Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 08/26/2019

Reading time: 6 min

7

329

Altman's model was developed based on an analysis of 66 American companies, half of which went bankrupt within 19 years, and the other half remained in the market.

- Concept and application of the five-factor model

- Classic five-factor model Example 1

- Example 2

- Example 3

Concept and application of the five-factor model

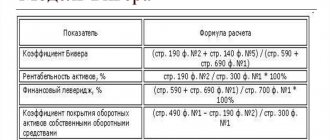

Altman analyzed 22 quantitative factors and identified 5 coefficients based on them, calculated as ratios of key financial indicators:

- asset value;

- arrived;

- working capital;

- volume of obligations , etc.

A constant was calculated for each coefficient, balancing its influence on the calculation result along with other coefficients. The probability of bankruptcy is determined by the numerical range in which the calculated main factor Z is located.

Classic five-factor model

The classical model is used to determine the risks of insolvency of joint-stock enterprises whose shares are traded on stock exchanges.

The main factor is calculated using the formula:

Z = 1.2 * K1 + 1.4 * K2 + 3.3 * K3 + 0.6 * K4 + K5 , where:

- K1 – the ratio of the amount of working capital to the value of assets;

- K2 – the ratio of net profit to the value of assets;

- K3 – ratio of operating income to asset value;

- K4 – the ratio of the total market price of all shares to the volume of debt obligations;

- K5 – the ratio of funds received for the entire period to the value of assets.

The numerical range in which the calculated Z indicator is located is divided into zones:

- red zone (high probability of bankruptcy) – Z less than 1.8;

- gray zone (the probability of bankruptcy is undetectable) – Z in the range from 1.8 to 2.9;

- green zone (the probability of bankruptcy is low) – Z exceeds 2.9.

The accuracy of the forecast depends on the specifics of the company, and for countries with homogeneous market processes the forecast is correct in 84-96 percent of cases.

In addition to the calculated Z value, the coefficients of the Altman model can also characterize the financial condition of the company independently of each other. K1 shows the degree of independence of the company from credit institutions, K3 also shows independence, but more universally - without taking into account the applied taxation system.

The K4 coefficient characterizes the company's safety margin in case of excessive growth of liabilities, and K5 is a measure of the efficiency of using assets to create income.

Example 1

The joint stock company has debt obligations in the amount of 4,500,000 rubles, and the market value of shares is 7,000,000 rubles, while the value of assets is 6,124,000 rubles, the amount of working capital is 1,570,000 rubles, retained earnings are 650,000 rubles, and operating profit - 584,000 rubles. Revenue for the entire period amounted to 8,000,000 rubles.

Coefficient values:

- K1 = 1570000 / 6124000 = 0,256;

- K2 = 650000 / 6124000 = 0,106;

- K3 = 584000 / 6124000 = 0,095;

- K4 = 7000000 / 4500000 = 1,555;

- K5 = 8000000 / 6124000 = 1,306.

The Z value is:

- 1,2 * 0,256 + 1,4 * 0,106 + 3,3 * 0,095 + 0,6 * 1,555 + 1,306 = 2,753.

Z is in the range from 1.8 to 2.9 (in the zone of uncertainty), and additional analysis is needed to determine the probability of bankruptcy.

Altman model (Altman Z-score): definition, calculation, examples >

The Altman model (Altman Z-score model) is a financial model for predicting the likelihood of a company going bankrupt, created by Edward I. Altman. Altman was a professor at New York University's Leonard N. Stern School of Business. His work on predicting the likelihood of bankruptcy began during the Great Depression in response to the sharp increase in default rates.

Altman Model - Explanation

According to the developments of Professor Altman, the Z-score provides an answer to a key question of the early 20th century. To calculate this indicator, the professor used a weighting system in combination with a set of 4 or 5 financial ratios to predict the likelihood of a company going bankrupt. Altman created three different Z-models, each serving unique purposes.

