Home / Installments

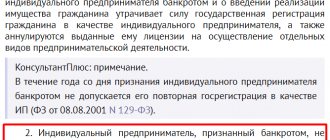

Back

Published: 04/06/2020

0

3

- 1 Amendments to legislation

- 2 What interest rates in MFOs must be by law?

- 3 How much interest will the MFO charge?

- 4 Best microloans with minimal interest

- 5 About fines and penalties

- 6 Comparative table of MFOs

- 7 Additional changes in the Russian microfinance market

- 8 Consequences of limiting interest on microloans for MFOs

- 9 How to reduce or freeze interest on a microloan

- 10 A separate product that is not subject to the general rules of final overpayment

- 11 Where do debts in the IFC come from?

- 12 The duty of MFOs is to comply with the law

- 13 What to do if you have debts

Amendments to legislation

The activities of MFOs in the Russian Federation are regulated by Federal Law No. 151 “On microfinance activities and microfinance organizations” dated July 2, 2010. This is a document about the basics of the work of MFOs and MCCs; it describes the rights and obligations of borrowers, and also lists the requirements for the organizations themselves.

In 2020, changes were made that limited the ability to further accrue interest.

The State Duma approved the provision that interest on microloans cannot exceed four times the loan amount.

However, this did not significantly change the situation with the debt burden of individuals. If a person borrowed 5,000 rubles before salary in one month and was forced to pay back 6,000 rubles along with interest, then next month he may be missing a larger amount. If repayment is not made on time, microfinance organizations may impose fines and penalties, turning the debt into an unaffordable amount. According to statistics, 25% of regular clients of MFOs have outstanding loans.

In this regard, the Government decided to amend the current legislation and limit MFOs from charging interest, fines and penalties. Changes will be introduced gradually. The first part is mandatory from January 28, 2019, the second - from July 1, 2020. The final stage of changes falls on January 1, 2020.

From January 28, 2020:

- Loans in the amount of up to 10,000 rubles and for a period of up to 15 days are allocated to a separate category of loans. The MFO cannot continue to accrue interest on this type of agreement when the amount of payments reaches 30% of the borrowed amount. It is only possible to charge fines of no more than 0.1% per day of the debt amount. This type of loan cannot be extended.

- The maximum interest rate under a microloan agreement is 1.5% per day.

- For loans up to one year, the maximum overpayment amount has been established. This concept includes not only interest on the use of money, but also fines, penalties and penalties. The maximum possible amount of overpayment is 2.5 times. From July 1, 2020, changes regarding the double calculation of interest on loans to microfinance organizations will come into force.

- In order to have the right to collect debt, an MFO must be licensed; companies will not be able to collect money even in court.

- Debts can only be sold to other microfinance organizations or companies that are included in the register of collection agencies.

The situation on the microloan market now

Since 2020, the microloan market has been growing rapidly. In 2017, the increase was 35%, and in 2020 – so far 25% . This is due to the fact that companies have considered the potential of the Internet and developed an online issuance system.

The most favorite microloan format is payday money. They constitute approximately 80% of the total amount of loans issued. The size of such a microloan does not exceed 15 thousand rubles, and the rate can be 720% per annum or even more. But due to the short period - up to 2-3 weeks - the overpayment does not seem so large.

Despite the fact that most borrowers pay off microloans without any problems, this greatly impacts the family budget. For example, if a family borrowed 15 thousand rubles, but was forced to return 20 thousand, then next month they may again not have enough money - and will have to turn to the microfinance organization again.

Read more: What documents are needed to obtain a dairy kitchen

Those who were unable to repay the loan have problems. Not only does it generally offer a high interest rate for a microloan. on top of the late fee - so a debt of 10 thousand rubles in just six months can turn into 300-400 thousand (these are extreme cases). It is clear that the average person does not have the opportunity to return that kind of money.

In one of his speeches, Vladimir Putin spoke about microloans in 2020. He instructed the Central Bank to develop standards that would regulate this market and allow borrowers not only to protect their rights, but also to reduce the credit burden.

According to statistics, every 4th of regular clients of MFOs has an unpaid debt . As a result, the debt load of the population is growing, and there is no way out due to the huge legalized fines.

What interest rates in MFOs should be by law?

Since January 2020, amendments to the law that regulates the work of microfinance companies came into effect. According to the changes made, the maximum interest rate on microloans is 1.5%. From July, microloan rates will drop to 1% per day.

According to the law, the maximum overpayment on a microloan should not exceed the loan amount by 2.5 times. From July this figure will also become lower. The limit for using credit funds, including fines and penalties, will be 2 times the amount of borrowed funds. Based on these figures, the maximum amount of debt, even with overdue payments, will be fixed and depends on the loan amount. The lender has no right to charge interest on loans indefinitely.

Interest in microfinance organizations in 2020

The weighted average interest rate for obtaining microloans is calculated based on the cost of loans issued and received by all microfinance organizations in the country.

The maximum 1% is the interest rate charged on microloans in most companies. Given the fierce competition, companies are gradually reducing the percentage.

Interest rates in popular microfinance organizations:

- “Pay PS” – 1%;

- "Konga" - 0.6%;

- "Mig Credit" - 0.09%;

- “Cash Bus” – 1%;

- “Money Man” – 1%;

- “Bystrodengi” – 0.85%;

- "GlavFinance" - 0.65%.

From these companies you can get money by online transfer. This is convenient for the borrower, as he receives the required amount on the card within 15-20 minutes.

The best microloans with minimal interest

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| 15 minutes. | Yes | 7-30 days | 30,000 RUR. | |

| 20 minutes. | Yes | 6-180 days | 50,000 RUR. | |

| 1 min. | Yes | 5-30 days | 70,000 RUR. | |

| 10 min. | Yes | 7-21 days | 30,000 RUR. | |

| 10 min. | No | 1-30 days | 70,000 RUR. | |

| 15 minutes. | Yes | 1-30 days | 15,000 RUR. | |

| New | – | No | 2-12 months | 90,000 RUR. |

After changes were adopted to the Federal Law regulating the activities of microfinance organizations, borrowers received the right to obtain cheaper loans. Limiting interest on microloans has made microcredit more accessible. Now even citizens with a minimum income can borrow money and repay the debt.

