Today I would like to talk about the bankruptcy of a pensioner.

The highest level of debt is among vulnerable segments of the population - disabled people, single mothers and pensioners. Unfortunately, these people are sometimes forced to turn to banks and microfinance organizations, unable to pay their bills. How to declare a pensioner bankrupt and write off debts? Is it possible?

Can a pensioner file for bankruptcy?

Many older people believe that even with huge debts they cannot file for bankruptcy: they have no income other than a pension, and often have no property. Is it so?

No, this is a fallacy. According to the law, bankruptcy of individuals can be declared by any citizen who has no criminal record for economic crimes. It is also important to confirm in court your good faith and unintentional debts. What is meant?

Situation No. 1.

Citizen Belousov, having retired, realized that his income was not enough for his usual life. He immediately applied to 2 banks for loans. His applications were approved. Having used up the loan funds, Belousov turned to a microfinance organization, then to another one.

However, he did not repay debts on any of the issued loans. He spent the money on life and luxury items. After six months of persistent calls from creditors and collectors, the debtor decided to declare bankruptcy of the individual.

Situation No. 2.

Citizen Solntsev, having retired, still continued to work in a small security company. Then he decided to take out a loan to travel to relatives in another country. Upon returning, he continued to regularly pay monthly payments, until the company unexpectedly announced a reduction in staff.

Considering his age, Solntsev was sent to a well-deserved rest, but it did not bring him joy - he had nothing to pay off the loan with. He took out another loan to get by, but the money quickly ran out. Loan payments along with utilities eat up the entire pension, and Solntsev is considering recognizing the insolvency of an individual.

Is bankruptcy possible for pensioners in the first and second cases? In the first case, the court will have reasonable suspicions of the debtor’s bad faith, since the loans were clearly taken without the purpose of repayment. In the second case, there is no doubt about good faith - the debtor took out a loan, being able to repay it, but a sudden change of circumstances prevented him from paying off the creditor.

When filing for bankruptcy, you need to be prepared for questions from the court: for what purposes did you take out the loans, and why did you not repay them? For a pensioner (unfortunately) it is normal to take out loans and microloans “for life”, for medicines, help for children, etc. It is important that the person initially paid according to the contract, but then was unable to do so.

For example, due to the crisis, prices rose and there was a shortage of money (indexation of pensions does not cover inflation).

Any debtor can declare bankruptcy, but the practice of our lawyers shows that it makes sense to go to court if the debt is over 250 thousand rubles.

Find out if your debts can be written off

A pensioner is bankrupt: is it possible?

The bankruptcy law does not define the difference between a working citizen and a person receiving an old-age or seniority pension. Based on this, the bankruptcy of a pensioner is a procedure similar to the bankruptcy of any other individual.

The only nuance of such bankruptcy is the high probability of the court ordering debt restructuring. But here, too, the risk group includes only citizens who receive a fairly large pension, and provided that their total amount of financial obligations to creditors is low.

Konstantin Loginov, Lawyer

It should also be taken into account that no simplified scheme is applied to the bankruptcy procedure for pensioners - it simply does not exist. The procedure for declaring them financially insolvent is the same as for any other category of citizens.

Differences between bankruptcy of pensioners

But there are still some differences in the bankruptcy procedure for retired persons. And it concerns debt restructuring. For pensioners, this procedure is somewhat simplified, which in most cases helps to achieve approval of a restructuring plan in record time - just a few months after filing for bankruptcy.

When appointing a restructuring procedure by the Arbitration Court, the following factors must be taken into account:

- the amount of the debtor's pension;

- availability of additional stable income;

- the living wage established in the region;

- the bankrupt has a disability;

- number of dependents (if any).

When assigning a restructuring procedure, the maximum period cannot exceed 3 years. The amount of monthly payments is calculated in such a way that the pensioner has at his disposal an amount not less than the subsistence level in his region of residence.

In what cases can a pensioner declare bankruptcy?

Bankruptcy of a pensioner is possible only if the following conditions are simultaneously met:

- the delay in fulfilling loan obligations is more than 90 days;

- the pensioner’s property is not enough to cover all debt obligations;

- the citizen does not have an outstanding conviction for economic crimes;

- the debtor was declared bankrupt or was subject to a debt restructuring procedure more than 5 years ago.

There is no minimum threshold for the amount at which a citizen can file for bankruptcy. The often mentioned amount of 500 thousand rubles applies not to debtors, but to creditors - only if the amount of accounts payable exceeds the amount, financial organizations have the right to initiate bankruptcy proceedings against the debtor.

