Citizens who previously regularly paid their loans are now unable to cope with their obligations. A study by the National Association of Collection Agencies, conducted in November 2020, showed that every fourth borrower is overdue for more than 3 months; there are already more than 10 million such debtors, and this figure is growing by 3-5% every year. Bankruptcy of financially insolvent Russians is regulated by Federal Law No. 127 of October 26, 2002 (hereinafter referred to as Law No. 127-FZ). At first, the normative act concerned only legal entities. In 2015, amendments were made to the law, and it began to regulate the bankruptcy of an individual. The process for declaring individuals insolvent is very different from the procedure provided for corporate debtors. It consists of other stages, has other conditions and consequences.

Who can benefit from bankruptcy?

Paragraph 1 of Article 213.3 states that an individual has the right to file for bankruptcy:

- the debtors themselves, and citizens are obliged to do this no later than 30 days from the moment they realized their insolvency, otherwise they face an administrative fine of 1 to 3 thousand rubles;

- bankruptcy creditors, financial institutions, other organizations or individual entrepreneurs;

- authorized bodies that recognize structures of the federal, regional or local scale, vested with the right to represent state interests in courts, to represent a subject of the Russian Federation or a municipal entity.

Expert opinion

Dmitry Tomilin

Experience more than 8 years.

Free consultation

To initiate a court hearing, the applicant is required to submit an application, which is indicated in Articles 213.4 and 213.5 of Law No. 127-FZ. When submitting a package of documents to the court, the applicant is obliged to transfer funds to the arbitration deposit account in the amount of the financial manager’s salary for one procedure for considering the case, as well as pay a state fee.

Customer Reviews

Feedback from Solovyova I would like to express my deep gratitude to lawyer Konstantin Vasilyevich Solovyov for his qualified assistance in resolving my issue. The decision was made in my favor, for which I am very grateful. I would also like to express my gratitude to the company’s team for their sensitive attitude towards clients.

Gratitude from Piskunov I.B. I just don’t have words to express my gratitude to Sergei Vyacheslavovich. Thank you for having such a lawyer. Thank you for your help regarding the issue regarding the employment contract.

Piskunov I.B. 12/12/2018

Gratitude to the team I express my gratitude to the legal team. department of St. Petersburg. for the service provided in terminating the loan agreement for the purchase of space. funds that I had the imprudence to enter into with one of the unscrupulous companies. The lawyers responded quickly, paid a visit to the company and filmed it. Once again I express my endless gratitude and wish you continued prosperity.

Review by Egorova A.N. I, Egorova Antonina Nikolaevna, am very pleased with the consultation of Yuri Vladimirovich Sukhovarov. Thank you for your attentiveness and understanding. I wish you further professional growth.

Gratitude from V.N. Skorokhodova Dear Alexander Viktorovich! Let me express my sincere gratitude to you for your understanding, sensitive approach to the situation, openness, emotions and professionalism. I wish you good luck, success in your work and prosperity.

Sincerely, Skorokhodova V.N.

Gratitude from A.S. Astafieva I express my gratitude to the Legal Agency and in particular to lawyer Alexander Viktorovich Pavlyuchenko for the work done, high qualifications and high-quality approach. Thanks to Alexander Viktorovich, we managed to achieve a result in court in a case on the protection of consumer rights that I did not even expect. The amount recovered in court even exceeded my expectations. Thank you very much for your qualified work and professionalism.

Sincerely, Astafieva A.S., 03/01/2019

Gratitude from gr. Tiuntsova G. A. I asked for advice from your “Legal Agency of St. Petersburg” - regarding deception by one person who presented himself as an employee of Rospotrebnadzor of the Krasnoselsky district, Novichkov A. A. Offered me a service - before the New Year, go on a tourist trade union voucher to Moscow on the Sapsan railway transport. I refused due to the manipulation of the placement of seats - in different trains, and then by car. Lawyer Sergei Vyacheslavovich Mavrichev handled this case and provided consultations. I thank you for such a sensitive and attentive attitude in office work, which was denied at the 58th police department of the Vyborg district, under Art. 24, 144, 145 of the Code of Criminal Procedure of the Russian Federation, I now have the right to appeal the conclusion and will send an application for further investigation to the district prosecutor's office.