Restrictions on the accrual of interest and an established limit on loan payments protect those clients who, due to unforeseen circumstances, were unable to repay the loan on time. Previously, laws did not regulate this point, so microfinance organizations charged interest that exceeded the loan amount several times.

Over the course of a year, there was a huge overpayment, which was often unaffordable for borrowers. Now, in case of delays, the maximum debt will be fixed and cannot exceed the limit established by law.

SmartCredit

When you need low interest rates from microfinance organizations, you should take out a loan from SmartCredit. The maximum amount for the first application is 15,000 rubles, the loan rate is 1.5%.

Microfinance is carried out using a passport and is available around the clock, without breaks or weekends. To avoid a huge mortgage, you can extend the microloan. Renewal is available online without additional fees.

Onzaem

You can find out what interest rates are on microloans from the Onzaem organization. The activities of this MFO are under the control of the Russian Central Bank, so lending to Onzaem is safe. The maximum percentage is limited to 1.5%, the available amount for new borrowers is 10,000 rubles. If you apply again, you can count on 30,000 rubles.

In case of delay, the microloan debt will be fixed in accordance with the law that regulates the activities of microfinance organizations. The amount of accrued interest will not exceed the loan amount twice. Therefore, you can safely apply for loans from Onzaem to solve temporary financial difficulties or improve your credit rating.

HoneyMoney

The question of how legal the interest rates in MFOs are and how much they will have to pay for a loan worries many borrowers. HoneyMoney is one of the microfinance organizations that are licensed by the Central Bank of Russia and form their interest for using money in accordance with current legislation.

At HoneyMoney you can take out a loan of up to 15,000 rubles. MFOs regulate interest within 1-1.5%, so you should not be afraid of high rates. If the bank refuses to lend, HoneyMoney is a good option. You can find out how to receive funds on the company’s website. The most popular option is instant transfer to a card or bank account.

At Petrovich's

When looking for the best interest rate for microloans, you should contact. The microfinance organization issues not only microloans, but also large loans up to 90,000 rubles. Repayment terms are up to a year. The company can give a positive answer even to borrowers with a bad credit history.

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| New | – | No | 2-12 months | 90,000 RUR. |

Timely repaid loans from this microfinance organization allow you to rehabilitate the CI and raise your credit rating. In case of delay, the company may charge fines. However, their size is regulated by the law on lending to microfinance organizations and cannot exceed a certain limit.

Moneyman

Thanks to changes in Russian legislation, the maximum interest on microloans does not exceed 1.5%. This maximum is allowed at Moneyman, which offers lending up to 80,000 rubles. The new amendments, which will come into force in July 2020, mean that the rate will be reduced by another 0.5%.

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| 1 min. | Yes | 5-30 days | 70,000 RUR. |

This is very beneficial for borrowers, since microcredit will become accessible even to clients with low income. If the bank refused because of a low salary or a bad CI, you should contact Moneyman. In just one minute, here you can get approval and money to your card or bank account.

Credit24

Interest on microloans is calculated according to the law by Kredito24. The MFO supports all changes in legislation, so the maximum interest rate is 1.5%. From July, the company is obliged to reduce payments on microloans. The microloan rate will drop to 1%.

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| 15 minutes. | Yes | 7-30 days | 30,000 RUR. |

In case of debt, a threefold increase in the loan amount is unacceptable; the maximum debt will not exceed twice the loan amount. The borrower can borrow up to 15,000 rubles by receiving funds on a card, bank account or webmoney wallet.

Zaymigo

The interest rate on microloans at Zaymigo does not exceed 1.5%. Thanks to the changes in the Federal Law that January 2020 brought, it is not possible to increase the cost of microloans. The MFO will reduce the interest rate in July, in accordance with the amendments described above.

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| 10 min. | No | 1-30 days | 70,000 RUR. |

Among all companies, Zaymigo stands out in that it not only provides loans to borrowers, but also provides the opportunity to invest in microfinance business. At Zaymigo you can get a loan of up to 70,000 rubles. In case of delay, the debtor is obliged to pay a fine and accrued interest; the total amount of the debt cannot exceed the size of the loan by 2.5 times.

E-Cabbage

The maximum rate on microloans at the E-Kapusta company is 1.49%. MFOs offer loans of up to 30,000 rubles for a period of seven days to three weeks. If the borrower was unable to repay the debt on time and there was a late payment, the maximum amount of debt for collection will not exceed the loan amount by 2.5 times.

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| 10 min. | Yes | 7-21 days | 30,000 RUR. |

Starting from July of this year, the coefficient in the calculation will decrease from 2.5 to 2. Considering the ban on collecting three times the amount of a microloan, the company adheres to all legal norms and recalculates the debt based on innovations. A serious attitude to the Federal Law allows the company to provide loans to borrowers cheaper and in larger quantities.

Quick money

When the decision was made to approve the rate change in the MFO, microcredit became more accessible to many clients. Low interest rates and debt ceilings protect consumer rights and limit the accrual of high interest rates. Amounts exceeding the loan amount by more than 2.5 times are considered illegal. Therefore, MFOs are obliged to limit the accrued penalties and fines even for persistent defaulters.

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| 20 minutes. | Yes | 6-180 days | 50,000 RUR. |

This initiative was supported by Bystrodengi. MFOs issue loans up to 100,000 rubles, the maximum interest rate can be 1.5%. Money arrives online to the recipient’s card, bank account, or e-wallet.

Web loan

Favorable lending conditions are provided by Web Loan. The company offers loans up to 30,000 rubles. The maximum percentage is 1.5%.

| Compare | Receipt time | First loan free* | Deadlines | Maximum amount |

| 15 minutes. | Yes | 1-30 days | 15,000 RUR. |

The amount of interest is regulated by Russian legislation. In case of debt on this loan, the amount of interest and principal cannot exceed the loan size by 2.5 times.

