Shared construction is a “double-edged sword”! On the one hand, this is perhaps the only real opportunity for an average-income family to purchase housing without getting into credit bondage for entire decades. On the other hand, there is a real “minefield” in which thousands of people have irretrievably lost their savings, the hope of living in their own apartment and their faith in justice.

Meanwhile, it was justice that underlay the idea of shared construction.

Interesting fact

The concept, first applied in 1985 in Argentina, was called construcción de la equidad - construction with justice. It arose during the deepest crisis of the Argentine economy and turned out to be very effective - the percentage of homeowners in the country increased from 2 to 20 percent. And all thanks to the fact that citizens directly invested in construction companies, bypassing the banking system (which still refused to issue long-term loans in the national currency, which was extremely unstable at that time). The nominal values of the shares were expressed not in money, but in square meters of area. Having accumulated the required number of shares, a person had the right to exchange securities for housing.

This experience was then successfully used by neighboring Chile. And El Salvador gave the world the first “defrauded shareholders” - the company that launched shared-equity construction turned out to be a financial fraud, and left many families without money and housing. Then the construction scheme using direct investment funds attracted the attention of Great Britain and began to operate successfully in many countries around the world.

In Russia, it is customary to talk more about the dangers of shared construction. It seems that “shareholder” and “victim of deception” are synonymous.

In fact, the majority of Russian equity investors are happily waiting for the completion of construction and celebrating housewarming. And he even uses a shared investment scheme to generate passive income and purchase housing for a family without the burden of credit. I “built” a small apartment - rented it out or sold the finished one for a profit. If you have business acumen, in a few steps you can become the owner of a completely decent home without any mortgage.

But “normal” shared-equity construction occurs peacefully and unnoticed. Whereas every case of bankruptcy of a builder (or developer, as you prefer) causes a great public outcry. However, starting in 2011, when a special paragraph dedicated to developers appeared in Federal Law No. 127 on bankruptcy, the problem of “defrauded equity holders” rapidly declined. The “Salvadoran option,” when the developer does not try to build anything, but only collects money from small investors in order to escape with it, is currently impossible in Russia. Attempts at deliberate bankruptcy are monitored and strictly suppressed.

If the bankruptcy of the developer is “real”, associated with unfavorable market factors or management error, the law provides shareholders with certain guarantees for the protection of their interests. But provided that the share investors of the bankrupt developer do not “sleep”, but take the necessary actions in a timely manner, allowing them to count on legislative protection. This article will tell you what these measures are. So, how should a shareholder act in order not to become a “deceived shareholder”.

The legislative framework

Not many documents have been adopted in Russia regulating the bankruptcy of developers using equity investment. The main ones are:

Federal Law No. 214 - a law establishing the rules for shared construction (dated December 30, 2004)

Federal Law No. 127 – on bankruptcy. More precisely, its paragraph No. 7, which describes in detail the procedures for returning invested funds

Every potential shareholder, that is, a person who has decided to provide himself with housing by participating in shared construction, needs to study them. At least check it out. Legal documents are hardly easy reading, but anyone can understand their basic provisions. And if you need clarification, you can always seek a free consultation from a professional lawyer.

On the Prav.io portal, such services are provided free of charge.

Signs of imminent bankruptcy of a developer

The rescue of drowning people is the work of the drowning people themselves. And it's not a joke. If you become an equity investor, get ready for the fact that throughout the entire construction you will have to vigilantly “monitor” the progress of work. Especially if your developer's rating is not very high.

Not the highest rating in itself does not mean that you will definitely be deceived. It is possible that the construction company is simply not yet experienced enough and has not gained credibility. As a rule, this state of affairs is compensated by a more favorable price (you need to somehow attract investors).

A bet on a “newbie” can bring very high “dividends”. But it requires great care and constant attention. A decent developer cannot go bankrupt overnight. Problems “mature” gradually. So don’t be lazy, “keep your finger on the pulse.”

