Individuals have been able to declare themselves bankrupt only since 2015. Previously, only legal entities had the right to declare financial insolvency. At this time, more and more people became insolvent and could not pay loans, mortgages and other debts that arose. This provoked an increase in the number of “criminals” who did not pay their debts. In order to at least partially compensate for the losses of creditors and allow debtors to legally get out of a difficult financial situation in a crisis, the possibility of bankruptcy for individuals was approved. There are many reviews online from individuals who have gone through bankruptcy proceedings. Judging by the statistics of the past, 2020, the majority of bankruptcy cases for individuals were successful, and reviews will help you verify this.

List of cases

There is little information available to citizens about bankruptcy of individuals. Many do not take advantage of their right to recognition of financial insolvency and the benefits that follow, simply because they are not aware of this possibility. Citizens who have undergone the procedure often leave feedback on their impressions, sharing their experience with people who are yet to undergo the procedure.

First of all, you need to know the list of cases that can become a compelling argument for declaring bankruptcy. Citizens can apply for this status if they meet the basic requirements:

- The first criterion is the amount of debt. For an individual, the debt must be at least half a million rubles. This does not mean that such a large debt should be owed to one creditor. This may be the sum of all the debts the alleged bankrupt has, for example, taxes, loans from several banks, loans. But debts must be monetary, not property. That is, if the debtor borrowed a car and does not return it, this does not apply to the bankruptcy case. Only if the debtor borrowed money for which he bought the car;

- The second criterion is that the overdue period must be at least 3 months from the last payment. But it is not recommended to delay it longer than expected.

To obtain status, you need to contact the relevant authorities (local administrative court). They can do this:

- Debtor;

- The lender, if it is an organization;

- The bank issuing the loan;

- Tax service.

It is the duty of every debtor to declare himself bankrupt before the bank if he sees that he cannot cope with financial responsibility. A person must do this 30 days from the moment he learns about his financial collapse. If this is not done on time, the judge has the right to impose an additional fine. The court may accept the application for a smaller amount, but only if this amount of debt exceeds the value of the debtor's property.

True, bankruptcy is not the only way out of the situation. The following measures may be taken:

- Debt restructuring. The terms of the contract (term, amount or repayment procedure) change.

- Confiscation of property. It is carried out if the money was issued on the security of things, real estate and other property.

- Settlement agreement. It is carried out if the participants in the trial agree on conditions that suit all parties.

But each case is original in its own way, so solving bankruptcy issues must be approached individually.

What consequences await creditors?

If we consider reviews about filing bankruptcy for an individual, then it is worth paying attention to the financial organization itself. Of course, for financial institutions that previously issued a loan to a citizen, it is absolutely unprofitable if the court declares him bankrupt.

First of all, you need to take into account that any law has certain loopholes that some unscrupulous debtors successfully take advantage of. They study the requirements in advance and understand in what situations they may face bankruptcy and, accordingly, not repay the loan at all. That is, they deliberately fall into arrears and do not pay their debts, so that in the future the bank can file claims exclusively with a judicial authority.

In addition, there is a huge likelihood that the borrower will be offered a debt repayment period that is too long in court. Moreover, the interest rate on the loan is often significantly reduced.

Also, in this case, the bank will not be able to collect interest or penalties, since during the consideration of the case and after the individual is declared bankrupt, all these costs are frozen.

Myths about personal bankruptcy

Since the law is relatively new, and reviews about bankruptcy of individuals are different, many myths have appeared regarding the topic of bankruptcy of ordinary citizens. The most popular of them:

- “Bankruptcy in the Russian Federation is intended to make people homeless, without a penny to their name.” In fact, the law has a whole list of property, sometimes very valuable, that cannot be taken from the debtor. This also applies to the roof over your head.

- “The appointed financial manager can control the entire life of the debtor, disposing of his property as he pleases.” There is also an error in this statement - the manager has a clear list of powers and responsibilities. If the manager goes beyond his powers, he will be held accountable to the law.

- “The debtor does not have the right to go on vacation abroad or leave the Russian Federation for any other reason.” In this case there is some truth. It is really impossible to rest, because it is assumed that the debtor has financial difficulties. But the ban can be lifted for those who have a good reason. For example, an illness requiring treatment abroad. When the bankruptcy procedure is completed, the travel ban will be lifted.

- “A bankrupt person should have no income.” Incorrect statement. According to the law, persons whose income has decreased so much that the person has lost the ability to pay bills and pay debts are recognized as bankrupt.

- “One loan can be declared bankrupt.” No. Bankrupt is a person who cannot pay off various types of debts (receipts, loans, credits, taxes).

- “Filing for bankruptcy is simple and cheap.” Wrong. Submitting an application is only the first step, which, along with collecting documents, is followed by a long and costly procedure. The most expensive services of a financial manager. A competent specialist will work for at least 60 thousand rubles, although the specific amount depends on the region.

- “The debtor’s relatives can pay for debts.” It is not true. Debt obligations are transferred to the relatives of the debtor if they act as his guarantors.

- “If the bank (other lender) has its license taken away in the process, the loan is repaid.” The debt is not paid off completely, although there are consequences. The debt must be repaid in full, as it is transferred to other institutions. That is, the debt remains, but the creditor changes.

