If you need assistance of a legal nature (you have a complex case and you don’t know how to fill out documents, the MFC unreasonably requires additional papers and certificates or refuses them altogether), then we offer free legal advice:

- For residents of Moscow and Moscow region - +7 (499) 110-86-37

- St. Petersburg and Len. region - +7 (812) 426-14-07 Ext. 366

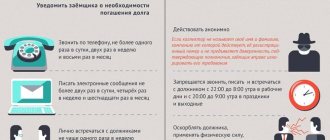

Krasnoyarsk Krasnoyarsk Territory Collection service employees call the debtor and relatives every day Rating: 1 Not counted Hello! I have an overdue debt for 2 weeks. Collection department employees call daily, both to me and to my wife. I have repeatedly announced to the employees of the collection service that I will pay the overdue debt by the end of the month! Calls come to my phone every day, and sometimes 2 times a day! According to the Federal Law, namely: The Federal Law clearly regulates how many times a day, according to the law, the bank can call the debtor: no more than 1 time a day; no more than 2 times a week; no more than 8 times a month.

He reviewed the decisions of the Nizhny Novgorod courts in the case of extorting a debt from a borrower.

Do banks have the right to call the debtor’s relatives? It is not always immediately possible to find a way out of a difficult situation, and banks, meanwhile, apply a number of measures to the debtor to collect the debt. The means aimed at attracting the fulfillment of debt obligations assumed by the debtor are not always legal. In order to find an unscrupulous payer, the creditor calls the debtor’s relatives, friends, and work.

Collectors call about relatives' loans: what to answer

You haven’t borrowed money anywhere, but suddenly the bank calls you about a relative’s loan and demands to repay his debt. In what cases are you obliged to pay for your wife, uncle or brother, and in what cases are you not? All situations can be divided into three types. In some cases, you are required to pay by law. In others, you are not required to, but it may be beneficial for you to help a relative sort out his financial problems.

And the third option is when other people’s debts have nothing to do with you. When you must pay 1. To ensure that the loan was definitely approved, he asked his aunt to become his guarantor. During his internship, Nikolai encountered unexpected expenses and fell behind on his loan payments. The bank immediately contacted his aunt and demanded payment for Nikolai. The guarantor bears the same responsibility to the lender as the borrower himself.

A bank or microfinance organization MFO has every right to demand payment of debt from you if the person for whom you have guaranteed violates the loan payment schedule.

Read more about the responsibilities of a guarantor in the article about surety. You are the heir of the debtor. Uncle Sergei included him in his will and left him his motorcycle. But when Sergei began to formalize the inheritance, it turned out that his uncle had taken out microloans at high interest rates. Now Sergei needs to assess the size of his debts and decide whether to inherit. Credits and loans of the deceased after his death pass to the heirs. The creditor has the right to demand repayment of the debt from you as soon as you inherit.

But you are obliged to pay debts within the value of the property that has been transferred to you. For example, if you inherited an apartment, a car and a dacha for a total amount of 5 million rubles, then only within the limits of this amount will the debt fall on you. The new car was registered for my sister, but we agreed to take turns using it. Later, my sister was offered a job in another city. She left with a new car and promised that she would pay the loan herself. But a few months later, Dmitry received a call from the bank and was informed that the payment was overdue.

My sister won't contact me. Should Dmitry now bear all this debt alone, or can it at least be halved? If you took out a loan or loan for two people at once and both signed the agreement, then you became co-borrowers. In this case, both of you are responsible for the debt equally. The bank does not care which of you will make payments and how you will divide them among you.

The main thing is that they arrive on time and in full. Dividing the debt and paying only your half will not work. It will not work to refer to the fact that you have not seen the second co-borrower for a long time and refuse to pay. If you took out a loan secured by, for example, a car, the car may be repossessed and sold so that the bank can get its money back.

But if there was no collateral, the creditor can sue you and your co-borrower, and your things can be taken from you and sold under the hammer to pay off the debt. You are using property that legally belongs to the debtor. Vladimir bought an apartment for his daughter Olga on a mortgage and registered it as his own.

But four years later, Vladimir was laid off and stopped making loan payments. Olga is not listed as a mortgage debtor, but she has a clear reason to pay off the loan for her father. Otherwise she will be left without an apartment. If you use a home, car or other property that belongs to a relative, and he cannot pay off his debts, it makes sense to help him.

Yes, perhaps you did not count on these expenses. But if the debt is not repaid, the procedure is standard: court, inventory of property and sale of things at auction at a price below market value. At the same time, it is worthwhile to play it safe and try to obtain ownership of this property.

For example, if your home is pledged to a bank, you can discuss with the lender how to transfer both the real estate and the mortgage responsibilities to you. The debtor owns part of your common home. Arina and her brother inherited a dacha from their grandmother. She was used to spending the summer there. My brother never showed up in his half - he likes holidays at sea much more. But he took out a large loan from an MFO secured by his share of this real estate, and now he cannot pay it off.

So his half of the dacha could be seized for debt. In such situations, the problem will affect you directly. On the one hand, you are not responsible for debts on your relative’s loans and no one will take away your part of the property. But if the loan debt is not repaid, it is quite possible that you will have to meet new neighbors.

If a relative owns part of your shared apartment, dacha or other real estate, the court may seize his share and then put it up for auction. First, you will be offered to buy this part of the property. If you do not agree or do not manage to find the required amount on time, the debtor’s share will be put up for public auction. This can be avoided. For example, you can buy out part of your relative’s property yourself, even if it is pledged.

But first you need to contact the creditor, get his consent to this transaction and formalize it so that the money goes specifically to repaying the debt. If the relative and his creditor agree, then selling part of the home to strangers can be avoided.

But it is better to consult with experienced lawyers. They will help you draw up an agreement in such a way that the deal cannot be disputed later and your interests are not infringed.

If he lives separately and you are not interested in what will happen to his property, then you are not obligated to solve his financial problems.

If you receive calls from creditors or debt collectors about debts that you have nothing to do with, you have the right to refuse to talk to them. What to do? Changed

They will play a game of silence

The bill was introduced to the State Duma by two deputies. They drew attention to the legal conflict. The law today protects the debtor from the excessively intrusive attention of the creditor. They can communicate with him within strictly limited limits. Call at night? It is forbidden. Third call in a week? Violation. Moreover, at some point the debtor may write an official refusal to communicate with debt collectors. But no one asks his loved ones for consent.

As Vladimir Gruzdev, Chairman of the Board of the Russian Lawyers Association, emphasized, the goal of the project is to protect the rights of citizens.

“Any communication between employees of banks and collection organizations with relatives of the debtor will be possible only with the written consent of the relatives themselves,” explained Vladimir Gruzdev, Chairman of the Board of the Russian Lawyers Association.

The rights of citizens will be protected primarily from the unlawful influence of debt collectors. Vladimir Gruzdev noted that today the standards are not very fair.

“Permission, of course, is required, but it is given by the debtor. The consent of the relatives themselves is not asked. But it is the relatives who must determine whether they want to communicate on this matter, because they have no obligations. In addition, collectors often begin to harass not only relatives, but also friends and neighbors of the debtor,” said Vladimir Gruzdev.

He also explained that the bill introduces a rule: any interaction with members of the debtor’s family, relatives, other persons living with the debtor, neighbors and any other individuals aimed at returning the debtor’s overdue debt can be carried out by creditors and collectors only with written prior consent the specified persons.

The bill also provides for their right to revoke previously given consent at any time.

Let us remember that in 2020 a law came into force that introduced rules for debt collection.

“For example, you can negotiate by phone no more than once a day, twice a week and eight times a month from 8.00 to 22.00 on weekdays and from 9.00 to 20.00 on weekends and holidays. For violation of the procedure for communicating with the debtor and other actions that go beyond the rules, administrative liability is provided,” explained Vladimir Gruzdev.

There are fines for violations of the rules.

According to the Federal Bailiff Service of Russia, in 2020 the courts considered 2,418 cases of administrative offenses under the article of the Code of Administrative Offenses, which punishes violations of the procedure for collecting overdue debts. The perpetrators were fined a total of 114.7 million rubles.

The Ministry of Justice is currently developing a bill to modernize the system of control over debt collection. In particular, collectors will be required to record their conversations with the debtor. The agency also prepared a draft order introducing requirements for equipment and software of professional collection organizations.

Among other things, the equipment used must ensure audio recording of conversations during personal meetings, automatic audio recording of telephone conversations with the preservation of audio information in licensed formats, storage of audio recordings of all cases of conversations with the debtor or his representative. Exactly the same requirements will be imposed on banks.

“Stop calling us!”

It is incorrect to say that debt collectors do not have the right to disturb the relatives of the debtor. Such actions are legal if the loan agreement contains a clause on the possible disclosure of the terms of the agreement to third parties and consent is given to the processing of personal data. Debt collection agencies can inform those relatives who have agreed to become guarantors for the loan about the debt. It must be remembered that the debtor’s spouse bears the same responsibility for the loan as the borrower himself, but only after an appropriate court decision. When entering into an inheritance, the successor receives not only the property, but also the debts of the deceased person.

Do debt collectors have the right to call at work?

In the case of work, the same rule applies as for relatives. When contacting third parties, we are talking about the disclosure of confidential information (this was already mentioned earlier).

When naming collectors for a job, you need to do the following:

- We inform callers of their intention to contact the police.

- If the warning does not work, we write a statement and submit it to law enforcement agencies and the prosecutor’s office.

- We ask colleagues who were affected by the calls to sign the statement.

- We are trying to resolve the issue with the banking institution.

If a debt arises, it is recommended to immediately go to your boss and explain the situation to him. Few people will like constant calls, so to avoid quarrels it is better to have a preliminary conversation.

To eliminate the problems discussed above, it is important to contact specialists and ask for help in resolving the issue of debts.

Debt consultation

Does the bank have the right to call the debtor’s relatives?

You haven’t borrowed money anywhere, but suddenly the bank calls you about a relative’s loan and demands to repay his debt. In what cases are you obliged to pay for your wife, uncle or brother, and in what cases are you not? All situations can be divided into three types. In some cases, you are required to pay by law. In others, you are not required to, but it may be beneficial for you to help a relative sort out his financial problems. And the third option is when other people’s debts have nothing to do with you. When should you pay 1.

What to do if this happens?

If you are unlucky and after explaining to the caller the fact that the debt is not yours, the calls continue, then you need to choose the right communication tactics and follow certain rules, which will be discussed further.

The first and most important rule that you should follow when debt collectors call you about your relative’s debt is not to panic and not to try to be rude and insolent in response.

When communicating, you must clearly understand who you are talking to, and that any word spoken may be considered not in your favor.

Communication methods

There are some general tips that a person receiving a family debt call should take note:

- If a debt collector calls you, be extremely collected and careful in your speeches. Do not promise anything and do not disclose any information about yourself, a relative or any other information. Answer only monosyllables to the questions put to you.

- If you were told that they will call you back after a while, then you should not carry your phone with you everywhere and be afraid of missing a call. Not only can they call by law only during strictly designated hours, but it is also possible that you may be busy at that moment. If they need to, they will call again.

- If you receive an automatic call from a certain number, then nothing prevents you from creating a blacklist.

- Record each such conversation, while warning your interlocutor about it. Specify the details of the person, position, name of the organization, details of the bank from which the information was transferred, as well as known details of the debtor.

The main mistake that relatives make is a state of panic associated with the possibility of shifting the debt onto their shoulders.

Many people begin to worry, get nervous, and block the number from which they were called, not even realizing that, most likely, the calls will always be from different phones. Moreover, such a measure will not lead to the desired result, since, knowing the phone number, it is not difficult to find out the person’s address.

Complain about their actions

A very popular method of combating injustice today is calling a hotline. But this doesn’t work with collectors. This complaint will be relevant only if banks and their employees bother you. After such a complaint, most often the calls will temporarily stop, since the banking organization or a specific employee will be detected and punished.

Another organization that receives complaints against debt collectors is NAPKA, but this can only give any results if this service is a member of this society. Don’t think that the debt collector will be fired immediately. It is unlikely that this will happen, but he will certainly be provided with a certain fine and a lot of written papers.

To the question “Do debt collectors have the right to call the debtor’s relatives and threaten them?” there can be only one answer: yes - they can call in certain cases described above, and no - threats are unacceptable, as is the demand to repay the debt.

According to the current legislation of our country, all abuses by collection services and other organizations involved in debt collection are subject to review and assessment by the police. It is also possible to seek help from the prosecutor's office, but most likely your appeal will be redirected to the same police.

If the actions and actions of debt collectors contain threats, insults, or signs of a crime in the form of extortion, then this may entail administrative or criminal liability against them.

Your loan isn't just an inconvenience for you. Read whether a bank can sell debt to collectors. How to calculate severance pay in case of layoff? See here.

Fraud when purchasing land is not uncommon. Find out how to protect yourself.

Don't call mom

When applying for a loan, the debtor must provide contact information. Often banks require you to write not just one number, but several - this is how the phone numbers of the debtor’s relatives get into their database. If there is a delay or payments stop coming in completely, bank employees start calling all the numbers that were specified in the application form when receiving the loan. Therefore, callers harass not only the debtor himself, but also his relatives.

.

.

Is it possible to stop calls?

In situations where the debtor indicates in the contract the telephone number of one of the relatives or collectors find it on their own, they can talk to the borrower’s relatives over the telephone. However, let us clarify that this is allowed to be done a limited number of times and only for the purpose of finding the person they need.

Collectors do not have the authority to force third parties to pay debts. They also cannot disclose the amount of debt and other data. All they can do is ask their interlocutor to convey information to the debtor about the need to repay the loan or provide information about his whereabouts.

How should that same relative behave in such a situation? He has the right to act at his own discretion. He can tell the collectors where the individual is, provide his contact information, and also ask him not to bother him anymore.

It is worth noting that in the latter case, extortionists, trying to obtain the necessary data, can intimidate with responsibility for hiding the data. Such information is not true and is only an attempt at psychological influence.

In real life, stopping calls is not so easy. Sometimes calls continue to come even after the interlocutor has provided all the information to the collectors. What should the debtor’s relatives do in such a situation?

- Ask the debt collector for his first and last name, as well as the position and organization that is his employer. It would also be a good idea to find out which bank issued the loan to the borrower. Having such information, you can contact the financial institution’s hotline or directly to the management of the collection agency. A company that values its reputation will make every effort to resolve the unpleasant situation that has arisen;

- Explain the whole situation to the collector again, clarifying who the loan is actually issued to. If this does not help, say that you intend to complain to Roskomnadzor;

- if the collector does not respond to explanations, you should really file a complaint with Roskomnadzor and add the collector’s number to the blacklist;

- Personally visit the nearest branch of the bank that issued the loan and try to understand the situation while communicating with the manager. Say that if the problem is ignored, you will complain to law enforcement agencies.

By using one of the above measures, you can stop annoying calls forever. However, it is possible that in the future the financial institution will transfer the debt to another collection organization and the situation will repeat again.

What to do when debt collectors call about someone else's loan

How to react

Are you absolutely sure that the bank is violating the rules of “fair play”?

The words that you don’t know where your relative lives now and you don’t have his phone number are not accepted? You can try to stop such unpleasant communication. For example, don't answer calls. Or, on the contrary, visit the office of a bank or agency, from where they are regularly distributed, and try to explain that you are absolutely unable to help them find a relative. You can even write a complaint to the Central Bank. Another option is to invite the agency to send all the necessary documents by mail or go to court. A more aggressive way to stop “telephone terrorism” of a bank or, what happens much more often, of an agency is considered effective: contacting the police. They say that they not only call you regularly, but actually have a serious psychological impact, demanding the impossible. Yes, they simply interfere with living in peace.

Why do they call

When concluding an agreement, credit department employees try to find out in advance, including over the phone, everything that will help them find a client even if force majeure occurs. This includes passport details, home address, place of work, mobile and home telephone numbers, as well as addresses and telephone numbers of guarantors and even relatives. The clients themselves, wanting to get a loan at any cost, willingly meet them halfway. In a word, the bank is practically delegated the right to search for the debtor if necessary, regularly calling his household and provoking them into family scandals in order to force him to pay. This is what the financial institution willingly uses, over time transferring all the information necessary to find the defaulter to the collection agency.