Why do microfinance organizations issue microloans without interest?

Such generosity seems suspicious to potential borrowers; many begin to look for a catch, commissions or hidden conditions. But in fact, these are real offers available to everyone. Microfinance organizations introduce such products into their product lines for a reason; they pursue specific goals.

Why do microfinance organizations issue interest-free microloans:

- The expansion of the customer base. Such promotions attract a huge number of borrowers who will subsequently use MFO programs on standard terms.

- Increasing customer loyalty. Citizens who have received a free loan will begin to advertise it: tell their friends and family about the product and the microfinance organization.

- Brand promotion. The availability of free lending contributes to the popularity of a microfinance organization; its brand becomes more popular and well-known.

Important! There are not many offers for free lending; promotional programs are not available in every microfinance organization.

The most important thing for borrowers is the conditions for receiving an interest-free microloan. Only the client’s first loan will be free: if you apply to an MFO for the first time, the rate will be 0%, but when you apply again, the client will pay interest on standard terms. In addition, the free nature of the program is only relevant if the client repays the debt on time and without complaints. If there is a delay, the MFO will charge interest for the entire period of using the money.

Loan parameters at 0%:

- a small amount of issue, usually from 1,000 rubles to 10,000. Even if an MFO promises to issue up to 20,000 or 30,000 rubles free of charge, in practice the maximum amounts are not issued on free terms. Don't expect to get more than 10,000;

- The loan is issued for a maximum of a month. The exact delivery time is chosen by the client, it can be a couple of days;

- There is no gradual repayment; the borrower must completely repay the debt at the appointed time.

If the client does not close the debt on time, the MFO charges all due interest on the loan and at the same time adds late fees. Having taken out an interest-free loan, be sure to repay it without any complaints.

About fines and penalties

After the introduction of innovations, MFOs lost the right to charge fines and penalties uncontrollably. Previously, an MFO could specify the amount of fines in the agreement and charge them legally, referring to the borrower’s signature. Clients usually did not read into this clause of the contract because they expected to pay on time.

For loans in the amount of up to 10,000 rubles for a period of up to 15 days, the situation is somewhat different. Under such agreements, the interest should not exceed 30% of the debt amount, and the penalty can be accrued indefinitely. The fine is 0.1% per day of the overdue amount.

Interest on short-term and long-term microloans

The rate directly depends on the loan product you choose. The more risks the lender bears, the higher the interest rate will be - risks are always included in the rate. MFO programs can be divided into two large groups:

- Short-term microloans. Amount - up to 30,000, term - up to 30 days. The most affordable and most expensive programs. Money is issued around the clock and always online, the probability of refusal is minimal, bank refusers and citizens with a bad credit history are loaned without problems. There is no need to go to the office, there is no meeting with the manager. Rates for such programs are usually 1.8-2.2% per day (regular clients enjoy more favorable conditions, new ones can receive a microloan without interest).

- Long-term microloans. The issuance amount is up to 60,000-100,000 rubles, the term is up to 6-12 months, the repayment is gradual in equal payments. The criteria for borrowers are more stringent, but still lower than in banks. For long-term loans, rates are set at 0.4-0.76% per day. Interest-free microloans are not issued for long-term products.

Comparative table of microfinance organizations

Since January, microfinance organizations have reduced the interest rate on loans to 1.5%. From July 2020, the rate will become even lower, dropping to 1%. Our table contains offers from microfinance organizations that operate in accordance with the law and issue loans in accordance with the new requirements of the Federal Law.

| MFO name | Amount of credit | % bid | Maturity | Peculiarities |

| Smart Credit | From 2,000 to 15,000 ₽ | 1,5% | 7-30 days | Loyalty program for regular customers |

| Onzaem | From 2,000 to 30,000 ₽ | 1,5% | 5-30 days | Possibility of early repayment |

| HoneyMoney | From 1,000 to 15,000 ₽ | 1-1,5% | 7-30 days | Transparent terms and no hidden fees |

| At Petrovich's | From 5,000 to 90,000 ₽ | 0,5% | 60-365 days | Restoring your credit history |

| Moneyman | from 1500 to 80 000 ₽ | 0-1,5% | from 5 to 126 days | First loan at 0% |

| Kredito24 | From 2,000 to 15,000 ₽ | 1,5% | 16-30 days | Possibility of partial repayment and loan extension |

| Zaymigo | From 4,000 to 70,000 ₽ | 0,49-1,5% | 1-140 days | Investing in microfinance organizations to generate income |

| E-Cabbage | From 100 to 30,000 ₽ | 0-1,49% | 7-21 days | Instant loan decision |

| Quick money | From 1,000 to 100,000 ₽ | 0,84-1,5% | 1-180 days | Social loan at a reduced rate |

| Web loan | From 1500 to 30 000 ₽ | 0,6-1,5% | 5-30 days | Loyalty system for regular customers |

“I have 20 microloans and it’s a nightmare”

The Bank of Russia has been putting things in order in the MFO segment for several years now. Restrictions have already been introduced on rates and on the maximum level of markup on a loan. Just these days, the State Duma is considering a bill, initiated by the regulator, prohibiting microfinance organizations from issuing loans secured by real estate. In general, work is underway to cultivate the microfinance segment. However, there are still plenty of “toxic emissions”. Therefore, if there is nowhere else to turn except MFOs, potential borrowers should be aware of both the pitfalls of this industry and their own safety precautions - how not to get blown up by a payday loan.

Dangerous “wants”

In theory, the MFO institution is intended for everyday situations that do not entail dramatic consequences. For example, the car was taken to an impound lot, 500 rubles in my pocket and two days until payday. During these two days, a round sum will accrue at the impound lot, and if you borrow 5 thousand from a microfinance organization for a couple of days, you can pick up the car right away, and the overpayment at a rate of 1.5% will be only 150 rubles.

But more often people end up in microfinance organizations either out of stupidity or out of dire need. Here are real stories taken from one of the sites:

“We somehow ended up in debt unnoticed. It all started like everyone else, the first microloan was issued for a cell phone. Neither my husband nor I had official work, but we were approved for a loan. They paid everything for the year, and after some time they found an envelope with a credit card in the mailbox. They activated it right away, they even considered it a sign from heaven, they just needed a certain amount of money. We decided to take out a computer on credit, it was already registered in my name, again the same story: the debt was paid off, the card was received. In general, over several years we ended up with seven cards from different companies, and three microloans. They themselves didn’t notice how they found themselves in a dead end.

“I also got into trouble with these MFOs... There are about 20 loans. Like many, there is no option to extend. As of today, arrears began in one office. Tomorrow there will be another one. It's creepy... I'm afraid..."

But often the reason for contacting an MFO is a real need, an emergency situation. There are a lot of similar stories on the same “bitter” site. Here is one of them. In one once friendly family, a second-grader son had an unsuccessful skiing down a hill. Leg surgery, payment for subsequent rehabilitation. The loan is still from a bank. Then it turned out that another operation was required. Another loan. And then the husband could not stand it and left, and the mother was left with her son, who still had a long rehabilitation ahead, and with a debt of half a million rubles. Bank loans were no longer given. This is where microloans come into play. Now the unfortunate mother has no way to pay for them...

In emergency situations, of course, there is no time to calculate the financial consequences. And microfinance organizations offer money here and now, just show your passport. And for some time now you can submit an application completely online, without getting up from the couch: the funds will be transferred to the card without unnecessary delays. The ease of obtaining a loan has played a cruel joke on a considerable number of borrowers.

Most often, according to experts, those who turn to microfinance organizations are those to whom the bank will not give a loan - either their income does not correspond to the requested amount, or the borrower has already ruined their credit history by previously committing a delay. A particularly compromising circumstance is the fact that they received a microloan in the past: banks often refuse former MFO clients and consider them a marginal group.

But the fact that banks refuse loans does not reduce the number of people in need of money. The number of people involved in the microloan wheel of debt is estimated at 10 million people, and every year their number increases by an average of a third.

Photo: Ivan Skripalev

Toxic tool

Last year, borrowers from microinstitutions increased their debt by so much—in proportion—and were unable to repay it. According to NRA research, while the market was growing at a rate of 40%, delinquency grew at a rate of about 35%.

The low solvency of MFO clients is indirectly confirmed by the structure of microloans. According to the NRA, in the fourth quarter of last year, the share of consumer microloans (more expensive analogues of bank loans) in the total portfolio was 51.5%, payday microloans - 21.6%. These two types of loans have long been synonymous with the chronic lack of money of those who take them.

The picture of borrowers' violation of payment discipline in this regard is also expressive. According to the same study, payments on almost half (41.4%) of issued consumer microloans are overdue. With payday loans, it’s even worse: the renewal rate is 26.4%, the delinquency rate is 43.7%. This is a clearly “toxic” tool.

How to avoid losing a roof over your head

The ease with which MFOs “distribute” money is more than offset by the “severity” of extracting debts from careless borrowers: collectors, threats... One borrower discovered an ax stuck in the windshield of his car, with a funeral wreath hanging from the handle. Another borrower was pointed at a porn site that featured a photo of his child, edited in Photoshop.

Visitors to the MFO debtors' website share their own stories. “I wasn’t even on Contact, but they found my brother there, and my brother and I have different surnames, then they found him on Facebook, and the terror against him and his family began. Nightmare... How do they do it, how do they find it? “Next to me was my 5-year-old daughter and I was in my eighth month. I say go to court. And they tell me - we don’t go to court, we’re not a bank, we’re an microfinance organization, we kind of work differently.” (Source spelling preserved. - M.T. ).

How exactly the so-called debt collectors work is on the same website: “The girl offered to sell the apartment - for a debt of 23 thousand, I won’t pick up the phone anymore.” We are talking, note, about a Moscow apartment, which is worth a thousand times more than this debt.

But at least stories about how families of borrowers - along with veterans and minor children - end up on the street will be stopped as soon as the law banning real estate lending is passed.

Deceptive insignificance

The Bank of Russia, we must give it its due, is trying to restore order in the MFO segment. In January of this year, changes to the law came into force, limiting the daily rate on microloans to 1.5%; the maximum amount of markups can now not be higher than 2.5 times the size of the loan. So, if the borrower took 10 thousand rubles, then with all interest, penalties, fines, he will pay back no more than 35 thousand rubles. (10 thousand is the debt itself, 25 thousand is the maximum markup). In the case of a special loan (up to 10 thousand rubles for a period of up to 15 days), the borrower will overpay no more than 200 rubles per day.

The maximum daily rate will be reduced further: from the current one and a half percent to 1% from July 1. But this deceptive ease of small numbers should not mislead the borrower. The maximum rate of 1.5% per day means 547.5% per annum. That is, for a couple of days - as in the story with the impound lot - the interest payment is quite acceptable. But per month this is already 45%. And borrowing at such a percentage “to live on” for several months is simply murderous. “Not a single family is able to service such loans without harm to health,” confirms Dmitry Yanin, Chairman of the Board of the International Confederation of Consumer Societies (ConfOP).

In addition, experts assure that microfinance organizations still easily circumvent the established restrictions. “The moneylenders successfully use a trick that citizens do not immediately figure out. MFOs re-issue overdue loans an infinite number of times, and they take money both for the very fact of restructuring and add accumulated interest, penalties and fines to the body of the principal debt - on which interest, penalties and fines are again added up. The Bank of Russia is not able to track this kind of manipulation. Both he and the legislator pretend that the legal requirement limiting the maximum markup is being observed,” points out financial ombudsman Pavel Medvedev.

By the way, the law on collectors has been in effect since 2020. The powers and standards of behavior of debt collectors are strictly regulated on paper. However, persistent calls to relatives, strong guys on the doorstep of the house and funeral wreaths on the hood are still a reality.

And yet, the screws in the MFO segment are being tightened, with varying degrees of success. And, according to the NRA’s forecast, more and more microfinancers will begin to seriously maintain clean balance sheets and increasingly refuse loans to those who, by definition, will not be able to pay. The agency estimates that the share of such refusals could be 10–15%, which is equivalent to one million contracts.

“It will be even more difficult for individuals to attract the necessary borrowed funds, and for a significant number of potential borrowers, the opportunity to quickly raise funds to meet their living needs will be cut off: first of all, for the target group with a monthly income of up to 30–35 thousand rubles, this opportunity will sharply decrease. As a result, they may face the risk of completely withdrawing from the field of regulation and legal protection of their interests,” suggests Karina Artemyeva, senior director of financial institution ratings at the NRA.

In other words, about a million people will not be able to obtain an expensive but civilized payday loan. But that doesn't mean they can't get into trouble. With the abandonment of MFOs, their need for money will not disappear. And then they have one road - to the “black” moneylenders. And you can’t get rid of them with just phone calls and unpleasant conversations. The repertoire there ranges from a “Molotov cocktail” through the window at night to a “forceful” squeezing of the only dwelling.

Microloans: how to avoid falling into debt bondage

Before making a decision:

1. Check whether the selected company is in the state register of microfinance organizations - this way you will protect yourself from scammers.

2. When you contact an MFO and they tell you about the terms of the loan, do not rush to sign the agreement right away. You have 5 days to consider the offer you have been given.

If the decision is made:

1. Assess interest rates, read the individual terms of the agreement (they should be in tabular form) and the general terms (set unilaterally by the MFO).

2. Carefully study the individual terms of the contract: they may contain conditions for additional services. They affect the amount you need to repay.

3. Check the total cost of the loan. It must be indicated in the frame in the upper right corner on the first page of the individual terms of the contract.

When the loan has already been taken:

1. Deadlines. Don’t forget that a microloan only works for you if you take it out for a short period of time. The faster you pay it off, the less money you'll have to pay out of your budget.

2. Penalty (fines, penalties). They can be charged only on the overdue portion of the principal amount, but not on interest. The penalty for late payment on a special loan should not exceed 0.1% of the debt amount for each day of delay in payment.

3. Save payment documents (check, receipt or cash receipt). Remember that the loan is considered repaid at the moment when the funds are credited to the account or cash desk of the microfinance organization. Ask the lender for a certificate stating that you have repaid the loan (part of the loan debt).

4. Powers of collectors. Debt collectors (the creditor himself or collectors) by law cannot abuse their rights and intentionally cause harm to the borrower or guarantor. If you encounter such illegal actions, you need to contact the Federal Bailiff Service.

5. Borrower rights. If you believe that an MFO is violating your rights, contact the Bank of Russia.

Source: Bank of Russia

Additional changes in the Russian microfinance market

The legal route to obtaining a loan from an MFO is chosen by adult Russians with a permanent place of registration. For clients with temporary registration, lenders often make exceptions, limiting the loan term to the date of registration at the current place of residence.

A prerequisite is income that allows you to fulfill loan obligations in full. This can be not only wages, but also additional sources - a deposit, funds from renting out real estate, dividends from copyrights, etc.

Many borrowers are interested in whether it is possible to get a microloan with a bad CI. Most lenders are tolerant of a low credit score, so there shouldn't be any restrictions. It also doesn’t matter social status, place of work or study, position, or marital status.

The main requirement of MFOs is timely repayment of debt. If there is a delay, the lender may charge a fine. This is allowed even if the debt is small and the payment delay is several days. Therefore, no matter what the size of the loan funds, you need to try to deposit money into the MFO account according to the schedule. The new law, which was adopted at the beginning of the year, regulates the calculation of fines and penalties, defining the maximum limit of the debt load.

Borrowers of microfinance organizations, in addition to restrictions on overpayment, are now additionally protected by two innovations. In particular, the circle of persons who can issue and purchase loans under an assignment agreement is limited.

This approach allows us to reduce or even eliminate the risks of interaction between borrowers and representatives of the black and gray financing market, where laws and standards on the mechanism for issuing money in debt and collecting it are often ignored.

Thus, only those companies that have indicated microfinance in the list of main activities have the right to collect debt issued after January 28, 2019 through the court.

Accordingly, the activities of these companies will be legal, since they are included in the state register and are controlled by the Central Bank of the Russian Federation.

The following persons have the right to buy debts:

- Individuals;

- Persons who are in the company's MFO register;

- Collection agencies included in the specialized register maintained by the Federal Bailiff Service (FSSP);

If everything is clear and transparent with the second and third points - they have undergone the legalization procedure and can assign rights to claims, then not every individual will be able to receive a loan under an assignment agreement.

To summarize the above innovations of the law on microloans, signed in 2020 and entered into force on January 1, 2020, it is necessary to compare the market situation on this issue. This will help you figure out which way the trend is going.

For comparison, let's highlight three points:

- Grocery cost. At the beginning of 2020, the maximum payday value of popular loans was 850% per annum. In 2020, this value decreased by 2.3 times.

- Restrictions on overpayment. It was not repealed; it was in force even before the new law came into force. At the beginning of 2020, restrictions did not apply to penalties associated with delayed payment of debts. Since the beginning of 2020, restrictions on repaying borrowed debt have been significantly reduced (from 3 times the amount of debt for timely payments to 1.5 times the amount for overdue payments).

- In 2020, the law limited individuals who have the right to forcefully demand repayment of a loan, which allows borrowers to reduce the risks of encountering black creditors and debt collectors, and also makes it possible to influence them when laws are violated.

How to get a microloan with a low interest rate

Your task is to find an MFO with a low interest rate. If you study the market, you can quickly come to the conclusion that the larger and more famous the MFO, the more expensive its loan programs. Large organizations usually offer the highest percentage: they spend a lot of money on advertising and promotion, and all these costs are included in the actual percentage.

To find out which MFOs charge the lowest rates, dig deeper. Study the offers of little-known microfinance organizations. These are companies with a small advertising budget. In addition, they are interested in expanding their client base, so they set more attractive conditions for borrowers. Funds are also issued online, but at a more favorable interest rate.