- “Bankruptcy gets rid of debt.” To pay off a debt and obtain bankruptcy status, you need to prove that you are insolvent. Moreover, the debtor must have an impeccable credit history before financial difficulties. In addition, there are some debts that will not be written off from the debtor. For example, debt for alimony, salary, utility bills, etc.

The practice of bankruptcy is new, and the reviews that some people write are not entirely true, creating many myths.

Bankruptcy procedure for an individual: reviews

Bankruptcy of individuals - reviews of persons who were assigned the status of insolvent during the trial:

- Igor. I will speak to the point. Bankruptcy of individuals persons - this is a rather expensive procedure, but you can use workarounds. In this case, you won’t have to break the law, you just need to save a little on specialists and also draw up an application to the arbitration court yourself. I had loans in the amount of 300,000 rubles, and I could not cope with monthly payments. In order to go through personal bankruptcy. persons, I spent about 40 thousand, of which: 6 for the state. fee, 20 for hiring a competent lawyer (of course, there are more expensive ones, but I was confident in this specialist), 14 to pay for the services of a financial manager.

- Anatoly. About bankruptcy of individuals. I learned the faces from a work colleague when I was in an almost hopeless situation. I took out loans for a car, after a while I was fired from my old position, and I lost the opportunity to regularly make payments to several banks. It was at this point that I turned to the arbitration court, as I had read other people's comments about the procedure. I would like to note a few details: it will not be possible to cheat or circumvent the law in any way. The fact is that the bank will be able to dot all the i’s within a month, so fraud is unlikely to go unnoticed. Bankruptcy of individuals persons – a procedure that lasts from 9 months. That is, the debtor will know the final result in about a year. Collectors will press you, it’s a fact - when they don’t get paid, they get angry. Naturally, the law provides some protection in such situations, but a person will still have a hard time. By the way, if the debtor does not repay the loan within 5 years, then bailiffs will begin to evaluate and sell his property - this, again, is the law. But overall, I'm glad I did it this way. I’m not one of those people who neglects a loan and doesn’t pay at all, but I needed a deferment. The amount of debt in my case was 700,000 rubles. The only thing is that for 3 years after the procedure I could not get a promotion at work, but I was already warned about this.

- Svetlana. I learned about the bankruptcy of individuals from a colleague. I didn’t know what to do with the debt, there was late payment, penalties, fines. Total 620 thousand. Plus utility bills, for three months we owed. They couldn’t pay off the loan after my husband lost his job; I can’t do it alone. We are already desperate, since my husband has odd jobs, no permanent job, and we have two children. Bankruptcy saved us, otherwise I don’t know what we would have done without bankrupt.online. Although the procedure is paid, the financial manager pays a fee, a state duty, for publications in the newspaper, but it is worth the cost. The whole family breathed a sigh of relief.

- Zhanna. Taking money from the bank has become vital, in the truest sense of the word. The doctor made a very serious diagnosis; the operation costs a lot of money. Relatives helped raise some money, but most of it had to be borrowed. I was only thinking about my health and future life, and I wasn’t really worried about how to repay the loan, but I thought I could handle it. Rehabilitation after the operation was delayed, expensive medications, I took out another loan, this time from a microfinance office. I had to quit my job, as it turned out I was no longer able to work in production. Only light work. I was looking for a job for a long time, naturally there was nothing to pay off loans. And the new job did not allow me to make monthly payments on two loans. The bank filed a lawsuit, I’m already exhausted, and now this happens. In a panic, I went to a law firm for a consultation and they offered to file for bankruptcy. At first I didn’t agree, it was all scary. I thought about it and sought advice, but the debts kept growing. Two weeks later I came to them again and had already signed an agreement for the provision of services. They helped me with bankruptcy from A to Z. I gradually forget about the sleepless nights, the main thing is that I am alive after the operation and have no debts left.

- Dmitriy. Stupidly, I took out a payday loan and didn’t pay it back on time. The percentages are crazy, I grabbed my head. I took another one to cover this one. The salary was delayed, was not returned on time, and then, like clockwork, there were nine loans in total. Although the amounts are not large, huge interest charges are charged for delays of even one day. The collectors cut off the phone; I owed more than 300 thousand rubles in total. A friend said the only thing left to do is file for bankruptcy. Well, I didn’t hesitate, you don’t joke with collectors. My car was inexpensive, but you still wouldn’t be able to cover the entire debt if you sold it. It was then put under the hammer by court decision, the money was paid for the debts, and they managed to cover a little of it. The remaining debt was removed from me, and the court made a positive decision. People, avoid these loan offices, learn from the mistakes of others.

- Andrey. I am currently in bankruptcy. I read the reviews, how everything goes, the possible consequences, and decided to free myself from debt. A procedure for the sale of property has been introduced against me. I have two apartments, one was left over from my grandmother, I took out a mortgage on the second, my family is growing after all, three children. I took out a mortgage in foreign currency, but now the dollar has become twice as expensive. I'm not a millionaire, I don't have that kind of money. I’m ready to part with the mortgage on my apartment because the debt is already unbearable. The apartment is up for auction, no interest is charged. The proceeds from the sale will be offset against debts. It’s good that there is a second apartment, we live there in cramped conditions but no offense. We are waiting for the court's decision, but in practice the court makes decisions in favor of the borrowers. I said goodbye to the apartment, but I won’t have millions of debts. Thanks to the state for the foreign currency mortgage.