Tiuntsov G. A.

8

Gratitude from gr. Bogodyazh N.G. I, Bogodyazh N.G. turned to the Legal Agency of St. Petersburg for help in a dispute with the company RTC JSC regarding the refusal to return the goods in accordance with the rules of trade, thereby my consumer rights were violated.

Thanks to the company’s lawyer, Stepanov D.Yu., I was able to return the money for the low-quality product, and I also received an apology from my opponent. I would like to express my gratitude for the qualified assistance provided to me by D. Yu. Stepanov and the Legal Agency of St. Petersburg.

With gratitude, Bogodyazh.

Customer Feedback We thank the employees of Legal Agency of St. Petersburg LLC and, first of all, Yana Maksimovna Matveeva and Andrey Valerievich Ermakov for their highly qualified and thorough consideration of our issue and the prompt solution to our housing problem.

Also to Daria Valentivna Kutuzov for her attentive and friendly attitude towards visitors.

Gratitude from Remedova A.G. I express my gratitude to the Legal Agency of St. Petersburg, namely Denis Yuryevich Stepanov, for the assistance provided in resolving my issue, and I also express my gratitude to the entire team of the consumer rights protection society for their responsiveness and pleasant communication.

Remedova A.G. 08/17/2018

In what cases is an individual declared bankrupt?

Article 213.3 of Law No. 127-FZ specifies the circumstances under which a citizen must declare himself bankrupt:

- the total debt to all creditors is at least 500 thousand rubles;

- debt period - more than 3 months from the date of occurrence of payment obligations

Many people are interested in the question: can banks file for bankruptcy? They can. If the application is submitted by a bankruptcy creditor or an authorized body, then only the amount of debt for a specific person whose interests they represent is taken into account. The amount of delay is the same. Bankruptcy creditors and authorized bodies can initiate bankruptcy proceedings only if there is a valid court decision that confirms the claim of debt creditors. The document indicates the reasons why the debtor is declared bankrupt. Documents confirming the debtor’s obligations and his insolvency are attached to the application.

Arbitration manager Bankruptcy of individual entrepreneurs Bankruptcy of individuals

At his own discretion, the debtor may file for bankruptcy under other circumstances:

- the amount of unpaid obligations is less than 500 thousand rubles, but the person is sure that he will not be able to repay current loan payments on time;

- the period for mandatory payments has already expired;

- More than 1 month has already passed since the moment when the amount of 10% of all debt obligations was due to be paid;

- the value of the property owned by the debtor does not cover all debts;

- The bailiffs sent a notification that the enforcement proceedings had been completed due to the impossibility of collecting the required amount of debt from the citizen.

In such a situation, the debtor will have to prove to the court that his demands are fair. To do this, it is necessary to collect documents confirming the above circumstances. The court may find that the facts provided are insufficient and refuse to accept the application. In this case, you need to find out the reason for the refusal and supplement the package of documents.

Cost of services

The first consultation with a bankruptcy lawyer in our agency is free of charge. The specialist gives a comprehensive answer to the visitor’s main questions about the legislation on bankruptcy of organizations. All other specialist services are paid.

The cost of legal support for bankruptcy cases depends on a number of factors:

- required scope of work;

- the amount of the defaulter’s obligations (volume of the bankruptcy estate);

- urgency and complexity of the matter.

If the procedure requires the involvement of additional specialists for expert assessment, the cost of legal support may be adjusted.

Competent lawyers of our agency in St. Petersburg will not only accurately calculate the amount of a bankrupt’s debts, but will also provide high-quality solutions to other problems:

- development of an optimal strategy for interaction with third parties;

- collection of documentation for trial;

- ensuring interaction with arbitration managers;

- drawing up a debt restructuring schedule;

- control of the legality of the procedure, preservation of the debtor’s property.

