development plans? Are you thinking about starting a franchise?

- Resume franchising, recruit partners in every region of Russia.

- Eliminate legal educational program

- That's all the plans for now.

Dmitry, what are you doing now? Would you like to do this all your life?

Yes. I will never leave this market.

Dmitry, what does it take to become an entrepreneur? What kind of person do you think has the potential to become a successful entrepreneur?

First of all, the person who can take responsibility. It has become fashionable in our country to have everything and have nothing for it. It is necessary 1 to do something in order for something to happen, 2 to take responsibility if something goes wrong. Here is my opinion of what is important for an entrepreneur today.

There is an opinion that the client is always right. How do you think?

I never understood this wording. We are all human - we all make mistakes.

As for the meaning of the saying, I can say this. If the client considers himself right - for God's sake - let him try to defend himself as he sees fit.

Let him achieve at least a small reduction in the amount of debt. On my own, without the help of anyone. If it works, then yes, you’re right. No - that means sit down, client, and don’t rock the boat. A woman, when she comes to a gynecologist, she tells everything, without any “undercurrents”

Also in the legal business. I believe that in order to avoid a discussion about who is right and who is wrong, both need to work on this. The client, first of all, should tell the truth and nothing but the truth, so that later I won’t blush in court for something I didn’t know about. Well, the truth must also come from the anti-collector side. There are moments and questions that need to be answered not as the client wants to hear, but as it actually happens.

This is the essence of solving the problem.

Dmitry, thank you very much for your answers, and the last question: What advice would you give to a beginner opening an anti-collection agency?

It’s easier to open an anti-collection agency under the guidance of an experienced partner. I invite everyone to our franchise network. Just write and we will answer all your questions. Lately I have become interested in self-improvement. And guess what? Do you know what my favorite technique is? The technique is a deaf frog.

I already spoke about her in an interview. This is about not listening to those who have not achieved anything in this matter. On the contrary, listen to those who have achieved. If you want to help people, this is the business for you. You can learn everything if you have the desire.

And who knows, maybe in a year or two your name will be known.

Why is the frog deaf? A parable will tell about this. The frogs decided to hold a competition in the forest to see which of the frogs could climb the mountain the fastest. The mountain was very steep and when the other animals heard about the news, they all laughed - how can a frog climb such a steep mountain? - they said.

All the animals came to laugh at the frogs on the day of the competition. I was in a great mood. And all the frogs ran up the mountain. The animals laughed at this. Frogs began to fall from the mountain.

But one frog climbed higher and higher up the mountain. She didn't fall. And when she found herself at the top of the mountain, it turned out that she was deaf. She did not hear the reproaches from the animals and therefore managed to reach the finish line.

Here is such a parable - happiness and success to you.

How to identify scammers?

If the specialist you contacted offers services from the following list, then this means that this is a scammer:

- removing negative information from your credit history by erasing records of overdue loans;

- cancellation of interest on a issued loan;

- complete deliverance of a person from debt payment, cancellation of penalties before trial.

Real collectors cannot guarantee such results, so be careful and do not fall for the promises of fraudulent agencies.

You can also identify ungodly individuals by the following characteristics:

- Pay attention to how many lawyers work on staff. Often, fraudsters are hidden under the anti-collection organization, whose staff consists only of sales managers. However, there is not a single real lawyer.

- Consider the interior of the office. There are lawyers who have been working at the agency for a long time, which means there will be corresponding signs. For example, an archive with the files of previous clients.

You may be interested in our article: “How to correct your credit history by removing negative information from it?”

Current situation in the lending market

According to information from the United Credit Bureau, at the moment 11 million residents of the Russian Federation have overdue debt, the term of which is one day or more. As a result of the current state of affairs, many specialists have appeared who promise to help people resolve problems with bank debts. Such specialists are called anti-collectors.

In the last couple of years, the demand for anti-collection services has increased several times. It is impossible to assess the scale of their business, since there is no legislative definition of who an anti-collector is . Lawyers, human rights organizations, and scammers can offer their services in a similar role.

Bankers report that they receive requests from anti-collection agencies on a regular basis. Thus, Home Credit Bank receives approximately 10,000 lawsuits in 12 months.

The claims state a requirement to terminate the loan agreement and relieve the person of debt as a result of changes that have occurred in his life. Often a person claims that he would not have taken out a loan if he had known how his life circumstances would change. However, in such cases, banks almost always win.

Experts say that if a client, in a difficult financial situation, immediately turns to lawyers rather than to the bank, then he may waste money, time and the opportunity to come to an agreement with the bank, coming to a compromise that suits both parties.

Instead of output

If you fall into a fraudulent organization, instead of receiving help, you will only worsen your current situation. You are fully responsible for all actions committed by anti-collectors. Choose only trusted agencies with an impeccable reputation. Unprofessional lawyers can worsen your credit file and the bank's attitude towards you to such an extent that you risk being accused of fraud.

Read our article: “What to do if you have large loan debts and have nothing to pay them with? We are looking for a way out of the situation."