When looking for microfinance institutions with low interest rates, do not forget to look at the restrictions. If a company sets a lower rate, most likely it makes the requirements for the borrower slightly higher.

Important! If you have a negative credit history, most likely you will only be able to get approval for a program with a rate of 2-2.2% daily.

Consequences of limiting interest on microloans for MFOs

Changes in legislation regarding the maximum amount to be recovered for a microloan could not go unnoticed. December 2018, as amended, forever changed the microcredit market in Russia.

For citizens, quick loans have become safer, and for MFOs they have marked a change. Restrictions on excess interest mean a significant reduction in company income. According to financial analysts, in 2019-2020 the number of lending organizations will decrease significantly. There will only be a few large companies focused on online loans. Maintaining offline offices for issuing short-term loans will become unprofitable.

It is likely that microfinance organizations will reconsider their product lines and refocus on issuing larger and longer-term loans. The selection of borrowers will be more careful, and the approval rate will be significantly reduced. Payday loans will cease to be a core area of activity. 80% of such microloans will be issued to verified regular clients.

We can definitely say that changes in legislation directly affected all MFOs. Each company will be faced with a choice: re-profile its business or leave the market.

Although changes to the rules came into force on January 1, 2020, they were introduced back in 2020 in the form of a law on microloans. The main changes concern not only overpayments in connection with debt obligations with a maturity of less than a year.

The provisions of the law on microloans, published in 2020 and which will come into force on January 1, 2020, apply only to agreements that were concluded after the introduction of the amended rules for lending money.

We can distinguish 3 periods, taking into account all the innovations provided for by Federal Law No. 554-FZ of December 27, 2018.

The period for issuing microloans is from January 28, 2020 to July 1, 2019. Two restrictions on overpayment were used:

- The daily rate should not exceed 1.5%;

- The amount of money returned in excess should not be more than 2.5 times the amount borrowed;

If the loan was issued between July 1, 2020 and January 1, 2020:

- Daily rate up to 1%;

- The overpayment should not be more than 2 times the amount borrowed;

Loan period after January 1, 2020:

- Rate – 1%;

- The amount of money that is returned in excess of the amount of the debt should not exceed 1.5 times the amount of the debt;

One caveat is that the overpayments indicated above relative to the main loan amount include, in addition to interest for using the funds of microfinance organizations (MFOs), also a penalty, that is, there are certain clear restrictions on the debt obligations in question.

From January 28 to July 1, 2020, the maximum amount of debt for collection should not exceed 2.5 times the size of the original loan. For example, if a borrower received a short-term loan in the amount of 11,000 rubles for 30 days and was unable to pay it on time, then the lender will not be able to recover more than 2.5 times this amount.

Collection amount = 11,000 * 2.5 = 27,500 rubles.

Once the borrower's debt reaches 2.5 times the original loan amount, from that moment the lender will no longer be able to charge interest, penalties, penalties or interest. Debt growth will stop.

It is noteworthy that the government has provided for a further reduction in the maximum amount that a lender can recover from a borrower. So, from July 1, 2020, it will decrease to 2 times the size of the loan received.

For example, if a borrower takes out a loan for 11,000 rubles and fails to repay it within the prescribed period, interest, penalties and fines will be accrued until the total debt reaches 2 times the original loan amount.

Total debt = 11,000 * 2 = 22,000 rubles.

From January 1, 2020, the amount of total debt on microloans for a period of up to 1 year will not be able to exceed 1.5 times the size of the initial loan. See. See also: Online microloan calculatorFor example, if a borrower issues a microloan in the amount of 11,000 rubles and does not repay it on time, then interest and fines will be accrued until the debt reaches 1.5 times the size of the issued loan.

Total debt = 11,000 * 1.5 = 16,500 rubles.

Thus, already in January 2020, borrowers can take out small loans and not worry that they will have to repay hundreds of thousands of rubles if they are overdue for several months.

Changes since 2020

Many changes have been made to the federal legislation regulating the issuance of loans and payday loans. A significant part of them will come into force on January 1, 2020, and some on July 1, 2020. Moreover, many measures begin to function from the beginning of the year in an incomplete manner, i.e. the period from January 1 to July 1 is transitional.

Maximum amount limit

The legislation on microfinance activities is not intended to change the maximum possible loan amount. Those. theoretically, the company can issue 1 million rubles at 2% per day. But, of course, this does not happen in practice.

However, there is a distinction between a microloan and just a loan. It is planned that the size of the microloan will be limited to 50 thousand rubles . What is the difference?

Microloans and credits are regulated by different laws and have different maximum interest rates. So, for microloans it is much higher: now it is 2.5% per day, or 912.5% per year. In different microfinance organizations, the annualized amount varies on average from 300 to 800% . For loans – 50% per year.

The maximum rate is calculated by the Central Bank of the Russian Federation based on many indicators and is published daily. No company can exceed this figure - otherwise it will face a fine.

Loan rate restrictions

The so-called interest law has also been adopted in the MFO sector. It regulates the size of the maximum charges on the loan. From January 1, the microloan rate will be limited to 1.5% per day (or 547.5% per year), and from July 1 - 1% per day (or 365% per year) .

In this case, it will be prohibited to use the “interest on interest” rule, i.e. debt will not be able to grow exponentially, as some microfinance companies are currently doing.

Limitation of maximum fines

The State Duma also proposed limiting the fines that an MFO can impose on a debtor. Now, in fact, they are not limited by anything. The company stipulates penalties and interest in the contract, but few clients are familiar with them, as they assume that they will repay the loan on time and will not encounter problems. And only then he is surprised to learn that he owes the company literally tens of times more than the debt was - and completely legally.

You can, of course, try to write off penalties through the court. But usually the court sides with the MFO, since the signature on the agreement confirms that the client has read the terms and conditions and agrees to receive a loan at the proposed rates.

The new law suggests that the maximum charge will now be tied to the size of the loan. During the transition period from January 1, 2020 it will be 200% of the loan amount, from July 1 - 100%.

For example, if a borrower borrowed 15 thousand rubles from an MFO and failed to repay it on time, then from January 1, MFOs will be able to charge him a maximum of 30 thousand rubles in fines, and in total he will be forced to pay the company 45 thousand. From July, payments will not be able to exceed 15 thousand rubles, i.e. such a debtor will only have to repay 30 thousand rubles.

Calculation of maximum debt load

In addition to the innovations regarding the calculation of interest, requirements have been introduced for companies to check the debt load of clients. A special methodology has been developed to calculate the maximum debt load ratio. If this ratio exceeds a certain value, the lender will receive a “fine” in its loan portfolio. If there are too many such loans in the “risk group,” the Central Bank will be able to take away the license.

Read more: 354 Government resolution as amended 2018

This system has been working for banks for a long time. This is why they do not issue loans to people with high debt loads, as this worsens the quality of their portfolio .

Similar rules will apply to microfinance organizations. This means that microloans will not help extremely over-leveraged citizens, since no one will issue them.

In addition, the rule “no more than 3 microloans per person” will be introduced. But this rule will not apply to refinancing existing loans. So companies will be able to refinance customer debts, offering them more favorable conditions.

Lifting the ban on loan collection

Now there is a paradoxical situation where microfinance organizations without a license can issue loans, but at the same time cannot collect overdue debts. As a result, they simply resell loans to other microfinance organizations or collection services.

The new law is designed to solve this problem in a radical way. Any companies or individuals, regardless of whether they have a license, will be allowed to collect debt - but only after going to court.

Features of secured lending

Since 2020, there has been permission for microfinance organizations to issue microloans secured by any property, and in case of delay, to confiscate the mortgaged property in their favor. The only requirement is that the amount of debt must be more than 500 thousand rubles.

This gave rise to many conflicts when borrowers lost their apartments and cars due to late payments on microloans and increased fines and penalties. Companies literally brought the loan debt to the required amount within six months and went to court to collect it.

Now it will be possible to issue microloans against collateral, but it will not be possible to actually recover the property. The fact is that the maximum amount of fines will be limited to 100-200% of the debt amount. As a result, the amount of debt will be insignificant when compared with the value of the pledged property.

For example, if a borrower owes an MFO 45 thousand rubles, and his mortgaged apartment costs 3.5 million rubles, then according to the law it cannot be confiscated. The amount of debt must exceed 5% of the value of the collateral .

How to reduce or freeze interest on a microloan

Whatever amount is borrowed, every effort must be made to repay the debt. When the borrower does not make required payments, arrears occur. In this case, the lender has the right to calculate a fine for failure to fulfill loan obligations.

Changes in the law on microfinance organizations introduced a restriction on the calculation of interest on debt: the rate is charged only on the balance of the debt, and the total payment amount cannot exceed the loan by two times or more. Only regular customers who repay all debts on time can reduce the interest on the loan. Otherwise it will be very difficult to do this. Details of freezing interest must be discussed with a specific microfinance firm.

How to reduce MFO interest rates in court

If a microfinance organization issued you a loan at a rate exceeding the limit established by the Central Bank, you can go to court. Since the credit institution violated the law, it will be punished and the interest will be recalculated. You can also send an application to the court if the creditor charges large penalties.

According to the law, penalties on a microloan and any loan cannot exceed 20% per annum (the rate under the agreement is accrued), and the amount of the required debt formed as a result of delay cannot exceed more than three times the initial amount of the microloan. That is, if you owed 8,000, the MFO cannot demand more than 24,000 from you: if the company collects more, the court will not side with the borrower.

A separate product that is not subject to the general rules of final overpayment

For microfinance organizations, there is a separate type of microloans, for which all of the above restrictions do not apply, but it has its own:

- Loan amount – up to 10,000 rubles;

- The contract period is less than 15 days;

- Extension is prohibited;

At the same time, such obligations still have their own maximum value values:

- Daily commission – no more than 200 rubles;

- The maximum permissible overpayment is 2000 rubles;

Here a limit of 30% is used in relation to the total overpayment and daily commission.

Federal Law No. 151 obliges MFOs to comply with the following rules:

- All information on loans must be posted in a place accessible to clients (on the website or in the office).

- It is necessary to inform clients that the company is licensed. At the client’s request, the MFO must provide the relevant certificate for review.

- Provide complete information about the conditions for issuing money.

- The client must be explained his rights and obligations, methods of obtaining and repaying the loan.

- Do not disclose information about the borrower and his financial transactions.

- The maximum microloan amount is 1 million rubles.

- The term of loans from microfinance organizations by law cannot be more than 1 year.

What law regulates the work of organizations?

The main legislative act that sets out the requirements and rules for the work of organizations is Federal Law 151 of June 23, 2010.

With the release of this law, the country’s borrowers had the opportunity to take advantage of the legal support of the state, and the lenders themselves began to conduct microcredit activities for individuals and individual entrepreneurs responsibly and in good faith.

The law mentioned above contains 17 articles divided into 5 separate chapters. Federal law includes:

- General provisions, key concepts and terms, legal basis for the activities of creditors.

- Conditions under which microcredit companies are required to issue loans.

- The procedure according to which MCCs undertake to provide credit products to the population.

- Features of supervision over the work of creditors, as well as ways to regulate their activities.

If you are an active borrower, or, on the contrary, have never used the services of an MCC, but at the same time want to be confident in financial and legal security, take a closer look at the federal law on MFO No. 151.

It would be a good idea to read all the changes made to the text of the act in question - there are quite a lot of them. It is better to study the text of a legislative act in official sources that regularly update information.

When it comes to lending to the population, one cannot fail to mention such a document as Federal Law No. 353 “On consumer credit (loan)” . This document describes in more detail the rights and obligations of both all borrowers and companies involved in lending to individuals. It also describes in detail such a concept as the full cost of a loan, provides the specifics of concluding an agreement, and so on.

Where do debts in the IFC come from?