At the meeting of equity investors, you were probably told in detail about the stages and timing of construction. It is important that they are respected. If you, passing by a construction site, find there is a “lull” there, which according to the plan should not exist, it’s time to sound the alarm. If the finishing work should already be going according to plan, but the rear ones have not yet been roofed, this is a reason to start finding out in detail what is wrong with the developer.

The most alarming signs are the following:

- The company stopped answering calls, and when visiting in person, the office turns out to be closed in the middle of the working day

- Construction has been completed, but the developer is in no hurry to transfer finished apartments to shareholders

Urgently gather an initiative group of shareholders and file a collective complaint with the company’s management. Or immediately look for a lawyer to go to arbitration court. The sooner you “get the hang of it,” the higher the chances that, despite the bankruptcy of the developer, you will receive your property or money in full.

What should shareholders do in the event of bankruptcy of a construction company?

Informing shareholders that the construction company has been declared insolvent is the responsibility of the insolvency administrator. This specialist should send notifications to people by mail. In addition, information about the bankruptcy of the developer is published in the Kommersant newspaper. Another way to find out about the results of the consideration of the case is to go to the website of the arbitration court and enter the details of the construction organization (OGRN or TIN) in the “Case File” section.

Then the shareholder has to decide what he wants to receive: money or an apartment. To do this, the buyer must contact the court-appointed administrator with a request to include information about himself in the register of claims. You must declare your rights within three months : one month at the observation stage and two months at the bankruptcy stage.

If the shareholder decides to return the money, he will have to renounce the DDU, that is, claims to the property. In this case, the applicant’s data will be included in the “Register of Construction Participants’ Requirements”.

The amount of compensation is determined by an independent appraiser, whose services are paid from the developer’s funds. In a situation where the deadline for delivery of the object has already expired, you can additionally request a penalty. After the sale of the property to the construction company, the corresponding amount will be compensated to the shareholder (of course, in order of priority).

If the shareholder insists on receiving housing, his data is entered into the “Register of Requests for the Transfer of Premises.” Here are the possible options:

- In cases where the house is completed and put into operation, a person has every chance of receiving the apartment due to him under the contract.

- In a situation where the construction of an apartment building is not completed, shareholders have the right to organize a housing cooperative and complete the construction themselves or involve another contractor in the process. But since this is a rather complex and slow process, most buyers choose financial compensation.

It is difficult to say what is preferable for the equity holder: to demand a refund or to wait for housing. Each situation is individual and requires a comprehensive legal analysis

What is the deadline for submitting an application for inclusion in the register of creditors?

If it turns out that the bankruptcy procedure against your developer has already started, it’s okay. By law, you have 60 days to submit an application to the bankruptcy trustee to enter your claims into the register of creditors. This is how long the so-called bankruptcy proceedings are carried out against a bankrupt developer.

The bankruptcy trustee appointed by the arbitration court is obliged to:

- Publish a message about the bankruptcy of a legal entity in the Kommersant newspaper

- Enter data on the beginning of the bankruptcy procedure into the Unified Register of Bankruptcy (UEFRSB)

- Notify equity investors about the beginning of bankruptcy of the developer

Once this information is received, you need to take action.

How is the amount of a shareholder's claim determined?

When it comes to refunds, it is important to remember the following:

- When calculating compensation, the amount paid by the equity investor under the equity participation agreement (EPA) is taken into account. And also the damage suffered by the investor - the difference between the amount actually paid under the DDU and the cost of the finished apartment.

- For non-residential premises (car space, storage room outside the apartment, etc.) only the amount paid under the DDU is refunded.

A representative of equity investors has the right to participate in the meeting of creditors. The number of his votes is calculated based on the size of financial claims (amounts paid under the DDU, plus damage).

How to find out about the bankruptcy of a developer

Can the bankruptcy of a company engaged in the construction of individual cottages be regulated by the norms of paragraph 7 of Chapter.

