Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: November 26, 2019

Reading time: 5 min

7

229

Failure to make regular loan payments results in overdue debt to the bank.

- The dangers of having debt

- Checking for debts via the Internet Bailiffs website

- Credit History Bureau (CBI)

- Register of information on bankruptcy of individuals

- other methods

What are black lists and stop lists?

Only disciplined payers are not included in banks' blacklists . And if a person deposits certain amounts, but does it late or completely refuses to repay the bank, then he will definitely be on this list.

You can get on the stop list on the following grounds::

- the presence of long or regular delays in payments;

- deception of bank employees when applying for a service (meaning the transfer of knowingly false information);

- fraudulent transactions;

- the client is declared incompetent or has mental illness;

- the presence of a prison sentence;

- sanctions from law enforcement officers (was wanted, debts were repaid through the courts, etc.).

For example , if a couple of times, while filling out documents when applying for a banking service, you accidentally made a mistake in your passport data, then you can easily get on the specified list. It is understandable if such an incident was an isolated incident, but if it is repeated several times, then you will definitely be suspected of fraud.

How bad is it to be blacklisted? You will definitely have difficulties applying for a loan , loan or opening a credit card.

Although there will be no difficulties with opening a debit account or deposit , because in this situation the client’s solvency does not matter to the bank. Having the client's name on the stop list is a more unpleasant problem.

In this case, banks will not want to have any business with the client. This is due to repeated attempts to present false information.

Are there bank blacklists?

Do banks really have blacklists that customers are afraid of getting on? Many financial structures have internal regulations that apply to employees and apply to the activities of the organization. If the borrower is several days late on his next payment, he will be warned about the possibility of being included in the blacklist. But in fact, only malicious defaulters who have made several delays and have large debts end up there. And in this case, when applying for a new loan, the person will definitely be refused.

Which debtors are blacklisted

There is no such thing as a “black list” at the state level . Banks use it. That is, the same person can be blacklisted by one bank, but be a priority for obtaining a loan from another institution. The blacklist includes those borrowers who have not repaid their debt to a specific lender.

Who can be blacklisted:

- who has an existing loan that is systematically in arrears;

- persons who obtained loans using forged documents. In this case, the list includes the data of the person in whose name the product is registered;

- entities that have not repaid their debt and have been declared insolvent by the court.

In any case, the criteria for those included in such a register are determined by the specifics of the institution’s credit policy .

What does the list look like?

It is impossible to say for sure what the list looks like. But if we are talking about credit history, then it contains the following information :

- When was the loan issued? Based on what agreement (number).

- Date of signing and type of loan agreement: mortgage, car loan, card, etc.

- The institution that issued the funds.

- The amount of the loan taken.

- It is indicated whether the loan is repaid, whether it is current, and whether there were any delays on the product. In this case, the delay is indicated in gradations from the period: up to 30 days, from 30 to 90 days, etc.

- The total amount of debt is indicated, taking into account the accrued fine and penalty.

You can find out such a credit history through the Credit History Bureau . There are several of them in Russia. There are private companies and state-owned ones.

You can also check the information through the database of enforcement proceedings. This database is presented on the website of the Federal Bailiff Service. This database contains the following information :

- In which court and region the case is being heard.

- Who is the plaintiff and defendant?

- Number of enforcement proceedings.

- Subject of execution.

But the information is presented in the database when enforcement proceedings have been initiated against the debtor. Otherwise, the data will not be in the bank.

Why do banks refuse?

If a loan is refused, how do you find out the reason? When considering applications from potential clients, banks study their credit histories. The CI reflects all transactions performed by the borrower, including dark spots on the reputation. These are debts, all delays, open contracts and other information that may affect the outcome of the application.

A common reason for bank refusals is not the client’s being on the blacklist, as many believe, but his damaged credit history, which reflects financial transactions and features of the execution of debt transactions. Not everyone ends up on the blacklist, but the CI reflects all mistakes made while complying with the terms of the contracts.

Has a unified data bank on defaulters been created?

Debtors are a problem for any financial organization. Nobody wants to deal with people they can't trust. For this purpose, separate registers are created for each bank . But this information is available to the National Credit Bureau.

Note! The BKI receives all collected information about non-payers. This information is stored for 15 years. At the same time, there are unified databases of different departments, where information about bank clients who do not pay their debts is also transmitted.

The Bailiff Service has created a second unified register of debtors . These lists contain persons against whom enforcement proceedings were initiated.

Searching for a person in such lists is made easier by the fact that identification is carried out by last name and first name. But this register contains information about citizens who have passed the judicial stage.

