Towards the end of 2020, the Federal Bailiff Service (FSSP) shared interesting statistics: the number of complaints about unlawful actions of debt collectors in the first 10 months of 2019 increased by 30% compared to the same period in 2018. Representatives of the service note that the point is not at all that collectors have become more active and annoying. It’s just that the legal awareness of citizens has grown - now people understand that it is not at all necessary to endure night calls and treat them as a given.

How to get rid of debt collectors

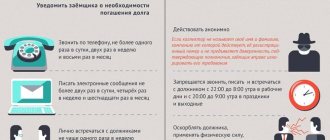

The law adopted in mid-2020 regulated the powers of collection agencies and outlined the rights of debtors when interacting with them. Art. 8 Federal Law No. 230 allows borrowers to limit contacts with collectors. The debtor may send a notice to the bank or collection company:

- on contacts with the debtor exclusively through a representative lawyer, indicating his personal and contact information;

- about refusal to contact debt collectors, provided that at least 4 months have passed since the delay.

Note!

The application must comply with the form approved. By FSSP Order No. 20 and can be handed over to collectors in person against signature, by mail with acknowledgment of delivery, or sent through a notary. In case of refusal to communicate, the collection agency has no right to make contacts with the debtor or send emails. The exception is letters by mail.

How to protect yourself from calls? ↑

The best way to protect yourself from annoying and mentally exhausting calls from debt collectors is to pay off the debt.

However, if this does not work out, all the borrower can do is add the collectors’ numbers to the “black” list, change the phone number, or ignore them.

Additionally, you can write a letter to the collection agency, asking them to communicate with you exclusively in writing.

After such a request, collectors do not have the right to call you. Moreover, such correspondence can help when going to court.

To work

If debt collectors start calling you at work and telling colleagues and management about your financial problems, we recommend that you immediately take the following measures:

- contact the police or prosecutor's office about the disclosure of personal data;

- contact the collectors association.

You must understand that until the court has recognized you as a debtor, no one has the right to disclose knowingly false information.

Where to complain about debt collectors

In accordance with Art. 18 Federal Law No. 230, the FSSP performs supervisory functions in relation to collection firms. If bailiffs receive messages from citizens about violations by collectors, the FSSP conducts an inspection against them. On its basis, bailiffs can issue an order to eliminate violations and bring the perpetrators to justice under Art. 14.57 of the Code of Administrative Offenses or deprive them of the right to engage in collection activities if there are gross violations of the requirements of the law, resulting in personal/property damage to the debtors.

You can file a complaint:

- in writing to the district OSB at the place of residence;

- through the online reception on the FSSP website;

- by telephone helpline number.

If debt collectors call about someone else's loan

When they call from an unfamiliar number and ask if we know the fictitious Fyodor Mikhailovich, who owes the bank 10 million, many people’s blood pressure rises and jitters begin. Although if you are not Fyodor Mikhailovich and did not vouch for him, they will definitely not “sew” anything on you.

People often behave incorrectly - they begin to wonder where the collectors got the number from or loudly demand that they not call. At the other end of the line is a person whose powers are severely limited. He is probably sitting on an auto-dialer via IP telephony and does not even see the number he was connected to. He cannot simply delete a number from the call database. The maximum is to convey information about your dissatisfaction. But he won’t do this either until you explain why he should do this.

People who receive calls about other people's debts are victims of imperfections in the system for distributing telephone numbers.

The previous owner of the number was in debt, the collectors were fed up with him, and he refused the SIM card. The number went on sale, a new owner appeared, but it remained in the collectors' calling database - that's why they call about other people's debts. The operator is not to blame - in Russia the system for monitoring the “cleanliness” of rooms is completely absent. The operator does not even have the right to find out from the subscriber the reason for refusing the SIM card.

If they call about someone else's debt, you need to act like this:

- Ask the debt collector to introduce himself and name the company he represents.

- Explain that you just bought a SIM card, you don’t know the former owner, and calmly ask that the number be removed from the database.

- If they continue to call, send a written statement to the management of the collection agency that you have nothing to do with the debt. It is better to attach to the application the contract that was given at the phone shop when purchasing the number, or a copy.

Usually this is enough, since collection agencies cannot afford to waste employees’ time. However, if the agency ignored the letter, it will have to involve the “heavy artillery” - NAPKA and the prosecutor’s office (if the collectors violated Federal Law No. 230). Statistics show that punctuality is not the strong point of debt collectors; 31% of complaints are about early/late calls. You can get caught up in this when filing an application with the prosecutor's office. It is important to attach evidence to the application - printouts of telephone calls, screenshots of correspondence.

What to do if debt collectors come home

In direct contact with collectors at the debtor’s place of residence, the latter has the right to:

- deny collectors access to housing;

- require notification of the last name, first name and patronymic, as well as the position of the contacting person;

- demand information about the creditor whose interests he represents;

- refuse communication if less than a week has passed since the last such contact;

- record communication with the collector using technical means of audio recording, photography and video recording.

Note!

Such contacts do not threaten the debtor with consequences. Collectors do not have the powers of bailiffs, so even refusal to communicate cannot be regarded as a violation.

If you are a debtor or guarantor

Not only the debtor, but also the person who vouched for him to the bank, are obliged to answer in accordance with the Civil Code for all debts of the borrower (Article 361), including paying interest on the loan and fines. At the same time, according to the law, credit organizations (banks) can transfer debts to third parties. Therefore, collectors who have agreed to purchase such debts have every right to call the debtors or their guarantors.

Another thing is that collection firms sometimes go beyond their powers and violate the law:

- they call early in the morning or too late in the evening (they have the right to call only from 8 (and on weekends from 9) to 22 o’clock (on weekends up to 20 o’clock) or try to talk to you more than 2 times a week;

- exert psychological pressure: they intimidate with physical violence (Criminal Code, Art. 119, 164) or that they will inform work, neighbors or disseminate information about the debt on social networks (Art. 152, violation of the Law “On Personal Data”, violation of bank secrecy, Art. 26 “About banks”);

- they are trying to break into your house (only law enforcement agencies have the right to enter it without your invitation, and only with a special order or bailiffs by court decision).

Important! If debt collectors try to break down doors or exert physical force on you, call the police. In this case, it would also be useful to have witnesses: neighbors or someone you know living nearby.

But still, it is worth going to court or the prosecutor’s office only in such exceptional cases. After all, even if you have found a way to get rid of debt collectors over the phone, at least for a while, remember: even if the court makes any decision regarding their illegal actions, it will not relieve you of the obligation to pay the debt.

In the event of a truly serious violation of the law by debt collectors, you can seek protection of your rights:

- to court: to stop illegal actions falling under articles of the Civil Code or the Administrative Code and for compensation for moral damage;

- prosecutor's office: for violations falling under articles of the Criminal Code;

- Roskomnadzor: in case of illegal processing of your personal data;

- Central Bank: in case of violation of banking legislation.

Naturally, to protect your rights you will need to present conclusive evidence of their violation.

How to protect yourself from debt collector threats

In accordance with paragraph 2 of Art. 6 Federal Law No. 230, threats of the use of physical force, threats of murder or damage are unacceptable when carrying out collection activities. When using them, the person in contact should:

- point out to him the inadmissibility and illegality of such behavior;

- detect threats by any available means;

- contact law enforcement agencies to obtain protection and bring the collector to justice under Art. 119 CC;

- contact the FSSP with a complaint against the collection company for the specified reasons.

How to fight legally?

You need to write a complaint against the debt collectors to the regulatory authorities.

A statement of claim can help recover compensation for moral damages.

If there is fear for the life and health of the debtor and his family, then you need to write a statement to the police.

You should purchase technical devices that allow you to block calls from collectors or record conversations - mobile and landline phones with a black list, voice recorders.

If you receive threats

It is imperative to record these threats by audio and video recording.

If threats are written on the wall or front door, then they should be photographed. This evidence must be included in your application to the police.

The application must indicate:

- information about the addressee;

- information about the claimant;

- detailed description: what were the threats of the collectors.

The application must be considered within 3 days after the application.

A sample police report against debt collectors is here.

A decision will be made whether to initiate criminal proceedings or not.

You can also contact human rights organizations that will provide free legal assistance. It is possible to contact the media and editors of popular television programs, for example, “Man and the Law.”

You should know how to deal with debt collectors if they threaten you. How to protect yourself from debt collectors? Read here.

What to do if debt collectors call about someone else's loan? Detailed information in this article.

Contacting law enforcement agencies

In addition to the police, you can contact the investigative authorities and the prosecutor's office. This is necessary when debt collectors threaten the debtor and his relatives with physical harm.

It is not necessary to contact the police department; you can call them directly during the next visit of the collectors.

We must remember that in 99% of cases, debt collectors act in violation of the law, try to put pressure on the debtor and do not know exactly how to influence him.

The debtor himself must build a line of communication with collectors. He does not need to constantly make excuses to collectors. He is not obligated to communicate with them at all.

It is recommended to seek support from a credit lawyer. He will be able to take on responsibilities for interacting with debt collectors and protect the rights of the debtor in court.

Is it worth paying debt collectors for overdue loans?

If the collectors perform only representative functions, being hired by a person for the purpose of returning a debt, it is not worth paying money to the collectors on account of the debt. Settlements should be made with the lender at the location of the office. But collection firms can also act as creditors if the debt was assigned in their favor by the original creditor under an assignment agreement. In this case, you can make payments with the collectors, but it is also recommended to do this at the organization’s office.

Should I pay debts to collectors?

If you want to get rid of debt collectors legally, yes, of course, you need to. After all, even if you die, the debt will not disappear, but will pass to your heirs. But you are obligated to repay only the amount (including interest or penalties) specified in the banking agreement. According to the Civil Code, you are not obliged to pay any “extra” claims made by the collectors themselves (Article 384).

Letter from a collection agency

Also, when communicating with debt collectors, be sure to check whether the agreement concluded with the bank contained conditions on the assignment (assignment) of your debt to a third party and whether you gave consent to it. Otherwise, the bank’s agreement with debt collectors is a violation of bank secrecy (and the Banking Law) and may be cancelled.

There are also cases when the bank does not sell the debt, but only enters into an agency agreement with debt collectors for assistance in debt collection. In this case, the rights of collection agencies are as limited as possible: they only have the right to conduct regular conversations with you.

After finding out the exact and legal (!) amount of the debt, act absolutely calmly. Explain to the collectors that you are going to go to court with a request to recalculate the loan, as well as check the legality of the required interest, fines and penalties. As a rule, the courts very often accommodate the borrower in the event of temporary absence of work, the birth of a child, a reduction in salary, etc.

If you don’t know how to get rid of debt collectors legally, declare yourself bankrupt (since October 2020, after changes were made to the legislation, this has also become possible for individuals). Therefore, very often collectors even agree to write off part of the debt, leaving the client only the minimum payment or give you a credit holiday (deferred payment).

It is curious that according to the Civil Code (Article 196), the limitation period for loans is simply canceled after 3 years. That is, the bank or collectors do not have the right to demand repayment of the debt from you after this period. But such a period is counted not from the moment the loan was taken out, but from the time when you last communicated with the bank (paid the debt, had telephone conversations, etc.). That is, you need to prove that for 3 years the bank has not applied for a loan.

But still, you should not hope that you can calmly wait for the expiration of the claim in the case of a large amount of debt. Chances are, if you are hiding from debt, the creditor may soon ask the court to put your property up for sale to pay off the debt.

How to check a collection agency in the registry

In accordance with paragraph 1 of Art. 12 Federal Law No. 230, an organization receives the right to perform the functions of a collection agency only from the moment it is entered into the register, maintained by the FSSP. Such a register is freely available on the FSSP website. The debtor has the right to check the collector for the presence of information about him in the specified register. If there is no information about him, you need to stop contacting him, citing that such an organization does not have the right to engage in collection activities.

Family ties

To put pressure on the debtor, collectors often call relatives (brothers, sisters, husband, wife and other persons). According to the law, collectors have the right to demand a debt from a family representative in three cases:

- the presence of a legal marriage and joint property;

- entering into inheritance;

- guarantee when signing a loan agreement.

Collectors do not pay attention to excuses from relatives, threatening to confiscate property and other consequences of late payment of debt.

How to get rid of collection company employees:

- we remind callers about the Criminal Code of the Russian Federation and the punishment for threats;

- recording the conversation;

- we file a complaint with NAPKA, law enforcement agencies, the prosecutor's office and Rospotrebnadzor.

In many cases, a warning is enough to stop calling about someone else's debt.

Questions and recommendations

How to talk and what to answer on the phone?

The main purpose of the collection agency's calls is to agree on payment of the debt.

It is important to conduct the conversation politely, without insults, regardless of the behavior of the interlocutor.

Some tips on how to talk to debt collectors on the phone:

- It is better to answer every phone call - even if the collectors are bothering you, since a blacklist or silence will not solve the problem.

- Turn on the recorder, warning the interlocutor. Ask him to introduce himself.

- Ignore any provocations of conflict or insults.

- Check the amount of the debt and whether the payment details have changed.

- Report that there is no money yet, but when it appears, the debt will be repaid.

If collectors call you at work, say that they are violating the laws on personal data (violation of bank secrecy).

Collectors came home - what to do and how to behave?

Before communicating with debt collectors during a personal visit, remember a few simple rules:

- videotape the conversation, attract witnesses;

- do not allow the collection agency employees into the house;

- demand to introduce yourself and show documents;

- respond to demands calmly.

If you plan to repay the debt, tell us within what time frame you are willing to pay what part of the amount.

To pay or not to pay debt to collectors?

Whether a collection agency needs to be paid depends on the pattern of its cooperation with the creditor. Mostly, the debtor continues to pay the debt to the organization where he executed the loan agreement. When a bank sells rights to a debt obligation, the debtor must pay a collection agency.

There is a legal way to avoid paying and write off debts. From October 1, 2020, any debtor can declare himself bankrupt. But the fact of insolvency must be proven in court. Also, you should not pay money to collection agencies that have not passed state registration and do not have legal rights to carry out such activities.

Many borrowers are interested in what happens if they don't pay the lender or collection agency. If the debtor refuses to repay the debt, does not want to communicate with employees of collection companies, goes into hiding, a frequent option for further developments is court proceedings, seizure of accounts, property with further confiscation, deductions from wages.

Video: what to do if the bank sold the debt to collectors.

What to do when receiving a subpoena?

First, you need to work with a lawyer to determine whether the filed claim is legal. Only the creditor has the right to submit it. The collection agency has the right to seek a court order for compulsory retention of debt only in the event of redemption of debt obligations.

If debt collectors sue, the course of action depends on the jurisdiction of the authority. If the amount of debt is less than 500 thousand rubles, the claim will be filed in the magistrate’s court, when the amount is larger - in a court of general jurisdiction.

The magistrate court considers the case without the presence of the parties, so the debtor can only appeal the received court order or pay the debt.

When do debt collectors start calling?

As a rule, calls, SMS and other attempts to contact begin several months after payments stop. At first, the banking organization waits for a response from the client, meanwhile charging penalties and fines for late payments. Then it acts in one of two scenarios:

- enters into an agreement with a collection agency, under which they provide her with a service by contacting the borrower and trying to negotiate. In this case, payments to the person will also need to be made in favor of the bank and on the same conditions as before;

- sells the debt to the agency under an assignment agreement, that is, makes an assignment of the right of collection. In this case, the collection organization becomes a new full-fledged creditor and can change the terms of payments, but not in a way that is worse for the borrower (for example, the successor creditor has no right to increase the amount of debt and impose new fines).

Once the agency gets involved, its representatives begin calling.

What to tell the client?

An offer like “Discounts on everything today only!”

or “Only here and now!” haven't worked for a long time. The client will hang up and be right. Try to put yourself in the buyer's shoes and imagine what he would like to hear. Briefly and clearly, without any falsehood, tell about your service in a pleasant, legible voice. It is not necessary to use a professional announcer. Your voice or the voice of your best employee is enough. If the offer is truly profitable, then applications from the buyer will follow immediately. Automation is beneficial for any business. The right business is a conveyor belt. In the West, large offices have not been measured for a long time. Business automation is important at the moment, be it auto-dialing or something else. One company makes 500 calls a day and has a staff of 10 employees, another has one professional salesperson and a subscription to the Autodial service. In the second case, each lead is much cheaper. Most likely, your competitors are already using automatic dialers.

How to get rid of debt collectors by phone if I am only a contact person

Lapochkin Sergey 05/06/2015, 01:33 # But try writing a complaint to Roskomnadzor (the body responsible for the protection of personal data). What right has been violated and requires restoration? In fact, nothing has been violated. If they call the contact person at the time permitted by law, then a formal reply will be received in response. Lapochkin Sergey 05/06/2015, 23:26 # Then what is the point and basis for trying to write a complaint, if the right is not violated? This is not a complaint, but a slander. Work officials should add a budget for sending an answer to the problem? then a formal reply will come in response. And in my understanding, this will be a response on the merits of the question posed to an objectively and comprehensively considered appeal. There is no point in writing a complaint. But for some it helps to calm themselves.

