The total amount of overdue debt in Russia is more than 10 trillion rubles. The bank sells your debts to collection agencies. It happens that they employ real bandits from the 90s who use any methods to get debts out of you. Collectors can intimidate, insult, or threaten you and your relatives. There have been cases of attacks, arson, kidnappings, etc. On January 1, 2020, a new law on collectors came into force. The law now clearly describes the rights and responsibilities of debt collectors.

The legislative framework

In a situation with overdue debt, any borrower subconsciously feels guilty. Therefore, he takes the rudeness and persistence of debt collectors for granted, and does not try to fight illegal behavior. Meanwhile, the debtor, like any citizen of the Russian Federation, has rights that no one is allowed to violate.

To understand what you are entitled to, we recommend studying two important pieces of legislation:

- Constitution of the Russian Federation;

- Federal Law No. 230 “On Collection Activities”.

The first document lists the basic rights of a citizen. These include the right to:

- inviolability of home;

- inviolability of family and private life;

- protection of honor and dignity;

- protection of a good name;

- freedom from cruelty and violence.

Thus, if debt collectors try to enter your apartment without permission, collect information about you without your consent, distribute information about the debt to your family and friends, or directly threaten you, this is a violation of your constitutional rights. Try to record a conversation containing threats, or obtain written testimony about the unlawful work of debt collectors, and feel free to file a claim for compensation for moral damages.

Who will work as a collector?

Federal Law No. 230 will significantly tighten the requirements for collection service employees. If earlier everyone was accepted there, now

Those who have no criminal record can work as collectors.

At the same time, there will be an order of magnitude fewer agencies themselves. A license to conduct collection activities will be issued only to companies with a net asset of 10 million rubles or more. The company also undertakes to insure its activities for an amount of at least 10 million rubles against possible damage to the property, health and life of borrowers.

All collection services are required to have their own website on the Internet and operate openly.

Any violation of the rules established by the new law entails very serious consequences - the collector may be fined in the amount of 500 thousand to 2 million rubles. In addition, he will be prohibited from further engaging in collection activities.

Provisions of the Federal Law “On Collection Activities”

The federal law regulating the activities of debt collection specialists largely follows the provisions of the Constitution. In particular, it prohibits collectors from threatening the debtor with physical violence, uttering threats against his relatives, entering the debtor’s home without permission (including posing as an employee of other authorities), transmitting information about the debt to third parties, etc.

Collectors' rights

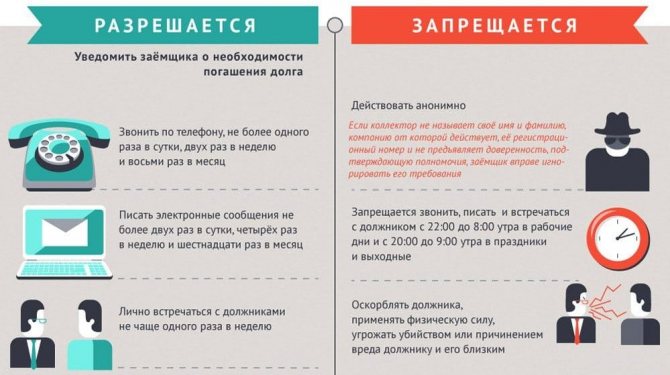

In addition to the above, the Federal Law strictly regulates the operation of collectors.

- At every contact, both in person and by telephone, the collector must introduce himself and name his agency. During a personal visit, the specialist must also present a document confirming his authority.

- Calls to the debtor can be made at strictly defined times: from 8 to 22 o'clock on weekdays and from 9 to 20 o'clock on weekends and holidays.

- The frequency of calls, meetings and SMS from debt collectors to the debtor is strictly regulated by law.

Advice: the first time you receive a call from a debt collection specialist, we recommend that you carefully study. In the future, all calls coming from debt collectors should be recorded. If you discover inconsistencies in the behavior of a specialist with the provisions of the Federal Law, you can, based on the records, file a complaint with the appropriate authorities.

Official way

The law regulating the activities of collectors contains certain conditions. A set of rules has been established that creditors or their representatives must comply with. Time frames have been established when working with the debtor:

- work activities in this matter are allowed to be carried out only during a certain period of time. The period from 22.00 to 8.00 is unacceptable. On holidays this period starts at 20.00 and ends at 09.00. Time is taken into account at the borrower’s place of stay or address;

- it is unacceptable to organize meetings with the defaulter more than one conversation per week;

- other restrictions are established for telephone conversations;

- violation – more than one call per day;

- violation – more than two conversations in a week;

- more than eight conversations with the debtor per month are not allowed.

The creditor and persons acting in his interests do not have the right to work with the defaulter in order to collect the existing debt through any types of messages (voice, telegraph, text, etc., which are transmitted over electrical networks, this also includes mobile radiotelephone communications):

- on weekdays from 22.00 to 08.00, holidays and weekends - from 20.00 to 09.00. Time is taken into account based on the location of the debtor;

- if the total number of messages exceeds: 2 times per day, 4 times per week, 16 times per month.

If there are violations on the part of collection agencies, it is worth taking measures to establish the fact of violation on their part. It is important to save all SMS messages and have a “call printout” on hand, which can be obtained from your mobile operator. Having evidence, you need to go to the Police to clarify the circumstances. It is better to do this in writing.

ATTENTION! In the application, indicate what form of appeal is used by the collectors, the number of calls for a specific period of time, and at what time the calls (messages) are received.

If your relatives or neighbors were disturbed, be sure to indicate this.

Study the loan agreement

The first thing you need to start defending against debt collectors is your loan agreement with the bank. In order for debt collectors to have the right to work with your loan, the agreement must contain two clauses:

- your consent to the processing of personal data;

- consent from you to the assignment of debt by the bank if necessary.

If these two conditions are not specified in the agreement, the banking organization from which you took out a loan simply did not have the right to transfer information about it to third parties. In this case, you can contact Rospotrebnadzor with a complaint about the violation of your rights.

Important! Please also pay attention to the date of the loan agreement. If 3 years have passed since its end, the statute of limitations on the debt has expired. In this case, immediately inform the collectors that you are ready to pay the debt after the court makes an appropriate decision on it.

Violations

To achieve this goal, the collector has at least basic knowledge of legislative norms. They understand perfectly well that they are committing direct violations while doing their job. It is unlikely that they think that their “clients” will assess the situation from the legal side.

Having started a conversation with a person who knows the legal intricacies of the existing laws of the Russian Federation, the collectors’ confidence quickly disappears. That’s why it’s so important to know what laws are on your side and what limits the actions of debt collectors.

ATTENTION! Having a collector have the phone number of a person who has no debt to the bank is considered a violation of the law on the part of the financial institution.

The violation concerns not only the misuse of personal data, but also involves the disclosure of bank secrecy. When starting a conversation with a “debt collector” on the phone, mention the rules of the law:

- Part 2 Art. 183 of the Criminal Code of the Russian Federation.

- Law “On Banks and Banking Activities” (Article 26).

- Clause 3 of Art. 857 Civil Code of the Russian Federation.

Tell the debt collector that you intend to protect your civil rights and sue anyone who discloses information about unfulfilled obligations. If there is evidence, the court will side with you.

Now there are anti-collector offices whose work is aimed at combating the arbitrary actions of debt collectors. The employees of such structures are often lawyers. They will tell you how to correctly present the circumstances and send them to the right authorities.

Don't shy away from meetings

At a certain stage of collection, collectors schedule personal meetings with debtors. Don't shy away from them. But try to protect yourself in advance:

- take care to video record the conversation;

- Take someone from your loved ones or relatives with you as a witness.

A personal meeting will allow you to understand how to protect yourself from debt collectors. Legal advice on this matter usually begins with asking the collection agency representatives to provide documents on the basis of which they work with your debt. The package of documents must contain:

- the original agreement for the assignment of the right to claim the debt (assignment) with blue seals and all the necessary signatures;

- notice of assignment of rights (original).

In practice, creditors often provide copies of these documents. This is, in principle, acceptable if the copies are notarized. An ordinary photocopier is a violation of the regulations for the actions of collectors. The documents themselves must necessarily contain the following information:

- license number for collection activities;

- name of collection agency;

- actual and legal address of the agency;

- Full name of the company director.

If any of this data in the presented documents is missing or does not match, you have the right to stop further dialogue with debt collectors until they confirm their authority. If the collectors insist on continuing the conversation or begin to behave rudely, call the police. And after the incident is resolved, write complaints to the appropriate authorities.

Who are these people really?

Before considering practical tips for protecting yourself from debt collectors, you need to have an idea of what they are.

According to the civil code of our state, any debt, that is, a loan (more often they say a loan portfolio) can be sold to another legal entity. Such a transaction is called an assignment of the right of claim.

The parties to it are banks or other financial institutions that can lend money at interest, and on the other hand, other legal entities that have a special license or are engaged in such activities as providing financial services.

Collectors are usually people who have served in law enforcement agencies. Therefore, they know their rights well, but also understand perfectly well that if the victim shows his legal knowledge, then it is better not to touch her.

This video will tell you how to deal with debt collectors if they threaten:

Some financial organizations that distribute loans or money in the form of loans to different people specifically create legal entities so that the latter are engaged in collecting debts.

Such activities can be divided into two types:

- those who, on the basis of a waiver of the right of claim (factoring agreement), purchased the loan portfolio;

- those who have entered into an agreement with a banking or other credit institution for assistance in collecting problem debts, without factoring.

Practical tips for protection

Having figured out who debt collectors are, you can move on to practical advice on how to protect yourself from their actions.

How do collectors work?

The first piece of advice is that a person who has started receiving calls demanding to pay a debt should carefully read the loan agreement. When reading it, you need to pay attention to the following points:

- Contract time. It happens that the loan expired three years ago, and the person receives a call and demands to repay the debt. The best way would be to say that the client is ready to resolve this issue in court if a claim is filed against him.

The next defense option can be characterized as filing complaints against persons who demand repayment of the debt to the prosecutor's office and the police. The criminal code contains such articles as extortion, as well as coercion to fulfill civil obligations.

Advice from a lawyer can be seen in this video:

The next tip is to carefully study the documents that the debt collector provides.

They must have the following details:

- originals of notices or agreements on the assignment of claims, with all signatures or seals; in practice, certified copies are mainly provided;

- the presence of a link to the license number issued by regulatory authorities, so that one can be convinced that this company has the right to engage in such activities;

- details of the collection company, that is, legal and actual addresses if they do not match, contact numbers, as well as personal details of the director or other authorized manager.

If this is not the case, the debtor has the right to demand it.

The last thing you need to pay attention to is that after the first call from a representative of such a company, you can immediately contact the bank and agree on debt restructuring or deferment of payment.

But this should be done by those who know their rights well. There are situations when bank employees are forced under threats to sign unfavorable documents. Therefore, if a person is not confident in his abilities, then it is better to go to the bank with his lawyer or lawyer.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) +7 (St. Petersburg)

Very often, those who do not pay their loan debt on time are forced to deal with collectors - representatives of special agencies whose task is to return the debt to the bank by any means.

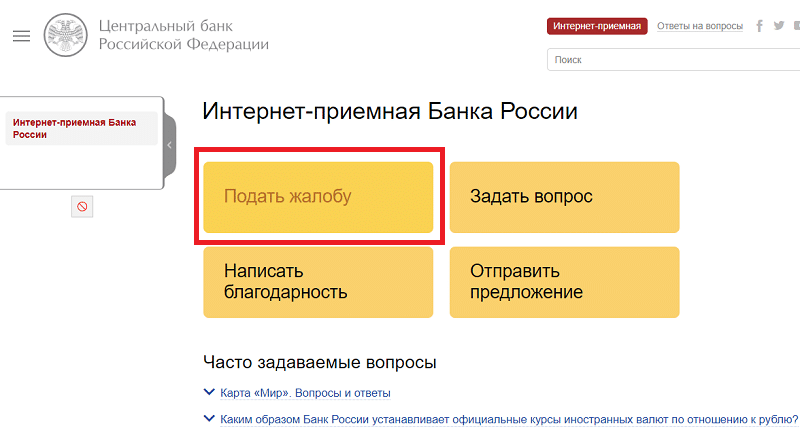

Where can you complain about debt collectors?

In Russia there is a National Association of Collection Agencies - NAPKA. You should contact it with complaints about unlawful actions of debt collectors:

- threats;

- rough treatment;

- violation of the regulations on calls, meetings and messages;

- Spread of information;

- attempts to break into your home.

The complaint can be sent in writing by mail or left

Scheme for considering a complaint to NAPCA

In addition, if debt collectors allow threats and blackmail, psychological pressure or acts of vandalism (there are often cases when unscrupulous collectors leave inscriptions on the walls of the entrance and entrance doors of the debtor), then this is a direct reason to file a complaint with the prosecutor’s office at the place of residence.

If specialists cooperate with a lender under an agency agreement, it would also be appropriate to complain to Rosportebnadzor. In this case, the complaint will be about the dishonest work of the bank. In addition, you can leave a complaint against the creditor

Important! Any claims must be accompanied by evidence of misconduct by collection professionals. This can be video or audio recordings, photos, as well as witness statements.

What to do if debt collectors violate rights?

If you violate the terms of loan payments, you are not released from financial obligations. However, no one has the right to “extort” money from you by acting outside the law. You must know your rights and be able to defend them legally.

You are not obligated to come into contact with debt collectors and have every right not to let them into your apartment.

It is necessary to warn family, friends and employer about possible calls. It is much better to present them with your version of events and prepare them for a possible visit from professional debt collectors.

Particular attention should be paid to children. If there are threats from collectors, they will have to be met and escorted, controlling their movements and constantly maintaining contact. Even a minor threat or insult to a child is a valid reason to file a complaint or claim.

If you attempt threats and intimidation from debt collectors, you must record conversations with a voice recorder.

Such recordings will become evidence in court; often the very warning about recording conversations will force debt collectors to behave more correctly. Against a debt collector who uses illegal methods or is too intrusive, you can:

complain to Roskomnadzor

How to protect your home

Legitimate debt collection specialists do not come to debtors unannounced. Usually meetings are agreed upon in advance, the time and place are agreed upon. But alas, “black” collectors often neglect this rule.

How to protect yourself from debt collectors if they come to your home? There are several options.

First of all, remember that you are not obliged to let anyone into your apartment against your will. If agency representatives are waiting for you near the entrance, talk to them on the street. Ask to see documents and then discuss the situation. If collectors insist on coming to you or, on the contrary, do not allow you into the house, feel free to call the police. Inform that unknown persons do not prevent you from entering the apartment. As a rule, this is where the claimants’ insistence weakens.

Follow the same principle if collectors are on the threshold of your apartment. Do not open the door, do not let debt collectors past the threshold, especially if they behave rudely and impudently. You are not obligated to engage in dialogue with them, especially if the meeting was not arranged in advance.

Remember that attempting to enter someone else's home by force or deception is a punishable offense. Depending on the situation, they may entail administrative or criminal liability. Therefore, if the collector:

- prevents you from closing the door;

- breaks into the apartment by force;

- makes noise on the landing;

- enters the house under the guise of a representative of regulatory authorities;

All this is a reason to call the police. Whatever your loan debt, the law will be on your side in this case.

Collectors' rights

Before talking about the rights of collectors, it is worth noting that only official organizations with a license can engage in collection. Departments of the bank that issued the loan can also carry out such activities, but they are not collectors.

A collection agency is a registered organization that works under an agreement with banks to collect debts within the limits of the law.

Usually, after several unsuccessful demands to repay the overdue debt, the bank sues or sells the debt to a collection agency, whose task is to collect not only the loan amount, but also the accrued interest.

Organizations involved in the collection of overdue loans may operate outside the legal framework, so when contacting them, it is necessary to know the rights and obligations of both parties.

The collector who comes to visit you must be asked to provide documents confirming his work in the relevant structure and the right to participate in debt collection.

In addition to personal documents, the agency employee is required to provide papers indicating the amount of debt and a detailed calculation of penalties.

At each contact, the collector must introduce himself, state his last name, first name, patronymic and position. Representation is mandatory both when communicating with the debtor and with members of his family. Refusal to do this procedure may result in a fine, and you have the right to limit all contacts with debt collectors.

After receiving the documents or their copies, you can begin the conversation. A collection agency representative has the right:

- demand repayment of the debt and payment of interest in a polite manner, without resorting to insults and threats;

- explain to the debtor what the consequences of delaying payment are;

- offer solutions to the problem;

- call a landline or mobile phone with a debt reminder;

- come to the debtor’s home (at the place of registration or actual residence).

The collector can gain access to your personal data only with written permission. If there is a corresponding entry in the loan agreement, agency representatives can find out your marital status as a citizen and contact your relatives, friends, and employers.

If there is no corresponding clause in the contract, access to personal data is considered a gross violation and can be prosecuted by law.

The debt collector has the right to sue the debtor, while the agency can wait, delaying the filing deadline in order to increase interest.

A properly drafted pre-trial claim will help protect against inflated claims of agencies. An anti-collection company or an experienced lawyer with experience working with credit organizations will help you arrange it.

If you are visited by collectors, first ask them for documents, and then start a conversation

How is protection against collectors carried out in Moscow?

You can order legal services in cases involving debt collectors in Moscow through our service. Your action plan will be as follows:

- Select the required service: assistance and protection from collection agencies.

- Enter your details into the application form. Try to describe the situation in as much detail as possible and, if available, attach copies of documents.

- Enter the amount you are willing to pay the human rights defender.

- Check the application text again and click “Submit”.

Your application will be sent immediately to all law firms cooperating with our service. After some time, you will begin to receive responses offering legal assistance. All you have to do is choose what you like.

Finding lawyers online - quickly and conveniently

Order legal assistance from debt collectors in Moscow right now, without leaving your home. To do this, it is enough to have a device with Internet access.

The advantages of online search for lawyers through our service are as follows:

- Save time - from application to first consultation can take just a few minutes.

- Adequate cost - you set the price yourself, which does not change until all the work stated in the application is completed.

- An integrated approach - the presence of multidisciplinary specialists allows us to solve even the most complex problems.

- Security of the transaction - payment for the work of a human rights defender is made only after completion of the work.

Law firms value their reputation and are interested in a positive solution to every problem.

Clients can count on confidentiality and constant information support. Read more