According to the Central Bank of the Russian Federation, the total debt of Russians on microloans now exceeds 100 billion rubles and is growing rapidly. Unlike a bank loan, microloans in case of delay have the unpleasant property of growing like a snowball. In this regard, the popularity of their refinancing is growing.

The Agency for Microloan Refinancing notes that in the first half of 2017 alone, demand for this service increased by more than a third, and the average amount of refinancing increased from 100,000 to 120,000 rubles. Let's talk about what microloan refinancing is and how to use it.

Life story

“Foolishly, I took out a microloan of 3 thousand rubles for 14 days in July 2020. I paid 2 thousand rubles once, and then I lost my job and the loan froze. On November 30, the MFO called me and offered to talk. At the meeting they showed a paper with a debt of 66 thousand. I almost fell out of my chair, and they explained: every day of delay there was interest (2%), fines of 0.25%, and some other penalties. I said that I was unemployed and didn’t have that kind of money.

They answered that they understood my difficult situation and if I paid 40 thousand by the end of the week, the rest of the debt would be forgiven. They expertly told where you can quickly get money (sell jewelry, beg from friends and acquaintances, take out a loan for relatives, and so on). They threatened, of course. I didn’t think that because of the unreturned thousand they would disperse so much.”

Adding to the drama of the situation is the fact that MFOs collect debts much more aggressively than banks. Therefore, if you value your reputation, as well as the peace of mind of your family, try by any means to get rid of the debt, or better yet, from the microloan itself. One of the best ways to do this is through refinancing.

How to refinance a microloan

Since microloans are issued, as a rule, without a serious check of the borrower’s credit history and solvency, financial organizations a priori consider MFO clients as a high-risk factor. Hence certain restrictions on refinancing.

The easiest way to refinance a microloan is at an early stage, when you are regularly paying off the debt. In this case (and if there have been no arrears before), you have a good credit history and the products of many banks are available to you.

Yes, most often you can’t get the most profitable loan, which is also burdened with insurance, but compared to hundreds of percent per annum from microfinance organizations, such conditions will seem like manna from heaven.

It’s another matter if you have already made a delay, which is reflected in your credit history. In this case, the range of options for you quickly narrows. Refinancing with another microfinance organization or a new loan with your own – these are all the options.

True, there is an opportunity to significantly improve conditions. In most microfinance organizations, each subsequent microloan is given at a more favorable interest rate than the previous one. Even with a large debt, the possibility of refinancing remains, especially if you do not have liquid property.

It is more logical for a microfinance organization to get at least something from you rather than futilely trying to shake the borrower with the help of collectors or sue him.

What are the dangers of unclosed debts in MFOs?

Many borrowers do not even realize how dangerous failure to repay a microloan will be for them. The consequences of such an oversight are unpleasant for the MFO client and his family members:

- penalties - interest on the debt can exceed the loan amount by 2-3 times, there are no restrictions on them unless you go to court, and an amount of 10,000 in a few months can turn into 100,000 rubles;

- “selling” debt to collectors - these professional collectors sometimes use the most harsh methods;

- lawsuits - MFOs rarely resolve the issue in this way, but if such a scenario is realized, the debtor will pay all costs, enforcement fees and risk his property, which the bailiffs can describe.

In addition, the borrower will not be able to fly abroad, since the bailiffs have the right to issue a travel ban even for a debt of 10,000 rubles.

Important!

But the court can be considered as a lifeline if interest debts have long exceeded the loan amount several times. By law, the MFO is obliged to stop accruing interest when its total amount exceeds the debt itself by more than 2.5 times, and after the trial the debtor should only pay this amount.

Three ways to refinance a microloan

To get out of an impending or deepening debt hole, you can take three paths.

Method #1: Refinancing a microloan at a bank

The most successful holders of MFO loans are refinanced by banks. Most often, we are not talking about refinancing in the full sense of the word, but about a new consumer loan, with which the bank client independently repays the microloan.

As a rule, this happens at an early stage of debt formation. And since the average microloan amount in the Russian Federation does not exceed 30 thousand rubles, taking out a similar or slightly larger loan, having a good credit history, is not so difficult.

The most realistic option would be to issue a credit card or receive a loan without proof of income. There is an opinion that there are banks where they don’t look at credit history at all, but this is not true. Credit cards may not be checked by microfinance organizations (and there are fewer and fewer such organizations), and the bank always analyzes the client’s credit history.

Another thing is that Tinkoff, Renaissance Credit or Home Credit Bank are much more loyal to the ratio of the borrower’s income and the loan amount than, for example, Raiffeisenbank or VTB24, so it will be easier to get a loan from these financial institutions than from others.

conclusions

Microloans are easy money that can lead to serious debt. Therefore, applications to microfinance organizations cannot be taken lightly - you need to soberly assess your capabilities and always fulfill your obligations.

And if a situation with a delay has already arisen, you cannot hide and wait until the solution comes by itself. Refinancing is the only way to avoid the debt trap and the unpleasant procedure of forced debt collection.

- Related Posts

- What happens if you don’t repay a microloan: real consequences and legal grounds for not paying the loan

- What is the essence of loan refinancing?

- The bank refused to refinance a consumer loan: what to do?

- Is it possible to refinance consumer loans without refusal?

- Credit card refinancing: the best bank offers in 2020

- Sberbank denied refinancing: what to do

Add a comment Cancel reply

How to refinance a microloan

The refinancing scheme is standard. All MFOs that refinance microloans have an online application form, on which a decision is made within 1 hour to 1 day. If everything is in order, you send the new lender scans of the agreements on the refinanced loans.

Then the MFO offers to choose the size of the monthly payment (not arbitrarily, of course, but within the limits of existing programs). An agreement is signed, which indicates the targeted nature of the loan, the amount, conditions and details of the recipient of the money. Funds are transferred to the account of the previous creditor.

However, this does not happen everywhere: for example, at Analyst Finance you will receive money in your hands, after payment you will need confirmation of closing loans in other microfinance organizations, otherwise the rate may increase from 80% per annum to 360%. Then payment begins according to a new schedule - usually monthly or twice a month, no more often.

When refinancing a microloan at a bank, the procedure is similar to obtaining a new loan (and in reality it is). You submit an application and documents, wait for approval, receive money, and repay your existing microloan with it.

Refinancing microloans: requirements for borrowers and necessary documents

Unlike issuing microloans, refinancing at a lower interest rate in large microfinance organizations is impossible without providing a package of documents, sometimes quite voluminous. The requirements for clients are also quite strict.

- The borrower's age is from 21 years (up to 25 years - a guarantor older than this age is required) to 70 years (NKB allows up to 75 years). The CPC “Promoting the Development of Mutual Lending” is ready to refinance loans to clients from 18 to 67 years old.

- Some microfinance organizations require at least 3 months of work experience (for the borrower or guarantor).

- Citizenship of the Russian Federation and permanent registration on the territory of the Russian Federation are required (not in all microfinance organizations. At Analyst Finance, for example, they provide on-lending with temporary registration).

- Confirmation of income and employment (refinance.rf and some other microfinance organizations are not required).

- At least one payment must be made on the loan being refinanced.

The best banks for refinancing microloans

Since banks do not carry out classic refinancing of microloans, the most suitable for refinancing will be those that issue money without collateral and with a minimum of certificates, as well as banks that turn a blind eye to not the best credit history.

Banking products with a minimum package of documents to replace microloans

| Bank's name | Interest rate and amount | Documents and conditions |

| Tinkoff, Platinum credit card | Up to 300,000 rub. 12.9%-49.9% | Scans of passport, TIN. Income documents can be provided in electronic form to reduce the interest on the loan. |

| Renaissance Credit, loan for urgent purposes | From 30,000 to 700,000 rubles. 11,9% – 26,3% | Passport + second document of your choice (ID, international passport, personal bank card, etc.). To reduce the rate - confirmation of income, solvency (document for a car, real estate, etc.). |

| OTP Bank, cash loan | From 15 thousand rubles. up to 1 million rubles 11,5%-14,9% | Passport, INN, SNILS. For a loan amount exceeding 200 tr. copy of employment record + certificate 2-NDFL. |

| Alfa Bank, cash loan | From 50 thousand rubles. up to 1 million rubles 15,99% – 25,99% | Passport, second document of your choice (VU, international passport, TIN). For a lower rate: 2-NDFL certificate + document confirming income of your choice (copy of work record, car document, etc.) |

| Vostochny Bank, cash loan | from 30 thousand rubles up to 500 thousand rubles. From 14.9% to 29.9% | Passport + a second document confirming your stable employment and income level (certificate 2-NDFL, or a certificate in the form of a bank). |

Life story

“In the past, the loan was overdue for 2 months, and although the loan was closed a long time ago, banks constantly refused when submitting an application. I needed 50 thousand rubles - I had to take out microloans from three microfinance organizations. Just in case, three days later I submitted an application to Tinkoff for a credit limit of 30 thousand - I thought I’d close 2 microloans. An employee called, had a good conversation, rewrote the application and approved the card limit of 60 thousand! Closed all loans. But, of course, their service... A week before the next payment they start pestering me with SMS messages, so I try to pay early.”