Debts in the IFC may arise due to lack of payments or delays. It happens that a client deposited money, but it was credited with a delay of several days. Therefore, it is worth transferring money two to three days before the deadline, taking into account the peculiarities of conducting banking operations.

Most often, debts arise due to a lack of ability or desire to repay the debt. An MFO can legally charge late fees and demand repayment of the loan. The activities of companies that provide microloans are regulated by Russian legislation. Therefore, accrued payments, taking into account penalties and interest rates, cannot exceed twice the size of the loan.

Are microloans worth taking out?

A quick loan is a helper in unforeseen life situations. Salaries were delayed, fired, unexpected expenses occurred - microloans help out in such situations. You can get money while staying at home in just 10 minutes.

However, a microloan should only be taken if you are sure that you can repay it within the prescribed period. This will help avoid fines, delays and proceedings with debt collectors or even court.

In what situations can you take out a microloan:

- your salary was delayed, but you are sure that it will be transferred;

- friends or acquaintances cannot borrow the required amount;

- hopeless situation;

- You are in a situation where you can only get money via the Internet.

In what situations is it not necessary to contact an MFO:

- there is no money to repay another microloan or loan;

- fail to meet the payment deadline;

- you see that the conditions are unfavorable for you;

- you know you won't be able to pay on time.

Advantages and disadvantages

Contacting microfinance organizations has several advantages:

- high speed of application approval: even a clean credit history or the presence of past delinquencies is not a stop factor for many microfinance organizations;

- a minimum package of documents: only a Russian passport is enough, however, if the amount is large or the credit history is damaged, employees may require you to provide a certificate confirming your income;

- receiving money in a way convenient for you: cash, transfer to a bank card, Golden Crown, Qiwi wallet, etc.;

- some microfinance organizations have programs for new clients at 0%;

- loyalty programs: many microfinance organizations issue loans to regular customers under more favorable conditions, for a longer period or at a lower interest rate;

- online service: this allows you to get a loan even on holidays, weekends or at night;

- possibility of early repayment and debt restructuring.

However, microloans have their disadvantages:

- interest rate: some microfinance organizations offer huge interest rates, so you need to pay attention to them when concluding an agreement in the first place;

- short loan period: usually microcredit companies issue loans for a period of 30 days to 3 months, in rare cases - up to 6;

- small amounts: you can only borrow a large amount from a bank, MFOs work with amounts up to 100 thousand rubles, less often - 200-300 thousand;

- collection methods: if you run into a fraudulent company, you may encounter unlawful actions on their part - night calls, visits, threats, etc.;

- scammers: among Internet companies there are scammers who take advantage of the borrower’s legal illiteracy and hopeless situation and impose impossible conditions on him;

- risk of delinquency: fines are a potential profit for MFOs, they are interested in debt, and for this they prescribe conditions that are difficult to fulfill.

Underwater rocks

The main disadvantage of using microcredit companies is the high interest rate. If you do not choose a program that offers the best interest rate, or incorrectly assess your financial capabilities, delays over time can lead to a financial hole. In a few days the amount overdue will be small, but in a month the debt can increase several times.

It is necessary to contact only trusted companies that are among the top largest microfinance organizations. This way you will avoid illegal ways of charging a fine: increasing the interest rate, charging interest on interest, etc. Since 2020, companies are limited in the amount of fines: they cannot charge interest more than three times the loan amount.

Information about each delinquency is transmitted to the Credit History Bureau. Delays made affect the credit rating. The lower it is, the more difficult it is to get a loan from a bank or microfinance organization. But loans closed on time also improve your credit history.

The duty of MFOs is to comply with the law

The activities of MFOs are controlled by the Central Bank and the state as a whole. Companies do not have the right to ignore any of the legal requirements. However, borrowers are increasingly faced with the rudeness of representatives of microfinance organizations and collectors in case of overdue payments.

The state has imposed the following restrictions on debt collection work:

- No one has the right to threaten or use physical violence.

- You can communicate with borrowers only during the day.

- The number of meetings with clients is strictly limited.

- After 4 months from the date of arrears on the loan, the client has the right to refuse to communicate with the debt collection service. To do this, you need to write an application and send it to a microfinance organization.

How to avoid paying interest on a microfinance loan

If there is no property or funds to collect against the debt, or the inability to work and repay the loan, the microfinance organization may write off the debt. The borrower must provide a document indicating his insolvency:

- work book with a record of dismissal;

- statement of registration at the employment center;

- rental agreement;

- a health certificate stating why the person is unable to work.

If you have a document, write an application to suspend the accrual of interest to the microfinance organization. The basis is Art. 35 Code of Civil Procedure of the Russian Federation.

MFO tricks

Microfinance companies are limited by the federal law “On Microfinance Activities,” but there are several tricks that some people fall for:

- Time . Sometimes funds are not credited instantly, but only within 1-3 business days. Interest is calculated from the date of signing the agreement.

- Interest rate . Make sure that when repaying a loan early, interest is charged not for the full term of using the loan, but for the actual one. The rate must be fixed and not subject to change.

- Redemption . Getting a loan is easier than paying it off. Money is issued in a way that is convenient for the client, but payment of debt is often accepted in such a way that the client needs more time, and he is late.

- Prolongation . MFOs promise to extend the contract if the client fails to make the payment on time. And they will do this, but only with a commission, the size of which is unlimited.

What is the maximum interest amount established by law?

On January 1, 2017, a law came into force that directly prohibits charging borrowers unreasonably high interest rates on microloans. This also applies to debtors. The law caused a stir and caused discontent among many companies, but was adopted.

In accordance with it it is established:

1

The interest limit has become threefold. You took out a microloan in the amount of 6,000 rubles. Even if you have not repaid it for a long time, in court you will be recognized as having a debt of a maximum of 24,000 rubles (18,000 rubles is interest, 6,000 is the “body” of the loan).

2

Restriction on accrual of overpayment. Previously, interest was charged not only on the principal debt, but also on the debt. Now the rate is 2 times the size of the loan body. And even if the contract stipulates otherwise, the court will only be able to demand twice the amount from you.

Both options are considered in court, the final decision is made by the court.