- Anna. Went through bankruptcy proceedings in 2018-2019. Due to my stupidity, I ended up where I ended up, as they say, “...and you wouldn’t wish it on your enemy.” I hasten to instill hope in the hopeless. Those who have doubts, I hope after my review they will finally decide on the path to freedom from unlawful actions of debt collectors. You need to be patient for about 10 months. Everyone is naturally interested in the financial side of the bankruptcy procedure. My payment was divided into 7,000 rubles for 10 months, but there is also a payment to the financial manager in the amount of 25,000 rubles + bank commission, but the financial manager will receive this money only after the completion of the trial, although it will need to be paid before the first court hearing to the Arbitration account courts of your city. In any case, this amount is much less than the one that does not allow us, who find ourselves in such a difficult situation, to live in peace.

- Dmitriy. Becoming bankrupt, on the one hand, is not bad, especially if there is nothing to repay the debt with. But, on the other hand, in the next few years a person will not be able to use any credit program. According to the law, he must submit information to the bank about the state of his affairs. No bank will issue him a loan for 3 years. Therefore, those who want to declare bankruptcy need to think carefully in advance. I think it's better to find the money and repay the debt.

- Olga. I read that to file for bankruptcy you need a debt of at least 500,000 rubles. But when I went for a consultation, they said that less was possible. After all, there are many people who have unmanageable debts, but cannot take advantage of the law. I would like to advise everyone to go to court at your place of residence, they will tell you for sure. We need to try, if large debts are forgiven, can’t small ones be annulled?

- Timofey. The law is designed for ordinary people who lost their business, took out a loan, but were unable to pay it back. But there is too much red tape with the documents, and the manager’s commission is quite large, but there is no money anyway. It seems to me that most people will not be able to take advantage of the law. The cases that have already been closed lasted more than six months. During this time, waste can amount to more than 60,000 rubles, in addition to the fact that you immediately have to pay 10,000 in remuneration to the manager, which means that you can end up with a new loan. No, I don’t like this prospect.

- Zinaida. The bankruptcy procedure for individuals is not much different from that of legal entities. For those, the company's property is sold for debts, while for citizens, personal property, plus legal costs, must be paid. I don't agree with such high expenses. If the court finds that the debt is not cancelled, not only will you have to pay for the procedure for several months, but you will also be left without property. This is where you need to think carefully before applying. The law is good for big debts.

- Konstantin. I see that the law benefits not only citizens, but also banks. Previously, they only had to work with collectors; in many cases, there was no possibility of returning the money at all if the agreement was without collateral and guarantors. Now they legally file a claim against the debtor. If the court decides to sell the property, they will easily repay the debt. Previously, things rarely came to a sale, because people were hiding from collectors.

- Dmitriy. Previously, there was an issue with the transfer of property to relatives, but this law can cancel all transactions. And if there is property, then they will simply sell it. And due to your bankruptcy status, you won’t be able to get a loan for several years. I think if you have something to sell, it’s better to do it yourself. And pay off the debt and not be listed as bankrupt.

- Tatiana. You can sell the property and pay off at least part of the debt, but then there is no point in filing for bankruptcy, they will not give you status. A bankrupt is someone who has nothing, neither money nor property to actually sell. Then the debt is canceled, and if there is something to sell, it is not the bankrupt, but the one who managed to invest what was borrowed.

- Nikolai. You can’t sit idly by, you have to go to the bank and ask for the debt to be restructured. Even if later there is nothing to pay and the bank files a lawsuit, the mitigating circumstance is that the debtor took some action.

- Irina. Many people do not know their rights, so they are afraid to apply, thinking that their only apartment will be taken away. You need to read the law carefully, bankruptcy is better than sitting with a huge debt, plus it is still growing. Even if they are ordered to sell something, it is not the most necessary thing in life; you can part with it, but you can get rid of the rest of the debt.

More information about the cost of bankruptcy proceedings:

Reservations and situations

Reviews from people who have undergone the procedure may be different, but they are not always true. Several reservations to the law on bankruptcy of individuals:

- All debts of a potential bankrupt are summed up. In total they should be from 500 thousand rubles;

- The law protects the interests of not only the debtor, but creditors and the tax service. That is, everyone who suffered from the debtor’s inability to repay funds;

- Applications can be submitted by debtors whose debts are less than the specified amount, but the debt must be greater than the value of the debtor’s entire property;

- Despite the fact that the debtor’s only property cannot be seized in case of non-payment of debts, this condition is canceled if the property is collateral;

- If a citizen is declared bankrupt, he is exempt from paying debts that he could not pay with property. But the case can be reopened if the debtor falsified the data;

- A settlement agreement can be concluded only after all the claims of the first and second priority creditors are satisfied. It must be agreed upon by all participants in the process.