But it is important to consider that bankruptcy of an individual is not a cheap pleasure. The average cost of the procedure is about 40–50 thousand rubles, and this does not include the services of lawyers. Thus, it is advisable to file a bankruptcy claim if the amount of debt is from 100–150 thousand rubles.

The positive side of bankruptcy is the one-time write-off of debt to all creditors at once. And they can be individuals and legal entities, municipal and state enterprises. Thus, the amount of debts at which one should already declare oneself bankrupt can be easily accumulated. It may consist of:

- debts on credits, loans, mortgages;

- debt obligations to individuals;

- debts for taxes, utility bills, fines, etc.

The only exceptions are alimony and payments aimed at compensating for harm - they will not be written off in bankruptcy.

How can a pensioner file for bankruptcy?

The process of recognizing a pensioner’s financial insufficiency is similar to the usual bankruptcy of an individual. To initiate the procedure, you must submit to the Arbitration Court at your place of residence:

- bankruptcy petition;

- list of property;

- marriage/divorce certificate;

- a complete list of creditors;

- data on the current financial situation (certificate of pension, from place of work);

- information on the number of dependents assigned to the disability group;

- other data related to the bankruptcy procedure.

When submitting an application, the pensioner must pay a state fee (300 rubles) and pay for the services of a financial manager in the amount of 25 thousand rubles - they are paid by depositing the entire amount on the court deposit.

Important! The arbitration manager is paid 25 thousand for conducting one procedure. But during bankruptcy, two of them can be initiated: first, debt restructuring, then, if it turns out to be impossible, then the sale of property. And the pensioner will have to pay for both procedures, that is, the cost of the financial manager’s services will double.

In addition, the bankrupt is obliged to reimburse all costs of the financial manager associated with the performance of his duties, including paying for the services of third parties, if the court determines the advisability of involving them in the bankruptcy process.

Consequences of bankruptcy for a pensioner

By declaring himself bankrupt, a pensioner not only gets rid of debts - he is also subject to a number of restrictions:

- Repeated bankruptcy will become possible only after 5 years.

- For 3 years, a pensioner cannot be a member of the founders or shareholders, or be appointed as the head of a company.

- For 5 years, a bankrupt must indicate his status when applying for loans.

Also, as one of the measures, a ban on traveling abroad may be applied to the debtor. But, as practice has shown, it is installed by courts quite rarely, and it can be removed within one day.

Bankruptcy without property: will debts be written off?

This is a pressing issue for pensioners who owe loans. As a rule, they do not have any property, except for their only home. Is insolvency recognized if there is nothing to pay off with?

Yes, they admit it. Practice shows that you can become bankrupt without selling your property, and loans with all penalties are repaid. But you must prove to the court that you have the money to pay the legal costs.

To start the procedure, you need an amount of 25,300 rubles - this is the salary of the financial manager and the state duty. This amount must be paid before the first court hearing.

How to pay for a citizen's bankruptcy?

- Money can be given by a relative or acquaintance: spouses, children, relationship does not matter.

- Your savings: dividends, money in your account, jewelry (sell, pawn in a pawnshop), loan balances.

If money is expected within the near future, you can submit a petition to defer the payment of remuneration to the insolvency administrator - at the end of the article.

Thus, if there are funds to pay legal costs, a pensioner can file for bankruptcy and expect to have all debts written off.

We talked in detail about the cost of bankruptcy in this article.

The price of bankruptcy depends on the value of the property for sale and the number of loans in different banks. How to find out the final cost? Are there any discounts for pensioners? Call a specialist to calculate the full cost of the procedure in your specific situation.

Features of the procedure for pensioners without property

According to statistics, the majority of citizens resort to the procedure of declaring their insolvency without owning property that could be suitable for sale and repayment of debts to creditors. For example, a pensioner may only have an apartment from liquid property, which is the only suitable housing. In this case, it is not subject to seizure and sale according to the rules of the Civil Procedure Code.

Previously, the courts did not have a clear position on the issue of whether citizens without property could go bankrupt. But the Supreme Court recently issued clarifications that clearly interpret this controversial legal issue. They say that the lack of property is not a barrier to bankruptcy.

To confirm the fact that the pensioner has the means to pay legal costs, the debtor may present:

- Jewelry or art that can be sold if necessary.

- Bank account statement with savings.

- A copy of the payment order confirming the payment of a certain amount to the court deposit to remunerate the manager.

For example, in case No. A19-21428/2015 of 2020, a retired man had a debt of more than 1 million rubles, while he had no money in bank accounts and no property. But he had certain finances to pay legal expenses. As a result, his bankruptcy was recognized in a timely manner without complications.

Bankruptcy of pensioners may have the following features that distinguish it from the bankruptcy of other citizens:

- Courts are usually very friendly to pensioners . If necessary, you can ask the court for a deferment in the payment of remuneration to the manager, which is 25,000 rubles.

- After the first court hearing, the pensioner no longer has the right to receive calls from creditors, collectors and bailiffs with demands . If they continue, the pensioner has the right to contact law enforcement agencies.

- In the absence of property for sale, bankruptcy costs for pensioners will amount to 60-80 thousand rubles. If there is such property, then the cost of going through the insolvency procedure will reach 100 thousand rubles.

- Since pensioners rarely have incomes over 30 thousand rubles. monthly, then the implementation stage is usually immediately introduced in their respect, bypassing debt restructuring . The pensioner himself can make a similar petition to the court. This will allow him to save at least RUR 25,000. at this stage of bankruptcy and reduce the procedure time.

- The bankruptcy period for a pensioner without property will be up to 6-8 months . If there is property, the process will take a year or more.

Is it possible for a pensioner-guarantor to go bankrupt?

Surety is a fairly common practice in Russia. Banks are willing to issue loans for very large amounts if there are guarantors. But if the borrower is fired, or the business does not take off, the guarantor will have to answer the debt. What to do if the main debtor stops paying?

In this case, the following scenario is possible:

- The primary debtor files for bankruptcy.

- The bank is included in the register of creditors.

- The procedure is completed and the debts are written off.

- Next, the bank turns to the guarantor.

- The guarantor declares bankruptcy, and his debts are also written off.

Until the main debtor has declared bankruptcy, claims are not usually brought against the guarantors. However, if the debt of the main borrower is written off through the court, then the guarantor has no choice but to also go through the procedure if there is nothing to repay the loan with. Read more about recognizing the insolvency of a citizen with a guarantee here.

Get a debt relief plan

What debts will be written off?

According to the law, debts in excess of 500 thousand rubles are subject to write-off. A pensioner can file a bankruptcy petition with a smaller amount if he can prove that he is unable to pay off his debt obligations. The debt subject to write-off is:

- under loan agreements;

- on tax payments;

- for paying utility bills;

- for harm caused to individuals, unless a criminal offense has been committed.

Debts on alimony, compensation for moral damage and wages will not be forgiven (if the pensioner worked as an individual entrepreneur and was an employer). After debts have been written off, bankruptcy cannot be re-initiated for at least 5 years.

Considering that general rules apply to a pensioner, the same debts are written off from him as from other categories of citizens. However, there are some debts that cannot be affected.

These include:

- alimony - both in relation to children and in relation to other categories of citizens;

- compensation for moral damage;

- wages. It can be recovered from the individual entrepreneur. In addition, individuals also have the right to register employees and pay their wages;

- other debts directly related to the person;

- fines for committing illegal acts. At the same time, some debts arising in accordance with the Code of Administrative Offenses of the Russian Federation, for example, fines to the traffic police, can be written off;

- debts arising after the issuance of the act.

Most often, loan debts incurred under other agreements, debt to the Federal Tax Service and utility bills are written off.

Pension in case of bankruptcy of an individual

Pensioners are usually not concerned about various restrictions during the procedure - the right to be the head of an enterprise. For most, selling property is not relevant, since there is usually nothing to sell - the apartment will remain so.

The “sore spot” is the bankruptcy pension.

It's no secret that monthly pension payments are the main, and often the only source of income. Will they take away my pension?

No, they won't take it. The law provides for the protection of the interests of the debtor. From all the income that a pensioner receives, he will be allocated a monthly amount no less than the subsistence level in the region at his place of registration. So, in Moscow it is more than 12,000 rubles. The pension of spouses, the salary of children or other persons living with the debtor will not be affected. The social supplement to your pension will not be taken away either.

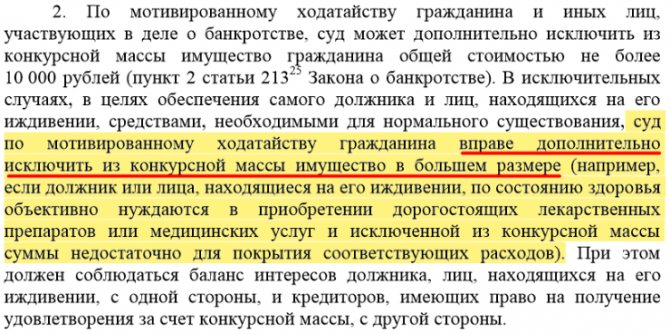

If the bankrupt is prescribed medications, medications, or receives paid medical services as prescribed by a doctor, you can petition the court to ask for an increase in the monthly monetary amount. The Supreme Court pointed this out to the Arbitration Courts in Plenum No. 48, paragraph 2:

Applications to exclude money for medicines from the bankruptcy estate can be found in the templates section (first form)

What will happen to the property?

If there is a dacha, a garage, a car, then the sale of the pensioner’s property takes place according to the usual scheme of auctioning the property of a debtor-citizen: inventory, assessment, preparation of regulations on the auction procedure, auction of bankrupt property and settlements. The apartment in which an insolvent pensioner lives will not be taken away.

Find out what property will be sold during bankruptcy

Bankruptcy of individuals of pensioners - the essence and stages of the bankruptcy procedure

The Law “On Insolvency” came into force in September 2020, but during this time judicial practice has already been developed, which allows one to make certain forecasts and count on a successful outcome of the case.

In September 2007, in Moscow, the Arbitration Court considered the case of declaring citizen I., born in 1952, financially insolvent and ordered the sale of property, bypassing the restructuring procedure. But since Citizen I. owned an apartment, which is her only home, she was accordingly excluded from the bankruptcy estate. Thus, the pensioner achieved the write-off of all debts and retained her property.

In February 2020, the Irkutsk Arbitration Court considered the case of citizen L., born in 1954. Debt obligations at the time of filing the application amounted to more than 1 million rubles. The citizen had no income other than the minimum pension and did not own any property. The court decided to completely write off debts and assign bankruptcy status.

In November 2020, during bankruptcy proceedings in one of the Arbitration Courts of Yekaterinburg, a pensioner was able to obtain satisfaction of her request for the full withdrawal of her pension from the bankruptcy estate. The citizen was able to prove that the subsistence minimum is not enough to ensure a decent standard of living and cover the costs of maintaining health.

has been conducting bankruptcy of individuals in Krasnodar since 2020. During this time, more than 80,000 people wrote off their debts. Sign up for a consultation and we will help you get rid of the debt yoke, write off any type of debt and preserve your property.

Federal Law “On the Insolvency of Individuals” dated June 29, 2020 No. 154 establishes the following criteria for declaring a citizen bankrupt:

- a citizen owes money to banks, individuals, government agencies, etc. 500,000 rub. and more;

- he does not pay off the debt for at least 90 days;

- he does not have a stable income, or the amount is less than the subsistence level established in the region;

- the total amount owed is higher than the value of the defaulter's property. But there is an important point: regardless of the amount of debts, a citizen’s only home cannot be confiscated.

The general algorithm for recognizing a person as financially insolvent is as follows:

- Within 30 days from the moment a citizen realizes that he can no longer pay creditors, he submits a petition to the arbitration court at his place of residence with a request to initiate bankruptcy proceedings. Attached to it are documents confirming the applicant’s financial collapse.

- The court examines the materials and appoints an independent specialist - a financial manager who will try to solve the debtor's financial problems without declaring him bankrupt.

- If the situation cannot be corrected, the debtor's bank accounts and all his assets are seized. The property is sold and the money is transferred to creditors.

- After this, the debtor is officially declared bankrupt and relieved of all financial obligations, even if he failed to fulfill them 100%.

The procedure for declaring a citizen financially insolvent takes from 6 months to several years. The decision on the timing of the procedure is made by the court at the initial stage of the case. After completing all the stages provided for by bankruptcy, a final meeting is scheduled, which may result in the writing off of the defaulter’s debts.

If a pensioner is declared insolvent, all his property may be taken away from him, except for his only home. But if the housing was used as collateral for the loan, the court can foreclose on it as well. The property will be sold at auction, and the proceeds will be used to pay off debts to the creditor.

In addition to the only housing, food products belonging to the debtor, as well as livestock and awards received are not subject to confiscation.

If the pensioner does not have any property, after reviewing the financial report presented by the arbitration manager, the court completes the procedure for declaring bankruptcy and decides to write off the debt.

Bankruptcy is a situation that implies the absence of any debts to be written off. But there are a number of obligations that cannot be avoided even in this case.

We suggest you read: Payment of compensation upon closure of a company

The write-off procedure is carried out after the completion of legal proceedings and the sale of property belonging to the pensioner. You can write off debts on all receipts and loans, on bank loans and on utility bills.

But there are also debts that must be paid in any case of bankruptcy. This category of debts includes alimony, debts for compensation of moral and physical harm, as well as requirements for current payments. Those debts that are associated with the personality of a bankrupt pensioner or have special instructions in the law are not repaid.

Declaring bankruptcy of a pensioner not only relieves him of debt, but also imposes a number of restrictions, including a ban on leaving the country and appointment to management positions.

The pension fund does not have the right to transfer pensions and other payments of a bankrupt pensioner to the accounts of financial managers or to other accounts not designated in the documents. Therefore, pensioners can receive their pension in the same manner, according to their will and in accordance with pension legislation. A change in the organization or details for the payment of pensions can only be carried out upon the personal application of the pensioner.

If a person does not have extensive knowledge in the field of lending, he may become a victim of bank fraud. Therefore, even before concluding a loan agreement, it is better to consult with a lawyer. Is a specialist useful in legal proceedings? He:

- Draw up a competent statement of claim with references to relevant legislative norms.

- Will represent the legitimate interests and protect the rights of the debtor’s pensioners during the consideration of the case.

- Will achieve a reduction in the amount of debt, the abolition of unlawful fines and penalties.

- Prepares petitions, challenges, statements.

- Appeals an unsatisfactory court verdict through appeal or cassation procedures.

As part of bankruptcy, the financial manager must sell part of the pensioner's property in the interests of creditors. If there is no property, then there will be nothing to sell. In this regard, bankruptcy of a pensioner without property is somewhat simpler than for other debtors.

The absence of property will also need to be documented. This is easy to do; you should send the appropriate requests, for example, to the Federal Registration Service, receive answers and submit them to the court. Specifically, the Federal Registration Service will provide you with information about the presence/absence of residential/non-residential premises and land plots in your property.

The law very strictly regulates the list of material assets that can be sold in the interests of creditors. For example, if you own a single apartment, you do not have the right to sell it.

But there is an exception to this situation. If your only apartment is pledged to a financial organization, then it will be sold in the interests of this same financial organization. Only those pledges that are formalized are taken into account, i.e. The pledge agreement must be registered with the Federal Registration Service.

Those who have property and also want to go bankrupt should not despair. It is also possible to go bankrupt with your property. Read about it below.

The bankruptcy procedure itself for a working pensioner will not be particularly different from the bankruptcy of an unemployed pensioner. It will be necessary to go through the same steps, collect almost the same documents, etc.

It will be somewhat more difficult to prove to the court that at your current level of income you cannot pay loan debts, utility bills, etc. After all, in addition to a pension, you also receive a salary, which means you have increased income. The court may be of the opinion that restructuring rather than complete debt write-off will be enough for you.

For example, your health may have deteriorated and you are now spending large sums on medications. Or maybe you have dependents{q} Or your close relative (husband/wife) requires special and expensive care and treatment{q} Or maybe you have received a disability{q} Don’t forget to document your arguments.

If you are not sure of the validity of your arguments, then it is better to contact professional bankruptcy lawyers; they know exactly how to deal with this problem.

There is a myth that after the bankruptcy procedure a pensioner will have no property left. Actually this is not true.

A car, jewelry, antiques, securities, expensive interior items and similar property can be confiscated for sale. But here is a list of what they are not entitled to take away:

- The only housing;

- Clothing and hygiene products for personal use;

- Nutrition;

- Medicinal and medical drugs that ensure the life and health of a pensioner;

- Fuel (in various forms) that the pensioner and his household use to heat their homes;

- Livestock (cows, chickens, pigs, bees, etc.) and premises for them;

- Means that ensure the vital functions of pensioners with disabilities (mobile wheelchairs, hearing aids, etc.);

- State awards and insignia;

- Tools used by a pensioner to generate income (for example, a motor mower, a car used as a taxi).

- Household appliances are cheaper than 30 thousand rubles.

The courts themselves, as a rule, are very sympathetic to the fact that older people are actively writing off their debts. Judicial practice in bankruptcy of pensioners is positive.

During the bankruptcy procedure, part of the pensioner's income will be withheld for the benefit of creditors. But only the income that is higher than the subsistence level established in the region of residence will be withheld. If the bailiffs could withhold up to 70% (!) of the pension, then immediately after the start of bankruptcy, the deductions will continue only from the amount that exceeds the subsistence level.

- Housing, if it is the only one;

- Clothing, personal hygiene items;

- Products;

- Medicines;

- Fuel that the debtor and his family use to heat the premises;

- Livestock, poultry, bees, as well as outbuildings that contain livestock;

- Equipment needed by a disabled person (for example, wheelchair, hearing aid, etc.);

- State awards, insignia;

- Equipment with which a pensioner receives income.

How can a pensioner file for bankruptcy in 2020?

The insolvency procedure begins with drawing up an application - a sample application to the court can be found on our website. We do not recommend blindly copying everything from the sample: each case is individual, and the specifics should be taken into account and reflected in the document.

For example, the bankruptcy of a working pensioner differs from the insolvency of a disabled pensioner - the likelihood of restructuring is higher.

You can go through the procedure:

- on one's own;

- by contacting lawyers.

What does legal assistance in bankruptcy include?

- Legal advice at all stages of the procedure.

- Preparation of documents, drawing up an individual application.

- Launching bankruptcy proceedings for a pensioner.

- Assistance in moving directly to the sale of property.

- Assistance in preserving property, if any.

- Providing a financial manager, monitoring publications in the Federal Resources Agency and other actions during the procedure.

- Assistance of a credit lawyer in defense in court and representation of the interests of the debtor.

- Being present at all court hearings, the pensioner will not have to go to court and sit for hours in waiting rooms - his interests are represented by a professional lawyer.

We provide: the entire bankruptcy procedure for a citizen is carried out by a professional, you pay a fixed amount and no additional payments. We take care of disputes and communication with collectors, bailiffs, housing and communal services (if you owe them), banks and microfinance organizations. According to the experience of those who have gone through the procedure, this is more profitable than delaying and accumulating interest that the bank illegally deducts from the pension.

Find out if free simplified bankruptcy is right for me

Judicial practice shows that pensioners go bankrupt quickly, debts are written off in 99% of cases. Download sample applications (claims and applications) for declaring the insolvency of an individual in the Arbitration Court below.

Documents required to begin bankruptcy proceedings

In order for a pensioner to be declared bankrupt, in addition to a statement of claim, he needs to prepare a package of papers:

- identity cards - passport, SNILS, TIN;

- documents confirming the existence of debt. This could be a loan agreement, receipts issued to individuals;

- a list of assets and documents on property owned by the pensioner;

- certificate of income for the last period.

It must be taken into account that bankruptcy is not free, since its implementation involves some expenses, for example, payment of state duty, publication in the bankrupt register.

If a pensioner took out a loan secured by property, he may lose it. A ban on leaving the country and engaging in entrepreneurial activities is introduced for 5 years.

A pensioner filing for bankruptcy will need to prepare the following list of documents:

- filing for bankruptcy;

- copy of the passport;

- copy of TIN;

- pension account statement;

- any documentation that confirms property rights, for example, purchase and sale agreements, certificates, and so on;

- information about creditors;

- documentation that will additionally indicate the impossibility of paying off existing debts;

- papers indicating marital status;

- information about income and taxes paid for the last three years.

Recognition of financial insolvency is possible only upon provision of the specified papers.

To begin the procedure, you need to submit the following documentation to the arbitration court:

- an application drawn up by the debtor according to the established template;

- an extract from the Unified State Register of Individual Entrepreneurs, which confirms whether or not the pensioner has individual entrepreneur status;

- duplicates of a civil passport, tax identification number, pensioner ID;

- pension account statement;

- a list of property owned by the debtor, if any, and documents confirming ownership;

- a list of all creditors indicating the name of the institution, its address or, in the case of citizens, full name and registration address: this includes banks, microloan organizations, utilities (if there are debts for housing and communal services), regulatory authorities to which the debt obligation arose, individuals, provided that the money was borrowed from them against a receipt;

- loan agreement, unpaid utility bills, promissory notes and other documents confirming the existence of debt;

- bank statements from all accounts of the debtor;

- documentation with information on income, tax deductions for the last 3 years;

- certificate of marriage, birth of children.

! Note. The Arbitration Court has the right to request any other documents if it considers that they are relevant to the case. For example, if you have sold any property within the last 3 years, the court must examine the transaction for signs of fictitiousness or illegality.

- Initiation of the procedure for recognizing financial insolvency. The application is submitted by the debtor himself, creditors or heirs in the event of the death of the debtor.

- Approval of the arbitration manager. The court is provided with a list of candidates or a petition to appoint a specific manager. If the parties have no objections, the candidate fully complies with the established requirements - the court approves the candidacy.

- The process of proving financial insolvency. The manager analyzes the situation, compiles a list of property, a register of creditors and their claims. Study all documents related to the case and submit them to the court for consideration. At this stage, it is necessary to prove that the debtor is truly bankrupt and does not have the funds or property to pay off the debts.

- Restructuring. After a citizen is declared insolvent, if there is any property or income above the subsistence level, the manager must reach an agreement with creditors and agree to revise the terms of the loan and the payment schedule.

- Sale of property. This stage occurs if a peace agreement is not reached or if creditors or the bankrupt accept the terms of the restructuring. The property owned by the debtor is sold at auction, the proceeds from the bankruptcy estate are used to pay off debts in order of priority according to the register, pay for the services of a manager, and cover expenses associated with organizing the auction.

- Assigning bankruptcy status and writing off all debts. If there was property, all funds from its sale are used to cover debt obligations. Part of the debts that could not be repaid is written off completely. If the debtor had no property at all and his pension is not enough to cover some part of the loan, the court writes off all debts 100%.

Before deciding to submit an application, many questions arise related to the assignment of the status of a financially insolvent citizen. Lawyers of Glav Bankrupt LLC gave answers to the most popular of them:

We invite you to read: An employee returns to work after maternity leave

- Can debts be written off from a pension? All income is transferred to the debtor’s special bankruptcy account, minus the subsistence level established in the region of residence. By law, pension payments are classified as income, so the court can order debts to be written off from the pension. The cost of living can be increased if a bankrupt pensioner has dependents or requires expensive treatment. These facts are confirmed by relevant documents.

- Can bailiffs write off debt from pensions? If the court has made a decision to cover debts from the pensioner’s income, for example, for debts to housing and communal services, tax, alimony or compensation for moral damage. Then the bailiffs have the right to write off part of the pension benefit as debt. All penalties are made taking into account the cost of living and other aggravating circumstances.

- Bankruptcy of a disabled pensioner who has lost his job. When a person retires due to disability, the court often decides to declare financial insolvency and completely write off debt obligations. Most often, property is not even taken into account. The main thing is to collect a sufficient evidence base: a certificate of disability, doctor’s notes, the approximate cost of treatment for a month and other documents that can sway the court on your side.

- Bankruptcy of a working pensioner. The stages of the procedure are no different, but in this case the court may have doubts that the debtor, receiving pension compensation and wages, is not able to cover the loans. To achieve 100% debt write-off, you need the help of experienced lawyers and arbitration managers who can develop an effective strategy for conducting the case and provide the court with compelling arguments.

Free consultation

Get an answer to any question regarding personal bankruptcy

The meaning of the procedure is simple - a pensioner can declare himself bankrupt if he proves his financial insolvency.

Bankruptcy of a pensioner is a judicial procedure. Having sent an application to the court, the pensioner must prove that his official income does not allow him to pay off his existing debts.

The court takes into account not only obligations to banks or microfinance organizations, but also debts for housing and communal services, contributions for major repairs, road accidents, and even ordinary debts to other people.

A pensioner can go bankrupt for any amount of debt. The size does not matter, only the financial insolvency to ensure the return of borrowed money is important.

The citizen himself or his creditor, for example, a bank, can initiate bankruptcy proceedings for a pensioner. You can start independent bankruptcy for any amount of debt, either less than 500 thousand rubles or more.

To start the procedure, you must fill out an appropriate application and submit it to the Arbitration Court. The document must indicate the total amount of all debts, a list of creditors, a list of property and information about income and expenses.

You should also indicate the name and address of the company whose employee will be appointed as the financial manager of the indebted pensioner.

Experts recommend writing down the reasons that prompted bankruptcy:

- Deterioration of health

- Death of a spouse who helped pay loans or bills

- Decrease in own income

- Other life circumstances

Documents that the court may require:

- Copy of passport, TIN, pension certificate. An account statement will be required from the Pension Fund;

- Documents for property and all information about this property (real estate, financial accounts in relevant institutions, coordinates of location of property);

- Information about individuals and legal entities to whom the debt has arisen (full name, address, amount of debt);

- Documents displaying debt obligations (agreements, receipts, account statements);

- An extract from the Unified State Register of Individual Entrepreneurs showing information about whether the specified individual is or is not an individual entrepreneur;

- Documents showing a person's income. Also, documents showing tax expenses for the period of three years before filing the application with the court;

- Certificate of marriage and birth of children.

After considering the case, the court makes one of three decisions:

- Refusal to review.

- Restructuring of obligations to creditors;

- Absolute cancellation of all debts.

In the first case, the court actually recognizes that the person is able to repay his debt obligations.

In the second, all interest and penalties on debts will be forgiven and a period will be set, on average three years, during which the citizen will have to fulfill all his obligations to creditors.

In the third, the court recognizes the pensioner as economically insolvent, which means that even installment payments will not help him. He will also install a financial manager who will help partially cover the debts by selling the property (we will tell you how to preserve the property in the next section).

The manager's responsibilities will include:

- Valuation and sale of pensioner’s property;

- Partial return of funds to creditors;

- Communication between debtor and creditor.

In different situations, the financial manager may have a positive attitude towards either the debtor or the creditors. If you start the bankruptcy of an individual pensioner yourself, then you can choose the right financial manager. It is his loyalty that determines what property will remain in the debtor’s ownership and how easy the procedure itself will be.

- For five years, it is not allowed to hide information about the fact of bankruptcy when applying for a new loan. That is, during this period you can take out loans, but you must report the procedure completed. And after the ban ends, this information can be kept secret.

- You cannot officially engage in business for 3 years. That is, the debtor will not be able to register an individual entrepreneur or become the head of an organization.

- During the judicial stage of the case, you cannot leave the country for an average of six months. After bankruptcy, traveling abroad is possible without restrictions.

- It will be possible to repeat judicial debt write-off only after 5 years.

- The main thing is freedom from debts and collectors!

- The interested party (debtor or creditors) begins the procedure (submits documents to the court);

- The court appoints a financial (arbitration) manager. The debtor can choose a manager himself by providing the court with information about the SRO (self-regulatory organization of arbitration (financial) managers), of which this manager is a member;

- The court analyzes the citizen’s solvency and finds out whether he really does not have the means to pay his debts, or whether these fears are unfounded. During this time, a ban on the disposal of property is imposed;

- If insolvency is confirmed, the restructuring phase begins. Restructuring is possible if the court decides that the debtor will be able to gradually (over a period of no more than three years) pay off on his own and the creditors agree with this. All prohibitions are lifted, penalties and fines cease to accrue. Creditors and the debtor, at their own discretion, provide the financial manager with a debt repayment plan. A meeting of creditors is scheduled, where a decision is made on the optimal settlement of the situation. A settlement agreement between the debtor and creditors is possible. The agreement can be concluded at any stage of the procedure, as long as the person is not declared bankrupt;

- If the plan is not provided or the creditors do not agree with the proposed restructuring, the manager may propose the sale (sale) of the debtor’s property at auction;

- Official recognition of the debtor as bankrupt. Occurs when all efforts to repay the debt have been exhausted.

- Application for bankruptcy;

- Copy of passport, TIN, pension certificate, account extract from the pension fund;

- Documents confirming ownership of property and all information about existing property (bank accounts, location of property);

- Information about creditors (full name, address, amount of debt);

- Documents confirming the debt (agreement, receipts) and the inability to pay debts (account statements);

- An extract from the Unified State Register of Individual Entrepreneurs confirming the presence or absence of individual entrepreneur status;

- Documents confirming income and taxes for the last three years;

- Certificate of marriage and birth of children.

We suggest you read: Where to get documents on bankruptcy of a developer

How can a pensioner be guaranteed to go bankrupt?

We considered the question of whether bankruptcy of pensioners is possible. However, given their often insufficient legal protection, it is best to entrust bankruptcy to specialists. A credit lawyer will help you achieve successful recognition of financial insolvency:

- pensioner by age or length of service;

- working pensioner;

- disabled pensioner;

- a military pensioner or retired law enforcement officer;

- pensioner guarantor.

By turning to bankruptcy lawyers for help, you can be sure that in the event of bankruptcy of an individual, your pension will be retained to the maximum extent possible, without infringing on the rights of pensioners to a decent standard of living and medical care.

Our specialists have developed several schemes for providing bankruptcy services to citizens: from assistance in drawing up an application to the court to turnkey bankruptcy for pensioners. This includes the possibility of payment by installments.

You shouldn’t wait for aggravation of relations with creditors, or for bailiffs to come to you - it’s better to immediately start filing your own financial insolvency in 2020 and within 8-10 months gain complete financial freedom.

You can get legal advice on all issues related to the bankruptcy of pensioners by calling us at the phone number listed on the website or using the feedback form.

Any citizen of the Russian Federation whose age is over 18 years can declare himself bankrupt or become one by a court decision after filing an application with an authorized body. Since the law on bankruptcy of individuals, which came into force on July 1, 2020, does not indicate an upper age limit, the answer to the question of whether a pensioner can exercise this right is positive - he can.

But let’s return to the sources: Chapter 10 on bankruptcy of a citizen was added to the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)” in 2014 and began to work in 2020. In accordance with the amendments, now bankrupt status can be obtained not only by a legal entity or individual entrepreneur, but also by an ordinary citizen who does not have the financial ability to fulfill his obligations to creditors (banks, housing and communal services, microfinance organizations, other individuals if they have receipts, etc. ), and his regular income and assets are not enough to cover the debt.

For example, bankruptcy of a pensioner without property has already become widespread. Let us remind you that a pensioner’s only home cannot be sold to pay off debts, so only household appliances, cars or excess luxury items can be sold.

For many retired individuals, bankruptcy becomes the main way out for writing off unaffordable debts and getting rid of intrusive debt collectors.