Inventory of a citizen's property

3 months from the start of the procedure New practice. Everything is based on integrity and reasonableness))))

- 356 KB Views: 457

Note page 8 “In any event, the financial manager was obligated” This is the end of the sentence and paragraph quotation. Very similar to the 37 troikas.

I had to, period. Is it also possible to change the locks in the debtor’s apartment?

Arbitrariness and restriction of civil rights and freedoms to reside at the place of registration (location of property) I think this will be problematic from the point of view of common sense.

And where is the guarantee that the locks will not be broken half an hour after the manager leaves?

Moreover, by providing access to their belongings as self-defense of the violated right to use residential premises.

Is it also possible to change the locks in the debtor's apartment? Based on the general message of such positions of the courts, it is possible not only to change the locks, but also to act on behalf of the debtor in bed with his wife. If, of course, everything is done in good faith.

Reactions: New practice. Everything is based on conscientiousness and reasonableness)))) IMHO: here they were punished for “delaying” - which seemed like objective obstacles in 3 months (by analogy with the KP) for the inventory it was not interesting this: did anyone change the locks? entered the residential and non-residential premises of the debtor without his consent? property was otherwise confiscated without a bailiff - on the principle of “I have the right to dispose of it.”?

if so, share your experience - how it was) IMHO: Article 25 of the Constitution applies only to the residential premises in which the debtor lives. Question: does the provision of Article 25 apply to all other residential premises of the debtor? (home, IMHO, then where is it registered; and if not registered anywhere from several objects?) Last edited: September 19, 2020 Pay attention to page 8 “In any case, the financial manager was obliged” and the judge of the Supreme Court in the ruling dated December 26, 2018 of the debtor Alimova A.

Inventory during insolvency proceedings

As you know, there are four such stages: observation, financial recovery, external management and bankruptcy proceedings. During external management, the management of the enterprise is removed from work. Then all the debtor’s property passes into the hands of the arbitration manager and he is obliged to conduct an inventory of it.

In this case, this is an integral stage of bankruptcy. Since this is essentially a rehabilitation procedure, inventory plays a non-determining secondary role. Whereas in bankruptcy management, its importance is difficult to overestimate: it is on the basis of this procedure that the bankruptcy estate is formed, which will subsequently be auctioned off to pay off obligations.

Therefore, the success of the business for creditors depends on the completeness of the information in the inventory. The former management of the enterprise is assigned the obligation to transfer all the necessary documentation for the inventory within three days after.

But this is usually only in theory.

In practice, the appointed manager usually gets into his hands a bankrupt enterprise, where the necessary reports are not submitted and documentation is not properly maintained. Moreover, the employees of the enterprise often create various barriers to the normal work of the manager in drawing up the inventory. Therefore, in practice, inventory in bankruptcy is a rather labor-intensive process. The temporary manager needs to make a lot of effort to find all the debtor’s property that is on his balance sheet or return that which was illegally alienated or transferred into the hands of interdependent persons. During monitoring and recovery, an inventory of property the debtor is not required, but is desirable for the actual accounting and control of inventory and fixed assets in order to take measures to improve the efficiency of the enterprise. At these stages, the manager can either use the finished results of a previously completed inventory or directly participate in the procedure or initiate it. The inventory of the enterprise’s obligations, which is carried out during the bankruptcy procedure, is documented in the register of creditors.

Property inventory period for bankruptcy of an individual

After the sale of the common property, the spouse's share is allocated.

If the owner of the property is the wife, then the procedure will look different.

Lenders must submit an application to allocate part of the property owned by the borrower. How to preserve common property To preserve common property, you can use one of two methods:

- sign an agreement on changing the joint ownership regime;

- write and sign a marriage contract by both spouses.

It is important to understand here that creditors can try to challenge any agreements, and the transaction will not be recognized. The inventory procedure is paid for by those persons who voted for its implementation.

- The property assets described as a result of the inventory process are sold at auction.

- If the arbitration manager has not fulfilled his duties or the creditors have waived any claims against the debtor, the owner of the property is restored to his rights.

- The starting price of inventory items at the auction is determined by the bankruptcy creditors. If any disagreements arise between them, each of them has the right to file a claim with the arbitration court. The sale of collateral is organized in accordance with the provisions of the Federal Law.

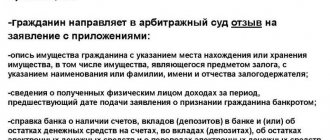

If a citizen has no property and no income, then he can declare himself insolvent. In this case, funds will only be needed to declare bankruptcy. To confirm the availability of such funds, a citizen will need to submit the following documents:

- a check confirming payment of funds;

- a letter with guarantees that the citizen can cover all costs of the bankruptcy process.