The introduction of this Law gave rise to many disputes. While some borrowers see the law as a way out of a difficult situation, others see only the bad side. The law has not been developed, but it provides many prospects for individuals who were previously limited in their rights to obtain bankruptcy.

What is bankruptcy of an individual

If an individual owes more than 500 thousand rubles to creditors, and there is no possibility of repaying the loan in the near future, there is only one legal way to get out of the “debt hole” and protect your loved ones from “inherited debts” - to file an application for recognition of bankruptcy of an individual faces. We are talking only about those cases where these monetary obligations are supported by an appropriate agreement. At the same time, the bankruptcy procedure applies not only to Russian citizens, but also to foreigners who received a loan under certain conditions.

The initiator of filing such an application can be not only the individual himself, but also the tax service. An application for recognition of the bankruptcy of an individual by a creditor (specifically a banking institution) is also widely used in judicial practice when he receives evidence of the insolvency of his client.

When the bankruptcy procedure for an individual is completed and the court makes its decision, the plaintiff will be released from all subsequent debt payments. There will also be an end to communication with collectors.

Why bankruptcy is unpleasant

The consequences for the debtor can be divided into several types, depending on the stage at which the person is. The consequences begin immediately after the debtor sends an application to the court, but they are most noticeable after the court declares the person bankrupt. Many of them relate to his rights to property:

- You cannot buy real estate or other valuable property, sell your assets (this is possible only with the permission of the manager);

- It is not allowed to donate property, contribute it to the authorized capital of the company, or in any other way try to hide it;

- It will be necessary to transfer all rights regarding registration to the manager;

- Removal from money transactions and bank accounts.

Many reviews of personal bankruptcy indicate that no matter who handles their accounts, sometimes the financial authorities may even require that they provide them with bank cards. If something happens, bank cards will be blocked. As for personal rights, a person cannot become a guarantor, travel abroad, open bank accounts, etc. In addition, a bankrupt person will not be able to open a business for 3 years.

Reviews about the consequences of bankruptcy

People who went through bankruptcy did not suffer any consequences. Here are the comments of those who wrote off debts:

You cannot be a member of the management bodies of a legal entity for 3 years - “I did not plan to create a legal entity, but if an idea to create a business comes up, I will open a legal entity in the name of my husband” - Gonchar T.

5 years you can’t go bankrupt again - “I don’t want to go through this stress again, experience pressure from collectors and bank collection services” - Paranina E.

5 years, when applying to the bank for a new loan, indicate the fact of your bankruptcy - “I decided for myself that I would never go to the bank again, and especially for new loans, we will live within our means with our family” - Zeynalov G.

Necessity to submit an application

To initiate bankruptcy, you need to file an application with the nearest Arbitration Court. This must be done as soon as there is confidence that the debtor will not be able to pay the debt he has accumulated and the interest on it. Since the bankruptcy procedure is complex and lengthy, it is necessary to draw up an application with the help of an expert. The document is drawn up in a standard form:

- In the header of the document - the name of the court, full name, date of birth of the debtor, passport details. As well as the address at which the applicant is registered and the place of his actual residence. The telephone number is used to contact the alleged bankrupt;

- In the body of the document you need to indicate information about the total amount of debt. The applicant may not agree with the information submitted by the creditors. In this case, the document indicates only the debt that does not need to be disputed. A separate line describes debts for mandatory payments, as well as debts for harm to life or health;

- The reasons that led the debtor to the emergence of financial problems are described;

- It is necessary to present documents (claims, enforcement proceedings, etc.) according to which the money is written off;

- This is followed by a listing of the person’s property and bank accounts. Moreover, you need to indicate accounts not only in the Russian Federation, but also outside the country;

- At the end of the application you need to indicate a list of documents that are also submitted to the judicial authorities.

At the time of submitting the application, you must pay the state fee. You can send documents, including an application, in three ways:

- Bring it in personally.

- Send by mail.

- Apply online.

Which method of submitting papers to choose depends on the capabilities of the applicant, but in any case, personal presence is preferable.

Bankruptcy conditions

First of all, it is worth studying the basic requirements. What do they say in the reviews of individuals who have gone through bankruptcy proceedings? If a person wants to declare himself unable to pay any financial bills in order to get rid of the necessary obligations, in this case he must meet several requirements.

First of all, he must have a loan debt that exceeds the amount of 500 thousand rubles. In addition, payments must be overdue for more than 3 months. However, this paragraph has some reservation, according to which there are a number of circumstances in which the borrower can already foresee in advance that he will not be able to pay the loan obligations assigned to him. It is worth considering that in order to declare yourself bankrupt, you need to contact specialists who actually recognize an individual as insolvent and conscientious enough not to apply additional penalties to him.

What does this mean? If we consider the reviews of individuals (who filed bankruptcy), many note that this procedure is quite grueling and long. The fact is that there are two categories of citizens who do not pay their loans. Some of them are hiding from banks or other financial institutions, while others are ready to make regular payments. However, they simply do not have the required amount of money. They inform employees of banking institutions about this and do not hide any data. According to reviews of individuals who went through the bankruptcy procedure, they belonged to the second category.

Real requirements for a person

Reviews indicate that the law on bankruptcy of individuals, even in 2020, requires improvements. The fact is that it does not clearly present the requirements for people who find themselves in a difficult situation. Among the main shortcomings:

- The perceived inequality between creditor and debtor. The creditor looks after his own interests, and the debtor must rely on the interest of the manager. Unfortunately, the latter does not always take care of the client’s interests, and the work is not done well enough. All this leads to tragic consequences for the debtor - he loses his property.

- Unclear financial issue. From what point should payments be calculated, because usually a person has already managed to pay the amount of the debt. If he is late in payments, he may be forced to pay not the remaining debt, but the entire loan, including the part already paid.

- The essence of bankruptcy is lost. It was invented to help people in difficult financial times, but in reality many cases turn into a battle against a downer.

And there are quite a lot of such controversial issues. People write about the incompetence of local authorities, the negligence of managers who, instead of helping, simply received money and still allowed the property to be sold, although there was a chance to recover financial losses with the right approach. And all because the law in its “pure form” is unprofitable for creditors who lose money.

Step-by-step instructions for the bankruptcy procedure - 5 stages

The process itself is quite lengthy. The minimum duration is 9 months. However, if procedural violations occur, additional time will be required to eliminate them. To avoid this and complete bankruptcy of an individual as quickly as possible, follow the step-by-step instructions below. Below are step-by-step instructions for personal bankruptcy.

STEP 1: Collecting documents - a list of all necessary papers

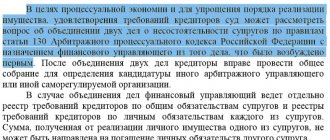

The list of necessary documents that are submitted to the court along with the application is specified in clause 3 of Article 231.4 of the Federal Law “On Insolvency (Bankruptcy)”.

| Document | Explanation |

| 1. Documents confirming debt and insolvency | Among them are a loan agreement, a receipt, a certificate of income, an account statement, a salary certificate from the employer, etc. |

| 2. Extract from the Unified State Register of Real Estate | It must be taken no earlier than 30 days before filing a lawsuit |

| 3. Lists of creditors | Drawed up in accordance with the form of Appendix No. 1 to Order No. 530 of the Ministry of Economic Development of Russia dated August 5, 2020, indicating the full name, address, and amount of debt. |

| 4. Inventory of property | It should also include collateral. Drawed up in the form of Appendix No. 2 of the same decree. |

| 5. Copies of documents on ownership | In relation to property and intellectual property. |

| 6. Copies of documents on transactions for the last 3 years | In relation to real estate, securities, shares in the authorized capital, vehicles and other transactions worth over 300 thousand rubles. |

| 7. Extract from the register of shareholders | If the debtor has shares of a legal entity. |

| 8. Information about income and taxes | It is necessary to obtain a certificate from the tax office about the status of payments for taxes, fees, penalties, etc. for 3 years. |

| 9. Certificates from banks about open accounts and statements about their status | Also for a three year period. |

| 10. Copy of SNILS and information about the status of the personal account | – |

| 11. Resolution from the employment service | If an individual is registered as unemployed. |

| 12. Copy of TIN | – |

| 13. Copy of marriage/divorce certificate | – |

| 14. Copy of the marriage contract | It is not always drawn up, but if it is, it must be attached to the claim. |

| 15. A copy of the court decision on the division of property of married spouses | The spouse has the right to divide the property even without a divorce, while continuing to be married. If the decision was made within 3 years before the filing of the claim, attach a copy of it. |

| 16. Copy of children's birth certificates | For parents, adoptive parents, guardians. |

| 17. Other documents confirming the substantiation of the applicant’s claims | – |

| 18. Receipt for payment of state duty | – |

STEP 2: Compose the correct application

In the statement of claim, we indicate the following information in order:

- Name of the court.

- Full name, passport details, date of birth, place of residence and registration, contact phone number of the applicant.

- List of creditors. Here you should remember everyone, since after the termination of the proceedings on your application, the creditors indicated in it will no longer be able to demand repayment of the debt from you.

- Total amount of debt. Separately, it is necessary to indicate debts for mandatory payments and compensation for damage to health.

- Causes of insolvency.

- Court decisions against the debtor, for which enforcement proceedings have been opened.

- Property owned by the debtor by right of ownership, including mortgage property.

- List of bank accounts opened in the name of the insolvent person, including those outside the Russian Federation.

- The name of the self-regulatory organization of arbitration managers, which will be entrusted with the right to appoint a financial manager in this case.

- Documents attached to the application.

When drawing up a claim, follow the requirements of Art. 125 Arbitration Procedure Code of the Russian Federation. Failure to comply with them entails the return of the statement of claim to eliminate errors, and all this takes time.

State duty

In addition to submitting the required package of documents, you will first need to pay the appropriate fees to the state. A receipt confirming that the state duty has been paid is also attached to the prepared papers.

The good news is that previously you had to pay 6 thousand rubles in order to declare yourself bankrupt. This was a little unfair, since a person wishing to declare insolvency, by default, cannot contribute such amounts of money. That is why in 2020 the amount of state duty was revised. Today, reviews from individuals who have undergone bankruptcy proceedings say that now you only need to pay 300 rubles.

