Home » Collection of funds

In the modern world, people often come into contact with banks. They borrow money for various needs, but cannot always correctly calculate a plan for timely payment of the debt. Credit debts of Russians in 2020 exceeded 14 trillion. rubles and the figure is growing steadily.

A huge number of debts have been declared unpayable, but citizens are trying with all their might to correct their credit history. A logical question arises: when are debts on loans from bailiffs written off? Do they have a statute of limitations? If so, how many years does it take for the loan to expire?

- 1 Procedure

- 2 Complete debt write-off

- 3 Powers of bailiffs

- 4 Timing

- 5 Debt withdrawal after repayment

- 6 Where to find out the amount

Let's look at these and other questions in more detail and consider possible solutions.

Statute of limitations for enforcement proceedings

To understand how long bailiffs have the right to collect debt obligations under a writ of execution, you should determine what kind of document it is and how it is issued.

A writ of execution is a document that serves as the basis for starting enforcement proceedings. The issued document gives the citizen the right to turn to bailiffs for forced collection of alimony or other debt obligations.

Note! A court hearing that ends in the applicant’s favor makes it possible to initiate collection under a writ of execution. To obtain this document, you need to contact the judicial authority that made a positive decision 10-14 days from the date of the verdict in the case.

To initiate collection under a writ of execution, the plaintiff must send it to the Bailiff Service. After receipt, this institution can carry out collection under a writ of execution, the validity of which is three years.

In accordance with current legislation, debt can be written off under a writ of execution during the period of time until the statute of limitations has expired.

After this time has expired, the document is considered invalid and it will not be possible to use it to start enforcement proceedings. In such a situation, the bailiffs will not be able to collect the debt under the writ of execution.

Calculation order

The above-mentioned three-year statute of limitations begins to expire from the moment the writ of execution is transferred by the court to the creditor, that is, from the moment the court decision enters into legal force (Article 21 of the Federal Law of October 2, 2007 N 229-FZ).

The writ of execution does not indicate a limitation period, and the interested party must monitor its compliance.

The statute of limitations expires in the following situations:

- the writ of execution has not been received by the creditor within three years. This can happen if the creditor decides not to collect the debt through bailiffs. For example, he was able to conclude a settlement agreement with the debtor, or an agreement on the restructuring of debt obligations, etc.;

- if the creditor decides not to continue enforcement proceedings within a three-year period. This can happen if the writ of execution was handed over to the Federal Bailiff Service, but for some reason they failed to fulfill their duties (for example, the debtor has nothing to collect).

Partial debt write-off or easing of payment terms through an agreement with the bank

A citizen in a difficult financial situation should not immediately look for ways to completely write off his debts. This is possible in the rarest cases, so you should turn to a more realistic option. It is advisable to consult a lawyer yourself, without waiting for the creditor to go to court, and notify the bank about any difficulties encountered in repaying the loan. In such cases, it is quite possible to agree on easing payment terms.

A citizen in a difficult financial situation should not immediately look for ways to completely write off his debts. This is possible in the rarest cases, so you should turn to a more realistic option. It is advisable to consult a lawyer yourself, without waiting for the creditor to go to court, and notify the bank about any difficulties encountered in repaying the loan. In such cases, it is quite possible to agree on easing payment terms.

- Restructuring. Many banks practice an individual approach. The borrower may be offered a deferment of payments or a reduction in their size, extending the loan repayment over a longer period. Sometimes the bank writes off part of the debt when the established portion of the loan is repaid.

To carry out restructuring you will need a package of documents:

- statement;

- a copy of the contract with all attachments and agreements;

- extract from the Unified State Register (if there is real estate);

- certificate of absence of other housing;

- copies of passport and TC;

- certificates confirming long-term disability, job loss, etc.

- · Refinancing. By contacting another financial institution, the borrower obtains a loan with more favorable conditions. The money received pays off debts in other banks.

To refinance you need:

- application;

- the original of the original contract;

- payment schedule;

- a certificate from the bank that issued the original loan indicating the loan amount, data on arrears, details, etc.

In this way, a share of debts is legally written off without litigation. It is advisable to invite a lawyer to negotiate with the bank. A specialist will help you choose the optimal conditions, understanding the situation of a particular client.

When does debt write-off occur?

After how many years can a debt from bailiffs be written off? The statute of limitations for the possibility of repaying debt obligations is established by law and is three years. However, hoping for this period, one should take into account all the details of the calculation.

For example, the time frame for debt obligations in the housing and communal services sector starts from the date established by the regulations of the service organization, and not from the last day of the past month.

And in interaction with a credit institution, the countdown will begin from the last agreement of the parties to the transaction.

Remember! The Civil Code and the Federal Law “On Enforcement Proceedings” establish how long debt claims can be held by bailiffs.

An assignment (transfer of an obligation from one party to a legal relationship to another) will not be a reason to change the mechanism for calculating the statute of limitations, but in some situations, due to serious circumstances, the period for claiming debt obligations may be extended.

Statutes of limitation do not apply in accordance with Article 208 of the Civil Code to the following claims:

- protection of non-property rights (to life, business reputation, etc.);

- requesting deposit funds from banks;

- compensation for damage to health following a traffic accident (confirmed by a traffic police report).

In other cases, debt obligations cannot fail to be paid.

If the defendant does not have the funds to repay the debt, or it is impossible to collect them for other reasons, the enforcement proceedings may be terminated, and the writ of execution is transferred to the plaintiff, after which he will again be able to submit it to the Bailiff Service within three years.

How long the bailiffs’ debt obligations “hang” can only be found out directly from the executor, along with all the details of the specific case.

Debts for housing and communal services: statute of limitations.

Can bailiffs deprive a driver’s license for debts? Read here.

Is it possible to pay off the debt for an apartment with maternity capital? Read the link:

Behavior of the debtor in case of delay

Inappropriate behavior can aggravate the severity of the debtor’s situation. You should refrain from rash steps and find ways to solve the problem:

• inform the lender in a timely manner about a possible delay (the bank is interested in the successful repayment of the loan, and will try to offer acceptable options for overcoming the crisis situation);

• maintain contacts with a credit institution (the disappearance of a debtor without a trace forces the creditor to turn to collectors or to court);

• refrain from re-registration of property and withdrawal of assets (transactions may be declared invalid, the actions of the debtor become a reason for initiating a criminal case).

Regularly checking your own debt and informing the creditor about problems with payments allows you to find the best way out of the current situation, repay the debt without unnecessary overpayment, and maintain a decent reputation.

Bad debts

Bad debt obligations are those that cannot be recovered from the debtor for one reason or another.

Enforcement proceedings may be suspended in the following cases:

- the statute of limitations has expired;

- the debtor is bankrupt, the company is liquidated;

- there are no funds and property to recover;

- the debtor tries to hide, but his whereabouts cannot be determined;

- the citizen obliged to return the funds is in prison;

- the debtor died.

Important! Before recognizing a debt as bad, bailiffs are obliged to take all possible measures to collect money from the debtor.

The death of the debtor is not in all cases a sufficient basis for non-repayment of the debt, because if the deceased person has close relatives who can pay off debt claims, then financial resources are collected from them.

Why is it better to contact a lawyer to write off debts?

A competent specialist will correctly assess in which cases the bank can write off the debt and when this is unrealistic, and will develop an up-to-date strategy for solving the problem.

Borrowers, trying to get rid of an unsustainable debt on their own, make mistakes:

- they are rude to bank representatives;

- come to court unprepared;

- unknowingly violate the statute of limitations;

- they are trying to achieve the impossible, having little idea of how and what debts banks write off;

- statements are made incorrectly;

- they sign papers, not realizing that they are falling into a new debt trap.

Problems can be eliminated by concluding an agreement with an experienced lawyer who will provide timely, comprehensive assistance in writing off debts:

- analyze the situation;

- find a rational way to solve the problem;

- will negotiate and find out whether the bank can write off the debt in principle;

- prepare a package of documents for the court and draw up a statement;

- will protect the interests of the principal in court.

If the borrower wishes to act independently, it is necessary to at least consult on how to legally write off loan debts. But even detailed advice cannot guarantee that a citizen will cope with the task. Only an experienced lawyer is able to adequately and promptly respond to changes in the situation or behavior of the creditor, etc. As a rule, the lawyer prepares the evidence base and represents the client in court; the borrower does not even have to attend the meetings - all that remains is to find out that the bank has written off the debt or agreed to soften the terms of refund.

Cancellation of debt after full payment

Having paid the creditor the entire amount due, the debtor is obliged to take actions to write off debt obligations from the bailiffs.

To remove your name from the list of defaulters, you should submit documents to the bailiffs that will certify that the debt has been paid:

- receipt or check;

- settlement agreement, if it was concluded between the debtor and the collector, and according to which both parties agreed on the issue of unpaid funds;

- identification document.

