List of required documents for liquidation of an individual entrepreneur

The main document for terminating the activities of an individual entrepreneur is a corresponding application. However, it is filled out last, only after the citizen has actually dissolved his company and settled issues with certain authorities. Complete absence of activity is confirmed:

- Certificate from the Pension Fund. For individual entrepreneurs without employees, you need a certificate stating that there were no persons in the company who needed insurance. For individual entrepreneurs with employees, you will need a certificate stating that insurance premiums have been paid for all employees.

- Receipt for payment of state duty.

- A certificate from the bank confirming the closure of a current account, however, such a document is required only for those individual entrepreneurs who have worked with foreign banks and opened an account abroad.

An account statement about the latest movements of funds is not a mandatory document to be attached to the application. However, in some cases, such an extract may be additionally required to close an individual entrepreneur.

Preparing for Closing

Collecting documents is an indispensable point in any step-by-step instructions on how to close an individual entrepreneur, and there is no way to do without it. An individual entrepreneur without employees will need to perform several sequential actions.

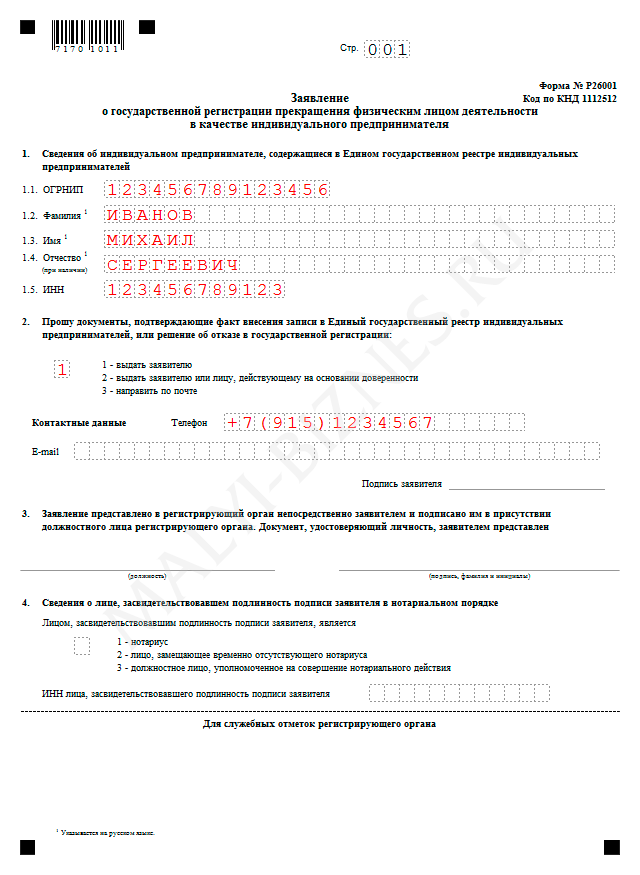

Fill out an application to terminate this activity (there is a special form for this, Form P26001), which can be downloaded and printed from a special website on the Internet or received in finished form at the territorial office of the Federal Tax Service. By using the services of legal websites, you can see how to fill out this document correctly so as not to repeat it twice.

There are four ways to apply in 2020:

- A personal visit to the tax office at the place of registration (sometimes the place of registration and registration coincides), but if these are different branches, then you need to go to the place where registration as an individual entrepreneur took place. In Moscow this is Inspectorate of the Federal Tax Service No. 46.

- Sending by mail an already completed application, but in this case it is certified by a notary, and the preferred method is a valuable letter, with acknowledgment of delivery, in order to avoid misunderstandings with postal services and tax officials.

- Through State Services - this option for submitting an official form requires the entrepreneur to have a personal account and signature, with the corresponding cost and procedure for obtaining (some businessmen draw it up, if necessary, even during the period of active activity), but to do this specifically for the sake of submitting documents, to close a business is expensive and irrational.

- A visit to the MFC, located near the house.

Advice!

In 2020, step-by-step instructions recommend submitting the entire package of required documents at once using any of the listed methods. If the entrepreneur worked without employees, a personal visit to the Federal Tax Service will reduce the closure period to 5 days.

Contacting the MFC will increase the duration to 11 and may create difficulties with accepting documents due to a certificate from the Pension Fund. It is not necessary to present it in 2020, but sometimes center employees insist on fulfilling this point. The duration of receipt of notification by mail depends on the quality of services in the region of residence.

Paying state fees is a small expense when it comes to closing a business. The amount is only 160 rubles. You can deposit it from your mobile device account, withdraw it from a bank card, pay it in person at the bank, or go to the State Services website for this purpose. But online payment is possible only in the latter case. For a personal visit to the tax office, you will need a banal paper receipt of payment, but the owner of an electronic digital signature is exempt from paying state duty on the website.

Some step-by-step instructions at the preparatory stage also indicate the filing of a declaration for the reporting period, which will pass until the receipt of a certificate of deregistration in the Unified State Register of Individual Entrepreneurs. Other experts are confident that this can be done during the main period, and the tax return can be taken care of in advance, if all the steps to close a personal enterprise without employees are needed to switch to another tax regime.