Refinancing methods

There are several ways to refinance microloans, including overdue ones. Let's look at each of them in more detail.

Extension in the same microfinance organization

Microloan refinancing

Reviews

The most popular way to refinance is to simply contact the same company to extend the loan. But you need to do this in advance - even before payment. In this case, the chances of approval will be much higher.

Some companies offer refinancing of microloans remotely by default - in this case, you just need to log into your personal account on the MFO website and apply for an online extension. Approval comes automatically.

This operation is convenient because the payment is postponed for several days. However, you will still have to pay interest during this time. For example, if the rate was 2% per day, then an extra 20 days of extension will add another 20% to the debt amount.

You can use this option only if you know for sure that after a certain time you will receive funds to repay the microloan. Otherwise, you can end up in further credit bondage.

Getting a loan from a bank

Strictly speaking, it is impossible to refinance microloans at a bank, since their programs involve refinancing loans taken from other banking institutions.

Therefore, to close a debt in an MFO, you need to obtain an ordinary consumer loan from a bank. Or get a credit card. Then the funds received will need to be withdrawn and taken to the microfinance organization, thus closing your microloans. In any case, the interest rate on banking products will be lower.

In this case, you should choose those banks that are fairly loyal to their customers. The presence of a loan from an MFO already indicates the credit load, so some institutions may refuse applicants.

The easiest way to refinance microloans is in banks:

- Tinkoff - you can get a Platinum card, the initial limit on it is 30-50 thousand rubles, and the rate starts from 15% per annum;

- Renaissance Credit - a simple cash loan is issued;

- Home Credit Bank;

- UBRD;

- VTB Bank is actively distributing a credit Multicard with a good loyalty program;

- OTP Bank - characterized by minimal loan rates (from 11.5%) and virtually no credit history checks;

- Alfa-Bank - getting a credit card is not a very easy task, but you can withdraw money from it without commission, and the grace period is 100 days.

Contacting Sberbank, Raiffeisenbank, Gazprombank, Rosselkhozbank is practically useless. If they record the presence of a microloan in their credit history, an almost 100% refusal will follow.

Contacting a microloan refinancing agency

Another best option is to contact another microfinance organization. Companies that refinance microloans include companies such as:

- Rusmicrofinance, official website - Refinance.rf;

- credit broker NKB Group;

- Financial Analyst.

Branches of the loan refinancing agency have already been opened in 11 cities of Russia, including Moscow, Voronezh and Kaliningrad.

Some CPCs also offer interesting options. For example, Promoting the development of mutual lending. The company offers microloan refinancing in Moscow. A new member who has joined the cooperative and paid the fee will be able to receive refinancing in the amount of up to 100 thousand rubles and with a rate of 48% per annum.

Each MFO offers its own conditions for refinancing microloans. To calculate whether this option will be beneficial for you, you need to consider:

- the rate in the new MFO should be at least 0.5% lower per day;

- the term should remain the same or be slightly longer (but keep in mind that when the term is extended, the amount of the overpayment also increases).

Also take into account the rates for loan refinancing, since the percentage of the final rate may depend on the amount and term.

For example, in the largest microfinance organization specializing specifically in on-lending to clients of other companies, the Microloan Refinancing Agency (aka Rusmikrofinance), the conditions are as follows:

| Sum | Loan term | Interest rate, per day | Do I need a guarantee? |

| Up to 20 thousand rubles | Up to 1 year | 0,315% | No |

| Up to 5 years | 0,213% | No | |

| Up to 300 thousand rubles | From 6 months to 5 years | 0,171% | No |

| Up to 500 thousand rubles | Yes |

If you decide to refinance microloans at the Analyst Finance MFO, there are two options:

- for refinancing consumer loans or credit cards - rate from 25%, term - up to 5 years;

- for refinancing a microloan - the rate is from 80% and the term is up to 1 year.

Approval will be given even if your credit history is damaged.

