Finance: Should you go bankrupt?

The bankruptcy law for individuals has been in effect for more than a year. During this time, only 17 thousand people managed to pass it, although about 600 thousand debtors fall under the law.

Those whose debt is more than 500 thousand rubles and whose payments are three months overdue can begin the bankruptcy process. In this case, the application can be submitted by both the debtor himself and his creditors. If the application is accepted, the debtor's property is seized and a financial manager is appointed who controls the entire process. There are two outcomes in a bankruptcy case: restructuring of payments or covering the debt with personal property. A bankrupt person may be prohibited from traveling abroad for five years, and he will also not be able to hold managerial positions for three years.

Why is the law not popular and do debtors manage to start a new life? The Village learned about this from the bankrupt and his financial manager.

How can you go bankrupt?

Oleg Sobolev, arbitration manager

Documentation

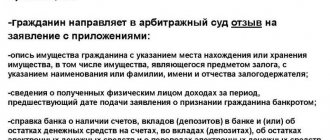

In order for the court to initiate bankruptcy proceedings, it is necessary to collect the documents listed in Article 213.4 of the Federal Law “On Bankruptcy (Insolvency)”. Such documents include information about the citizen (copy of his passport, SNILS, TIN certificate), information about the amount of debts (loan agreements and other agreements (loans, supplies, etc.), certificates from banks about the amount of debt (or reconciliation reports), decisions courts (decrees of bailiffs), information about property (extracts from the Unified State Register, certificates from the State Traffic Safety Inspectorate, inventory of property).It is necessary to put 25 thousand rubles on the deposit of the court as a remuneration of the arbitration manager for each bankruptcy procedure and 6 thousand rubles as payment of the state duty.

Procedure

The Bankruptcy Law provides for two bankruptcy procedures for citizens: restructuring of a citizen's debts and sale of a citizen's property. Debt restructuring involves repaying the debt from the debtor's income for three years. At the same time, both the debtor and the creditors have the right to come up with a debt restructuring plan. The procedure itself lasts seven months, but can be extended. The sale of property involves the sale of the debtor's property. It lasts for six months and can also be extended.

The complexity of the bankruptcy procedure lies in the fact that debtors hide their property from the administrator and the court. There are also unsettled relations with banks. For example, banks continue to write off money from the debtor’s accounts, despite the introduction of bankruptcy proceedings. And the manager has a large amount of work and low official remuneration.

Advantages and disadvantages

The advantages of the bankruptcy procedure are the possible write-off of debts and freedom from calls from banks and collectors. All debtor trials take place in one court and before one judge. The disadvantages of the procedure are the chance of non-writing off debts, as well as risks when buying an apartment and a car, because transactions can be challenged. The procedure is beneficial for those who have a good “legend” and debts of 1 million rubles. In other cases, the effect is often less than the costs.

Many managers and experts argue that the law on bankruptcy of citizens does not work the way it was intended by legislators. In particular, they refer to such points as the high cost of the bankruptcy procedure, the complex procedure for collecting documents, as well as the lack of desire among financial managers to work with bankrupt citizens.

Personal experience

Taisiya, daughter of a debtor declared bankrupt

A family misfortune occurred nine years ago. At that moment, my mother's son needed a lawyer. A fraudster came to her and called herself his friend. She volunteered to help and find a lawyer - for this she needed money. She said that she would borrow money from some businessman, and invited her mother to sign a loan agreement in order to have guarantees. Then the mother was in a state of shock and would have signed anything to get help for her son. The fraudster disappeared, there was no money, no lawyer - in the end there was a free lawyer at the trial. Everything worked out well, and we seemed to have safely forgotten about this story. But it was written in the contract that my mother had already received the money before signing it - we learned about this much later. And a condition was prescribed: if after a year she does not give them back, then the amount will double.

A year has passed, the scammer has appeared. The mythical 1.5 million rubles grew to more than two million. The fraudster filed a lawsuit, and as a result, the mother was ordered to pay money.

Mom worked for 15 years in the secret part of the FSB, kept state secrets - the person has an untarnished reputation. But the fraudster has never worked anywhere, this is not her first case: she “gave” 8 million rubles to one person, and took a car from another. But the human factor was not taken into account at all.

This situation occurred in 2008. I began to find out what to do. All the lawyers unanimously said that it was useless - we had to pay. My mother had 50% of her salary deducted every month. Of the 9 thousand rubles of pension, 4.5 thousand remained for living.

We think the scammer wanted her mother's apartment. She didn't show up for a year, and the debt increased. Then she could index the debt, over time it would increase to the size of an apartment. Of course, my mother’s apartment would not have been taken away - this is her only place to live. But after her death, the apartment would go to the fraudster. Therefore, even before the court’s decision, my mother registered the apartment in my name.

In the end, the scammer did just that. She indexed the debt, but that was even good. Because until the amount increased, mom had no choice but to pay. After indexation and an increase in debt, I turned to a specialized website and began to consult with lawyers. I was recommended to go through bankruptcy proceedings. In our situation, this was a salvation.

It seems that the bankruptcy law was created specifically for deceived grandparents

How is a person declared bankrupt? He submits a statement to the court that he is unable to pay his debts and provides information about his income. If within a certain time he was unable to cover the debt, the court considers the application and declares him bankrupt or not. Once it has been recognized that a person is unable to pay, the process of selling his property begins. All “luxury goods”—things that can be taken and sold—are taken and sold. The only housing cannot be sold, but it can be arrested. A person lives in it, but essentially it is not his property.

We turned to the bankruptcy manager - he should act as a disinterested person: meet with creditors and propose a settlement agreement. He also finds out what property the debtor has, and, if he has it, sells it. The manager checks and submits to the court all the necessary documents, provides a report on the basis of which the court makes a decision.

Prices for manager services vary, as do lawyers’ fees. But if a person does not have money for a manager or he cannot pay the state fee, then he will not be able to go bankrupt. Our manager turned out to be a very decent person: he didn’t like that the elderly woman was put in such a situation. But I didn’t delve into his work because I don’t have the right to do so. The manager has no personal interest.

Our process took six months - from the moment of filing the application to the trial. While the bankruptcy process was going on, everything was seized from my mother and she did not even receive half of her pension. The court decided to declare my mother bankrupt and release her from paying the debt on the grounds that she has no property and income. Restructuring would not make sense here because the person is insolvent. The decision could have been appealed within ten days, but our lender did not do this.

It seems that the bankruptcy law was created specifically for deceived grandparents. There are dead ends: people get into them when they are unable to pay these debts.

The procedure cost us 45 thousand rubles. If we talk about the disadvantages, then a bankrupt cannot travel abroad for several years, occupy management positions and open a business. During this time, the person seems to be frozen. If he is going to make a large purchase, he must inform the bankruptcy trustee about it. This results in some kind of oversight. But for us this is not a minus: my mother is not going to go abroad and open a business. The downside is that she suffered a heart attack from a sense of injustice.

Text of the book “Bankruptcy of an individual (citizen). Everything the debtor and creditor need to know"

Igor Galichevsky Bankruptcy of an individual (citizen). Everything the debtor and creditor need to know

© Galichevsky I.N., 2018

© LLC “Publishing books com”, o-layout, 2018

* * *

Presentation of the author and book

Hello! My name is Igor Galichevsky, I am the founder and head of a legal company that has been successfully operating since 2007. In 2014, I wrote the book “ProBusiness” and, to be honest, I thought that I would quit writing. The paper edition did not bring me any special bonuses: perhaps only expenses, since I ultimately published at my own expense. But the electronic version, which I prudently translated into audio format, sold quite well. To date, about 10 thousand people have downloaded it, and their feedback made me happy. For a book of this format, which deals with business, advertising, marketing and law (not the most compatible things, it would seem), this can be considered a good result. What helped me achieve this, first of all, was my own group in Contact https://vk.com/onegin_consulting, which exists on money. But that’s not what we’re talking about now.

Although I promised myself that I would never waste time on “writing” again, nevertheless, dear reader, you are holding my new book in your hands. What made me write it? Yes, the topic of BANKRUPTCY is more than relevant for many of our citizens today, and I am at the forefront of all these processes and accompany bankruptcy procedures as an arbitration manager. Yes, that’s right, I am the person whom the state and the arbitration court trust to conduct bankruptcy procedures for citizens and legal entities.

Thus, I had an idea: to tell you in an accessible and simple language everything you wanted to know about bankruptcy, but did not know where to look and how to summarize the huge amount of conflicting information scattered on the Internet. I wanted to help you understand the complex processes that accompany all stages of bankruptcy of an individual – a citizen. And it doesn’t matter whether you are a debtor or a creditor: in this book you will find answers to your questions and receive all the necessary information that will help you understand the essence of bankruptcy and make the right decisions, as well as control the bankruptcy process itself and the persons involved in it.

I will try to use the professional legal terminology of arbitration managers as little as possible. the Federal Law itself

[1]

1

1. Next 127-FZ, Law or Federal Law.

[Close] and separately Chapter X “Bankruptcy of a citizen”

extremely confusing and contradictory, from my point of view. I will try in my own language, as close as possible to the actual state of affairs, to explain to you the issues that you will have to face if, God forbid, you become a participant in a citizen’s bankruptcy case.

Chapter 1. General provisions

§ What is bankruptcy of a citizen

1) According to the law (Article 2 127-FZ):

Insolvency (bankruptcy) is the inability of a debtor recognized by an arbitration court to fully satisfy the demands of creditors for monetary obligations, for the payment of severance pay and (or) for the payment of wages to persons working or who worked under an employment contract, and (or) to fulfill the obligation to make mandatory payments .

2) Through the eyes of a debtor-citizen:

Possibility to write off debts. Get rid of harassment and calls from annoying collectors, banks and other creditors.

3) Through the eyes of the lender:

The ability to turn the debtor “inside out.” To prohibit him from leaving the Russian Federation, to gain access to information about the flow of funds in his accounts for the last few years preceding bankruptcy, to challenge past transactions on the alienation of property. This is also an opportunity to identify the debtor’s hidden property and allocate the marital share (if the debtor is or was married). In general, try to create so many problems for the debtor that it will be easier for him to pay off existing debts or enter into an adequate dialogue in order to subsequently avoid serious consequences.

§ Insolvency of a citizen

The insolvency of a citizen and the insufficiency of his property to cover existing debts is the main step towards his possible bankruptcy.

Insolvency is understood as the inability to satisfy in full the claims of creditors for monetary obligations and (or) to fulfill the obligation to make mandatory payments[2]2

2. We are talking about taxes.

[Close] (Clause 3 of Article 213.6 of the Law). A citizen is presumed to be insolvent provided that at least one of the following circumstances occurs:

– the citizen has stopped making payments to creditors, that is, has ceased to fulfill monetary obligations and (or) the obligation to pay obligatory payments that have become due;

– more than 10% of the total amount of monetary obligations and (or) obligations to pay mandatory payments that a citizen has and the deadline for fulfillment of which has come, have not been fulfilled by him for more than one month from the day when such obligations and (or) obligations are due to be fulfilled;

– the amount of a citizen’s debt exceeds the value of his property, including the right to claim;

– the presence of a resolution on the termination of enforcement proceedings due to the fact that the citizen does not have property that can be foreclosed on.

§ What is bankruptcy estate

All identified property of a debtor-citizen, which is subject to subsequent sale in order to pay off his existing debts, constitutes the bankruptcy estate

.

In paragraph 2 of Art. 213.25 of the Law states: “Upon a reasoned petition from a citizen and other persons participating in a citizen’s bankruptcy case, the arbitration court has the right to exclude from the bankruptcy estate the citizen’s property, which, in accordance with federal law, may be levied under executive documents, and income, the sale of which will not significantly affect the satisfaction of creditors' claims. The total value of a citizen’s property, which is excluded from the bankruptcy estate in accordance with the provisions of this paragraph, cannot exceed ten thousand rubles.”

. That is, the legislator granted the right to interested parties to exclude from the bankruptcy estate ordinary household items and other things that have a small value, in total not exceeding 10 thousand rubles.

There are also some types of property of a debtor-citizen that under no circumstances can be included and be part of the bankruptcy estate (more details in Article 446 of the Code of Civil Procedure of the Russian Federation):

– residential premises (parts thereof), if for the debtor citizen and members of his family living together in the premises they own, it is the only premises suitable for permanent residence;

– food and money for a total amount not less than the established subsistence level of the debtor citizen himself and his dependents;

– means of transport and other property necessary for the debtor citizen in connection with his disability;

- etc.

Important!

(Clause 4 of Article 213.25 of the Law)

“ The bankruptcy estate may include the property of a citizen, constituting his share in the common property, which may be foreclosed on in accordance with civil law and family law.

The creditor has the right to make a demand for the allocation of a citizen’s share in the common property in order to foreclose on it.” In other words, for example, during a marriage, spouses acquire jointly acquired property, and any creditor or financial manager can foreclose on the share of the debtor spouse, having previously separated it from the total amount of marital property.

§ What debts are not written off by bankruptcy of a citizen

The following debts are not written off by bankruptcy:

– creditors’ claims for current payments[3]3

3. Current payments are those payments that arose during the period when the arbitration court accepted an application for bankruptcy of a citizen before the end of such a process. Also see § “Registered and current obligations (payments)”.

[Close];

– compensation for harm caused to life or health;

– payment of wages and severance pay;

– compensation for moral damage;

– demand for alimony;

– requirement to bring a citizen as a controlling person to subsidiary liability[4]4

4. A special type of liability, the meaning of which is that the management of a legal entity (or another entity controlling the debtor) is liable for the debts of its legal entity to the extent that this legal entity has not paid its debts.

[Close];

– compensation by a citizen for losses caused by him to a legal entity of which he was a participant, intentionally or through gross negligence;

– compensation for damage to property caused by a citizen intentionally or through gross negligence;

– as well as other requirements inextricably linked with the identity of the creditor.

The above list contains the main cases, but is not exhaustive. You can read more in Art. 213.28 and other provisions of the Act.

Important!

If it is established that the debtor has concealed any property, then any creditor whose claims were not satisfied in bankruptcy (provided that he was a participant in this process) may apply to the court for a review of the completed bankruptcy of a citizen on newly discovered grounds within months from the moment these circumstances became known to him. And then, if the creditor’s claims are found to be justified, the court restores all previously written off debts, and the citizen’s bankruptcy procedure is resumed (more details, Article 213.29 127-FZ).

§ If the citizen is an individual entrepreneur (IP)

If a citizen has the status of an individual entrepreneur, then he goes bankrupt according to the same rules as a citizen who does not have such status, with the exception of a few minor nuances. In this case, all debts of a citizen are subject to inclusion in the register: both those that he incurred as a result of entrepreneurial activity, and those that he has as an ordinary individual.

Now about the nuances that I mentioned above. The right to apply to declare a citizen who is an individual entrepreneur bankrupt arises for the applicant (creditor or the citizen himself) only subject to prior (at least fifteen calendar days before the day of application to the arbitration court) publication of the notice in the “Unified Federal Register of Information” on the facts of the activities of legal entities" (https://se.fedresurs.ru).

§ In what cases are guardianship authorities involved in participation in a bankruptcy case?

In a situation where the debtor has minor children, the court involves the guardianship and trusteeship authorities to participate in the bankruptcy case of a citizen (Clause 2 of Article 213.6 127-FZ). The same situation applies to incapacitated citizens or other persons dependent on the debtor (for example, guardianship of an elderly person has been issued).

In itself, the involvement of a guardianship and trusteeship body is a benefit for the debtor, since this structure will defend his property and other property rights, trying to exclude them from the bankruptcy estate, which is subject to sale in bankruptcy proceedings. Thus, there is additional protection of the interests of the debtor.

§ Persons participating in a bankruptcy case and persons who are participants in the arbitration process in a bankruptcy case

The legislator in 127-FZ clearly separates two groups of persons, giving them different scope of procedural rights and obligations in the bankruptcy case of a citizen debtor. The bottom line is that only one is given a full range of opportunities to influence the course of the bankruptcy procedure - these are the persons participating in the bankruptcy case

, and others are given only a part of such opportunities - these are

persons who are participants in the arbitration process in a bankruptcy case

. Further, in certain chapters and paragraphs, I will periodically separate these two categories so that you understand that in the same situation the rights and responsibilities of these groups may be different.

The main persons involved in the bankruptcy case

, are recognized (Article 34 of the Law):

– debtor;

– arbitration manager[5]5

6. See § “Who is an arbitration manager (financial manager)”.

[Close];

– bankruptcy creditors[6]6

7. See § “Types of creditors”.

[Close];

– authorized bodies[7]7

8. See § “Types of creditors”.

[Close];

– federal executive authorities, as well as executive authorities of constituent entities of the Russian Federation and local government authorities at the location of the debtor in cases provided for by this Federal Law[8]8

9. For example, this is a guardianship and trusteeship authority in cases where the debtor-citizen has minor children.

[Close].

The specified list of participants in the bankruptcy case

is not exhaustive and affects only the main persons and subjects whom I considered necessary to mention when considering the issue of bankruptcy of a debtor-citizen.

In bankruptcy arbitration proceedings

participate (Article 35 of the Law):

– representative of the debtor’s employees;

– a representative of the creditors’ meeting or a representative of the creditors’ committee;

– a representative of the federal executive body in the field of security (if the exercise of the powers of the arbitration manager is related to access to information constituting a state secret);

– other persons in cases provided for by the Arbitration Procedure Code of the Russian Federation and this Federal Law[9]9

10. Important! Here we are also talking about creditors whose claims against the debtor are still being considered and are not included by the court in the register of creditors’ claims. See also “Chapter 6. Register and types of payments (obligations)”.

[Close].

In bankruptcy arbitration proceedings

have the right to participate:

– a self-regulatory organization of arbitration insolvency practitioners, which nominates insolvency insolvency practitioners for approval in a bankruptcy case, or whose member is approved in a bankruptcy case, when considering issues related to the approval, dismissal, removal of insolvency insolvency practitioners, as well as complaints against the actions of insolvency insolvency practitioners;

– creditors for current payments – when considering issues related to violation of the rights of creditors for current payments.

As in the case of participants in a bankruptcy case

, the list

of participants in the arbitration process in a bankruptcy case

and those who are entitled to be

a participant in the arbitration process in a bankruptcy case

is not exhaustive.

Persons who are participants in the arbitration process in a bankruptcy case,

just like the direct

participants in the bankruptcy case

, they have the right to get acquainted with the materials of the bankruptcy case, make extracts from them and make copies.

Chapter 2. Responsibility in a bankruptcy case of a citizen

§ Fictitious and deliberate bankruptcy

Deliberate bankruptcy

(Article 196 of the Criminal Code of the Russian Federation)[10]

10

11. Criminal Code of the Russian Federation.

[Close] – the commission by a citizen, including an individual entrepreneur, of actions (inaction) that obviously entail the inability of the citizen, including an individual entrepreneur, to fully satisfy the claims of creditors for monetary obligations and (or) to fulfill the obligation to pay mandatory payments, if these actions (inaction) caused major damage.

Fictitious bankruptcy

(Article 197 of the Criminal Code of the Russian Federation) - a deliberately false public announcement by a citizen, including an individual entrepreneur, of his insolvency, if this act caused major damage.

At the beginning of 2020, major damage amounts to 2 million 250 rubles.[11]11

12. See Art. 170.2 of the Criminal Code of the Russian Federation, note.

[Close], and its size changes periodically. Sanctions for these crimes vary: from a banal fine to imprisonment. All this can be viewed and read about in detail in the above articles. You need to understand that today in the Russian Federation there are negligibly few cases brought under these circumstances, but this cannot be neglected. And if a fictitious bankruptcy

is indeed extremely rare, signs

of intentionality

appear quite often. And this is due to the desire of the debtor, first of all, to preserve and take away his property in anticipation of future collections and possible subsequent bankruptcy. Schemes for such diversion of property are, as a rule, simple and uncomplicated: purchase and sale to relatives or donation. There are two main mistakes here: the first is that the debtor’s relatives, spouse or children (affiliates) are woven into this chain. The second common mistake is making transactions without actually transferring money (using receipts, cells, etc.), which indicates the possible nullity or contestability of such transactions. Therefore, if the debtor has decided to commit a crime, he should first consult with a good lawyer-practitioner in the bankruptcy field, since the state has enough opportunities to check this chain completely. In general, on my own behalf, I advise you not to cross the line.

Who is the main initiator of appeals to initiate these criminal cases?

1. First, the financial manager

.

His responsibilities include analysis of the citizen’s financial condition

(clause 8 of Article 213.9 of the Law).

This is one of the key documents, but not the only one, that determines the fate of the debtor in the bankruptcy procedure. Basically, this analysis is carried out to establish signs of fictitious

and/or

deliberate bankruptcy

and to identify transactions that do not comply with the law (voidable transactions). Therefore, if a financial manager becomes aware of violations of the law in the course of his work, he must contact law enforcement agencies.

2. Secondly, creditors

, dissatisfied with the fact that property was hidden from them. They can get information about it from various sources: from contacting friends and acquaintances to directly familiarizing themselves with the results of the work of the same financial manager.

Important!

An analysis of fictitious bankruptcy by the financial manager is not carried out if the debtor has been filed for bankruptcy by the creditor, since from the content of Article 197 of the Criminal Code of the Russian Federation it follows that it is the debtor himself who must publicly declare his insolvency.

§ Unlawful actions in bankruptcy (Criminal Code of the Russian Federation)

There is another such unpleasant article for a debtor-citizen as 195 of the Criminal Code of the Russian Federation. Its meaning, in a nutshell, is that the actions of the debtor, causing major damage

[12]

12

13. At the beginning of 2020, major damage amounts to 2 million 250 thousand rubles. See art. 170.2 of the Criminal Code of the Russian Federation.

[Close], are punishable by a fine or a real term of imprisonment if associated with:

– concealment of property, property rights or property obligations or information about them; transfer of property into the possession of other persons, alienation or destruction of such property; concealment, destruction, falsification of accounting and other accounting documents reflecting the economic activities of the debtor (for example, this is relevant for a citizen who has the status of an individual entrepreneur). An important condition for bringing to responsibility here is also the commission of named actions in the presence of signs of bankruptcy

;

– unlawful satisfaction of property claims of individual creditors, obviously to the detriment of other creditors, if these actions were committed in the presence of signs of bankruptcy

;

– illegally obstructing the activities of the arbitration manager, including evasion or refusal to transfer to the arbitration manager documents or other property necessary for the performance of the duties assigned to him.

Fortunately for debtors, our legal system today is not ideal, and, according to my personal observations, 99.98% of all such cases remain without due attention from the relevant structures.

§ Unlawful actions in bankruptcy (Administrative Code of the Russian Federation)

Art. 14.13 Code of Administrative Offenses of the Russian Federation[13] 13

14. Code of the Russian Federation on administrative legal relations.

[Close] provides for sanctions for the debtor in the same cases as Art. 195 of the Criminal Code of the Russian Federation[14] 14

15. See § “Illegal actions in bankruptcy (Criminal Code of the Russian Federation)”.

[Close], provided that these events do not contain a criminal offense

. Liability here is usually limited to a fine.

Also, compared to Art. 195 of the Criminal Code of the Russian Federation, administrative code in art. 14.13 contains several additional grounds for holding the debtor liable. For example, among them:

– failure by an individual entrepreneur or citizen to fulfill the obligation to file an application for declaring himself bankrupt to the arbitration court in cases provided for by the legislation on insolvency (bankruptcy)[15]15

16. See § “Who and under what conditions can initiate bankruptcy proceedings for a citizen.”

[Close];

– illegal obstruction by an individual entrepreneur or citizen of the activities of an arbitration manager, including evasion or refusal to provide information, as well as failure to transfer to the arbitration manager documents necessary to fulfill the duties assigned to him (here we are talking mainly about the debtor ignoring the requests of the financial manager or untimely answer them)[16]16

17. See § “Requests from the financial manager and the deadline for responding to them.”

[Close].

But Article 14.13 of the Code of Administrative Offenses of the Russian Federation is not limited to the above. It also contains a rule that is useful to the debtor and creditors from the point of view of influencing the arbitration manager himself. The provisions of this article allow you to file a complaint against illegal actions (inaction) of the arbitration manager. If the complaint turns out to be justified, he may face sanctions, including disqualification (see § “Where to complain about a financial manager”).

Chapter 3. Arbitration manager (financial manager)

§ Who is an arbitration manager (financial manager)

A person entrusted with handling a citizen’s bankruptcy case must have the status of an arbitration manager

.

He is appointed by the arbitration court, and only the arbitration court can remove him from the procedure. In the text of the Law, an arbitration manager taking part in a citizen’s bankruptcy case is named as a financial manager

, that is, this is a narrower designation of an arbitration manager, which he acquires in the bankruptcy procedure of a citizen. But, regardless of what they call him, the essence will not change: this person will accompany the entire bankruptcy procedure from “A” to “Z”, and a lot will depend on his actions.

Links[ | ]

- Text of the play

- Summary of the play

| Plays by Alexander Ostrovsky | |

| |

The fate of bankrupt citizens will be eased

The State Duma plans to consider a bill in the near future that would allow Russians who find themselves in difficult life situations to solve their problems without bureaucratic delays. The document was introduced by a number of deputies led by the Chairman of the Committee on Natural Resources, Property and Land Relations Nikolai Nikolaev.

Who can get rid of the debt burden?

Read on the topic

Bankruptcy will be declared faster

The bankruptcy procedure for individuals in Russia was legislatively formalized in 2020 in the form of a separate federal law No. 127-FZ. It implies recognition by the arbitration court of a citizen’s inability to fulfill loan obligations. The document also makes it possible to restructure the debt by paying it off according to a plan approved with creditors. At the same time, the accrual of penalties and fines is suspended.

According to experts, the new law allowed insolvent citizens with overdue payments of more than three months in an amount exceeding 500 thousand rubles to get rid of the debt burden.

True, not everyone. The fact is that in order to exercise the right to declare oneself bankrupt, the debtor must meet the criteria specified in the law. In particular, an insolvent citizen must own property, which is subsequently seized and sold during bankruptcy proceedings. Debts are repaid, and the remainder of the proceeds are returned to the debtor. At the same time, the lack of property of a citizen could previously be the reason for the refusal to introduce bankruptcy proceedings. That is, creditors continued to charge penalties on the amount of the debt, and the debt itself increased in size. Now the situation must change.

The new bill allows bankruptcy of an individual even if the debtor does not have property that could cover the obligations. According to the co-author of the document, Deputy Chairman of the State Duma Committee on Regional Policy and Problems of the North and Far East Oksana Bondar

, the proposed amendments are based on the fact that “in addition to proportionate satisfaction of creditors’ claims, the bankruptcy procedure for a citizen has a social rehabilitation goal, which is achieved by writing off unsustainable debt obligations.”

A person’s lack of property with which it is impossible to cover debts, for example, the only home, should not be an obstacle to starting bankruptcy proceedings.

The deputy believes that the enforcement practice of bankruptcy law needs further improvement. “The current insolvency law only states that when considering a citizen’s bankruptcy case, the restructuring of the citizen’s debts, the sale of the citizen’s property, and a settlement agreement are applied. We clarify that a person’s lack of property with which it is impossible to cover debts, for example, the only home, should not be an obstacle to starting bankruptcy proceedings,” the parliamentarian emphasized.

According to the developers, this norm will help increase the number of those who will be able to deal with their debts if they find themselves in a difficult life situation.

Legal protection will not hurt

The bankruptcy procedure is accompanied by many nuances. What matters here is the size of the debt, the length of the delay in payments, etc. But the issue of legal protection of the debtor remains somewhere on the sidelines, the authors of the amendments believe.

The proposed bill, according to Viktor Karamyshev

, contains quite a lot of innovations that will help strengthen the protection of the property rights of citizens subject to bankruptcy proceedings. For example, it is planned to transfer information on the collection of overdue debts to the public.

Read on the topic The people of Russia owe banks half a year's salary

“Now a person who has debts to a creditor receives a registered letter from him, in which he learns that the rights to “knock out” debts from him have been transferred to a third party. We offer another way of informing - through posting information in the unified federal register of information on bankruptcy. Thus, debtors will be able to “monitor” the situation on their own, without waiting for letters,” the deputy explained.

The parliamentarian is convinced that the norm will allow citizens to more actively protect their rights and legitimate interests. “It’s no secret that letters do not always arrive on time and often the debtor learns about the transfer of the debt to another person after the collection procedure has begun,” Karamyshev clarified.

Co-author of the bill is Deputy Chairman of the State Duma Committee on Security and Anti-Corruption Anatoly Vyborny

noted another important innovation in the bill: the definition of the concept of the sale of a citizen’s property as a rehabilitation procedure “in order to proportionately satisfy the claims of creditors and free the citizen from debts.” In addition, the bill involves eliminating contradictions between the requirements of articles of the bankruptcy law regarding compliance with deadlines when applying to an arbitration court with an application from the debtor. The document proposes to increase the period for the liquidation commission to file a debtor’s application with the arbitration court to 20 days, thereby eliminating the contradiction that has arisen.

Pros and cons of bankruptcy

Advantages:

- Penalties and fines cease to accrue on the debt amount.

- Having an official “bankrupt” status provides protection from the claims of creditors and collectors. The bankruptcy procedure is also possible after the death of the debtor, which frees the legal heirs from debt obligations.

Flaws:

The debtor loses all property at the auction, except for personal belongings and household items. After completing bankruptcy, a citizen will not be able to apply to the bank for a loan for five years. A bankrupt person is deprived of the status of an individual entrepreneur and can only register again after five years. The services of the financial manager are paid from the debtor's funds.

In case of bankruptcy, the following cannot be taken from the debtor:

- the only housing, with the exception of collateral and mortgage properties;

- transport used for main work;

- computer equipment used in work;

- State prizes and awards;

- household items necessary to support life.

The situation has improved: there are fewer potential bankrupt individuals

There are fewer potential bankrupt citizens in Russia. According to data at the end of the first quarter of 2020, 337.7 thousand bank clients can be considered insolvent debtors. This is stated in a study by the Equifax credit history bureau, which Izvestia reviewed. In January–March 2018, there were 18% more such defaulters. The figure has been declining for the last three years. Potential bankruptcy does not always turn into real bankruptcy, since there are pre-trial mechanisms for resolving the situation, including loan restructuring, experts note.

Russians are less likely to find themselves in a pre-bankruptcy state. As of the end of March 2020, out of 42 million bank clients, only 337.7 thousand can be considered insolvent, according to calculations by the Equifax credit history bureau, which Izvestia reviewed. A year earlier, there were 410 thousand potential bankrupts.

Penalties were lifted: debts of potential bankrupts reached 39.6 billion rubles

In 2020, this amount increased by 28%

The indicator has been declining for three years, about. In 2020, the number of potential bankrupts in different months reached 460 thousand; in 2017 there were about 450 thousand.

Potential bankrupts are borrowers who have not paid their loan for more than three months, and the amount of debt exceeds 500 thousand rubles.

Based on the results of the first quarter of 2020, the share of such defaulters is 0.8% of all consumers with loans, Oleg Lagutkin, general director of the Equifax financial institution, told Izvestia. One of the reasons is the increase in the number of solvent clients with active loans, which was caused by rapid lending to the population by banks.

The law on bankruptcy of individuals has been in effect since 2020. In January–February 2019, arbitration courts declared 8.3 thousand individuals insolvent. The Central Bank did not answer Izvestia’s question whether the number of bankrupt citizens is currently decreasing.

Potential bankruptcy does not always turn into real bankruptcy, since there are pre-trial mechanisms to prevent it, noted NUS Amulex lawyer Victoria Sokolova. For example, citizens who are experiencing financial difficulties can contact the bank with a request to provide credit holidays, refinancing, and also receive installment payments.

Non-recoverable asset: Russians are overdue on loans by almost 1.6 trillion rubles

Despite the fall in real incomes, citizens continue to take out bank loans

Now, when average rates on consumer loans range from 12 to 18%, individuals have less motivation to initiate their ruin - it is much easier and more profitable to restructure debts, says Narek Avakyan, head of the investment department at BCS Broker. According to him, bankruptcy is a last resort. After such a procedure, the chances of taking out even a small loan in the future, not to mention a mortgage, are significantly reduced, the expert emphasized.

The Law on Bankruptcy of Individuals was aimed at helping those who really found themselves in a difficult situation and are no longer able to cope with their debt load, explained Elman Mehdiyev, president of SRO NAPKA. However, according to him, the question is increasingly being raised that this is an unaffordable procedure for real bankrupts, since it is paid. In particular, the costs consist of several components: state duty (6 thousand rubles), remuneration to the financial manager (at least 10 thousand rubles), payment for the services of companies that provide assistance in filing bankruptcy for an individual.

As a result, the minimum cost of recognizing insolvency reaches 30–40 thousand rubles, said Vladimir Rozhankovsky, an expert at the International Financial Center. According to him, in practice the amount usually exceeds 150–200 thousand rubles. Moreover, this procedure is free abroad, and the debtor is required to attend financial literacy courses in order to avoid repeated bankruptcy.

Russians will be allowed to go bankrupt without trial and new expenses

MOSCOW, August 24 - PRIME, Natalya Karnova. Writing off debts in the amount of up to 500 thousand rubles out of court will increase the total number of bankrupts, but is unlikely to affect the banking system, since we are talking about a long-standing overdue debt, according to experts interviewed by Prime. In their opinion, those who literally have nothing but debts behind their souls will be able to take advantage of the innovation. But for such people it can be a chance to start life from scratch.

From September 1, an extrajudicial bankruptcy procedure will be introduced in Russia - debts from 50 to 500 thousand rubles can be written off without trial through a multifunctional center. We are talking about the amount excluding penalties, penalties and fines, but the interest for using the loan is included in the principal amount. Before this, it was possible to become bankrupt only in court, with a debt of over 500 thousand rubles, and the procedure itself cost about 100 thousand rubles.

According to the chief economist of Expert RA, Anton Tabakh, the procedure is aimed at clearing away old rubble, aggravated by the pandemic. The requirements have been tightened for a long time by both banks and regulators, credit history bureaus provide this data - so they will write off mainly what has already been written off and given to bailiffs and collectors, he explained.

Thus, a significant impact on the banking system and the current process of lending to citizens is not expected. However, the increase in bankruptcies could be significant.

Potentially, the requirements of the law could affect up to 2 million people.

“However, some of them have greater obligations or do not fall under the new regime (there are assets subject to seizure). For the first two years, we can estimate the demand for the new procedure at 500-600 thousand people, against the backdrop of 150 thousand bankruptcies in the first five years of ordinary bankruptcies, this is a lot,” Tabakh noted.

HOW TO USE

In order to use this procedure, the debtor must submit documents to the MFC stating that the enforcement proceedings against him have been completed and there are no assets to be seized to pay the debt. He will have to indicate all creditors known to him. One day is allotted for consideration, and within three working days the MFC must post information in the Unified Federal Register of Bankruptcy Information.

From the moment of inclusion in the register, a moratorium is introduced on satisfying the claims of creditors specified in the debtor’s application, as well as on the payment of mandatory payments, with a number of exceptions. At the same time, penalties and other financial sanctions for non-payment of debt cease to be accrued. The bankruptcy procedure is allotted 6 months, if after this no new claims arise, the person is declared bankrupt, and his debts are written off as hopeless.

The innovation will allow you to write off loans taken by the debtor from banks or microfinance organizations. However, there are debts that cannot be written off under any circumstances. These are claims of creditors for current payments, for compensation for harm caused to life or health, for payment of wages and severance pay, for compensation for moral damage, for the collection of alimony, as well as other claims inextricably linked with the personality of the creditor, the lawyer told Prime, partner of spacecraft No. 5 Vyacheslav Golenev.

“The debt for compensation for damage to property caused by a citizen intentionally or through gross negligence, the debt for subsidiary liability for a controlled company, losses caused to a controlled legal entity and a number of others cannot be written off,” he added.

LOSS OF RIGHTS

During the entire extrajudicial bankruptcy procedure, which is allotted six months, a citizen is prohibited from taking loans, credits, issuing guarantees, or making other security transactions.

After its completion, he is affected by a number of rights. Thus, a bankrupt does not have the right to hold positions in the management bodies of a legal entity, or otherwise participate in the management of a legal entity - that is, in fact, he will not be able to conduct business through a legal entity for three years, Golenev said.

For ten years from the date of completion of the procedure for the sale of property in relation to a citizen or the termination of bankruptcy proceedings during such a procedure, he has no right to hold positions in the management bodies of a credit organization or otherwise participate in management.

According to experts, this innovation is not beneficial for everyone.

“Citizens should not declare themselves bankrupt if they have made transactions in the last three years, since these transactions can be appealed,” advises Maria Spiridonova, a member of the Russian Lawyers Association.

It is also unlikely that it will be possible to go through the procedure under the new rules in cases where there is jointly acquired property, the property is pledged, there are guarantors, or there is a share in an LLC. Essentially, it assumes that the debtor has nothing but the debt itself.

Most likely, this opportunity will be used by citizens who have debt for housing and communal services and borrowers from microfinance organizations and banks, the expert believes. These people are more likely to meet the above conditions.

According to Vladimir Shalaev, senior lawyer at BMS Law Firm, innovation can be a good help for those who want to start “life from scratch.” “I believe that many may be stopped from official employment by the need to give half of their salary to the creditor through the bailiffs. Writing off debts in such a situation can help a debtor who finds himself in such difficult living conditions,” he explained.