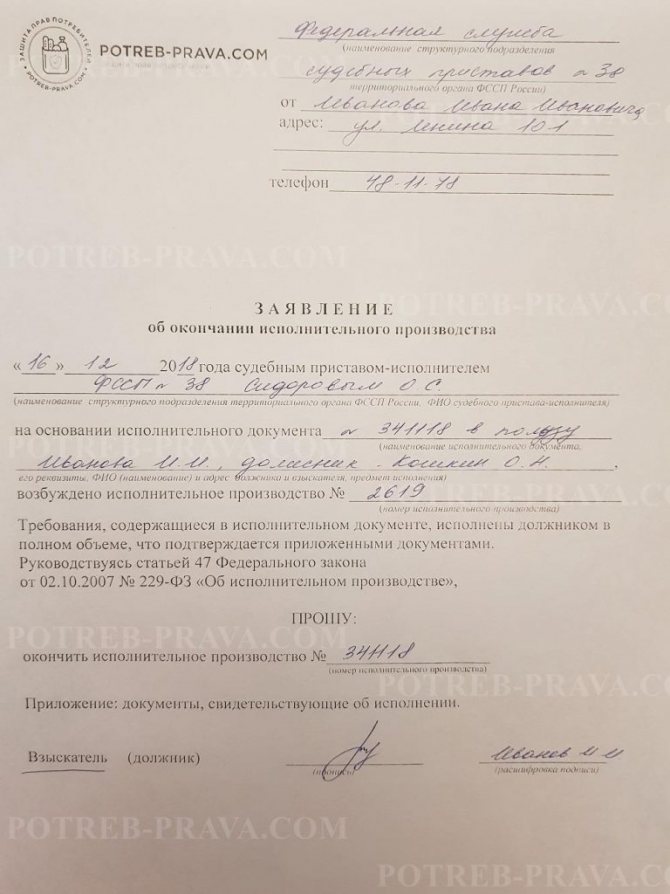

ATTENTION! View the completed sample application for termination of enforcement proceedings:

You need to contact bailiffs at the applicant’s place of residence. After submitting the application and the required documents, the employee of the institution is obliged to terminate enforcement proceedings against the debtor.

Employees of the Service, having analyzed the information provided, issue a resolution to terminate the case, which records the reasons for the occurrence of enforcement proceedings, and also indicates information confirming the fulfillment of obligations by the defaulter.

After issuing a decision to terminate proceedings, the bailiffs must remove the former debtor from the list of defaulters.

After making the payment, debtors are concerned with the question of how long the debt obligation will “hang” with the bailiffs, because even after full repayment of the debt obligations, the borrower is on the list of defaulters for a certain period of time, which is not entirely pleasant.

If the defaulter’s bank account or property has been seized, the bailiff must take measures within seven days to eliminate the restrictions.

In addition, if a ban on traveling abroad was imposed on the debtor, the bailiff must lift it after receiving information about the repayment of the debt.

Watch the video. Statute of limitation period:

Closing loan debt

Many citizens and legal entities, finding themselves in difficult circumstances, find a way out of the situation by obtaining borrowed funds from a bank. Unemployment and the economic situation in the country lead to the loss of payment functions by borrowers. Failure to fulfill obligations under loan agreements aggravates the relationship between the parties and leads to the transfer of proceedings to court.

Based on a judicial act, the creditor receives the right to compulsorily collect the loan debt from individuals and organizations by contacting the bailiffs. The service provides the debtor with a period for voluntary fulfillment of the plaintiff’s demands, then a forced collection procedure is launched with recourse to wages, as well as to property.

It is especially important to understand after how many years debts on loans from bailiffs are written off. The minimum validity period of a writ of execution is thirty-six months. Completion of the i/p and transfer of the form to the plaintiff allows the period to be calculated from the beginning.

Debt closure occurs when an individual goes bankrupt

In isolated cases, the bank is ready to forgive the debt to the borrower:

- When the amount of obligations exceeds the cost of collecting it.

- If the debtor has died and no successors have been found.

- It is impossible to bring a claim due to the expiration of the claim period.

It is worth noting that the credit institution will not initiate debt write-off, but rather will take all possible actions to extend the claim period and find ways to fulfill the obligations of the user of the borrowed funds.

Debt write-off is possible by a court decision declaring the defaulter bankrupt and unable to fulfill the obligations stipulated by the agreements. The debtor, creditor, or authorized state body has the right to initiate the procedure for declaring a person insolvent.

A credit institution can repay the borrower’s obligation after unsuccessfully using all possible methods of repaying the debt. A bad debt situation is characterized by the following characteristics:

- There is no initiative on the part of the borrower to resolve the dispute.

- The defendant is deprived of official earnings and a source of income.

- As a result of foreclosure on the defaulter's property, not a single object was identified.

- There are no bank accounts where cash receipts are recorded.

- Fraudulent actions of the borrower, resulting in liability under Article 159.1 of the Criminal Code of the Russian Federation.

- The bailiffs issued a decision to terminate the proceedings due to the lack of possibility of executing the court decision.

It is important for debtors to know that writing off loan debts entails negative consequences in the form of deterioration of credit history, the inability to use borrowed funds, and the client being blacklisted by the bank.

If there is no income, the debt can be closed

Lapse of time

Although the creditor is given a period of three years to submit documents to recover the debt, this time frame may not be enough to recover the money.

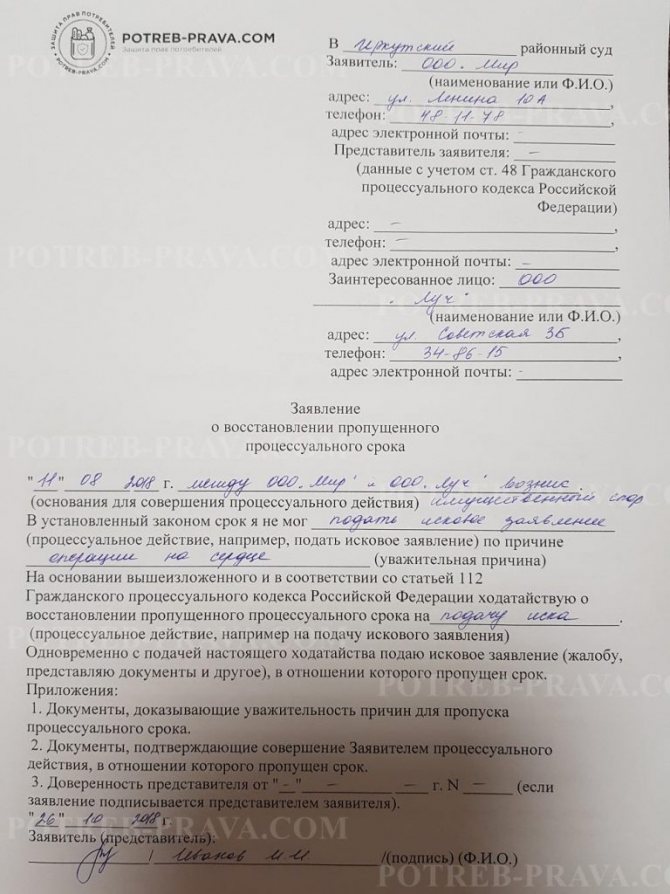

When the statute of limitations expires within the framework of enforcement proceedings, the creditor must file a petition with the court, which will need to record the reasons for missing the allotted period.

The judge will analyze the document and issue a verdict on extending the period for collecting funds, after which you should go to the bailiffs with this decision.

Bailiffs issue orders to recover funds as usual. It is worth noting here that restoring the procedural deadline for the return of finances from the debtor is a difficult and troublesome matter.

ATTENTION! Look at the completed sample application for reinstatement of a missed procedural deadline:

If the statute of limitations has expired, the creditor loses the right given to him to collect money from the debtor.

True, the legislation makes it possible to suspend this period for some time due to the following reasons:

- the party to the case serves in the armed forces of the country or participates in hostilities;

- the presence of a deferment on the part of the dispute;

- events occurred that did not depend on the will of people - an earthquake, mudflow and other unforeseen circumstances;

- a third party intervened in the disagreement to help resolve the dispute;

- the legislation that governs the relationship between debtor and creditor has changed or been repealed.

Remember! If you are not sure that you will be able to collect the debt within the established period, it is better to try to suspend the established period of enforcement proceedings by declaring this in court in a timely manner.

The debtor may challenge the court's verdict to restore the compensation period within thirty days from the date of receipt of the notice. In this case, the disagreement between the parties will drag on for a long time.

Debt write-off through litigation

Without reaching an agreement with the payer, the credit institution sues him. Can the loan debt be written off in this case? If the debtor participates in the proceedings, does not hide and provides objective evidence of insolvency, the chances of reducing the debt are high. Often the judge decides that the borrower must pay only the body of the loan, and fines and penalties are canceled.

How to prepare for court in order to write off loan debts as much as possible? It is wiser to leave this to a lawyer. Having thoroughly understood the specific situation, the specialist will develop a behavior strategy, complete the necessary package of documents and legally competently represent the interests of the debtor in court.

If the court recognizes the debt as bad, the bank refuses further claims. The question arises: why do financial organizations write off debts? This procedure frees the bank from the need to hold reserves, freeing up funds for income-generating assets.