Altmann's original Z-model was developed in 1968. It was compiled

1) based on statistical data from state-owned production companies

2) excluded all companies with assets less than $1 million

However, this original model is not intended for small, non-manufacturing or private companies. Dr. Altman later developed two additional models to the original Z-model. In 1983, a model was developed for private manufacturing companies and a general model for private companies, including the service sector. Different models have different variables, weights and prediction accuracy.

Altman Model - Purpose

The purpose of the Altman model is to measure the financial health of a company and predict the probability of bankruptcy within 2 years. Based on empirical data, the Altman Z-score has been proven to predict bankruptcy quite accurately in a wide variety of market situations and economic cycles. Research shows that the model has a 72%-80% reliability in predicting bankruptcy. However, the Z-Score does not apply to every situation. It can only be used for forecasting if the company being analyzed can be compared to the database Altman used to develop the formula.

Altman Z-score – Formulas

In simple words, the lower the Z-score, the higher the risk of bankruptcy of the company, and vice versa. Different models have different overall forecast scores.

For public companies, the Z-score is calculated as follows:

| 1.2 * T1 + 1.4 * T2 + 3.3 * T3 + 0.6 * T4 + 1.0 * T5 |

T1 = working capital / total assets. This measures the size of liquid assets relative to a company's total assets, since a struggling firm is typically experiencing a liquidity crunch.

T2 = Retained earnings / total assets. This indicates the company's cumulative earnings over many years, as declining profitability is a warning sign.

T3 = EBIT / total assets. This ratio shows how efficiently a company generates revenue relative to its size.

T4 = market capitalization / book value of total liabilities. Evaluates how far the company is from technical default (i.e., how soon its liabilities will exceed its assets).

T5 = revenue / total assets. Asset turnover is a measure of how effectively a company uses its assets to generate sales.

| Altman Z-score | Forecast |

| > 3 | Bankruptcy unlikely |

| From 1.8 to 3 | Bankruptcy is difficult to predict |

| < 1.8 | Bankruptcy is very likely |

Additional models

The practicality of Altman's original model is limited to 2 coefficients. The first is T4, the market value of equity divided by total liabilities, the second is T5 or asset turnover.

Obviously, unless a firm is publicly traded, its equity capital has no market value. To deal with this, there is a revised Z-score for private companies:

| Z1 = 0.717 * T1 + 0.847 * T2 + 3.107 * T3 + .42 * T4 + 0.998 * T5 |

In this case

T4 = book value of equity / amount of liabilities.

Another ratio is asset turnover T5. This ratio varies significantly by industry, but since the original Z-score was based on the manufacturing sector, Altman derived the formula for non-manufacturing businesses:

| Z2 = 6.56 * T1 + 3.26 * T2 + 6.72 * T3 + 1.05 * T4 |

Altman model and the global financial crisis

On the eve of the global recession of 2008-2009. credit ratings of asset-backed securities were rated higher than their actual quality. At the same time, Altman's Z-score showed that credit risks in the financial market had increased significantly and, perhaps, the default rate would soon increase.

According to Altman's model, the average Z-score in 2007 reached 1.81 points. The credit quality of many issuers has fallen to S&P ratings of B. About 50% of issuers had a higher rating than their credit indicators indicated.

Altman's calculations led him to believe that a crisis was imminent and that default rates were about to rise. Altman believed that the crisis would be associated with corporate defaults, but the recession began with the collapse of the market for mortgage-backed securities (MBS). Corporations soon began to default as well in 2008.

conclusions

Investors should regularly review the Z-score of each issuer in their investment portfolio. A deteriorating Z-score can indicate impending problems, and allows you to more quickly analyze the credit quality of a corporation, as opposed to a mass of indicators. Given its shortcomings, the Altman Z-score is intended as a measure of relative financial health rather than a leading indicator. Hedge fund analysts use the Altman model as a quick check of an issuer's creditworthiness, but if the score indicates a problem, a more detailed independent analysis is recommended.