STEP 3: Submit an application to the court along with documents

After you have completed an application and a package of documents, go to the arbitration court at your place of residence.

The cost of filing a claim (state fee) is 300 rubles.

By the way, you can also send an application to the court by mail or submit it with your authorized representative (in which case you will also need to attach a notarized power of attorney to the documents).

STEP 4: We implement the court decision

It would be more accurate to say that we are watching the implementation. The fact is that the court, depending on the circumstances of the case, can make the following decisions on the issue of satisfying the requirements:

- Approve the restructuring plan.

- Start selling property without prior restructuring.

- Start selling property if the restructuring plan is not implemented or is cancelled.

- Approve the settlement agreement concluded between the debtor and creditors.

It is better for an individual to attend all court hearings and meetings of creditors. Thus, he will have more opportunities to protect his interests.

Bankruptcy of individuals implies debt restructuring in cases where the debtor has a stable income or at least the prospect of its appearance. This criterion is quite subjective, so in each specific case the court makes an individual decision, taking into account the life circumstances of the debtor, his personal and professional characteristics. If the restructuring plan can be implemented even within the framework of court proceedings, the debtor will not be declared bankrupt.

If the plan is not completed on time or is canceled ahead of schedule, the stage of selling the property begins. It also begins if it is not advisable to initially apply restructuring (the financial situation does not allow even a little repayment of debts).

The property is sold at auction. They are organized by the financial manager. But first, the bailiffs come to the debtor’s place of residence and describe all visible property. At this moment, they do not have to prove anything: it is understood that all the property in the debtor’s home belongs to him.

If the bailiff described “excess” - something that does not belong to you, you can file a lawsuit. Such property will be excluded from the inventory if, of course, it is proven that the item is not yours. This fact can be proven by documents (sale and purchase agreements, checks, invoices, receipts), as well as by testimony of witnesses.

STEP 5: Completing the procedure

The decision to declare a person bankrupt is essentially a document that confirms that all measures to satisfy the creditors’ claims have been taken, which means that they no longer have the right to present them to you. From this moment you are “freed” from paying the remaining debts.

Thus, bankruptcy of individuals - step-by-step instructions, if followed, helps to avoid mistakes and do everything on time.

If you liked the material and want to learn more about bankruptcy and other financial topics, subscribe to our newsletter:

Important Additions

The main difficulty that prevented people from going through the procedure was the high cost of filing bankruptcy and the complexity of the procedure. People on the verge of a financial apocalypse simply do not have the money to hire a financial manager. That is why there have been debates around simplifying the procedure for some time. Then the debtor will receive several advantages, but the main thing is a noticeable reduction in costs. True, some requirements for the debtor have also changed. A few important additions:

- The number of creditors is limited - there should be no more than a dozen;

- The amount of debt can be from 50 thousand rubles, but not more than 700 thousand (in the old version the amount was up to 900 thousand rubles);

- The debtor’s place of residence cannot be changed 4 months before filing the application;

- Alienation of property - this cannot be done over the past 3 years. But provided that the amount is at least 200 thousand rubles.

The purpose of the additions is to reduce not only the price of the procedure, but also to make it faster. And all because you don’t need to use the services of a financial manager. If according to the classic procedure the minimum period was about 8 months, then in the updated form the procedure will take at least 4 months. But the simplified procedure is available only to persons with an impeccable borrower reputation.

Costs of bankruptcy proceedings

No matter how paradoxical it may sound, the bankrupt will have to pay for his bankruptcy, and at the same time, a lot of money. How much will personal bankruptcy cost?

- State duty - 300 rubles.

- Publication in the EFRSB – 402 rubles. 50 kopecks

- Financial manager services – minimum 10 thousand rubles + 2% of proceeds from satisfied claims or sold property.

- If you turn to lawyers for help in preparing documents, take into account their remuneration.

In total, the actual bankruptcy procedure costs 100-150 thousand rubles. Perhaps, if the total amount of debts slightly exceeds 500 thousand rubles, an individual should not attempt bankruptcy.

What papers will be required?

Reviews from people who have filed for bankruptcy say that this procedure is impossible unless a package of relevant documents is submitted along with the application. Depending on the specific situation of the debtor, it may include different papers, but often it is enough for a person to provide a classic list of documents:

- Documents containing personal information about the debtor. For example, his full name, date of birth. That is, you need to provide papers confirming the identity of the debtor.

- Documents about marital status. This list includes documents about marriage or divorce. It also includes documents about children that the debtor has, and therefore are dependent on him. Including if the children do not live with the debtor, but he pays them alimony.

- You need to provide SNILS. This document will be required to assess the citizen’s situation.

- Papers for existing valuables , including real estate, cars, etc.

- Documents on the financial situation of a citizen . This could be account statements, salary information, etc.

- Debt documents . It is necessary to attach to the case documents indicating the amount of debt, how much money has already been given and how much is left, when the last payment was made and how “clean” the citizen’s credit history was in the past.

Depending on the situation, you may need documents about the loss of a breadwinner, about the loss of a job, and other papers confirming that there really are financial difficulties and that they were provoked by objective circumstances, and not by the debtor himself in an attempt to get rid of a large debt with minimal effort. Many people who have undergone the procedure claim that it is better to use the services of a professional who will tell you what documents to prepare.

What property cannot be seized?

Reviews from individuals who have gone through bankruptcy say that not every item can be put up for auction as payment of debt. For example, if the borrower lives in a single apartment or owns a plot of land with a house, which is also his only place of residence, then such real estate cannot be sold in favor of the credit company.

Such things also include necessary household items for individual use, furniture and clothing. They also cannot be subject to such sanctions. Also protected are those items that the debtor needs in his professional activities. This requirement also applies to livestock kept on a suburban area. The same applies to utility rooms, which are required in order to keep livestock in good condition.

Lawyers' opinions

In law firms, where ordinary people are helped to deal with bankruptcy cases and loan debts, professionals talk about shortcomings in the law. So far there is little practice in these cases, but this will change every year. Already today, difficulties in understanding, inaccuracies and other problems of the law are noticeable. That is why lawyers continue to doubt whether they should get involved in bankruptcy cases.

The Ministry of Finance is working to simplify the law, but so far the results are just beginning to be put into practice, and it is difficult to understand how much they have changed the picture, as well as to understand whether the changes were really beneficial. So far, professionals advise only one thing - to use the help of lawyers who are already familiar with personal bankruptcy cases.

These professionals become real assistants in matters related to collecting documents, filling out an application, and filing it in court. They can also recommend a competent financial manager who will help in trying to improve the financial situation without selling off the debtor’s valuable property. And if you write a power of attorney in the name of a lawyer, he can replace the debtor at most stages related to the legal process.

Reviews about the cost of the procedure

If you look at the law about how much it costs to file bankruptcy, the amount will not seem that big. According to the law, the prices are as follows:

- The state fee that must be paid when submitting an application is 300 rubles;

- Payment for the services of a financial manager – about 25 thousand rubles;

- Up to 10 thousand rubles for publishing information about bankruptcy.

But according to people's reviews, these prices are rarely justified. You don’t need to search long - just compare the average market prices for the services of financial managers. In Moscow, for example, the average market price is 200 thousand rubles. In addition, any particular professional is not obligated to take on any bankruptcy case. It is more profitable for him to take the business that will bring him more money.

The financial manager will first look at how much interest he will receive after selling the property (7%). If the amount is small or there is no benefit at all, the manager may ask to pay him unofficially. If the debtor refuses, the manager will not take on the case, and you will have to look for a new specialist who is willing to work for the 25 thousand rubles specified by the state. It is clear that there are few such people willing.

Of course, this is illegal and is a huge impudence on the part of a specialist, but these are the realities, if you believe the reviews of some people. Of course, you can file a complaint against the manager himself, but this will also require the services of a lawyer, plus time to consider the complaint. That is, the alternative is not very good.

In addition, the financial manager in bankruptcy cases can hardly be called a friend of the debtor. This person will look for hidden property, legalize the person’s unofficial income and try in every possible way to squeeze the remaining money out of the supposed bankrupt. In order for the financial manager to behave professionally, it is advisable to hire a lawyer who will monitor the legality of the actions performed, which is also not free.

Frequently asked questions about bankruptcy

Those who have gone through bankruptcy proceedings are often asked:

- What is the percentage of successful cases for declaring bankruptcy and writing off debt? Almost 100% of cases. The exception is when a person turns out to be a fraudster, flees abroad, or otherwise violates the law. But you need to be prepared that the debtor’s actions will be checked from beginning to end, and all the procedures that he carried out will be studied. This is necessary to identify violations, if any have occurred.

- Can debts be written off without declaring bankruptcy? No, debts will not be written off completely, but they may reduce penalties and eliminate commissions. Only the “body” of the debt will remain.

- Where to find a financial manager? He needs to be hired. To do this, debtors turn to special law firms that find a good specialist. And most importantly, the manager will not be able to abandon the case at the most inopportune moment.

- Is it possible to replace the financial manager during the work process? There is such an opportunity, but it is advisable to think twice before using it. First of all, there must be serious reasons for this. For example, the actions of the manager harm the interests of the debtor. But all this still needs to be proven in court. That’s why it’s so important to choose the right financial law from the very beginning.

- Will the debtor's accounts be seized? Not immediately, but all credit cards must be handed over to the manager. If you don’t do this and use them on the sly, the bank will block the account. But a person is not left without money. Each month the manager issues from the person’s account an amount equal to the minimum subsistence level. Additional money is issued by court decision. As soon as the bankruptcy procedure is completed, the accounts will be unblocked.

There are still many nuances unknown to citizens; you can learn more about them from people who have experienced all this.

Bankruptcy law - what they say

This provision came into force on October 1, 2020. According to this law, individuals and individual entrepreneurs can declare themselves bankrupt. The amount of debt in these situations should be from 500,000 rubles. The period from the date of payment of the last loan payment is more than 3 months.

A citizen can be declared bankrupt only by a court. By the way, the application can be accepted even with a smaller amount of debt. But in the end, legal proceedings can only be started from the moment the amount of debt reaches a certain point or exceeds the value of all the borrower’s property.

People are skeptical about this law. Many people do not like the fact that the procedure takes quite a long time - sometimes the process takes up to six months, but on average it takes a month or two. Also, borrowers do not like the fact that a citizen can be declared bankrupt, but they are not released from loan obligations, but only minimal concessions are made.

The imperfection of the law is the first thing people who have gone through bankruptcy proceedings note. If the payer has the minimum ability to pay the debt, any property can be seized: real estate, car, jewelry, etc. The exception is the case when residential real estate is the only one, and the citizen does not have the above. Otherwise, loan obligations remain; only the repayment terms change for the better.

Is it true that you will not be allowed to leave the country?

Citizens against whom bankruptcy proceedings have been filed are indeed often unable to travel to other countries. But just as often, the court does not impose such a restriction. The court has little interest in the debtor sitting in one place; creditors want this more, fearing that the alleged bankrupt will be able to take the rest of his money abroad. Therefore, it is the bank or other organizations/persons to whom the bankrupt owes a debt that is seeking a travel ban.

There are cases when restrictions can be lifted from the debtor. To do this, you need to write a petition to the arbitration court and coordinate the issue with the creditor and financial manager. If there are no objections, the restrictions may be lifted early. And when the bankruptcy procedure is over, the ban will be lifted automatically. After this, you need to submit copies of documents to the border and migration authorities.

Can relatives' property be taken away?

Property that can be confiscated to cover the debts of the debtor must belong only to him. The property of relatives, including the wife/husband, cannot be confiscated. But there are caveats. For example, in 2020, the property of a relative who acted as a guarantor for the debtor may be confiscated.

The spouses' common property is forcibly sold, and the second spouse's share is returned to him in cash. But since it is rare to sell property at its real market price, the amount of compensation is far from standard. Also, transactions carried out by the spouse over the past three years can be challenged.

Transactions between citizens and their relatives made during the year are disputed, therefore it is advisable to sell apartments and cars to third parties. There is less chance that the sale will be challenged.

Is it worth going through the procedure: pros and cons

After reading real reviews about bankruptcy, you may get the impression that people are divided into two camps. Those who see advantages in bankruptcy for individuals, and those who perceive this procedure negatively. Let's list the positive points:

- Since the total debt can be many times greater than the debtor's property, after it is sold, the remainder will be forgiven to the person.

- As soon as the consideration of the case begins, the accrual of fines and penalties for all debts owed by the debtors will stop.

- The person’s housing will remain, as will his personal belongings. But there is one condition for real estate - it must be the only place where a person lives, and it must not be a collateral or a mortgage (provided that it is unpaid). Also, the debtor will be left money in the amount of the subsistence minimum.

Citizens argue that bankruptcy will only be useful if the debt is very large. Otherwise, it is better to look for an alternative. Disadvantages of personal bankruptcy:

- Bank accounts and cards are given to a financial manager, who gives the debtor only a subsistence minimum, on which he must live for at least six months;

- The manager's services are not free. Even if he was appointed by the court, he will have to pay 25 thousand rubles and 7% of the proceeds from the sale of property. You also need to pay a state fee of 300 rubles and pay for the publication of a bankruptcy announcement (up to 10 thousand);

- If a desire suddenly arises to become an entrepreneur, the bankrupt will not have such an opportunity for another three years;

- A person's property is sold;

- Transactions of an individual made three years before bankruptcy can be challenged. Especially if they were committed with relatives;

- There will be difficulties in obtaining a loan. The debtor will not be able to hide his bankruptcy status, and banks rarely make concessions when they see that the client is insolvent. Although there is always a chance;

- Sometimes the debtor is prohibited from crossing the border while the case is ongoing.

The court may establish fictitious or deliberate bankruptcy. In this case, the consequences may be more serious - even criminal liability. They are deprived of freedom for up to six years. In case of fictitious bankruptcy, administrative liability arises - you need to pay large fines.

Opinions on the bankruptcy procedure

This procedure, according to individuals, is tedious and lengthy. It is necessary to provide documents about insolvency, which is quite difficult to do, especially if there is no work.

Also, court proceedings are often postponed and rescheduled, and at this time the interest on the loan continues to increase in full.

Creditors benefit from cases when the bankruptcy procedure takes a long period of time and its result is a refusal to recognize a person as insolvent in paying debt obligations, which happens quite often - 70% of cases.

Opinions about the procedure are negative - debtors do not like many of the nuances of bankruptcy law, as well as the speed of registration. A much more pleasant moment for most Russians is the result - freedom from loan obligations. In general, many understand that such a serious decision is not easy for the court - a clear evidence base is needed for a person to be declared bankrupt. If citizens try to do this on their own, this rarely happens.

When involving third-party lawyers, the problem is solved in almost all cases. And opinions regarding the procedure are divided into positive and negative on this basis - those who used the help of a lawyer respond positively, those who tried to prove their bankruptcy on their own have a negative attitude towards this.

It is quite obvious that without being “savvy” in the procedural side of bankruptcy, it is difficult to go through it. This means that its cost for the average citizen will be high.