Bank bankruptcy

The unstable economic situation forces Russians to look for ways to preserve their accumulated savings.

At the same time, many citizens question the reliability of banks and prefer to find other ways to solve this problem.

All that remains is to confirm that these fears are far from unfounded.

Recent bankruptcies of Moscow banks

In May 2012, the Moscow Arbitration Court registered a bankruptcy claim against AMT Bank CJSC, which was filed by the state deposit insurance agency.

It is worth noting that this credit institution was deprived of its license in 2011, and the management, led by Chairman of the Board Elena Messerle, challenged this decision in court, but did not achieve the desired results.

As of April 1, 2012, the bank's assets were estimated at 8.5 billion rubles, while debts amounted to 32 billion rubles.

At the end of May 2012, the Central Bank of the Russian Federation filed a claim for bankruptcy of MI-Bank CJSC, through which many students of Lomonosov and Sechenov universities paid for educational services.

In April, the bank's license was revoked, after which most students were required to re-deposit money under threat of expulsion. Chairman of the Board of Directors Gitas Anilionis filed an application to postpone the bankruptcy case.

But the court left his application without consideration. Currently, this credit institution is undergoing bankruptcy proceedings, which should end in May 2013. At the beginning of April, the value of the bank's assets was 550 million rubles.

, and the amount of debt is 13.4 billion rubles, including 112 million - unpaid obligations for educational payments.

In 2011, at the request of the Central Bank of the Russian Federation, bankruptcy was initiated, CJSC Ratibor-Bank and arbitration introduced bankruptcy proceedings against it.

The bank began making payments on customer accounts untimely, did not take measures to restore a normal financial situation and did not eliminate the reasons that served as the basis for revoking the license.

The value of assets was 158.5 thousand rubles, and the amount of liabilities was 544 thousand rubles.

Bank bankruptcy procedure and its features

According to the law, bank bankruptcy can be initiated only after the license is revoked.

When initiating a case for the forced liquidation of a legal entity, in this case, a closed joint-stock company, debts to clients and creditors confirmed by a court decision and debts on mandatory payments confirmed by a decision of the tax or customs authorities on collection from the debtor’s property are taken into account.

Signs of bank bankruptcy:

- mandatory payments are not paid within 14 days from the date established for their transfer;

- the value of assets does not cover the amount of liabilities;

- creditor claims amount to at least 1000 minimum wages and are not fulfilled within a month.

A feature of the bank bankruptcy procedure is that measures for financial recovery are prescribed not by the court, but by the Bank of Russia, subject to certain conditions:

- repeated violation of creditors' requirements and untimely transfer of obligatory payments within six months;

- violation of liquidity and equity adequacy standards;

- reducing the amount of equity below the amount of the authorized capital, etc.

After receiving the relevant request, the bank must develop a recovery plan and implement it within the prescribed period.

If a claim for bankruptcy of a credit organization is filed, arbitration may order bankruptcy proceedings or refuse to recognize insolvency.

Source: https://2201551.ru/articles/bankrotstvo-bankov/

Ways to avoid bankruptcy proceedings

In order to avoid the insolvency of a credit institution, you can use one of the methods, namely:

- begin the reorganization procedure;

- serious financial investments from the founders;

- changes in the organizational work plan;

- revision of the authorized capital and own financial resources;

- decision to use temporary administration.

As practice shows, using at least one of these methods will not only avoid bankruptcy proceedings, but also significantly increase the profit of a credit company due to an increase in clients and the turnover of its own assets.

An interesting fact: as practice shows, today there is a tendency to artificially bring a credit company into insolvency. About 60% of all applications to initiate bankruptcy turn out to be false and they are sentenced to an administrative fine or criminal proceedings, providing for a prison term of up to 7 years .

How and why banks go bankrupt

Insolvency, insolvency, bankruptcy - during a crisis, these words are used more and more often in financial analysts' reports. In the conditions of instability of the country's economy, not only a small trading company can become bankrupt, but bankrupt banks have begun to appear.

Taking into account the specifics of the activities of credit institutions, the procedure for recognizing insolvency occurs differently than for other companies.

What is bankruptcy

In the explanatory dictionary of the Russian language S.I.

Ozhegov’s concept of bankruptcy is characterized by an extreme degree of insolvency in which an organization is unable to pay debt obligations.

In economics, bankruptcy is a set of actions aimed at liquidating a commercial bank, accompanied by debt restructuring and the sale of bank property.

An important reason for bankruptcy in Russia is the reluctance of banks to carry out full-fledged analytical work. Future insolvency can be predicted 1.5-2 years before the organization’s price begins to decline under the influence of external and internal factors.

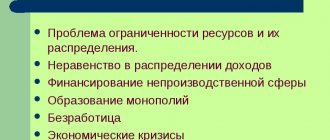

Only constant monitoring and analysis of the economic market can prevent financial insolvency, which is the economic filler of bankruptcy. The prerequisites for recognizing a financial collapse can be divided into two groups.

Reasons for declaring a bank bankrupt.

Internal factors that can lead to bank liquidation include:

- The emergence of overdue loans. A loan is considered overdue if the borrower cannot repay the resulting debt on time. Once a decision is made to write off a given loan, the bank no longer has the right to report it on the balance sheet.

- Decrease in the value of securities. If during the period from the date of acquisition of shares to the moment of sale their price has decreased significantly, bankruptcy is inevitable.

- Unprofitable activities of the bank. As a result of the lack of profit, the equity capital of a financial organization gradually decreases, the ratio of assets and liabilities increases in favor of the latter, and debt obligations increase. Lack of liquidity leads to bankruptcy of the organization.

External factors that can affect the deterioration of a bank’s solvency include:

- high level of inflation;

- low interest rate on bank deposits;

- decrease in income of the population of Russia;

- tax rates.

None of the reasons separately can serve as grounds for declaring a bank bankrupt. Insolvency is the result of improper activities of a credit institution over several years.

Signs of bank bankruptcy

There are a number of signs by which you can determine the insolvency of a bank. A credit institution will soon be declared bankrupt if:

- there has been a regular violation of creditor requirements over the past 6 months;

- contributions to the state budget and payment of mandatory payments are made late;

- decrease in own assets by 10% or more;

- gradual reduction of the authorized capital by more than 20%.

This video explains how a bank goes bankrupt:

Laws governing banking and bankruptcy procedures

The procedure for liquidation and recognition of bankruptcy of banks in our country is regulated by both general and highly specialized legislation.

The procedure for carrying out the bankruptcy procedure of a credit institution

According to the legislation of the Russian Federation, the applicant in the case of declaring a credit institution bankrupt may be:

- Debtor bank;

- A creditor of a financial institution whose debt exceeds five hundred minimum wages;

- Prosecutor.

Bank insolvency occurs after the expiration of a two-week period following the date of fulfillment of debt obligations.

An application established by the Central Bank of Russia can be submitted by both the bank itself and its creditor.

The country's main monetary institution has 30 days to review the application.

If, after the expiration of the specified period, the Central Bank has not responded, the applicant has the right to apply to the arbitration court in order to declare the insolvent institution bankrupt.

If the Central Bank independently revoked the bank’s rights to carry out financial transactions, it must file a bankruptcy petition for the credit institution with the court within 5 days.

Source: https://PravoZa.ru/polozheniya/yurlits/banki-bankroti.html

Consequences of bankruptcy of an organization

Advice from lawyers:

1. In the event of bankruptcy, the KPK sent an application to the Arbitration Court to be included in the register of creditors. The organization proposes to conclude an assignment agreement. If I subsequently decide to terminate this agreement, will I be returned to the register of creditors? And what will need to be done to be included back in the register of creditors?

1.1. Olga, if you conclude an assignment agreement, you will not be able to terminate it later at will, since the agreement is an agreement between two parties. Accordingly, you will also not be able to return to the register of creditors.

Did the answer help you?YesNo

1.2. Olga, hello. You can’t just go ahead and terminate a contract. Any contract implies the presence of conditions for termination, and if the other party fulfills its obligations, then it is almost impossible to terminate it. Therefore, you either yourself are on the register and try your luck to get your money, or you enter into an assignment and receive a smaller amount, but it is guaranteed.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. I acted as a guarantor for the deputy of a legal entity from a credit institution, and subsequently this legal entity fell into bankruptcy proceedings. Currently, this deputy under an assignment agreement was bought by another legal entity in order to enter the list of creditors, does this legal entity have the right to present any financial claims to me as a guarantor?

2.1. Yes, you have the right, you are a guarantor and bear joint liability.

Did the answer help you?YesNo

2.2. Certainly. You took upon yourself the guarantee.

Did the answer help you?YesNo

2.3. Yes, you have the right. But it's not that simple. If a new creditor makes claims against you, he may be removed from the register of creditor claims. Therefore, until the bankruptcy procedure of the legal entity is completed or it is understood that nothing can be squeezed out of the procedure, the new creditor will not contact you. He has other goals for now.

Did the answer help you?YesNo

2.4. Vladislav, of course, this legal entity has the right to make demands on you, but then you are the guarantor.

Did the answer help you?YesNo

3. The situation is as follows: Organization A owes money to Organization B, but Organization B is in bankruptcy, Organization A is delaying the return of receivables. What risks and consequences may arise for organization A, and is it even possible to transfer receivables from a bankrupt organization? This is an asset of the debtor and should it be distributed among creditors or not?

3.1. The meaning of the question is not very clear. Do you think that in such cases the provisions of Art. 309 of the Civil Code of the Russian Federation do not apply (should not apply)? Article 309. General provisions Obligations must be fulfilled

properly in

accordance with the terms of the obligation

and the requirements of the law, other legal acts, and in the absence of such conditions and requirements - in accordance with customs or other usually imposed requirements.

Did the answer help you?YesNo

4. Please help me with this question. A bankruptcy petition was filed against the OJSC (resource supply organization). The JSC owns the property. How to withdraw property belonging to an OJSC without consequences.

4.1. Good afternoon According to contracts, if you currently do not have a ban on the alienation of property.

Did the answer help you?YesNo

4.2. Those. You want to ask on this website in the public domain how to withdraw a bankrupt’s assets to the detriment of the interests of creditors, i.e. a serious offense that may be subject to the criminal code? What answer are you expecting? Arbitration manager Vitaly Snytko.

Did the answer help you?YesNo

5. Is this a gross violation and what consequences might there be? Our developer is going bankrupt (external management has been introduced) as an ordinary organization, and not as a developer. Although they have not met all the requirements for the transfer of housing. At the same time, he sells the property, the shareholders are not notified and do not participate in the bankruptcy. Is this a gross violation and what consequences might there be? For example, were all trades declared illegal due to an incorrect bankruptcy procedure or some other reason?

5.1. Hello! Submit your application.

Did the answer help you?YesNo

6. Our developer is going bankrupt (external management has been introduced) as an ordinary organization, and not as a developer. Although they have not met all the requirements for the transfer of housing. At the same time, he sells the property, the shareholders are not notified and do not participate in the bankruptcy. Is this a gross violation and what consequences might there be? For example, were all trades declared illegal due to an incorrect bankruptcy procedure or some other reason?

6.1. Hello! You need to look at the documents.

Did the answer help you?YesNo

6.2. It is impossible to answer this question from one message.

Did the answer help you?YesNo

6.3. This is called draining assets.

Did the answer help you?YesNo

6.4. Well, of course, it’s difficult to answer without documents, but as creditors you should at least register with the Manager.

Did the answer help you?YesNo

7. Please advise. Our developer is going bankrupt (external management has been introduced) as an ordinary organization, and not as a developer. Although they have not met all the requirements for the transfer of housing. At the same time, he sells the property, the shareholders are not notified and do not participate in the bankruptcy. Is this a gross violation and what consequences might there be? For example, were all trades declared illegal due to an incorrect bankruptcy procedure or some other reason?

7.1. At the same time, he sells the property, the shareholders are not notified and do not participate in the bankruptcy. Is this a gross violation and what consequences might there be? It will be liquidated and you will be left without apartments.

Did the answer help you?YesNo

8. I have this question: I have an organization (LLC) with a debt in the amount of (n 00-000-000) rubles, I won’t specify the amount.. there is no possibility of payment, not with property, no way.. can I file for bankruptcy in arbitration? And what could be the consequences? And in general, if there are other options, tell me the debt to Bank One.

8.1. Only through bankruptcy. The cost of the arbitration manager’s work will be 250 - 400 thousand rubles.

Did the answer help you?YesNo

9. Organization 1 took out a loan. Organization 2 acted as a guarantor (providing its property as collateral, thereby securing the loan). Subsequently, organization 2 files for bankruptcy. What consequences does this fact entail: - what will happen if organization 1 cannot pay the loan; - what will happen to the collateral securing the loan (if the organization soon ceases to exist)?

9.1. If they go bankrupt, the collateral property will pass to the new owner, but the collateral remains intact. If org. 1 will not be able to pay, they will sue her and foreclose on the mortgaged property.

Did the answer help you?YesNo

9.2. Absolutely wrong answer. Due to the possible loss of loan collateral, on the basis of the loan agreement and the guarantee agreement, organization 1 will be offered to provide other collateral or repay the loan. If you do not do this, the bank declares its claims in the bankruptcy case of organization 2 and sues organization 1, and so on according to the circumstances. If there is a need, please contact us.

Did the answer help you?YesNo

10. Is it right to get a job in an organization that is in the process of bankruptcy, with the expectation of staying there after restructuring, when it will be under a different name? What unpleasant consequences are possible?

10.1. You risk being left without a work book, as it can simply be lost.

Did the answer help you?YesNo

11. I have a question, my organization is at the stage of bankruptcy, a new enterprise has been created. Accordingly, employees of the old organization are transferred to the new organization by submitting a resignation letter. I am on maternity leave for up to 1.5 years. I will be transferred only on the condition that the position will be different, where the salary is less than the previous one! I categorically disagree with the new conditions! Are such actions legal? And what will be the consequences if I do not agree to the terms? Thank you in advance!

11.1. If you do not agree with the transfer, the administration will fire you due to the liquidation of the company.

Did the answer help you?YesNo

12. The organization began bankruptcy proceedings, but with large tax debts. What threatens the Chief Accountant in this situation, and what might be the consequences for the Chief Accountant? The chief accountant is not included in the Unified State Register of Legal Entities by organization.

12.1. Dear Ulyana! If the tax inspectorate imposes a penalty on a legal entity for late payment of taxes and other deductions, and the chief accountant is to blame for this, then in this case the employer will have the right to hold the chief accountant financially liable in the manner established by the Labor Code of the Republic of Kazakhstan. Also, the tax inspectorate has the right to initiate an administrative case against this legal entity and its head to bring to administrative responsibility for failure to comply with the provisions of the Tax Code of the Russian Federation. Good luck to you.

Did the answer help you?YesNo

13. Our Management Company is heading towards bankruptcy. A bankruptcy trustee has already been selected. Money received from residents is not transferred to the resource supply organization. In this case, can we not pay the receipts, and what could be the consequences of this?

13.1. Of course it's better not to pay. And immediately transfer directly to the service provider. Otherwise, everything will be stolen and then they will demand payment again.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. What are the consequences of the organization’s lack of property necessary to satisfy the claims of creditors? What confirms the validity and size of creditors’ claims when initiating bankruptcy proceedings?

14.1. 1. Declaring her bankrupt and opening bankruptcy proceedings. 2. A court decision on inclusion in the register of creditors.

Did the answer help you?YesNo

15. Please explain what negative consequences of bankruptcy of an organization await the employees of this organization? Can salary payment be delayed? How soon will they be fired? Thank you in advance.

15.1. Dear Sergey. Everything depends on the integrity of the head of the enterprise: during observation - on the current director; in case of external management and bankruptcy proceedings - from the arbitration manager. In accordance with Federal Law No. 127-FZ of October 26, 2002, when settling with creditors, debt payments to employees of the debtor enterprise are made in the so-called second priority (the first is disabled people), and current payments are made out of turn. Only after settlements with you, the arbitration manager has the right to settle with other creditors: banks, counterparties to transactions, etc. The liquidation of an enterprise and, accordingly, the dismissal of employees occurs during bankruptcy proceedings. The possible period of its conduct is from six months to two years from the date of initiation of the case in court. At the same time, the enterprise will operate and must pay wages. Often during bankruptcy there is a simple change of ownership and a change in the top management of the enterprise. It is not a fact that you will have to quit. Sincerely,

Did the answer help you?YesNo

Bank bankruptcy

Banks, according to current legislation, are classified as financial organizations. The bankruptcy procedure for banks is carried out according to the same scheme as the bankruptcy procedure for insurance companies and securities market participants. Bankruptcy may be recognized by an arbitration court.

A bank is considered bankrupt if the organization can no longer satisfy the demands of creditors. One of these requirements may be the payment of monthly bills. A bank that cannot fulfill its obligations after 14 days is declared insolvent.

