Hello dear friends!

Today there will be an article on the topic: Old songs about the main thing!

Many articles have been written about the procedure for writing off debt, many practical recommendations for action have been published, and debtors have always asked their question:

Why do I pay the loan, I pay, but the amount of debt under the loan agreement does not decrease.

Well. Today we have prepared for you not only an analysis of the current legislation, but also a practical guide to action. Use and apply in your practical activities.

What is the essence of the problem?

But first, a little history. We have been represented on the anti-collection agency market for quite some time. Our company was the first in this segment to use legal examination of documents.

What does legal examination of documents have to do with it? Are you starting to sell your services again? - you ask!

You may consider our answer ridiculous, but we noticed one very interesting fact: Out of 100 legal reviews carried out, 99 contracts contain this violation. Namely, the procedure for writing off debt has been violated.

Believe it or not, this violation is spelled out in black and white in your contract. This is where all your problems come from.

The problem is that, according to Art. 421 of the Civil Code of the Russian Federation, the parties are free to conclude an agreement and can enter into an agreement, both provided for by law and not provided for by law. This gives the Bank the right to write into the agreement what is beneficial to it - despite the fact that some such “prescribed clauses” infringe on the rights of the other party - the Borrower.

And while the agreement is signed and in force, the Bank acts on the basis of the agreement. Those. in fact, the Bank does not violate anything. Therefore, by writing off your payment to the wrong place, the Bank does not violate anything. But for the time being!

This time comes for the Bank when a specific clause of the agreement is declared invalid in court. Then the Bank will not be able to refer to the terms of the agreement and will stop carrying out actions that infringe on your rights.

In general, to be fair, it must be said that the loan agreement is the weakest link in the banking system. Why? You will find the answer in our Anti-Banker newsletter, where we explain this very important point for our subscribers. So, hurry up and subscribe:

But these are all general points. After a short introduction, we move on to the practical part of our research:

Start and end

To find the balance of the debt, you need to study the first numbers in the act. The required value is given in numbers or words.

The ending balance allows you to reconcile the status of settlements. It is important for companies where accountants have to record a lot of incoming documents.

The coincidence of the final balance indicates that all calculations for the specified period were carried out correctly by both companies, so there are no problems or complaints. If discrepancies appear, this leads to additional checks of all transactions performed during the audited period.

What is this procedure for writing off debt?

So, according to Art. 319 of the Civil Code of the Russian Federation, the procedure for writing off debt is as follows:

- First of all, payments aimed at the creditor's costs of obtaining execution are written off;

- Secondly, interest on the agreement;

- Thirdly, the principal debt.

Dear Borrowers and Debtors! Remember this rule once and for all! There is simply no other order in our country at the moment.

Accordingly, all bank commissions, penalties, other penalties, late payments (both interest and the amount of principal) must be written off after those payments specified in Art. 319 of the Civil Code of the Russian Federation.

However, bankers resort to tricks. Let's give a small example to make it clear to you.

So, your monthly loan payment is only 5,000 rubles. 2,000 rubles of this goes to repay the principal amount, and 3,000 rubles goes to repay interest. Not much, but you will be surprised how out of thin air this amount turns into lifelong bondage. Ready? Go!

- A one-time fine for late payment is 500 rubles

- Penalty 0.5% for each day of delay from the amount of the late payment.

- The delay was only 14 days.

So, the conditions are given - let's start the calculations. You pay 5,000 rubles late.

- 500 rubles goes towards paying off the fine!

- 0.5% for each day of delay or 25 rubles per day. 25 rubles * 14 days = 350 rubles went to pay off the penalty.

In total, it turns out that 850 rubles went to nothing: to pay off some kind of penalties. Let's count further.

3,000 rubles went to pay off interest. The balance is 1150 rubles, which actually goes to repay the principal amount. Therefore, although you paid late, the principal amount has not been repaid.

And the bank begins to charge a penalty and a fine for 850 rubles of your underpayment (the amount that went nowhere). Let's count.

