What are the functions of a document

The introduction of the obligation to notify of the intention to initiate the process of recognition as bankrupt is intended to minimize abuse, primarily on the part of the bankrupt entity. After all, previously the debtor could have seized the “reins of power” in the process before creditors. Before the innovations, he had the right to independently appoint a controlled manager for the period of observation, who:

- Did not influence the further activities of the bankrupt.

- He analyzed the financial state in a light favorable to the bankrupt person and with optimistic conclusions.

- Prevented by possible means the inclusion in the register of creditors who are undesirable for the debtor.

- Helped to make invisible or give a legal appearance to transactions made for the purpose of withdrawing property that would be included in the bankruptcy estate.

- Directly or indirectly (observed, but did not participate) in concealing documents and information necessary for the process.

Not only the debtor, but also the creditors can file for bankruptcy.

In general, the borrower had carte blanche to the lenders, giving him the opportunity to illegally retain property and minimize the volume of debt repayments.

Publishing a notice to creditors of a debtor's bankruptcy in publicly available resources is intended to ensure that all of them are notified so that they can assert their claims in the process.

Notice of intent to file for bankruptcy

- did not influence the subsequent actions of the bankrupt person;

- carried out a financial analysis in favor of the bankrupt person, in connection with which the latter received a certain benefit for himself;

- created all kinds of obstacles to the inclusion of certain creditors who are most disadvantageous for the bankrupt person;

- helped to hide or make legal transactions concluded in order to remove property from the bankruptcy estate;

- participated independently or witnessed participation in the process of concealing documentation or any information relevant during the trial.

We recommend reading: Resume of a college graduate without work experience

The notice in question is the very first document with which the bankruptcy process begins. Moreover, the law regulating the procedure was amended in July 2020 regarding this issue. According to it, information that a claim for bankruptcy will be filed in court is published in the media. One such source is the Unified Federal Register of Information on the Functions of Legal Entities. persons

Cases requiring mandatory notification

The Law “On Insolvency” defines the circle of persons who are entitled to apply to the arbitration court with an application to declare the debtor bankrupt. These include:

- the debtor himself;

- bankruptcy creditors;

- individual government agencies (tax and local government and self-government bodies).

The same law, in Article 37, establishes the obligation to publicly notify one’s intention. This happens by placing a corresponding message about the intention to file a bankruptcy petition in the Unified Federal Register of Information on the Facts of the Legal Entity, and is also published in the printed publication Kommersant. The obligation itself is assigned only to the debtor or bankruptcy creditors. Once the condition for public notification has been met and at least the minimum established period, which is equal to 15 calendar days, has been met, filing a claim in court will be legal.

The last category of entities authorized to address the court is not required to officially notify of their intentions and can be immediately sent to court.

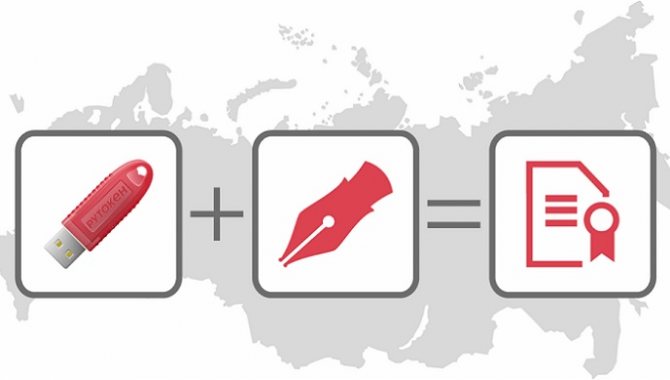

The notification must be confirmed by an electronic digital signature

Notice of intention to file for bankruptcy

At the end of the monitoring procedure, the 1st meeting of creditors is held. On it, all creditors included in the register make a decision on the future fate of the debtor. As previously stated earlier, in the overwhelming majority of cases they sentence the bankrupt to death - transition to the function of bankruptcy proceedings, when all property is sold off and the enterprise is closed.

The bankruptcy function is generally considered to be an open and completely public event. Thus, before submitting a notice of intent to the court, it is fundamentally necessary to disclose information about the legally recognized insolvency of the company.

Contents and form of the document

The notification is prepared in electronic form, a sample of which contains a number of mandatory information:

- Information about the applicant (name and other data of the debtor or bankruptcy creditor, depending on who intends to go to court, and places the notice itself).

- The name of the document, as well as its details, through which the legal status of the applicant is verified.

- Regulatory and legal justification for posting the notice (links to articles of laws and other acts of the Russian Federation that impose the corresponding obligation).

- Petition (petition) to include a notification in the EFRS.

- Other information.

Notice of intention to apply to the arbitration court

In cases where a monitoring procedure is introduced in relation to the debtor, this fact is also subject to publication in the Unified Federal Register of information about the facts of the activities of legal entities. However, the deadline for this publication is set at 3 working days and this obligation is regulated by clause "n" clause 7 of article 7.1 of Federal Law No. 129 "On state registration of legal entities" dated 08.08.2001.

P.p. 5 p. 2 art. 61.11. establishes subsidiary liability for the impossibility of full repayment of creditors' claims if, on the date of initiation of bankruptcy proceedings, information subject to mandatory entry in accordance with federal law has not been entered or false information about a legal entity has been entered into the Unified Federal Register of Information on the Facts of the Activities of Legal Entities in terms of information , the obligation to contribute which is assigned to the legal entity.

Filing for bankruptcy

Please note that bankruptcy is an extreme and necessary measure, the ultimate goal of which is not to write off your debts. In many cases of judicial practice, the creditor is protected to a greater extent as the victim. In addition, this litigation itself will bring financial costs that will need to be paid by the debtor himself. In addition, declaring a company or person bankrupt has consequences for further economic activity, in particular, it can affect the citizen’s credit history.

- The document indicates the data of the debtor, as well as the data of creditors, documents confirming the financial relationship between the parties; the reasons for declaring a person insolvent are indicated.

- In the document, the bankruptcy creditor indicates the candidacy of a temporary manager, with all his details.

- Creditors may join together to file a claim against a person, in which case the claim must be signed by all parties and a representative appointed on their behalf.

- A copy of the document is sent to the debtor.

Why do you need a publication about your intention to file for bankruptcy?

This condition is established by the Federal Law “On Insolvency (Bankruptcy)”. It is applied when recognizing the insolvency of legal entities, as well as if the initiative to initiate the procedure comes from the debtor himself, who has the status of an individual entrepreneur. There is no requirement to publish a similar notice to initiate bankruptcy of a citizen.

We recommend reading: Providing housing for young families, subsidy calculation calculator

From the beginning of 2020, this requirement applies to a wider circle of persons than was previously established by law, and failure to comply with this rule before sending documents to arbitration threatens the applicant with a number of unpleasant consequences.

Where and how to publish a statement

It is necessary to publish information about the intention to file for bankruptcy in electronic (federal resource message about the intention to file for bankruptcy) and printed (Kommersant newspaper) form.

Bankruptcy is a complex, multi-component and costly undertaking. They are regulated by special federal law No. 127-FZ of October 26, 2002 “On insolvency (bankruptcy)”. In addition to the fact that the company actually recognizes itself as unable to fulfill its obligations, it must carry out a number of required measures at the official level before going to court.

Publication of the intention to file for bankruptcy is the first step in the process of declaring the insolvency of an enterprise. If you ignore this requirement, all other activities can be considered in vain.

We invite you to read: Notice of concluding a new lease agreement

Materials about bankrupts are posted on the EFRS website. This is a federal platform that contains up-to-date information about current events in the life of companies. Data on legal entities has been available since 2011, on citizens - since 2020. The information is publicly available.

On the official website of the Kommersant newspaper, in the search section you can find the desired business entity. The database is updated on Saturdays, weekly.

How to Notify of Intent to File for Bankruptcy

If the initiator of bankruptcy is the debtor, then his director, when preparing a notice of intention to apply to the court for bankruptcy, supplements it with constituent documents (certificate of state registration, tax registration, accounting documents about the property of a legal entity, etc.).

The beginning of the registration of financial insolvency of a legal entity or a citizen engaged in entrepreneurial activity (an individual registered as an individual entrepreneur) does not coincide with the date the court accepted the corresponding application. In fact, this is the moment when a notice of intention to file for bankruptcy will be publicly available in a special register. This procedure was introduced on July 1, 2012, is also regulated by law and is mandatory.

Moratorium on debtor bankruptcy: how can creditors protect their interests?

- Debt amount:

300 thousand rubles.

- Overdue period:

3 months

- Publication in the EFRSFYUL about the intention to file an application to declare the debtor bankrupt:

no earlier than 15 days before submission

- Validity of the debt:

the debt is confirmed by a court decision or based on a loan agreement

- MORATORIUM:

the debtor is not included in the list of persons who are temporarily prohibited from going bankrupt

Who does the moratorium apply to?

As of today, virtually half of the economy is under the moratorium:

- systemically important organizations approved by the interdepartmental commission (Letter of the Ministry of Economic Development of the Russian Federation dated March 23, 2020 No. 8952-RM/D18i);

- strategic enterprises, large joint-stock companies with state participation (Decree of the President of the Russian Federation dated 04.08.2004 No. 1009);

- strategic organizations (Order of the Government of the Russian Federation dated August 20, 2009 No. 1226-r);

- organizations and individual entrepreneurs affected by the pandemic (defined according to OKVED, Decree of the Government of the Russian Federation dated 04/03/2020 No. 434).

You can find out about the effect of the moratorium in relation to a specific company on the tax website using its tax identification number.

What are creditors prohibited from doing during the moratorium period?

- Initiate bankruptcy of the debtor under a moratorium

- To foreclose on the debtor's pledged property

- Collect debt under a writ of execution from a bank

- Collect debt through enforcement proceedings

- Charge the debtor penalties and fines for failure to fulfill obligations

- Set off counterclaims with the debtor

What does a lender need to monitor during the moratorium period?

- Changes in legislation

- The debtor's release from the moratorium (risk of controlled bankruptcy)

- Initiation of liquidation proceedings by the debtor

- Withdrawal of the debtor's assets in favor of third parties

- Change of management and founders of the debtor to nominees

- Preparing the debtor for bankruptcy after the end of the moratorium

- Violation by the debtor of moratorium restrictions (payment of dividends, actual value of the share).

On a note

An important bill was adopted in the third reading by the State Duma on May 22, 2020. It provides for the possibility of judicial installment payment of companies' debt under a moratorium for a period of one to three years (Bill No. 953580-7). If a company's revenue has decreased by 20% or more compared to last year and the company has no salary arrears, it will be able to apply for a judicial restructuring of all debts. We will publish a detailed review of the amendments to the legislation as soon as the law is signed by the President.

What should the creditor do?

First of all, the creditor of the debtor under the moratorium should judge the debt and obtain a court decision.

In addition, property may be seized for companies under a moratorium. Valery Eremenko noted that recently courts have become more active in using interim measures.

Another option is to require additional collateral. And if the debt is large, the creditor should try to appoint its representatives to the debtor’s management bodies.

Within the framework of non-bankruptcy interaction with the debtor, the creditor can:

- settle the debt

- require additional security

- seize the debtor's property in enforcement proceedings

- appoint their representatives to the debtor’s management bodies

- restructure debt

Prepared based on materials from the online discussion “Anti-crisis strategies: how can companies survive during a pandemic and after?”

Intent to file for bankruptcy

- existing debt obligations must be overdue for 3 months, and the excess amount must be 300 thousand rubles;

- Having made a precise decision on insolvency, debtors half a month before applying to the arbitration court notify about their future intentions to the relevant registering state body and always to the “Bulletin of State Registration”;

- the debtor must express his intention to apply to the arbitration court in connection with filing a claim with the signatures of the directors of the enterprise or other persons in authority;

- the document specifies the amount of debt and the circumstances leading to insolvency, complete information about the financial activities, as well as the property of the enterprise, its debts and income;

- copies of documents must be sent to creditors;

- within 5 days the court accepts or rejects the claim.

The bankruptcy procedure is considered to be an open and completely public event. Thus, before filing a notice of intent with the court, it is important to strictly disclose information about the legally recognized insolvency of the company.