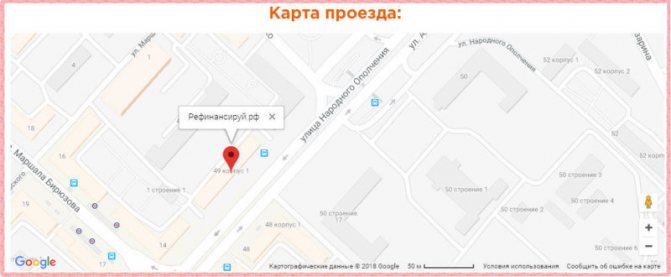

In Moscow, the Microloan Refinancing Agency is located at: st. People's Militia, 49, bldg. 1

How to refinance a loan with bad credit

Interest rates on short-term loans are so high because with this MFO they insure themselves against delays on the part of part of their clientele. Hence the advertisements like “We give money even to the homeless” found on the Internet. They may not give it to homeless people, but it’s not that difficult for a person with a damaged credit history to get money to refinance a microloan. If there is only one delay, try applying for a Tinkoff card. Even if you get a rate of 40% per annum, it will be much better than the current 2% per day.

If the banks refuse, there is a direct path to MFOs that refinance microloans. Here, it is not your credit history that will be of great importance, but the presence of a regular income and place of work. If you have this, the chances of refinancing at interest rates of 75-80 per annum increase.

Be wary of loan brokers who promise loans for any credit history. Especially with those who ask for money in advance.

Life story

“For God’s sake, do not believe those who promise to help you get a loan with a bad credit history. I have already run into outright scammers twice. The scheme is as follows: you submit an application on the Internet, they call you back, supposedly from the bank and inform you: the application has been approved, come over. I’m flying with joy, and on the way the “consultant” calls me three times, all the time from different numbers. Does not allow you to concentrate and think. When I approached the bank, he called back again and said that he had “persuaded” the bank administration, he just needed to “grease up” the head of the security service. He, like, agrees for a modest amount, but he will only take the money outside the bank.

I run to borrow 10 thousand from friends and go to the bank again. A bearded man is waiting in front of the door and introduces himself as the boss. He takes the money and goes into the building. I’m trying to call the “consultant” - the numbers are not active. Of course, no one at the bank had ever heard of the bearded head of the security service. In my presence, a woman with a small child was also divorced. Don’t give any money up front!”

Is it possible to refinance an overdue microloan?

Different organizations transmit information about late payments on a loan or microloan to credit history bureaus (one or several at once) with varying degrees of efficiency. There are banks and microfinance organizations that report late payment to the BKI within 24 hours, and there are those that wait 3-4 days to avoid taking into account “technical” delays - when the borrower, for a good reason, did not pay on the same day.

Accordingly, non-payment of a microloan quickly becomes known to many other credit organizations. Hiding the fact of delay is pointless and even harmful. But it is useful to know what criteria for delayed payment are considered significant for banks and microfinance organizations. The “barrier” to hopes of getting a loan on at least decent terms closes with a one-time delay of 30 days.

Even some microfinance organizations will be afraid to contact a person who has delayed payment of a loan for 90 days. The most difficult case is an open overdue debt on the date of filing a new application.

The list of microfinance organizations where you can reborrow if the current overdue debt is pressing is not too long, but it is available.

5 MFOs with the most loyal attitude to credit history and arrears

| MFO | Interest rate and amount | Conditions |

| Credit24 | 9000 – 30000 rub. From 1.9% per day for 7-30 days. | A very bad credit history may be offered to be corrected first by taking out and repaying several minimal loans in succession. |

| Zaimer | 1000 – 30000 rub. From 0.63% to 2.2% per day for 7-30 days | For regular customers, the interest rate is 3 times lower than for first-time customers. costs 1700 rubles. |

| eCabbage | 100 – 30,000 rub. From 1.7 to 2.1% per day for 7-30 days | If you have not used this service before, then the first loan will cost you 0%, subject to timely repayment. |

| CreditPlus (Credit Plus) | 500 – 15,000 rub. 0.5 to 2.5% per day for up to 30 days | There is an option “Loan extension” during which you can extend the loan term if you do not have time to repay on time. You can also use bonuses under the Cashback program. For new clients, the first loan is at 0%. |

| MigCredit | 3000 – 98,000 rub. from 97.655% to 358.404% per annum, up to 48 weeks | Variety of loan programs, long loan terms. High approval rate, including for borrowers with a bad credit history and unofficial work. |

Procedure for refinancing remotely and online

You can apply for refinancing in the same way as a loan without visiting a bank branch. You can do this directly on the website of the credit institution you are going to contact for help. The remote procedure procedure is as follows:

- Go to the credit institution's website.

- Go to the refinancing section.

- Click the “Submit Application” button.

- Please provide all required information in your application and submit it for consideration.

- After some time, a bank employee will contact the client and inform about further actions.

Refinancing microloans should be done carefully so as not to worsen the financial situation.

Read about what credit holidays are at Sberbank

You can find out about the AK Bars Generation debit card here

How to save with a MIR pension card from Binbank: