Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 02.09.2019

Reading time: 6 min

0

306

Federal legislation, in accordance with the norms of which the procedure for recognizing a legal entity as financially insolvent is carried out, states that any person can join an already ongoing bankruptcy case if there are prerequisites for such entry. However, in order for entry into such a case to be legal, it is necessary to contact the bodies of the arbitration court that are handling the specific case, where a special application should be submitted.

- The concept of an application to join a bankruptcy case

- Conditions required for entering into bankruptcy proceedings and filing an application

- Rules for drawing up an application Required documents

- Where and how to serve

Where to submit

The first step is to understand to which body the application of the established form is being submitted. Today, the document being studied is being considered in court. There are several of them in Russia. Which one should I contact?

An application to join a bankruptcy case is considered exclusively in an arbitration court. It is filed after a claim for bankruptcy has been filed by one person or another, but it has not yet been recognized as valid. In other words, when the case is already being considered.

By the way, you need to apply to the arbitration court at the place of registration of the organization or at the registration of the individual. Other judicial authorities do not work with the document being studied.

The amount of state duty assigned in case of bankruptcy of individuals

Making a decision on bankruptcy is considered the work of the arbitration court (AC). Citizens themselves, creditors, and various authorized bodies have the right to submit an application to this body. Applications from the AS are accepted in situations where claims from creditors exceed 500 thousand rubles. Compliance with the 3-month payment delay requirement is considered mandatory. (this is the minimum period).

An individual submitting an application to the bankruptcy court is required to pay a state fee. The amount of the state duty assigned to an individual for bankruptcy varies depending on the fact who sends the application to the CA:

- The state fee for bankruptcy of individuals, when the application is sent by personally bankrupt people, is represented by 300 rubles.

- The state duty for individuals in case of bankruptcy, when the application is sent to organizations, is 6,000 rubles. This is provided for in Art. 333.21 Tax Code of Russia.

- In case of bankruptcy of individuals, when the initiator of the process is the authorities (Federal Tax Service), the state duty is not paid at all. This is mentioned in Art. 333.35 Tax Code.

Submission conditions

It should be noted that an application to join a bankruptcy case, as already mentioned, is submitted if there is a claim to declare an organization or person bankrupt. Such paper can be submitted:

- creditors;

- debtors;

- subordinates of the potential bankrupt;

- authorized bodies of municipal or state power.

In this case, it is necessary to have grounds for declaring bankruptcy. Among them are the following points:

- presence of monetary obligations to creditors;

- the requirement is at least 500,000 rubles for individuals or 300,000 rubles for organizations;

- the debt is overdue for more than 3 months from the date when it should have been repaid;

- the existence of the debt has been proven and confirmed by a court decision.

There is nothing special about the process. This information is important for opening a bankruptcy case. What else do you need to know?

The order of repayment of current payments in bankruptcy proceedings state duty

quoted1 > > In accordance with paragraph 2 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2009 No. 63, the claims of creditors for payment of goods supplied, services rendered and work performed that arose after the initiation of bankruptcy proceedings are current. In other words, any claims for payment for goods, works and services supplied, performed and rendered after the initiation of bankruptcy proceedings are current.

Including, in pursuance of contracts concluded before the date of acceptance of the application for declaring the debtor bankrupt. Consequently, only monetary obligations and obligatory payments that arose after the initiation of bankruptcy proceedings are current.

In this connection, monetary obligations and obligatory payments that arose before the initiation of bankruptcy proceedings, regardless of the deadline for their execution, are not current in any procedure.

In which line of the register of creditors' claims for current payments by the debtor is the collected duty included?

Art.

134 of the Federal Law “On Insolvency (Bankruptcy)” establishes the order of satisfaction of creditors’ claims for current payments.

In the bankruptcy procedure, the debt was collected from the debtor outside the scope of the bankruptcy case and the bankruptcy trustee recognized the collected debt as current. A state fee is collected from the debtor. Question. In which line of the register of creditors' claims for current payments by the debtor is included the state duty collected from the debtor, which is current in the bankruptcy procedure?

The first or fifth stage includes the state duty in accordance with Art.

134 of the Bankruptcy Law? How to argue your position in business correspondence. November 26, 2020, 11:47, question No. 2178870 Oleg,

Saratov Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (2) 38 answers 10 reviews Chat Free assessment of your situation Lawyer, Saratov

About joining

An application for entry into a bankruptcy case of a citizen or legal entity, but before its legality is examined, filed after the main claim is considered an application for entry. These documents are considered by the judicial authorities no more than 15 days from the date of verification of the first claim.

Without a court decision recognizing the debt of a citizen, as a rule, it will not be possible to file an application to join a bankruptcy case. Every lender needs to remember this.

The courts examine all bankruptcy claims filed by a person or organization in the order in which they were accepted. If the very first statement was considered evidentiary, then all other documents are considered statements for inclusion in the register of creditors’ claims.

State duty for entering into bankruptcy

Contents Bankruptcy is understood as a procedure related to the restoration of the paying capacity of a legal entity or individual, as well as the reimbursement of debts to creditors.

In some situations, not every citizen can make the necessary contributions to formalize bankruptcy status. From January 1, 2020, changes were made to the legislation that affected the amount of state duty for individuals.

is paid, so the question often arises - what is the state duty in a bankruptcy case?

In accordance with the 2002 law, which regulates all issues related to the recognition of insolvency, the cost of bankruptcy services in law firms varies from 100 to 200 thousand rubles. It is important to point out that it consists of the need to pay for the services of everyone in the procedure. These include: Creditors – debts are repaid to them.

It is important that they can arise from a contract or from causing harm or liability.

Lawyers - payment for services, which include assistance in drawing up an application and submitting it, collecting documents and providing answers to questions, support in court and representing the interests of the debtor. Bankruptcy When applying for bankruptcy, you should take into account all the nuances. The rules are regulated in accordance with Article 223 of the Arbitration Procedure Code of the Russian Federation.

Federal Law No. 127-FZ controls the procedure and circumstances for applying measures to recognize bankruptcy. Where to file An application for bankruptcy is filed in court.

, , , , , , FREE CONSULTATIONS ARE AVAILABLE TO ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT MODE Dear readers! We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance. To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

The tribunal acts in a similar manner when the bankruptcy applicant refuses his own application and signs a settlement agreement between the applicant and the debtor.

Fundamentally! Having received information about the appeal and taking into account the events of the case, the tribunal may (but should not) stop the bankruptcy case even if there are other applications (para.

2 resolution of the plenum of the Supreme Arbitration Court of the Russian Federation dated June 22, 2012 No. 35).

About the content

Now a little about what exactly needs to be written in the paper being studied. What components will an application to join a bankruptcy case have? There is nothing difficult or special about it. Having memorized the elements of a claim, even a citizen without a legal education will be able to create one.

Typically, an application to join a case is not much different in content from the original bankruptcy claim. So, the document contains the following information:

- the name of the judicial authority in which the case is being heard;

- information about the debtor: full name (or name of organization), address;

- OGRN and TIN - for legal entities;

- information about the creditor;

- a description of the requirements against the debtor, indicating penalties and the exact amount of the debt;

- the basis for the occurrence of obligations (usually the contract number);

- court decision on the existence of a debt;

- evidence confirming the existence of debts of the citizen/company;

- list of papers attached to the claim;

- number of the person's bankruptcy case.

Remembering all this is easier than it seems. Below is a sample of the document being studied. What else do you need to know before submitting it?

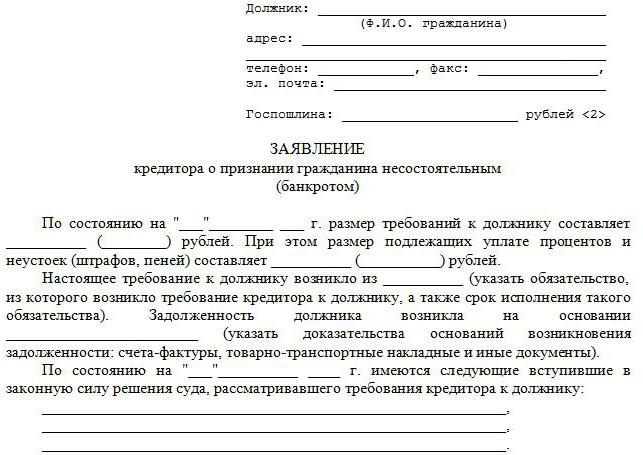

Bankruptcy application: sample

In order for the court to accept an application to declare a legal entity bankrupt, it is necessary that this document meets all legal requirements, in particular the provisions of Articles 41 of the Federal Law “On Insolvency (Bankruptcy)”. The content of the application depends on who initiated the filing of a bankruptcy application for a legal entity. Since the issue of recognizing the application as justified depends on the category of the applicant, the legislation contains requirements that must be taken into account in the application and which will help the court determine whether the applicant’s demands are legal and justified.

Applicant – bankruptcy creditor

According to these requirements, the bankruptcy application must contain (Article 40 of Law No. 127-FZ):

- Name of the court to which the application is filed;

- Debtor details: name, legal address, state registration number, TIN, contact information;

- Information about the applicant: name, address, contacts;

- The amount of debt indicating the amount of principal, interest, penalties;

- Information about the obligations from which the debt arose, accompanied by documentary evidence;

- Information about court decisions that have entered into force confirming the debt;

- Data on the candidacy of the arbitration manager, or SRO, from whose members he should be appointed.

The application is accompanied by copies of the documents specified in it, as well as other requests at the discretion of the applicant.

The law allows bankruptcy creditors to file a petition combining several debt claims against a debtor. In this case, copies of documents must be submitted for each specified requirement. The bankruptcy creditor who filed the application is obliged to send a copy of it to the debtor.

The applicant is a debtor

The debtor's application for bankruptcy assumes a slightly different content (Article 37, Law No. 127-FZ). The name of the court and the details of the debtor must also be indicated here, but other information, including about creditors, is not indicated in the “header” of the document. The application itself must contain:

- The amount of debt, indicating the grounds for its occurrence;

- The amount of debt related to the first and second stages of repayment: compensation for harm to life and health, arrears of wages, royalties;

- The amount of debt for mandatory payments;

- Documentary justification for the impossibility of fulfilling the demands of creditors, including in the future;

- Information about legal proceedings against the debtor, as well as enforcement proceedings initiated against him;

- Information about the property, as well as information about open current accounts, the availability of funds on them, as well as information about accounts receivable.

The debtor must attach to the application copies of all the documents mentioned in it, as well as copies of the constituent documentation, balance sheet, list of debtors and creditors indicating the amounts of debts.

Application papers

For example, a list of documents that must be attached by the lender. An application to join a bankruptcy case (after the introduction of supervision) that does not have certain attached papers will not be accepted by the judicial authorities. Therefore, it is necessary to be well prepared for the application process.

Each applicant must attach the following package of documents along with the claim:

- identification;

- the agreement that served as the basis for the debt;

- papers indicating that the citizen/organization has been informed about the debt;

- a court decision that has already entered into force;

- registration documents of applicants;

- receipts for payment of state duty;

- extracts from the Unified State Register or Unified State Register of Legal Entities (not older than 30 days);

- evidence indicating the existence of a debt.

As a rule, all listed papers are submitted not only in originals, but also with copies. An exception is an extract from the Unified State Register/Unified State Register of Legal Entities. It is given to the judicial authorities only in the original.

Decor

Some people are interested in how to properly format the paper they are studying. It's actually easier than it seems. Especially if the citizen has previously dealt with claims.

All generally accepted rules of business correspondence apply to an application to join a bankruptcy case. This also applies to design. To ensure that the document is drawn up as correctly as possible, you must adhere to the following tips:

- The header of the claim is drawn up in the upper right corner of the sheet. Information about the debtor, applicant, and court is written here.

- The name of the paper is usually printed on a new line, under the “header”, in the center of the page.

- The main part consists of a description of the essence of the applicants' claims.

- The list of attached documents is written in a separate numbered list after the main part.

- The application ends with the date of filing and the signature of the applicants.

The document does not have any other significant features. We can say that the rules for drawing up paper are exactly the same as for any other claim.

Sample

What does an application to join a bankruptcy case look like? A sample of this paper will be presented below. This is just a small template of the main part of the document, which is individual in each case. Therefore, it cannot be called exhaustive.

So, an application to join a bankruptcy case looks something like this:

“As of (date of appeal), the size of the claims was (amount of debt, taking into account sanctions). This claim arose against the debtor due to (agreement number). The court recognized that the citizen had debts (data about the debtor) to me. I ask you to declare him bankrupt. Evidence of debt is attached."