Scoring is an express assessment of the borrower’s reliability and the bank’s potential risks, determined using a special program. Scoring is widely used when issuing all types of loans, including mortgages. But most often the scoring system is used when issuing so-called express loans, where a decision on an application is made within a few minutes. In this article we will look at types of scoring with examples, and also tell you what main parameters influence obtaining a positive decision when issuing a loan.

What is scoring

So, client scoring is an assessment of the solvency of a potential borrower using special software tools. The word “scoring” is derived from the English “score”, which means “score” or “number of points”. The program, the algorithm of which is kept secret even from bank employees, evaluates the client according to a certain point system. The total number allows the employee to make a decision regarding whether to issue a loan, refuse it, or issue it under more stringent conditions. Bank scoring can be carried out in several stages:

- preliminary scoring;

- in-depth scoring;

- manual review of the application by a specialist.

Prescoring (pre-scoring)

A preliminary assessment of your solvency as a borrower can be carried out by filling out a short questionnaire on the bank’s website or at the bank’s office. You will need to provide your full name, date of birth and passport details. Many of you have probably received SMS from banks about a pre-approved loan for a certain amount. This means that prescoring (preliminary scoring) in the bank was carried out automatically. This check excludes factors such as:

- Criminal record.

- Registration in psychoneurological and narcological dispensaries.

- Debt transferred for collection to the bailiff service.

- Bankruptcy of an individual.

- High credit load. The criteria for determining the credit load are individual for each bank and amount on average to more than 60-70% of the borrower’s income.

- A large number of applications for loans over the past few days. If you submitted applications to different banks at the same time, there is a high probability that you will be denied a loan.

So, if you do not meet all the above points, this means that the preliminary scoring has passed. Next, you may be asked to provide income information, contact numbers and other information electronically or in person at the bank office.

Pros and cons of a scoring system

If we consider the scoring system from an objective point of view, then it can highlight both strengths and weaknesses. The advantages can be considered:

- the use of points when determining the client’s solvency - this procedure gives a fairly high objective result, allowing one to quickly assess whether there are possible risks of insolvency;

- reducing the subjective impact of human and personal factors in the process of considering applications from candidates - often too loyal behavior of an employee of a banking organization can result in a company issuing a loan to a person who belongs to the financially disadvantaged category of potential defaulters;

- reducing the time it takes to study the applicant’s identity and make a final decision;

- growth in the rating competitiveness of a credit company that uses a scoring lending policy, in comparison with those organizations that work “the old fashioned way” and use a manual method of processing information;

- the risk of issuing a loan to a fraudster is reduced to a critical minimum.

The method of automatic scoring analysis of information also has its disadvantages:

- special analyzer programs used by scoring often fail due to attempts to hack confidential information and external hacker attacks (failure of such programs is often caused by viruses and malware, it is almost impossible to eliminate the risk of their introduction into the network);

- the need to maintain the analyzer in an objective state - for this it is necessary to regularly make current changes to the existing database;

- the system is not able to quickly respond to difficult economic situations occurring in the country;

- it is necessary to take into account all the nuances and factors that were in demand and relevant in the past and do not provide valuable information at the current time;

- According to some experts, the rating scale is too high, which, due to its inaccessibility, deprives a large category of citizens with average and low incomes of the opportunity to obtain a loan, which, in principle, they can well afford financially;

- the sample can be made only from those people who have used lending services at least once (if a person does this for the first time, it will not be possible to obtain objective data).

Despite a significant number of shortcomings, the credit scoring system is widely used by domestic banks and is by far the most effective tool that combines a study of the credit history of a potential borrower and a quick opportunity to identify the level of his solvency for financial obligations.

How does he work

It should be noted right away that the scoring system is constantly being improved in order to eliminate errors based on a stereotypical approach when calculating points.

Example. There are two potential borrowers - Nikolay and Konstantin. Nikolai is single, Konstantin has been married for 5 years. Both men are about the same age (about 30 years old), have a good credit history and high incomes, neither of them has a criminal record or debts. However, according to the scoring results, Nikolay will receive fewer points than Konstantin. This is because clients who are married with no dependents (both men do not yet have children) are awarded more points because the spouse's income is taken into account.

This does not mean that Nikolai will be denied a loan. Most likely, both borrowers will receive a positive decision. But there will be a difference between them in terms of the number of points awarded, which clients will not know about.

Thus, without even checking whether Konstantin’s wife is employed and what her income is, the system applies a stereotype.

Another example. Svetlana is a full-time student and works at a real estate agency offering apartments for rent. From this job, the girl has a good income and is even officially employed. However, young age and incomplete higher education will be grounds for reducing scores: it is believed that students and young people in general are not creditworthy clients.

Svetlana applied to the bank for a loan to buy equipment. She may be able to get money from the bank, but the conditions may be more stringent, for example, the bank may reduce the loan amount.

Thus, the scoring program analyzes the data provided by the client according to certain stereotypes that are embedded in it based on information from previous transactions.

In addition, the questionnaire data is checked in various sources. These include:

- Credit history bureau.

- Data from the Unified State Register of Legal Entities (when indicating the place of work, it is checked whether the organization is active).

- Tax service.

- Pension Fund.

- Bailiff Service, etc.

When conducting scoring, information from the credit history bureau is requested in all cases without exception. If you don't have a credit history, your chances of passing bank scoring are minimal.

Scoring system - why do banks need it?

Banking expert's opinion

I decided to find out what is hidden behind such a wonderful name for us, and why the scoring system is becoming an indispensable assistant in bank lending. Deputy Chairman of the Board of Ukrgasbank, Elena Dmitrieva, agreed to help us in our small investigation.

Elena Mikhailovna, what is a scoring system and why is it so popular with Ukrainian banks?

Scoring is one of the components of the decision-making process on a credit transaction. The goal of the scoring system is to weed out borrowers that are undesirable for the bank. At the same time, undesirability is formed on the basis of historical data on the parameters and outcome of lending to existing borrowers. Today, scoring is actively used when issuing express loans.

In its most simplified form, the scoring model is a table of certain client characteristics: gender, age, marital status, income, place of work and others. Depending on the value of such characteristics, the system assigns a certain number of points to the client. The higher the total amount, the higher the likelihood that the loan will be repaid on time. This total is then compared to a “threshold”, which is determined based on the bank’s risk appetite. Those clients whose indicator exceeds the “threshold value” are issued a loan. For those who have it lower, no.

As a rule, banks have several scoring tables: scoring differs for different products, regions, and client segments.

I would like to note that scoring is used not only at issuance, but also during the life of the loan. For example, to assess the possibility of full or partial repayment of the loan by the borrower if he fails to repay the debt.

How objectively can a scoring system assess the real chances of a borrower to receive, and most importantly, repay a bank loan?

Each bank may have its own scoring methodology, which is based on certain lending experience (both domestic and foreign). As a rule, in the process of creating a scoring model, a large array of data about borrowers is analyzed and, based on the results obtained, a statistical model is developed that allows one to determine the probability of the outcome of a credit transaction. The size and quality of the existing array of data on borrowers is of great importance: the more quality data, the more objective the scoring model.

To date, the experience of many systems shows that the probability of screening out good borrowers based on scoring results is very low. Moreover, every year the systems are improved and modernized, so confidence in scoring systems is growing.

But still, are situations possible when the system says “no”, but in reality the client is solvent and can repay the loan?

Solvency is not the only factor that is taken into account by the scoring system. It is very important that the client provides as accurate information as possible about his social status. In this case, the likelihood of a refusal to a bona fide borrower is extremely low.

What if the data is deliberately distorted, for example by a fraudster? After all, the system will not be able to recognize where the data is correct and where it is not?

Of course, such a possibility exists. However, to do this, the fraudster needs to know the scoring algorithm in order to “correctly” distort data about himself. In practice, obtaining such information is quite difficult, since banks carefully hide it. In addition, banks use hidden methods of cross-checking the information provided.

I would also like to note that scoring results are definitely a significant, but not the most important factor that influences the process of making the final decision on issuing a loan. A credit expert communicates with the client, who during the communication process can determine the real motives for obtaining a loan. Also, in most cases, information about the borrower is verified through various databases.

It is obvious that scoring technologies are needed by banks. How much do borrowers need them? What dividends will they receive from the implementation of such systems?

First of all, this is the speed of processing and receiving loans. Such automation allows you to build the credit process in the form of a kind of conveyor belt. With minimal participation of bank specialists, the loan application goes through all the necessary stages of analysis, and the decision to issue a loan is made within 20 - 30 minutes. In this case, the client only needs a minimum package of documents: passport, identification code, income certificate

Just the other day, Ukrgasbank announced the start of implementation of the CREDITINFO scoring system, tell us a little about this system. What loan programs will it apply to?

The peculiarity of today's market is that in the conditions of growing competition in it, it is possible to reduce the price of a loan and speed up the decision-making process only through the introduction of the most modern innovative technologies. Technological solutions should make it possible to standardize retail credit operations in the bank's system and automate the entire process of issuing a loan - from receiving an application to making a decision and transferring money. In addition, they should contain not only such elements as a scoring system for assessing the borrower and a system for checking him against the bank’s own “black lists,” but also make it possible to obtain information from the credit bureau and implement debt collection systems.

Only powerful information systems can comprehensively solve such a problem, the search and implementation of which has already been undertaken by the most active banks in retail. We chose a fairly well-known software product called “Creditinfo”. The complex includes a system for automatic processing of applications and paperwork and a debt collection system.

We will begin the implementation of this system using the example of credit cards and mortgages. In the future, Ukrgasbank plans to automate other types of loans from the bank’s retail product line.

That is, this is not just a scoring system, but a whole credit complex that interacts with the client throughout the entire period of using the loan?

Yes, you are absolutly right. For example, the system has a module called Debt Manager, which will help the bank repay overdue debts as efficiently as possible, as well as encourage disciplined borrowers by increasing credit limits and lowering interest rates. As part of the work of Debt Manager, a special free service will operate to notify the client about current credit debt via SMS messages and e-mail.

Who else uses this scoring system?

Users of such systems are such international financial groups as Citibank, UniCredit Group, OTP bank, Raiffeisen Bank, Credium.

Will this scoring system be implemented throughout the bank's branch network?

After the completion of the project (approximately in July of this year), Ukrgasbank plans to introduce a similar credit conveyor throughout the bank’s entire branch network, which includes almost 200 points of sale. By the end of the year, the bank will open another 100 mini-branches equipped with the most modern banking technologies specifically for retail lending. It is also planned to sell credit products through remote access channels: the Internet, mobile communications, self-service banking kiosks. Can it be assumed that with the massive introduction of scoring systems in Ukrainian banks, interest rates on consumer loans will begin to decline? Rates on consumer loans can be significantly reduced only due to, firstly, a significant reduction in inflation - at least to five percent per year. Secondly, by reducing the credit risks of banks. But this will happen only after the rights of creditors in terms of collecting overdue loans are properly protected, and credit history bureaus and collection agencies that professionally work with problem debtors begin to operate fully.

We can give an example from the Czech Republic, where we studied the experience of introducing information products. Naturally, we were interested in interest rates for individuals. Now their card loans for unsecured consumer loans cost clients from 18 to 25% per annum. At the same time, the cost of mortgage loans in the Czech Republic is up to 3% per annum. The difference is at least 15% - a fee for additional risk, which is lower than ours, as we see, on average by only 5%. Therefore, the dynamics of rates on consumer loans will still largely depend on inflation in Ukraine.

Data required for scoring

What data does scoring use to check clients? In different banks, the questionnaire items may differ from each other. Information about age, registration address and marital status can be taken from the passport. In addition, the client must also indicate:

- Information about education.

- Information about employment (work experience, position, income, address of the organization, telephone numbers of contact persons).

- Information about the presence or absence of dependents.

- Information about the availability of property (real estate, car).

- Data on existing loans from other banks (type of loan, debt balance and amount of monthly payments).

Which structures use scoring?

Scoring is carried out by banks when issuing loans to individuals, individual entrepreneurs and corporate clients. In addition, scoring bureaus are engaged in:

- assessment of lending risks;

- dealing with overdue debts;

- conducting surveys among bank clients for a preliminary analysis of solvency.

To collect debts pre-trial, banks can engage collection agencies - specialized financial organizations - to work with debtors. Such companies also conduct debtor scoring, which assesses the likelihood of repaying the debt or taking the case to court.

Scoring is not carried out in microfinance organizations, because they issue loans for small amounts with minimal requirements, which are compensated by high interest rates.

Scoring can also be carried out by appraisal companies that are involved in the examination of property or business. The activities of such companies are subject to licensing and include assessment of:

- real estate;

- Vehicle;

- valuable papers;

- business;

- equipment;

- damage.

Types of scoring

Let's look at four types of scoring.

Application-scoring

This is the most common type of scoring, which we discussed above. Application-scoring includes:

- obtaining information about the borrower;

- checking and processing data with a special program;

- getting the result.

Collection-scoring

This type of scoring uses a special program designed to work with debt that is not repaid on time. The program analyzes data about the borrower and makes a decision on what to do, for example:

- limit yourself to warning;

- apply financial sanctions;

- refer the case to collectors.

What does collection-scoring analyze? First of all, the frequency of late payments on previously issued loans, as well as the amount of debt and the current financial situation of the borrower.

If difficult situations arise (for example, loss of a job or a long period of incapacity), you can contact the bank yourself with an application for debt restructuring - a deferment of payment or a reduction in the amount of the monthly payment. Many credit institutions are accommodating, taking into account that the borrower previously repaid the loan in good faith on time. If you find yourself in a difficult situation, contact the bank with such an application, attaching supporting documents (a copy of your work book, a certificate from the labor exchange, a copy of the certificate of incapacity for work, etc.), without waiting for the collectors to call.

Behavioral-scoring

This type of scoring is used when setting limits on issued amounts. The analysis is carried out based on data for previous periods:

- timely payment of debts by the borrower;

- amount of monthly payments;

- monthly income amount.

Example. Irina has a credit card with which she pays for some large purchases and trips abroad. During the entire period of using the credit card, Irina never paid off the debt during the grace period, always paying the monthly minimum payment.

On the one hand, with a minimum payment, the interest rate on a credit card is quite high and this is beneficial for the bank. On the other hand, Irina’s behavior suggests that for several years she did not have any extra money. Is such a borrower reliable? Of course, yes, since Irina always made payments on time. But Irina can hardly count on a large amount of the amount issued or a credit card limit. And when setting small limits, banks usually do not require proof of income.

Fraud-scoring

This type determines the likelihood that the borrower will be a fraudster. Cases of fraud when applying for a loan are not uncommon. Fraud-scoring is used in combination with other types of credit scoring. Next, we will analyze in more detail the mechanism of its operation.

What does the process of opening and reviewing an application look like in banks?

When applying for any type of loan (consumer loan, mortgage or credit card), the client’s personal data is entered into the banking program.

In fact, there are two main stages of processing an application (in some financial institutions there may be more of them - the final decision is made by the credit committee, but this is an exception):

- Automatic check. At this stage, the questionnaire is processed by bank scoring.

- the verification is as follows: the entered passport data is checked against all bank accounts with which the lender cooperates. Any information is taken into account: from the date and amount of the first loan issued, to the quality of fulfillment of obligations. Whether there are delays or not. If available, the amount, frequency and duration are important. The scoring program also analyzes the general profile of the client: his demographic indicators (age, duration of registration and residence at the last place, work experience, whether he has a diploma, employment in his specialty), checks the database for the presence or absence of current debts to government agencies. The depth of verification is set by each bank at its own discretion and directly depends on the credit policy of the organization. During periods of active attraction of new clients for lending, the level of requirements and indicators required to pass scoring weakens. At other times, standards become stricter.

- Another important function of the scoring program is to determine the likelihood that the borrower will fall into arrears in the next 12 months, that is, what are the chances that the borrower will repay the loan received on time and without delays. Conclusions about the possible successful repayment of a loan are based on the client’s previous behavior and the nature of his payment discipline. The greater the number of loans that were repaid on time without a single delay or ahead of schedule, the higher the chances that such a client will repay the new obligation on time and without debt.

- When credit scoring is completed at the bank. A manual check occurs, carried out by a security officer or underwriter (in some banks, after security or an analyst, the risk manager reviews the application). In manual mode, the data specified in the questionnaire is checked - a call to the client, at work or contact persons. The received report from the BKI is analyzed. A final decision is made on the possibility of issuing a loan. This stage is provided for all loans, except for those where the decision is made instantly.

Fraud scoring: how it works

You have applied for a loan and are waiting for a decision, but there is still no decision. You are told that your application is being scored. What does it mean? If the system detects something suspicious, the scan may take longer. However, there is no need to panic in advance.

All information provided in the loan application is checked for relevance and accuracy. For example, a passport or other identification document must not be in the database of stolen or lost documents. The contact phone number must also be current. An error in one digit of a phone number may result in a loan being denied.

For the address of the company where you work, please indicate the address of your actual location. The fact is that there are still organizations whose addresses are “massive”. These may be companies registered in large business centers or on the territory of large enterprises. If you indicate the street and house number where many companies are registered, this may reduce your points.

If you have temporary registration and several other people who are not your relatives are registered at the address you indicated, this may also negatively affect the bank’s decision. I recommend providing telephone numbers of contact persons who can confirm your trustworthiness. These could be colleagues or close relatives. But be sure to warn these people about a possible call from the bank.

In addition, each bank has a black list of clients. If your phone number differs by one digit from the number on such a blacklist, even this may serve as a basis for classifying you as a “suspicious” client. The system may consider that your relative, who was noticed in some illegal transactions, is inclining you to commit fraud.

What is a scoring score?

A scoring score is an indicator of the borrower’s reliability in digital terms, his credit rating. Points are calculated based on credit history data.

Your credit rating depends on how you repaid your loans with banks. If you have not had a single delinquency, your scoring score will be high. If there is no credit history, points will be awarded based on other indicators - marital status, age, education, place of work and position, income, etc.

How the system works

Scoring analyzes the answers to questions provided by a person in points. Answers about a person’s financial condition are particularly influential:

- availability of real estate or movable property (car);

- good stable income, official employment;

- expensive household appliances;

- working age of the potential client;

- absence of other loans, dependents in care.

A positive parameter may be the presence of minor children and rented housing. This speaks to the applicant’s ability to plan his finances and his confidence in the future.

The reducing factors are mainly as follows:

- age less than 28 years or more than 35;

- location of the apartment in disadvantaged areas;

- work as a waiter, courier, etc., where high qualifications are not essential;

- empty credit history: the person who applied to the bank has never taken out or repaid loans;

- If the applicant has a criminal record, then with a high degree of probability he will be refused a loan.

Organizations that specialize in selling scoring systems have identified the following relationships between factors and customer behavior.

Thus, on average, women, couples with children and older borrowers treat their financial obligations responsibly. The level of education does not play a significant role - what is more important is work experience of at least 3 years. But if a person does not have a higher education, this can be a disadvantage. If an employee has communicated with a potential borrower on his own, then he completes the person’s profile with his impression - the applicant’s appearance, clothes, watches, gadgets, gestures, competent speech, signs that the person is telling the truth or lying. The overall impression that a potential borrower will have on a representative of a financial institution depends on self-confidence and external neatness, speech and conviction.

Based on the results, the system assigns one rating or another to each item in the questionnaire, after which it sets the final scoring point.

There is also a verification of the validity of the data provided by the client (the existence of the address indicated by him, the legality of the passport). Therefore, for those who are interested in whether it is possible to deceive this system, the answer is no.

Next, specialists decide whether it is worth spending time on the applicant and studying his application in more detail or whether it is better to refuse him. As for MFOs, in this case, after a low scoring score, a person’s application is automatically rejected.

Thus, banks and microfinance organizations have a unique profile of a solvent borrower. Thanks to scoring, a financial institution automates the search for just such people among a huge number of loan applicants.

Calculation of scoring points

Scoring scores can be provided by two credit bureaus:

- National Bureau of Credit History (NBKI);

- United Credit Bureau (UCB).

These institutions use a different scale to calculate your credit score.

Decoding scoring points

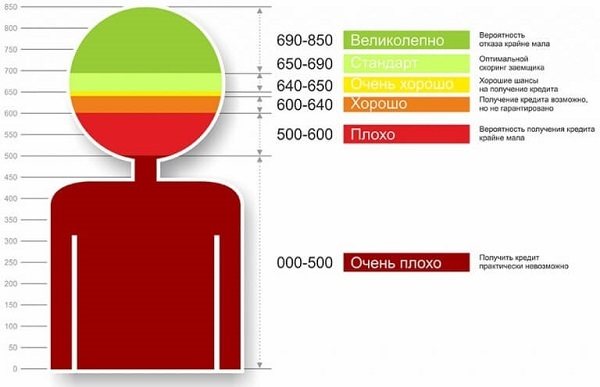

According to the NBKI scale, the borrower is given a rating:

- 690-850 points – excellent. The loan will be approved with a high probability in any bank.

- 650-690 points – good. Lending is available on general terms.

- 600-650 points – satisfactory. You can get a loan, but not from any bank. It is possible to reduce the amount or increase the rate.

- 500-600 points – below average. It is possible to refuse or approve a small amount for a short period of time.

- 300-500 points – bad. High probability of failure. Only microloans may be available to such a client.

In the OKB, a score of more than 960 points is considered very high. The maximum value is 1200 points.

The meaning of the scoring score for loan approval

To get a positive decision you need to dial:

- on the NBCI scale – 650 points;

- on the OKB scale – more than 800 points.

If you score fewer points, this does not mean that you will be rejected. It is possible that the loan will be approved, but the bank will most likely dictate its terms.

What influences the assessment of solvency

The main factors negatively affecting the credit rating:

- Delays over 30 days.

- High credit load.

- Credit history is less than 1 year old.

- A large number of requests to check your credit history over the past 6 months.

Scoring rejection - are there any chances of approval?

Statistics on refusals of loan applications from all bank credit institutions indicate that most of them occur at the stage of bank scoring. These failures most often occur for the following reasons:

- A bad credit history is the most common reason for application rejection. Current or recently closed delinquencies, missed payments lasting more than 60-90 days over the past 12-36 months.

- High debt load - the client has many open contracts. Or there are repaid loans, information about which the lender has not updated in the BKI. The client is sure that the loan is closed, and upon request to the BKI, the banks learn that these loans are active. Another common mistake is duplicate information on obligations. The client actually pays one mortgage, and two identical agreements are listed in the BKI.

As Ekaterina Kotova, Marketing Director of the United Credit Bureau (UCB), which was organized by Sberbank, explains, “quite often a credit institution does not update account information within the period established by law - five days from the date of the last change. Then a situation arises when the borrower has repaid the loan, but this is not reflected in the credit history.”

- The more information about open microloans is present in the BKI, the higher the probability of refusal. Banks do not like clients who use microloans.

- Having debts based on the FSSP (an option to receive a refusal if the client has an excellent CI, a minimum of open loans or none). The banking program also checks this information.

- The presence of unpaid debts on the subscriber number registered to the client. Cellular operators (Beeline, Megafon, MTS) also transmit information about their subscribers.

How to find out your scoring score

Before going to the bank for a loan, it is a good idea to find out your credit rating. Especially if you have doubts. To do this you need:

- Register on the State Services portal.

- Find out which bureau stores your credit history.

- Make a request to the credit history bureau.

Twice a year you can order your credit history for free. The results will be sent by email. You can also order the report in paper form.

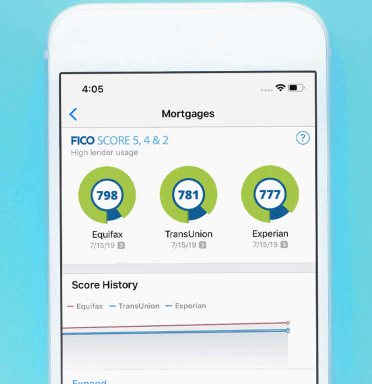

Gradation of rating in the FICO system: what does the scoring score mean for the borrower?

The FICO scoring model helps determine the client's potential solvency and assign an appropriate rating to both the borrower and the contract. Following the principles of FICO assessment, in June 2017 the Central Bank issued Resolution No. P-590, according to which banks must assign one of five quality categories to each loan. For example, quality category I is for standard loans, category V is for bad debts.