Appointment of a temporary manager

The appointment of a temporary manager is a forced measure taken in order to avoid bankruptcy of a financial organization.

This unit is appointed the next day after the license is revoked by the Central Bank.

The decision to appoint a temporary administrator is made by the Arbitration Court, based on applications from creditors and consumers of services.

The tasks of the temporary manager include a set of resuscitation tasks, the main of which is identifying violations and errors in the work of the organization. Further actions to restore the institution's solvency and performance are coordinated by the Central Bank.

Bankruptcy of credit institutions

Unlike industrial and manufacturing enterprises, the bankruptcy of credit institutions is officially recognized in the following cases:

- The credit institution (credit institution) has not satisfactorily fulfilled its financial obligations to clients and creditors for a month;

- the total value of its assets, assessed after the revocation of the license, does not exceed the total volume of claims.

Creditors (who automatically become bank clients), the relevant authorized bodies, the prosecutor's office, the Central Bank and, of course, the financial institution itself can file an application with the court to declare a financial organization bankrupt. Unofficially, the bank is considered bankrupt immediately after the license is revoked.

How bank bankruptcy is regulated by law

Like any other organization or individual, a bank can be declared bankrupt only on the basis of a decision of the Arbitration Court.

But clients of credit institutions need to keep in mind that the Central Bank has the right to suspend or revoke a license for many reasons.

It’s also a good idea to know how bank bankruptcy is regulated by law, so as not to panic at the first warning sign.

It should be taken into account that the Central Bank can and is obliged to carry out a reorganization, appoint a temporary manager of the bank’s assets, and also carry out its reorganization.

These measures may well keep the bank afloat.

Source: https://www.Sravni.ru/enciklopediya/info/bankrotstvo-bankov/

“Prevention” of enterprise bankruptcy

This stage is also called the recovery or rehabilitation stage. The task of this period is to restore the solvency of the company. Management of the company at this stage is returned to the previous owners, but with some restrictions on powers. For example, management is prohibited from making decisions on transactions related to the disposal of authorized capital.

The Civil Code has its own characteristics of the concept of insolvency and the legal regulation of bankruptcy. A sign of a citizen’s insolvency is the presence of unfulfilled obligations in the amount of at least 500 thousand rubles, while to initiate bankruptcy proceedings for a legal entity, a debt of 300 thousand rubles is sufficient. An analogue of the reorganization stage for citizens can be called debt restructuring, which implies changing the terms of the debt obligation and debt repayment with the consent of the creditor.

Restoring the solvency and financial health of companies is a complex and lengthy process. Sometimes the reorganization of companies lasts several months, but its maximum duration can reach two years. The concept and signs of insolvency (bankruptcy) of legal entities remain fundamentally important at this stage. If, upon completion, the lender’s requirements remain unsatisfied, a repeat meeting of creditors is held. After the rehabilitation stage, a claim may be filed against the debtor in an arbitration court in order to hold him accountable and take additional measures of legal coercion.

Bankruptcy banks: what is the procedure, its features and consequences

Bankruptcy of credit institutions in Russia is a fairly common procedure nowadays, since not all banks can cope with the loss of assets, strong competition and a difficult economic situation.

Financial companies can be declared insolvent for many reasons, but the main ones are:

- systemic lack of payments to creditors;

- violation of laws adopted by the Central Bank;

- failure to fulfill obligations to clients (late payments for more than 10 days).

The list of bankrupt banks is growing every day, mainly made up of new organizations, since they are more difficult to tolerate the loss of assets and a decrease in the overall budget.

Example: if the debtor does not pay Sberbank 100,000 rubles on a loan, this will not affect the company in any way. But for an organization that has been opened recently, the loss of this amount will have a serious impact. If a bank has a small budget, then the loss of assets can lead to bankruptcy.

Bank bankruptcy procedure

The bankruptcy procedure begins with the credit institution filing an application with the arbitration court. The following persons can do this:

- investors or creditors to whom the company owes money;

- authorized persons (employees of the prosecutor's office and tax service);

- Central Bank of the Russian Federation;

- debtor.

It is worth noting that credit institutions are checked regularly, especially in the event of debts and complaints from clients. Because of this, banks whose financial situation is unstable necessarily come to the attention of the tax or prosecutor’s office.

