Debt collection in court is a set of procedural measures carried out by the creditor in order to protect his violated rights. At the same time, conducting a trial and winning a case are not independent goals. The main task of this stage of debt collection is the subsequent enforcement of the court decision and the actual repayment of the debt.

Here are our victories in court - Won cases, and here are the real results of our debt collection services - Collected debts.

Loan preparation

In order to repay the loaned money in a timely manner, it is important to correctly prepare the documents during the transaction. A well-drafted receipt or a full-fledged loan agreement will help increase the chances of receiving a debt from an individual.

The text indicates:

- amount;

- return period;

- penalties in case of delays;

- passport details of the parties with registration.

The agreement is confirmed by the signatures of the parties at the end of the document. An additional confirmation of the authenticity of the agreement will be certification of the document by a notary.

Without a receipt or agreement, the process of repaying debt in court becomes more complicated.

Methods for collecting debts from individuals

Debt collection from individuals is carried out using three methods:

- pre-trial;

- judicial;

- extrajudicial.

The last scenario can be implemented by third parties - collectors. Their activities have been limited by law in recent years (Federal Law 230 of January 1, 2017): telephone calls to the debtor can be made from 8 to 22 pm on weekdays and from 9 to 20 pm on weekends and holidays. More than once a day, twice a week and eight times a month, the collector is threatened with legal proceedings for interference in his personal life. The rights of categories of persons in special conditions, for example, pregnant women, mothers with children under 3 years of age, disabled people, etc., are taken into account separately.

Pre-trial collection

The task of pre-trial debt collection from individuals. persons - to convince the borrower that it is more profitable for him to return the money or agree to change the terms of the loan than to avoid obligations. To do this, carry out:

- regular calls;

- mailing letters;

- communication with the employer and relatives of the borrower.

Before making demands on the debtor, study his solvency using open sources.

Pre-trial collection is preparation for the next stage of proceedings – the trial. It is important to gather evidence that you have tried to resolve the issue amicably. The borrower is sent a letter indicating the legal consequences in case of failure to fulfill obligations:

- by mail with notification;

- by email;

- by fax.

To speed up information, delivery methods are duplicated.

The procedure for collecting debts through court

So, debt collection is carried out through the court in two ways:

- Through a court order for debt collection.

How it works? You provide the court with documents about the funds loaned, after which the court reviews them and makes an appropriate decision. By the way, the practice of debt collection shows that banks, and often MFOs, like this procedure most of all. - Through a lawsuit for debt collection. This method is not as fast as obtaining a resolution. It requires a more thorough consideration of the case, familiarization with all the details.

Receiving debts through court

If the parties fail to reach an agreement, the lender files a claim with the court at the place of residence of the debtor individual. An experienced lawyer will help you draw up the document in accordance with the rules and not miss anything.

Next, the lender faces a difficult path of forced collection of debt from an individual. There will be meetings, petitions, examinations and disputes. Your goal is to achieve not only a writ of execution, but also direct repayment of the debt from an individual.

If the court makes a decision on forced compensation of the debt, the plaintiff receives a writ of execution. From this moment you can begin the collection process:

- with the help of the bank that services the defendant’s accounts;

- the borrower's employer, who has the right to deduct a fixed amount from the borrower's salary to repay the debt;

- The Federal Bailiff Service is an extreme measure, relevant when there is not enough money to pay off the debt (attention will be paid to property, including those in shared ownership).

In order for collection to be carried out faster, request information in advance about the accounts and place of work of the individual of interest.

How receivables are collected from legal entities

The first question that a specialist providing legal services for collection of accounts receivable will clarify is the statute of limitations. By law, it is 3 years from the moment at which the debtor company agreed to pay for products or services under the contract. If it is not specified, then lawyers rely on the norms of civil law. Based on judicial practice, we can make an unambiguous conclusion that quite often difficulties arise in determining the limitation period. Therefore, it is best to contact a qualified and knowledgeable lawyer to clarify this issue.

Here is a step-by-step algorithm for the actions of a lawyer who works to collect receivables:

- Step one is filing a claim.

In this document, the specialist must express his client’s dissatisfaction with the overdue payment deadline. Next, you should wait for a response to the complaint.

- Step two is filing a claim.

This step is inevitable if the claim was sent, but a response letter from the debtor was not received, or the management of the enterprise was not satisfied with it. As a rule, the claim is sent to arbitration; sometimes it is possible to submit an application to an arbitration court or a court of general jurisdiction.

- Step three is participation in court proceedings.

The lawyer will have to speak at meetings, defending the interests of his client. Before this, the specialist must prepare all the necessary documentation and provide it to the court as evidence.

- Step four – collection of receivables through the court.

After the court makes a decision in favor of the plaintiff, the defendant must repay the debt as soon as possible. If this does not happen, then the lawyer must obtain a writ of execution and insist on forcibly collecting the debts. To do this, the received sheet is sent to the defendant’s bank or to the FSSP.

It should be noted that pre-trial collection of accounts receivable services are very effective. It is enough for management to hire an experienced lawyer to negotiate with the debtor in order to sort out the problem that has arisen. Convincing arguments from a lawyer are enough for the company to find ways to quickly pay off the debt, because no businessman wants to resolve cases in court. Among the advantages of pre-trial resolution of debt disputes are the preservation of friendly partnerships, the absence of costs for litigation, as well as saving nerves, resources and money on participation in arbitration sessions.

Is it possible to collect a debt from relatives?

The creditor has the right to collect debts from the borrower’s relatives if they:

- entered into inheritance rights (along with property, relatives also receive debts);

- divided debt obligations when dividing property during a divorce;

- acted as co-borrowers or guarantors for the debts of an individual.

If a relative refuses the entire inheritance, then it will not be possible to collect the debt from him.

Debt collection by collection firms

The practice of turning to collection agencies for help in collecting debts is quite common, despite the fact that the latter are not endowed with any special powers, such as, for example, the bailiff service.

This popularity is determined by the fact that collection agencies have an independent interest in returning the debt to the creditor, since they work for a percentage of the amount of the collected debt. At the same time, such interest often pushes debt collectors, when fulfilling debt collection obligations, to use methods that not only go beyond their legal authority, but also directly constitute various types of crimes. This attracts the interest of law enforcement agencies not only to the work of an individual collector, but also to the person in whose interests he acted.

What does bankruptcy give to a debtor?

Debt obligations from an individual can be written off through bankruptcy.

However, according to statistics, in 2% of cases debt forgiveness is still refused. What are the grounds for collecting debts from individuals? It is still possible for a bankrupt person to:

- the borrower distorted information about property or income;

- the bankruptcy was fictitious or deliberate;

- debt obligations arose in connection with the unlawful actions of an individual.

Even in court it will not be possible to write off debts:

- for alimony;

- assigned as subsidiary liability;

- necessary to compensate for damage or harm to health.

It is important that the court declares an individual bankrupt before the creditor initiates debt collection proceedings.

Claimant's rights

Federal Legislation gives the claimant a number of individual rights:

- contact the FSSP of the Russian Federation to initiate proceedings;

- request information about bank accounts and deposits of the borrower through the Federal Tax Service of the Russian Federation;

- insist on including in the amount of recovery the costs of searching for an individual and forcing the return of funds under the writ of execution;

- keep the debtor’s property, which could not be sold within 2 months from the date of seizure;

- find out from the bailiffs at what stage the process is being carried out;

- stop the collection process without giving reasons;

- do not accept seized property if it cannot be sold.

If, by violating debt obligations, an individual causes damage to third parties, the latter also have the right to compensation.

Debtor's rights

The debtor is also entitled by law to the following rights and guarantees:

- FSSP employees confiscate property in an amount not exceeding that specified in the writ of execution.

- The debtor can return the property seized from him if he fulfills the requirements of the writ of execution independently within two months.

- The borrower will receive his belongings, land and real estate back if the lender refuses to accept them after a failed auction.

The bailiff will also not be able to take away the property necessary for life and work (including family). The list of items prohibited for collection is specified in Art. 446 of the Civil Procedure Code of the Russian Federation:

- the only housing with a plot of land;

- items necessary for everyday life - kitchen, toilet and bathroom utensils;

- clothing, shoes, hats;

- domestic animals and livestock;

- products;

- funds within the subsistence level;

- items that are used to earn money.

The debtor can also focus the attention of the bailiffs on property that can be seized first. Phys. the person recommends, and the decision on the order of collection of items is made by FSSP employees independently.

The amount of the penalty is indicated in the court decision and writ of execution. The total amount is greater than the debt because it includes payment of additional costs that the lender and government agencies incurred to repay borrowed funds.

Debt collection is a global problem for creditors

Taking advantage of this opportunity, people continue to actively take out loans for a wide variety of purposes. Some happily live on credit all their lives, others face serious financial problems.

When a person is unable (or willing) to repay his debt voluntarily, the creditor has to take emergency measures to return his money. Almost any debt can be recovered, at least partially, but there are no universal methods.

The problem may not be so global if you approach its solution professionally and step by step. Even at the first stage there is a real chance to convince the debtor to fulfill his obligations.

In practice, several methods are used:

- pre-trial dispute resolution;

- through the court;

- by selling (assigning) debt.

Before going to court, you can resolve the dispute through negotiations yourself or engage a competent lawyer.

A competent approach will help you find the right arguments, convince the borrower to repay the debt or come to a compromise solution, for example, draw up an agreement on the gradual repayment of debt, indicating the size of payments and the timing of their repayment.

Before bringing the matter to trial - and this is a long, nervous and expensive matter - it is worth trying to resolve the dispute peacefully.

Debt collection scheme.

If ways to convince the debtor to repay the debt have been exhausted, there is only one way left - to the court. To competently draft a statement of claim regarding your claims, seek help from a professional. Such cases are considered by general courts or a magistrate. A creditor can apply to the magistrate’s court under the following conditions:

- there is a promissory note or a loan agreement (preferably notarized), i.e. documentary evidence of the requirements, a sample contract can be downloaded here;

- the amount of debt does not exceed 50 thousand rubles.

In this case, the case can be considered without the presence of the parties, after which the court issues a document called a court order.

The remaining cases are considered in the usual manner of claim proceedings.

Along with filing a claim, you can demand the seizure of the debtor's property or its assets. After the decision is made, enforcement proceedings begin. Then the work of the bailiffs begins. They take the necessary measures to collect the debt by force.

When selling a debt, a necessary agreement for the assignment of the claim is concluded - an assignment agreement. A large number of companies - usually collection companies - are engaged in buying up citizens' debts, including problematic ones.

The creditor, having lost hope of real repayment of the debt, sells it, while receiving no more than half of the amount of the existing debt. The legislation provides for the possibility of assigning debt to a new creditor for any obligations, except those related to the personality of the debtor (compensation for moral damage or the right to alimony).

How can you collect a debt if the debtor has no property?

The current legislation does not provide for real sanctions for the debtor’s failure to repay his debt. A citizen can evade collection of debts from him for a long time and with impunity.

If there is all the necessary evidence (loan agreement or receipt), duly executed, the creditor has the right to go to court with a demand to collect the debt, and the defendant, without evidence of the return of money, cannot oppose anything to this.

It seems that everything is going well - a positive decision has been made, a writ of execution has been issued and handed over to the bailiffs. Further, the situation may be complicated by the fact that it is impossible to collect the debt, because the citizen does not have movable or immovable property and bank savings, and he himself does not work anywhere.

It will not be difficult to collect a debt from a person who works officially and receives a salary, has movable or immovable property, and savings in bank accounts. It is more difficult when the debtor has no property (registered in the name of relatives), and the work is unofficial.

The legislation provides for a number of measures that a bailiff can apply to a debtor, but, unfortunately, one should not hope for much effect from them. After the initiation of enforcement proceedings and the end of the period for voluntary repayment of the debt, a number of standard actions are performed to search for the debtor’s existing property by sending the necessary requests.

If the search does not yield positive results, the bailiff:

- goes to the place of actual residence of the debtor for the purpose of inventory and seizure of property (household or electronic equipment);

- establishes a ban on traveling outside the country - such restrictions for many are a serious incentive to pay off debts;

- sends a request to the registry office - if the debtor is married and the property is registered in the name of the spouse, they allocate a share in the jointly acquired property and impose a penalty.

The bailiff has the right to seize the debtor's property.

Russian legislation does not provide for criminal punishment for debts, the only exception being debt on alimony obligations (Article No. 157 of the Criminal Code of the Russian Federation).

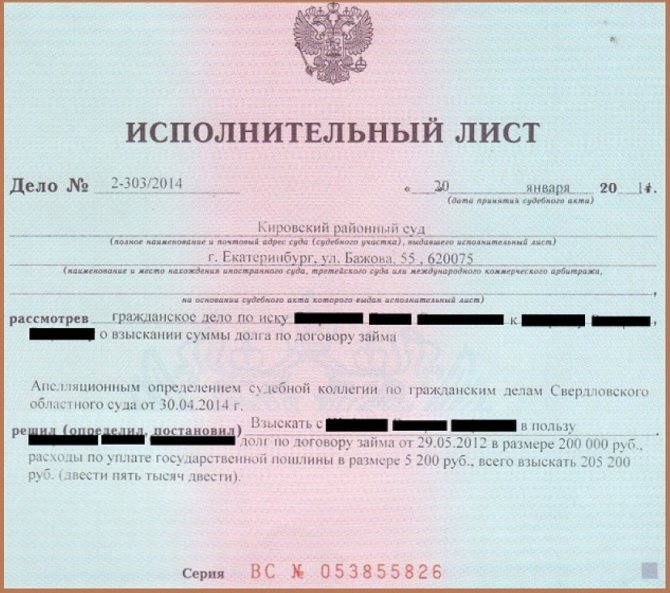

An example of a writ of execution for debt repayment.

If the measures taken do not bring the desired result, the enforcement proceedings are terminated and the writ of execution is returned to the creditor.

Debt collection from a guarantor individual

A common method of securing an obligation is a surety bond. It happens that a bank agrees to issue a loan to a citizen only if there is a person who agrees to be responsible for the borrower’s fulfillment of his obligations to repay the debt (loan).

As a rule, these are relatives or close friends of the borrower.

Having decided to help a loved one and signed a surety agreement, you need to understand that if the debtor is unable to repay the debt, the guarantor will have to answer together with him (jointly) or instead of him (according to Article 361 of the Civil Code of the Russian Federation).

The bank has the right to demand repayment of the debt in accordance with the terms of the guarantee agreement.

Collection of debts from individuals in a simplified manner

Since July, Russia has had a system of extrajudicial debt collection - based on a notary’s writ of execution.

But only if banks can carry out actions under a simplified procedure for collecting debt from an individual when this is provided for by the terms of the loan agreement or an additional agreement to it.

Procedure for banks:

- provide the notary with a package of documents that confirms the indisputability of the claims and a copy of the previously sent notice of debt to the debtor;

- notify the debtor two weeks before contacting the notary;

- the debt period does not exceed two years.

The simplified scheme can only be used by commercial banks. However, the procedure does not apply to mortgages and is not applicable to domestic contracts; such debts will still have to be collected in court.

A blow to collectors in the presence of debt

It's no secret that the actions of debt collectors towards debtors are often, to put it mildly, incorrect. Extorting debts through pressure and threats is a common practice of collection firms.

As of January 1, 2017, the relationship between collectors and debtors begins to be regulated by the Federal Law “On the Protection of the Rights and Legitimate Interests of Individuals when Carrying Out Activities to Recover Overdue Debts.”

According to this law, creditors or collectors are prohibited from threatening citizens, putting pressure on them, using force, disturbing them at night with telephone calls (you can call only once a day), it is prohibited from causing harm to citizens and their property, and providing other persons with information about the debtor and his debt.

Only banks or credit organizations, collectors that are officially engaged in this type of activity have the right to negotiate with the borrower.

The law provides for the possibility of concluding an agreement on additional interaction between the debtor and his creditor. However, a person has every right, after notifying the creditor in advance, to refuse to fulfill such an agreement.

The issue of collecting debts from individuals remains topical. The situation is unpleasant for both the debtor and the creditor.

A citizen is obliged to repay the debt, be it credit, alimony, or tax obligations, otherwise he will have to bear responsibility for his actions.

The creditor is interested in using any means (sometimes not even entirely legal) to get the money back. You have to fight to get your money back. It has been tested in practice that with sufficiently active actions on the part of the creditor, you can get your money back even from long-term and inveterate debtors.

For more information on how you can collect a debt, watch this video: