Any collection agency, in its own work, cooperates with the territorial departments of bailiffs in court, namely, the office acts as a collector in enforcement proceedings.

It is clear that the main goals of the official work of a bailiff in court and a collector are combined. Bailiffs must take certain measures to quickly and fully comply with the requirements of all documentation, this will be the main point of their work. Also, the office employee aims to achieve satisfaction of the borrower's demands for funds.

The trial took place, I pay the bailiffs, and the collectors got it!!!

Attention

Here you can see a sample of an official request - statement.

- Find out from the bank the exact amount of your debt with a breakdown (interest, interest, penalties, fines, etc.) by ordering a special certificate.

- Collect all loan documents in one place: agreement, payment receipts, payment schedule, etc. You will need such a package for competent communication with agency representatives or, if necessary, to contact lawyers, as well as if the case goes to court.

Note that collectors do not always go to court, and completely hopeless dogs are often written off after the statute of limitations has expired.

- If you have the assignment agreement in your hands, you are convinced of the legality of the sale of your debt and the fairness of the collectors’ demands, then you can make payments using new details.

What should a borrower do to prove infringement of his rights:

Collectors cannot collect debt. Prohibits Art. 330 of the Criminal Code of the Russian Federation. However, a citizen can represent the interests of the bank, having the appropriate power of attorney, and therefore take measures in the manner prescribed by law. If the court upheld the bank's claim, then after the court decision enters into legal force, a writ of execution will be issued, which will be handed over to the bailiffs.

Such actions are the essence of the work and profit of a collection agency. Mistakes of the debtor when communicating with the collector: - panic and confusion, instead of composure and a firm position: sue; - frantic attempts to borrow and pay off an unrealistically growing debt, which is not clear how it is increasing ( there is no legal payment scheme or schedule).

Sergey 04/14/2016 Russia, Moscow and Moscow region, Moscow Dear experts, tell me, do collectors have the right to charge interest? An assignment agreement was concluded between the microloans and the collectors; I was notified of the assignment (at my request) a week after the assignment was concluded; the assignment agreement itself was not provided to me.

There was a trial, I paid the bailiffs. What should I do to prevent collectors from calling me?

Now, legally, the agency has the right, on its own behalf and in its favor, to collect debt from a former banking client. From a legal point of view, the phrase “sale of debt” sounds illiterate, but is quite effective for borrowers who hear it. Often in such a situation, collectors demand from debtors an even larger amount of money than was necessary to deposit into a bank account to repay the loan, which is a violation of the rules.

To answer in more detail whether a bank can sell debt to collectors, let us turn to Article 382 of the Civil Code of the Russian Federation. According to what is described in it, the creditor actually has the right to transfer the debt to another person under an assignment agreement concluded with him. The debtor's consent to this action is not required unless otherwise provided in the loan agreement between the bank and the borrower.

Regulations for the activities of collectors

There is a note on the Rospotrebnadzor website that talks about “semi-criminal methods of debt collection that debt collectors constantly use.” Unfortunately, defenders of the legal framework of the state's residents are not exaggerating.

Not in all cases do creditors manage to keep themselves within the legal framework: frequent complaints from borrowers and numerous court precedents only confirm this. The adoption of the draft “On activities for collecting overdue debt” helped resolve this situation and regulate the activities of collectors.

Analyzing the rights, obligations and work of collectors and collection offices, today we can only talk about those provisions of the law that apply to the relationship between the creditor and the debtor regarding the latter’s failure to fulfill his own obligations under the loan. The legislation does not provide for any participation of collection workers in such relationships.

This material will tell you where to complain about unlawful actions of debt collectors.

However, this does not mean that absolutely every collector does not work according to the law. Acting as an agent, an office employee is considered nothing more than an intermediary, whose entire role is to provide debt collection services to the creditor.

If we turn to the provisions of the legislation on consumer loans, then all the legal possibilities of the collector in relation to the borrower can be reduced to a short but laconic definition - he can only politely and politely ask for the repayment of the debt.

The law defines the general rules for performing actions aimed at repaying debts, establishes acceptable methods and restrictions of interaction with the debtor

Free legal advice on credit issues and debts

Who should pay the debt to bailiffs or collectors? Any citizen or organization has the right to go to court if their rights or interests have been violated (Article 3 of the Code of Civil Procedure of the Russian Federation). Collectors are no exception; they also go to court.

True, much less often than banks. It is not economically profitable for them to sue; it is an extra expense item. If a lawsuit is filed against you, even if the debt is sold to collectors, you must pay the person who has the court decision in hand.

Info

If the collectors decide to keep it, then the bailiffs will not even know that there was a trial.

According to Art. 30 of Federal Law 229, enforcement proceedings are initiated on the basis of a writ of execution. But in the case of debt collectors, unlike the original creditor, there is a high probability of challenging or overturning the court order. This is done due to the illegality of debt transfer or constant violations on the part of agencies.

Interaction between the Ministry of Justice and collectors

The Ministry of Justice carries out regulatory and legal regulation of the work on the return of overdue debt of individuals, as well as individual entrepreneurs for financial obligations that they have acquired as a result of the activities of the entrepreneur.

The Ministry of Justice of Russia and the Federal Bailiff Service are ready to maintain a state register of collectors and implement state policy in the field of collection work in a situation where they are vested with certain powers.

In addition, the Ministry of Justice regulates the collection market and establishes the procedure for collecting overdue debt from citizens , as well as the interaction between creditors and debt collectors.

Consequently, the Ministry of Justice and the FSSP must manage and monitor collectors on an ongoing basis; they are already developing a number of regulatory documentation for collectors. However, most of the collectors who should be included in the new register are still not included in it.

Who should pay the debt to the bank or collectors?

We explained above that under such circumstances, no one needs to pay anything, because it has not been proven whether your bank actually sold the debt to collectors. What to do next? You can just wait patiently, and after 3 years from the date of sale of the debt, according to the collector, you will be able to file a claim to write off the debt due to the statute of limitations. But this does not mean that one should deliberately “evade” one’s obligations, although on the other hand, who prevented claimants from proving their rights and powers legally? And yet, creditors most often win such cases. We do not recommend that you resort to trickery.

Limiting the activities of collection agencies

A new project on the work of collectors says that such offices are required to be registered in the state register of legal entities. Also, an office employee must have an insurance policy. It is needed for the situation when compensation of expenses to the debtor is carried out.

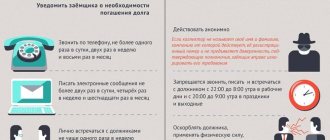

Based on the provisions of the legislative act, collectors can:

- carry out personal meetings with borrowers, but not more than once a week;

- make phone calls only at set times;

- make calls a specific number of times, which is specified in Federal Law 230;

- According to the law, negotiations are supposed to be carried out only with the borrower, with the exception of a certain category of citizens (bankrupts, disabled people and minors);

- The collector is only able to make telephone calls 8 times a month, 2 times a week, and there should not be more than one call per day;

- call the borrower on weekdays from 8 am to 8 pm, on weekends - from 9 am to 8 pm;

- The collector does not have the right to hide the phone numbers from which the borrower receives a call.

Can a bank sell debt to collectors?

Thank you very much for your clear and specific answer.

A creditor who has assigned a claim to another person is obliged to transfer to him documents certifying the right of claim and provide information relevant to the implementation of the claim. If the debtor was not notified in writing of the transfer of the creditor's rights to another person, the new creditor bears the risk of the adverse consequences caused by this for him. In this case, the fulfillment of the obligation to the original creditor is recognized as fulfillment to the proper creditor. Pay for response Continue dialogue Detailed consultation on your question: “Legal Defense Center” st. Glinka, 7, 4th floor, tel.

My husband is a borrower, I am a co-borrower. Along with the loan, we also received insurance (life and health insurance). The insurance amount is quite large. Can we now... more The collectors called and said that a visiting team had been sent to me, what should I do? I have a loan. Due to my difficult financial situation, I stopped paying. The non-payment period will soon be three months. The other day, collectors called and said that a visiting team had been sent to me... more The bank calls too often to remind me about loan payments. In November 2014, I took out a loan from the bank, for which I pay according to schedule, without delays. But every month the bank starts calling a few days before the payment date, and continues to call even...

further All questions in this section »» In 2008, most countries of the world were shocked by the financial crisis, which in one way or another negatively affected all sectors of the economy.

Can debt collectors charge penalties?

But not everything is so simple. However, the norms of civil legislation provide for the possibility of requiring the borrower to pay interest for the use of other people's funds. It should not be confused with interest on a loan. The amount of interest for using other people's funds changes periodically, but on average it is about 10 percent per annum.

Indexation of awarded amounts of money is essentially protection of money from depreciation as a result of inflation.

As for the fact that the debt is growing, this is another topic, and we need to understand why this is so. As a separate point, it is worth noting that the organizations that provided the loan do not have the right to charge fantastic interest, since there is nothing like that, they once tried to impose some kind of fines, sanctions on me, but apparently the collectors came across inexperienced ones.

But here it is necessary to note one nuance - only those debts for which the statute of limitations has not expired are subject to return through the court. In other words, there is a certain period of time during which the creditor in court has every right to demand repayment of the debt. In such situations, all interested participants are present at the hearing - the defendant, the applicant and the plaintiff, who initially filed a petition to foreclose on the debtor's funds in the bank.

A year ago, during an accident there was a collision with a pedestrian, during the consideration of the case, the victims were provided with a certificate with one diagnosis of damage, and after the expiration Does the bank have the right to charge penalties and fines on interest for using a loan? The loan itself has already been paid ahead of schedule, interest too, but later.

This indicates the probability of transferring the right of claim to third parties after the announcement of a court verdict only if the judge makes an appropriate determination of such a transaction.

And then third parties start pestering you, urgently demanding your money back. You know perfectly well who they are from the Internet and TV. But is it worth paying debt collectors for an overdue loan? Or should I take the money to the bank? Or maybe you are being deceived? It’s worth saying right away that it’s worth paying collectors. But only if their demands are legal.

Order of the Minister of Defense of the Russian Federation dated April 23, 2014 N 255 “On measures to implement in the Armed Forces of the Russian Federation the resolution of the Government of the Russian Federation dated August 5, 2008.

What happened before

The law was also required because before it, a clear and well-developed legislative framework regulating the activities of collectors simply did not exist.

That is, it is even in some way beneficial to those collectors who acted completely correctly before - and there were still some, since before they, like everyone else, did not have a firm legal status. Whether collectors in principle have the right to conduct their activities was an uncertain factor from the point of view of the law, a question to which no clear answer was given. And this semi-legal situation gave a free hand to less scrupulous collectors, who believed that they had the right to use all the tricks that the legislation did not directly prohibit. The result is many high-profile cases that received coverage from journalists. Some representatives of the collection shop have become a habit of writing signs on garages and entrances calling on citizens to repay their debts, while others even make open threats; in short, legal regulation of this area has been brewing for a long time. Finally, in 2020, it is overdue.

Revoke the writ of execution from the bailiffs

Such a statement is an indisputable basis for the bailiff to issue a decision to end the enforcement proceedings. The writ of execution is returned to the claimant. The adoption of this resolution does not prevent the re-initiation of enforcement proceedings in the future. However, the writ of execution must be presented within the time limits established by Article 21 of the said federal law. It is necessary to distinguish between an application for the return of a writ of execution and a refusal to recover.

According to part 2 of this article, the enforcement fee is established by the bailiff after the expiration of the period specified in part 1 of this article, if the debtor has not provided the bailiff with evidence that the execution was impossible due to force majeure, that is, extraordinary and unpreventable under the given conditions circumstances. The enforcement fee is established in the amount of seven percent of the amount to be recovered or the value of the recovered property, but not less than five hundred rubles from a debtor-citizen and five thousand rubles from a debtor-organization (Part 3 of Article 112 of Law No. 229-FZ). Thus, the basis for releasing the debtor from paying the enforcement fee in the event of his failure to fulfill the requirements of the writ of execution within the established period is the presence of evidence of the impossibility of fulfilling the requirements contained in the writ of execution due to force majeure circumstances, of which the bailiff must be notified.

We recommend reading: When Driving School Training Starts Summer 2019