Five-Factor Model for Unincorporated Companies

For non-joint stock companies, the five-factor model has been modified - the K4 coefficient is calculated as the quotient between the amount of equity capital and the amount of all liabilities, the remaining coefficients are calculated in the same way as in the classic five-factor model.

The Z value is calculated using the modified formula:

- Z = 0.717 * K1 + 0.847 * K2 + 3.107 * K3 + 0.42 * K4 + 0.998 * K5.

Distribution of Z values by zone:

- Z greater than 2.9 – green zone;

- Z in the range from 1.23 to 2.9 – zone of uncertainty;

- Z less than 1.23 – red zone (high risks of bankruptcy within a year).

Example 2

The company's capitalization is 7,540,000 rubles with a volume of loan obligations of 4,500,000 rubles. Revenue for the entire period amounted to 6,000,000 rubles, retained earnings - 560,000 rubles, and profit before taxes - 480,000 rubles.

Coefficient values:

- K1 = (7540000 — 4500000) / 7540000 = 0,403;

- K2 = 560000 / 7540000 = 0,074;

- K3 = 480000 / 7540000 = 0,064;

- K4 = 7540000 / 4500000 = 1,676;

- K5 = 6000000 / 7540000 = 0,796.

Z = 0.717 * 0.403 + 0.847 * 0.074 + 3.107 * 0.064 + 0.42 * 1.676 + 0.998 * 0.796 = 1.627.

The Z value is in the gray zone, but closer to its lower limit (1.23), so there is a probability of bankruptcy, but additional research into the financial condition of the company is needed for an accurate determination.

Altman-Sabato model

This model is a universal way to assess bankruptcy risks, since based on the results of calculations, the probability of bankruptcy of a legal entity is given as a percentage. The model is based on the logistic regression method and takes into account the terms of debt obligations and interest accrued for the use of loans.

The probability is calculated using the formula:

A = 1 / (1 + e^(-y)),

Y = 4.28 + 0.18 * K1 - 0.01 * K2 + 0.08 * K3 + 0.02 * K4 + 0.19 * K5 , where:

- K1 is equal to the ratio of operating profit to the amount of assets;

- K2 – the ratio of short-term liabilities to equity;

- K3 – ratio of net profit to asset value;

- K4 – the ratio of funds in the company’s account to the value of assets;

- K5 – the ratio of operating profit to interest on borrowed funds.

e is an exponent; in calculations of this type it is taken with an accuracy of six significant figures.

The relevance of using Altman models for domestic companies

Based on the history of the economic sphere of the world, we can conclude that the use of each financial instrument requires the presence of not only certain characteristics, but also the conditions where a certain company is located and operates. The most important parameter that requires attention is that the Altman method formula was created for enterprises that operated in a fairly developed Western economy. That is, a completely obvious question arises: will it be legitimate to use the methods of the American economist in our economic realities?

It is clear that the methodology can be used by any company, because analyzing the possibility of going bankrupt assumes universality. However, the extensive application has its drawback - the Altman formula was derived based on the characteristics of specific organizations, and sometimes the information on bankruptcy did not coincide with the forecasts provided. There have been situations when it was precisely those enterprises that were most at risk of bankruptcy that survived.

We can conclude that, regardless of the accessibility and simplicity of each economist’s formula, when predicting the probability of bankruptcy of a domestic company, their use will be inappropriate. Of course, the approach to creating the formula itself can be adopted, but the characteristics must be selected based on these circumstances:

- The indicators are required to be mutually independent, and their selection should be made taking into account the correlation of characteristics.

- Each factor must indicate one of the options for the crisis of the organization.

- Information for calculating characteristics must be reliable and understandable.

- A special reporting base will be required for companies from our country that are in crisis, close to a crisis and have stability.

- It is important to optimize weight indices based on filling the database with updated information and take into account the correction of environmental factors of organizations.

Regardless of the methodology used, the results obtained according to Altman cannot be considered final, because there have always been exceptions.