Mandatory actions before closing an individual entrepreneur

Despite the fact that the list of documents that are attached to the application for liquidation of an individual entrepreneur is quite small, their preparation and receipt require additional steps that are performed in a certain sequence. First of all, you need to contact the Pension Fund. If there are employees in the organization, information about these people is transmitted to the Pension Fund of the Russian Federation, and an insurance premium is paid for each employee. The individual entrepreneur himself must also make a contribution for himself, since he is an employee. However, this can be done even after the closure of the individual enterprise. If, in addition to the owner, the company had no other employees, contacting the Pension Fund is necessary to register the fact of the absence of employees and the need to pay insurance premiums.

After the issue with the Pension Fund has been resolved, the current account can be closed, for which the owner of the company needs to contact the bank where the account was opened. Some individual entrepreneurs open accounts in foreign banks. In this case, you will need to take the corresponding document from the bank, since the tax office cannot independently verify the activities of accounts in foreign banks. But if such an account is not closed and its existence is hidden, the citizen will be punished with an administrative fine. Please note that you need to close the current account after the issues with the Pension Fund have been resolved if there are employees in the company. Thus, the last movements on the account will be insurance premiums.

You will also need to file a tax return. After completing all the steps, the individual entrepreneur can fill out a liquidation application.

Responsibility and consequences

Arrears in taxes and pensions are an offense for which liability is provided. In the absence of financial support for contributions to the Russian Pension Fund, fines and penalties are applied to the owner. If mandatory payments were not transferred or the amount was not paid in full, then the amount of the sanction is 20-40% of the debt.

Read also: When to pay personal income tax on vacation pay

Forced collection of arrears provides for the following algorithm:

- A notification is sent about the need to pay the debt.

- If the request is ignored or refused, funds are debited from the bank account.

- If there is not enough money in the bank account, litigation is initiated.

This process of forced collection is similar for all debt obligations of individual entrepreneurs.

Thus, the closure of an individual entrepreneur is allowed if there is arrears, but a complete cessation of activity with unpaid taxes is practically impossible. For Russian Pension Funds, the procedure is easier, but even after the application is approved, the owner is obliged to pay the funds within 14 working days.

Refusal will result in bailiffs calling on the citizen’s property. The confiscation procedure negatively affects the quality of life not only of the former business owner, but also of his family. Therefore, experts recommend not delaying debt repayment to a critical point and, if possible, peacefully resolving the problem with creditors.

Application template for termination of the activities of an individual entrepreneur Form No. P26001

A template for an application to terminate the activities of an individual entrepreneur can be downloaded from the website of the Federal Tax Service or by clicking on the link. The application, with the necessary package of documents, can be done in person if you have a passport. In case of electronic submission of an application, the completed template must be supported by a qualified electronic signature. Only in this case the application will be accepted.

Advantages and disadvantages of this method

The procedure for liquidating an individual entrepreneur through the State Services portal has its pros and cons. Among the advantages are:

- Availability. The procedure can be completed at home; all you need is an Internet connection.

- No material costs for the assistance of intermediaries. You only need to pay the state fee - 160 rubles.

- Simplicity of the method. The individual entrepreneur is only required to carefully follow the instructions. You must be extremely careful when filling out the form.

- Saving time on preparing documentation packages and eliminating queues.

- Quick closing and receipt of certificate.

The procedure does not have any disadvantages as such. There are just a few nuances that are worth considering:

- there may be a delay in confirming your identity or a delay in the code from the portal;

- a refusal is acceptable if all fields are not filled in or the font is incorrectly selected;

- You must have a digital signature or confirm your identity through the MFC.

Closing an individual entrepreneur through State Services is a fairly convenient way to terminate activities. A minimum package of documents and Internet access greatly simplify the procedure. In just 5 working days, the Federal Tax Service issues a certificate of termination of the entrepreneur’s activities.

Step-by-step instructions for closing an individual entrepreneur through State Services

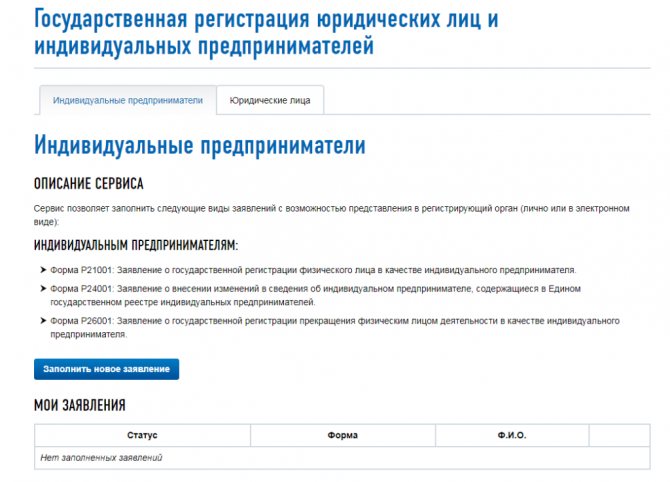

In fact, the State Services portal does not register applications for the liquidation of individual entrepreneurs. Submission of documents is carried out through the official website of the Federal Tax Service. However, only a registered user can submit an application, and logging into the Federal Tax Service account is available through an account on State Services.

Note! When authorizing through the State Services portal to fill out applications for registration of an individual entrepreneur or its liquidation, the amount of state duty is reduced by 30%. Payment is made online. In other cases, payment must be made in advance and a scan of the receipt must be attached to the set of documents.

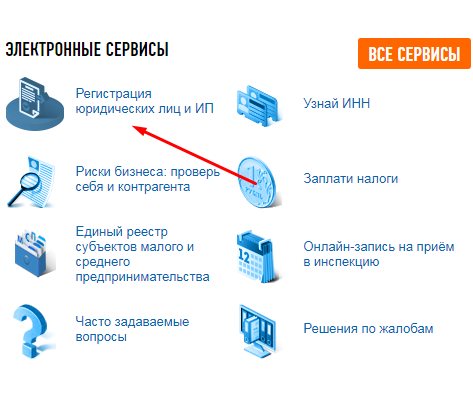

After authorization on the Federal Tax Service website, you need to find the section “Registration of legal entities and individual entrepreneurs”;

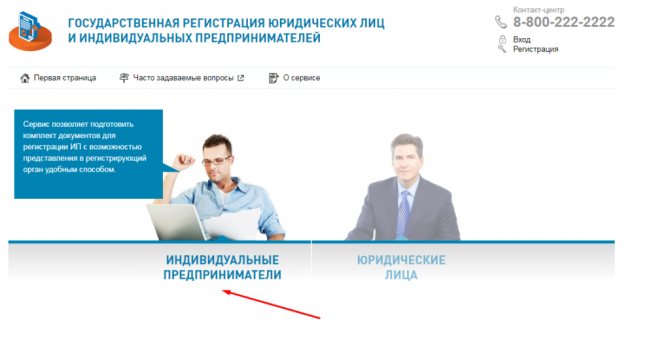

Select “Individual entrepreneurs”;

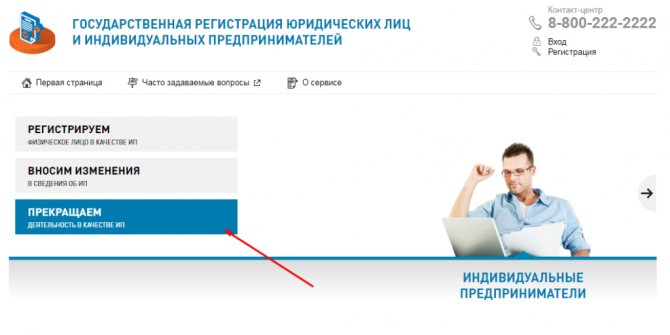

Follow the link “We are ceasing to operate as an individual entrepreneur.

Next, you will be taken to a page with the opportunity to submit an application to close an individual entrepreneur.

The form does not require you to manually enter any data, since the main block is a form for uploading documents. Before uploading them, each document must be certified with a qualified electronic signature.

How to close an individual entrepreneur in other ways

You can contact a reliable intermediary company. Among many, we can highlight the Documentoved service. For 1,690 rubles, they will correctly prepare all the necessary documents and send them to you.

All you have to do is send or take them to the tax office. After which, after 5 days, your individual entrepreneur will be closed.

Important! The Documentoved service carries a legal guarantee that your individual entrepreneur will cease to exist. Believe me, not many people guarantee this.

Register in the Documentoved service

Terms of liquidation of individual entrepreneurs

After loading all the necessary data, the form is sent for review. The closure of the individual entrepreneur is carried out within 5 working days, after which the status of the application changes and the former individual entrepreneur is provided with a USRIP entry sheet, and the entrepreneur himself is deregistered.

The main work during the liquidation of an individual entrepreneur is the preparation of documents. In some cases, a reasoned refusal may be received in response to an application. In this case, you can appeal the decision or fill out the application again and attach documents that were not enough for a positive decision last time. Reference! Liquidation of an individual entrepreneur according to the specified instructions is carried out in cases where a citizen no longer plans to engage in entrepreneurial activity. If an entrepreneur wants to make any changes, an application in a different form and a different set of documents will be required.

Deadlines

Will individual entrepreneurs with debts be closed - for taxes, to the Pension Fund or employees?

In this case, the liquidation of the organization does not provide for clear deadlines within which the businessman must notify the authorities. However, the period for consideration of the application is regulated. It will take several hours to pay the state fee, fill out the application and submit papers to the Federal Tax Service. Review of the request takes no more than five days. A specific time is allotted for repaying debts. Thus, the debt to the Pension Fund is no more than 14 days from the date of official termination of activity.

The time for submitting the declaration depends on the tax system under which the organization operated:

- “simplified” - until the 25th day of the next month following the approval of the application;

- UTII - until the company ceases operations.