Is marital property taken into account in bankruptcy?

Let's start with the fact that joint property acquired by spouses during marriage (Article 34 of the RF IC), in the event of bankruptcy of one of them, will be sold

. It will not be possible to avoid the sale of common property. However, in case of bankruptcy, joint property will not be entirely aimed at repaying the debt of the bankrupt citizen - after all, according to clause 1 of Art. 45 IC, a wife is not responsible for her husband’s debts, just as a husband is not responsible for his wife’s loans.

We wrote in detail in this article about what property is taken away for sale in bankruptcy and what property is not entitled to be taken.

In any case, jointly acquired property during bankruptcy will be included in the bankruptcy estate and subsequently sold. Let's consider what happens to the property of spouses when individuals go bankrupt.

Arbitrage practice

Judicial practice shows that spouses, not wanting to pay debts to creditors, draw up fictitious purchase/sale transactions, registering property in the name of one of them. Or, already being married, they draw up or rewrite a marriage contract for the same purpose. And at the same time they do not notify their creditors. A spouse's liability for the other spouse's debts is considered to cause less damage .

But here the law equalizes the rights of creditors and debtors, and does not allow outright fraud. The creditor has the right to terminate the loan agreement between him and the borrower in the event of bankruptcy of one spouse, or change its terms due to changes in circumstances. And debt collection can be carried out without taking into account the marriage contract. The debtor, in turn, can count on the fact that he will not be deprived of shelter over his head, personal belongings, household items, and means of earning money.

Confiscation and sale of common property of spouses

In practice, the procedure for selling property acquired during marriage is as follows:

- The financial manager forms the bankruptcy estate. Includes property owned by the debtor: sole, shared and common family property. Excludes protected Art. 446 Code of Civil Procedure.

- The implementation process is carried out through open bidding.

- The spouse's share is compensated to him in cash equivalent.

If the wife’s property is sold during her husband’s bankruptcy, the money for her share will be returned. True, psychological discomfort will not be compensated.

privacy policy "Federal Center for Citizens' Bankruptcy"

How to protect yourself from bankruptcy of one spouse?

Having basic knowledge of the Family Code of the Russian Federation and the Federal Insolvency Law, a spouse can protect himself from financial losses, even despite such a concept as “property acquired during marriage.” There are several scenarios that allow you to stay “in your own way” and not suffer losses:

1) If the spouse owns an individual entrepreneur and the property is registered directly in his name, then all the property (the only housing is not included in it) is sold, and half of the funds are returned to the partner as his share in the family budget;

2) If the debtor in bankruptcy is an individual, and the property is registered in the name of a respectable spouse, then legally the procedure repeats the first point with one exception. The partner who has no debts has the right to sell the acquisition (since it is registered in his name), and any such transactions will not appear in the spouse's bankruptcy case. Forward-thinking families, noticing the financial difficulties of their wives or husbands, often resort to this very scenario.

REFERENCE: If some part of the family capital was donated personally to a non-debtor by a third party, then it is not included in the sale and remains personal.

Thus, with minimal knowledge and effort, the spouse of the defaulter can remain with his funds, and sometimes even win financially.

When is joint bankruptcy beneficial?

Spousal bankruptcy in one procedure is the optimal solution when the husband and wife have common creditors. A common situation is a mortgage loan.

, under which the spouses act as co-borrowers. Or everyone took out loans and microloans, but spent them on general needs - education, repairs, or accumulated debt for housing and communal services. By combining bankruptcy procedures in one case, you will receive:

- a chance to get rid of joint debts without creditors making claims against the spouse. For example, my wife took out a loan (issued in her name) and bought a car. If the husband goes bankrupt, the car will be sold, and the woman will receive half of the proceeds from the auction. But the loan will remain on her; only her husband’s debts will be written off. And with a joint procedure, the loans and borrowings of both are repaid;

- the opportunity to reduce the time for recognizing financial insolvency - compared to the alternate bankruptcy of both spouses;

- cost reduction: state duty, financial manager, publication of bankruptcy information;

- increasing the chances of debt restructuring: the income of one spouse may not be enough to approve the plan, but the salary of the second may ensure the introduction of restructuring and preserve the property of the spouses.

Consolidation of bankruptcy cases between spouses is a non-standard procedure, but the RF Supreme Court directly stated that this is possible “for the purpose of procedural economy.” The Law on Bankruptcy of Individuals does not prohibit joint bankruptcy, but the court must be convinced of the necessity and justification of this step.

Paragraph 10 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 25, 2018 No. 48:

Often only experienced credit lawyers can cope with this task.

Official website of the Supreme Court of the Russian Federation

How to divide the debts and common property of spouses in bankruptcy, whether it is possible to insure against the collection of creditors by a marriage contract or pre-trial agreement, what responsibility the former spouses bear for the debtor, the Supreme Court of the Russian Federation explained in the draft resolution of the plenum on the peculiarities of a citizen’s bankruptcy.

Husband and wife, one of Satan

In a bankruptcy case, both the claims of creditors for the personal obligations of the debtor and for the general obligations of the spouses are taken into account. Repayment of claims at the expense of the bankruptcy estate is carried out in the following order:

- first, the claims of all creditors, including creditors for current obligations, from the value of the debtor’s personal property and the value of the spouses’ common property attributable to the debtor’s share.

- then the funds attributable to the debtor’s spouse are directed to satisfy the claims of creditors for general obligations (in the outstanding part), and the remaining funds attributable to the debtor’s spouse are transferred to this spouse.

“Solidary debtors remain obligated until the obligation is fully fulfilled. Therefore, the mere distribution of the spouses’ common debts between them, made without the consent of the creditor, does not change the joint and several obligation of the spouses to such creditor to repay the common debt,” explains the Supreme Court.

Spouses must fulfill obligations to creditors in good faith, and in case of violation, the latter have the right to demand fulfillment of the obligation without taking into account the distribution of common debts. In this case, the spouse who has fulfilled a joint and several obligation in an amount exceeding his share has the right of recourse against the other spouse.

Ex-spouses are also responsible

In a bankruptcy case, both the debtor’s personal property and those belonging to the spouse or former spouse by right of common ownership are subject to sale.

“At the same time, a spouse (former spouse), who believes that the sale of common property in a bankruptcy case does not take into account his legitimate interests or the interests of his dependent persons, has the right to apply to the court with a demand for the division of the common property of the spouses before its sale in bankruptcy procedure,” explains the Supreme Court.

He clarifies that the common property of the spouses subject to division cannot be sold within the framework of bankruptcy procedures until this dispute is resolved.

When considering bankruptcy cases, courts should take into account that the debtor's spouse is subject to involvement in separate disputes, within the framework of which issues related to the sale of their common property are resolved.

Presumption of equality

If the spouses did not enter into an out-of-court agreement on the division of common property or a marriage contract, or the court did not divide their common property, then when determining the shares, one should proceed from the presumption of equality.

“In the absence of common obligations of the spouses, transfer to the spouse of the debtor citizen half of the proceeds from the sale of the common property of the spouses (before repayment of current obligations),” the draft states.

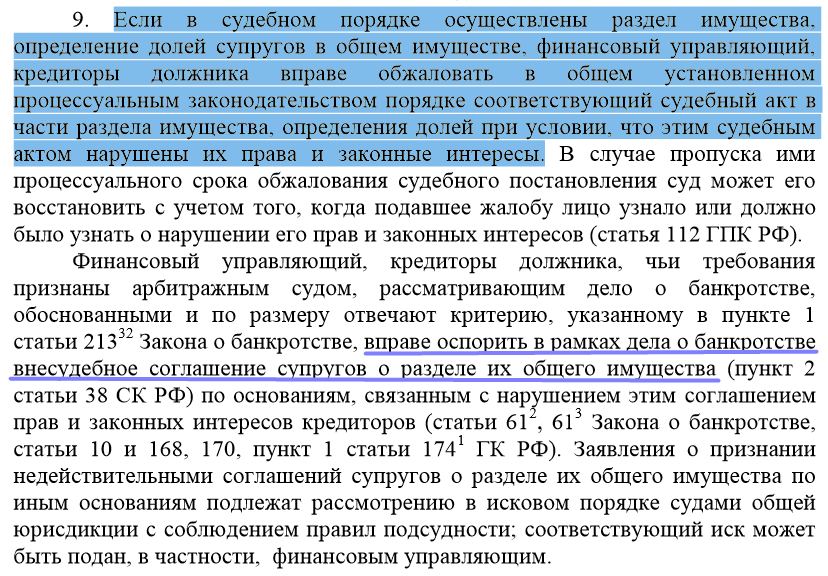

If the spouses divided the property, and creditors or the financial manager believe that their legitimate interests were violated, then they have the right to appeal this division in a court of general jurisdiction.

“If the division of property, the determination of the spouses’ shares in the common property are carried out extrajudicially, creditors whose obligations arose before such division of property, the determination of shares and the re-registration of rights to property in the public register are not legally bound by a change in the property regime of the spouses. This means that both the debtor’s property and the common property transferred to the spouse as a result of division are included in the debtor’s bankruptcy estate,” explains the court.

The included common property is subject to sale by the financial manager in the general manner with further payment to the debtor's spouse of a portion of the proceeds received from the sale of the common property, as indicated in the document.

When the common property transferred to the debtor’s spouse is included in the bankruptcy estate, he is obliged to transfer everything to the financial manager, and if he evades this obligation, the financial manager has the right to demand that this property be taken away from the spouse.

If the property has already been sold, then the debtor’s spouse must transfer its full value to the manager.

In this case, the financial manager may also file a claim to recover property from someone else's possession of a third party that was to be transferred to the insolvency manager.

Bankruptcy of an ex-husband - consequences for the wife

Divorce does not always avoid the sale of property acquired during marriage. Although bankrupt citizens resort to this method, trying to hide valuables from creditors and leave everything in the family. The bankruptcy of an ex-husband has a number of nuances

:

- if you are a guarantor or co-borrower of your ex-husband, then if he is declared bankrupt, the bank will present you with demands for loan repayment - after all, with the dissolution of the marriage, loan obligations are not canceled;

- if the divorce took place within the last three years, even worse, immediately before the ex-spouse filed for bankruptcy, the agreement or court decision on the unequal division of property may be challenged, and all transactions with it may be cancelled;

- if a divorce occurs simultaneously with bankruptcy, the division of property is perceived as an attempt to hide/withdraw property. Creditors will even be able to participate in partition proceedings or appeal the withdrawal of property if a court decision (settlement agreement) infringes on their rights.

Plenum of the Armed Forces of the Russian Federation of December 25, 2020 No. 48:

On the other hand, if joint liability of spouses for loans is not provided for, and more than 3 years have passed since the divorce process, then there is no need to be afraid. Then the bankruptcy of one of the spouses will not affect his former “other half”.

Summary

Recognition of bankruptcy of one of the spouses is regulated by:

- FZ-127;

- norms of the Family Code;

- Civil Code of the Russian Federation.

These regulations simultaneously regulate property family legal relations. According to them, spouses can open proceedings for one of them to obtain bankruptcy status. And at the same time save the property by transferring everything to the other spouse. This procedure is legal and does not contradict current legislation.

You can exit the bankruptcy procedure with minimal financial losses by following some simple steps. For this it is necessary

- obtain information about the legal possibility of avoiding collection;

- share values in advance;

- or draw up a marriage contract.

Property in a common-law marriage

To begin with, it is worth understanding that the current Russian legislation does not enshrine such a concept as “civil marriage,” despite the fact that even judges use this term. The concept of common property and the procedure for its division do not apply to a civil marriage.

The principle works here: whoever is registered on it owns it.

In other words, if you live in a civil marriage (not registered in the registry office), and your partner decides to file for bankruptcy, the procedure will not apply to you. With the exception of cases where there are general loans, the obligation to pay which is assigned to you by the loan agreement.

Property purchased during a civil marriage is in the undivided use of its acquirer and is not considered

.

For example, a couple bought an apartment together, but the property is registered only in the name of the woman. If a cohabitant goes bankrupt, the financial manager cannot include her in the bankruptcy estate and sell her to pay off her debts. Legally, the common-law husband has no rights to this housing.

Can a debtor's only home be seized if it is mortgaged?

Many debtors believe that their only home is excluded from the bankruptcy estate, and therefore this rule also applies to the apartment they bought with a mortgage. In fact, this is not so: an apartment pledged with a mortgage has a special status . It is not owned by the debtor until he has fully repaid his debt to the bank. He has the right to use the apartment or house, but cannot sell it.

The foreclosure of a mortgaged apartment does not take place according to the norms of the Code of Civil Procedure, but on the basis of the Law “On Mortgage”.

The debtor will have to part with the mortgaged apartment during the procedure for recognizing financial insolvency with a high degree of probability. Before 2019, a debtor who faithfully fulfilled his mortgage obligations had the potential to go bankrupt on all other debts and be left with a mortgaged apartment.

After the issuance of SC Resolution No. 48 of 2020, there should be uniformity in judicial practice on the issue of the status of the mortgagee. It states here that those creditors who do not include their claims in the register lose their status as mortgagee. They do not have the right to demand the sale of the collateral for priority satisfaction of obligations to them (a mortgaged apartment can be sold to pay off debts to all creditors without taking into account advantages based on their share and priority).

When selling a pledged item, its initial price is set by the manager in agreement with the pledged creditor. If one of the parties does not agree with the proposed price, the issue is referred to the court for consideration. The collection of collateral is carried out on the basis of compliance with the following conditions:

- The delay was more than 3 months.

- The amount of debt exceeded 5% of the value of the property.

After the pledged property has been sold, 70% is to be transferred to the pledged creditor, 20% is needed to pay off other creditor claims, 10% is sent to legal costs and the manager’s remuneration.

Family property in case of bankruptcy of an individual

In case of bankruptcy of one partner, if he is an individual, the payment of debts occurs, first of all, at the expense of the debtor himself, if any. The problem arises due to the fact that all property acquired and increased after marriage falls into the category of common property, which means that it will be sold in the event of family bankruptcy.

That is, the bailiffs will sell the entire capital of the married couple, and then half of it will be given to the debt-free partner. If the debtor's share does not cover the required amounts, the missing part will be taken from the share of the second.

There is a practice of allocating the debtor’s share in the common property (Article 255 of the Civil Code of the Russian Federation): together with the second spouse, the defaulter’s share in the joint capital is determined, which is then sold. If a partner who has no debt wants to keep this share of the fortune (this may be part of the apartment), then he has the right to buy out this share at market value, and the money already raised will be used to sell the debt.

Separate conditions for the distribution of assets are provided in the case of a marriage contract, according to which shares in the joint budget can be regulated.