How to fight off debt collectors if your contacts are provided by the debtor

If it's not a secret, why don't you just want to change your phone number? Is this a matter of principle? You can think about leverage if you know what exactly the collectors are saying. Are they rude, threatening, or just pestering for attention? Re: How to get rid of calls from debt collectors to the wrong address? If your mother-in-law herself indicated your phone number as a contact number, then it will be difficult to get rid of calls.

On banking forums, every second complaint is about calls regarding loans to third parties, even complete strangers. Collectors are usually reckless and lacking in sanity. But try writing a complaint to Roskomnadzor (the body responsible for the protection of personal data).

The police and the Prosecutor's Office will not help here. If the collectors work for the bank, and not under assignment, also try writing a claim to the bank itself. Banks are more adequate in this matter. You can think whatever you want - our country is free in this regard! But there is no need to accuse me of lying, especially without evidence. Maybe this is not the prosecutor’s diocese, but I didn’t think about it - I didn’t care. I simply wrote to the department that, as it seemed to me, would treat the letter in a non-formal manner. And so it happened. First, a letter came from the prosecutor's office saying that the case had been taken under control and transferred to the police, and then a letter from the police also came with a report on the work done. And remember what you recommend doing when appealing something or the actions of someone... That? That’s right - write a lot and everywhere, incl. and to the prosecutor's office. Although not all cases of this department are “obscure.” Lapochkin Sergey 05/06/2015, 01:25 # And remember, what do you recommend doing when appealing something or the actions of someone? That’s right - write a lot and everywhere, incl. and to the prosecutor's office. In most cases, collection agencies buy debts in bulk, in batches, paying 10-15% of the value of the debt for them. It is more important for banks to get rid of unnecessary liabilities than to bargain with collectors, since the volume of overdue debts worsens their rating in the eyes of

Central Bank. What does a borrower need to know about an assignment agreement? It is important to know that the borrower himself cannot influence the assignment agreement. This means that such a concession is completely legal. How to get rid of collectors in this case? The fact is that the borrower must be notified that the lender has changed.

According to the civil code, this is the responsibility of the credit institution that issued the loan. In other words, if your debt was transferred to a third party, then the bank, and not the collectors, is obliged to notify you about this. In practice this rarely happens. Banks sell loans, especially small ones, in bulk.

What does the legislation say?

We should start with the fact that the activities of collection agencies in Russia are not illegal, but there is no specialized legal act in the country regulating the activities of such market participants. In 2011, such an initiative was proposed by a group of parliamentarians, but the matter never reached law.

Scrolling through the current legislation, you can come across the following points:

- The activities of collection services fully comply with the provisions of civil legislation , which does not consider the specifics of the activities of collectors, but only the form of its organization (such companies are most often registered as LLCs).

- Federal Law No. 353 “On Consumer Credit” establishes that the bank has the right to assign overdue loans to other legal entities. Moreover, both they and the bank itself can use telephone communication with the borrower, sending him letters and SMS, as well as personal meetings to repay the debt (Article 15).

These seemingly harmless legislative provisions are actively used by collectors to carry out their not at all harmless activities.

What measures to take if debt collectors call at night?

Obviously, if a collector violates the law, we are definitely not talking about conscientious organizations that put the comfort and needs of the client first. This means that you should not contact such agents, even if the debt actually exists. Perhaps this is not a professional agency at all, but a fraudulent company posing as a collection organization.

- The first thing to check is the existence of such a company. All collection agencies are listed in the FSSP register, which is open for viewing, and when calling, the collector must introduce himself. If the organization does not exist, most likely you have become a victim of scammers.

- In the case of real agents, you can try to negotiate peacefully by informing them that their behavior violates the law.

- If the problem is not resolved, it is necessary to collect information proving illegal actions on the part of the agents. Warn that the conversation is being recorded, save the call record.

Where to contact.

Some advise filing a complaint with Rospotrebnadzor, but the activities of collection agencies are not within the jurisdiction of this body. Contact NAPCA, the National Association of Professional Collection Agencies, which ensures debt collectors follow the law and code of ethics. Attach to your complaint the evidence you have collected and try to describe the problem in as much detail as possible. The complaint form is available on the official website of the Association and is as easy as possible to fill out.

What else to check.

Pay attention to whether people calling you are violating other legal requirements. If debt collectors make threats, divulge information about you or provide false information, do not introduce themselves or behave harshly, it is also better to mention all this in the complaint.