The unified register of persons who are insolvent was created with the aim that among individuals and legal entities it would be possible to recognize those with whom financial transactions should not be concluded. Also included in the register are borrowers of financial companies who have accumulated debts.

So, we have listed the main databases where debtors are listed. But large creditors, for example Sberbank of Russia, have their own “black lists” . They record bank clients who were unable to fulfill their financial obligations. You can also find information about defaulting borrowers here.

Gaining access

Is there a chance for an ordinary person to look at lists of bank debtors? Based on the fact that banks have the right to maintain trade secrets, there is no such access for ordinary people .

But no one took this right away from law enforcement agencies . This way, they can get similar information if they need it for a specific case. If a person is a client of a certain structure, he can contact the lender with a similar request.

Things are different with a unified database of debtors . Of course, no one will publish the names of the debtors and put them on public display. But those who wish to do so always have the opportunity to obtain information about a potential borrower. This can be done by sending a corresponding request to well-known unified registries.

Note! Sometimes, so that a person can obtain information that concerns him personally, he submits his documents. These are the norms of the Law “On Personal Data”.

Organizations that own data on persons blacklisted by banks put forward their own special requirements for obtaining information. The easiest way is to obtain personal credit history information.

The Bank of Enforcement Proceedings is perhaps the only “open” database that can be accessed quite easily. Next, let's look at some of the nuances of the openness of the above-mentioned resources.

Credit Bureau

Citizens of the Russian Federation can obtain information from the NBCH completely free of charge, but only once a year . Other cases will be paid.

If a person applies again, he will have to pay from 595 to 795 rubles . Such amounts are determined by the frequency and quantity of circulation.

You can only get information about your credit history . Information about other debtors is not available, and attempts to disclose them are illegal. It was already mentioned above that the Bureau stores data for 15 years, which guarantees its reliability. The blacklist itself is formed using information provided by various banks in the country.

The register provides information about lending, fines and taxes, criminal records, etc. The advantage of such registers is obvious.

To obtain the necessary information, the applicant submits a passport, information about the place of registration and actual place of residence. He draws up a special request and signs it. The signature must be certified.

In order not to deal with paperwork, it is better to contact the institution yourself . But since there are few such places in the country (20 branches), requests are sent by mail or sent via the Internet.

Federal Bailiff Service (FSSP)

If the defaulter’s case has gone through the Bailiff Service, information about him is immediately transferred to a single database compiled by representatives of the enforcement service. Thus, this register contains persons for whom a court decision was made.

Note! These are public lists. That is, anyone can obtain information about people included in the register.

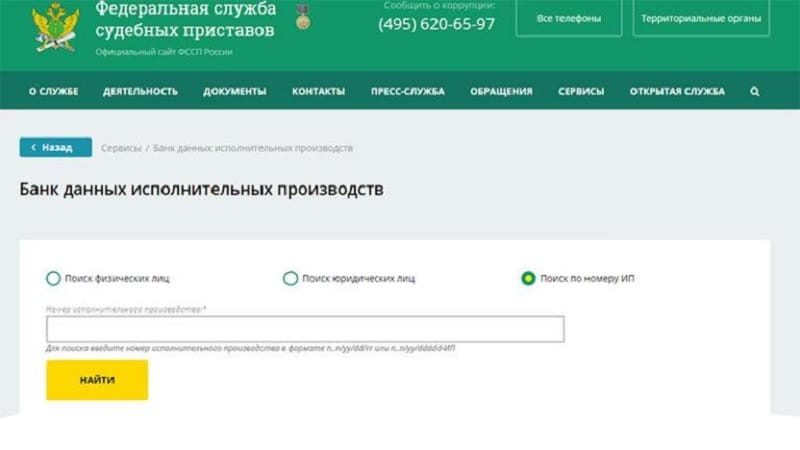

Access to the bailiff database is free. To clarify the debt situation, you need :

- Open the organization’s website, select the “Data Bank of Enforcement Proceedings” option.

- Select search criteria: by individuals, legal entities, individual entrepreneurs; search for individuals is installed by default.

- Information about the registration of the debtor, full name, date of birth is entered in the empty fields.

- After clicking on the “Find” item, the captcha is entered.

The result of the work done is obtaining a list of persons whose data corresponds to the application . Searching for individual entrepreneurs requires indicating the number of the writ of execution. This limits the number of persons who have access to information.

I like the Bailiff Service registry because all information is provided online. It takes at least 2-10 minutes to request and receive a response.

Important! Persons who have repaid the debt, as well as those citizens whose enforcement proceedings have been completed, are not removed from the list.

The same picture occurs in the situation with the termination of forced collection (according to paragraph 4 of Article 46 of the Law “On Enforcement Proceedings”). This algorithm of actions allows creditors to respond to the situation in a timely manner and compensate for the financial damage that arose due to the fault of the defaulter.

If a person was convicted of failure to fulfill financial obligations , then this fact will be publicly available. Usually, a mark is placed next to the full name of the defaulter, which states the reasons for ending the enforcement proceedings.

If a person wants to get a loan in the future , but is not sure of his solvency, he should think about the last described fact.

Unified Federal Register of Bankruptcy Information

This register contains information about insolvent individuals and legal entities . Anyone can receive information. But at the same time, information is available only to those who can introduce themselves and declare their status.

In addition, you need to be registered SRO users . In this case, documents confirming the applicant’s right to access information are attached to the request.

Important! And in this situation, there are “protective barriers” that do not allow the full disclosure of personal data of insolvent citizens and organizations.

The EFRSB opens information about bankrupt individuals and legal entities online. You can find out information about a specific person free of charge . The site interface is simple, so a person will receive information online within 5 minutes.

Follow these steps to get the information you need::

- The empty lines of the form are filled in with the initials, address, and region of residence of the defaulter.

- The division of debt is noted.

- Indicate TIN, OGRNIP/SNILS.

How to analyze your creditworthiness yourself

How can I find out which loans are issued to me? To find out this and the likelihood of being blacklisted by banks, or simply to analyze the creditworthiness and chances of approval of the application, you need to contact the bureau .

There are several ways to request:

- In the office . To find out the CI, come to the branch, write an application and wait for an answer. The service is provided once annually for free, and any number of times - for money. The cost ranges from 400-500 rubles.

- Through the Internet. To find out your credit history, you need to go to the website. Many BKIs have Internet resources, but only three large ones have online services for users. This number includes Russian Standard, Equifax, OKB. Register, identify yourself to confirm your identity, log in, deposit funds into your account and leave a request.

- At partners, for example, in communication shops or in branches of agent banks: Sberbank, Pochta Bank, B&N Bank. The service will be paid, the cost is fixed and set by a specific partner.

- By mail . You can send a written request with a notarized signature or send a telegram with feedback information.

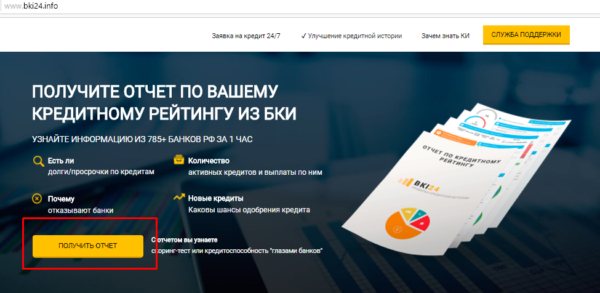

- Through services. You can find out whether you are blacklisted by banks and whether loans have been issued to you through specialized services, such as ➥ “BKI24.info”, which cooperates with “NBKI”. Leave a request on the website by filling out a short form, make a payment, wait for a response by e-mail. From the report you will find out your loans, the results of passport verification against blacklists and much other useful information.

Which institutions share information?

Getting a loan with a damaged credit history is not easy. Few financial institutions are loyal to malicious defaulters . They are developing special programs for unreliable clients (these are offered by Tinkoff, Renaissance Credit, Citibank), but the rate will be high.

Russian standard

When signing a contract, you need to carefully study the clause regarding delays . At the initial stage, this institution notifies the client about non-payment through mail notifications and calls. After approximately 2 weeks, the case is received by the debt collection department, and the data is entered into the BKI. If the situation turns into a problem, the financial institution can sell the debt to a collection company or file a lawsuit.

Note! To view payments on a Russian Standard loan, you can use the unified database of defaulters provided by the FSSP website. There is no need to go to paid services with hacked lists of debtors, they are created by scammers

Another option is to contact the financial institution with which the financial institution works . To find the location where client data is stored, you should send a request from the website of the Russian Bank to contact the central catalog of credit histories.

also send a letter by regular mail or email . A client of a financial institution has the right to receive information not only about the status of loan payments, but also about the financial institutions that sent them to the bureau, individual entrepreneurs, and legal entities that had access to payment reports. A person also has the right to partially or completely challenge what was received by submitting a special application to the BKI.

Alfa Bank

If a person is unable to repay the loan, then one should not aggravate the situation by ignoring bank alerts . If problematic situations arise, you must contact the branch with an application for a deferment or debt restructuring, receiving a new payment schedule with a different interest rate (different financial organizations have different rates). The rate may be higher, but there is a chance to safely pay off the debt, improve the state of your credit file, and remove your name from the blacklist.

If there are delays in payment, the bank sends notifications about the need to make payments. After some time, the banking institution has the right to sell the debt to a collection company or, under special conditions, offer to issue a new loan in order to close the debt in another institution.

You can clarify the data on payments at Alfa Bank by submitting a request to the Equifax Credit Services Bank . This is done in writing or online through a branch of the financial institution. The BKI report contains personal data (full name, series, passport number, telephone number), terms, amounts of loans, overdue payments, and a list of creditor organizations. The service is paid, the cost is 1000 rubles.

Debtors of Sberbank

To find out what is the list of debtors of Sberbank , whether the person’s name is in the unified database of the Federal Bailiff Service, you can fill out a special application on the website by going to the “Bank of Enforcement Proceedings” section, or use the help of BKI.

You can clarify your data at any time through the Sberbank Online service . The result of the request about the status of the credit file will arrive in a couple of minutes. An ordinary client cannot obtain information about other debtors of this bank; access is open to some managers who are deciding the issue of issuing credit funds.

The algorithm of actions is as follows:

- Log in using your username and password.

- Select the Other - Credit history option, submit an application.

- The report will appear automatically.

Home Credit Bank

For late payments, this institution fines from the first day of non-payment . If the situation worsens, the creditor will demand early repayment of the debt. Actions are recorded in the borrower's file.

In order not to be blacklisted, if any difficulties with payment arise, the client must:

- Notify about the impossibility of paying the amount 2 weeks before the payment date.

- Postpone the payment date once, taking into account interest for the days missed before the payment date chosen by the client.

- File bankruptcy (subject to certain conditions), apply to the arbitration court at your place of residence.

Where to find out about loans

How can I find out which banks I have loans from, including open and outstanding ones? You can contact these financial institutions and request statements. But if the borrowed funds were received a long time ago, you could simply forget who issued them.

Banks have archives and electronic databases that store information about clients. But any officially registered and legally operating organization undertakes to transfer information from contracts to the credit history bureau.

Bank credits appeared in the country more than ten years ago, and the need for their creation was associated with the development of the credit system and its introduction to the masses. The bureaus were created to collect, systematize and store information, and initially they collaborated with financial institutions that assessed the creditworthiness of potential clients.

Today, there are seventeen bureaus operating in the Russian state, and not only banks and other lenders, but also ordinary citizen borrowers turn to them. The financial institution from which you received borrowed money could transfer data about this to any bank account, so to check your loans, first try to find out where the information is stored.

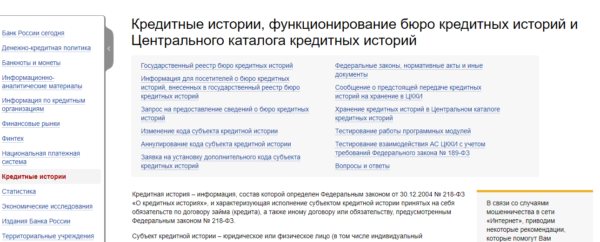

In the BKI you will not find blacklists , but you will receive a report characterizing the creditworthiness and integrity of the borrower. You can find out where your credit history is stored on the Central Bank website in the Central Catalog of Credit Histories. Through the CI section, select the information request item and fill out the form, indicating personal, passport and contact information, subject code.

Blacklist of debtors: what are the consequences

A person included in the unified FSSP database may have difficulties traveling abroad . Such bans first began to be used in 2005. Although, if you have debts, this does not mean that the restriction regarding you has already come into force.

If you have any doubts, check the status of your debts on the FSSP website before traveling. Usually they don’t let people go abroad only when an individual entrepreneur is open.

We are talking about situations like this:

- the requirements specified in the writ of execution received on the basis of a court decision were not fulfilled at the specified time;

- a claimant's application has been drawn up in the case provided for in Part 2 of Article 30 of the Federal Law (when the executive document is an act or issued on the basis of it);

- collectors or a bailiff filed an application with the court to prohibit the debtor from traveling abroad (temporarily).

The defaulter must be informed of the existence of such a decision . To do this, copies of the relevant documents are sent to his address (specified in the court decision). If the credit debt is less than 5 thousand rubles, the ban on travel abroad does not apply.

If your name is among the debtors of Russian Standard, Home Credit Bank or other credit organizations, the first thing to do is to pay off all debts. After this, a receipt for full repayment of the debt is presented to the court.

Important! According to the law, based on the evidence presented, the ban on traveling abroad is lifted within 24 hours. In fact, the time frame for making such a decision is often extended. Sometimes such a decision may appear only after 30 days.

Who will benefit from information about debtors?

By monitoring such information, organizations reduce financial risks and minimize non-returns. Debtors have the right to correct the situation. Strict conditions on the part of lenders are becoming a necessary measure : more than half of borrowers are behind on payments. Financial institutions are reinsuring themselves, reducing economic risks: pre-trial collection through collection companies or internal banking resources do not give the expected result.

Those wishing to borrow a large amount for mortgage lending should definitely check the blacklists in advance . Lenders update their databases from time to time. MFOs offer borrowers to improve their credit reputation by taking out a small loan, but such offers are unprofitable due to high rates and overpayments. For these reasons, it is better to avoid overdue loans and constantly monitor personal accounts.

What to do if you are on the list

People have different reactions to the fact that their name appears on the bank's blacklist. Often they simply don't pay attention to it. Attempts to go to the bank to somehow negotiate with the financial manager. organizations will lead nowhere.

Therefore, in order for people to believe in you again, you need to take yourself seriously and change your attitude towards fulfilling financial obligations :

- The first thing you need to do is repay the debts to the bank.

- If you are included in a special list of unreliable clients, try opening a deposit account with this institution. And then - regularly transfer funds to it, carry out various banking transactions on your account, regularly pay through bank com. services. All these actions will show managers that you can be dealt with as a responsible client.

- Often salaries are transferred through a bank. If suddenly this is a bank with which you have a tense relationship, open a current account with it, where the employer will regularly transfer your salary. Constant replenishment of the account is a guarantee of regaining trust in the client. That is, a chance to get off the blacklist.

Ways to Improve Your Credit Score

Anyone can worsen their credit history. But there are ways that will help improve it qualitatively. This does not mean that you will be excluded from the blacklist of a particular institution. But the fact that your rating will improve is clear. We will tell you below what will help improve your credit rating.

Applying for a credit card

Active use of the card. You can now get such a product in almost any institution . It doesn’t matter what limit is set on the card. The main thing is that the borrower fulfills his obligations on time every month. By paying the minimum monthly fees on the card, the client receives “pluses” to his rating.

Applying for a microloan in microfinance organizations

MFOs say that they are ready to work with any segment of the borrower . The company promises to issue loans even to those who have a bad credit history and no official income. You won't be able to get a huge loan right away. It doesn't matter.

It's better to take less, but more. Get a loan for 300 rubles and repay it immediately. Then register the product for 600 rubles, etc. MFOs transmit information to the Credit History Bureau.

Take out a consumer loan in a store

As a rule, stores where there are bank representatives arrange an installment purchase service on the spot , providing the client with a guarantee for receiving the service. A consumer loan also improves the rating.

Pay off at least one of your debts

This is a guaranteed option . If the debt is closed, the bank closes the debt completely. History is completely corrected.

We also remind you that for a couple of years in Russia there has been the right to declare an individual bankrupt . The procedure is not very simple. To initiate it, you must meet certain criteria. The decision on bankruptcy is made by the court. But as a result of legal proceedings, some debts may be written off, some loans cancelled, and some debts will be restructured. Bankruptcy does not completely improve your credit history, but it does help improve your score by a few notches.

Loans secured by property

Having property as collateral is an effective way to get a microloan for a borrower with a bad credit history. Such loans (secured by a car or real estate) cannot be issued online; this is only possible in the company’s office.

The maximum amount of borrowed funds in this case is 50-70% of the market value of the collateral property, and the assessment is carried out directly at the microfinance organization. Also, the borrower can independently contact an independent expert and come to the branch of the credit institution with an assessment report.

In the case of a transaction secured by property, in addition to the loan agreement, a pledge agreement is drawn up. The property remains the property of the owner, but certain restrictions are placed on it. The borrower does not have the right to re-mortgage/sell it as long as the debt on the loan exists.

Look at the same topic: Loans in Novosibirsk using a passport or secured by a passport

If the borrower refuses to repay the debt, the financial institution, through the court, receives the right to own his property and will be able to sell it at auction to cover its costs.

Rating of companies issuing microloans indiscriminately

The best microloan offers:

| MFO | Rate per day | Maximum amount, rub. | Maturity |

| "Mig Credit" | from 0.27% to 1.45% | 99 500 | up to 336 days |

| "eKapusta" | 1.49% | 30 000 | up to 21 days |

| "Bystrodengi" | from 0% to 1.5% | 30 000 | up to 30 days |

| "E Loan" | from 0% to 1.5% | 30 000 | up to 30 days |

| "Lime" | from 0% to 1.5% | 70 000 | up to 168 days |

By submitting an application for a microloan, you can receive it in 10-15 minutes. find out the preliminary decision of the microfinance organization and receive money on favorable terms.