- papers stating that the bankruptcy case is being successfully conducted;

- certificate in form 2-NDFL (needed to confirm the availability of funds to conduct a bankruptcy case);

Thus, even a citizen who does not have any property can declare himself bankrupt.

Extend the period for inventory of the debtor's property

Based on the submitted inventory, the bankruptcy estate is subsequently formed. During the control, the financial manager excludes some property from the list submitted by the citizen.

This, in particular, is the only housing, property less than 10 thousand rubles. Deadlines for making an inventory of property in case of insolvency The bankruptcy law does not contain any deadlines for carrying out the inventory procedure.

The procedure and timing of the procedure are approved by the financial manager in the work plan and agreed upon at the creditors' meeting. But the manager should not delay this process too much: he must act reasonably and in good faith to maintain the balance of the debtor, his creditors and society. This is indicated by the 2020 Arbitration Court ruling.

Info Therefore, managers abused their duties.

Inventory in the event of bankruptcy of a legal entity. Powers of the arbitration manager. Certain cases of bankruptcy proceedings vest the arbitration manager with the following powers:

Rules for taking inventory in bankruptcy

In the case of an initiative (voluntary) inspection, the procedure and timing of the inventory in the organization are established by it independently. In the case of a mandatory audit, certain rules for conducting an inventory are prescribed by law.

Let's talk about them in more detail. Inventory deadlines before preparing annual reports Every company must conduct an inventory at least once a year before preparing annual accounting reports. With such a check, the company establishes the actual condition of its property and, if necessary, makes adjustments to the accounting data.

When should such an inventory be carried out? Let's turn to the regulations.

Important The Company Insolvency Law provides for the introduction of one of or four stages in succession:

- supervision, financial recovery, external management, bankruptcy proceedings.

At the observation stage, measures are sought to preserve the debtor’s property, a temporary manager is appointed, who collects information about the company’s capabilities and draws up a register of creditors’ claims.

Also at the observation stage, a meeting of creditors is held, which approves one of the three subsequent procedures and appoints an insolvency practitioner. At the stage of financial recovery, the head of the company manages it together with the administrative manager and under the supervision of a committee of creditors. At the stage of external management, the company's management is removed from management and an external manager is appointed.

The inventory procedure is paid for by those persons who voted for its implementation. The property assets described as a result of the inventory process are sold at auction.

The starting price of inventory items at the auction is determined by the bankruptcy creditors.

Inventory deadlines in bankruptcy proceedings.

If any disagreements arise between them, each of them has the right to file a claim with the arbitration court. The sale of collateral is organized in accordance with the provisions of the Federal Law.

Carrying out an inventory of the debtor’s property during bankruptcy proceedings

When conducting an inventory, the actual availability of property is identified, the actual availability of property and its condition are compared with accounting data, and the completeness of the accounting of the organization’s obligations is checked.

Rules for conducting inventory in bankruptcy.

Discrepancies identified during the inventory between the actual availability of property and its condition and accounting data are subject to appropriate reflection in the accounting accounts.

Currently, when conducting an inventory, the Guidelines for taking an inventory of property and financial obligations, approved by order of the Ministry of Finance of the Russian Federation, are used. 4. The Bankruptcy Law of 1992 also established the duty of the bankruptcy trustee to conduct an inventory of the property (assets) of the debtor and his obligations (liabilities).

Despite the fact that during the period of external management a similar duty was assigned to the arbitration manager, practice has shown that in cases where the arbitration manager removes the debtor’s manager from performing duties for managing the debtor, as well as in order for the arbitration manager to develop a plan for external management of the debtor’s property, an inventory of property and obligations of the debtor was also carried out within the framework of external management of the debtor’s property.

5. Carrying out an inventory of the debtor’s property and obligations, as a rule, is the first and necessary step in assessing the debtor’s property, which should be understood as determining the value of the property owned by the debtor.

The purpose of the assessment is to establish the value of the property, which allows us to estimate with a sufficient degree of reliability the proceeds that are expected to be received as a result of the sale of this property. There are different types of cost: for example, the original cost of fixed assets (i.e.

i.e. the cost of these assets when they are registered by the debtor, which is determined on the basis of their acquisition prices, construction costs, etc.

and may increase

The role of inventory in the bankruptcy of an organization or individual

For your information, the inventory process in bankruptcy is regulated by such regulatory legal acts as the Law “On Accounting”, Regulations on Accounting and methodological guidelines for maintaining inventory and obligations in the financial sector. Goals of the process in case of insolvency of a legal entity An inventory of the property of an enterprise declared bankrupt is aimed at achieving the following goals:

- Identification of actual property indicators.

- Comparison of the actual availability of property with what is contained in accounting documents.

- Checking how realistic the obligations that have been taken into account are.

The bankruptcy estate, formulated as a result of the inventory of property during bankruptcy, is a source of funds for settlements with creditors through open tenders.

Info

Home Latest news for today Inventory in case of bankruptcy of a legal entity At the final phase of the insolvency procedure of a legal entity, bankruptcy proceedings are introduced, taking place under the control of an arbitration court. From this moment on, the debtor is declared bankrupt and the main task of the bankruptcy trustee is to conduct a complete inventory and assessment of the enterprise’s property.

In addition, he must ensure the safety of valuables.

— Law “On Accounting”; — Regulations on maintaining accounting records; — Methodological guidelines for inventory of property and financial obligations. Forms of primary documents for recording inventory results and instructions for filling them out are approved by Resolution of the State Statistics Committee of the Russian Federation No. 88. According to Art. 12 of the Law “On Accounting”, etc.

The concept of bankruptcy is defined by the Federal Law “On Insolvency”. The inventory process is regulated by Articles 70, 99 and 129, 213.26 of this provision. According to them, inventory during bankruptcy consists of several stages:

- Transfer of necessary documents to the inventory commission.

- Establishing the property that is actually owned by an individual or legal entity.

- Data analysis that compares the actual availability of property with what the documents reflect.

- Documentation of inspection results. They should reflect the identified discrepancies.

We suggest you read: How to check the correctness of rent calculations

Based on the results of the inventory, the claims of creditors are satisfied. Inventory in the event of bankruptcy of an enterprise Inventory involves the transfer of assets by the enterprise to the arbitration manager. His job is to preserve and inventory them. One of the duties of the bankruptcy trustee is the obligation to conduct an inventory of the property of the bankrupt company (Article 129 of the Bankruptcy Law of October 26, 2002). Until December 21, 2016, specific deadlines for conducting inventory in bankruptcy proceedings were not established.

This created certain difficulties in practice due to the improper fulfillment of this duty by bankruptcy trustees. The situation was corrected by introducing changes in this part by Federal Law of June 23, 2020.

Important

The Company Insolvency Act provides for the introduction of one of or four stages in succession:

- observations,

- financial recovery,

- external control,

- bankruptcy proceedings.

At the observation stage, measures are sought to preserve the debtor’s property, a temporary manager is appointed, who collects information about the company’s capabilities and draws up a register of creditors’ claims. Also at the observation stage, a meeting of creditors is held, which approves one of the three subsequent procedures and appoints an insolvency practitioner.

The table presents a step-by-step procedure for bankruptcy proceedings, clarifying the specific deadlines and legislative basis for each action.

| № | Element of the bankruptcy process | Deadlines | Article of the law |

| 1 | An individual entrepreneur or legal entity cannot pay off its obligations; the amount of debt has increased by more than 10 thousand rubles. | More than 3 months after the expiration of the obligation | Article 65 of the Civil Code of the Russian Federation |

| 2 | The arbitration court, considering a bankruptcy case, decides to declare a bankruptcy trustee and approve a bankruptcy trustee | On the day of bankruptcy declaration | Clause 4 art. 72 of Federal Law No. 127 of October 26, 2002 |

| 3 | Notification of the bankruptcy proceedings of the debtor - individual entrepreneur or legal entity, issuance of an order for the transfer of all documents, stamps and remaining property of the newly-made bankrupt to the appointed administrator. | On the same day | Clause 2 art. 126 Federal Law |

| 4 | Transfer of all of the above, activation of this procedure (it is desirable that one of the debtor’s former employees be a member of the inventory commission) | Within 3 days | Clause 2 art. 126 Federal Law |

| 5 | Notification of the Federal Tax Service in the prescribed form about the bankruptcy of an enterprise | Within 3 days after delivery of documentation | P.2. Article 23 of the Tax Code of the Russian Federation |

| 6 | Publication of a message about the introduction of the CP in the media (Kommersant) with notification of the Arbitration Court | 10 days after the appointment of the CP | Art. 28, 126 Federal Law |

| 7 | Transfer by the Federal Bailiff Service of all enforcement documents to the bankruptcy trustee | 10 days after the appointment of the CP | Art. 126 Federal Law |

| 8 | Collecting information about the debtor’s property: sending requests to various organizations where it can be recorded, for example, the land committee. FSS, banks, registration service, etc. | During the entire term of the CP | Art. 126 Federal Law |

| 9 | Notice of impending dismissal is given to the bankrupt’s employees (it does not matter whether the activity is ongoing or not) | Within a month after the start of the procedure | Art. 129 Federal Law |

| 10 | Selecting one bank account (main) on which all accumulated funds will be collected, closing other accounts (if any) | In continuation of KP | Article 133 Federal Law |

| 11 | Drawing up a complete inventory list with the involvement of independent experts to evaluate the property | 30 days from the beginning of the CP | Art. 129-131 Federal Law |

| 12 | Identification of debts to a bankrupt enterprise. If any are discovered, debts are declared for collection, existing contracts are suspended, and transactions are declared invalid. If part of the bankrupt’s property is in the possession of third parties, it must be found and returned. All procedures should be reflected in reports. | Constantly during the CP | Art. 102, 103,129 Federal Law |

| 13 | Formation of the bankruptcy estate, approval of the terms of its implementation at the meeting of creditors. In case of disputes, the Arbitration Court will reconcile everyone | Before 6 months have passed | Art. 131, 132, 139 Federal Law |

| 14 | Open auction for the sale of property with preliminary publication in Rossiyskaya Gazeta and local publications | In accordance with the terms adopted at the meeting of creditors | Art. 139 Federal Law |

| 15 | Settlement with creditors: first, legal costs, repayment of current claims, then - according to the register. If there are not enough funds, the calculation is proportional for each queue | After the sale of the bankruptcy estate | Art. 142 Federal Law |

| 16 | After all payments, the main bank account is subject to closure, of which the tax office is notified along with an application for deregistration of the debtor | 10 days after application | Clause 5 of Article 84 of the Tax Code of the Russian Federation |

| 17 | All documents of the debtor subject to storage are transferred to the archive | It is better to start preparing immediately after the introduction of the CP | Art. 129 Federal Law |

| 18 | Report on the results of the CP to the arbitration court | After settlement with creditors | Art. 147 Federal Law |

| 19 | Publication in the media of a message about the termination of a bankruptcy case (Rossiyskaya Gazeta) with notification to the Arbitration Court | After the decision of the Arbitration Court | Article 28 Federal Law |

| 20 | Exclusion of the debtor enterprise from the Unified State Register of Legal Entities | Until this moment, the bankruptcy trustee exercises his powers | Art. 149 Federal Law |

Inventory of property in the event of bankruptcy of a legal entity or individual belonging to the debtor is carried out within a clearly limited time frame. Currently, the inventory of property in bankruptcy proceedings is carried out within no more than three months from the date of commencement of bankruptcy proceedings.

During the inventory process during the bankruptcy procedure, all of the debtor’s property is identified, which subsequently forms the so-called “bankruptcy estate.” The concept of “bankruptcy estate” means movable and immovable property that can be put up for public auction in order to obtain material funds that will subsequently be used to pay off the debts of a company or individual to creditors.

We invite you to read: Penalty for debt in case of bankruptcy of a developer

Inventory in bankruptcy is an integral part of the procedure and is mandatory.

The main regulatory document on the inventory of property in bankruptcy is the Federal Law “On Accounting”. Also, some regulations when inventorying property during the bankruptcy procedure of an organization or individual may be regulated by the requirements specified in the Federal Law “On Insolvency”.

As a rule, an inventory of property for the purpose of bankruptcy of an enterprise is carried out similarly to the usual inventory of an organization's inventory. Inventory includes several stages:

- providing the commission with the necessary accounting documentation;

- determination of the actual amount of company property (inventory, fixed assets, etc.);

- comparison of the actual availability of property with accounting data;

- documenting the results of the property inventory indicating all discrepancies.

In accordance with the requirements of the current regulatory framework for the bankruptcy procedure of companies, the inventory commission must necessarily include representatives of third-party, independent audit companies, as well as a bankruptcy trustee appointed by a government agency.

ORRLA company provides inventory services in case of bankruptcy of an enterprise. For any questions, you can contact us by phone or leave a request on the website.

Info

If a company has a level of current assets that is too low for normal financial activities, this will lead to an imbalance in the balance of equity and debt capital. The level of assets involved in the organization's turnover and the quality of cash flow. Too rapid and active expansion of the enterprise will sharply reduce the level of assets involved in turnover.

- At the preparatory stage, the manager is provided with all the necessary documentation, which makes it possible to determine account balances and a list of assets/liabilities.

- At the second stage, the actual existence of property and liabilities is established.

- At the third stage, a valuation of the obtained data is made (in fact, it forms the basis for the formation of the bankruptcy estate).

- At the fourth analytical stage, actual data is analyzed and compared with accounting information.

- At the final stage, the inventory results are compiled and the resulting discrepancies are reflected in the reporting.

- The Guidelines contain a classification of inventory types depending on assets: stocks, fixed assets, goods, money and financial liabilities.

Property inventory period for bankruptcy of an individual

The exception is cases when this process is mandatory. According to the Law “On Accounting” these include:

- The enterprise is being liquidated or reorganized.

- If there is theft, damage to property or abuse of it.

- Transfer of financial responsibility from one person to another.

- Emergency incidents caused by extreme conditions.

- Transformations occurring with a state or municipal unitary enterprise.

- The inventory precedes the preparation of financial statements for the year.

- Drawing up a lease, sale or purchase agreement.

One of the reasons for conducting an inventory during an insolvency procedure may be to check the safety of some property assets.

Certain cases of bankruptcy proceedings vest the arbitration manager with the following powers: All duties of the arbitration manager are aimed at monitoring inventory activities and obtaining reliable information about the property base of the enterprise.

Features of the inventory of property assets belonging to an individual are reflected in Article 213.26 of the Federal Law “On Insolvency”.

According to this provision, the inventory conditions in the case of a private person must comply with the following points:

- The starting price of inventory items at the auction is determined by the bankruptcy creditors.

- The property assets described as a result of the inventory process are sold at auction.

- The arbitration manager is obliged to submit to the court the results of the inventory and inspection carried out within 1 month from the date of its completion. At the same time, separate inventory documents are drawn up for property assets located outside the Russian Federation.

- The decision to independently carry out inventory activities is made by the financial manager in writing. The inventory procedure is paid for by those persons who paid for its implementation.

Deadlines for conducting an inventory of bankrupt property

If a shortage of property is identified during the inventory, the Representative, no later than two months from the date of completion of the inventory of property, notifies the director of the DLKO (DLFO), the Deputy General Director of the Agency supervising the DLKO (DLFO), and presents a plan for working with the shortage, including the work carried out and planned actions to search and return missing property.

Accounting provisions, in order to ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of property and liabilities, during which their presence, condition and valuation are checked and documented.

The bankruptcy estate includes real estate (apartments, country buildings, land), vehicles (cars, motorcycles, air transport, water transport, etc.), shares, shares in LLCs, household appliances, luxury goods, jewelry, cash, funds for bank accounts, etc.

One of the reasons for conducting an inventory during an insolvency procedure may be to check the safety of some property assets.

Inventory bankruptcy law deadlines

According to paragraph 4 of Article 20.3 of the Bankruptcy Law, when carrying out procedures applied in a bankruptcy case, the arbitration manager is obliged to act in good faith and reasonably in the interests of the debtor, creditors and society. The property inventory process includes checks of the following types:

- Documentary check. The rights and obligations of the company, confirmed by documents, are identified.

- Material or natural verification. The material and material base of the enterprise is subject to inspection. Weighings, measurements and calculations are carried out.

During monitoring and recovery, an inventory of the debtor’s property is not mandatory, but is desirable for the actual accounting and control of inventory and fixed assets for taking measures to improve the efficiency of the enterprise. At these stages, the manager can either use the ready-made results of a previously conducted inventory, or take direct part in the procedure or initiate it.

The inventory of the enterprise's obligations, which is carried out during the bankruptcy procedure, is documented in the register of creditors.

This is an official document that contains a list of all organizations that have material claims against the debtor, and the order in which their claims are satisfied. A certain period of time is allotted for its preparation from the moment of publication of information about the bankruptcy of a legal entity.

Federal Law of June 23, 2016 N 222-FZ) (see text in the previous edition) 2.

If circumstances arise during bankruptcy proceedings in connection with which a change in the procedure, terms and (or) conditions for the sale of the debtor’s property is required, the bankruptcy trustee is obliged to submit corresponding proposals regarding such changes to the meeting of creditors or to the committee of creditors for approval. 3. After an inventory and assessment of the debtor’s property, the bankruptcy trustee begins to sell it. The sale of the debtor’s property is carried out in the manner established by paragraphs

Grounds for extending inventory in bankruptcy proceedings

If the auction does not take place, the manager sells the property in parts.

According to established practice, after the auction has not taken place, the bankruptcy trustee notifies in writing agricultural organizations that own a plot of land directly adjacent to the debtor’s lands about the sale of its property to the debtor, and in the event of non-reception of proposals for the acquisition of the debtor’s property, the sale is carried out in the general manner , without taking into account the features provided for in Article 179 of the bankruptcy law.

Thus, by the decision of the arbitration court dated May 31, 2005 no.

The agricultural production cooperative "Dolina" of the Ukholovsky district of the Ryazan region was declared bankrupt and bankruptcy proceedings were introduced against it. Since the purpose of bankruptcy proceedings is to form a bankruptcy estate, sell the debtor’s property and satisfy the claims of creditors, for

Deadlines for making an inventory of property in a citizen’s bankruptcy

Features of the sale of a citizen’s property 1.

Within one month from the date of completion of the inventory and assessment of the citizen’s property, the financial manager is obliged to submit to the arbitration court a regulation on the procedure, conditions and timing for the sale of the citizen’s property, indicating the initial sale price of the property.

This provision is approved by the arbitration court and must comply with the rules for the sale of the debtor’s property established by Articles 110, 111, 112, 139 of this Federal Law. A ruling is issued on the approval of the provision on the procedure, conditions and timing for the sale of a citizen’s property and on establishing the initial sale price of the property.

If the financial manager is unable to sell the citizen’s property and (or) claims against third parties in the prescribed manner and the creditors refuse to accept said property and (or) claims to pay off their claims, after the completion of the sale of the citizen’s property, his right to dispose of the said property is restored. property and (or) claims. In this case, the property that constitutes the bankruptcy estate and has not been sold by the financial manager is transferred to the citizen under an act of acceptance and transfer.

In this case, paragraph 1 of Article 148 of this Federal Law does not apply. 6. The financial manager is obliged to inform the citizen, bankruptcy creditors and the authorized body upon their requests about the inventory, assessment and sale of a citizen’s property, and also report to the meeting of creditors.

During monitoring and recovery, an inventory of the debtor’s property is not mandatory, but is desirable for the actual accounting and control of inventory and fixed assets for taking measures to improve the efficiency of the enterprise.

At these stages, the manager can either use the ready-made results of a previously conducted inventory, or take direct part in the procedure or initiate it.

The inventory of the enterprise's obligations, which is carried out during the bankruptcy procedure, is documented in the register of creditors.

Inventory of the debtor’s property in bankruptcy proceedings during bankruptcy of a legal entity

Identification of a debtor's valuables during the rehabilitation procedure once again emphasizes his chances of restoring his solvency.

Inventory during external management is mandatory. With external management, all management functions are transferred to the manager, and he must decide how much property he will have to work with. The main task at the stage of bankruptcy proceedings is the accumulation of the debtor’s property and its subsequent sale for the purposes of creditors. If you want to find out how to solve your particular problem, please contact us through the online consultant form or call:

- Moscow: .

- Saint Petersburg: .

Before the start of the stage of sale of property before the start of bankruptcy proceedings, the bankruptcy trustee must make an inventory of the property of the debtor company.

One of the purposes of conducting a property inventory by the bankruptcy trustee is to verify the information provided by the debtor about the property he owns and the size of his assets.

At this stage, the manager can identify facts of fictitious or. Property inventory involves two types of verification of information provided by the debtor about the size of the debtor’s assets:

- Documentary verification is a study of documented rights, financial obligations and debts of the company (both payables and receivables), taking into account the submitted documentation.

- Material or natural verification - calculations and measurements of the material base of the enterprise. It involves weighing, counting, and measuring.

Inventory is a stage in the formation of the debtor, which will be aimed at repaying the claims of creditors. The bankruptcy estate includes all the property of the debtor, which belongs to him as a property, at the time of the commencement of bankruptcy proceedings and identified later.

The inventory serves the following purposes:

- Determine the actual indicators of the availability and condition of property assets.

- Compare

Arbitration manager

conduct bankruptcy proceedings,

the arbitration court appoints an arbitration manager, whose responsibilities include an inventory of all the debtor’s property, as well as an assessment of this property. The purpose of the work of the arbitration manager is to discover property owned by the debtor and included in the bankruptcy estate.

The process of searching for the debtor's property is sometimes complicated by its manager, who refuses to provide the manager with the required documents. In this case, the manager violates F3 “On insolvency (bankruptcy)”, in clause 3.2 of Art. 64 of which it is stated that the management of the debtor, no later than 15 days from the date of approval of the temporary manager, must submit to him, and also send to the arbitration court, a list of the debtor’s property, incl. property rights, accounting and other documentation reflecting the financial activities of the debtor over the last 3 years.

An assessment of the debtor’s financial and economic activities, as well as an inventory of property, make it possible to identify all property. If during the inspection it is discovered that the debtor has sold the property, the arbitration manager begins to search for him and challenge the property transaction.

According to paragraph 2 of Art. 126 of the same F3, the debtor’s management is obliged to submit to the bankruptcy trustee all accounting and other documentation of the debtor, seals, stamps, material and other valuables no later than three working days from the date of approval of the bankruptcy trustee. But very often these obligations are not fulfilled by the debtors’ managers, which makes it difficult to find the debtor’s property, and often it is not possible to find any property at all.

In such situations, the arbitration manager organizes a number of activities aimed at obtaining the necessary information. Among them: appealing to the arbitration court in order to force management to fulfill obligations under the law, sending requests to the internal affairs department, the prosecutor's office and other law enforcement agencies. You can also influence the management of the debtor if you bring him to administrative responsibility. In some cases, criminal liability cannot be excluded. The sources for obtaining the necessary information for the arbitration manager are:

- Inventory acts of the debtor's property.

- Accounting documentation.

- Structural department of the traffic police.

- State technical supervision.

- State Inspectorate for Small Vessels of the Ministry of Emergency Situations of the Russian Federation.

- Local government.

- Federal Bailiff Service.

- Federal Service for State Registration, Cadastre and Cartography

- Pension Fund of the Russian Federation.

- Social Insurance Fund of the Russian Federation.

- Bank branch.

- The Federal Tax Service.

- The Federal Migration Service.

In addition, there are different ways to discover property that belongs to the debtor. For example, if this is an individual, then you can find out where this debtor most often travels and where he usually spends his holidays. In these frequently visited places, he may have real estate.

Each case is individual and has its own solutions.

Resolution of May 6, 2020 in case No. A07-4518/2014

in terms of untimely inventory of the debtor's property, reflection of unreliable information in the bankruptcy trustee's reports on his activities and on the results of bankruptcy proceedings, failure to include the debtor's property in the bankruptcy estate, violation of deadlines for publishing information in the Unified Federal Register of Bankruptcy Information (hereinafter referred to as the EFRB), unfounded attracting persons to ensure the activities of the arbitration manager. Rakhimov M.S. suspended from acting as the bankruptcy trustee of Bakalymoloko OJSC.

The rest of the application of the authorized body was denied. By a court ruling dated March 3, 2016, Sergey Sergeevich Chulakov (hereinafter referred to as S.S. Chulakov), a member of the NP SRO AU Mercury, was approved as the debtor’s bankruptcy trustee. In the appeal, arbitration manager Rakhimov M. WITH. requested the court ruling dated February 11, 2016 regarding the satisfaction of the application of the Federal Tax Service of Russia to be canceled, citing the discrepancy between the court’s conclusions and the actual circumstances of the case and the incorrect application of the law.

According to the appellant, the court of first instance unreasonably declared his actions of untimely inventory of the debtor’s property illegal, and did not take into account the arguments of M.S. Rakhimov. that he did not have the obligation to conduct a repeated inventory, since the inventory was carried out by the acting bankruptcy trustee M.R. Zhdanov.

The arbitration manager considers the references of the authorized body to the provisions of paragraph four of clause 2 of Art. 12 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, etc.

1.4 of the Guidelines for the inventory of property and financial obligations, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 (hereinafter referred to as the Guidelines for the inventory of property), believes that these standards are not subject to application, the arbitration manager is responsible only for non-fulfillment or improper execution

Inventory in insolvency proceedings

The exception is cases when this process is mandatory.

According to the Law “On Accounting” these include:

- If there is theft, damage to property or abuse of it.

- The enterprise is being liquidated or reorganized.

- Drawing up a lease, sale or purchase agreement.

- Transformations occurring with a state or municipal unitary enterprise.

- Transfer of financial responsibility from one person to another.

- The inventory precedes the preparation of financial statements for the year.

- Emergency incidents caused by extreme conditions.

One of the reasons for conducting an inventory during an insolvency procedure may be to check the safety of some property assets. Certain cases of bankruptcy proceedings vest the arbitration manager with the following powers:

- Acceptance of property belonging to the debtor into custody and carrying out its inventory ().

- Participation in ongoing inventory ().

- Using the available results of the inventory of valuables belonging to the debtor ().

- Taking material assets into your management and making an inventory of them ().

All duties of the arbitration manager are aimed at monitoring inventory activities and obtaining reliable information about the property base of the enterprise. Features of the inventory of property belonging to an individual are reflected in the article.

According to this provision, the inventory conditions in the case of a private person must comply with the following points:

- The decision to independently carry out inventory activities is made by the financial manager in writing.

- The arbitration manager is obliged to submit to the court the results of the inventory and inspection carried out within 1 month from the date of its completion. At the same time, separate inventory documents are drawn up for property assets located outside the Russian Federation.

Grounds for extending inventory in bankruptcy proceedings

For your information, the inventory process in bankruptcy is regulated by such regulatory legal acts as the Law “On Accounting”, Regulations on Accounting and methodological guidelines for maintaining inventory and obligations in the financial sector. Goals of the process in case of insolvency of a legal entity An inventory of the property of an enterprise declared bankrupt is aimed at achieving the following goals:

- Identification of actual property indicators.

- Comparison of the actual availability of property with what is contained in accounting documents.

- Checking how realistic the obligations that have been taken into account are.

The bankruptcy estate, formulated as a result of the inventory of property during bankruptcy, is a source of funds for settlements with creditors through open tenders.

Extension of the inventory period in bankruptcy proceedings.

Inventory in bankruptcy

These include trucks and passenger cars, agricultural equipment, motorcycles, and vehicles traveling by air or water.

- Shares and securities.

- Fact of participation in an LLC.

- Luxuries.

- Precious accessories and jewelry.

- All funds are in the form of cash or bank accounts.

In addition to the list of property, the legal component of the inventory process in bankruptcy is documented.

The arbitration manager evaluates the property, compiling the bankruptcy estate based on the data received. The only housing and property whose price is less than 10,000 rubles is excluded from the inventory.

Inventory deadlines in bankruptcy Previously, inventory could take about 6 months. Attention Regulatory

Inventory deadlines

→ → Update: February 9, 2020

Inventories can be voluntary or mandatory.

Depending on the type of inspection, the timing of the inventory is set differently.

In the case of an initiative (voluntary) inspection, the procedure and timing of the inventory in the organization are established by it independently. In the case of a mandatory audit, certain rules for conducting an inventory are prescribed by law.

Let's talk about them in more detail. Every company must conduct an inventory at least once a year before preparing annual accounting reports.

With such a check, the company establishes the actual condition of its property and, if necessary, makes adjustments to the accounting data. When should such an inventory be carried out? Let's turn to the regulations.

The rules defining the timing of inventory are contained in the orders of the Ministry of Finance ( and ). According to these rules:

- inventory is carried out annually before the preparation of annual accounting reports;

- OS inventory can be carried out every three years;

- if an inventory of some property was carried out in the 4th quarter of the reporting (calendar) year, then a repeated inventory of this property is not required.

The question arises when exactly it is necessary to conduct an annual inventory. There are some nuances to keep in mind here.

In relation to the company's property, such an inventory must take place in the 4th quarter of the year for which reporting is being prepared (with the exception of fixed assets, for which the rules include a clause requiring an inventory to be carried out once every three years). At the same time, an annual inventory should also be carried out regarding the company’s obligations. And in this part, the existence of the company’s obligations must be established as of December 31 of the year for which the reporting is prepared.

This conclusion was made by the Russian Ministry of Finance ().

It follows from this that it is advisable to reconcile settlements with the company’s counterparties as of December 31. In this case, if the company’s liabilities are identified as a result of such reconciliation, they can be reflected in accounting and reporting. One of the cases of mandatory inventory, which is established by law, is bankruptcy proceedings against a bankrupt company.

One of the duties of the bankruptcy trustee is the obligation to conduct an inventory of the property of the bankrupt company ().

Until December 21, 2016, specific deadlines for conducting inventory in bankruptcy proceedings were not established.

This created certain difficulties in practice due to the improper fulfillment of this duty by bankruptcy trustees.

The situation was corrected by making changes to this part. From December 21, the bankruptcy trustee is given 3 months to conduct an inventory from the date of commencement of bankruptcy proceedings.

If the amount of property of the bankrupt company is very large, the court may set a longer period at the request of the bankruptcy trustee. Also read:

Accountant forum: Share:

Subscribe to our channel at