15 years of experience in the legal services market

Legal Agency of St. Petersburg was founded in 2004 and has been successfully operating for 15 years

30 experienced specialists

Our team consists of competent lawyers and attorneys with narrow specialization in certain areas of law

10 years minimum legal experience

All consultations are conducted by lawyers with experience in successfully resolving similar situations, which ensures maximum assistance to the client.

91% of cases won

The results speak for themselves - since 2004, 3,756 cases have been won, 5,073 clients have been satisfied, and 874,474,045 have been paid to them

72% of appealed court decisions

We take on cases of any complexity and at any stage of the process, but the sooner you contact a specialist, the more likely a positive outcome of the case is

24 hours on call

We are ready to handle your case from start to finish, accompanying and supporting you throughout the entire process.

With the help of our specialists, the insolvency case will be completed faster, calmer and with the least losses for the bankrupt. We provide legal services to debtors themselves and their creditors who want to receive their money in full.

| | | |

Pros and cons of bankruptcy of an individual

Among the positive points it should be noted:

- the issue with debts will be resolved, you will not have to endure reproaches from creditors and communicate with annoying collectors;

- debts will no longer increase, the accumulation of interest will stop, fines and penalties will not be charged;

- the debtor will not lose more than what he owns at the time of bankruptcy.

All debts on loans, taxes and payments to government agencies will be written off, even those that have not been repaid in full, but in the case of paying alimony debts and compensation for harm to someone else’s health and life, this rule does not apply. Of course, there are disadvantages: the debtor’s reputation will be damaged, the credit history will deteriorate, and it will be difficult to borrow again; until the end of the procedure, you are not allowed to travel abroad, but for a good reason, for example, to attend the funeral of a close relative, you will be allowed to go; the procedure is expensive. But all the disadvantages are nothing compared to freedom from debt obligations and a quiet life.

Would you like to write off all your debts?

A free consultation with our specialists will allow you to compare risks and take the first steps towards bankruptcy.

Send a request

Individuals went bankrupt

In Russia, the law on bankruptcy of individuals has come into force. In the Samara region, during its operation, the arbitration court received about a hundred claims for bankruptcy of individuals, and in most cases the debtors themselves filed applications to the court. Although there are several lawsuits from banks. However, according to some experts, for now credit institutions have taken a wait-and-see approach. In general, representatives of the banking industry interviewed by Kommersant Bank, as well as lawyers, assess the law positively, although they note that there are some controversial issues in it, and new amendments are still awaiting the document.

- legislation -

On October 1, amendments to the Law “On Insolvency” regarding bankruptcy of individuals came into force in Russia. This bill has been in preparation for more than ten years. It was approved at the end of last year and was supposed to come into force on July 1, 2020. However, in mid-June it was decided to postpone its launch to October. This was explained by the unpreparedness of arbitration courts to consider these cases. If we talk about the Samara region, then the number of claims for bankruptcy of individuals, according to the file of arbitration cases of the Supreme Arbitration Court, as of November 23, 2020, is about 100. Moreover, most of them are claims received from the debtors themselves, that is, the so-called applications for self-bankruptcy. But there are also several claims for bankruptcy of individuals from banks, including Rusfinance Bank LLC, Nordea Bank OJSC and Joint Stock Bank GPB-Ipoteka OJSC.

Court and case

According to amendments to the bankruptcy law that came into force on October 1, a citizen who is unable to pay off his debts can apply to the court with a request to declare him bankrupt. The creditor can also initiate the same procedure against the debtor. Applications are submitted to the arbitration courts at the place of residence of the defendant.

Creditors, which may include the tax service, have the right to apply to the court for bankruptcy of an individual if the debt is at least 500 thousand rubles and the delay in its execution is three months. To open a bankruptcy procedure at the initiative of the debtor himself, there is no lower threshold for the amount of debt. However, if the liabilities exceed 500 thousand rubles and the person is unable to pay all creditors, then he is obliged to apply for bankruptcy within 30 days. As noted on the portal “EsliBankrot.rf”, “if there are circumstances clearly indicating that he is unable to fulfill his obligations within the prescribed period, the debtor has the right to file for bankruptcy regardless of the amount of the debt.”

