The Civil Code protects the rights of creditors and, when filing an application with an arbitration court, allows you to get your money. Many debtor companies, without declaring bankruptcy and opening liquidation proceedings, often cannot pay their creditors.

Current payments in bankruptcy proceedings must be collected first.

Monitoring the legality of settlement of such payments is entrusted to the arbitration court.

Bankruptcy of enterprises

The basis for declaring an organization or entrepreneur bankrupt may be the inability to make payments to creditors, the inability to pay taxes and other obligations (alimony, harm to life and health), as well as a situation where the property is worth less than the debts that need to be paid off.

The arbitration court, having considered the bankruptcy case of an enterprise or individual entrepreneur, sends a decision to the registration authorities to initiate bankruptcy proceedings and monitors the liquidation work.

If an entrepreneur is declared bankrupt, state registration is no longer valid, and licenses for previously carried out types of business activities are canceled. Farms find themselves in the same situation.

A private entrepreneur, upon recognition of bankruptcy, can register and open his own business only after a year.

Along with all financial obligations for business activities, claims for other debts (alimony, payment of utilities, compensation for harm caused, etc.) may also be presented.

The nature of the current debt of the bankrupt

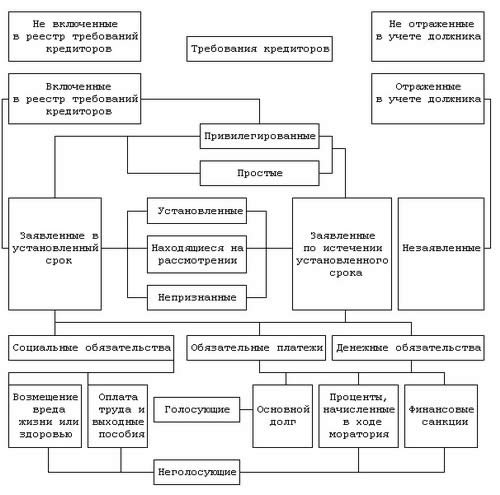

The process of declaring insolvency is a long and complex story. Relations in the sphere of entrepreneurship, including when declaring an inability to pay obligations, are regulated by Art. 1. Federal Law on Bankruptcy. The document clearly states that all claims against the defendant must be brought exclusively through the court, by entering into the register of creditors. But there is also a separate part of the debt that is formed after the start of the trial. These are the current requirements in a bankruptcy case, which are discussed in Article 5 of Federal Law No. 127.

Sometimes the consideration of an insolvency case for a legal entity lasts for several years. For a certain amount of this time, and maybe the entire period, the enterprise continues to operate, rent production and retail space, use electricity, water, and heat resources. Also, no company can exist without the involvement of workers - security guards, cleaners, accountants, lawyers, and so on. No one relieves the subject of taxes and other payments to the budget, as well as from paying claims under contracts that were signed after the announcement of the beginning of the insolvency procedure. All of these costs are considered ongoing claims in the bankruptcy case.

Article 5 of the Federal Law on Bankruptcy states that the party must notify the arbitration manager in writing about current requirements, providing the relevant documents:

- work agreement;

- rental agreement;

- invoices for payment;

- acts of completed work;

- acts of acceptance of goods and so on.

If the arbitration manager does not consider the claims to be current, you should contact the judge to clarify the legality of his actions.

Bankruptcy proceedings

The decision to close an enterprise or terminate the activities of an entrepreneur begins with the arbitration court. By a court decision, financial rehabilitation can be introduced, and then the interested bodies and commissions monitor liquidation or rehabilitation actions.

In bankruptcy proceedings, a manager is appointed and the bankruptcy estate is formed. The debtor is removed from the management of his company; only observation is possible on his part.

Bankruptcy proceedings are introduced for one year, if necessary it can be extended for another 6 months. An extension of this period occurs if it is necessary to complete current settlements with creditors, while completing the sale of the bankrupt’s property.

The manager elected by the arbitration court is given all the powers of the manager to dispose of the property and manage all the affairs of the debtor.

Accountants, auditors and other specialists are involved in the liquidation procedure.

Within 5 days, the commencement of bankruptcy proceedings is officially notified.

After the decision to open bankruptcy proceedings, the accrual of interest, fines, penalties, and penalties for all types of payments ceases.

The writs of execution held by the bailiffs are transferred to the person acting for the liquidation of the organization.

Restrictions and seizures on the debtor's property are lifted in connection with the decision of the arbitration court to open a liquidation procedure for the enterprise.

Monitoring of the bankruptcy case is carried out by the arbitration court and a committee or meeting of creditors.

During bankruptcy proceedings, the manager must submit a report on the activities, financial and property status of the debtor’s organization at least once a month.

If the founder or owners have paid off their debts, then the bankruptcy process ends from that moment

Types of current payments in bankruptcy

The legislative framework in the field of insolvency regulates various current types of ongoing debts in the event of insolvency, which will be impossible to avoid not only for the bankrupts themselves, but also for the arbitration managers involved in resolving the financial problems of the company. The following current types of debt exist:

- Current finances necessary to pay wages, severance pay and various monetary compensations to former employees who were dismissed due to the liquidation of the organization.

- Fines and financial penalties that have been temporarily suspended while litigation is pending.

- Current debt amounts for work performed and services provided, subject to the terms of agreements and contracts.

- Finances necessary to pay for the services of notaries and lawyers, as well as legal costs.

- Previously suspended tax obligations.

- Current amounts for payment for goods and resources that were supplied before the institution was declared bankrupt.

- Rental payments.

- Fines incurred during the competitive sale of seized property by arbitration administrators.

Current debtor payments

Current payments in bankruptcy according to the law are determined by the requirements of creditors for payment for goods, services, work that arose after the acceptance of an application to the arbitration court for the debtor's bankruptcy.

Claims of creditors during bankruptcy proceedings are satisfied not at the expense of the bankruptcy estate (property, property rights), but at the expense of funds received from the sale of this property at auction. To do this, only one current account is used, while the debtor’s other accounts are closed.

After the debtor's property is sold at auction, the manager pays the creditors in order of priority.

First of all, extraordinary expenses during liquidation are paid off:

- court expenses;

- remuneration to the manager, registrar (securities specialist), and other necessary specialists working during the liquidation procedure;

- current operating and utility payments when carrying out activities.

Then, under the supervision of the commission, settlements take place on the claims of individuals or legal entities and arrears of wages to workers.

Settlements for damage to health or life, compensation for moral damage are made first.

Then severance pay is paid to those working under an employment contract and remuneration under copyright contracts.

And only then, in the third place, calculations are considered according to the register of creditors’ claims, with the supervision of persons interested in this.

Debt settlements are carried out in accordance with the register of claims of legal entities, which must be closed after 2 months of the official publication of bankruptcy proceedings and the debtor being declared bankrupt.

The register of creditors' claims contains all the information about creditors, the order of current payments in bankruptcy proceedings, and the amount of debt repayment

Satisfaction of claims of each queue occurs only after full settlement of payments of the previous queue.

Basic moments

The main criterion that determines a payment as current in a bankruptcy case is the date of its occurrence - no earlier than the date when the court accepted the debtor’s application to initiate proceedings to declare him bankrupt.

To enforce payment, the bearer must indicate the period during which the obligation arose.

The following requirements are entered into the register of current payments in bankruptcy:

- Wages, compensation payments, severance payments to employees who were dismissed due to downsizing or liquidation of the enterprise;

- Resumed tax payments that were previously frozen due to confirmation of financial insolvency;

- Payments of penalties, sanctions or fines if they were suspended during the trial;

- Debts for the supply of materials or other services made before the debtor was declared insolvent;

- Leasing payments due later than confirmation of insolvency;

- Debts for legal costs, legal services and paperwork during the proceedings;

- Payment of penalties and fines that could arise during the sale of the debtor’s seized property.

The requirement to pay wages is a priority and must be fulfilled in full within the specified time frame. Amounts exceeding the legal limit on benefits and wages may be frozen in order to reduce ongoing payments in bankruptcy proceedings.

Collection deadlines

The exact terms for payments are not established by law. The whole point is that this happens in accordance with the order. Payments begin at the time the court decision is made.

If we talk about the sale of property, then after completion of the procedure, the financial manager is obliged to distribute the profit received to creditors in accordance with the priority established by law. Upon completion of the procedure, a report on the work done is issued.

Important! Payment for the services of the financial manager is carried out last. In fact, when the bankruptcy procedure has already been completed.

Is there anything difficult in understanding what current payments are? Not really. In short, these are new obligations of the debtor that arose after the arbitration court issued a ruling declaring him insolvent. It is worth noting that these payments are mandatory and subject to repayment. Otherwise, after completing the entire procedure, the person will have to deal with new debts.

0

Author of the publication

offline 17 hours

Time limits for collecting current payments in bankruptcy

Current debts must be paid within certain periods, which are determined by the court decision that declared the organization bankrupt. This document also predetermines the procedure for depositing funds and repaying any types of debts.

Initially, the deadlines for conducting competitive bidding must be met, as a result of which funds will be transferred to the organization’s account. These finances will become a source for repaying debts in bankruptcy in the future. Here you can read about LLC bankruptcy .

The deadlines for paying current debts in bankruptcy may change, but this procedure necessarily requires agreement with the arbitration officer who is called upon to manage the organization after it is declared bankrupt.

The deadlines for paying these debts are set by the court individually, depending on the specifics of each type of debt. Current amounts in bankruptcy may also include excess financial debts that may be the last to be repaid.

Article 5 of the Bankruptcy Law and the concept of current payments

Article 5 of the Federal Law “On Insolvency” No. 127 of October 26, 2002 defines the essence of current payments, and also establishes a list of rights of persons who have the right to demand their execution. According to paragraph 1 of this article, current payments are monetary claims issued to a person unable to fulfill his financial obligations after an application for granting him bankrupt status has been accepted.

These include:

- demands for the payment of benefits or funds as payment for the work of persons with whom the debtor had an employment contract;

- material obligations arising to contractors who supplied goods, performed work or provided services to the debtor.

Paragraph 2 of Article 15 of Federal Law No. 127 indicates that payments having this status are not subject to inclusion in the main list containing information about the debtor’s obligations, and creditors who have the right to demand such payments are not participants in the bankruptcy case.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

According to paragraph 1 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 60 dated July 23, 2009, if certain financial obligations arose with an enterprise before arbitration proceedings were initiated against it, but their repayment period relates to the period of time that occurred after the start of the process, the status of current payments not assigned. This means that they must be redeemed in the order of the general queue.

According to paragraph 4 of Article 15 of Federal Law No. 127, creditors who have the right to collect current payments in bankruptcy can defend it by appealing the actions of the appointed administrator.