There are 14 days left until the next payment.

0.5% of 850 rubles is 4.25 rubles. Multiply by 14 days for a total of 59.5 rubles. The next payment due date arrives. 5,000 rubles. Let's say you pay in full. But, again, 59.5 rubles are missing for the amount of the principal debt. Consequently, you will be assessed a one-time fine of 500 rubles.

And now the debt is not 59.5 rubles, which was not enough, but 559.5 rubles, because the fine is written off first, and not the amount of principal and interest. Consequently, when writing off the next payment, the Bank charges a penalty for late payment, debits from the received amount to repay it, and again the amount of the principal debt is not enough.

It turns out to be entertaining mathematics. Our company will prepare a separate book about this entertaining mathematics, in which we will include all the formulas for calculating debt, how to carry out calculations, and so on. So don’t miss the release of the book - become our subscriber

As you already understood, even if you pay all remaining payments on time, the amount of the principal debt will not decrease. In addition, Banks resort to tricks and transfer the amount of overdue debt (in our example, this amount is 559.5 rubles) into the category of principal debt.

Thus. It turns out that the amount of the principal debt not only does not decrease, it also increases. It is growing rapidly upward, since it is on the amount of the principal debt that interest under the agreement begins to accrue, and the commission fees of banks also increase.

Read about all the ways to increase the principal amount in our practical guide!

Our company really hopes that you understood the essence of the problem. If you want to know for sure whether you have such a violation, order a legal examination of the documents. Our experts will help you understand this complex issue.

Well, we move on! And let's talk to you - what should we do with you if such a disgusting violation was revealed in your contract?

The employee quit, but the debt remains

Thus, interest on loans and borrowings outstanding at the reporting date is reflected in the balance sheet separately from the main amount of loan obligations (credits), namely, divided into long-term and short-term liabilities on separate lines of the balance sheet.

This is interesting: Can Bailiffs Seize a Mortgaged Apartment for Other Debts

The debt of Dyatkovo Crystal Plant LLC amounted to 14 million rubles

The expert recalls that interest payable to the lender (creditor) is recognized as expenses associated with the fulfillment of obligations under received loans and credits. The procedure for accounting for expenses on loans and credits is regulated by PBU 15/2008 “Accounting for expenses on loans and credits.”

It is worth noting that non-payment of accounts payable refers not only to the situation with loans from banking institutions. In fact, evasion of repayment of accounts payable can also arise in relations between various entities, when one individual or legal entity owes another.

A guide to action or how to recognize the procedure for writing off debt as illegal?

Step one - submit a pre-trial claim to the Bank

Yes exactly. You will not be able to cancel the clause in the agreement regarding the illegal procedure for writing off debt. The pre-trial claim is a free document, i.e. written in free form, but it must indicate:

- To whom the claim is sent – full name of the bank;

- Regulatory justification: why do you think that the procedure for writing off debt that was established in the agreement does not comply with current legislation and violates your rights? Here you will have to justify your position!

- Indication of specific clauses in the contract which you are asking to be declared invalid.

- An indication of the specific action of the Bank, what it needs to do so that your request to invalidate the debt write-off procedure is satisfied by the Bank.

Regarding the last point, we can say this: What does the Bank need to do? Draw up an additional agreement, issue a certificate or provide an account statement, according to which the procedure for writing off the debt will comply with that specified in the law. A specific action that would suit you and you would be calm that this violation is no longer in the contract.

You can submit a claim to the Bank in several ways. We provided information about this in our video course Help for Debtors using D. Guryev’s system. Go ahead and buy!

There will also be a separate article in the future on this issue, so don’t switch, and in order not to miss new products from our company, become our subscriber:

Step two is drawing up and filing a claim in court.

It is the court that is your lifesaver. There is no need to be afraid of judgment. On the contrary, if the court says that the Bank should not do this, you will achieve your result. And believe me, your debt will begin to decrease after such a decision right before your eyes.

How to conduct a court hearing and how to prepare for it, some of the features of drawing up a statement of claim are described in great detail in our 88-page guide for the plaintiff - How to win the court? We advise you to pay attention to it:

The book will be useful to all Borrowers and Debtors who want to file a claim against the bank.

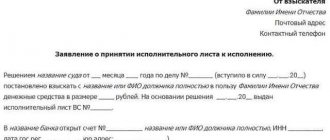

Step three - execution of the court decision

When the court decision comes into its legal possession - acquires its legal force - go to the Bank and demand the conclusion of an additional agreement on this issue. If the Bank refuses you, take written evidence (letter from the Bank, certificate, etc., etc.).

Then go to court to issue a writ of execution. If the Bank does not want to properly execute a court decision, it will execute it through the bailiff service.

Possible excuses in the Bank's position against your claim in court

Understand that it is not profitable for the Bank to lose its chips under the loan agreement. Therefore, the Bank will resist in every way that the law provides it with. Our company will tell you about the most common positions of the Bank.

The first refutation of your claims: the parties can enter into any agreement on the basis of Art. 421 Civil Code of the Russian Federation

At the very beginning, remember we started with a general discussion of the problem? So, Article 421 of the Civil Code of the Russian Federation gives the parties the right to conclude any agreement and include any conditions in it. If you agree, you sign; if you don’t, it means you won’t receive the loan.

The requirements of the articles may work in your favor

- 16 of the Law of the Russian Federation “On the Protection of Consumer Rights”, which says that the clauses of consumer lending agreements must necessarily comply with the norms of the law (in particular, Article 319 of the Civil Code of the Russian Federation);

- Art. 428 of the Civil Code of the Russian Federation - point out that you did not take part in the discussion of the terms of the contract. You were given ready-made conditions - whether you want to agree or not, with all the ensuing consequences.

Loan repayment methods

The repayment method for citizens almost does not depend on the type of loan. This is because the bank almost always issues the borrower a bank card. By a certain date, the borrower must replenish the account of this card in an amount sufficient to write off the payment. Whether it is annuity or differentiated is not important. The bank will debit the money automatically. No commissions.

Repaying a loan if there is overdue debt

One of the terms of the loan agreement is repayment of the loan. Namely, timing, order and size. The loan agreement is concluded by the credit institution and the borrower on the terms of payment, repayment and urgency. And repaying the loan in the manner and in accordance with the terms of the agreement is the direct responsibility of the borrower. Therefore, the publication contains general recommendations. First of all, carefully study your loan agreement.

3. A meeting of creditors that has decided to amend the debt repayment schedule may contact the person or persons who provided security for the debtor’s fulfillment of obligations in accordance with the debt repayment schedule with a proposal to increase the amount of security for the debtor’s fulfillment of obligations in accordance with the debt repayment schedule.

1. In case of failure by the debtor to fulfill the debt repayment schedule (failure to repay the debt within the established time frame and (or) in the established amounts), the founders (participants) of the debtor, the owner of the property of the debtor - a unitary enterprise, third parties who provided security, no later than fourteen days from the date provided for by the debt repayment schedule, has the right to apply to the meeting of creditors with a petition for approval of changes made to the debt repayment schedule or to pay off the claims of creditors in accordance with the debt repayment schedule. A copy of the petition is sent to the administrative manager. The administrative receiver shall convene a meeting of creditors no later than fourteen days from the date of receipt of the petition.

Federal Law “On Insolvency (Bankruptcy)” (127-FZ)

If a decision is made to make changes to the debt repayment schedule, the meeting of creditors has the right to apply to the arbitration court with a petition to approve the changes made to the debt repayment schedule.

The concept of principal on a loan is quite common in practice. Therefore, this term should be familiarized to everyone who has already entered into a loan agreement or is just planning to do so. This is one of the phenomena that is studied especially carefully before signing new agreements. Let's take a closer look at what the principal debt on a loan is.