When filing for personal bankruptcy, a citizen must provide the court with a very extensive package of documents, including information about property, debts, as well as all transactions for the purchase or sale of movable and immovable property over the past three years, the amount of which exceeds 300 thousand rubles. In addition, when submitting an application, a citizen will have to pay a state fee of 6 thousand rubles and deposit 10 thousand rubles with the court to remunerate the financial manager.

Procedural points

The law provides for three options for developing a bankruptcy case for an individual - debt restructuring, sale of property and a settlement agreement. As explained on the portal “EsliBankrot.rf”, debt restructuring is a rehabilitation procedure that is introduced for three years, its plan is approved by the court. The purpose of this procedure is to fully pay off debts, using the relief provided by the law. From the moment the restructuring plan is approved, the accrual of penalties, fines, penalties, as well as interest on all obligations, with the exception of current payments, ceases. Restructuring is possible if the debtor has a source of income and subject to a number of other conditions provided for by law.

Also, by analogy with the bankruptcy of legal entities, it is possible to conclude a settlement agreement if the debtor and creditors were able to agree on the terms of debt repayment that suit all parties. The conclusion of a settlement agreement is possible at any stage of a bankruptcy case. It is worth considering that if the debtor does not comply with the terms of the settlement agreement, creditors have the right to apply to the court with a demand to resume the bankruptcy procedure.

If the parties were unable to agree on the terms of repayment of the debt or if the debtor did not comply with the restructuring plan, a procedure for the sale of property is introduced. Thus, a person is declared insolvent and the process of selling his property begins. Under this procedure, through the sale of the debtor's property, debts to creditors are proportionally repaid. As explained on the portal “EsliBankrot.rf”, “that part of the debt to creditors that could not be returned as a result of the bankruptcy procedure due to the insufficiency of the debtor’s property is considered repaid, and the debtor is considered free from obligations to creditors.”

Banks are cautiously positive

Timur Nigmatullin, a financial analyst at IH FINAM, notes that, in his opinion, the bankruptcy procedure has so far had virtually no effect on the activities of banks, their financial and operational performance. “Given the current dynamics, we can assume that at best, approximately 50-100 thousand applications will be submitted per year, which is insignificant on the scale of the domestic banking system. In the region, it is unlikely that more than five hundred such applications will be submitted per year,” says Mr. Nigmatullin. The main factor limiting the number of applications submitted in the regions, in his opinion, is the high debt threshold and the low level of information among the population. “In general, the adoption of the law has clearly led to some simplification and standardization of the procedure for banks to work with debtors. Thus, as statistics show for the first 1.5 months of the law, only about half of the applications for bankruptcy were filed directly by the debtors themselves,” notes Timur Nigmatullin.

According to the chairman of the board of Yugra Bank, Yuri Gusev, banks reacted positively to the bankruptcy law, because it spells out in detail the mechanism for collecting debts from individuals. But, according to Mr. Gusev, it is too early to talk about the practice of conducting such cases. “However, we believe that such a law will simplify work with debtors, because it regulates transactions with clients’ property, and the mechanism for its implementation is clear. This law accustoms people to financial discipline, because in the future it will be difficult to get a new loan, and a ban on engaging in entrepreneurial activity is introduced for a year,” notes Yuri Gusev.

Anastasia Tsurtsumiya, director of the retail lending department at Loko-Bank, in turn, notes that there is no clear assessment of the law yet. “In relation to Loko-Bank’s total portfolio of individual borrowers, cases of filing for bankruptcy are rare. I don’t think that banks will actively initiate bankruptcy proceedings. According to the law, if the debtor does not have funds sufficient to pay the expenses in the bankruptcy case, the applicant in the bankruptcy case is obliged to pay off these expenses in the part not paid from the debtor’s property. And these are extra financial costs for the bank if it was the bank that initiated this procedure. In addition, if there is collateral for a loan, when it is sold through bankruptcy proceedings, the bank, by force of law, in most cases is guaranteed to receive only 80% of the value of such property, while in enforcement proceedings - 100%,” says Ms. Tsurtsumiya.

Koshelev Bank JSC said that the credit institution has not yet filed such applications in court. Banks are wary of the new mechanism and often take a wait-and-see approach, since at the moment the practice of applying the law on bankruptcy of individuals has not yet developed. Among the changes in working with clients, bank representatives note the complication of some procedures related to the control of payments on individual accounts, in accordance with the requirements of the new law. Among the positive aspects, they highlight the possibility of initiating the return of withdrawn assets to the bankruptcy estate when the bank receives information about such acts, which is important in the case of unsecured loans. “In our case, the absolute majority of loans in the portfolio are collateral, so initiating bankruptcy procedures for clients is not relevant for us,” added Koshelev Bank.

But Sberbank, according to its press service, has already applied to the courts with such statements. As Kommersant-Bank was told, Sberbank mainly filed bankruptcy petitions for guarantors for loans to legal entities, but bankruptcy petitions were also filed for borrowers on mortgage loans and borrowers who provided other liquid collateral. “Long-term practice of collecting debts from legal entities shows that the bankruptcy tool is more effective than other methods of collection (for example, enforcement proceedings). This tool is more flexible than enforcement proceedings. Thus, if in enforcement proceedings it is not possible to sell the pledged property at two auctions, the pledge may be terminated. In bankruptcy, after this, you can begin the procedure of trading for a decrease, the so-called public offer. Therefore, in our opinion, the bankruptcy procedure for citizens should be quite effective. In addition, the legislation allows the debt of citizens for whom bankruptcy proceedings have been introduced to be written off immediately after the start of the procedure. Therefore, this law can help creditors; at the same time, it also corresponds to the interests of bona fide debtors who, due to objective circumstances, cannot fulfill their obligations,” the Sberbank press service notes.

Irina Andreichenko, director for retail business at the Samarsky operating office of Alfa Bank, previously reported that the bank has a refinancing program for clients who have objective difficulties with income. “To do this, you need to contact the department, provide documents, confirm your position and still try to stay within the framework of contractual relations, and not bring the matter to some kind of court. Moreover, bankruptcy is still not a painless procedure; it imposes certain restrictions on the client,” explained Mrs. Andreichenko.

Plus to minus

Lawyers interviewed by Kommersant Bank generally assessed the introduced amendments positively, but noted that there are certain shortcomings in the law. Thus, the managing partner of the RBL law office, Dmitry Samigullin, generally assessed the amendments to the Insolvency Law that entered into force on October 1, 2020 as positive and necessary. According to Mr. Samigullin, a significant amount of debt has accumulated in recent years, and the law on enforcement proceedings can no longer cope with the situation. “There were fears that there would be a flood of applications and that the courts would not be able to cope. But, as I predicted, this did not happen,” added Mr. Samigullin. In his opinion, the law benefits both creditors and debtors. “For creditors, it expands the possibilities of debt collection and provides a fairly wide range of tools. The debtor has the opportunity to clear himself of debt,” says Dmitry Samigullin. True, in his opinion, there is still one controversial point in the law - this is the amount of remuneration for the financial manager, which is 10 thousand rubles per procedure. On the one hand, the amount of remuneration for the financial manager is very small, explains Dmitry Samigullin, but he continues by adding that due to the fact that these costs fall on the debtor, bankruptcy itself becomes not so cheap. “It turns out that even if you want to go bankrupt, you must have a certain amount,” notes Mr. Samigullin. Maxim Lavrov, a lawyer at the Vegas Lex law office, also says that the cost of a financial manager’s work, established by law, can cause difficulties. Arbitration manager of NP SOAU "Mercury" Alexander Bratyashin, in turn, said: “I and all my acquaintances said the main thing - we will never bankrupt individuals. The matter is complex, little known and unpromising.”

Maxim Lavrov also noted that the law has both pros and cons. Thus, according to him, the document protects the interests of banks in terms of, for example, the possibility of challenging debtor transactions. Debtors, as he emphasizes, with the introduction of this law have the opportunity to write off their debt. Although, as Maxim Lavrov adds, the bankruptcy procedure is very difficult and takes about a year. Banks, according to him, are now filing lawsuits to a greater extent against large debtors whose debt exceeds 10–20 million rubles. “But now all banks are in the process of developing a position regarding the remaining debtors. There is an opinion that bankruptcies initiated by banks will be widespread,” suggests Maxim Lavrov.

According to Mr. Lavrov, those citizens who are now the first to file claims for their own bankruptcy are in a better position than those who can initiate this procedure later. He explains his opinion by the fact that subsequently a number of provisions of the law may be tightened. In particular, according to Mr. Lavrov, adjustments may be made to the cost of the financial manager’s work, the amount of transactions that the debtor must show when opening the procedure, and other points. “But now, of course, all this is at the level of assumptions,” Maxim Lavrov emphasized. By the way, according to Mr. Lavrov, the relatively small number of self-bankruptcy applications filed may well be due to the low awareness of citizens and the fact that they do not fully understand all the requirements of the law. At the same time, he emphasizes that the law has a provision obliging debtors to file for their own bankruptcy if they show signs of insolvency and their debts amount to more than 500 thousand rubles. And failure to comply with this provision, according to Maxim Lavrov, can lead to serious consequences - even to the point that the court, having declared a person bankrupt, may refuse to write off his debts.

Ekaterina Borisenkova

What debts are written off when an individual goes bankrupt?

According to Law No. 127-FZ, declaring an individual bankrupt entails writing off debts:

- under loan agreements with banks;

- for loans taken from microfinance organizations;

- on borrowed funds received from other citizens, individual entrepreneurs and organizations;

- on taxes and fees to state funds.

It is not allowed to write off debts: for alimony obligations that arose after causing harm to health and life (compensation for damage); resulting from a crime committed; formed after bringing a citizen under subsidiary liability, if the debtor, through his actions, brought the company to bankruptcy; compensation for damage caused to the property of other people, fines received as a result of an administrative or criminal offense.

Main stages and procedures for bankruptcy of an individual in an arbitration court

Article 213.2 of Law No. 127-FZ specifies the scheme for conducting the bankruptcy process for citizens:

Stage 1. After the court has accepted an application for recognition of financial insolvency, it will consider the validity of the claims within 15 days; in complex situations that require additional verification of information, the period can be up to 3 months.

Stage 2. If the debtor did not submit the application himself and did not choose a financial manager, the court itself proposes its candidacy from among the participants registered in a special self-regulatory organization. The requirements for such a person are presented in Article 45 of Law No. 127-FZ.

Stage 3. A debt restructuring procedure is underway. It allows the debtor to pay off obligations on his own by paying fixed amounts to creditors every month. According to the requirements specified in Article 213.3 of Law No. 127-FZ, restructuring is permitted in relation to a person: having a permanent stable income; not brought to administrative or criminal liability for crimes in the economic sphere; not being a defendant in bankruptcy cases within the next 5 years; not having financial obligations for which a repayment schedule has already been drawn up over the next 8 years.

Would you like to write off all your debts?

The total restructuring period cannot exceed 3 years. Article 213.21 of Law No. 127-FZ states that during this period changes may be made to the plan when they are proposed by creditors. If the changes were proposed by the debtor, then they must be approved by arbitration, after which copies of the amended plan are sent to all creditors. After the expiration of the period specified in the document, the financial manager submits a report to the court in which he prescribes the fulfillment of the terms of the restructuring. If the debt repayment schedule is violated, creditors turn to arbitration, and the last stage of the bankruptcy process comes.

If the debtor meets all these requirements, the financial manager draws up a plan according to which the debts will be repaid. The document must indicate the amount of debt owed to each of the creditors, the terms and conditions for the return of funds. This plan is signed by all participants in the proceedings, and it is submitted to arbitration for approval.

Stage 4. The court declares the debtor insolvent, his property is put up for sale, and the proceeds are used to pay off the debts. Property necessary for the debtor to run a household and lead a normal life is not accepted for sale. Also, the only apartment in which the debtor lives is not subject to sale.

Would you like to write off all your debts?

A free consultation with our specialists will allow you to compare risks and take the first steps towards bankruptcy.

Send a request

No later than a month after the description and assessment of the debtor’s property, the financial manager submits to the arbitration court a regulation on the process of selling the property, indicating the terms, conditions, procedure and starting price of things, equipment and real estate. This provision is approved by the court, its form and content must comply with Articles 110-112, 139 of Law No. 127-FZ. Upon approval of the document, a determination is issued, which participants in the bankruptcy procedure can appeal. If the property is located outside the Russian Federation, another determination is drawn up, which is executed in accordance with the legislation of the country in whose territory such property is located, or the terms of international treaties between this state and Russia are applied.

Expert opinion

Dmitry Tomilin

Experience more than 8 years.

Free consultation

The legislation establishes that a bankrupt’s property is sold at public auction, but the meeting of creditors has the right to choose a different procedure for sale. Luxury items whose value exceeds 100 thousand rubles are required to be put up for public auction.

How to successfully go through the bankruptcy procedure at the MFC

After filing a bankruptcy application through the MFC, employees check the information. Within 24 hours, they must send an electronic request to the FSSP to clarify the availability of open enforcement proceedings. If they are absent, then the MFC employee will be obliged to publish information on the recognition of a citizen as insolvent on the EFRSB within 3 days.

From this moment on, the extrajudicial procedure for declaring a citizen insolvent begins. A 6-month observation period is introduced, during which:

- The debtor is prohibited from obtaining new loans

, credits, acting as a guarantor and making other security transactions. Even a popular microloan in an MFO, issued during the observation period, will become a reason for canceling out-of-court bankruptcy. - A restriction is introduced on the repeated initiation of enforcement proceedings

. Exception: collection of payments affecting the identity of creditors and collection of debts to creditors not specified in the application. - The accrual of penalties

, penalties and penalties for late payments is suspended. Bailiffs, representatives of creditors and collectors temporarily lose the right to interact with the debtor. - The debtor is obliged to notify the MFC

about a significant improvement in his financial situation within a 5-day period: accepting a gift or inheriting property, taking possession on the basis of cancellation of transactions. We are talking about assets that can be used to fully or partially satisfy the claims of creditors during the judicial procedure for the sale of property. This rule does not apply to property assets listed in Art. 446 Code of Civil Procedure of the Russian Federation. - Creditors have the right to submit requests

to official state registration (accounting) bodies. If his property is discovered, creditors have the right to apply to the Arbitration Court and transfer the pre-trial bankruptcy within the framework of the standard judicial procedure for recognizing the financial insolvency of a citizen.

Important:

creditors who were intentionally or accidentally not included by the debtor in the list when filing an application (for example, to reduce the final amount of debt in order to fall under the conditions established by law) have the right to apply to the court to declare the debtor bankrupt according to the standard scheme.

To successfully complete the monitoring procedure and write off debts through the MFC, a citizen will have to:

- make the most detailed list of creditors;

- do not enter into property rights in the next six months;

- do not apply for credits or loans throughout the entire procedure.

Before filing for bankruptcy through the MFC, be sure to check whether you really meet the conditions of the out-of-court procedure. For creditors, submitting an application to the MFC means unequivocally writing off your debt without the possibility of even partial repayment.

And it is quite logical that they will look for anyone capable of transferring bankruptcy to the judicial level. Therefore, your slightest mistake, inaccuracy or deliberate distortion of facts will be used to the maximum by creditors.

What consequences await the debtor after bankruptcy?

In accordance with Article 213.30 of Law No. 127-FZ, the rights of a debtor in bankruptcy of individuals include several points:

Useful articles

Law on bankruptcy of individuals No. 127-FZ

Financial manager in bankruptcy proceedings of citizens

Application for bankruptcy of an individual

- You cannot apply for loans without first notifying the financial institution of your bankruptcy status.

- For 5 years, the debtor cannot apply for bankruptcy proceedings again.

- For 3 years, the debtor does not have the right to hold the position of top manager in organizations. He is prohibited from holding managerial positions in insurance companies and investment funds for 5 years, and from banks and other credit institutions for 10 years.

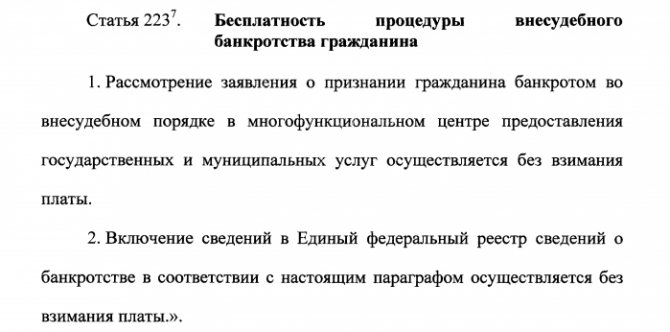

Cost of out-of-court bankruptcy

Declaring insolvency under an out-of-court scheme will be free for citizens.

The law does not provide for the payment of state duty and other expenses

However, the bankruptcy law through the MFC introduced additional items of expenses for the debtor related to ensuring the progress of the procedure. Eg:

- An application for bankruptcy is filed by the debtor or his representative acting in his interests. Here we are talking not only about paying for a lawyer’s services, but also about the costs of notarizing a power of attorney.

- The refusal of the MFC to conduct the procedure can be challenged in the Arbitration Court. Arbitration disputes are a rather complex part of judicial practice, and it often becomes difficult for a citizen to achieve the protection of his rights in court. Which will cause additional costs for the representative.

- Creditors will try their best to transfer out-of-court bankruptcy into a judicial procedure. Since banks often have entire teams of lawyers on their side, capable of confusing not only the court, but also the debtor himself, it will be very difficult for a citizen to resist them alone. Which again entails the cost of a representative.

You can find out the real cost of out-of-court bankruptcy and check whether it is right for you from our credit lawyers. For advice and to receive a personal offer for legal debt relief, call us by phone or ask your question online.

Assistance in completing out-of-court bankruptcy

A lawyer will call you back in 1 minute and provide advice. It's free.

How much does bankruptcy of an individual cost?

The price for the bankruptcy procedure is divided into several components:

- Pre-trial and legal costs. Before submitting an application to arbitration, a state fee of 300 rubles and postage costs of 100 rubles are paid. Legal costs are considered to be: publication in the Komersant newspaper - 11,000 rubles, several publications in the Unified Federal Register of Bankruptcy Information - 430 rubles, other expenses of the financial manager in conducting the case - up to 3,000 rubles.

- The financial manager's remuneration is 25,000 rubles deposited with the arbitration court. If debt restructuring is introduced first, and then the sale of property, the amount will be 50,000 rubles.

- Price for legal assistance. This includes: assistance in collecting documents, representation in court, consultations, resolving controversial issues in arbitration and with creditors. On average, the cost of such work starts from 50,000 rubles.

In total, we get an amount starting from 89,400 rubles. But it may differ in each law firm; much depends on the experience of the specialists, the region of residence of the debtor and the pricing policy of the firm.

How much does it cost to declare bankruptcy when involving lawyers?

It is no coincidence that bankruptcy is singled out as a separate area of legal services and stands everywhere as a separate, unrelated procedure. This is due to the fact that it is impossible to declare oneself bankrupt on one’s own - it is still necessary to involve a financial manager, who is an intermediary between the debtor, creditors and the court. However, the difficulties do not end there. Finding a good financial manager, a member of an SRO, is difficult; not all SROs provide specialists, because it is not always possible to find a professional at the right time. It is impossible to submit an application to the Arbitration Court without a financial manager.

The procedure itself is complex, especially if it is necessary to preserve property and housing. In order to minimize risks and get help with paperwork, it is best to involve a lawyer who deals with bankruptcy cases to work on the case. There is no point in asking for help from a generalist firm, since bankruptcy requires an approach with extensive experience, and such lawyers can only be found in specialized firms.