After this, a case is initiated during which the bank’s insolvency is proven or disproved. During this process, an arbitration manager is appointed, his responsibilities include managing the organization and finding the main problems that prevent the work from stabilizing.

Source: https://dolg.guru/bankrotstvo/bank-bankrot.html

What should a depositor do?

What should a depositor do if the bank becomes bankrupt? In such a situation, many people think about how not to lose their savings.

Payments

If a person has a deposit in a bank that has become bankrupt, then he can get the money back in full or in part, depending on how much was stored there.

Currently, the maximum amount of insurance payments on bank deposits is one million four hundred thousand rubles.

After the occurrence of an insured event, that is, the revocation of a bank’s license or the imposition of a moratorium by the Central Bank on payments to the bank’s creditors, a client of a bankrupt bank can contact another bank, which the Deposit Insurance Agency declares authorized.

The citizen must write an application for the return of the deposit, after which the money will be returned to him within three days.

However, in this case there is a limitation - the transfer is carried out after fourteen days from the date of the insured event.

If a person had several deposits in one bank or its branches, then the payment amount will remain unchanged - a maximum of 1,400 thousand rubles.

If clients have amounts remaining that have not been repaid by the Deposit Insurance Agency, they can demand their return when selling the bank's property.

However, in this case it is worth considering that money is issued on a first-come, first-served basis, so there may not be enough for all investors.

When obtaining deposit insurance, you must also take into account the timing of the application.

This can be done from the moment the insured event occurs until the day when the liquidation of the bank is completed.

After the closure of the credit institution, only those clients who were unable to write an application during the specified period for a good reason (business trip, illness, stay abroad, etc.) will be able to receive their funds.

The stages of bankruptcy of a legal entity are defined by Federal Law No. 127. How is the simplified procedure carried out in a bankruptcy case? See here.

How much does bankruptcy cost an individual? Read in this article.

Signs of bank bankruptcy

Bank bankruptcy is a common occurrence during an economic crisis.

In the Russian Federation, in recent years, the Central Bank (CB) has revoked the licenses of more than a dozen different commercial banks.

Law

Bank bankruptcy in the Russian Federation is carried out on the basis of the Law “On Insolvency (Bankruptcy)” No. 127 of 2002.

This legal act specifies all the main points regarding this procedure, such as reasons, deadlines, preventive measures, etc.

Forecasting

Since the economic situation in the modern Russian Federation is not the most favorable, the problem of predicting the bankruptcy of credit institutions is very acute.

It is relevant both for the country’s leadership, who need to keep the banking system afloat in difficult times, and for the ordinary population, who leave their savings in bank deposits.

Recognizing the signs of bankruptcy in advance is an important task that is currently not always possible to cope with.

Probability Estimation

Due to the instability of the economic situation in the country and the high risks of bankruptcy in the banking sector, scientists began to actively use various economic methods and models to assess the likelihood of insolvency of individual commercial banks.

Bank bankruptcy

During difficult economic situations, problems always arise in the banking sector.

They may be expressed in a temporary deterioration in the positions of some banks, and in some cases, their bankruptcy.

Signs

Signs of bankruptcy of credit institutions are (in accordance with Article 3 of Federal Law No. 127):

- reduction of equity capital is less than the level of authorized capital;

- violation of current reporting standards by more than ten percent;

- failure to satisfy creditor claims within several months;

- a decrease in equity capital by more than twenty percent compared to the maximum value achieved during the last year;

- violation of Bank of Russia regulations regarding bank capital adequacy.

Causes

The reasons for the bankruptcy of credit institutions are varied.

They can be divided into several main groups:

- Financial difficulties. These may include massive non-repayment of loans taken by the population and legal entities, as well as the active withdrawal of money from deposits. All these factors can lead to a decrease in the bank's equity capital.

- Ineffective management that cannot properly solve emerging problems is another problem that can push a credit institution to bankruptcy.

- Fierce competition in the banking industry leads to a constant struggle for clients and their money. In this case, the bank is forced to pursue a more risky policy, which may lead to insolvency during an economic crisis.

- Dishonest acquisition of property is another component of the complex of reasons for the bankruptcy of credit institutions.

Each reason individually can make the bank insolvent in fulfilling its loan obligations, but in this case the situation can be corrected.

But during a period of economic turmoil in the country, correcting even one point requires the government to “inject” huge sums of money into the banking sector to maintain it in a stable condition.

Deadlines

The bankruptcy procedure can last one year, during which bankruptcy proceedings must be carried out and the main credit obligations of the credit institution must be repaid.

Pre-trial stages are also limited in time and in their totality can last for several years.

Procedure

The bank bankruptcy procedure is carried out in several stages.

https://www.youtube.com/watch?v=KVDqnENNF6E

Initially, pre-trial procedures are carried out to improve the financial system of the credit organization.

As part of this stage, the following is carried out:

- appointment of a temporary manager;

- rehabilitation;

- bank reorganization.

If these measures do not bring the desired result, then the case is referred to the court, which orders bankruptcy proceedings.

The last stage can last up to one year.

Peculiarities

A feature of the bankruptcy of credit institutions is the revocation of a license to provide services or the introduction of a moratorium on payments to creditors.

Both of these measures initiate bankruptcy proceedings and are carried out by the Central Bank of the Russian Federation.

In addition, a feature of the bankruptcy of credit institutions is that the stages of supervision, settlement agreement, external management and financial recovery that are common in other cases are not applied to them.

Source: https://nam-pokursu.ru/bankrotstvo-banka/

Bank bankruptcy payments to depositors 2020

Today, even small children know that the best way to increase their capital is a bank deposit.

Despite this, the reliability of banks in our country is under threat.

In the article we will tell you in more detail which banks are at risk of going bankrupt in 2020, how much money can be returned if a financial institution goes bankrupt, etc.

Banks on the verge of bankruptcy 2018

According to the Central Bank of the Russian Federation, the list of bankrupt companies in 2020 will not be published on the official website; the measure was taken to avoid the outflow of deposits and loss of customers. It is impossible to say with 100% certainty which company will fail, but we can name those companies that are at risk. This:

Tinkoff; Euroinvest; Vanguard; Summer; HE WOULD; Vesta; GenBank; Idealbank; Sovinkom; Russian standard

Despite the fact that the situation of these banks is unenviable, they have a chance to change the situation for the better.

Bankruptcy of Deutsche Bank

John Cryan, head of Deutsche Bank, warned the population about possible problems. According to him, due to the constant intervention of the European Central Bank (ECB), force majeure may arise that could lead to the collapse of this company.

Those who manage to withdraw their money from this organization will also suffer. Pensioners, unfortunately, will also fall under the distribution.

Zero interest rates, so popular in the EU, make the work of pension funds impossible. They have nowhere to invest money.

Despite this, recently benefits to people of retirement age have been issued at the expense of the fixed assets of the banking system.

Many pension funds will have to suspend pension payments indefinitely if Deutsche Bank's license is revoked.

Bankruptcy of Platinum Bank

On January 10, 2020, the National Bank of Ukraine announced that Platinum Bank’s license had been revoked.

According to his calculations, 97 percent of clients will receive their money in full, since the size of these deposits does not exceed the guaranteed amount of 200 thousand hryvnia.

And clients with large deposits will receive them within the amount guaranteed by the Fund. The amount is about 4.8 billion hryvnia.

Alfa bank bankruptcy 2018

Many clients of Alfa Bank began to receive letters saying that this company was going through hard times and there was a risk of going bankrupt. Many large clients began to hastily withdraw their money from this financial structure.

The head of Alfa Group states that these were the machinations of envious people and competitors. A criminal case was opened regarding fraud. Regarding the possible collapse of Alfa Bank, they did not want to explain anything.

Bank Trust

Since 2014, Trust Bank was transferred to the hands of temporary managers from the DIA (Deposit Insurance Agency). It must implement a rehabilitation program for this bank.

Rehabilitation is by no means bankruptcy. This means an improvement in the company's financial condition. Bank Trust will operate as before during this event. Clients do not have to worry about their money.

Renaissance Bank bankruptcy

The fact that Renaissance went bankrupt became known back in December 2015. The Central Bank of the Russian Federation revoked its license due to the institution’s failure to comply with federal laws, as well as regulations of the Central Bank regulating the activities of credit enterprises.

In addition, the values of the company's own asset adequacy standards were below 2%. This indicated that the company's policy was overly risky. At the beginning of 2020, there are no changes in this situation.

Source: https://feib.ru/dolgi/kakie-banki-na-grani-bankrotstva-vyplaty-pri-bankrotstve.html