Disputes with shareholders regarding the recognition of the right to apartments in a decent or unfinished building are now referred to the exclusive jurisdiction of arbitration courts and will be considered in the direct bankruptcy process of the developer. Judicial proceedings can be carried out not only at the location of the developer, but also at the place of construction and at the location of the majority of shareholders.

If there is full or partial payment, the participant’s claim is subject to inclusion in the register of claims for the transfer of residential premises.

Cases on recognition of the ownership rights of shareholders to a real estate property are subject to consideration within a period of up to 3 months.

All construction participants whose claims are included in the register of creditors’ claims and the register of claims for the transfer of residential premises have the right to be members of these organizations (with the exception of construction participants who refused to transfer an unfinished construction project).

This law, with the changes it introduced to the sphere of relations for the creation of housing in the form of shared participation in construction , changed the relations between the participants in the share participation in the obligatory plane, expanded the circle of entities recognized as the “Developer”, and to a certain extent decided the fate of long-term construction projects. Now, any company that attracts funds from shareholders is recognized as a developer, even if the activities of this company were not legal:

- the developer did not have legal rights to the land plot used for development;

- the realization of the rights of shareholders to the object being created was formalized not by an agreement on shared participation in construction, but by any other agreement (preliminary, investment, joint activity, etc.;

In this case, both categories of initiators have only a monetary interest, so they do not always have a need to start a lawsuit.

Conclusion: as can be seen from the above data, the concept of a developer according to Law No. 127-FZ is interpreted more broadly, this is due to the need to ensure the rights of citizens.

Claim form for bankruptcy of a developer

According to Article No. 201.1 of Federal Law No. 127, an equity investor in the event of bankruptcy of a developer has the right to enter into the register of claims a refund or transfer of a finished apartment or non-residential premises (if the DDU was concluded for non-residential premises in a building under construction).

The form of these statements is similar. But each has its own characteristics, determined by the content of the requirement. You can draw up an application yourself, using the help of a professional lawyer, for example, on the Prav.io portal.

The corresponding statement should be written in triplicate and personally handed over to the financial manager. The manager returns one of the copies to the applicant with a note of acceptance.

What is developer bankruptcy?

Bankruptcy of a legal entity means the official recognition by the arbitration court of the fact that the company is unable to fulfill its obligations. The procedure for repaying creditors' claims in bankruptcy cases is established in the arbitration court. The court is located at the official registration address of the company.

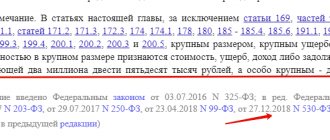

The bankruptcy procedure for developers, as well as other legal entities, is regulated by the provisions of 127-FZ. The bankruptcy of developers is addressed in paragraph 7 of Chapter 9 of Federal Law-127. These provisions appeared in Federal Law-127 in 2011 through the adoption of Federal Law 210-FZ. These amendments are often called the law on the bankruptcy of a developer during shared-equity construction, although in fact a separate legal act on this issue has not been adopted.

In order for the provisions of paragraph 7 to begin to apply in bankruptcy, the arbitration court must recognize that the bankruptcy case of a developer, and not an ordinary legal entity, is being considered . If such a decision was not made by the court, then interested parties file a petition with the court to recognize the debtor as a developer. The petition can be filed by participants in the bankruptcy case: in this case, these can be shareholders whose claims were included in the register.

Typically, equity holders are directly interested in declaring the debtor-developer bankrupt, since the application of paragraph 7 of Chapter 9 of Federal Law No. 127 provides them with a number of privileges. In particular, a special part of the register of creditors’ claims will be formed – a register of claims for the transfer of residential premises.

In this case, the claims of shareholders will be repaid as part of the third priority, and other creditors - later. Also, shareholders have the right to recognize agreements disguised as purchase and sale agreements as purchase and sale agreements.

Provisions on bankruptcy of a developer are characterized by a special composition of participants. This is a developer and participant in shared construction. These terms have a slightly different meaning in 127-FZ from the Law “On Shared Construction ...” of 2004 No. 214-FZ.