Bad (from 300 to 629 points). This rating means a low probability of loan approval on favorable terms. This number of points is received by borrowers who have previously undergone bankruptcy proceedings, citizens without sources of income and liquid assets in property, and persons without citizen status. If, when assessed by the FICO method, the client received a Bad rating, the minimum amount of borrowed funds can be obtained from an MFO (microfinance organization) either under the guarantee of solvent third parties (relatives, friends), or by providing collateral.

Fair (from 630 to 689 points). This rating is assigned to clients who have previously repaid several loans with significant delays, or who have frequently contacted the bank for loan restructuring. The likelihood of receiving a loan on standard terms is low, but clients with a Fair rating are given loans by microfinance organizations and some newly opened banks. Also, a borrower with a Fair rating can apply for a small overdraft to a debit card or take out a credit card from a bank that services a salary or pension project.

Good (from 690 to 719 points). This rating is assigned to conscientious borrowers who regularly take out various loans. Small (up to 15 calendar days) delays in payments, early repayment of debt or registration of “credit holidays” (deferment of loan payments) are allowed. Clients with a Good rating can qualify for preferential lending conditions in most commercial and some government banks; loans are easily issued without guarantors or collateral. If a client plans to apply for a loan with government support (for example, a mortgage with maternity capital, a car loan with a subsidy), the Good rating increases the chances of receiving approval.

Excellent (from 720 to 850 points). The rating is assigned to solvent borrowers with a long (from three years) history of repayment of various types of loans without delays, restructuring and “credit holidays”. The client's debt burden does not exceed 30% of monthly income, the borrower has been officially employed at his current place of work for at least six months. The Excellent rating allows clients to freely choose banks to receive a loan; financial organizations offer loans on preferential terms and approve large amounts without collateral or guarantee.

The gradation of points for each rating is determined by the bank or microfinance organization individually. For example, large state-owned banks can assign a Good rating with 700 points, microfinance organizations with 650 points. In general, the solvency and reputation of the borrower are most strictly assessed when applying for loans with government support, as well as before issuing long-term loans for large amounts.

What does a credit history consist of?

The report received from the credit bureau includes the following sections.

- Borrower's personal data.

- Credit scoring.

- Statistics – this section contains information about existing and closed loans, including credit cards. The section consists of subsections:

- the total amount of debt as of the date of the request;

- information about existing contracts:

- name of the credit institution;

- payment status (if timely payment is made, the status “on time” is assigned);

- amount of credit;

- loan terms;

- current debt;

- information about closed loan agreements includes the same items as for existing agreements.

- Credit History Inquiries. This section contains information about who and when requested a credit history from this bureau.

- Information about applications and decisions. Here you can find out when and where you applied for a loan, as well as the results of bank decisions.

- Information about court decisions. Includes information about court decisions that have entered into legal force.

- Information about collateral and bank guarantees.

- Bankruptcy. Information about initiated bankruptcy procedures for an individual.

- Contact information for credit bureaus.

What can affect your credit history and scoring score?

We have already examined the situation in which borrowers with the same income were assigned different credit ratings. Let us summarize the main factors influencing the size of the rating and credit history:

- High level of income.

- Prestigious position.

- Long term of work in the last place.

- Timely repayment of loans.

- Higher education.

- Registered marriage and no dependents.

- Ownership of property.

Recommendations for improving your credit rating before scoring

How can you legally increase your scoring score? It is clear that if you do not have a higher education diploma or are not married, then nothing can be done about these points. But you can make your rating increase due to other points:

- Order a credit history as described above. Check to see if you have any outstanding credit cards. Sometimes an error or forgetfulness can be the reason for a bank's scoring failure.

- If you have outstanding debt, pay it off as soon as possible.

- Indicate additional income in the application form, if you have any. Even in the absence of documentary evidence, this will not be superfluous.

- Open a deposit account at a bank. Having open accounts has a positive effect on your credit rating.

- Provide only reliable information and do not be afraid to indicate telephone numbers of contact persons.

Results

The FICO scoring method is based on credit history (Payment History), current debt load (Amounts Owed), length of use of loans (Length of Credit History), types and frequency of loans (Credit Mix and New Credit). Scoring based on FICO principles was first used in the USA; today the assessment model is widely used in the Russian Federation. For example, the FICO credit rating is used by the National Credit History Bureau, Sberbank, and VTB Bank.

According to the FICO scoring method, each client is assigned a number of points and a rating that determines the quality of the loan provided. For example, a borrower with a high income and frequent minor arrears receives a Good rating, corresponding to quality category II (loans issued without additional benefits). Russian legislation and internal banking regulations allow financial institutions to implement unique scoring models based on FICO and establish their own rating gradations. Small private banks and microfinance organizations evaluate the credit histories of borrowers more loyally; clients of large state corporations undergo the most stringent selection.

Advantages and disadvantages of a scoring system

In simple words, scoring is a check of the borrower’s reliability, carried out to assess the bank’s risks. The scoring system has both advantages and disadvantages.

Advantages

- Fast application review.

- Minimum costs for assessing the borrower.

- Absence of the subjective opinion of a bank employee and other risks from the “human factor” category.

- Identification of fraud risks using an automated system.

Flaws

- The scoring system does not analyze the client, but the information that is provided to them. Thus, there is a risk that the borrower may prepare the correct answers in advance.

- The program has technical imperfections and needs constant updating.

- For clients without a credit history, it will be difficult to review an application using a scoring system, since the program cannot predict the behavior of a potential borrower.

How does the scoring system evaluate the data?

When checking, the scoring system uses only data that can be obtained legally, for example:

- analysis of an application for a loan or credit and the questionnaire attached to it. The questions are designed in such a way as to accurately assess the client’s financial capabilities and reliability. This is called application scoring.

- assessment of the client's credit behavior. If the client has not been late, the credit institution can offer him additional services. This example of credit scoring is called behavioral.

- Fraud scoring is another form of borrower assessment. This means that the bank or MFI will determine whether the potential client will intentionally avoid repaying the loan - that is, whether he will be a fraudster. Unfortunately, 1 out of 10 cases of non-repayment of loans refers to fraud on the part of the borrower, who initially did not intend to return the funds received.

Most modern scoring systems have a self-learning algorithm - in other words, the program takes into account all the behavior patterns of borrowers who have ever taken out a loan or credit from a given financial institution.

Is it possible to cheat the scoring system?

It is impossible to cheat the scoring and you should not try to do so. Information on your debt is always verified and concealment of data can be equated to fraud.

If you have income that cannot be confirmed by a certificate, leave the telephone numbers of contact persons, for example, your manager or accountant. Warn these people about a possible call from the bank. Employees must verbally confirm the amount of income you indicated on the application form. If you knowingly indicated an amount greater than you receive, and the accountant does not confirm this information, you may also be added to the list of scammers.

In addition, it should be remembered that scoring exists for a reason. If you indicated an income amount of 225,000 rubles. ($3,000 or 87,000 UAH), and you get 60,000 rubles. ($800 or 23,200 UAH), think about how you will repay the loan, whether you will have money left to live on. Please review the preliminary monthly payment schedule before signing the application.

What should I do if I found an error in my credit history?

There are unpleasant situations when a bank refuses a loan without explanation. Having ordered a credit history, a person finds an error in it. What should be done in such cases?

Most errors are caused by the human factor. For example, a bank employee did not transmit information about the repaid loan to the BKI. Or maybe you were confused with a namesake and someone else’s loan was added to your credit history. Or there was a technical glitch in the program.

In all these cases, you will have to deal with the problem yourself. It would be useful to know that banks are subject to sanctions for reporting false information to the BKI. A BKI employee also faces a fine for a mistake.

The algorithm of actions is as follows:

- We go to the bank and receive a certificate stating that the loan has been repaid in full. The certificate must contain your unique credit history subject number. Perhaps, in order to find out this number, you need to write a separate application.

- If you have been assigned a non-existent loan, contact the bank whose loan is mistakenly assigned to you. There you should be given a certificate of all previously issued loans, if any. If you have never received a loan from this bank, ask for confirmation.

- We contact the BKI with the received documents. This can be done once a year in writing, free of charge. In addition, you have the right to an unlimited number of paid requests electronically. Such a request can be submitted on the Central Bank website.

- The error must be corrected by a BKI employee within 30 days, after which the already corrected credit history will be sent to you by email.

- If a BKI employee refuses to correct the data, you have the right to go to court or Rospotrebnadzor.