Before deciding on the procedure for the bankruptcy of a developer in the process of shared construction, it is necessary to understand the difference in terminology. According to 127-FZ, a developer is understood to be a legal entity, regardless of its form of ownership, as well as an individual entrepreneur (according to 214-FZ, this must be a business company or non-profit organization). Such a company is engaged in raising funds or other property of construction participants. According to Federal Law 214, such a company must have at least three years of experience in construction in multi-unit residential buildings.

In 127-FZ, when classifying a company as a developer, it does not matter what its rights to the land plot being developed are. Whereas, according to 214-FZ, a mandatory requirement for the developer is that he has ownership rights to the site being built.

To declare a developer bankrupt, monetary claims or demands for the provision of residential premises must be presented to him.

Thus, according to the requirements of 127-FZ, the concept of a developer is interpreted more broadly. The arbitration court adheres to a similar broad interpretation.

According to the definition of the Supreme Court of 2020 No. 305-ES18-5428 in case No. A40-180791/2016, the provisions of Federal Law-127 allow a person who is the copyright holder of the construction project to be recognized as a developer (even if it is not directly involved in raising funds), regardless of the fact the presence or absence of residential premises for transfer in kind. The Supreme Court also indicated that even an individual without individual entrepreneur status can be recognized as a developer if he raised funds for the construction of an apartment building (that is, you can make demands to the individual with whom the agreement on the transfer of an apartment in the building under construction was signed).

Does a shareholder have advantages over other creditors in bankruptcy?

Yes, the law recognizes equity investors as priority creditors. Firstly, they have the right to choose how their losses from the bankruptcy of the developer will be compensated - cash or a finished product (apartment). Secondly, they will first pay off with them, and then with the rest of the creditors.

Shareholders will receive back the money they spent on paying for childcare. As for the losses incurred (the difference between what the shareholder paid and the price of the finished apartment), they will be compensated if the size of the bankruptcy estate allows it. That is, bankrupt funds.

Who is last? I'm behind you: queues of creditors during bankruptcy of a developer

Note to equity investors. “First among creditors” does not mean “First on the list.” There are categories that have an advantage over shareholders.

In total, there are four queues of applicants for payments from the bankrupt’s funds:

- Citizens who were physically harmed due to the actions of the bankrupt. That is, those whose health was damaged

- Employees of a bankrupt enterprise (if the bankrupt owes them wages)

- Equity Investors

- Other creditors who lent money to the bankrupt, performed contract work for him, and supplied materials

That is, while not being the very first in line, equity holders are still the first among lenders.

The number of shareholders may also include citizens who purchased housing from a bankrupt developer not under the DDU, but under a preliminary purchase and sale agreement. To do this, they should submit to the arbitration court a request to recognize the preliminary sale agreement as a DDU. According to judicial practice, such requirements are always satisfied. After this, the citizen who has entered into a preliminary purchase and sale agreement is equal in rights with other equity investors and receives the right to demand the same as them.

Bankruptcy of a developer: what should a shareholder do?

Therefore, when people invest in the purchase of real estate under construction, they must understand in advance what actions they will need to take in the event of unforeseen situations and bankruptcy of the developer.

Federal Law No. 391-FZ of December 29, 2015 “On Amendments to Certain Legislative Acts of the Russian Federation” introduces a number of changes to the regulation of bankruptcy procedures.

A contractor can go bankrupt objectively or fictitiously. If fictitious insolvency is discovered, the head of the unscrupulous developer faces criminal prosecution.

In general, these changes are aimed at resolving the problems of unfinished construction, one of which is the settlement of claims of participants in shared construction if the developer has an apartment building, the construction of which is not completed.

This article will help you understand what happens to a shareholder when a developer goes bankrupt, what court practice says, and what rights a client of such a company has. Let's figure out what actions you should take immediately after you learn about the bankruptcy of the company.

Not to mention the collection of penalties, fines, compensation for losses and moral damage. It will be good if you can return at least half.

The Founder's wife urgently enters into inheritance in order to sell the residential complex plot. They promised everyone that January 15th. 2020 a new developer will begin construction. Rave! He will sell it for a cardon to bask in the sun! Tell me, based on your knowledge, where should I now go as a “single” housing company to sue the founders (police, prosecutor’s office) for payment of the money contributed? Or ask for the Founder and seizure of his property? Thank you.

The plot of land is currently sold to another developer (they built a complex of high-rise buildings nearby) and this developer resold it to a garage LLC. They were going to build a parking lot there. If I am a member of the housing cooperative, does it mean that when selling a plot of land, my signature must be on the written document?

But not everything is as rosy as it might seem at first glance. No one guarantees that these requirements will be met in full and within the expected time frame. Deceived shareholders should keep in mind the following circumstances.

If the house has not been built, then there is no point in making a demand to transfer the premises - although no one can limit you in this right.

However, you have to pay for the savings with risks, which are perhaps the most significant risks of civil transactions involving individuals today.

Secondly, even shareholders who entered into a shared construction agreement found themselves in a difficult situation if the developer, who did not fulfill his obligations, turned out to be bankrupt. The fact is that until recently, only a monetary claim could be made against a bankrupt. The house has not been put into operation, the deed has not been signed. What actions are expected of us as a shareholder under Article 201.4 of the Federal Law on Bankruptcy? We bought an apartment under a preliminary purchase and sale agreement, all terms have expired. There are a lot of decisions on recognition of property rights in the Odintsovo court of our neighbors, but we didn’t have time (What to do now? Submit an application to the AC or arbitrator to the manager and which one?

Consideration of claims regarding real estate in a bankruptcy case of a developer Article 201.8-1. Peculiarities of invalidating developer transactions Article 201.8-2. Special bank account for financing the construction of an unfinished construction project Article 201.9.

V., the explanations of the representatives of the persons participating in the separate dispute, the judicial panel established: by the decision of the Moscow Arbitration Court dated October 21, 2016, a procedure for the sale of a citizen’s property was introduced in relation to Vadim Ivanovich Palamarchuk (hereinafter also referred to as the debtor).

What requirements must be declared in case of bankruptcy of a developer?

Let's take a closer look at what demands an equity investor can present to a bankrupt developer. We have already listed them:

- Return the money invested in construction, plus a penalty and the amount of damage

- Transfer ownership of an unfinished building (each share investor receives the right to a share corresponding to his monetary contribution)

- Recognize the shareholder's ownership of the finished apartment (this point is regulated by Article No. 201.8 of Federal Law No. 127)

Thus, there are three possible demands, and two possible registers: for monetary compensation and compensation in property. The shareholder has the right to include his claim in both registers, or to be satisfied with one. The method of action depends on what exactly you have chosen.

If you choose compensation in the form of completed or unfinished housing, you should know:

To receive an apartment built by a bankrupt at your disposal, it is necessary that the court conducting the bankruptcy case of the developer recognizes your ownership of it. Then the apartment is registered in Rosreestr

Only after this will your home be removed from the bankruptcy estate and will not be sold at auction

Demanding recognition of ownership of an unfinished building makes sense if an initiative group of shareholders knows what to do with it next. There are two options: create a cooperative and complete the house yourself, or sell the “unfinished” house yourself. It is clear that both options are not feasible for every association of shareholders. They require a professional approach.

If you just want to get your money back, you need to consider the following:

- A bankrupt person has no “real” money - that’s why he’s bankrupt

- If there are still some funds in the developer’s accounts, they will barely be enough to pay the first two phases

But in 2020 the money will still be returned - through insurance or from a special shared construction fund. These funds were created thanks to the new edition of Federal Law No. 214. It also stipulates the obligation of developers to insure the investment deposits of shareholders.

That is, the amount that was invested when concluding the DDU will be returned. As for losses, it depends on your luck.

Rights of shareholders in the event of bankruptcy of a developer

What to do if a construction company is bankrupt? First of all, do not panic: the Law “On the Bankruptcy of Developers in Shared Construction” gives individuals many opportunities to defend their rights. And having studied some of the features, you can figure out in which cases what outcome to count on.

1. Presentation of monetary demands. It makes sense when construction has not actually begun yet. The shareholder can recover not only the amount under the contract, a penalty from the bankrupt developer, but also the actual losses incurred.

Important!

In 2020, a compensation fund was established, which should protect the rights of shareholders in the event of bankruptcy of the developer. According to legislators, deceived citizens will be able to return their money invested in construction if the construction company is declared insolvent. However, there is no clear mechanism for the fund’s work yet, so we can’t count on it in the near future.

2. Presentation of claims of a property nature. Applies if the house is actually built. Possible options:

Providing square meters in a high-rise building.

Implementation is likely if:

- the high-rise building was put into operation;

- there are no transfer papers for the apartment;

- the remaining assets are sufficient to repay debts to priority creditors;

- the desired apartment can be identified in a high-rise building;

- the price of the apartment does not exceed by more than 5% the price of all stated claims, or two quarters of the final creditors do not object to the transfer, or the required amount is transferred to the deposit of the justice authority.

Recognition of the right to square meters. Implementation is possible if:

- the unfinished project was transferred to operation;

- the transfer papers are available and signed before the papers are presented to arbitration.

What to do if the developer is declared bankrupt, but citizens still want to live in a problematic high-rise building? There are two options provided for in paragraph 7 of the Law “On the bankruptcy of a developer during shared-equity construction”:

- Completion of the house by another contracted construction company. To do this, you need a positive conclusion about the possibility of development, the desire of the company itself and a court order. The construction will be financed from the compensation fund.

- Transfer of the high-rise building to equity holders for completion. To complete the work, individuals must organize a consumer cooperative, but there are also many conventions here. For example, the land under the house should be owned by the company, and subsequent creditors should not be against these measures.

So, what to do if a developer in shared-equity construction goes bankrupt? The algorithm is as follows:

- Preparation of papers. A bankruptcy petition for a developer is filed if insolvency proceedings have not yet been opened. If the process has already been initiated, the individual writes an application for inclusion in the register of creditors’ claims. Other documents must be attached to the developer’s bankruptcy application, for example, an agreement, receipts for payment under the contract, claims, etc.

- Submitting documents to arbitration hearing a bankruptcy case. Please note that claims can be submitted within 1 month if we are talking about supervision, and within 3 months if we are talking about bankruptcy proceedings.

- Supporting your bankruptcy petition in court.

- Obtaining a determination on inclusion in the register of creditors' claims, and, if necessary, appealing it to a higher authority.

- Present the act to the comp fund or guarantor to receive your finances.

Submit your application

The developer is bankrupt, what next?

Let's consider some difficult situations related to the peculiarities of bankruptcy of developers:

- The shareholder emerged victorious in court and received a writ of execution, but the money never arrived in the account.

If you have not yet contacted the FSSP, do so. To do this, contact the FSSP department at the location of the construction company with a judicial act and write a statement. If there is a claim for bankruptcy of the developer, but the bailiffs are not active, write a complaint addressed to the head of the FSSP division.

- The shareholder is going to sue the construction company, but finds out that bankruptcy proceedings have already been initiated against it.

The subject has no right to apply to other justice bodies other than the one that is considering the case. He must prepare an application for inclusion in the register of creditors' claims.

- The shareholder learns that bankruptcy proceedings have begun, but expects that the court will return the money to him (including a penalty from the bankrupt developer) or organize the completion of the house without his participation.

A very dangerous situation. The peculiarities of a developer’s bankruptcy are such that it will simply be impossible to present all claims not submitted in arbitration. As a result, the citizen will be left without square meters and without finances. In this case, a developer bankruptcy lawyer will provide invaluable assistance in the resolution process.

Mortgage in case of bankruptcy of the developer: comment from the lawyer of Legal Petersburg:

“Another difficult situation is a mortgage in case of insolvency of the developer. Problems with the construction of a multi-storey building do not concern the bank, and therefore it will require payment of monthly contributions. If insolvency has been officially recognized, then the shareholder can terminate the mortgage agreement if the developer goes bankrupt, which, however, will not save the citizen from having to pay off the entire mortgage debt.”

What does the status of “defrauded shareholder” give?

The phrase “deceived shareholder” was initially a self-name for groups of citizens protesting against the violation of their rights by developers - unscrupulous ones, or those who themselves became victims of harsh market relations. In this form, it moved into the legal space. At the moment, “defrauded shareholder” is the official name for an equity investor who has suffered as a result of the bankruptcy of a developer.

Local authorities maintain a “Register of defrauded shareholders.” It contains the names of equity investors who contributed money but did not receive housing. To receive government support, you must ensure that your personal data is included in this “Register”.

Officially recognized “Defrauded Shareholders” can receive significant government support. For example, if a bankrupt construction company is not liquidated, it may be given a government subsidy to complete construction. Or transfer the contract to another company that will successfully complete the construction.

Legal side of a bankruptcy case

The bankruptcy process lasts more than one month. Before the introduction of the latest amendments to the law, the procedure consisted of two stages - observation and bankruptcy management. During the observation, which lasted about six months, the financial manager understood the real economic situation of the potential bankrupt. He then presented the report to the court and creditors.

Based on the results of the report, bankruptcy proceedings began. The company was either declared bankrupt and liquidated, or a debt restructuring plan was drawn up for it, external management was introduced, and the developer continued to operate.

In 2020, bankruptcy proceedings are the only stage of the process. If the court decides that the developer is bankrupt, then by its decision it removes the company’s management from work and transfers the reins to the bankruptcy (arbitration) manager. The insolvency administrator immediately begins selling the bankrupt’s property and paying off his debts.

Stages of bankruptcy procedure

The procedure under the supervision of an arbitration court can last several years. It all starts with rehabilitation procedures:

- observation (the financial condition of the company is checked, the first meeting of creditors is convened - held within 6 months);

- external management (lasts 1.5 years, can be extended for another 6 months, the external manager becomes the head of the enterprise, a moratorium on debt payments is declared);

- financial recovery (can last up to 2 years, includes debt restructuring, restoration of payments to creditors).

If it was not possible to “reanimate” the organization, the stage of liquidation of the legal entity begins. This stage is called bankruptcy proceedings. The duration of the stage is 6 months, it is possible to extend it for another period of time.

During this time, the manager sells the property and pays off debts. In case of bankruptcy of developers, in practice, only supervision and bankruptcy proceedings are most often used. Control and distribution of the bankruptcy estate of a liquidated company is in the hands of a court-appointed receiver. Fair repayment of debts depends on his skill and impartiality.

The candidacy of the manager is proposed by the initiating creditor. If a candidate is not submitted to the arbitration court, the court independently selects a specialist for the position of manager. The list of applicants is submitted to the court by the self-governing organization of insolvency practitioners.

Photo: pixabay.com/mrganso

Register of creditors in a bankruptcy case

A similar register is compiled in the event of bankruptcy of all legal entities. But the developer is a special legal entity, since in addition to demands to repay debts in money, he may be required to transfer real estate in kind to equity investors.

Sometimes arbitration courts tend to ignore this specificity and begin bankruptcy according to the usual procedure, as for other legal entities. If construction is completed or nearly completed at this point, this approach is disadvantageous to equity investors.

To ensure the protection of their interests, they should file a petition with the court to consider the bankruptcy case in a special manner. Namely, in accordance with the regulations of the seventh paragraph of Federal Law No. 127. It is important to do this before the sale of the bankruptcy estate begins under the hammer.

Disputes during the creation of a register of construction participants

Disputes when creating a register most often arise if the financial manager does not want to include certain requirements of shareholders in the register. Either, if the list contains duplicate entries relating to the same apartment, or even fictitious equity investors.

To resolve disputes with the financial manager, you should contact a judge. The shareholder, in accordance with Article No. 201.4 (clause 8) of Federal Law No. 127, has the right to file a complaint with the court against the actions of the financial manager within 15 days after the reason for it arises. The court considers the petition within a month. If the judge’s decision does not suit the shareholder, he can appeal to a higher-level arbitration court.

The procedure for submitting demands by construction participants

In Art. 201.4 describes the specifics of presenting demands by construction participants. This article regulates the presentation of the following categories of claims:

- On the transfer of residential premises.

- On the transfer of non-residential premises and parking spaces.

- Monetary requirements of construction participants.

It says here that after the introduction of the stages of bankruptcy proceedings or external management, claims are transferred only within the framework of the bankruptcy process and according to the rules that are prescribed in 127-FZ.

Based on the provisions of Art. 201.4 127-FZ, the bankruptcy procedure for a developer can include only two stages: bankruptcy proceedings (if there is no chance of restoring solvency) or external management (if there is a chance of restoring the balance of payments). Whereas the standard process of declaring a legal entity insolvent may include the stages of monitoring, financial rehabilitation, external management and bankruptcy proceedings. Thus, the bankruptcy of the developer occurs in an accelerated, simplified manner and in most cases is reduced to the stage of bankruptcy proceedings. Based on the results of its passage ] is liquidated[/anchor].

In Art. 201.4 127-FZ also states that after the stage of bankruptcy proceedings is introduced in relation to the debtor, the validity of the executive documents is automatically terminated.

Provisions of paragraph 2 of Art. 201.4 127-FZ obliges the head of the developer company to transfer information about all construction participants to the bankruptcy trustee within 10 days after the arbitration court approves the candidacy of the manager. The manager, in turn, notifies the construction participants about the opening of bankruptcy proceedings and the possibility of the development participants presenting demands for the transfer of residential premises or monetary claims. In the notification, the manager indicates the procedure and deadlines for submitting claims and including them in the register. All costs of notifying creditors are passed on to the debtor.

In paragraph 3 of Art. 201.4 127-FZ indicates another feature of presenting claims during the bankruptcy process of a developer. In the standard case, before inclusion in the register, claims must be confirmed by the arbitration court. According to paragraph 7, the requirements are transferred to the bankruptcy trustee, who independently includes them in the register without the participation of the arbitration court.

Based on clause 4 of Art. 201.4 127-FZ, the register of creditors’ claims within the framework of bankruptcy proceedings is closed within 3 months. This period is counted from the date of opening of bankruptcy proceedings (in the standard bankruptcy procedure of a legal entity, the register of creditors' claims is closed within 2 months after the introduction of the bankruptcy proceedings). In this case, the demands of construction participants are included in the register if they were submitted no later than 2 months after receipt of the notification, regardless of the closing date of the register. But the deadlines are subject to restoration if there is a good reason.

Persons who participate in a bankruptcy case have the right to familiarize themselves with the register of claims of construction participants. Objections from construction participants are submitted within 15 days after the creditors' claims are closed.

According to changes in the legislation on shared construction, developers and shareholders now interact when using escrow accounts. In this regard, 127-FZ now provides for another group of possible demands of shareholders, in addition to monetary and property ones: construction participants can receive money from an escrow account under Art. 201.12-1, 201.12-2.

Challenging inclusion in the register of claims of other shareholders

Disputes can arise not only between shareholders and the financial manager, but also between the shareholders themselves. If they relate to claims already included in the register of creditors, first both parties to the dispute need to study the register. The arbitration manager is obliged to issue the register for review to any interested party, in accordance with the requirements of Article No. 201.2 of Federal Law No. 127.

After the register is received, the shareholder who intends to make a claim has 15 days to study it and file a claim.